COND 1

Introduction

COND 1.1

Application

- 01/12/2004

Who?

COND 1.1.1

See Notes

COND applies to every firm, except that:

- (1) for an incoming EEA firm or an incoming Treaty firm only threshold conditions 1, 3, 4 and 5 apply and only in so far as relevant to:

- (a) an application for a top-up permission under Part IV of the Act (that is, permission to carry on regulated activities in addition to those permitted through the incoming firm's authorisation under Schedule 3 (EEA Passport Rights) or 4 (Treaty Rights) to the Act); and

- (b) the exercise of the FSA's own-initiative power under section 45 of the Act (Variation etc on the FSA's own initiative) in relation to the top-up permission;

- (2) COND also applies to an applicant for Part IV permission;

- (3) threshold conditions 3, 4 and 5 do not apply to a Swiss General Insurance Company; and

- (4) COND 2.6 (Additional conditions) is only relevant to non-EEA insurers.

- (5) [deleted]

- 06/08/2010

- Past version of COND 1.1.1 before 06/08/2010

COND 1.1.2

See Notes

- 03/09/2001

What?

COND 1.1.3

See Notes

- 03/09/2001

Where?

COND 1.1.4

See Notes

- 03/09/2001

COND 1.2

Purpose

- 01/12/2004

COND 1.2.1

See Notes

COND gives guidance on the threshold conditions set out in or under Schedule 6 to the Act (Threshold conditions). The threshold conditions represent the minimum conditions which a firm is required to satisfy, and continue to satisfy, in order to be given and to retain Part IV permission.

- 03/09/2001

Applications for Part IV permission or variation of Part IV permission

COND 1.2.2

See Notes

- (1) Under section 41(2) of the Act (The threshold conditions), in giving or varying a Part IV permission or imposing or varying any requirement, the FSA must ensure that the firm concerned will satisfy, and continue to satisfy, the threshold conditions in relation to all of the regulated activities for which it has or will have permission.

- (2) If, however, the applicant for permission is an incoming firm seeking top-up permission, or variation of top-up permission, under Part IV of the Act (Permission to carry on regulated activities), then under paragraphs 6 and 7 of Schedule 6 to the Act, the FSA will have regard only to satisfaction of threshold conditions 1, 3, 4 and 5, as relevant to the regulated activities for which the applicant has, or will have, Part IV permission.

- 03/09/2001

Exercise of the FSA's own-initiative power

COND 1.2.3

See Notes

- (1) If, among other things, a firm is failing to satisfy any of the threshold conditions, or is likely to fail to do so, section 45 of the Act (Variation etc. on the FSA's own initiative) states that the FSA may exercise its own-initiative power . Use of the FSA's own-initiative power is explained in SUP 7 (Individual requirements), and EG 8 (Variation and cancellation of permission on the FSA's own initiative and intervention against incoming firms).

- (2) If, when exercising its own-initiative power under section 45(1) of the Act, the FSA varies a firm's permission, or imposes or varies a requirement, then, under section 41(2) of the Act, the FSA must ensure that the firm concerned will satisfy, and continue to satisfy, the threshold conditions in relation to all of the regulated activities for which it has or will have permission. However, section 41(3) of the Act states that the duty imposed by section 41(2) of the Act does not prevent the FSA taking such steps as it considers necessary in relation to a particular firm in order to secure its regulatory objective of consumer protection.

- (3) The FSA can also exercise its own-initiative power under section 45 of the Act in relation to the top-up permission of an incoming firm. But this is only on the grounds that the incoming firm is failing, or likely to fail, to satisfy threshold conditions 1, 3, 4 or 5 in relation to that permission.

- 06/04/2010

- Past version of COND 1.2.3 before 06/04/2010

Approval of acquisitions or increases of control

COND 1.2.4

See Notes

- (1) Under section 186(3) of the Act (Objection to acquisition of control), in deciding whether the approval requirements for a proposed acquisition or increase of control are satisfied, the FSA must have regard, in relation to the control that the acquirer:

- (a) has over the firm; or

- (b) will have over the firm if the proposal which has been notified to the FSA is carried out;

- to its general duty to ensure that the firm will continue to satisfy the threshold conditions.

- (2) The FSA must also have regard to the threshold conditions in imposing any conditions on its approval of an acquisition or increase of control (section 185(2) of the Act (Conditions attached to approval)). See SUP 11.7.3 G (Acquisition or increase of control: procedures).

- 03/09/2001

COND 1.3

General

- 01/12/2004

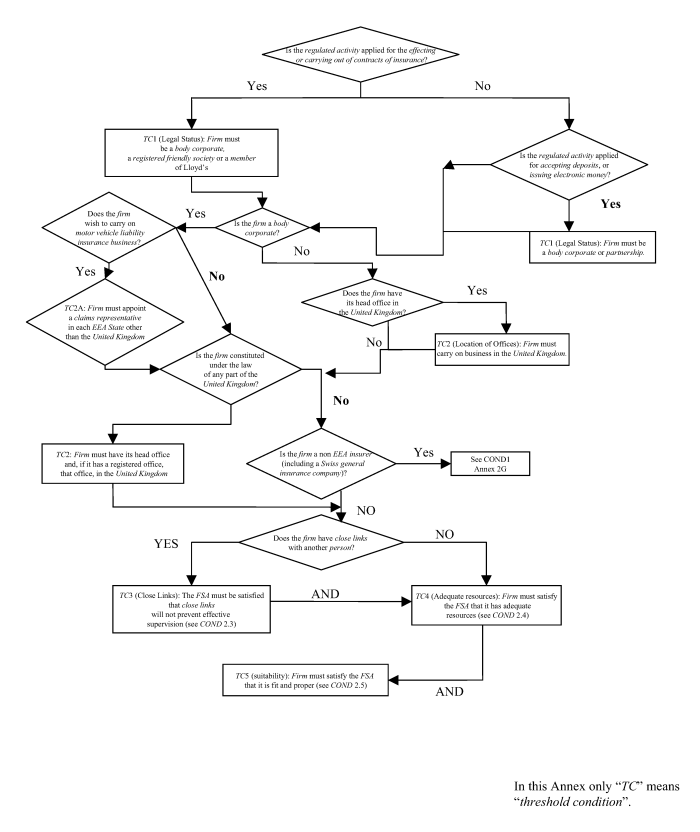

An overview of the threshold conditions is given in COND 1 Annex 1 G.

COND 1.3.1

See Notes

- 03/09/2001

COND 1.3.2

See Notes

- (1) The FSA will consider whether a firm satisfies, and will continue to satisfy, the threshold conditions in the context of the size, nature, scale and complexity of the business which the firm carries on or will carry on if the relevant application is granted.

- (2) In relation to threshold conditions 4 and 5, the FSA will consider whether a firm is ready, willing and organised to comply, on a continuing basis, with the requirements and standards under the regulatory system which apply to the firm, or will apply to the firm, if it is granted Part IV permission , or a variation of its permission. These matters will also be considered if the FSA is exercising its own-initiative power (see COND 1.2.3 G). Guidance to firms on the implications of this is given under each of those threshold conditions.

- 03/09/2001

COND 1.3.3

See Notes

- 03/09/2001

Statutory quotations

COND 1.3.4

See Notes

- (1) For ease of reference, the threshold conditions in or under Schedule 6 to the Act have been quoted in full in COND 2.

- (2) As these provisions impose obligations, they are printed in bold type. The use of bold type is not intended to indicate that these quotations are rules made by the FSA .

- (3) Where words have been substituted for the text of these provisions the substitutions are enclosed in square brackets ([ ]). However, none of the changes made by the FSA in these quotations for the purpose of the text in COND can supersede or alter the meaning of the statutory provision concerned.

- 03/09/2001

COND 1 Annex 1

Introduction

- 01/12/2004

See Notes

- 19/01/2003

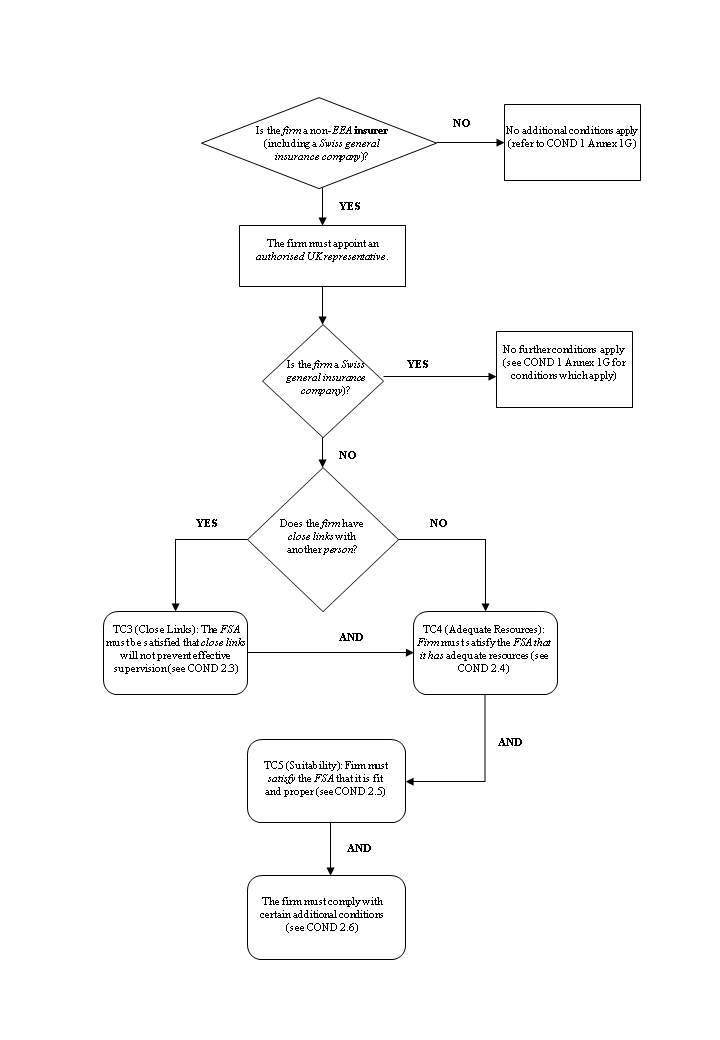

COND 1 Annex 2

Overview of the threshold conditions (COND 1.3.1 G) applicable to Non-EEA Insurers

- 01/12/2004

See Notes

- 03/09/2001

COND 2

The threshold conditions

COND 2.1

Threshold condition 1: Legal status

- 01/12/2004

COND 2.1.1

See Notes

Paragraph 1, Schedule 6 to the Act

| (1) | If the regulated activity concerned is the effecting or carrying out of contracts of insurance the authorised person must be a body corporate (other than a limited liability partnership), a registered friendly society or a member of Lloyd's. | |

| (2) | If the person concerned appears to the [FSA] to be seeking to carry on, or to be carrying on, a regulated activity constituting accepting deposits or issuing electronic money, it must be- | |

| (a) | a body corporate; or | |

| (b) | a partnership. | |

COND 2.1.2

See Notes

- 06/11/2008

- Past version of COND 2.1.2 before 06/11/2008

COND 2.1.3

See Notes

- 27/04/2002

COND 2.2

Threshold condition 2: Location of offices

- 31/12/2004

COND 2.2.1

See Notes

Paragraph 2, Schedule 6 to the Act.

| (1) | Subject to sub-paragraphs 1(A) and (3), if the person concerned is a body corporate constituted under the law of any part of the United Kingdom - | |

| (a) | its head office, and | |

| (b) | if it has a registered office, that office, must be in the United Kingdom. | |

| (1A) | If - | |

| (a) | the regulated activity concerned is any of the investment services and activities, and | |

| (b) | the person concerned is a body corporate with no registered office, | |

| sub-paragraph (1B) applies in place of sub-paragraph (1). | ||

| (1B) | If the person concerned has its head office in the United Kingdom, it must carry on business in the United Kingdom. | |

| (2) | If the person concerned has its head office in the United Kingdom but is not a body corporate, it must carry on business in the United Kingdom. | |

| (3) | If the regulated activity concerned is an insurance mediation activity, sub-paragraph (1) does not apply. | |

| (4) | If the regulated activity concerned is an insurance mediation activity, the person concerned - | |

| (a) | if he is a body corporate constituted under the law of any part of the United Kingdom, must have its registered office, or if it has no registered office, its head office, in the United Kingdom; | |

| (b) | if he is a natural person, is to be treated for the purposes of subparagraph (2), as having his head office in the United Kingdom if his residence is situated there. | |

| (5) | "Insurance mediation activity" means any of the following activities - | |

| (a) | dealing in rights under a contract of insurance as agent; | |

| (b) | arranging deals in rights under a contract of insurance; | |

| (c) | assisting in the administration and performance of a contract of insurance; | |

| (d) | advising on buying or selling rights under a contract of insurance; | |

| (e) | agreeing to do any of the activities specified in sub-paragraph (a) to (d). | |

| (6) | Paragraph (5) must be read with - | |

| (a) | section 22; | |

| (b) | any relevant order under that section; and | |

| (c) | Schedule 2. | |

| [Note: article 5(4) of MiFID] | ||

- 06/02/2008

- Past version of COND 2.2.1 before 06/02/2008

COND 2.2.2

See Notes

- 01/11/2007

- Past version of COND 2.2.2 before 01/11/2007

COND 2.2.3

See Notes

Neither the Post BCCI Directive , MiFID, the Insurance Mediation Directive nor the Act define what is meant by a firm's 'head office'. This is not necessarily the firm's place of incorporation or the place where its business is wholly or mainly carried on. Although the FSA will judge each application on a case-by-case basis, the key issue in identifying the head office of a firm is the location of its central management and control, that is, the location of:

- 01/11/2007

- Past version of COND 2.2.3 before 01/11/2007

COND 2.2A

Threshold condition 2A: Appointment of claims representatives

- 01/12/2004

COND 2.2A.1

See Notes

Paragraph 2A, Schedule 6 to the Act

| Appointment of claims representatives | |||

| 2A | (1) | If it appears to the Authority that - | |

| (a) | the regulated activity that the person concerned is carrying on, or is seeking to carry on, is the effecting or carrying out of contracts of insurance, and | ||

| (b) | contracts of insurance against damage arising out of or in connection with the use of motor vehicles on land (other than carrier's liability) are being, or will be, effected or carried out by the person concerned, | ||

| that person must have a claims representative in each EEA State other than the United Kingdom. | |||

| (2) | For the purposes of sub-paragraph (1)(b), contracts of reinsurance are to be disregarded. | ||

| (3) | A claims representative is a person with responsibility for handling and settling claims arising from accidents of the kind mentioned in Article 1(2) of the fourth motor insurance directive. | ||

| (4) | In this paragraph "fourth motor insurance directive" means Directive 2000/26/EC of the European Parliament and of the Council of 16 May 2000 on the approximation of the laws of the Member States relating to insurance against civil liability in respect of the use of motor vehicles and amending Council Directives 73/239/EEC and 88/357/EEC." | ||

COND 2.2A.2

See Notes

COND 2.2A.3

See Notes

COND 2.3

Threshold condition 3: Close links

- 01/12/2004

COND 2.3.1

See Notes

Paragraph 3, Schedule 6 to the Act.

| (1) | If the person concerned ("A") has close links with another person ("CL"), the [FSA] must be satisfied- | |

| (a) | that those links are not likely to prevent the [FSA's] effective supervision of A; and | |

| (b) | if it appears to the [FSA] that CL is subject to the laws, regulations or administrative provisions of a territory which is not an EEA State ("the foreign provisions"), that neither the foreign provisions, nor any deficiency in their enforcement, would prevent the [FSA's] effective supervision of A. | |

| (2) | A has close links with CL if: | |

| (a) | CL is a parent undertaking of A; | |

| (b) | CL is a subsidiary undertaking of A; | |

| (c) | CL is a parent undertaking of a subsidiary undertaking of A; | |

| (d) | CL is a subsidiary undertaking of a parent undertaking of A; | |

| (e) | CL owns or controls 20% or more of the voting rights or capital of A; or | |

| (f) | A owns or controls 20% or more of the voting rights or capital of CL. | |

| (3) | "Subsidiary undertaking" includes all the instances mentioned in Article 1(1) and (2) of the Seventh Company Law Directive in which an entity may be a subsidiary of an undertaking. | |

- 06/02/2008

- Past version of COND 2.3.1 before 06/02/2008

COND 2.3.2

See Notes

- 03/09/2001

COND 2.3.3

See Notes

In assessing this threshold condition, factors which the FSA will take into consideration include, among other things, whether:

- (1) it is likely that the FSA will receive adequate information from the firm, and those persons with whom the firm has close links, to enable it to determine whether the firm is complying with the requirements and standards under the regulatory system and to identify and assess the impact on the regulatory objectives in section 2 of the Act (The FSA's general duties); this will include consideration of whether the firm is ready, willing and organised to comply with Principle 11 (Relations with regulators and the rules in SUP on the provision of information to the FSA;

- (2) the structure and geographical spread of the firm, the group to which it belongs and other persons with whom the firm has close links, might hinder the provision of adequate and reliable flows of information to the FSA; factors which may hinder these flows include the fact there may be branches or connected companies in territories which supervise companies to a different standard or territories with laws which restrict the free flow of information, although the FSA will consider the totality of information available from all sources;

- (3) the firm and the group to which it belongs are, or will be, subject to supervision on a consolidated basis (consolidated supervision) (for example, if a financial resources requirement is determined for the group as a whole); and

- (4) it is possible to assess with confidence the overall financial position of the group at any particular time; factors which may make this difficult include lack of audited consolidated accounts for a group, if companies in the same group as the firm have different financial years and accounting dates and if they do not share common auditors.

- 31/12/2004

- Past version of COND 2.3.3 before 31/12/2004

COND 2.3.4

See Notes

- 03/09/2001

COND 2.3.5

See Notes

- 03/09/2001

Meaning of "parent undertaking" and "subsidiary undertaking"

COND 2.3.6

See Notes

- (1) Section 420(1) of the Act (Parent and subsidiary undertaking) states that, except in relation to an incorporated friendly society, 'parent undertaking' and 'subsidiary undertaking' have the same meaning as in the Companies Acts (see section 1162 of, and schedule 7 to, the Companies Act 2006). These are the cases referred to in COND 2.3.7 G (1)(a) to (f).

- (2) Section 420(2) of the Act supplements these definitions in two ways; these are the cases referred to in COND 2.3.7 G (1)(g) and (h).

- (3) Paragraph 3(3)of Schedule 6 to the Act extends the meaning of 'subsidiary undertaking' for the purposes of threshold condition 3 (Close links) to all the cases in articles 1(1) and (2) of the Seventh Company Law Directive in which one undertaking may be a subsidiary of another undertaking (see COND 2.3.11 G).

- 01/10/2009

- Past version of COND 2.3.6 before 01/10/2009

COND 2.3.7

See Notes

- (1) For the purposes of threshold condition 3 (Close links) and except in relation to an incorporated friendly society, an undertaking is a parent undertaking of another undertaking (a subsidiary undertaking) if any of the following apply to it:

- (a) it holds a majority of the voting rights in the subsidiary undertaking; or

- (b) it is a member of the subsidiary undertaking and has the right to appoint or remove a majority of its board of directors; or

- (c) it has the right to exercise a dominant influence over the subsidiary undertaking through:

- (i) provisions contained in the subsidiary undertaking's memorandum or articles; or

- (ii) a control contract; or

- (d) it is a member of the subsidiary undertaking and controls alone, under an agreement with other shareholders or members, a majority of the voting rights in the subsidiary undertaking; or

- (e) it has the power to exercise, or actually exercises, dominant influence or control over it, or it and the subsidiary undertaking are managed on a unified basis; or

- (f) it is a parent undertaking of a parent undertaking of the subsidiary undertaking; or

- (g) it is an individual and would be a parent undertaking if it were an undertaking; or

- (h) it is incorporated in or formed under the law of another EEA State and is a parent undertaking within the meaning of any rule of law in that State for purposes connected with implementation of the Seventh Company Law Directive.

- (2) A flowchart of COND 2.3.7 G (1) is set out in COND 2 Annex 1.

- 01/06/2010

- Past version of COND 2.3.7 before 01/06/2010

COND 2.3.8

See Notes

- (1) In relation to COND 2.3.7 G (1)(b) and (d), an undertaking is treated as a member of another undertaking if any of its subsidiary undertaking is a member of that undertaking, or if any shares in that other undertaking are held by a person acting on behalf of the undertaking or any of its subsidiary undertakings.

- (2) [deleted]

- (3) [deleted]

- 01/06/2010

- Past version of COND 2.3.8 before 01/06/2010

COND 2.3.9

See Notes

- 01/10/2009

- Past version of COND 2.3.9 before 01/10/2009

COND 2.3.10

See Notes

Section 420(3) of the Act (Parent and subsidiary undertaking) (supplemented by paragraph 3(3) of Schedule 6 to the Act) states that an incorporated friendly society is a parent undertaking of another body corporate (a subsidiary undertaking) if it has the following relationship to it:

- (1) it holds a majority of the voting rights in the subsidiary undertaking; or

- (2) it is a member of the subsidiary undertaking and has the right to appoint or remove a majority of the subsidiary undertaking's board of directors; or

- (3) it is a member of the subsidiary undertaking and controls alone, under an agreement with other shareholders or members, a majority of the voting rights in it.

- 03/09/2001

COND 2.3.11

See Notes

For the purposes of this threshold condition 3 (Close links), an undertaking is a subsidiary undertaking of another undertaking if:

- (1) the other undertaking (its parent) is a member of the undertaking;

- (2) a majority of the undertaking's board of directors who have held office during the financial year and during the preceding financial year have been appointed solely as a result of the exercise of the parent's voting rights; and

- (3) no one else is the parent undertaking of the undertaking under COND 2.3.7 G (1)(a) or COND 2.3.10 G (1).

- 03/09/2001

COND 2.3.11A

See Notes

- 01/06/2010

COND 2.3.12

See Notes

COND 2.4

Threshold condition 4: Adequate resources

- 01/12/2004

COND 2.4.1

See Notes

Paragraph 4, Schedule 6 to the Act

| (1) | The resources of the person concerned must, in the opinion of the [FSA], be adequate in relation to the regulated activities that he seeks to carry on, or carries on. | ||

| (2) | In reaching that opinion, the [FSA] may- | ||

| (a) | take into account the person's membership of a group and any effect which that membership may have; and | ||

| (b) | have regard to- | ||

| (i) | the provision he makes and, if he is a member of a group, which other members of the group make in respect of liabilities (including contingent and future liabilities); and | ||

| (ii) | the means by which he manages and, if he is a member of a group, which other members of the group manage the incidence of risk in connection with his business. | ||

- 06/02/2008

- Past version of COND 2.4.1 before 06/02/2008

COND 2.4.2

See Notes

- (1) Threshold condition 4 (Adequate resources), requires the FSA to ensure that a firm has adequate resources in relation to the specific regulated activity or regulated activities which it seeks to carry on, or carries on.

- (2) In this context, the FSA will interpret the term 'adequate' as meaning sufficient in terms of quantity, quality and availability, and 'resources' as including all financial resources, non-financial resources and means of managing its resources; for example, capital, provisions against liabilities, holdings of or access to cash and other liquid assets, human resources and effective means by which to manage risks.

- (3) High level systems and control requirements are in SYSC. Detailed financial resources and systems requirements are in the relevant section of the Prudential Standards part of the Handbook , including specific provisions for particular types of regulated activity. The FSA will consider whether the firm is ready, willing and organised to comply with these requirements when assessing if it has adequate resources for the purposes of this threshold condition.

- 31/12/2006

- Past version of COND 2.4.2 before 31/12/2006

COND 2.4.3

See Notes

- (1) When assessing this threshold condition, the FSA may have regard to any person appearing to it to be, or likely to be, in a relevant relationship with the firm, in accordance with section 49 of the Act (Persons connected with an applicant); for example, a firm's controllers, its directors or partners, other persons with close links to the firm (see COND 2.3), and other persons that exert influence on the firm which might pose a risk to the firm's satisfaction of the threshold conditions and would, therefore, be in a relevant relationship with the firm.

- (2) In particular, although it is the firm that is being assessed, the FSA may take into consideration the impact of other members of the firm's group on the adequacy of its resources. For example, the FSA may assess the consolidated solvency of the group. The FSA's approach to the consolidated supervision of a firm and its group, is in the relevant part of the Prudential Standards part of the Handbook.

- 31/12/2006

- Past version of COND 2.4.3 before 31/12/2006

COND 2.4.4

See Notes

- (1) When assessing whether a firm will satisfy and continue to satisfy threshold condition 4, the FSA will have regard to all relevant matters, whether arising in the United Kingdom or elsewhere.

- (2) Relevant matters may include but are not limited to:

- (a) whether there are any indications that the firm may have difficulties if the application is granted (see COND 2.4.6 G), at the time of the grant or in the future, in complying with any of the FSA's prudential rules (see the relevant part of the Prudential Standards part of the Handbook );

- (b) whether there are any indications that the firm will not be able to meet its debts as they fall due;

- (c) whether there are any implications for the adequacy of the firm's resources arising from the history of the firm; for example, whether the firm has:

- (i) been adjudged bankrupt; or

- (ii) entered into liquidation; or

- (iii) been the subject of a receiving or administration order; or

- (iv) had a bankruptcy or winding-up petition served on it; or

- (v) had its estate sequestrated; or

- (vi) entered into a deed of arrangement or an individual voluntary agreement (or in Scotland, a trust deed) or other composition in favour of its creditors, or is doing so; or

- (vii) within the last ten years, failed to satisfy a judgment debt under a court order, whether in the United Kingdom or elsewhere;

- (d) whether the firm has taken reasonable steps to identify and measure any risks of regulatory concern that it may encounter in conducting its business (see COND 2.4.6 G) and has installed appropriate systems and controls and appointed appropriate human resources to measure them prudently at all times.; see SYSC 3.1 (Systems and Controls), SYSC 3.2 (Areas covered by systems and controls) and SYSC 4.1.1 R (Organisational requirements); and

- (e) whether the firm has conducted enquiries into the financial services sector in which it intends to conduct business (see COND 2.4.6 G) that are sufficient to satisfy itself that:

- (i) it has access to adequate capital, by reference to the FSA's prudential requirements, to support the business including any losses which may be expected during its start-up period; and

- (ii) Client money, deposits, custody assets and policyholders' rights will not be placed at risk if the business fails.

- (3) In the context of threshold condition 4 (Adequate resources), the FSA will only take into account relevant matters which are material (see COND 1.3.3 G). The FSA will consider the materiality of each relevant matter in relation to the regulated activities for which the firm has, or will have, permission, having regard to the regulatory objectives in section 2 of the Act (The FSA's general duties). It should be noted that a series of matters may be significant when taken together, even if each of them in isolation might not be significant.

- (4) In making its assessment, the FSA will consider the individual circumstances of each firm on a case-by-case basis.

- 01/01/2007

- Past version of COND 2.4.4 before 01/01/2007

COND 2.4.5

See Notes

- 01/01/2007

- Past version of COND 2.4.5 before 01/01/2007

COND 2.4.6

See Notes

- (1) Any newly-formed firm can be susceptible to early difficulties. These difficulties could arise from a lack of relevant expertise and judgment, or from ill-constructed and insufficiently tested business strategies. A firm may also be susceptible to difficulties where it substantially changes its business activities.

- (2) As a result, the FSA would expect a firm which is applying for Part IV permission, or a substantial variation of that permission, to take adequate steps to satisfy itself and, if relevant, the FSA that:

- (a) it has a well constructed business plan or strategy plan for its product or service which demonstrates that it is ready, willing and organised to comply with the relevant requirements in the Prudential Standards part of the Handbook and SYSC that apply to the regulated activity it is seeking to carry on;

- (b) its business plan or strategy plan has been sufficiently tested; and

- (c) the financial and other resources of the firm are commensurate with the likely risks it will face.

- (3) The FSA would expect the level of detail in a firm's business plan or strategy plan in (2) to be appropriate to the complexity of the firm's proposed regulated activities and unregulated activities and the risks of regulatory concern it is likely to face (see SYSC 3.2.11 G (Management information) and SYSC 7 (Risk control). Notes on the contents of a business plan are given in the business plan section of the application pack for Part IV permission. A firm requiring specific guidance on the contents and level of detail of its business plan should contact the Firm Contact Centre (020 7066 3954), or, if relevant, its usual supervisory contact at the FSA, or seek professional assistance.

- 06/10/2007

- Past version of COND 2.4.6 before 06/10/2007

COND 2.5

Threshold condition 5: Suitability

- 01/12/2004

COND 2.5.1

See Notes

Paragraph 5, Schedule 6 to the Act

| The person concerned must satisfy the [FSA] that he is a fit and proper person having regard to all the circumstances, including- | |

| (a) | his connection with any person; |

| (b) | the nature of any regulated activity that he carries on or seeks to carry on; and |

| (c) | the need to ensure that his affairs are conducted soundly and prudently. |

- 06/02/2008

- Past version of COND 2.5.1 before 06/02/2008

COND 2.5.2

See Notes

- (1) Threshold condition 5 (Suitability), requires the firm to satisfy the FSA that it is 'fit and proper' to have Part IV permission having regard to all the circumstances, including its connections with other persons, the range and nature of its proposed (or current) regulated activities and the overall need to be satisfied that its affairs are and will be conducted soundly and prudently (see also PRIN and SYSC).

- (2) The FSA will also take into consideration anything that could influence a firm's continuing ability to satisfy this threshold condition. Examples include the firm's position within a UK or international group, information provided by overseas regulators about the firm, and the firm's plans to seek to vary its Part IV permission to carry on additional regulated activities once it has been granted that permission by the FSA.

- 03/09/2001

COND 2.5.3

See Notes

- (1) The emphasis of this threshold condition is on the suitability of the firm itself. The suitability of each person who performs a controlled function will be assessed by the FSA under the approved persons regime (see SUP 10 (Approved persons) and FIT). In certain circumstances, however, the FSA may consider that the firm is not suitable because of doubts over the individual or collective suitability of persons connected with the firm.

- (2) When assessing this threshold condition in relation to a firm, the FSA may have regard to any person appearing to it to be, or likely to be, in a relevant relationship with the firm, as permitted by section 49 of the Act (Persons connected with an applicant) (see COND 2.4.3 G).

- (3) In relation to a firm which is an EEA regulated entity, the Financial Groups Directive provides that the FSA should consult other competent authorities when assessing the suitability of the shareholders and the reputation and experience of directors involved in the management of another entity in the same group.

- 06/10/2007

- Past version of COND 2.5.3 before 06/10/2007

COND 2.5.4

See Notes

- (1) When determining whether the firm will satisfy and continue to satisfy threshold condition 5, the FSA will have regard to all relevant matters, whether arising in the United Kingdom or elsewhere.

- (2) Relevant matters include, but are not limited to, whether a firm:

- (a) conducts, or will conduct, its business with integrity and in compliance with proper standards;

- (b) has, or will have, a competent and prudent management; and

- (c) can demonstrate that it conducts, or will conduct, its affairs with the exercise of due skill, care and diligence.

- (3) The FSA will take into account relevant matters only to the extent that they are significant (see COND 1.3.3 G). In determining whether relevant matters are significant to the firm, the FSA will consider significance in the context of the suitability of the firm, having regard to the regulatory objectives in section 2 of the Act (The FSA's general duties); a series of matters may be significant when taken together, even if each of them in isolation may not be significant.

- (4) In making its assessment, the FSA will, therefore, consider the individual circumstances of each firm on a case-by-case basis.

- 03/09/2001

COND 2.5.5

See Notes

- 03/09/2001

Conducting business with integrity and in compliance with proper standards

COND 2.5.6

See Notes

In determining whether a firm will satisfy, and continue to satisfy, threshold condition 5 in respect of conducting its business with integrity and in compliance with proper standards, the relevant matters, as referred to in COND 2.5.4 G (2), may include but are not limited to whether:

- (1) the firm has been open and co-operative in all its dealings with the FSA and any other regulatory body (see Principle 11 (Relations with regulators)) and is ready, willing and organised to comply with the requirements and standards under the regulatory system and other legal, regulatory and professional obligations; the relevant requirements and standards will depend on the circumstances of each case, including the regulated activities which the firm has permission, or is seeking permission, to carry on;

- (2) the firm has been convicted, or is connected with a person who has been convicted, of any criminal offence; this must include, where provided for by the Exceptions Order to the Rehabilitation of Offenders Act 1974 , any spent convictions; particular consideration will be given to offences of dishonesty, fraud, financial crime or an offence whether or not in the United Kingdom or other offences under legislation relating to companies, building societies, industrial and provident societies, credit unions, friendly societies, banking and or other financial services, insolvency, consumer credit companies, insurance, and consumer protection, money laundering, market manipulation or insider dealing ;

- (3) the firm has been the subject of, or connected to the subject of, any existing or previous investigation or enforcement proceedings by the FSA, the Society of Lloyd's or by other regulatory authorities (including the FSA's predecessors), clearing houses or exchanges, professional bodies or government bodies or agencies; the FSA will, however, take both the nature of the firm's involvement in, and the outcome of, any investigation or enforcement proceedings into account in determining whether it is a relevant matter;

- (4) the firm has contravened, or is connected with a person who has contravened, any provisions of the Act or any preceding financial services legislation, the regulatory system or the rules, regulations, statements of principles or codes of practice (for example the Society of Lloyd's Codes) of other regulatory authorities (including the FSA's predecessors), clearing houses or exchanges, professional bodies, or government bodies or agencies or relevant industry standards (such as the Non-Investment Products Code); the FSA will, however, take into account both the status of codes of practice or relevant industry standards and the nature of the contravention (for example, whether a firm has flouted or ignored a particular code);

- (5) the firm, or a person connected with the firm, has been refused registration, authorisation, membership or licence to carry out a trade, business or profession or has had that registration, authorisation, membership or licence revoked, withdrawn or terminated, or has been expelled by a regulatory or government body; whether the FSA considers such a refusal relevant will depend on the circumstances;

- (6) the firm has taken reasonable care to establish and maintain effective systems and controls for compliance with applicable requirements and standards under the regulatory system that apply to the firm and the regulated activities for which it has, or will have, permission (see SYSC 3.2.6 R to SYSC 3.2.8 R (Compliance) and SYSC 6.1.1 R to SYSC 6.1.5 R and SYSC 6.3);

- (7) the firm has put in place procedures which are reasonably designed to:

- (a) ensure that it has made its employees aware of, and compliant with, those requirements and standards under the regulatory system that apply to the firm and the regulated activities for which it has, or will have permission;

- (b) ensure that its approved persons (whether or not employed by the firm) are aware of those requirements and standards under the regulatory system applicable to them;

- (c) determine that its employees are acting in a way compatible with the firm adhering to those requirements and standards; and

- (d) determine that its approved persons are adhering to those requirements and standards;

- (8) the firm or a person connected with the firm has been dismissed from employment or a position of trust, fiduciary relationship or similar or has ever been asked to resign from employment in such a position; whether the FSA considers a resignation to be relevant will depend on the circumstances, for example if a firm is asked to resign in circumstance that cast doubt over its honesty or integrity; and

- (9) the firm or a person connected with the firm has ever been disqualified from acting as a director.

Competent and prudent management and exercise of due skill, care and diligence

COND 2.5.7

See Notes

In determining whether a firm will satisfy and continue to satisfy threshold condition 5 in respect of having competent and prudent management and exercising due skill, care and diligence, relevant matters, as referred to in COND 2.5.4 G (2), may include, but are not limited to whether:

- (1) the governing body of the firm is made up of individuals with an appropriate range of skills and experience to understand, operate and manage the firm's regulated activities;

- (2) if appropriate, the governing body of the firm includes non-executive representation, at a level which is appropriate for the control of the regulated activities proposed, for example, as members of an audit committee;

- (3) the governing body of the firm is organised in a way that enables it to address and control the regulated activities of the firm, including those carried on by managers to whom particular functions have been delegated (see SYSC 2.1 (Apportionment of responsibilities) and SYSC 3.2 (Areas covered by systems and controls) and SYSC 4.1.1 R (General organisational requirements));

- (4) those persons who perform controlled functions under certain arrangements entered into by the firm or its contractors (including appointed representatives or, where applicable, tied agents) act with due skill, care and diligence in carrying our their controlled function (see APER 4.2 (Statement of Principle 2) or managing the business for which they are responsible (see APER 4.7 (Statement of Principle 7));

- (5) the firm has made arrangements to put in place an adequate system of internal control to comply with the requirements and standards under the regulatory system (see SYSC 3.1 (Systems and Controls) and SYSC 4.1 (General organisational requirements));

- (6) the firm has approached the control of financial and other risk in a prudent manner (for example, by not assuming risks without taking due account of the possible consequences) and has taken reasonable care to ensure that robust information and reporting systems have been developed, tested and properly installed (see SYSC 3.2.10 G (Risk assessment) and SYSC 7.1 (Risk control));

- (7) the firm, or a person connected with the firm, has been a director, partner or otherwise concerned in the management of a company, partnership or other organisation or business that has gone into insolvency, liquidation or administration while having been connected with that organisation or within one year of such a connection;

- (8) the firm has developed human resources policies and procedures that are reasonably designed to ensure that it employs only individuals who are honest and committed to high standards of integrity in the conduct of their activities (see, for example, SYSC 3.2.13 G (Employees and agents) and SYSC 5.1 (Employees, agents and other relevant persons));

- (9) the firm has conducted enquiries (for example, through market research or the previous activities of the firm) that are sufficient to give it reasonable assurance that it will not be posing unacceptable risks to consumers or the UK financial system;

- (10) the firm has in place systems and controls against money laundering of the sort described in SYSC 3.2.6 R to SYSC 3.2.6J G and SYSC 6.3 (Financial crime);

- (11) where appropriate, the firm has appointed auditors and actuaries, who have sufficient experience in the areas of business to be conducted (see SUP 3.4 (Auditors' qualifications) and SUP 4.3.8 G to SUP 4.3.10 G (Actuary's qualifications)); and

- (12) in the case of a firm that carries on insurance mediation activity:

- (a) a reasonable proportion of the persons within its management structure who are responsible for the insurance mediation activity; and

- (b) all other persons directly involved in its insurance mediation activity;

- demonstrate the knowledge and ability necessary for the performance of their duties; and

- (c) all the persons in its management structure and any staff directly involved in insurance mediation activity are of good repute (see MIPRU 2.3.1 R (Knowledge, ability and good repute)).

- 06/08/2010

- Past version of COND 2.5.7 before 06/08/2010

COND 2.6

Additional conditions

- 01/12/2004

COND 2.6.1

See Notes

| Paragraph 8 of Schedule 6 to the Act | |||||

| (1) | If this paragraph applies to the person concerned, he must, for the purposes of such provisions of this Act as may be specified, satisfy specified additional conditions. | ||||

| (2) | This paragraph applies to a person who: | ||||

| (a) | has his head office outside the EEA; and | ||||

| (b) | appears to the [FSA] to be seeking to carry on a regulated activity relating to insurance business. | ||||

| Article 3 of the financial services and Markets Act 2000 (Variation of Threshold Conditions ) Order 2001 (SI 2001/2507) | |||||

| 3.- | (1) | If paragraph 8 of Schedule 6 (additional conditions applying to non-EEA insurers) applies to the person concerned, it must, for the purposes of section 41 and Schedule 6, satisfy the following additional conditions - | |||

| (a) | it must have a representative who is resident in the United Kingdom and who has authority to bind it in its relations with third parties and to represent it in its relations with the [FSA] and the courts in the United Kingdom; | ||||

| (b) | subject to paragraph (2), if the person concerned is not a Swiss general insurance company - | ||||

| (i) | it must be a body corporate entitled under the law of the place where its head office is situated to effect and carry out contracts of insurance; | ||||

| (ii) | it must have in the United Kingdom assets of such value as may be specified; | ||||

| (iii) | unless the regulated activity in question relates solely to reinsurance, it must have made a deposit (of money or securities, as may be specified) of such an amount and with such a person as may be specified, and on such terms and subject to such other provisions as may be specified. | ||||

| (2) | Where the person concerned is seeking to carry on an activity relating to insurance business in one or more other EEA States (as well as in the United Kingdom), and the [FSA] and the supervisory authority in the other EEA State or States concerned so agree - | ||||

| (a) | the reference in paragraph (1)(b)(ii) to the United Kingdom is to be read as a reference to the United Kingdom and the other EEA State or States concerned; and | ||||

| (b) | the reference in paragraph (1)(b)(iii) to such a person as may be specified is to be read as a reference to such a person as may be agreed between the [FSA] and the other supervisory authority or authorities concerned. | ||||

- 06/02/2008

- Past version of COND 2.6.1 before 06/02/2008

COND 2.6.2

See Notes

- 03/09/2001

COND 2.6.3

See Notes

- 03/09/2001

COND 2.6.4

See Notes

- 03/09/2001

COND 2.6.5

See Notes

- (1) A non-EEA insurer must be a body corporate formed under the law of the country where its head office is situated.

- (2) A person seeking to carry on insurance business in the United Kingdom must have assets in the United Kingdom to a value specified in GENPRU. Where the applicant wants to carry on insurance business in other EEA States, the applicant must have assets in those other EEA States as are agreed between the FSA and the supervisory authorities in the other states.

- (3) Unless the regulated activity to be carried on by the applicant relates solely to reinsurance business, the applicant must make a deposit of an amount, and type and on terms with a person and agreed between the FSA and the supervisory authorities in other EEA States where the applicant wishes to carry on insurance business. This deposit will be subject to provisions in INSPRU 1.5.

- 31/12/2006

- Past version of COND 2.6.5 before 31/12/2006

COND 2.6.6

See Notes

- 31/12/2004

COND 2 Annex 1

The threshold conditions

- 01/12/2004

Export chapter as

Transitional Provisions and Schedules

COND TP 1

- 01/12/2004

COND Sch 1

Record keeping requirements

- 01/12/2004

COND Sch 1.1

See Notes

| There are no record keeping requirements in COND. |

- 01/12/2004

COND Sch 2

Notification requirements

- 01/12/2004

COND Sch 2.1

See Notes

| There are no notification rules in COND but guidance is given in COND 1.3.3 G on disclosure to the FSA in connection with applications. |

- 01/12/2004

COND Sch 3

Fees and other required payments

- 01/12/2004

COND Sch 3.1

See Notes

| There are no requirements for fees or other payments in COND. |

- 01/12/2004

COND Sch 4

Powers exercised

- 01/12/2004

COND Sch 4.1

See Notes

- 01/12/2004

COND Sch 5

Rights of action for damages

- 01/12/2004

COND Sch 5.1

See Notes

| There are no rules in COND. |

- 01/12/2004

COND Sch 6

Rules that can be waived

- 01/12/2004