1

Introduction

1.1

This supervisory statement (SS) applies to Capital Requirements Regulation (CRR) firms (hereafter, ‘firms’) and CRR consolidation entities on an individual, consolidated, and where relevant, sub-consolidated basis. The purpose of this SS is to give guidance on the UK leverage ratio capital requirements and buffers for firms in scope of the leverage ratio capital requirement, and to set out the Prudential Regulatory Authority’s (PRA) expectation as to how other firms will manage their risk of excessive leverage. It also provides guidance on the methodology for additional reporting and disclosure of an averaged leverage ratio for firms in scope of the leverage ratio capital requirement. It should be read alongside the Leverage Ratio – Capital Requirements and Buffers, Leverage Ratio (CRR), Disclosure (CRR), Reporting (CRR) and Internal Capital Adequacy Assessment Parts of the PRA Rulebook.

- 05/08/2024

1.A

Overview – the UK leverage ratio

1.A.1

The Leverage Ratio – Capital Requirements and Buffers Part applies to the following firms on the following bases:

- i. All firms with retail deposits equal to or greater than £50 billion or foreign assets equal to or greater than £10 billion, when calculated on an individual basis are in scope.4 Such firms must comply with the Part on an individual basis (subject to section 4 below), unless they are otherwise subject to the Part on the basis of their own consolidated situation because they are either: CRR consolidation entities referred to in (ii); or a ring fenced body identified in (iii) that is the ultimate parent within its RFB sub-group.

- ii. CRR consolidation entities meeting either threshold referred to in (i) above on the basis of their consolidated situations are in scope. They must comply with the Part on a consolidated basis.5

- iii. Ring-fenced bodies that have been required by the PRA to comply with the CRR on an RFB sub-consolidated basis and whose RFB sub-group meets either threshold referred to in (i) above on an RFB sub-consolidated basis are in scope. They must comply with the requirement on the same RFB sub-consolidated basis that they are required to comply with the CRR.

Footnotes

- 4. For this purpose, foreign assets means financial assets for which the counterparty is resident in a country or territory outside the UK, as reported in LV44, line 0050.

- 5. Where necessary for this purpose, references in this SS to firm, should be read as including a CRR consolidation entity.

- 05/08/2024

1.A.2

The minimum leverage ratio capital requirement, which must be met at all times, is 3.25% of the leverage exposure measure (LEM) defined in the Leverage Ratio (CRR) Part of the PRA Rulebook. The LEM excludes assets constituting claims on central banks, where they are matched by liabilities, denominated in the same currency and of identical or longer maturity. Further conditions apply where claims on central banks are held in omnibus accounts – these are described in Chapter 7. Mirroring the risk-weighted capital framework, three quarters of this requirement must be met with Common Equity Tier 1 (CET1) capital instruments. The requirement must otherwise be met with Tier 1 capital, but additional Tier 1 capital must have a conversion trigger in relation to a firm’s risk-weighted CET1 ratio of at least 7% in order to count towards the leverage ratio minimum. CRR transitional measures affecting Tier 1 capital apply to the definition of Tier 1 for the purposes of the leverage ratio, including the IFRS 9 transitional the PRA encouraged firms to use as part of the Covid-19 response,6 and the continued eligibility of certain AT1 instruments.7

Footnotes

- 6. Article 473a of the CRR.

- 7. Article 494b of the CRR.

- 05/08/2024

1.A.3

Firms in scope of the leverage ratio minimum capital requirement are subject to buffers in addition to this minimum. These buffers must be met with CET1 resources and are set out in more detail in Chapter 2.

- 05/08/2024

1.A.4

Firms that are not in scope of the leverage ratio requirement are nevertheless expected to manage their leverage risk so that their leverage ratio – to be calculated based on the same rules as the in-scope firms - does not ordinarily fall below 3.25%. This PRA expectation is further described in Chapter 5.

- 05/08/2024

2

Leverage Ratio Buffers

2.A

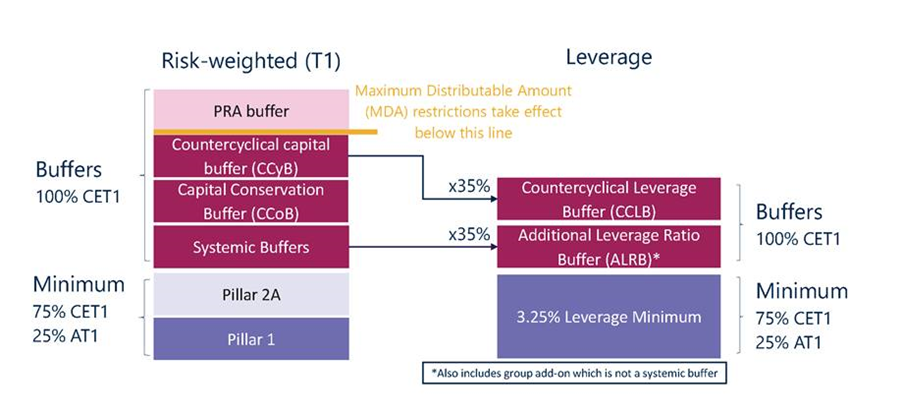

There are two buffers in the leverage ratio framework, and an add-on. The buffers are:

- i. the countercyclical leverage ratio buffer (CCLB); and

- ii. the additional leverage ratio buffer (ALRB) to reflect systemic importance.

- 05/08/2024

2.B

The CCLB and ALRB are intended to make the leverage ratio framework equally resilient relative to the risk-weighted framework (i) over the cycle and (ii) for systemic and non-systemic firms. As a result, they are scaled at 35% of their risk-weighted equivalents with the CCLB rate percentage rounded to the nearest 10 basis points.

- 05/08/2024

2.C

The leverage ratio buffers must be met with CET1 resources. The PRA requires firms not to double count CET1 towards the CCLB, the ALRB, and the minimum capital requirement. If a firm does not hold an amount of CET1 capital that is equal to or greater than the sum of its ALRB, CCLB and the CET1 component of its minimum requirement, it will be required to notify the PRA in accordance with Leverage Ratio – Capital Requirements and Buffers 5.1 and prepare a capital plan and submit it to the PRA, including the information required in Leverage Ratio – Capital Requirements and Buffers 6.2.

- 05/08/2024

Figure 1 The Tier 1 Risk Weighted and Leverage Capital Stacks

2.1

Firms that do not hold an amount of CET1 equal to or greater than their applicable leverage ratio buffers will not face automatic restrictions on their distributions.

- 05/08/2024

2.2

[Deleted]

- 05/08/2024

2.3

The ALRB is firm specific, and scaled relative to systemic buffers. Where applicable to a firm, the ALRB and related reporting and disclosure requirements will be set by the PRA using its powers under section 55M of the Financial Services and Markets Act (2000), and will incorporate the ALRB Model Requirements.8 Where applicable to an approved holding company, the ALRB and related reporting and disclosure requirements will be set by the PRA using its powers under section 192C of the Financial Services and Markets Act (2000), and will incorporate the ALRB Model Requirements. Where a firm is subject to both a G-SII buffer and an O-SII buffer on the same basis of consolidation, the higher of the two buffers shall apply for the purpose of calculating the ALRB.

Footnotes

- 8. Current version available at: https://www.bankofengland.co.uk/prudential-regulation/publication/2020/vreq-additional-leverage-buffers-model-requirements.

- 05/08/2024

2.3A

The PRA considers that ring-fenced body (RFB) group risk9 may arise when an RFB is subject to the ALRB at the level of the RFB sub-group,10 but the consolidated group is either not subject to the ALRB, or its consolidated ALRB rate is lower than the ALRB rate applicable to the RFB sub-group. The PRA expects firms to take this RFB group risk into account by holding additional capital (the ‘Leverage Ratio Group Add-on’) on a consolidated basis. This is to ensure there is sufficient capital within the consolidated group, and distributed appropriately across it, to address both global systemic risks and domestic systemic risks. Where the ALRB applicable on a sub-consolidated basis for the RFB sub-group is higher than the RFB sub-group’s share of the ALRB on a consolidated basis, the difference will generally be reflected in the Leverage Ratio Group Add-on, in order to take account of the associated RFB group risk at the consolidated group level. The PRA calculates the ‘Leverage Ratio Group Add-on’ as the positive difference between the ALRB set for the RFB at a subconsolidated level, and (if any) the ALRB set for the consolidated group at a consolidated level, scaled by the relative size of the RFB sub-group in terms of its LEM. This add-on is expressed in percentage points. The ALRB is floored at zero. The formula is as follows:

Footnotes

- 9. Group risk, as defined in the PRA Rulebook (Internal Capital Adequacy Assessment 1.2), means the risk that the financial position of a firm may be adversely affected by its relationships (financial or non-financial) with other entities in the same group or by risk which may affect the financial position of the whole group, including reputational contagion.

- 10. An RFB sub-group is a subset of related group entities within a consolidated group, consisting of one or more RFBs and other legal entities, which is established when the PRA gives effect to Article 11(5) of the CRR.

- 11. When calculating the RFB LEM for the purpose of the LR Group Add-on, exposures of the RFB subgroup to group entities that are not members of the RFB subgroup can be excluded.

- 05/08/2024

2.3B

The PRA will notify the firm of the amount of any Leverage Ratio Group Add-on it is expected to hold in addition to its minimum leverage ratio requirement, CCLB and ALRB (where applicable). The PRA will update this on a regular basis. Firms will be expected to meet the Leverage Ratio Group Add-on with CET1 capital that shall be in addition to any CET1 capital maintained to meet the minimum leverage ratio, CCLB and ALRB. Consistent with Fundamental Rule 7, a firm should notify the PRA if a firm’s capital has fallen or is expected to fall below the level necessary to meet the Leverage Ratio Group Add-on.

- 05/08/2024

2.4

Where a firm is using its buffers, the PRA will assess a firm’s capital plan to determine whether, if implemented, it would be reasonably likely to secure that the amount of the firm’s CET1 will be equal to or greater than the firm’s leverage ratio buffers within a period which the PRA considers appropriate. When exercising its judgement on what constitutes a reasonable time to rebuild buffers drawn down in stress, the PRA will take into account the drivers of the firm’s shortfall, including in the context of current and forecasted macroeconomic and financial conditions.

- 05/08/2024

2.5

In determining the appropriate period for a firm to satisfy its CCLB when that has been raised, the PRA will have regard to the period of time the firm has to meet the associated increase in its Countercyclical Capital Buffer (CCyB) rate(s). The PRA expects any increase in the CCLB rate to follow the transitional periods set for the increase in the relevant CCyB rate(s), which will generally become effective twelve months after an announcement. This approach would ensure consistency and complementarity between the CCyB and CCLB.

- 05/08/2024

2.6

When calculating its CCLB, a firm is expected to take into account any decrease in relevant CCyB rate(s) immediately.

- 05/08/2024

3

Averaged leverage ratio calculation

3.A

All firms are required to report and disclose their leverage ratios as per the Reporting (CRR) and Disclosure (CRR) Parts of the PRA Rulebook (see Chapter 6 below). The guidance in this section relates to the additional requirements for reporting and disclosure of averaged leverage metrics that apply only to firms in scope of the leverage ratio minimum requirement.

- 05/08/2024

3.1

The PRA expects firms not to engage in short-term balance sheet management activities with a view to boosting their leverage ratio temporarily at any point in time.

- 05/08/2024

3.2

For the purpose of calculating an averaged leverage ratio over a quarter, the PRA rules12 require firms to calculate the exposure measure based on:

- daily on-balance sheet assets and securities financing transactions (SFT) exposures averaged over the quarter; and

- end-of-month exposures averaged over the quarter for the remaining off-balance sheet items.

The capital measure and relevant deductions and adjustments should be calculated based on end-of-month averages.

Footnotes

- 12. As per the second subparagraph of Article 430(2A) and Article 451(4) of the CRR.

- 05/08/2024

3.3

During the transitional period for daily averaging of SFT exposures up to Sunday 1 January 2023, the PRA permits firms to calculate the exposure measure based on:13

- daily on-balance sheet assets averaged over the quarter; and

- end-of-month off-balance sheet exposures, including off-balance sheet SFT exposures, averaged over a quarter.

The capital measure and relevant deductions and adjustments should be calculated based on end-of-month averages. The same methodology should apply to the computation of the averaged leverage ratio disclosed during the transitional period for disclosures.

Footnotes

- 13. As defined in the third subparagraph of Article 430(2A) and Article 451(5) of the CRR, applicable until Sunday 1 January 2023.

- 05/08/2024

3.4

The PRA recognises that there might be difficulties in valuing certain accounting assets at the end of each day and therefore intends to adopt a pragmatic approach to the implementation of the averaging requirement. The PRA considers that ‘best estimates’ are acceptable so long as they are measured consistently and prudently. For the purpose of daily valuation of on-balance sheet assets and SFT exposures, firms should apply methodologies and a valuation basis that are consistent with those used for quarter-end reporting. The PRA expects firms to have appropriate governance and procedures to ensure the accuracy and representativeness of the averaged leverage ratio and its components which are reported and disclosed. Firms should provide an explanation of the assumptions used in their calculations.

- 05/08/2024

4

Sub-consolidation as an alternative to application on the individual basis

4.1

For firms that are subject to the leverage ratio capital requirement on an individual basis, the PRA will consider on a case-by-case basis replacing that requirement with a sub-consolidated requirement where a firm has subsidiaries that can be consolidated. In such cases, a firm may apply to the PRA for a permission under section 144G of FSMA that (i) dis-applies the requirements on an individual basis; and (ii) provides for the requirements to apply on a sub-consolidated basis in relation to the firm, with such modifications as may be specified in that permission. Even in such cases, however, individual requirements would continue to apply to subsidiary firms meeting one of the thresholds within the proposed sub-consolidation group. In the PRA’s approach, individual capital requirements ensure that capital can absorb losses where they occur. In the case of internationally active firms, this is also a Basel requirement.

- 05/08/2024

4.2

The PRA will consider the following conditions to assess whether to grant the application:

- (i) the entities within the proposed sub-consolidation must be subsidiaries (as defined in the CRR) of the firm that is the ultimate parent of the sub-consolidation group. For example, this condition would be fulfilled when the firm at the top of the sub-consolidation group holds the majority of voting rights in the subsidiary undertaking, or is a member of the undertaking and has the right to appoint or remove a majority of the members of the management body of the subsidiary, or otherwise exercises dominant influence over the subsidiary undertaking, or it and the subsidiary undertaking are managed on an unified basis. The same conditions need to apply to all subsidiaries at each level of the sub-consolidation group;

- (ii) evidence that leverage ratio risks and capital can effectively be managed and reported at sub-consolidated level: risk evaluation, measurement, and control procedures of the parent undertaking should cover the subsidiary, and the firm should be able to calculate the leverage ratio requirement and buffers (including a sub-consolidated CCyB rate) at sub-consolidated level;

- (iii) evidence that effective governance is in place for the sub-group: the governance structure clearly allocates responsibilities for risk and capital decisions at sub-consolidated level for the firms included in the sub-consolidation; and

- (iv) effective supervisory cooperation, including information exchange, in the countries where the subsidiaries are located, and transparent regulation / adherence to Basel standards. This would allow the inclusion of US and EU subsidiaries, for example.

- 05/08/2024

4.3

The PRA would specify the scope of the sub-consolidation group in the permission and may also consider withdrawing this permission when the conditions are not fulfilled anymore.

- 05/08/2024

4.4

With regard to condition (iv), i.e. that there be effective supervisory cooperation, including information exchange, in the countries where the subsidiaries are located, and transparent regulation and adherence to Basel standards, the PRA intends to rely as much as possible on the assessments of equivalence and supervisory cooperation made by PRA in relation to international banks, as set out in SS5/21.14 The PRA would base its analysis on a range of sources, which include the Basel capital and group supervision standards, the Basel Committee’s Regulatory Consistency Assessment Programme reviews,15 the International Monetary Fund’s Financial Sector Assessment Programme reviews,16 and the Financial Stability Board’s (FSB) peer reviews17 where appropriate, supplemented by other sources as necessary. The PRA will also take account of its own experiences in its interactions with the home state supervisors. It will also be important for the PRA to factor in any conduct concerns that the FCA may raise concerning a jurisdiction.

Footnotes

- 14. SS5/21 - International banks: The PRA’s approach to branch and subsidiary supervision | Bank of England.

- 15. November 2019: https://www.bis.org/bcbs/publ/d482.htm.

- 16. Financial Sector Assessment Program (FSAP) (imf.org).

- 17. Peer Reviews - Financial Stability Board (fsb.org).

- 05/08/2024

4.5

The PRA’s assessment on supervisory cooperation will also be informed by the existence of a memorandum of understanding (MoU) between the PRA and the supervisory authority in the foreign jurisdiction.18 Such MoUs establish a formal basis for: co-operation, including the exchange of information and investigative assistance; the facilitation of timely and effective supervision; and the identification of risks to the financial system, including emergency situations. Further, the assessment would be informed by adherence to the principles in the following Bank for International Settlements publications: ‘High-level principles for the cross-border implementation of the New Accord’,19 ‘Principles for effective supervisory colleges’,20 and Principle 13: Home-host relationships in ‘Core Principles for Effective Banking Supervision’.21

Footnotes

- 18. The PRA has entered into a new MoU with the European Banking Authority (EBA), and MoUs with other competent authorities in the European Economic Area (EEA), to facilitate continued supervisory co-operation and information sharing. All current MoUs are available here: https://www.bankofengland.co.uk/about/governance-and-funding.

- 19. August 2003: https://www.bis.org/publ/bcbs100.htm.

- 20. June 2014: https://www.bis.org/publ/bcbs287.htm.

- 21. September 2012: https://www.bis.org/publ/bcbs230.htm.

- 05/08/2024

4.6

Unregulated subsidiaries, which are not subject to Basel standards within equivalent jurisdictions, would not be excluded a priori. Assessing that a subsidiary meets the relevant conditions for Core and Non-Core Large Exposure Group membership may assist the PRA in its determination of whether sub-consolidation permission should be granted. However, it would not be determinative as they are distinct permissions and any assessment of whether it is appropriate to grant the sub-consolidation permission must be decided on a case-by-case basis.

- 05/08/2024

5

Supervisory expectation on risk of excessive leverage for firms not subject to a minimum requirement

5.1

The PRA expects firms not in scope of the leverage ratio minimum capital requirement and buffers should manage their leverage risk so that their leverage ratio, as calculated in accordance with the Leverage Ratio (CRR) Part of the Rulebook, does not ordinarily fall below 3.25%.

- 05/08/2024

5.2

The PRA expects firms not in scope of the leverage ratio requirement to meet the expectation with 75% CET1, i.e. the highest quality of capital.

- 05/08/2024

5.3

The PRA expects that for a firm not in scope of the leverage ratio minimum capital requirement and buffers, the leverage ratio will not fall below 3.25% in the normal course of business or as part of its base business plan. The PRA acknowledges, however, that for such firms there may be occasions, such as in a systemic stress, or immediately following an idiosyncratic stress, where firms may not meet this expectation. Failure to meet the expectation does not create a presumption that a firm is breaching Chapter 11 of the ICAA Part or not meeting Threshold Conditions. The PRA would not expect the leverage ratio expectation to be met immediately following resolution. In line with ICAA 11.3, firms should take a forward-looking view of leverage risk in order to withstand stress events.

- 05/08/2024

5.4

The PRA expects that firms should notify their supervisors as soon as practical if they do not meet or expect not to meet the PRA’s expectation. There will be no automatic consequences; but a firm which does not meet the expectation can expect enhanced supervisory attention, and should prepare a credible plan to reduce excessive leverage. If the PRA is satisfied with the rationale presented for not meeting the expectation, the PRA will allow a firm to manage its excessive leverage by restoring compliance with the expectation over a reasonable period of time. In exercising its judgement on what constitutes a reasonable time to manage excessive leverage and other potential supervisory action, the PRA will take into account the firm’s leverage ratio, the firms’ rationale for not meeting the expectation, the expected period over which the firm would not meet the expectation, the drivers of the excessive leverage, the context of the excessive leverage (whether firm-specific or systemic) and macroeconomic and financial conditions. If the PRA is not satisfied with the firm’s plan to reduce excessive leverage or with the firm’s reasons for not meeting the expectation it may consider using its powers under section 55M of FSMA to resolve the issue, including by requiring the firm to raise sufficient capital to meet the expectation within an appropriate timeframe.

- 05/08/2024

6

Reporting and disclosure

Reporting

6.1

All firms are required to report their leverage ratios as per the Reporting (CRR) Part of the PRA Rulebook. Firms subject to the leverage ratio minimum capital requirement are subject to additional reporting requirements, at the same level of application as the minimum capital requirement applies, including the calculation of the leverage ratio on an averaged basis, the countercyclical leverage ratio buffer, reporting on trading exposures that may be sources of contingent leverage risk and, where applicable, the additional leverage ratio buffer, and capital surpluses/shortfalls to the requirement.

- 05/08/2024

6.2

The leverage reporting templates are set out in the following table.

- 05/08/2024

Table 1 – Description of leverage reporting templates

| Template | Content |

|---|---|

| LV47 | Reporting on the calculation of the leverage ratio, including the calculation of the leverage ratio on an average basis for firms in scope of the UK’s leverage ratio requirement. |

| LV40 | Reporting on an alternative treatment of the exposure measure. |

| LV41 | Reporting on an additional breakdown of on- and off-balance sheet exposures in accordance with the risk weight.22 |

| LV43 | Reporting on an alternative breakdown of leverage exposure measure components. |

| LV44 | Reporting on general information. |

| LV49 - LV52 |

Reporting on trading exposures that may be sources of contingent leverage risk (additional reporting requirement only) |

Footnotes

- 22. This template is based on COREP template C41. Although the EBA is removing this template as part of the Taxonomy 3.0 changes, the PRA has retained this template. The data helps in monitoring the risk composition of leverage ratio exposures, supports the PRA’s supervisory activities, and provides useful information for future reviews of the leverage ratio framework.

- 05/08/2024

6.3

The PRA requires firms to report templates LV40 to LV47 on a quarterly basis, and LV49 to LV52 on a semi-annual basis, with a remittance of 42 calendar days, in line with the proposed timelines for quarterly and semi-annual reporting of non-leverage information.23 Reporting and remittance dates for each quarter of the year are outlined in the table below. Note that where the remittance day is a public holiday or falls on a Saturday or Sunday, the data shall be submitted on the following working day.

Footnotes

- 23. Article 2 of Chapter 5 of the Reporting (CRR) Part.

- 05/08/2024

Table 2 – Reporting and remittance dates for leverage reporting templates

| Quarter | Reporting date | Remittance date |

|---|---|---|

| 1 | 31 March | 12 May |

| 1 | 30 June | 11 August |

| 3 | 30 September | 11 November |

| 4 | 31 December | 11 February |

- 05/08/2024

Disclosure

6.4

All firms are required to disclose their leverage ratios as per the Disclosure (CRR) Parts of the PRA Rulebook. Firms subject to the leverage ratio minimum capital requirement are subject to additional disclosure requirements, at the same level of application as the minimum capital requirement applies, in relation to averaging and the countercyclical leverage ratio buffer and, where applicable, the additional leverage ratio buffer.

- 05/08/2024

6.5

Leverage ratio disclosure frequency requirements are set out within Articles 433(a) – 433(c) of the Disclosure (CRR) part of the PRA Rulebook. Requirements relating to the disclosure of the additional leverage ratio buffer may be set separately. The following table summarises the frequency with which firms are required to disclose leverage ratio templates:

- 05/08/2024

Table 3 - Frequencies for leverage ratio disclosures

| Template | Frequency large institutions (listed or G-SII) | Frequency large institutions (neither listed nor G-SII) |

Frequency other institutions (listed) |

Frequency SDDTs(1) (listed(2)) |

Frequency other institutions (not listed) |

| UK LR1 - LRSum: Summary reconciliation of accounting assets and leverage ratio exposures |

Semi-annual |

Annual |

Annual |

N/A |

N/A |

| UK LR2 - LRCom: Leverage ratio common disclosure; note row 27 and following are for firms in scope of the leverage ratio minimum requirement |

Annual (for rows 28 to UK-34); Semi-annual (for rows up to row 28) (3) | Annual(4) |

Annual(5) |

N/A |

N/A |

| UK LR3 - LRSpl: Split-up of on balance sheet exposures (excluding derivatives, SFTs, and exempted exposures) |

Semi-annual |

Annual |

Annual |

N/A |

N/A |

| UK LRA: Free format text boxes for disclosure on qualitative items |

Annual | Annual |

Annual |

N/A |

N/A |

| UK KM1 – Key metrics template; rows 13 to 14 |

Quarterly | Semi-annual |

Semi-annual |

Semi-annual |

Annual |

| (Where in scope of the leverage ratio minimum requirement) UK KM1; rows 14a-e | Quarterly | Semi-annual |

Semi-annual |

N/A | N/A |

Footnotes:

(1) From 1 January 2024 to 30 June 2027, transitional arrangements exist for firms which disclosed under the Small and Non-Complex Institution definition prior to 1 January 2024 but which do not meet the SDDT definition. See Articles 433(b) and 433(c) of the PRA Rulebook.

(2) SDDTs which are not listed do not have disclosure obligations in respect of the leverage ratio.

(3),(4),(5) Institutions that are in scope of the leverage ratio minimum requirement shall disclose values in UKL2 – LRCom;25, UKL2 – LRCom;UK-25a, UKL2 – LRCom;UK-25c, UKL2 – LRCom;27, UKL2 – LRCom;UK-27a (this is only relevant for institutions subject to the ALRB – see paragraph 2.3), UKL2 – LRCom;UK-27b, UKL2 – LRCom;UK-32, UKL2-LRCom;UK-33 and UKL2 – LRCom;UK-34 with a quarterly frequency.

- 05/08/2024

7

Conditions for the exclusion of central bank claims held in omnibus accounts from the leverage exposure measure

7.1

The assets constituting central bank claims that are excluded from the LEM referred to in paragraph 1.A.3 shall include reserves in omnibus accounts provided they meet further conditions, in addition to those set out above in 1.A.3. These further conditions are in Article 429a(A2) of the Leverage Ratio (CRR) Part of the PRA Rulebook. This chapter elaborates on the PRA’s expectations in relation to them.

- 05/08/2024

7.2

These conditions aim to ensure that any risks associated with omnibus account reserves, additional to those arising in respect of reserves held on traditional accounts, are mitigated. The PRA considers that omnibus account reserves qualify for the central bank claim exemption only where these additional risks are mitigated. The conditions further ensure that firms have the ability to satisfy the liability-matching condition for the exclusion24, set out in 1.A.3 above25, by having visibility over their reserves at all times.

Footnotes

- 24. Additional to having to be matched by liabilities denominated in the same currency and of identical or longer maturity.

- 25. Article 429a(A1)(b), Leverage Ratio (CRR) Part.

- 05/08/2024

7.3

In accordance with Fundamental Rule 7, the PRA expects firms in scope of the leverage ratio minimum requirement to notify the PRA of existing or planned participation in an omnibus account, and whether they meet, or expect to meet the conditions in Article 429a(A2).

- 05/08/2024

7.4

The PRA views that the expectations in Supervisory Statement (SS) 2/21 ‘Outsourcing and third party risk management’ around robust governance and controls of third parties would apply in respect of third parties26 associated with omnibus account arrangements.

- 05/08/2024

7.5

Pursuant to Article 429a(A2)(g), reserves placed in the omnibus account should meet certain Liquidity Coverage Ratio (LCR) requirements. The PRA expects firms to analyse risk holistically, paying due regard to any idiosyncratic risk specific to the omnibus account or any associated payment system, to assure themselves that reserves meet these requirements.

- 05/08/2024

7.6

Where the account in which reserves are placed is used for the purpose of settlement via a payment system, condition A2(e) applies. The PRA expects that, to satisfy A2(e), there should be safeguards which ensure balances on the payment system are backed at all times, on a one-to-one basis, with reserves on the omnibus account. These should include robust contingency and risk management and governance arrangements.

- 05/08/2024

7.7

The PRA views that the exercise of rights of deduction on the omnibus account by the central bank to recover charges has the potential to cause participants to pay more than their due share. Such excess payments could happen if the central bank were to exercise rights of deduction where (for example) one participant did not have enough on the account to meet its share, leading to the other participants paying the owing amount. The PRA’s intention in respect of condition A2(d) that any risk of such excess payments is removed.

- 05/08/2024

7.8

To that end, the account arrangements should ensure that a central bank does not debit a participant's reserves with any more than the amount the participant is liable to contribute (A2(d)(iii)). One way to achieve this outcome is by appropriately circumscribing rights of deduction - the central bank could maintain visibility over the composition of the ledger and have the right to exercise deductions only when it views that that would not result in a participant paying more than its share.

- 05/08/2024

7.9

Condition A2(d)(ii) requires that, where the central bank maintains rights of deduction, the method of apportionment of central bank charges is not unfair or unreasonable. It may be possible to meet condition A2(d)(iii) by, instead of preventing excess payments from arising due to central bank deductions, arranging to mutualise them according to an agreed schema. Where this is the approach taken, however, firms should note that to meet condition A2(d)(ii), omnibus account arrangements must set in place a process to apportion these excess payments which is not unfair or unreasonable.

- 05/08/2024