2

Leverage Ratio Buffers

2.A

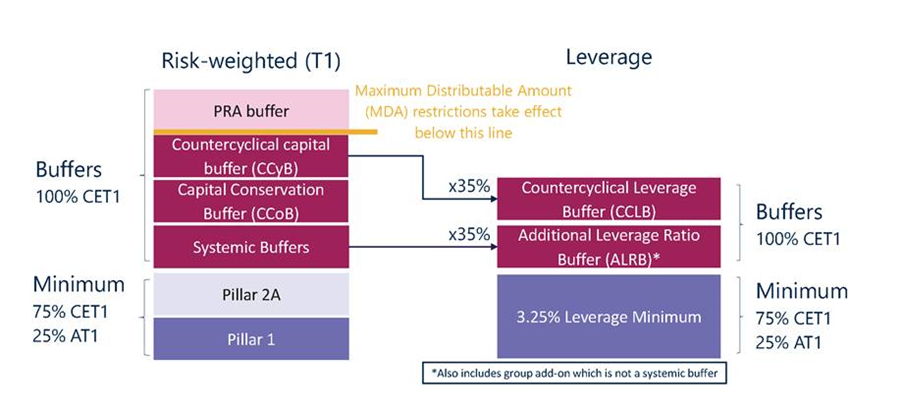

There are two buffers in the leverage ratio framework, and an add-on. The buffers are:

- i. the countercyclical leverage ratio buffer (CCLB); and

- ii. the additional leverage ratio buffer (ALRB) to reflect systemic importance.

- 05/08/2024

2.B

The CCLB and ALRB are intended to make the leverage ratio framework equally resilient relative to the risk-weighted framework (i) over the cycle and (ii) for systemic and non-systemic firms. As a result, they are scaled at 35% of their risk-weighted equivalents with the CCLB rate percentage rounded to the nearest 10 basis points.

- 05/08/2024

2.C

The leverage ratio buffers must be met with CET1 resources. The PRA requires firms not to double count CET1 towards the CCLB, the ALRB, and the minimum capital requirement. If a firm does not hold an amount of CET1 capital that is equal to or greater than the sum of its ALRB, CCLB and the CET1 component of its minimum requirement, it will be required to notify the PRA in accordance with Leverage Ratio – Capital Requirements and Buffers 5.1 and prepare a capital plan and submit it to the PRA, including the information required in Leverage Ratio – Capital Requirements and Buffers 6.2.

- 05/08/2024

Figure 1 The Tier 1 Risk Weighted and Leverage Capital Stacks

2.1

Firms that do not hold an amount of CET1 equal to or greater than their applicable leverage ratio buffers will not face automatic restrictions on their distributions.

- 05/08/2024

2.2

[Deleted]

- 05/08/2024

2.3

The ALRB is firm specific, and scaled relative to systemic buffers. Where applicable to a firm, the ALRB and related reporting and disclosure requirements will be set by the PRA using its powers under section 55M of the Financial Services and Markets Act (2000), and will incorporate the ALRB Model Requirements.[8] Where applicable to an approved holding company, the ALRB and related reporting and disclosure requirements will be set by the PRA using its powers under section 192C of the Financial Services and Markets Act (2000), and will incorporate the ALRB Model Requirements. Where a firm is subject to both a G-SII buffer and an O-SII buffer on the same basis of consolidation, the higher of the two buffers shall apply for the purpose of calculating the ALRB.

Footnotes

- 8. Current version available at: https://www.bankofengland.co.uk/prudential-regulation/publication/2020/vreq-additional-leverage-buffers-model-requirements.

- 05/08/2024

2.3A

The PRA considers that ring-fenced body (RFB) group risk[9] may arise when an RFB is subject to the ALRB at the level of the RFB sub-group,[10] but the consolidated group is either not subject to the ALRB, or its consolidated ALRB rate is lower than the ALRB rate applicable to the RFB sub-group. The PRA expects firms to take this RFB group risk into account by holding additional capital (the ‘Leverage Ratio Group Add-on’) on a consolidated basis. This is to ensure there is sufficient capital within the consolidated group, and distributed appropriately across it, to address both global systemic risks and domestic systemic risks. Where the ALRB applicable on a sub-consolidated basis for the RFB sub-group is higher than the RFB sub-group’s share of the ALRB on a consolidated basis, the difference will generally be reflected in the Leverage Ratio Group Add-on, in order to take account of the associated RFB group risk at the consolidated group level. The PRA calculates the ‘Leverage Ratio Group Add-on’ as the positive difference between the ALRB set for the RFB at a subconsolidated level, and (if any) the ALRB set for the consolidated group at a consolidated level, scaled by the relative size of the RFB sub-group in terms of its LEM. This add-on is expressed in percentage points. The ALRB is floored at zero. The formula is as follows:

Footnotes

- 9. Group risk, as defined in the PRA Rulebook (Internal Capital Adequacy Assessment 1.2), means the risk that the financial position of a firm may be adversely affected by its relationships (financial or non-financial) with other entities in the same group or by risk which may affect the financial position of the whole group, including reputational contagion.

- 10. An RFB sub-group is a subset of related group entities within a consolidated group, consisting of one or more RFBs and other legal entities, which is established when the PRA gives effect to Article 11(5) of the CRR.

- 11. When calculating the RFB LEM for the purpose of the LR Group Add-on, exposures of the RFB subgroup to group entities that are not members of the RFB subgroup can be excluded.

- 05/08/2024

2.3B

The PRA will notify the firm of the amount of any Leverage Ratio Group Add-on it is expected to hold in addition to its minimum leverage ratio requirement, CCLB and ALRB (where applicable). The PRA will update this on a regular basis. Firms will be expected to meet the Leverage Ratio Group Add-on with CET1 capital that shall be in addition to any CET1 capital maintained to meet the minimum leverage ratio, CCLB and ALRB. Consistent with Fundamental Rule 7, a firm should notify the PRA if a firm’s capital has fallen or is expected to fall below the level necessary to meet the Leverage Ratio Group Add-on.

- 05/08/2024

2.4

Where a firm is using its buffers, the PRA will assess a firm’s capital plan to determine whether, if implemented, it would be reasonably likely to secure that the amount of the firm’s CET1 will be equal to or greater than the firm’s leverage ratio buffers within a period which the PRA considers appropriate. When exercising its judgement on what constitutes a reasonable time to rebuild buffers drawn down in stress, the PRA will take into account the drivers of the firm’s shortfall, including in the context of current and forecasted macroeconomic and financial conditions.

- 05/08/2024

2.5

In determining the appropriate period for a firm to satisfy its CCLB when that has been raised, the PRA will have regard to the period of time the firm has to meet the associated increase in its Countercyclical Capital Buffer (CCyB) rate(s). The PRA expects any increase in the CCLB rate to follow the transitional periods set for the increase in the relevant CCyB rate(s), which will generally become effective twelve months after an announcement. This approach would ensure consistency and complementarity between the CCyB and CCLB.

- 05/08/2024

2.6

When calculating its CCLB, a firm is expected to take into account any decrease in relevant CCyB rate(s) immediately.

- 05/08/2024