1

Introduction

1.1

This Prudential Regulation Authority (PRA) Supervisory Statement (SS) sets out expectations for certain firms engaged in trading activities that may affect the financial stability of the UK.1 The PRA expects such firms to have a set of capabilities that will allow them to execute a full or partial wind-down of their trading activities in an orderly fashion (hereinafter referred to as trading activity wind-down, or TWD).2

Footnotes

- 1. For these purposes, ‘trading activities’ includes the trading book (as defined in Article 4(86) of Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012, available at: https://eur-lex.europa.eu/legal-content/en/TXT/?uri=celex:32013R0575), and activities carried out in connection with the trading book, such as margin loans and other financing activities carried out in relation to trading, that the firm would consider appropriate to wind down as part of post-resolution restructuring. For these purposes, ‘trading activities’ does not include banking book activity that the firm would expect to continue after a full wind-down in post-resolution restructuring. Where a legal entity contains only trading activity business, such as a broker-dealer business model, the wind-down of trading activities would likely mean the wind-down of the legal entity.

- 2. An orderly wind-down of trading activities would consist of, for example, the trading book portfolio being wound down in a timely and measured manner, such that disruption to the UK financial system is avoided. It may consist of the wind-down of the firm’s entire operations (for example in the case of a broker-dealer firm where trading activities represent a majority of its balance sheet), or a wind-down of a part of the firm’s operations (for example in the case of a universal bank where trading activities are concentrated in particular business units or legal entities). A firm winding down its UK equities business, but not its European fixed income business, would be an example of a partial wind-down of that firm’s trading activities.

- 03/03/2025

1.2

The expectations in this SS aim to further the PRA’s general objective to promote firms’ safety and soundness, advanced primarily by minimising the adverse effect firm failure could have on financial stability.

- 03/03/2025

1.3

The expectations aim to enhance firms’ ability to recover from firm-specific and/or market-wide stress, and should be read in conjunction with the Bank of England’s (‘the Bank’s’) approach to assessing resolvability, including the Bank’s Statements of Policy (SoP) published as part of the Resolvability Assessment Framework (the ‘RAF policies’).3 These expectations are also relevant in terms of firms meeting two PRA rules:

- Rule 2.11 in the Recovery Plans Part of the PRA Rulebook, which requires that a firm must be able to demonstrate that the implementation of its recovery plan is reasonably likely to maintain or restore the firm’s viability and financial position, and that the recovery plan is reasonably likely to be implemented quickly and effectively; and

- Rule 8 in the Fundamental Rules Part of the PRA Rulebook, which requires that a firm must prepare for resolution so if the need arises it can be resolved in an orderly manner.

Footnotes

- 3. These include The Bank’s Approach to Assessing Resolvability SoP, The Bank’s SoP on valuation capabilities to support resolvability, The Bank’s SoP on Restructuring Planning, The Bank’s SoP on Funding in Resolution, The Bank’s SoP on Continuity of Access to Financial Market Infrastructure (FMIs), and The Bank’s SoP on Management, Governance and Communication, available at: https://www.bankofengland.co.uk/financial-stability/resolution/resolvability-assessment-framework/resolvability-assessment-framework-policy-documents.

- 03/03/2025

1.4

Firms whose trading activities may affect the financial stability of the UK, and that have been identified by the PRA as ‘other systemically important institutions’ (O-SIIs), are likely to have the full or partial wind-down of their trading activities as a recovery option.

- 03/03/2025

1.5

As set out in SS9/17 ‘Recovery planning’ (paragraphs 2.5-2.9),4 firms should have measures available to restore their financial position following a stress, including radical options which might include fundamentally changing the firm’s structure and business model.

Footnotes

- 03/03/2025

1.6

Firms with Bank-led bail-in as their preferred resolution strategy may need to have the wind-down of their trading activities as a post-resolution restructuring option when developing their business reorganisation plan (BRP).5

Footnotes

- 5. Paragraph 3.3(a)(i) of The Bank’s SoP on Restructuring Planning, May 2021: https://www.bankofengland.co.uk/financial-stability/resolution/resolvability-assessment-framework/resolvability-assessment-framework-policy-documents.

- 03/03/2025

1.7

The expectations in this SS apply to O-SII firms (identified by the PRA) that have the full or partial wind-down of trading activities as a recovery and post-resolution restructuring option; and have either been notified by the Bank that their preferred resolution strategy is Bank-led bail-in, or have been notified by the Bank that they are a ‘material subsidiary’ of a third-country group for the purposes of setting internal minimum requirements for own funds and eligible liabilities (MREL) in the UK.6 Collectively, these firms are referred to as ‘TWD firms’ for the purposes of the expectations set out in this document. The expectations in this SS do not apply to third-country branches.

Footnotes

- 6. For the purposes of this SS, references to PRA O-SII designation shall be treated as being on an individual entity basis to PRA-authorised firms within an O-SII group. It is not intended that the expectations will apply at group level in respect of O-SIIs. References in this SS to the designation of a firm as an O-SII should be taken to exclude the designation of a group of firms at the highest level of consolidation in the UK.

- 03/03/2025

1.8

The application of these expectations to TWD firms is set out in more detail in Chapter 2.

- 03/03/2025

1.9

In this SS, the wind-down of trading activities, whether it be full or partial, or whether it would be carried out as a recovery or post-resolution restructuring option, is referred to as ‘the TWD option’. The TWD option is likely to be one option that a firm will develop as part of a recovery plan and BRP, and is likely to be a ‘risk off’ set of actions that TWD firms will put into effect in order to stabilise their capital or liquidity positions, minimise liabilities or limit impacts on financial stability. Other options might include the sale of a business unit or raising capital by market issuance. The PRA’s expectations relating to how TWD firms should develop the TWD option are set out in Chapter 3.

- 03/03/2025

The TWD option in the context of a TWD firm’s recovery plan

1.10

All firms subject to the PRA’s recovery planning rules are required to have a recovery plan containing a range of executable options. SS9/17 sets out expectations for recovery planning relating to governance, information and reporting requirements, fire drills and playbooks, amongst other areas.7

Footnotes

- 7. As the TWD option is a recovery option, the expectations in SS9/17 apply. The interaction between the expectations in SS9/17, other relevant PRA policies, and this SS is set out in the PRA’s Trading activity wind-down SoP.

- 03/03/2025

1.11

As part of the recovery plan, a TWD firm is expected to have planned when it might need to execute the TWD option and mitigate potential barriers that might impede that execution. TWD firms may need to produce a concise implementation guide or ‘playbook’ for implementing their plan, including the TWD option, with detailed analysis, evidence, and testing supporting the credibility of the information.8

Footnotes

- 8. May 2022: Chapter 2, https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 03/03/2025

1.12

Developing the TWD option is likely to be more complex compared with other recovery options, as the actions, arrangements, and measures that a firm may take are likely to be highly contingent on prevailing market conditions. A firm’s recovery plan should be sufficiently flexible to anticipate the need to make different decisions and use different actions, arrangements, and measures depending on those market conditions (for example, deciding the time period over which trading activities are wound down).

- 03/03/2025

1.13

The PRA expects firms to use scenario testing to demonstrate the credibility of their recovery plans and the options within them. For firms to be able to demonstrate that their recovery plans are sufficiently flexible to make the TWD option credible, this SS sets expectations that TWD firms should:

- include a baseline set of factors when designing the scenario or scenarios to develop and test the TWD option (hereinafter ‘the TWD scenario’); and

- have additional capabilities to allow senior management and decision-makers to respond to changing real-life circumstances.

- 03/03/2025

1.14

The PRA expects O-SIIs to include analysis of at least four scenarios in their recovery plans, and that the range of scenarios included should be adequate to test the plan.9

Footnotes

- 9. May 2022: Paragraphs 2.54-2.57, https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 03/03/2025

The set of capabilities firms should have to develop and execute the TWD option

1.15

The expectations in this SS set out the capabilities that TWD firms should have, which are additional to the expectations in SS9/17 and other related PRA policies. The PRA emphasises ‘capabilities’ because execution of the TWD option may occur in a variety of real-life circumstances. Firms should have a set of capabilities that can be utilised depending on the real-life circumstances faced by the firm at the time the TWD option is executed.

- 03/03/2025

1.16

This set of capabilities is referred to as ‘TWD capabilities’. These capabilities are explained in the following way:

- Information provision and decision-making capabilities: these capabilities enable a firm to produce information and data, which is of sufficient granularity and quality to support decision-making before, during, and after a firm-specific and/or market-wide stress.

- Refresh capabilities: these capabilities enable a firm to refresh the information supporting the development and execution of the TWD option in a timely manner. Firms should be able to refresh data on their balance sheet (including data on trading book positions at the individual contract, collateral and asset levels), their quantification of wind-down costs, and capital and liquidity projections, within a matter of days (the ‘data refresh’). Firms should be able to refresh the material components of the TWD option, including changes to assumptions and approximations that inform the TWD option, changes to the modelling or methodology firms use as part of their information provision and decision-making capabilities, and changes to the factors that make up the TWD scenario within weeks (the ‘full plan refresh’).10

Footnotes

- 10. Material components are those whereby the impact of a change could influence decision-making. TWD firms should define material component and change thresholds.

- 03/03/2025

1.17

Expectations relating to TWD capabilities are set out in more detail in Chapter 4.

- 03/03/2025

1.18

In order to provide firms with a guide to the breadth and granularity of data they should be able to produce, the PRA has set out templates in the appendices. TWD firms can choose to use these templates and are responsible for the development and maintenance of their TWD capabilities. Additional information relating to these TWD templates is set out in Chapter 5 and the appendices.

- 03/03/2025

1.19

Expectations relating to the full or partial wind-down of trading activities for UK subsidiaries of third-country groups are set out in more detail in Chapter 6.

- 03/03/2025

1.20

This SS should be read in conjunction with:

- the PRA’s policies set out in the Trading activity wind-down SoP;

- the Bank’s Approach to Assessing Resolvability SoP;

- the Bank’s SoP on Funding in Resolution;

- the Bank’s SoP on Continuity of Access to Financial Market Infrastructure (FMIs);

- the Bank’s SoP on valuation capabilities to support resolvability;

- the Bank’s SoP on Restructuring Planning; and

- the Bank’s SoP on Management, Governance and Communication.

- 03/03/2025

2

Application of TWD expectations

2.1

This SS applies to firms that meet each of the following criteria:

- a) firms that have been identified by the PRA as an O-SII;

- b) firms that have the full or partial wind-down of their trading activities as a recovery and post-resolution restructuring option; and

- c) firms that have either been notified by the Bank that their preferred resolution strategy is Bank-led bail-in, or have been notified by the Bank that they are a ‘material subsidiary’ of a third-country group for the purposes of setting internal MREL in the UK.

- 03/03/2025

2.2

The PRA expects firms to understand their own business models and the impact a disorderly wind-down of trading activities would have on their balance sheet. Given the systemic importance of TWD firms, TWD firms that engage in trading activities should have the full or partial wind-down of their trading activities (TWD option) as a recovery option.

- 03/03/2025

2.3

The PRA expects a firm not to discount the TWD option on the basis that it may not be able to resume trading activities following a wind-down. In accordance with Rule 2.11 in the Recovery Plans Part of the PRA Rulebook, the implementation of arrangements proposed in the recovery plan should be reasonably likely to maintain or restore a firm’s viability and financial position; this may involve a firm having recovery options that may fundamentally change the firm’s structure and business model.11

Footnotes

- 11. May 2022: Paragraphs 2.6 and 2.10, https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 03/03/2025

2.4

If firms are in any doubt about whether they should have the TWD option as a recovery and post-resolution restructuring option, they should speak to their PRA supervisor.

- 03/03/2025

2.5

These expectations do not apply to third-country branches and other firms with smaller and less complex trading activities. However, other PRA-regulated firms may find these expectations helpful in developing capabilities that are appropriate to the size and complexity of their trading activities. If such a firm starts to anticipate that it is going to become a TWD firm, as its business changes or grows, it would need to anticipate meeting these expectations. These other firms continue to be subject to Rule 2.11 in the Recovery Plans Part of the PRA Rulebook and so are required to be able to implement their recovery plans quickly and easily in a stress.

- 03/03/2025

3

The TWD option

3.1

This chapter sets out the PRA’s expectations for:

- the development of the TWD option;

- scenario testing;

- the flexibility of the recovery plan in the context of the TWD option; and

- TWD firms’ execution of the TWD option.

- 03/03/2025

The development of the TWD option

3.2

As with any recovery option, a TWD firm’s TWD option should set out the actions, arrangements, and measures that the TWD firm would implement in a scenario of severe macroeconomic and financial stress relevant to the TWD firm’s specific conditions.12 These actions, arrangements, and measures should allow a TWD firm to reduce risk and leverage, and wind down its trading activities in an orderly manner.13 A TWD firm should also ensure that the actions, arrangements and measures would be effective in post-resolution restructuring and should identify alternative actions, arrangements, and measures if they are not. Box 1 sets out the actions, arrangements, and measures a firm might identify when developing the TWD option.

Footnotes

- 12. Rule 2.10 in the Recovery Plans Part of the PRA Rulebook. See also paragraphs 2.53-2.60 and 2.76-2.78 of SS9/17

- 13. Article 9 of Commission Delegated Regulation (EU) 2016/1075 as it forms part of UK law

- 03/03/2025

3.3

The TWD option should be explained in the TWD firm’s recovery plan, including the playbook where relevant, such that the TWD option would be easily implemented in a stress. The quantification of the costs of the wind-down, set out in more detail in Chapter 4, and any impacts on the TWD firm’s projected capital and liquidity resources throughout the period from the time at which the TWD option is executed to the time at which the TWD firm’s trading activities have been wound down (hereinafter referred to as the ‘wind-down period’), should also be set out in the TWD firm’s recovery plan.14 The wind-down period can be split into the period from the time at which the TWD option is executed to the time at which the TWD firm has exited all the positions it can exit without incurring undue costs (hereinafter referred to as the ‘active wind-down period’); and the rest of the wind-down period, during which the firm hedges the exposures of the remaining ‘rump’ positions (insofar as this is possible) until they expire (hereinafter referred to as the ‘passive wind-down period’).

Footnotes

- 14. May 2022: Paragraph 2.66, https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 03/03/2025

3.4

TWD firms should consider the information that should be provided to support the viability and credibility of the TWD option in recovery. In addition, TWD firms should be able to provide further information and analysis on the viability and credibility of the TWD option in the context of a post-resolution restructuring.15

- 03/03/2025

Box 1 Actions, arrangements, and measures in the context of the TWD option

According to Article 9 of Commission Delegated Regulation (EU) 2016/1075, as it forms part of UK law, recovery options should indicate arrangements and measures to reduce risk and leverage, or to restructure business lines, among other outcomes.

For the TWD option, the actions, arrangements, and measures a TWD firm might identify could include, but are not limited to, the following:

- 1. division of the trading activities portfolio into sub-portfolios or segments (hereinafter referred to as ‘segmentation’), each of which will be subject to a specific exit strategy;

- 2. the close-out or termination of positions prior to maturity (subject to stays that may be in effect in resolution in the relevant jurisdiction);

- 3. contractual run-off (allowing contracts to run to maturity without being replaced or renewed);

- 4. the auction or transfer of positions to a third party, or novation (the termination of a contract and its replacement with a new economically equivalent contract with a different party) of such positions;

- 5. actions taken to reduce risk via hedging; and

- 6. actions taken to manage the liquidity of the balance sheet

- 03/03/2025

3.5

The Resolution Assessment Part of the PRA Rulebook and SS4/19 ‘Resolution assessment and public disclosure by firms’ contain, respectively, rules (requiring firms to assess their preparations for resolution, submit a report of their assessment, and publish a summary of their report) and, in SS4/19, expectations on how firms should comply with the rules. The Bank’s Approach to Assessing Resolvability SoP sets out, amongst other things, the outcomes firms must, as a minimum, be able to achieve to be considered resolvable. This SS should be read in conjunction with the Resolution Assessment Part of the PRA Rulebook, SS4/19 and the Bank’s Approach to Assessing Resolvability SoP.

- 03/03/2025

Scenario testing

3.6

Under existing recovery planning requirements, a recovery plan must contemplate a range of scenarios of severe macroeconomic and financial stress relevant to the firm’s specific conditions including system-wide events and stress specific to individual legal persons and to groups. SS9/17 sets out that global systemically important institutions (G-SIIs) and O-SIIs should include analysis of at least four scenarios that are:

- relevant to the firm’s business model;

- sufficiently severe to test the plan; and

- designed to take the firm to the point of near failure if recovery measures were not implemented in a timely manner, with the firm defining and justifying its point of near failure.16

Footnotes

- 16. May 2022: Paragraph 2.58, https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 03/03/2025

3.7

These stress scenarios must involve severe macroeconomic and financial stress, including system-wide events, legal entity-specific stress, and group-wide stress.17 The PRA expects that for TWD firms, at least one of the four scenarios should be used to develop and test the TWD option (the TWD scenario, see paragraph 1.13 above).

Footnotes

- 17. Rule 2.10 in the Recovery Plans Part of the PRA Rulebook.

- 03/03/2025

3.8

The PRA expects a TWD firm to include a baseline set of factors when designing the TWD scenario. This baseline set of factors should include, at a minimum:

- factors relating to the stage of firm-specific stress;

- factors relating to market-wide stresses; and

- factors relating to the full or partial wind-down of trading activities.

- 03/03/2025

3.9

This baseline set of factors is set out in more detail below. A TWD firm should identify additional factors as appropriate, to ensure that the TWD scenario is relevant to the TWD firm’s specific circumstances.

- 03/03/2025

Factors relating to the stage of firm-specific stress

3.10

In a firm-specific stress, a TWD firm’s capital and liquidity positions may be deteriorating quickly, potentially due to issues unrelated to its trading activities. The TWD firm may need to execute the TWD option in order to reduce its risk and prevent its capital and liquidity positions from deteriorating further.

- 03/03/2025

3.11

The actions, arrangements, and measures a TWD firm chooses when developing the TWD option should be appropriate to the points at which a TWD firm would expect to execute the TWD option, given the TWD scenario. This may be at an early stage while the firm is a going concern, as the TWD firm approaches the point of failure, or as a gone concern in post-resolution restructuring.

- 03/03/2025

Factors relating to market-wide stresses

3.12

The actions, arrangements, and measures a TWD firm chooses as part of the TWD option should be appropriate to the anticipated market-wide stresses and other issues that occur when trading becomes difficult. TWD firms should include the following minimum baseline set of factors when designing the TWD scenario:

- duration of market-wide stress;

- the TWD scenario should have two phases: a stressed phase in which risk premia and market volatility increase significantly and market liquidity is significantly reduced; and a phase in which markets return to normal (scenario dynamics);

- severity of credit downgrade of the TWD firm, and severity of general credit downgrade as part of the macroeconomic scenario;

- barriers to over the counter (OTC) derivative market access;

- barriers to the sale of portfolios during market-wide stress; and

- funding sensitivities to full or partial closure of secured funding markets and foreign exchange markets.

- 03/03/2025

Factors relating to the full or partial wind-down of trading activities

3.13

The actions, arrangements, and measures a TWD firm chooses when developing the TWD option should be appropriate as to whether the TWD firm is planning to conduct a full or partial wind-down of its trading activities, given the TWD scenario.

- 03/03/2025

3.14

A TWD firm may consider the wind-down of part of its trading activities based on the geographic location of those activities, or the asset classes that make up those activities, when developing the TWD option. A TWD firm winding down its UK equities business, but not its European fixed-income business, would be an example of a partial wind-down of a TWD firm’s trading activities.

- 03/03/2025

3.15

This does not impact the expectation (set out in more detail in Chapter 4) that a TWD firm’s TWD capabilities should be built on the basis of the full wind-down of its trading activities.

- 03/03/2025

The flexibility of the recovery plan in the context of the TWD option

3.16

The PRA expects the actions, arrangements, and measures set out in a TWD firm’s recovery plan to be appropriate with reference to the TWD firm’s business model and anticipated or real-life circumstances.18

Footnotes

- 18. Rules 2.10 and 2.11 in the Recovery Plans Part of the PRA Rulebook.

- 03/03/2025

3.17

A TWD firm’s recovery plan should be sufficiently flexible to anticipate the need to make different decisions and use different actions, arrangements, and measures depending on prevailing market conditions.

- 03/03/2025

3.18

A TWD firm should be able to flexibly amend the actions, arrangements, and measures to demonstrate that the TWD option is credible, to improve the consistency of different parts of the TWD firm’s recovery plan, and to demonstrate that the plan is credible as a whole. The actions, arrangements, and measures should be tailored to the TWD scenario, and relevant to the TWD firm’s specific conditions.19

Footnotes

- 19. Paragraphs 2.61-2.65 of SS9/17 and Rule 2.10 in the Recovery Plans Part of the PRA Rulebook.

- 03/03/2025

3.19

This is particularly important in the context of the TWD option, as the real-life circumstances in which a TWD firm may need to execute the TWD option are difficult to predict in advance, and can change rapidly. TWD firms should use the most up to date information available to them when selecting which actions, arrangements, and measures to use.

- 03/03/2025

3.20

In developing the TWD option, a TWD firm should seek to conserve both capital and liquidity, and adopt a prudent approach to risk management. In selecting the actions, arrangements, and measures that make up part of the TWD firm’s recovery plan, the TWD firm may choose, within an overall prudent approach, whether it wants to prioritise capital conservation or liquidity conservation, given the TWD scenario.

- 03/03/2025

3.21

In either case (whether a TWD firm chooses to prioritise capital or liquidity conservation), the TWD firm should be able to set out which different actions, arrangements, and measures it would select if it were to alter its approach.20 For example, a TWD firm that prioritised capital conservation should be able to set out how it might change the selection of actions, arrangements, and measures set out in its recovery plan, should it change to prioritise liquidity conservation. It could do this, for example, by changing the order in which portfolios are sold, accepting haircuts or accelerating portfolio sales to conserve liquidity.

Footnotes

- 20. The TWD firm’s sensitivity analysis capability, set out in paragraph 4.49, may be useful.

- 03/03/2025

TWD firms’ execution of the TWD option

3.22

The PRA expects TWD firms to execute their TWD option in line with expectations for the execution of recovery options set out in SS9/17.

- 03/03/2025

3.23

For example, the PRA expects firms to leverage their indicator framework (paragraphs 2.45- 2.52 of SS9/17) to identify emerging signs of firm-specific and/or market-wide stress, and to indicate different stages of stress as implied by a particular metric. The calibration of indicators should be sufficiently sensitive to alert the firm to stress and sufficiently forward-looking to allow time for the TWD option to be executed.

- 03/03/2025

3.24

As set out in SS9/17, the use of this indicator framework may trigger the convening of a senior decision-making committee. To allow firms flexibility in their response, the trigger of an indicator should not be used as an automatic trigger for a predefined set of management actions.

- 03/03/2025

3.25

Similarly, firms should include in their recovery plans a sufficiently clear description of escalation and decision-making processes relevant to the recovery plan, as part of the firm’s wider risk management framework. Firms should detail who is responsible for taking what decisions and when. This should ensure effective action is taken in a timely manner and should include procedures to be followed during recovery, including identification of the key people involved and their roles and responsibilities.21

Footnotes

- 21. May 2022: Paragraph 2.80, https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 03/03/2025

3.26

TWD firms should use relevant information produced using their TWD capabilities (see Chapter 4) in order to feed into decision-making throughout a wind-down of their trading activities, as appropriate. This information should have a bearing on the parts of a TWD firm’s recovery plan playbook that are relevant to the TWD option.

- 03/03/2025

3.27

As set out by the Bank in its SoP on Restructuring Planning, TWD firms should be able to determine and describe how they would execute their TWD option in post-resolution restructuring, and should be able to describe their TWD option in sufficient detail for the TWD option to be actionable by the firm and to be deemed credible by the Bank. TWD firms should also consider the extent to which the description of the TWD option in their recovery plans could be relied on for this purpose, and what detail may be needed beyond what is provided in their recovery plans.22

Footnotes

- 22. Paragraphs 4.9-4.11 of The Bank’s SoP on Restructuring Planning, May 2021: https://www.bankofengland.co.uk/financial-stability/resolution/resolvability-assessment-framework/resolvability-assessment-framework-policy-documents.

- 03/03/2025

3.28

The interaction between the expectations set out in this SS, other PRA policies, and the Bank’s RAF policies, is set out in more detail in the Trading activity wind-down SoP.

- 03/03/2025

4

TWD capabilities

4.1

TWD firms should have TWD capabilities that will enable them to develop and execute the TWD option in a variety of real-life circumstances. TWD firms should use their TWD capabilities to help them to develop and execute their recovery plan and BRP.

- 03/03/2025

4.2

A static plan is unlikely to be sufficient when executing the TWD option, whereas a set of capabilities, supporting the development and execution of the TWD option, will allow senior management and decision-makers to respond to changing real-life circumstances.

- 03/03/2025

4.3

The PRA expects TWD firms to have the following TWD capabilities:

- Information provision and decision-making capabilities: these capabilities enable a TWD firm to produce information and data which is of sufficient granularity and quality to support decision-making before, during, and after a firm-specific and/or market-wide stress.

- Refresh capabilities: these capabilities enable a TWD firm to refresh the information supporting the development and execution of the TWD option in a timely manner. TWD firms should be able to refresh data on their balance sheet (including data on trading book positions at the individual contract, collateral and asset levels), their quantification of wind-down costs, and capital and liquidity projections, within a matter of days (the data refresh). TWD firms should be able to refresh the material components of the TWD option, including changes to assumptions and approximations that inform the TWD option, changes to the modelling or methodology that TWD firms use as part of their information provision and decision-making capabilities, and changes to the factors that make up the TWD scenario, within weeks (the full plan refresh).

- 03/03/2025

4.4

- 03/03/2025

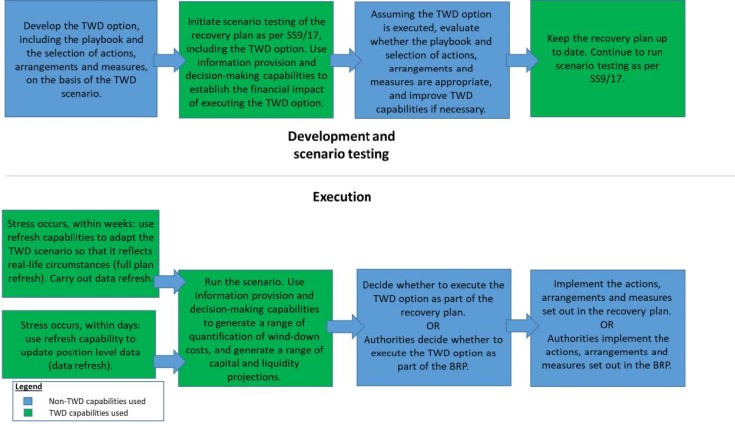

Diagram 1: How TWD capabilities support the development and execution of the TWD option

- 03/03/2025

4.5

The rest of this chapter sets out the PRA’s expectations for:

- developing TWD capabilities based on a full wind-down of trading activities in post-resolution restructuring;

- the TWD capabilities a TWD firm should have;

- further detail on TWD firms’ information provision and decision-making capabilities;

- TWD capabilities being responsive to circumstances;

- how TWD capabilities should be used to meet recovery planning policy; and

- governance of TWD firms’ TWD capabilities.

- 03/03/2025

TWD firms should base the development of their TWD capabilities on a full wind-down of trading activities in post-resolution restructuring

4.6

TWD firms should develop their TWD capabilities based on having to execute a full wind-down of their trading activities in post-resolution restructuring. This situation may also involve the full wind-down of the legal entity. TWD capabilities developed to deliver a full wind-down of trading activities in post-resolution restructuring should be adaptable to deal with less severe circumstances.

- 03/03/2025

4.7

TWD firms might only identify certain post-resolution restructuring options during the pre-resolution contingency planning phase, or during the resolution itself. Nonetheless, the PRA expects TWD firms to focus on a full wind-down of their trading activities in post-resolution restructuring, such that the TWD firms will have developed TWD capabilities that will be useable in a variety of real-life circumstances.

- 03/03/2025

The TWD capabilities

Information provision and decision-making capabilities

4.8

TWD firms are expected to be able to provide information to allow senior management, the PRA, and the Bank (as the resolution authority) to make strategic decisions in recovery and resolution. These strategic decisions include changes to the actions, arrangements, and measures the TWD firm would implement when the TWD option is executed in order to reduce risk and leverage, and wind down its trading activities. SS9/17 sets out that firms’ senior management should be able to use and navigate recovery plan (or playbook) quickly and easily, enabling recovery options to be quickly implemented in a stress.23

Footnotes

- 23. May 2022: Paragraphs 2.76-2.77, https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 03/03/2025

4.9

A TWD firm’s capital and liquidity projections are the key components of the information TWD firms should be able to provide. Before a TWD firm makes a decision as to whether the TWD option should be executed, these projections inform the TWD firm’s senior management, the PRA, and the Bank of any capital and liquidity shortfalls that are likely to occur throughout the wind-down period, and at what stage of the wind-down these shortfalls are likely to occur.

- 03/03/2025

4.10

These projections may be subject to significant levels of uncertainty, and it would not be proportionate for TWD firms to build and maintain capabilities to fully model a large number of scenarios. TWD firms should focus the modelling of their quantification of wind-down costs, used to determine their capital and liquidity projections, on the TWD scenario, and the actions, arrangements, and measures that the TWD firm would implement under that scenario. TWD firms should be able to account for the potential impact of market price movements throughout the wind-down period on the valuations of trading positions, known as risk-based losses (RBLs, see paragraphs 4.26 and 4.38-4.40).

- 03/03/2025

4.11

TWD firms should also be able to conduct sensitivity analysis to quantify the impact of alternative key assumptions to those assumed under the TWD scenario. TWD firms should be able to use their sensitivity analysis capabilities to set out the upper and lower bounds for TWD firms’ key assumptions so that senior management can understand the range of plausible impacts on TWD firms’ capital and liquidity projections following execution of the TWD option. This sensitivity analysis capability should include an ability to analyse the minimum baseline set of factors included as part of the TWD scenario, among other factors (see paragraphs 3.6-3.15 for more detail).

- 03/03/2025

4.12

For TWD firms’ capital and liquidity projections to improve planning and decision-making throughout the development and execution of the TWD option, TWD firms should be able to base the projections on a reasonable quantification of wind-down costs using data of a sufficient breadth and granularity. This quantification of wind-down costs should be modelled with reference to the most recent available information on the TWD firm’s balance sheet and the TWD scenario. TWD firms should be able to quantify their wind-down costs in the run-up to the execution of their recovery plan; the PRA does not expect TWD firms to constantly refresh their quantification of wind-down costs on an ongoing basis.

- 03/03/2025

4.13

TWD firms should be able to project their exit costs,24 operational costs,25 capital resource impacts and requirements,26 liquidity and funding,27 and RBLs from the assumed reference date28 of the TWD option through the wind-down period.

Footnotes

- 24. An exit cost is the gap between the expected exit value under the TWD scenario and accounting book value for positions to be novated, terminated or liquidated under the actions, arrangements and measures for the TWD scenario.

- 25. Operational costs include costs incurred directly by the trading businesses as well as intercompany recharges for provision of critical services. Operational costs should include staff costs (including severance and retention) as well as costs of real estate, technology and systems, legal, audit and accounting, FMI access, and other services.

- 26. This should include projections of capital resources impacts through the wind-down period in the TWD scenario, incorporating the impact of expected exit, operational costs and RBLs defined above on capital resources, as well as a forecast of the impact of the TWD scenario on trading book-related capital deductions and projections of the impact of the implementation of the actions, arrangements and measures set out as part of the TWD option on capital requirements in the TWD scenario, including projections of RWAs for market, counterparty credit and operational risks.

- 27. This should include projections of costs and cashflows associated with the wind-down costs, RBLs, and operational costs calculated as set out above; and the impact of actions, arrangements, and measures taken to manage the liquidity of the balance sheet, taking account of potential additional collateral requirements, adverse actions taken by FMIs’ collateral requirements and the effect of speed and asymmetry of unwinding businesses (eg the prime brokerage business).

- 28. The reference date is the date from which the valuation of TWD firms’ trading activities is used to project their financial resources throughout the wind-down period.

- 03/03/2025

4.14

TWD firms should have the methodologies, models, and data management frameworks needed to calculate these projections at an appropriate level of granularity to produce reasonable estimates that aid decision-making in a variety of real-life circumstances. TWD firms should have controls in place to ensure the input data is complete and accurate, with appropriate cross referencing and reconciliation to business-as-usual data sources such as regulatory reporting data. TWD firms should also have a management information system (MIS) to communicate the key quantitative information to internal and external decision-makers in a clear and timely manner.

- 03/03/2025

4.15

- 03/03/2025

Refresh capabilities

4.16

The PRA expects TWD firms to be able to refresh information relevant to the TWD option in a timely manner. The timely production of accurate information in a firm-specific and/or market-wide stress supports decision-making by TWD firms, the PRA, and the Bank, as set out in Chapter 3.

- 03/03/2025

4.17

Given potentially rapid changes in TWD firms’ balance sheets and real-life circumstances, TWD firms should be able to update key parts of the TWD option quickly. The inability to do so would reduce the speed of execution and effectiveness of the TWD option. The inability to update relevant information in a timely manner may result in delayed or ill-informed decision-making in the development and execution of the TWD option. Delayed or ill-informed decision-making could negatively impact the safety and soundness of the TWD firm and the UK financial system more generally; the disorderly wind-down of trading activities may stem from TWD firms being forced to sell out hold positions, generating larger losses than would have been the case if the TWD firm had been able to update key parts of the TWD option quickly.

- 03/03/2025

4.18

The PRA’s expectations for TWD firms’ refresh capabilities are set out below:

- The PRA expects TWD firms to be able to refresh data on the net gains and losses with respect to their trading activities (including data on trading book positions at the individual contract, collateral and asset levels), liquidity resources, and contractual liquidity flows, such that the impact of these refreshes is reflected in an updated, and materially accurate, quantification of wind-down costs, and capital and liquidity projections, in a matter of days (the data refresh).

- TWD firms should be able to initiate a data refresh on any business day. TWD firms should use any relevant data that is stored in business-as-usual systems calculated as at the date of the refresh. Where relevant position data is not calculated daily in business-as-usual (eg some capital requirement numbers may only be calculated for quarter ends), TWD firms should decide whether this could materially affect the execution or effectiveness of the TWD option in a stressed market. If so, TWD firms should build and maintain the capability to reflect the impact of changes since the last date the refresh was conducted.

- The PRA expects TWD firms to be able to carry out a refresh of the TWD option, including being able to amend all of the factors that make up the TWD scenario, in a matter of weeks. This would help to mitigate risks posed by changing real-life circumstances by helping TWD firms ensure factors in the TWD scenario can be altered such that the TWD option is based on a materially accurate reflection of the real-life circumstances that a TWD firm faces. TWD firms should be able to implement modelling or methodology changes to better align the outputs from scenario testing to the outcome of the execution of TWD firms’ TWD option in real-life circumstances (the full plan refresh).

- In the event a TWD firm conducts a full plan refresh as set out above, the impact of the actions, arrangements, and measures relevant to the new TWD scenario should be assessed in order to calculate new capital, liquidity, and RBL projections. This could consist of refinements to elements of the sensitivity analysis that are more aligned with the new TWD scenario.

- The PRA expects that TWD firms’ data refresh and full plan refresh capabilities can be utilised such that TWD firms are able to perform a refresh of the material components of the TWD option that require judgement, between a matter of days and a matter of weeks (depending on the nature and extent of the stress).29 This should include sensitivity analyses of updates to the factors set out in paragraphs 4.49-4.51.

- In the run-up to the execution of a TWD firm’s recovery plan or BRP, the extent of such adjustments will depend on the TWD scenario, how different the real-life circumstances the TWD firm faces are to that scenario, and the amount of time and resource available to the TWD firm. TWD firms should develop a matrix of alternatives for the types of refresh that could be applied under different circumstances and under different time and resource constraints.

Footnotes

- 29. Material components are those whereby the impact of a change could influence decision-making. TWD firms should define material component/change thresholds.

- 03/03/2025

Further detail on information provision and decision-making capabilities

4.19

- 03/03/2025

4.20

This information should be based on the TWD scenario. It should include the following:

(i) relevant data on the trading portfolios as at the reference date of the TWD option;

(ii) the projected financial impact of the TWD scenario through the wind-down period;

(iii) analysis of the likely rump portfolio;30 and

(iv) sensitivity analysis (as described in paragraph 4.11 above) on (ii) and (iii) above.

Footnotes

- 30. The rump portfolio is the residual portfolio of trading activity positions expected to remain following the active wind-down period.

- 03/03/2025

4.21

TWD firms should have controls in place to ensure this quantitative data is complete and has been subject to quality assurance. It should be available in a format that is readily understandable and usable by the authorities (the PRA and the Bank), with appropriate cross referencing and reconciliation to other business-as-usual data sources such as regulatory reporting data.31

Footnotes

- 31. The planning objective set out in paragraph 3.3 of The Bank’s SoP on Restructuring Planning is relevant here: https://www.bankofengland.co.uk/financial-stability/resolution/resolvability-assessment-framework/resolvability-assessment-framework-policy-documents.

- 03/03/2025

4.22

Expectations in respect of these aspects of the quantitative information are set out below.

- 03/03/2025

Portfolio data

4.23

TWD firms should be able to produce position and risk data in a usable format to support decision-making by management with respect to the development and execution of the TWD option.

- 03/03/2025

4.24

This should include all risk and trade data necessary to calculate the financial impact projections and sensitivity analysis in paragraphs 4.25-4.51, including information to support segmentation of TWD firms’ trading portfolios in multiple ways (for example, alternative packaging of trades for novation).

- 03/03/2025

Financial resource and risk projections

4.25

TWD firms should have the methodologies, models, and frameworks needed to forecast the impact of the TWD scenario on capital requirements, capital resources, and liquidity. This will involve projecting the following (defined in paragraphs 4.29-4.47) from the reference date of the TWD option through the wind-down period:

- (a) exit costs, including re-hedging costs;

- (b) operational costs;

- (c) RBLs;

- (d) capital resources impacts and requirements; and

- (e) liquidity and funding.

- 03/03/2025

4.26

Although TWD firms should consider the factors listed in paragraph 3.12 when designing the scenario, it may not be necessary to fully specify how market pricing inputs evolve over the wind-down period when modelling the financial impacts of the TWD scenario. Market movements and related hedging actions during the wind-down period will have an impact on risks, exit costs, and on future capital requirement measures. The interactions between these elements are likely to be complex however, and it is likely to be impractical to meaningfully model them.

- 03/03/2025

4.27

TWD firms may therefore separate the modelling of their financial impact projections into two parts:

- Modelling exit costs, liquidity flows, and capital requirements through the wind-down period under an assumption of no changes to market mid prices (but reflecting the widening of bid-offers in market-wide stress, and factors such as restricted access to OTC markets and credit downgrades as outlined in paragraph 3.12).

- Estimating the potential impact of RBLs on the above projections. The magnitude of these potential losses should be commensurate with the severity of the TWD scenario (as set out in paragraphs 3.6-3.7). The estimate should take account of risk changes through the unwinding of the portfolio and the likely hedging strategy.

- 03/03/2025

4.28

This approach allows appropriate focus of modelling precision towards impacts that are relatively less sensitive to the evolution of market pricing factors through the wind-down period, and can therefore be estimated with greater certainty. The two outputs can then be re-combined to produce a projection of capital resources, capital requirements, and liquidity through the TWD scenario.

- 03/03/2025

Exit Costs

4.29

TWD firms should have the capability to model the gap between the expected exit value under the TWD scenario and the accounting book value for positions to be novated, terminated, or liquidated under the actions, arrangements, and measures of the TWD scenario. Such gaps arise due to differences between assumptions in the TWD scenario and assumptions under accounting fair value. This may include different assumptions regarding the reaction of other market participants in those circumstances (which may distort the market) or greater perceived likelihood of certain pricing factors crystallising in the TWD scenario compared to a sale in business-as-usual. Examples of factors driving such differences include:

- charges that would be levied by a novation counterparty to reflect its required return on capital over the remaining life of the position(s);

- bid-offer charges that may arise when splitting offsetting risks into different disposal segments. These include the cost of finding replacement hedges, where risks and their hedges are disposed of at different times;

- the limited ability of the TWD firm executing the TWD option to construct novation packages that are within the risk appetite of a potential step-in counterparty firm in a timely manner;

- the marginal future operational and administrative costs that firms accepting the novation of an OTC derivatives portfolio would incur;

- under fair value accounting, the TWD firm may assume it can close out risks in which it is market maker at mid-price. However, under the TWD scenario, the TWD firm may cease to be a market maker and would therefore be charged a spread;

- position concentration: the TWD firm executing the TWD option may need to exit large positions and so may need to accept size discounts that may not be present in accounting valuations;

- compensation required to incentivise exiting counterparties to be novated to another counterparty; and

- loss of value where Credit Support Annex terms, or other beneficial pricing factors, are modified on novation.

- 03/03/2025

4.30

TWD firms should decide whether differences between the risk and liquidity management strategy in the TWD scenario, and the risk and liquidity management assumptions underlying accounting valuation models, give rise to incremental expected hedging costs that are not already reflected in the accounting valuation. The additional cost of hedging asymmetrically timed wind-downs of offsetting risks should be included in this category.

- 03/03/2025

4.31

The expected incremental bid-offer spread from exiting positions in a stressed market (including replacement hedges) should be included in this category. Although this relies on assumptions about future market projection (and so might be considered as a component of RBLs), its expected value could generally be assumed to be negative to the TWD firm given that a stressed market implies an increase in spreads. It may therefore be considered to fall on the ‘cost’ side when evaluating the cost of an unwinding strategy against its risk or liquidity impacts in a given situation.

- 03/03/2025

4.32

TWD firms should be able to determine the extent to which the above exits costs are covered by existing prudent valuation adjustments and note the value of any such offsets that are identified.

- 03/03/2025

4.33

In order to model exit costs, TWD firms should make assumptions regarding how the trading book portfolio would be split for the purpose of operationalising wind-down actions, arrangements, and measures in the TWD scenario (segmentation). There will be some uncertainty regarding the exact grouping of individual positions into disposal packages, which will be subject to future negotiation with multiple counterparties. These uncertainties may have a material impact on exit costs (for example, there may be uncertainty over whether offsetting market risks can be novated to the same party, thus avoiding cost of an asymmetric unwinding). The segmentation used for modelling exit costs should be selected to reflect a reasonable estimate of expected exit costs. The granularity of the modelled segmentation should accordingly be calibrated to reflect all position characteristics that materially impact the method or cost of exit. Segmentation uncertainties should be quantified in the sensitivity analysis (see paragraph 4.49).

- 03/03/2025

4.34

Template A (Appendix 1) provides a guide to the breadth and granularity of data that TWD firms should be able to provide to demonstrate an ability to analyse exit costs and liquidity flows through the segmentation of the balance sheet by method and price of exit.

- 03/03/2025

4.35

It is the TWD firms’ responsibility to ensure that their capabilities in respect of estimating exit cost are built in a way that is consistent with the Bank’s SoP on valuation capabilities to support resolvability, and related guidance.

- 03/03/2025

Operational costs

4.36

TWD firms should be able to identify operational dependencies and model the time profile of operational costs expected to be incurred in the TWD scenario. This should include costs incurred directly by the trading businesses, as well as intercompany recharges for the provision of critical services. It should include staff costs (including severance and retention) as well as costs of real estate, technology and systems, legal, audit and accounting, FMI access, and other services.

- 03/03/2025

4.37

Template B (Appendix 3) provides a guide to the breadth and granularity of data that TWD firms should be able to provide to demonstrate an ability to analyse operational costs.

- 03/03/2025

Risk-based losses

4.38

TWD firms should be able to estimate risk exposures and the potential range of RBLs in the TWD scenario. The estimate should include losses from market, credit, and operational risks.

- 03/03/2025

4.39

Because RBLs would be incurred over the duration of the TWD scenario as the risk profile of a firm’s trading activities changes due to their wind-down, a full calculation of RBLs is likely to be complex. For this reason, firms may use approximations, provided they can demonstrate that the resulting RBL is a reasonable estimate of potential losses.

- 03/03/2025

4.40

The PRA will compare TWD firms’ estimates of RBLs with Pillar 1 plus Pillar 2A in order to assess the proportion of capital that executing the TWD option might absorb. It should be understood that the PRA does not regard the sum of Pillar 1 plus Pillar 2A capital as an appropriate measure of RBLs, but rather as a metric for the purpose of providing context to understand the results of a firm’s RBL calculation as part of the PRA’s assessment.

- 03/03/2025

Capital forecast

4.41

TWD firms should be able to project the contribution of the in-scope business to capital resources and capital requirements through the wind-down. This should incorporate:

- projections of capital resources impacts through the wind-down period in the TWD scenario, incorporating the impact of expected exit, operational costs, and RBLs on capital resources, as well as a forecast of the impact of the TWD scenario on trading book-related capital deductions; and

- a projection of the impact of the implementation of the actions, arrangements, and measures set out as part of the TWD option on capital requirements in the TWD scenario, including the projection of risk-weighted assets (RWAs) for market, counterparty credit, and operational risks.

- 03/03/2025

4.42

When combined with the non-trading book components of the regulatory group, this should enable the projected capital position to be monitored against capital requirements.

- 03/03/2025

4.43

Template D (Appendix 7) provides a guide to the breadth and granularity of data TWD firms should be able to provide and analyse to demonstrate a materially accurate estimation of capital resource and RWA movements throughout the wind-down period.

- 03/03/2025

Liquidity and funding

4.44

In order to generate liquidity projections, TWD firms should have the ability to forecast and aggregate the following elements under the TWD scenario (including on a single currency basis for major currencies):

- costs and cashflows associated with the wind-down costs, RBLs, and operational costs calculated as set out above; and

- the impact of actions, arrangements, and measures taken to manage the liquidity of the balance sheet, taking account of potential additional collateral requirements, adverse actions taken by FMIs’ collateral requirements, and the effect of speed and asymmetry of unwinding businesses (eg the prime brokerage business).

- 03/03/2025

4.45

TWD firms should be able to assess and monitor the liquidity position against regulatory requirements and quantify the size and duration of any projected shortfalls in liquidity against their internal resources, such that authorities can understand the potential requirement for central bank lending.

- 03/03/2025

4.46

Template E (parts a and b of Appendix 9) provides a guide to the breadth and granularity of data that TWD firms should be able to provide and analyse to demonstrate a materially accurate estimation of liquidity movements throughout the wind-down period.

- 03/03/2025

4.47

The liquidity analysis should be supplemented by the ability to produce encumbered and unencumbered asset data for any point in the wind-down. Template C (parts 1 and 2 of Appendix 5) provides a guide to the breadth and granularity of data that TWD firms should be able to provide and analyse to produce encumbered and unencumbered asset data for any point in the wind-down.

- 03/03/2025

Rump Analysis

4.48

TWD firms should have the ability to model the rump portfolio. This should include identifying and maintaining an inventory of potential rump positions. These positions could be considered under four categories:

- positions which the TWD firm believes it would be unable to liquidate under the TWD scenario despite all reasonable efforts (‘non-discretionary rump’);

- positions which the TWD firm holds to support non-discretionary rump positions but which in and of themselves could be exited;

- positions the TWD firm believes can be liquidated but are within the appetite for residual positions assumed under the TWD scenario. This might be the case where the cost to liquidate would be greater than the full cost of maintaining positions to maturity or to some future date where liquidation would be optional (‘discretionary rump’); and

- to accommodate partial wind-down capabilities into a single MIS, TWD firms should have the capability to add selected portfolios that would be retained under a partial TWD option into a fourth category of the rump, named ‘trading activities retained’.

- 03/03/2025

Sensitivity Analysis

4.49

TWD firms should have the ability to perform sensitivity analyses of the key market factors set out in the TWD scenario, assumptions, and judgments that could have a material impact on capital and liquidity projections and on RBLs. At a minimum, sensitivities of capital and liquidity to the following factors should be included:

- duration of market-wide stress;

- severity of credit downgrade of the TWD firm, and severity of general credit downgrade as part of the macroeconomic scenario;

- barriers to OTC derivative market access;

- barriers to the sale of portfolios during market-wide stress;

- full or partial closure of secured funding markets and foreign exchange markets;

- market calibration inputs such as input parameters for the exit cost calculations;

- shifting the relative prioritisation of capital resource maintenance vs liquidity maintenance vs risk reduction;

- increasing or reducing the targeted wind-down period;

- applying different segmentations of portfolios for the purpose of novation to step-in counterparties;

- partial wind-down: TWD firms should be able to quantify the impact on the projections of removing portfolios from the wind-down; and

- risk appetite for the discretionary rump, for example the likely cost of closing out discretionary rump positions within the active wind-down period.

- 03/03/2025

4.50

This is not an exhaustive list. TWD firms should include in their sensitivity analysis the elements of their TWD planning assumptions that could lead to material differences to capital and liquidity projections under stressed market conditions.

- 03/03/2025

4.51

TWD firms should carefully consider the appropriate level of modelling complexity for the sensitivity analysis. Where possible and proportionate, sensitivity analysis should be incorporated into the model for the projections based on the TWD scenario. For some types of sensitivity, this may not be possible without generating undue modelling complexity that is disproportionate to the extra informational value. For example, there is a danger of false precision, given the high levels of uncertainty inherent in the exercise. In such cases, more approximate methodologies may be appropriate. Bounding techniques, such as applying conservative assumptions in order to simplify the calculation, may be useful in determining which assumptions are material and their likely range.

- 03/03/2025

TWD capabilities being responsive to circumstances

4.52

The PRA expects a TWD firm’s senior management to use the TWD firm’s information provision and decision-making capabilities to inform decisions on whether:

- the TWD option is appropriate for maintaining or restoring the viability of the TWD firm;

- the recovery plan is credible as a whole; and

- the TWD option is sufficiently tailored to the TWD scenario.32

Footnotes

- 32. May 2022: Paragraphs 2.61-2.65, https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 03/03/2025

4.53

Using the information provision and decision-making capabilities, including sensitivity analyses, TWD firms should be able to determine how changes to one part of the TWD option affects other parts of the TWD option. For example, TWD firms should be able to determine how any changes to the TWD scenario impact the quantification of wind-down costs. TWD firms should also be able to determine how these changes to the quantification of wind-down costs impact their capital and liquidity projections. Finally, TWD firms should be able to use those projections to make decisions on whether to execute the TWD option.

- 03/03/2025

4.54

TWD firms’ information provision and decision-making capabilities should also ensure the TWD firm can provide information to authorities that will help the PRA and Bank make their decisions throughout a firm-specific and/or market-wide stress. These decisions may include, for example, whether liquidity support should be offered to firms.

- 03/03/2025

TWD firms’ TWD capabilities should help them to meet recovery planning policy

4.55

- 03/03/2025

4.56

TWD firms should implement an approach that best delivers the expectations in this SS depending on their business model, and should utilise their existing capabilities to meet expectations where possible, and develop new capabilities where necessary.

- 03/03/2025

4.57

TWD firms should ensure they are prepared for resolution (Rule 8 in the Fundamental Rules Part of the PRA Rulebook). For example:

- TWD firms should ensure their TWD capabilities could be utilised to aid the independent valuer in carrying out relevant resolution valuations on a sufficiently timely and reasonable basis;

- When developing TWD capabilities, TWD firms should determine the information they will need to be able to develop and execute the TWD option in both recovery and post-resolution restructuring; and

- TWD firms should determine how their TWD capabilities may help them to leverage resolution tools (eg transfer of positions to an asset management vehicle) if relevant according to the TWD firm’s resolution strategy.

- 03/03/2025

Governance

4.58

The PRA expects TWD firms to provide evidence that their board of directors, or other appropriate senior governance committee or group, has appropriately overseen and sufficiently challenged the design, implementation, maintenance, and testing of the TWD firm’s TWD capabilities. In particular, the board should approve and regularly review the TWD firm’s TWD capabilities, including the design of the MIS. The TWD firm’s head of stress testing should be involved in the review of TWD capabilities.33

Footnotes

- 33. May 2022: Paragraph 2.84, https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 03/03/2025

4.59

TWD firms should set and document criteria to guide judgements they will have to make in developing TWD capabilities and scenario testing the TWD option. These judgements might include, for example, judgements on the usefulness of alternative approaches to financial impact projections, the level of testing and monitoring to be performed, and resource prioritisation. These criteria should include how the expectations in this SS should be interpreted in relation to the size, systemic importance, and business model of their trading activities.

- 03/03/2025

4.60

These governance arrangements should be integrated within the wider business-as-usual recovery planning governance arrangements.34

Footnotes

- 34. For example, paragraphs 2.83 and 2.84 of SS9/17: https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 03/03/2025

4.61

Developing and maintaining the firm’s recovery plan and resolution pack35 is a prescribed responsibility (PR) under the Senior Managers Regime.36 The maintenance of TWD capabilities and of the TWD option falls under this PR.

Footnotes

- 35. Rule 4.1(10) in the Allocation of Responsibilities Part of the Rulebook, and SS28/15 ‘Strengthening individual accountability in banking’, December 2021: https://www.bankofengland.co.uk/prudential-regulation/publication/2015/strengthening-individual-accountability-in-banking-ss.

- 36. May 2022: Paragraph 2.97, https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 03/03/2025

4.62

SS9/17 sets out the PRA’s expectations regarding the governance arrangements for recovery planning.37 These expectations apply for a TWD firm’s TWD capabilities; these capabilities should be integrated into the TWD firm’s wider arrangements for recovery planning.38

Footnotes

- 37. May 2022: Paragraphs 2.83-2.84, https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 38. For example paragraphs 2.83-2.84 of SS9/17: https://www.bankofengland.co.uk/prudential-regulation/publication/2017/recovery-planning-ss.

- 03/03/2025

TWD firms’ model risk management

4.63

Footnotes

- 39. April 2018: Paragraphs 2.1-2.9, https://www.bankofengland.co.uk/prudential-regulation/publication/2018/model-risk-management-principles-for-stress-testing-ss.

- 03/03/2025

5

TWD templates

5.1

The PRA has set out the TWD templates in the appendices. TWD firms should use these templates as a guide to the breadth and granularity of data that the PRA would expect TWD firms to be able to produce.

- 03/03/2025

5.2

TWD firms may present the relevant data in a different form than has been set out in the templates, as the PRA considers it is important that TWD firms have responsibility for how they meet the expectations set out in this SS for the methodology, models, and frameworks needed to forecast the impact of the TWD option on TWD firms’ capital requirements, capital resources, and liquidity throughout the wind-down period.

- 03/03/2025

5.3

The PRA expects TWD firms to be able to produce data of a breadth and granularity consistent with that set out in the TWD templates. However, TWD firms are also expected to increase or decrease the breadth and granularity of data as appropriate, given the size and complexity of their trading activities.

- 03/03/2025

5.4

Where TWD firms consider that a different level of breadth and granularity of data is appropriate instead of that set out in the TWD templates, firms should be able to provide justification and assurance to the PRA. The PRA expects firms to conduct an analysis on their own format of data templates against the TWD templates in the appendices, and be able to explain that the firms’ data templates achieve the same outcomes and level of completeness as expected in this SS.

- 03/03/2025

5.5

Appropriate completion of the templates would be sufficient for TWD firms to provide assurance to the PRA that they can provide data of an appropriate breadth and granularity to meet the expectation that TWD firms should have the methodology, models, and frameworks needed to forecast the impact of the TWD option on the TWD firm’s capital requirements, capital resources, and liquidity throughout the wind-down period.

- 03/03/2025

6

TWD in the context of groups

6.1

The expectations set out in this SS for TWD firms are consistent with the expectations set out in SS5/21 ‘International banks: The PRA’s approach to branch and subsidiary supervision’.

- 03/03/2025

6.2

For UK subsidiaries of third-country groups, the PRA applies the same regulatory requirements, and follows the same supervisory framework, as those firms that are based in the UK and are either not part of a group or are part of a group based in the UK. However, its supervisory approach takes into account the links between the subsidiary and the rest of the group of which it forms a part. Where that group is not based in the UK, the PRA will typically have less information on the risks arising in the group, and less ready access to those responsible for group risk management.

- 03/03/2025

6.3

The PRA tailors its supervisory approach according to the nature, scale, and complexity of a firm’s UK operations, and potential impact on financial stability in the UK, and also according to the extent to which the firm’s UK operations are integrated with overseas operations. Accordingly, the PRA’s expectations of subsidiaries of third-country groups may differ in some areas from those of subsidiaries belonging to groups based in the UK.

- 03/03/2025

6.4

Consistent with this approach, the PRA is likely to tailor its supervisory approach to TWD firms that are UK subsidiaries of third-country groups with regards to the expectations in this SS according to the nature, scale, and complexity of the trading activities in which those TWD firms are engaged in the UK. The PRA is likely to tailor its supervisory approach for these TWD firms with regards to their potential impact on financial stability in the UK. Accordingly, the PRA’s expectations of these TWD firms may differ in some areas from those of TWD firms that are UK headquartered firms on a case-by-case basis.

- 03/03/2025

6.5

For example, in designing the TWD scenario the PRA expects TWD firms to make appropriately severe assumptions regarding a minimum baseline set of factors (set out in Chapter 3). For TWD firms that are subsidiaries of third-country groups, these TWD firms may align their assumptions with the assumptions used for developing an option to wind down trading activities under the oversight of the home-state regulator. For TWD firms which are part of Capital Requirements Regulation (CRR) consolidation entities, these assumptions are the responsibility of the TWD firm.

- 03/03/2025

6.6

TWD firms should be able to co-ordinate the full or partial wind-down of trading activities across group entities and jurisdictions if their trading activities to be wound down span different group entities and jurisdictions.

- 03/03/2025

6.7

TWD firms that are subsidiaries of third-country groups should leverage their group capabilities in order to meet these expectations. A TWD firm subject to US Title I requirements, for example, should leverage relevant existing capabilities in order to meet the expectations set out in this SS. However, if a TWD firm’s group does not have sufficient capabilities to meet these expectations, the PRA expects the TWD firm to develop local capabilities of its own.

- 03/03/2025

6.8

TWD firms that are UK subsidiaries of third-country groups should include the TWD option at the legal entity level in their own recovery plans and provide local assurance of their TWD capabilities for executing the TWD option. This enables firms to comply with the requirements in the Recovery Plans Part of the PRA Rulebook and meet the PRA’s expectations as set out in SS9/17. These firms should also demonstrate that their TWD capabilities (whether leveraging group capabilities or using locally-built capabilities) can support the execution of the TWD option during post-resolution restructuring to demonstrate that they comply with Rule 8 in the Fundamental Rules Part of the PRA Rulebook.

- 03/03/2025

6.9

The PRA will discuss its expectations with TWD firms through ongoing supervisory dialogue. If TWD firms are in any doubt about how these expectations apply to them, they should speak to their PRA supervisor. These expectations do not apply to third-country branches.

- 03/03/2025

Appendices

The following templates and accompanying instructions provide a guide to the breadth and granularity of data that the PRA would expect TWD firms to be able to produce under this SS. They are available at: https://www.bankofengland.co.uk/prudential-regulation/publication/2021/october/trading-activity-wind-down.

| 1 | Template A |

| 2 | Template A instructions |

| 3 | Template B |

| 4 | Template B instructions |

| 5 | Template C |

| 6 | Template C instructions |

| 7 | Template D |

| 8 | Template D instructions |

| 9 | Template E |

| 10 | Template E instructions |

- 03/03/2025