SIFA 18

Fees

SIFA 18.1

Fees

- 01/12/2004

SIFA 18.1.1

See Notes

- 09/09/2005

SIFA 18.1.2

See Notes

- 09/09/2005

SIFA 18.1.3

See Notes

- 09/09/2005

SIFA 18.1.4

See Notes

- 09/09/2005

SIFA 18.1.5

See Notes

- 09/09/2005

SIFA 18.2

Periodic Fees

- 09/09/2005

SIFA 18.2.1

See Notes

- 09/09/2005

SIFA 18.2.2

See Notes

- 09/09/2005

SIFA 18.2.3

See Notes

- 09/09/2005

SIFA 18.2.4

See Notes

- 09/09/2005

SIFA 18.2.5

See Notes

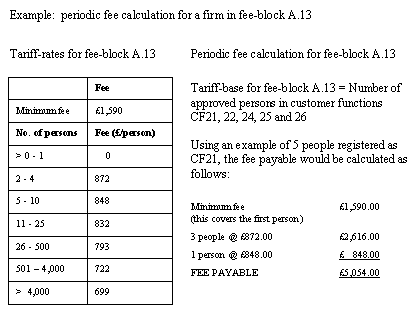

Periodic fee = (tariff-base data for firm) x (fee-block tariff-rates)

- 09/09/2005

SIFA 18.2.6

See Notes

- 09/09/2005

SIFA 18.2.7

See Notes

- 09/09/2005

SIFA 18.2.8

See Notes

- 09/09/2005

SIFA 18.3

Application Fees

- 09/09/2005

SIFA 18.3.1

See Notes

- 09/09/2005

SIFA 18.3.2

See Notes

- 09/09/2005

SIFA 18.3.3

See Notes

- 09/09/2005

SIFA 18.3.4

See Notes

- 09/09/2005

SIFA 18.3.5

See Notes

- 09/09/2005

SIFA 18.3.6

See Notes

- 09/09/2005

SIFA 18.4

Where Are The Relevant Handbook Sections?

- 09/09/2005

SIFA 18.4.1

See Notes

- 09/09/2005

SIFA 18.5

Further Information

- 09/09/2005

SIFA 18.5.1

See Notes

- 09/09/2005

SIFA 18.5.2

See Notes

- 09/09/2005

SIFA 18.5.3

See Notes

- 09/09/2005

SIFA 18.5.4

See Notes

- 09/09/2005

SIFA 18.5.5

See Notes

| The following sections of the Guide are also relevant: | |

| • | 'Authorisation' - Chapter 6 |

| • | 'Variation of permission (VOP)' - Chapter 15.1 |

| • | 'Further information' - Chapter 19. |

| • | If you do mortgage or general insurance business you should also refer to MIGI 19. |

- 09/09/2005