SIFA 11

Complaints

SIFA 11.1

How to handle a complaint

- 01/12/2004

SIFA 11.1.1

See Notes

- 09/09/2005

SIFA 11.1.2

See Notes

- 09/09/2005

SIFA 11.1.3

See Notes

- 09/09/2005

SIFA 11.1.4

See Notes

- 09/09/2005

SIFA 11.1.5

See Notes

- 09/09/2005

SIFA 11.1.6

See Notes

- 09/09/2005

SIFA 11.1.7

See Notes

- 09/09/2005

SIFA 11.1.8

See Notes

- 09/09/2005

When and where should you publicise your procedures?

SIFA 11.1.9

See Notes

- 09/09/2005

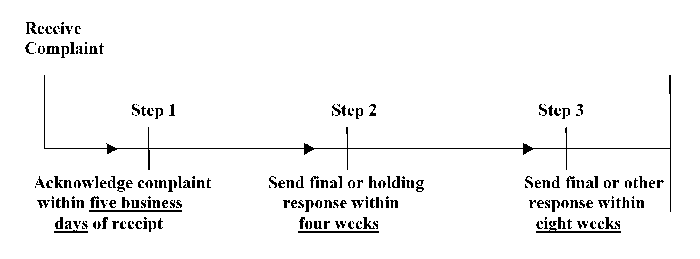

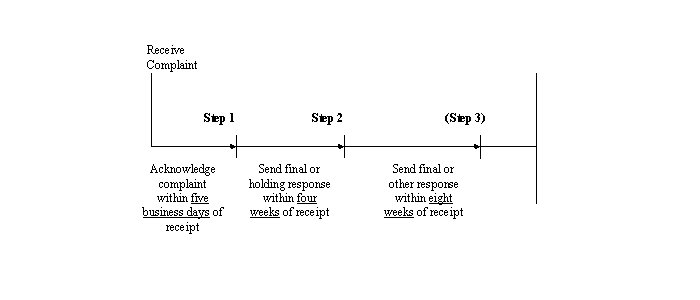

How quickly do you need to deal with a complaint?

SIFA 11.1.10

See Notes

- 09/09/2005

SIFA 11.1.11

See Notes

| Step 1 | Within five business days | |

|

-send a copy

of your internal complaints procedures; and-inform them

who will be handling the complaint; or-inform the complainant

of the referral by way of a final response and include the other firm's contact

details.

| ||

| Step 2 |

Within four weeks

Send a final response - including: | (It should be a separate document and written in plain English) |

|

-a summary of

the complaint;-details of any

offer made;-right your client

has to go to the FOS;-a copy of the

leaflet about the FOS - 'your complaint and the ombudsman';-a summary of

your investigation;-the time limit

on any offer made; and-the six-month

time limit for referrals to the FOS.

| ||

| Or send a holding response | ||

| Explaining why you are not yet in a position to resolve the complaint and indicating when you will make further contact with the client. | ||

| Step 3 |

Within eight weeks

Send a final response | |

| As per the details in step 2 above. | ||

| Or a response explaining: | ||

|

-why you are

not able to respond;-when you expect

to provide a final response;-explaining that

the client is entitled to refer the complaint to the FOS if unhappy with the

delay;-the reasons

for the delay;-giving a copy

of the leaflet about the FOS - 'your complaint and the ombudsman'; and-the six-month

time limit for referrals to the FOS.

| ||

- 09/09/2005

SIFA 11.1.12

See Notes

- 09/09/2005

SIFA 11.1.13

See Notes

- 09/09/2005

Exception to the rules: quick resolution of complaints

SIFA 11.1.14

See Notes

- 09/09/2005

SIFA 11.1.15

See Notes

- 09/09/2005

Charging customers for handling their complaints

SIFA 11.1.16

See Notes

- 09/09/2005

SIFA 11.1.17

See Notes

- 09/09/2005

SIFA 11.1.18

See Notes

- 09/09/2005

Cooperation with the financial ombudsman service

SIFA 11.1.19

See Notes

- 09/09/2005

SIFA 11.1.20

See Notes

- 09/09/2005

Mortgage endowment complaints

SIFA 11.1.21

See Notes

www.fsa.gov.uk/pubs/ceo/ceo_letter_4apr02.pdf

www.fsa.gov.uk/pubs/ceo/ceo_letter_23jan04.pdf

- 09/09/2005

Where are the relevant Handbook sections?

SIFA 11.1.22

See Notes

- 09/09/2005

Record keeping requirements

SIFA 11.1.23

See Notes

| Information about a complaint that you should keep: | |

| The name of the complainant. | The substance of the complaint. |

| Copies of correspondence between your firm and the complainant. | Details of any redress offered by your firm. |

| Documentation relating to the referral of a complaint | |

| The following section of the Guide is also relevant: | |

| • | 'Complaints reporting to the FSA' - Chapter 11.2 |

| If you do mortgage or general insurance business you should also refer to MIGI 14. | |

- 09/09/2005

SIFA 11.2

Complaints reporting to the FSA

- 01/12/2004

SIFA 11.2.1

See Notes

- 09/09/2005

Why do you need to submit a complaints report?

SIFA 11.2.2

See Notes

- 09/09/2005

When are the reporting periods?

SIFA 11.2.3

See Notes

- 09/09/2005

SIFA 11.2.4

See Notes

- 09/09/2005

SIFA 11.2.5

See Notes

- 09/09/2005

How do you submit a report?

SIFA 11.2.6

See Notes

- 09/09/2005

Where are the relevant Handbook sections?

SIFA 11.2.7

See Notes

| The following sections of the Guide are also relevant: | |

| • | 'How to handle a complaint' - Chapter 11.1 |

| • | 'Reporting requirements' - Chapter 12.1 |

- 09/09/2005