SIFA 1

Introduction

SIFA 1.1

Purpose of the Guide

- 09/09/2005

- Past version of SIFA 1.1 before 09/09/2005

SIFA 1.1.1

See Notes

- 09/09/2005

- Past version of SIFA 1.1.1 before 09/09/2005

SIFA 1.1.2

See Notes

- 09/09/2005

- Past version of SIFA 1.1.2 before 09/09/2005

SIFA 1.1.3

See Notes

- 09/09/2005

- Past version of SIFA 1.1.3 before 09/09/2005

SIFA 1.1.4

See Notes

- 09/09/2005

- Past version of SIFA 1.1.4 before 09/09/2005

SIFA 1.1.5

See Notes

- 09/09/2005

- Past version of SIFA 1.1.5 before 09/09/2005

SIFA 1.1.6

See Notes

- 09/09/2005

- Past version of SIFA 1.1.6 before 09/09/2005

SIFA 1.1.7

See Notes

- 09/09/2005

- Past version of SIFA 1.1.7 before 09/09/2005

SIFA 1.1.8

See Notes

- 09/09/2005

SIFA 1.1.9

See Notes

- 09/09/2005

SIFA 1.1.10

See Notes

- 09/09/2005

SIFA 2

10 key points

SIFA 2.1

10 key points

- 09/09/2005

- Past version of SIFA 2.1 before 09/09/2005

SIFA 2.1.1

See Notes

- 09/09/2005

- Past version of SIFA 2.1.1 before 09/09/2005

SIFA 2.1.2

See Notes

- 09/09/2005

- Past version of SIFA 2.1.2 before 09/09/2005

SIFA 3

Accessing the handbook

and keeping up to date

SIFA 3.1

Accessing the handbook

- 09/09/2005

- Past version of SIFA 3.1 before 09/09/2005

SIFA 3.1.1

See Notes

The contents are the same in each medium. You can order one-off paper copies of the Handbook or modules of the Handbook by contacting The Stationery Office (telephone 0845 608 2372) and selecting option 1.

- 09/09/2005

- Past version of SIFA 3.1.1 before 09/09/2005

SIFA 3.2

Installing the CD-ROM

- 09/09/2005

SIFA 3.2.1

See Notes

- 09/09/2005

SIFA 3.3

Further information

- 09/09/2005

SIFA 3.3.1

See Notes

- 09/09/2005

SIFA 3.4

Structure of each sourcebook or manual

- 09/09/2005

SIFA 3.4.1

See Notes

- 09/09/2005

SIFA 3.4.2

See Notes

- 09/09/2005

SIFA 3.4.3

See Notes

- 09/09/2005

SIFA 3.4.4

See Notes

| Schedule | Contents |

| Schedule 1 | Record keeping requirements (see Chapter 13 of the Guide) |

| Schedule 2 | Notification and reporting requirements (see Chapter 12 of the Guide) |

| Schedule 3 | Fees (see Chapter 18 of the Guide) |

| Schedule 4 | FSA powers used in making the provisions |

| Schedule 5 | Rules where rights of action exist under section 150 of the Financial Services and Markets Act 2000 (action for damages by a private person who suffers loss as a result of a breach of the rules) |

| Schedule 6 | Rules which the FSA has powers to waive or modify (see Chapter 16 of the Guide) |

- 09/09/2005

SIFA 3.5

Keeping up-to-date with handbook changes

- 09/09/2005

SIFA 3.5.1

See Notes

- 09/09/2005

SIFA 3.5.2

See Notes

- 09/09/2005

SIFA 3.5.3

See Notes

- 09/09/2005

SIFA 3.5.4

See Notes

- 09/09/2005

SIFA 3.5.5

See Notes

- 09/09/2005

SIFA 3.5.6

See Notes

- 09/09/2005

SIFA 3.5.7

See Notes

- 09/09/2005

SIFA 4

Contents of

the handbook

SIFA 4.1

The parts of the handbook that apply to smaller investment intermediaries

- 09/09/2005

- Past version of SIFA 4.1 before 09/09/2005

SIFA 4.1.1

See Notes

- 09/09/2005

- Past version of SIFA 4.1.1 before 09/09/2005

SIFA 4.1.2

See Notes

- 01/12/2004

SIFA 4.1.3

See Notes

- 01/12/2004

SIFA 4.1.4

See Notes

- 01/12/2004

SIFA 4.1.5

See Notes

| THE PRINCIPLES | |

| 1. | A firm must conduct its business with integrity. |

| 2. | A firm must conduct its business with due skill, care and diligence. |

| 3. | A firm must take reasonable care to organise and control its affairs responsibly and effectively, with adequate risk management systems. |

| 4. | A firm must maintain adequate financial resources. |

| 5. | A firm must observe proper standards of market conduct. |

| 6. | A firm must pay due regard to the interests of its customers and treat them fairly. |

| 7. | A firm must pay due regard to the information needs of its clients, and communicate information to them in a way, which is clear, fair, and not misleading. |

| 8. | A firm must manage conflicts of interest fairly, both between itself and its customers and between a customer and another client. |

| 9. | A firm must take reasonable care to ensure the suitability of its advice and discretionary decisions for any customer who is entitled to rely upon its judgement. |

| 10. | A firm must arrange adequate protection for client's assets when it is responsible for them. |

| 11. | A firm must deal with its regulators in an open and co-operative way, and must disclose to the FSA appropriately anything relating to the firm of which the FSA would reasonably expect notice. |

- 01/12/2004

SIFA 4.1.6

See Notes

- 01/12/2004

SIFA 4.1.7

See Notes

- 01/12/2004

SIFA 4.1.9

See Notes

- 01/12/2004

SIFA 4.1.10

See Notes

Table:

|

The

following sections of this Overview are also relevant:

• Threshold Conditions in 'Authorisation' - Chapter 5 •'Money Laundering' - Chapter 14 |

- 01/12/2004

SIFA 4.2

Abbreviations

- 09/09/2005

SIFA 4.2.1

See Notes

| Manual / sourcebook | Manual / sourcebook | ||

| APER | Statements of Principle and Code of Practice for Approved Persons | FS | Feedback Statement |

| AUTH | Authorisation manual | GEN | General Provisions |

| CASS | Client Assets | ICOB | Insurance: Conduct of Business |

| COAF | Complaints against the FSA | IPRU(INV) | Interim Prudential sourcebook for Investment Businesses |

| COB | Investments: Conduct of Business | MAR | Market Conduct |

| COMP | Compensation | MCOB | Mortgages: Conduct of Business |

| COND | Threshold Conditions | ML | Money Laundering |

| CP | Consultation Paper | PERG | Perimeter Guidance |

| DEC | Decision Making (gives guidance on the FSA's decision making and other procedures for giving statutory notices) | PRIN | Principles for Businesses |

| PROF | Professional firms | ||

| PRU | Integrated Prudential sourcebook | ||

| DISP | Dispute Resolution: complaints | PS | Policy statement |

| DP | Discussion paper | SUP | Supervision manual |

| ENF | Enforcement manual | SYSC | Senior Management Arrangements Systems and Controls |

| FIT | Fit and Proper test for Approved Persons | TC | Training and Competence |

- 09/09/2005

SIFA 4.3

Contents of the Handbook

- 09/09/2005

SIFA 4.3.1

See Notes

- 09/09/2005

High Level Standards (Block 1):

SIFA 4.3.2

See Notes

| Sourcebook | Contents |

| PRIN | Sets out the overarching standards we expect of firms and will be familiar to you. It includes the Principles. |

| SYSC | Outlines our management arrangement requirements. While this is important to all firms, management control and accountability should clearly be simpler in a small firm. |

| FIT | Sets out our standards applied when giving approved person status and so is relevant when a firm submits an application for an employee to become an approved person. It is also relevant for the purposes of assessing the continuing fitness and propriety of approved persons. |

| APER | Is of continuing relevance as it sets out the standards of behaviour that we expect of approved persons. |

| COND | Sets out the minimum standards that firms must satisfy to retain authorisation (the 'Threshold Conditions'). |

| GEN | Sets out some of the underlying legal framework. GEN 1.2 is likely to be one of the most relevant parts. The purpose of the section is to ensure that clients are not misled about the extent to which we have approved a firm's affairs. GEN 4 on statutory status disclosure is discussed at section 9.11 of the Guide. GEN 5.1 deals with the use of the FSA logo and the Keyfacts logo which must be included on a firm's initial disclosure document (IDD) and menu. |

- 09/09/2005

Prudential Standards (Block 2):

SIFA 4.3.3

See Notes

- 09/09/2005

Business standards (Block 3):

SIFA 4.3.4

See Notes

- 09/09/2005

SIFA 4.3.5

See Notes

- 09/09/2005

SIFA 4.3.6

See Notes

| COB Sourcebook | |

| Chapter | Subject |

| Most of the following chapters will have practical relevance: | |

| 4 | Accepting customers and customer classification |

| 5 | Advising and selling |

| 5A | Providing basic advice on stakeholder products |

| 6 | Product disclosure and the customer's right to cancel or withdraw |

| Parts of the following chapters will have practical relevance: | |

| 2 | Rules which apply when conducting designated investment business |

| 3 | Financial promotion |

| 7 | Dealing and managing |

| 8 | Reporting to customers |

| Not relevant in most cases: | |

| 1 | General application: the various limitations of application are unlikely to be relevant to small firms doing UK business |

| 8A | Claims handling under long-term care insurance contracts |

| 10 | Collective investment schemes |

| 11 | Trustee and depositary activities |

| 12 | Lloyd's |

- 09/09/2005

SIFA 4.3.7

See Notes

- 09/09/2005

Regulatory processes (Block 4):

SIFA 4.3.8

See Notes

- 09/09/2005

SIFA 4.3.9

See Notes

- 09/09/2005

Redress (Block 5):

SIFA 4.3.10

See Notes

- 09/09/2005

Specialist sourcebooks (Block 6):

SIFA 4.3.11

See Notes

- 09/09/2005

Listing, Prospectus and Disclosure Rules (Block 7):

SIFA 4.3.12

See Notes

- 09/09/2005

Special guides:

SIFA 4.3.13

See Notes

'MIGI' - General rules

http://fsahandbook.info/FSA/html/handbook/MIGI

'MOGI' Mortgage intermediaries (additional rules)

http://fsahandbook.info/FSA/html/handbook/MOGI

and 'GIGI' - Insurance Intermediaries (additional rules)

http://fsahandbook.info/FSA/html/handbook/GIGI.

- 09/09/2005

SIFA 4.4

Fees

- 09/09/2005

SIFA 4.4.1

See Notes

- 09/09/2005

SIFA 4.5

Interpreting the handbook

- 09/09/2005

SIFA 4.5.1

See Notes

- 09/09/2005

SIFA 4.6

Rules and guidance

- 09/09/2005

SIFA 4.6.1

See Notes

- 09/09/2005

SIFA 4.6.2

See Notes

- 09/09/2005

SIFA 4.6.3

See Notes

- 09/09/2005

SIFA 4.6.4

See Notes

- 09/09/2005

SIFA 4.6.5

See Notes

- 09/09/2005

SIFA 4.6.6

See Notes

- 09/09/2005

Export chapter as

SIFA 5

FSA Principles, Systems and Controls

SIFA 5.1

FSA Principles

- 09/09/2005

- Past version of SIFA 5.1 before 09/09/2005

SIFA 5.1.1

See Notes

- 09/09/2005

- Past version of SIFA 5.1.1 before 09/09/2005

SIFA 5.1.2

See Notes

- 09/09/2005

- Past version of SIFA 5.1.2 before 09/09/2005

SIFA 5.1.3

See Notes

Table:

| • | Authorise firms that satisfy the necessary conditions (the threshold conditions) by granting permission to carry on specified regulated activities; |

| • | Approve individuals to carry on controlled functions in firms as being fit and proper to carry out these functions; |

| • | Answer technical enquiries about whether firms require authorisation or individuals require approval; |

| • | Seek to ensure that investment business is not being carried out by unauthorised firms; and |

| • | Collect and maintain intelligence information about authorised firms and individuals. |

- 01/12/2004

SIFA 5.1.4

See Notes

- 01/12/2004

SIFA 5.1.5

See Notes

| Threshold Conditions | |

| • | Legal status - can be a sole trader, partnership, limited liability partnership or a limited company. |

| • | The head office and registered office must be in the UK if your firm is a body corporate formed in the UK. |

| • | Close links with connected persons such as directors, controllers or partners must not impede FSA supervision. |

| • | A firm must have adequate financial resources. |

| • | Suitability - the applicant must be fit and proper. |

- 01/12/2004

SIFA 5.1.6

See Notes

- 01/12/2004

SIFA 5.1.7

See Notes

- 01/12/2004

SIFA 5.1.8

See Notes

Table:

| Typical investment business regulated activities for IFAs are: | |

| • | Arranging deals in investments. |

| • | Making arrangements with a view to transactions in investments. |

| • | Advising on investments. |

| • | Advising on pension transfers and opt-outs. |

- 01/12/2004

SIFA 5.1.9

See Notes

- 01/12/2004

SIFA 5.1.10

See Notes

- 01/12/2004

SIFA 5.1.11

See Notes

- 01/12/2004

SIFA 5.1.12

See Notes

- 01/12/2004

SIFA 5.1.13

See Notes

Table:

| • | Permission to carry on regulated activities: AUTH 3.4 |

| • | Information on specified investments: AUTH 3.5 |

| • | Information on limitations: AUTH 3.6. An example of a limitation is where we limit the number of clients a firm can deal with during an initial period until its systems are proven. |

| • | How we may impose requirements: AUTH 3.7. For example, some firms have a requirement to submit independent compliance reviews or not to hold client money. |

- 01/12/2004

SIFA 5.1.14

See Notes

- 01/12/2004

SIFA 5.1.15

See Notes

- 01/12/2004

SIFA 5.1.16

See Notes

- 01/12/2004

SIFA 5.1.17

See Notes

- 01/12/2004

SIFA 5.1.18

See Notes

- 01/12/2004

SIFA 5.1.19

See Notes

Table:

|

The

following sections of this Overview are also relevant: •'FSA supervision of small firms' - Chapter 6; •'Approved persons' - Chapter 7; •'Variation of permission' - Chapter 15.1; •'Cancellation of permission' - Chapter 15.2; and •'Fees' - Chapter 18. |

- 01/12/2004

SIFA 5.2

Who do the Principles apply to and what is their purpose?

- 09/09/2005

SIFA 5.2.1

See Notes

- 09/09/2005

SIFA 5.3

Where are the Principles in the Handbook?

- 09/09/2005

SIFA 5.3.1

See Notes

| The Principles | |

| 1. | Integrity: A firm must conduct its business with integrity. |

| 2. | Skill, care and diligence: A firm must conduct its business with due skill, care and diligence. |

| 3. | Management and control: A firm must take reasonable care to organise and control its affairs responsibly and effectively, with adequate risk management systems. |

| 4. | Financial prudence: A firm must maintain adequate financial resources. |

| 5. | Market conduct: A firm must observe proper standards of market conduct. |

| 6. | Customers' interests: A firm must pay due regard to the interests of its customers and treat them fairly. |

| 7. | Communications with clients: A firm must pay due regard to the information needs of its clients, and communicate information to them in a way, which is clear, fair, and not misleading. |

| 8. | Conflicts of interest: A firm must manage conflicts of interest fairly, both between itself and its customers and between a customer and another client. |

| 9. | Customers: relationships of trust: A firm must take reasonable care to ensure the suitability of its advice and discretionary decisions for any customer who is entitled to rely upon its judgement. |

| 10. | Clients' assets: A firm must arrange adequate protection for client's assets when it is responsible for them. |

| 11. | Relations with regulators: A firm must deal with its regulators in an open and co-operative way, and must disclose to the FSA appropriately anything relating to the firm of which the FSA would reasonably expect notice. |

- 09/09/2005

SIFA 5.4

Senior Management Arrangements, Systems and Controls

- 09/09/2005

SIFA 5.4.1

See Notes

- 09/09/2005

SIFA 5.4.2

See Notes

- 09/09/2005

SIFA 5.4.3

See Notes

We do not expect small and large firms to have similar systems and controls. The important point is that they should be fit for purpose given the size and business of the firm. With a sole practitioner, one person is responsible for all aspects of the firm but we expect there to be systems that allow that person to monitor and manage the firm adequately.

- 09/09/2005

SIFA 5.4.4

See Notes

- 09/09/2005

SIFA 5.5

Other Requirements

- 09/09/2005

SIFA 5.5.1

See Notes

| The following sections of the Guide are also relevant: | |

| • | Threshold Conditions in 'Authorisation' - Chapter 6 |

| • | 'Money Laundering' - Chapter 14 |

| If you do mortgage or general insurance business you should also refer to MIGI 3. | |

- 09/09/2005

SIFA 6

Authorisation

SIFA 6.1

Authorisation

- 09/09/2005

- Past version of SIFA 6.1 before 09/09/2005

SIFA 6.1.1

See Notes

- 09/09/2005

- Past version of SIFA 6.1.1 before 09/09/2005

SIFA 6.1.2

See Notes

- 09/09/2005

- Past version of SIFA 6.1.2 before 09/09/2005

SIFA 6.1.3

See Notes

- 09/09/2005

- Past version of SIFA 6.1.3 before 09/09/2005

SIFA 6.1.4

See Notes

- 09/09/2005

- Past version of SIFA 6.1.4 before 09/09/2005

SIFA 6.2

The Authorisation Approval Process: Our Functions

- 09/09/2005

SIFA 6.2.1

See Notes

| We: | |

| • | Authorise firms that satisfy the necessary conditions (the threshold conditions) by granting permission to carry on specified regulated activities. |

| • | Approve individuals as being fit and proper to carry out controlled functions in firms. (Controlled functions are functions that enable the person responsible for them to exercise a significant influence on a firm's affairs or which involve that person in dealing with customers or customers' property). |

| • | Answer technical enquiries about whether firms require authorisation or individuals require approval. |

| • | Seek to ensure that investment business is not being carried out by either unauthorised firms or firms acting outside of their permitted activities. |

| • | Collect and maintain intelligence information about authorised firms and individuals. |

- 09/09/2005

SIFA 6.3

Threshold Conditions

- 09/09/2005

SIFA 6.3.1

See Notes

| Threshold Conditions | |

| • | A firm's legal status can take any form e.g. sole trader, partnership, limited liability partnership or a limited company. |

| • | The head office and registered office must be in the UK if your firm is a body corporate formed in the UK. |

| • | Close links with connected persons such as directors, controllers, other group companies or partners must not impede FSA supervision. |

| • | A firm must have adequate financial resources in relation to the regulated activities it carries on. |

| • | Suitability of the applicant firm: must be fit and proper. |

- 09/09/2005

SIFA 6.3.2

See Notes

- 09/09/2005

SIFA 6.4

Scope of Permission

- 09/09/2005

SIFA 6.4.1

See Notes

| Typical investment business regulated activities for investment intermediaries are: | |

| • | Arranging deals in investments. |

| • | Making arrangements with a view to transactions in investments. |

| • | Advising on

investments. Providing basic advice on stakeholder products is a separate regulated activity. This does not prevent a person from selling stakeholder products in other circumstances provided he has the relevant permission, for example, by giving full advice in a way that amounts to advising on investments. |

| • | Advising on pension transfers and opt-outs. |

| • | Agreeing to carry on most regulated activities is itself a regulated activity (you will need to make sure that you have appropriate permission at the stage of agreement and before you actually carry on the underlying activity such as arranging or advising). |

- 09/09/2005

SIFA 6.4.2

See Notes

- 09/09/2005

SIFA 6.4.3

See Notes

- 09/09/2005

SIFA 6.4.4

See Notes

- 09/09/2005

SIFA 6.5

Which Parts of the Handbook Apply

- 09/09/2005

SIFA 6.5.1

See Notes

- 09/09/2005

SIFA 6.5.2

See Notes

| • | When is Part IV permission required and what does it contain: AUTH 3.3 |

| • | Information on specified investments: AUTH 3.5 |

| • | Information on limitations: AUTH 3.6. An example of a limitation is where we limit the number of clients a firm can deal with during an initial period until its systems have demonstrated they are effective. |

| • | How we may impose requirements: AUTH 3.7. For example, some firms are required not to hold client money. |

- 09/09/2005

SIFA 6.5.3

See Notes

- 09/09/2005

SIFA 6.5.4

See Notes

- 09/09/2005

SIFA 6.5.5

See Notes

- 09/09/2005

SIFA 6.6

Further Information

- 09/09/2005

SIFA 6.6.1

See Notes

- 09/09/2005

SIFA 6.6.2

See Notes

- 09/09/2005

SIFA 6.6.3

See Notes

- 09/09/2005

SIFA 6.7

Further Issues

- 09/09/2005

SIFA 6.7.1

See Notes

| The following sections of the Guide are also relevant: | |

| • | 'Approved persons' - Chapter 7 |

| • | 'Variation of permission' - Chapter 15.1 |

| • | 'Cancellation of permission' - Chapter 15.2 |

| • | 'Fees' - Chapter 18 |

| If you do mortgage or general insurance business you should also refer to MIGI 4. | |

- 09/09/2005

SIFA 7

Approved Persons

SIFA 7.1

Approved Persons

- 01/12/2004

SIFA 7.1.1

See Notes

- 09/09/2005

- Past version of SIFA 7.1.1 before 09/09/2005

SIFA 7.1.2

See Notes

- 09/09/2005

- Past version of SIFA 7.1.2 before 09/09/2005

SIFA 7.1.3

See Notes

- 09/09/2005

- Past version of SIFA 7.1.3 before 09/09/2005

SIFA 7.1.4

See Notes

- 09/09/2005

- Past version of SIFA 7.1.4 before 09/09/2005

SIFA 7.2

Controlled Functions

- 09/09/2005

SIFA 7.2.1

See Notes

- 09/09/2005

SIFA 7.2.2

See Notes

- 09/09/2005

SIFA 7.2.3

See Notes

- 09/09/2005

SIFA 7.2.4

See Notes

- 09/09/2005

SIFA 7.2.5

See Notes

- 09/09/2005

SIFA 7.3

Becoming and Ceasing to be an Approved Person

- 09/09/2005

SIFA 7.3.1

See Notes

| Form | When to use the forms: |

| A | To perform a controlled function. The person who is to be appointed to perform the controlled function should complete the form and it should be authorised by an individual with a governing function within the firm. Form A is also used if an already approved person is increasing their functions but sections 4 and 5 of the Form will not always require completion. |

| B | To withdraw an application to perform a controlled function (i.e. to withdraw the application before it has been approved by the FSA). Both the firm and the candidate must sign this form. |

| C | To cease to perform a controlled function or to reduce the number of functions that an individual performs (i.e. to withdraw controlled functions from an approved person). Only the firm is required to sign this form. |

| D | To change an approved person's details. |

| E | To notify a person remaining with the same firm but changing a controlled function (e.g. to apply for a change from CF22 trainee investment adviser to CF21 investment adviser). |

- 09/09/2005

SIFA 7.4

How Long Will An Application Take?

- 09/09/2005

SIFA 7.4.1

See Notes

- 09/09/2005

SIFA 7.4.2

See Notes

- 09/09/2005

SIFA 7.5

Which Parts Of The Handbook Are Relevant?

- 09/09/2005

SIFA 7.5.1

See Notes

- 09/09/2005

SIFA 7.6

The Approval Process

- 09/09/2005

SIFA 7.6.1

See Notes

- 09/09/2005

SIFA 7.6.2

See Notes

- 09/09/2005

SIFA 7.6.3

See Notes

- 09/09/2005

SIFA 7.6.4

See Notes

- 09/09/2005

SIFA 7.7

Principles For Approved Persons

- 09/09/2005

SIFA 7.7.1

See Notes

- 09/09/2005

SIFA 7.7.2

See Notes

| Statements Of Principle | |

| • | An approved person must act with integrity in carrying out his controlled function. |

| • | An approved person must act with due skill, care and diligence in carrying out his controlled function. |

| • | An approved person must observe proper standards of market conduct in carrying out his controlled function. |

| • | An approved person must deal with the FSA and with other regulators in an open and co-operative way and must disclose appropriately any information of which the FSA would reasonably expect notice. |

| • | An approved person performing a significant influence function must take reasonable steps to ensure that the business of the firm for which he is responsible in his controlled function is organised so that it can be controlled effectively. |

| • | An approved person performing a significant influence function must exercise due skill, care and diligence in managing the business of the firm for which he is responsible in his controlled function. |

| • | An approved person performing a significant influence function must take reasonable steps to ensure that the business of the firm for which he is responsible in his controlled function complies with the relevant standards and requirements of the regulatory system. |

- 09/09/2005

SIFA 7.8

Further Information And Other Issues

- 09/09/2005

SIFA 7.8.1

See Notes

- 09/09/2005

SIFA 7.9

Record Keeping Requirements: Apportionment Of Responsibilities

- 09/09/2005

SIFA 7.9.1

See Notes

- 09/09/2005

SIFA 7.9.2

See Notes

| The following sections of the Guide are also relevant: | |

| • | 'Authorisation'- Chapter 6 |

| • | 'Notifications' - Chapter 12.2 |

| If you do mortgage or general insurance business you should also refer to MIGI 6. | |

- 09/09/2005

SIFA 8

Financial resources and professional indemnity insurance

SIFA 8.1

Summary

- 01/12/2004

SIFA 8.1.1

See Notes

- 09/09/2005

- Past version of SIFA 8.1.1 before 09/09/2005

SIFA 8.1.2

See Notes

- 09/09/2005

- Past version of SIFA 8.1.2 before 09/09/2005

SIFA 8.1.3

See Notes

- 09/09/2005

- Past version of SIFA 8.1.3 before 09/09/2005

SIFA 8.1.4

See Notes

- 09/09/2005

- Past version of SIFA 8.1.4 before 09/09/2005

SIFA 8.2

Financial Resources

- 09/09/2005

SIFA 8.2.1

See Notes

- 09/09/2005

SIFA 8.2.2

See Notes

- 09/09/2005

SIFA 8.2.3

See Notes

- 09/09/2005

SIFA 8.2.4

See Notes

- 09/09/2005

SIFA 8.3

Professional Indemnity Insurance (PII)

- 09/09/2005

SIFA 8.3.1

See Notes

- 09/09/2005

SIFA 8.3.2

See Notes

- 09/09/2005

SIFA 8.3.3

See Notes

- 09/09/2005

SIFA 8.3.4

See Notes

- 09/09/2005

SIFA 8.3.5

See Notes

- 09/09/2005

SIFA 8.3.6

See Notes

- 09/09/2005

SIFA 8.4

Financial Resources Record Keeping

- 09/09/2005

SIFA 8.4.1

See Notes

- 09/09/2005

SIFA 8.4.2

See Notes

- 09/09/2005

SIFA 8.4.3

See Notes

- 09/09/2005

SIFA 8.5

Reporting and Notification Requirements

- 09/09/2005

SIFA 8.5.1

See Notes

- 09/09/2005

SIFA 8.5.2

See Notes

- 09/09/2005

SIFA 8.5.3

See Notes

| The following sections of the Guide are also relevant: | |

| • | 'Reporting and notifications' - Chapter 12 |

| • | 'Variation and cancellation of permission' - Chapter 15 |

| • | 'Waivers and Rule Modifications' - Chapter 16 |

| If you do mortgage or general insurance business you should also refer to MIGI 7 and MIGI 8. | |

- 09/09/2005

SIFA 9

Conduct of business

SIFA 9.1

Summary

- 09/09/2005

- Past version of SIFA 9.1 before 09/09/2005

SIFA 9.1.1

See Notes

- 09/09/2005

- Past version of SIFA 9.1.1 before 09/09/2005

SIFA 9.1.2

See Notes

- 09/09/2005

- Past version of SIFA 9.1.2 before 09/09/2005

SIFA 9.1.3

See Notes

| • | Managing investments: | COB 7 Dealing and managing |

| COB 8 Reporting to customers | ||

| • | Holding client money: | Client Assets Sourcebook (CASS) (but see comments at section 9.16 of the Guide) |

- 09/09/2005

- Past version of SIFA 9.1.3 before 09/09/2005

SIFA 9.1.4

See Notes

- 09/09/2005

- Past version of SIFA 9.1.4 before 09/09/2005

Exclusion of liability

SIFA 9.1.5

See Notes

- 09/09/2005

- Past version of SIFA 9.1.5 before 09/09/2005

Reliance on Others

SIFA 9.1.6

See Notes

- 09/09/2005

- Past version of SIFA 9.1.6 before 09/09/2005

SIFA 9.1.7

See Notes

- 09/09/2005

- Past version of SIFA 9.1.7 before 09/09/2005

SIFA 9.2

Clear, fair and not misleading communication

- 01/12/2004

SIFA 9.2.1

See Notes

- 09/09/2005

- Past version of SIFA 9.2.1 before 09/09/2005

Why is it important to communicate clearly?

SIFA 9.2.2

See Notes

- 09/09/2005

- Past version of SIFA 9.2.2 before 09/09/2005

SIFA 9.2.3

See Notes

- 09/09/2005

- Past version of SIFA 9.2.3 before 09/09/2005

SIFA 9.2.4

See Notes

- 09/09/2005

- Past version of SIFA 9.2.4 before 09/09/2005

How should you communicate and where are the relevant rules?

SIFA 9.2.5

See Notes

- 09/09/2005

- Past version of SIFA 9.2.5 before 09/09/2005

SIFA 9.2.6

See Notes

- 09/09/2005

- Past version of SIFA 9.2.6 before 09/09/2005

SIFA 9.2.7

See Notes

- 09/09/2005

- Past version of SIFA 9.2.7 before 09/09/2005

A further consideration:

SIFA 9.2.8

See Notes

| The following sections of the Guide are also relevant: | |

| • | 'Financial promotions' - Chapter 9.3 |

| • | 'Client classification' - Chapter 9.5 |

| • | 'Know your customer' - Chapter 9.8 |

| • | 'Suitability' - Chapter 9.9 |

| • | 'Assessing your customer's understanding of risk' - Chapter 9.10 |

| If you do mortgage and general insurance business you should also refer to MOGI 2 and GIGI 3. | |

- 09/09/2005

- Past version of SIFA 9.2.8 before 09/09/2005

SIFA 9.3

Financial Promotions

- 09/09/2005

- Past version of SIFA 9.3 before 09/09/2005

SIFA 9.3.1

See Notes

- 09/09/2005

- Past version of SIFA 9.3.1 before 09/09/2005

SIFA 9.3.2

See Notes

- 09/09/2005

- Past version of SIFA 9.3.2 before 09/09/2005

SIFA 9.3.3

See Notes

- 09/09/2005

- Past version of SIFA 9.3.3 before 09/09/2005

SIFA 9.3.4

See Notes

- 09/09/2005

- Past version of SIFA 9.3.4 before 09/09/2005

Real Time Promotions

SIFA 9.3.5

See Notes

- 09/09/2005

- Past version of SIFA 9.3.5 before 09/09/2005

SIFA 9.3.6

See Notes

- 09/09/2005

- Past version of SIFA 9.3.6 before 09/09/2005

Non-Real Time Promotions

SIFA 9.3.7

See Notes

- 09/09/2005

- Past version of SIFA 9.3.7 before 09/09/2005

SIFA 9.3.8

See Notes

- 09/09/2005

- Past version of SIFA 9.3.8 before 09/09/2005

SIFA 9.3.9

See Notes

- 09/09/2005

- Past version of SIFA 9.3.9 before 09/09/2005

Direct Offer Financial Promotions

SIFA 9.3.10

See Notes

SIFA 9.3.11

See Notes

SIFA 9.3.12

See Notes

SIFA 9.3.13

See Notes

SIFA 9.3.14

See Notes

SIFA 9.3.15

See Notes

- 09/09/2005

Record keeping requirements

SIFA 9.3.16

See Notes

- 09/09/2005

SIFA 9.3.17

See Notes

| Period of Retention | Product Type the Financial Promotion Relates to: |

| Indefinitely | Pension transfer, pension opt-out, FSAVC. |

| Six years | Life policy, pension contract, stakeholder pension scheme. |

| Three years | All other cases. |

- 09/09/2005

SIFA 9.3.18

See Notes

- 09/09/2005

Other useful information

SIFA 9.3.19

See Notes

| The following sections of the Guide are also relevant: | |

| • | 'Clear, fair and not misleading communication' - Chapter 9.2 |

| • | 'Key features' - Chapter 9.15 |

| If you do mortgage or general insurance business you should also refer to MOGI 2.1 and GIGI 3.2. | |

- 09/09/2005

SIFA 9.4

Inducements and Commissions

- 09/09/2005

- Past version of SIFA 9.4 before 09/09/2005

SIFA 9.4.1

See Notes

- 09/09/2005

- Past version of SIFA 9.4.1 before 09/09/2005

SIFA 9.4.2

See Notes

- 09/09/2005

- Past version of SIFA 9.4.2 before 09/09/2005

Where are the relevant sections in the Handbook?

SIFA 9.4.3

See Notes

- 09/09/2005

- Past version of SIFA 9.4.3 before 09/09/2005

Other considerations

SIFA 9.4.4

See Notes

- 09/09/2005

- Past version of SIFA 9.4.4 before 09/09/2005

Record keeping requirements

SIFA 9.4.5

See Notes

| Information | Required period of retention |

| Each payment of disclosable commission | At least six years from the date of payment. |

| Each indirect benefit given to a firm | At least six years from the date on which it was given. |

These are minimum requirements and you may decide to keep material for longer.

| The sections below are also relevant: | |

| • | 'Depolarisation - Chapter 9.7 |

| • | 'Excessive charges' - Chapter 9.12 |

| • | 'Disclosing charges, remuneration & commission' - Chapter 9.13 |

| • | PRIN 2.1 in the Handbook |

| • | If you do mortgage or general insurance business you should also refer to MOGI 2.2 and GIGI 3.3. |

- 09/09/2005

- Past version of SIFA 9.4.5 before 09/09/2005

SIFA 9.5

Client classification

- 01/12/2004

SIFA 9.5.1

See Notes

- 09/09/2005

- Past version of SIFA 9.5.1 before 09/09/2005

Why do you need to classify your customers?

SIFA 9.5.2

See Notes

- 09/09/2005

- Past version of SIFA 9.5.2 before 09/09/2005

SIFA 9.5.3

See Notes

- 09/09/2005

- Past version of SIFA 9.5.3 before 09/09/2005

When and how should you classify your clients?

SIFA 9.5.4

See Notes

|

The three client categories are listed below:

(the full definitions are in the Handbook Glossary) | Likelihood of a small personal investment firm dealing with each type of customer: | |

| Private customer: | Private customers are mainly private individuals. They are given additional protections under COB rules covering financial promotions, know your customer and suitability. | Most of your clients will fall into this category |

| Intermediate customer: | Examples of intermediate customers could include individuals with substantial investment experience and businesses for whom the firm is arranging group schemes. | Possibly |

| Market counterparty: | An example of a market counterparty is a central bank. A large intermediate customer may be classified as a market counterparty in some circumstances. | Very unlikely |

- 09/09/2005

- Past version of SIFA 9.5.4 before 09/09/2005

Other considerations when classifying customers:

SIFA 9.5.5

See Notes

- 09/09/2005

- Past version of SIFA 9.5.5 before 09/09/2005

SIFA 9.5.6

See Notes

- 09/09/2005

- Past version of SIFA 9.5.6 before 09/09/2005

Where are the relevant Handbook sections?

SIFA 9.5.7

See Notes

- 09/09/2005

- Past version of SIFA 9.5.7 before 09/09/2005

Record keeping

SIFA 9.5.8

See Notes

| Period of retention: | When client classification relates to: |

| Indefinitely | Pension transfer, pension opt-out or FSAVC |

| At least six years | Life policy or pension contract |

| At least three years | In any other case |

| The following sections of the Guide are also relevant: | |

| • | 'Terms of business' - Chapter 9.6 |

| • | 'Know your customer' - Chapter 9.8 |

| • | 'Suitability' - Chapter 9.9 |

| If you do mortgage and general insurance business you should also refer to MOGI 2 and GIGI 3. | |

- 09/09/2005

- Past version of SIFA 9.5.8 before 09/09/2005

SIFA 9.6

Terms of business

- 01/12/2004

SIFA 9.6.1

See Notes

- 09/09/2005

- Past version of SIFA 9.6.1 before 09/09/2005

Why do you need to provide terms of business?

SIFA 9.6.2

See Notes

- 09/09/2005

- Past version of SIFA 9.6.2 before 09/09/2005

SIFA 9.6.3

See Notes

- 09/09/2005

- Past version of SIFA 9.6.3 before 09/09/2005

When do you need to provide terms of business?

SIFA 9.6.4

See Notes

- 09/09/2005

- Past version of SIFA 9.6.4 before 09/09/2005

What should you include in terms of business?

SIFA 9.6.5

See Notes

- 09/09/2005

- Past version of SIFA 9.6.5 before 09/09/2005

SIFA 9.6.6

See Notes

- 09/09/2005

- Past version of SIFA 9.6.6 before 09/09/2005

SIFA 9.6.7

See Notes

- 09/09/2005

- Past version of SIFA 9.6.7 before 09/09/2005

Where is the relevant information in the Handbook?

SIFA 9.6.8

See Notes

- 09/09/2005

- Past version of SIFA 9.6.8 before 09/09/2005

Other considerations

SIFA 9.6.9

See Notes

- 09/09/2005

- Past version of SIFA 9.6.9 before 09/09/2005

Record keeping requirements

SIFA 9.6.10

See Notes

SIFA 9.6.11

See Notes

| Period of retention: | When terms of business relates to: |

| Indefinitely | Pension transfer, pension opt-out or FSAVC. |

| Six years | Life policy, pension contract or stakeholder pension scheme. |

| Three years | In any other case. |

| The following sections are also relevant: | |

| • | 'Client classification' - Chapter 9.5 |

| • | 'Depolarisation' - Chapter 9.7 |

| • | 'Know your customer' - Chapter 9.8 |

| • | 'Suitability' - Chapter 9.9 |

| • | PRIN 2.1 in the Handbook |

| If you do mortgage or general insurance business you should also refer to MOGI 2 and GIGI 3. | |

SIFA 9.7

Depolarisation

- 09/09/2005

- Past version of SIFA 9.7 before 09/09/2005

SIFA 9.7.1

See Notes

- 09/09/2005

- Past version of SIFA 9.7.1 before 09/09/2005

SIFA 9.7.2

See Notes

- 09/09/2005

- Past version of SIFA 9.7.2 before 09/09/2005

SIFA 9.7.3

See Notes

- 09/09/2005

- Past version of SIFA 9.7.3 before 09/09/2005

SIFA 9.7.4

See Notes

This means that a firm cannot use the word independent in its name unless it offers customers the opportunity of paying by fee.

- 09/09/2005

- Past version of SIFA 9.7.4 before 09/09/2005

Initial disclosure document (IDD)

SIFA 9.7.5

See Notes

- 09/09/2005

- Past version of SIFA 9.7.5 before 09/09/2005

SIFA 9.7.6

See Notes

- 09/09/2005

- Past version of SIFA 9.7.6 before 09/09/2005

Menu (fees and commission statement)

SIFA 9.7.7

See Notes

- 09/09/2005

- Past version of SIFA 9.7.7 before 09/09/2005

SIFA 9.7.8

See Notes

- 09/09/2005

- Past version of SIFA 9.7.8 before 09/09/2005

SIFA 9.7.9

See Notes

- 09/09/2005

- Past version of SIFA 9.7.9 before 09/09/2005

Other Considerations

SIFA 9.7.10

See Notes

SIFA 9.7.11

See Notes

SIFA 9.7.12

See Notes

- 09/09/2005

SIFA 9.7.13

See Notes

- 09/09/2005

SIFA 9.7.14

See Notes

- 09/09/2005

SIFA 9.7.15

See Notes

- 09/09/2005

Record keeping Requirements

SIFA 9.7.16

See Notes

| The following sections are also relevant: | |

| • | Terms of business - Chapter 9.6 |

| • | Suitability - Chapter 9.9 |

| • | Training and Competence - Chapter 10 |

| • | Complaints - Chapter 11 |

- 09/09/2005

SIFA 9.8

Know your customer

- 01/12/2004

SIFA 9.8.1

See Notes

- 09/09/2005

- Past version of SIFA 9.8.1 before 09/09/2005

Why do you have to gather know your customer information?

SIFA 9.8.2

See Notes

- 09/09/2005

- Past version of SIFA 9.8.2 before 09/09/2005

SIFA 9.8.3

See Notes

- 09/09/2005

- Past version of SIFA 9.8.3 before 09/09/2005

How do you assess a private customer?

SIFA 9.8.4

See Notes

There is guidance in the table at COB 5.2.11 G.

- 09/09/2005

- Past version of SIFA 9.8.4 before 09/09/2005

SIFA 9.8.5

See Notes

- 09/09/2005

- Past version of SIFA 9.8.5 before 09/09/2005

SIFA 9.8.6

See Notes

- 09/09/2005

- Past version of SIFA 9.8.6 before 09/09/2005

SIFA 9.8.7

See Notes

- 09/09/2005

- Past version of SIFA 9.8.7 before 09/09/2005

Which part of the Handbook is relevant?

SIFA 9.8.8

See Notes

- 09/09/2005

- Past version of SIFA 9.8.8 before 09/09/2005

Other considerations

SIFA 9.8.9

See Notes

- 09/09/2005

- Past version of SIFA 9.8.9 before 09/09/2005

SIFA 9.8.10

See Notes

SIFA 9.8.11

See Notes

Record keeping requirements

SIFA 9.8.12

See Notes

| Period of retention: | When a private customer's details relate to: |

| Indefinitely | Pension transfer, pension opt-out or FSAVC. |

| At least six years | Life policy or pension contract, or stakeholder pension scheme. |

| At least three years | In any other case. |

| The following sections are also relevant: | |

| • | 'Suitability' - Chapter 9.9 |

| • | 'Assessing your customer's understanding of risk' - Chapter 9.10 |

| • | 'Money laundering' - Chapter 14 |

| • | PRIN 2.1 in the Handbook |

| If you do mortgage or general insurance business you should also refer to MOGI 2 and GIGI 3. | |

SIFA 9.9

Suitability

- 01/12/2004

SIFA 9.9.1

See Notes

- 09/09/2005

- Past version of SIFA 9.9.1 before 09/09/2005

SIFA 9.9.2

See Notes

- 09/09/2005

- Past version of SIFA 9.9.2 before 09/09/2005

SIFA 9.9.3

See Notes

- 09/09/2005

- Past version of SIFA 9.9.3 before 09/09/2005

SIFA 9.9.4

See Notes

- 09/09/2005

- Past version of SIFA 9.9.4 before 09/09/2005

SIFA 9.9.5

See Notes

- 09/09/2005

- Past version of SIFA 9.9.5 before 09/09/2005

Suitability Letters

SIFA 9.9.6

See Notes

- 09/09/2005

- Past version of SIFA 9.9.6 before 09/09/2005

SIFA 9.9.7

See Notes

- 09/09/2005

- Past version of SIFA 9.9.7 before 09/09/2005

Record Keeping

SIFA 9.9.8

See Notes

| The following sections of the Guide are also relevant: | |

| • | 'Depolarisation' - Chapter 9.7 |

| • | 'Know your customer' - Chapter 9.8 |

| If you do mortgage and general insurance business you should also refer to MOGI 2 and GIGI 3. | |

- 09/09/2005

- Past version of SIFA 9.9.8 before 09/09/2005

SIFA 9.10

Assessing your customer's understanding of risk

- 01/12/2004

SIFA 9.10.1

See Notes

Why do you have to assess your customer's understanding of risk?

SIFA 9.10.2

See Notes

SIFA 9.10.3

See Notes

SIFA 9.10.4

See Notes

Where is the relevant section in the Handbook?

SIFA 9.10.5

See Notes

SIFA 9.10.6

See Notes

SIFA 9.10.7

See Notes

Other considerations

SIFA 9.10.8

See Notes

SIFA 9.10.9

See Notes

| The following sections are also relevant: | |

| • | 'Clear, fair and not misleading' - Chapter 9.2 |

| • | 'Know your customer' - Chapter 9.8 |

| • | 'Suitability' - Chapter 9.9 |

| • | PRIN 2.1 in the Handbook |

| If you do mortgage or general insurance business you should also refer to MOGI 2 and GIGI 3. | |

SIFA 9.11

Information about the firm

- 01/12/2004

SIFA 9.11.1

See Notes

SIFA 9.11.2

See Notes

such as stationery, business cards, or other business documents.

Why is it important for you to disclose the information?

SIFA 9.11.3

See Notes

What information do you need to disclose?

SIFA 9.11.4

See Notes

This is unless you have given the information to the client on a previous occasion and it is still up to date (COB 5.5.3 R). For business involving packaged products this information is included in the IDD which is given to the private customer on first contact.

Which section of the Handbook applies?

SIFA 9.11.5

See Notes

| Statutory status disclosure | |

| • | When sending a letter or an email to a private customer you are required to disclose that your firm is 'Authorised and regulated by the Financial Services Authority'. |

| • | If your firm is an appointed representative you are required to state '[Name of appointed representative] is an appointed representative of [name of principal] which is authorised and regulated by the Financial Services Authority'. |

| • | Please note that the abbreviation 'FSA' should no longer be used in this context. |

| • | Authorised Professional Firms may also disclose that they are regulated by their professional body, as long as - when taken together - the whole disclosure is clear, fair and not misleading. |

| It may be convenient for you to include the required disclosure on your letterhead. | |

Other considerations

SIFA 9.11.6

See Notes

SIFA 9.11.7

See Notes

| The following sections are also relevant: | |

| • | 'Clear, fair and not misleading' - Chapter 9.2 |

| • | 'Depolarisation' - Chapter 9.7 |

| • | PRIN 2.1 in the Handbook |

| If you do mortgage or general insurance business you should also refer to MOGI 2 and GIGI 3. | |

SIFA 9.12

Excessive charges

- 01/12/2004

SIFA 9.12.1

See Notes

How do you ensure that you do not charge customers excessively?

SIFA 9.12.2

See Notes

Where is the relevant section in the Handbook?

SIFA 9.12.3

See Notes

| The following sections are also relevant: | |

| • | 'Inducements' - Chapter 9.4 |

| • | 'Depolarisation' - Chapter 9.7 |

| • | 'Disclosing charges, remuneration and commission' - Chapter 9.13 |

| • | PRIN 2.1 in the Handbook |

| If you do mortgage and general insurance business you should also refer to MOGI 2.10 and GIGI 3. | |

SIFA 9.13

Disclosing charges, remuneration & commission

- 01/12/2004

SIFA 9.13.1

See Notes

'Associate' has a wide meaning and you should refer to the definition in the Handbook glossary.

Why do you have to disclose this information?

SIFA 9.13.2

See Notes

SIFA 9.13.3

See Notes

How do you disclose this information?

SIFA 9.13.4

See Notes

SIFA 9.13.5

See Notes

SIFA 9.13.6

See Notes

Where are the relevant sections in the Handbook?

SIFA 9.13.7

See Notes

Other considerations

SIFA 9.13.8

See Notes

- 09/09/2005

SIFA 9.13.9

See Notes

| The following sections are also relevant: | |

| • | 'Clear, fair and not misleading' - Chapter 9.2 |

| • | 'Inducements' - Chapter 9.4 |

| • | 'Terms of business' - Chapter 9.6 |

| • | 'Depolarisation' - Chapter 9.7 |

| • | 'Excessive charges' - Chapter 9.12 |

| • | 'Key features' - Chapter 9.15 |

| • | PRIN 2.1 in the Handbook |

| If you do mortgage or general insurance business you should also refer to MOGI 2 and GIGI 3. | |

- 09/09/2005

SIFA 9.14

Projections

- 01/12/2004

SIFA 9.14.1

See Notes

Why do you need to follow these rules?

SIFA 9.14.2

See Notes

How do you disclose this information?

SIFA 9.14.3

See Notes

SIFA 9.14.4

See Notes

SIFA 9.14.5

See Notes

Other considerations

SIFA 9.14.6

See Notes

SIFA 9.14.7

See Notes

| If you do mortgage or general insurance business you should also refer to MOGI 2 and GIGI 3. |

SIFA 9.15

Key Features

- 01/12/2004

SIFA 9.15.1

See Notes

Key features document

SIFA 9.15.2

See Notes

SIFA 9.15.3

See Notes

SIFA 9.15.4

See Notes

SIFA 9.15.5

See Notes

SIFA 9.15.6

See Notes

SIFA 9.15.7

See Notes

SIFA 9.15.8

See Notes

Simplified prospectus Rules

SIFA 9.15.9

See Notes

SIFA 9.15.10

See Notes

SIFA 9.15.11

See Notes

Financial Promotion Rules

SIFA 9.15.12

See Notes

Record Keeping Requirements

SIFA 9.15.13

See Notes

| The following sections are also relevant: | |

| • | 'Financial promotions' - Chapter 9.3 |

| • | 'Suitability' - Chapter 9.9 |

| • | 'Assessing your customer's understanding of risk' - Chapter 9.10 |

| If you do mortgage and general insurance business you should also refer to MOGI 2 and GIGI 3. | |

SIFA 9.16

Custody and client money

- 01/12/2004

SIFA 9.16.1

See Notes

How can you avoid inadvertently holding client money and custody assets?

SIFA 9.16.2

See Notes

SIFA 9.16.3

See Notes

SIFA 9.16.4

See Notes

Mandates

SIFA 9.16.5

See Notes

SIFA 9.16.6

See Notes

| If you do mortgage or insurance business you should also refer to MOGI 2 and GIGI 2. |

SIFA 9.17

Providing basic advice on stakeholder products (basic advice)

- 09/09/2005

SIFA 9.17.1

See Notes

- 09/09/2005

SIFA 9.17.2

See Notes

These products are the only products that can be sold with basic advice and they must meet certain criteria to be stakeholder products. For example, the charges are capped. Currently, medium-term investment products cannot include a smoothed fund because our research found a risk that consumers who received basic advice may not understand the concept of smoothing.

- 09/09/2005

SIFA 9.17.3

See Notes

- 09/09/2005

SIFA 9.17.4

See Notes

- 09/09/2005

SIFA 9.17.5

See Notes

- 09/09/2005

SIFA 9.17.6

See Notes

Individuals who give basic advice do not need to be approved persons. They must be competent but there is no specified examination requirement.

- 09/09/2005

SIFA 9.17.7

See Notes

- 09/09/2005

SIFA 9.17.8

See Notes

- 09/09/2005

SIFA 9.17.9

See Notes

- 09/09/2005

SIFA 10

Training and Competence

SIFA 10.1

Training and Competence

- 01/12/2004

SIFA 10.1.1

See Notes

SIFA 10.1.2

See Notes

SIFA 10.1.3

See Notes

SIFA 10.1.4

See Notes

SIFA 10.2

Commitments

- 09/09/2005

SIFA 10.2.1

See Notes

- 09/09/2005

SIFA 10.2.2

See Notes

'Employee' is a generic term that covers everyone who works in a firm.

- 09/09/2005

SIFA 10.3

Rules And Guidance

- 09/09/2005

SIFA 10.3.1

See Notes

- 09/09/2005

SIFA 10.3.2

See Notes

Knowledge and skills must be assessed, measured and improved where necessary.

- 09/09/2005

SIFA 10.3.3

See Notes

- 09/09/2005

SIFA 10.3.4

See Notes

- 09/09/2005

SIFA 10.3.5

See Notes

- 09/09/2005

SIFA 10.3.6

See Notes

- 09/09/2005

SIFA 10.3.7

See Notes

In applying the T&C rules you should consider the following:

- Who do the rules apply to? (TC 2.1)

- What is the existing level of knowledge and skills of the individual? (TC 2.2, TC 2.3)

- What knowledge and skills are required to carry out the role to an adequate standard? (TC 2.4)

- What action such as training is required to fill the gaps? (TC 2.3)

- How is it known whether the training has worked? (TC 2.3)

- How to measure the level of knowledge and skills already achieved and compare this with the level required? TC 2.4)

- What are the time limits for passing an appropriate examination? (TC 2.5)

- Once achieved, how is competence to be maintained? (TC 2.6)

- What arrangements need to be in place to ensure that non-competent employees are appropriately supervised? (TC 2.7)

- What arrangements need to be in place to ensure that competent employees are appropriately monitored? (TC 2.7)

- 09/09/2005

SIFA 10.4

Training Plan

- 09/09/2005

SIFA 10.4.1

See Notes

- 09/09/2005

SIFA 10.5

Recruitment

- 09/09/2005

SIFA 10.5.1

See Notes

- 09/09/2005

SIFA 10.6

Maintaining Competence

- 09/09/2005

SIFA 10.6.1

See Notes

- 09/09/2005

SIFA 10.7

Supervision And Monitoring

- 09/09/2005

SIFA 10.7.1

See Notes

- 09/09/2005

SIFA 10.7.2

See Notes

- 09/09/2005

SIFA 10.7.3

See Notes

- 09/09/2005

SIFA 10.7.4

See Notes

- 09/09/2005

SIFA 10.8

Record Keeping

- 09/09/2005

SIFA 10.8.1

See Notes

| Information about recruitment, training and competence that must be retained: |

| • The criteria applied in assessing competence and how and when the competence decision was arrived at. |

| • The time limits within which an appropriate examination has been passed. |

| • The criteria used to decide that an employee is exempt from an appropriate examination. |

| • The criteria applied in assessing continuing competence and how the employee continues to be competent. |

| • The criteria used to decide the level of supervision and monitoring and how it carries out the supervision and monitoring of its employees. |

- 09/09/2005

SIFA 10.8.2

See Notes

- 09/09/2005

SIFA 10.8.3

See Notes

- 09/09/2005

SIFA 10.9

T&C Toolkits

- 09/09/2005

SIFA 10.9.1

See Notes

- 09/09/2005

SIFA 10.10

Further Help

- 09/09/2005

SIFA 10.10.1

See Notes

- 09/09/2005

SIFA 10.10.2

See Notes

- 09/09/2005

SIFA 10.10.3

See Notes

- 09/09/2005

SIFA 10.10.4

See Notes

- 09/09/2005

Export chapter as

SIFA 11

Complaints

SIFA 11.1

How to handle a complaint

- 01/12/2004

SIFA 11.1.1

See Notes

SIFA 11.1.2

See Notes

SIFA 11.1.3

See Notes

SIFA 11.1.4

See Notes

SIFA 11.1.5

See Notes

SIFA 11.1.6

See Notes

SIFA 11.1.7

See Notes

SIFA 11.1.8

See Notes

When and where should you publicise your procedures?

SIFA 11.1.9

See Notes

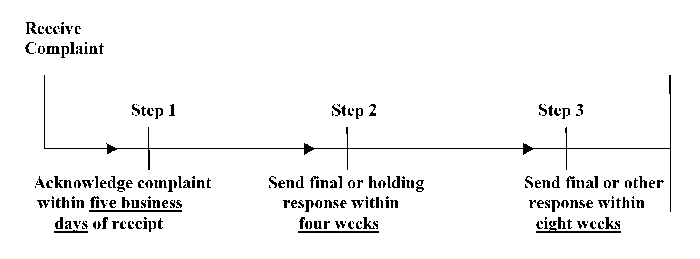

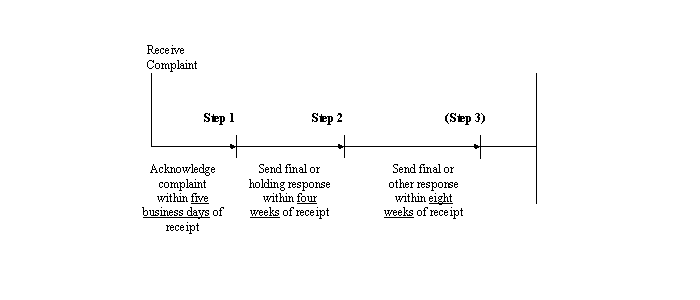

How quickly do you need to deal with a complaint?

SIFA 11.1.10

See Notes

SIFA 11.1.11

See Notes

| Step 1 | Within five business days | |

|

-send a copy

of your internal complaints procedures; and-inform them

who will be handling the complaint; or-inform the complainant

of the referral by way of a final response and include the other firm's contact

details.

| ||

| Step 2 |

Within four weeks

Send a final response - including: | (It should be a separate document and written in plain English) |

|

-a summary of

the complaint;-details of any

offer made;-right your client

has to go to the FOS;-a copy of the

leaflet about the FOS - 'your complaint and the ombudsman';-a summary of

your investigation;-the time limit

on any offer made; and-the six-month

time limit for referrals to the FOS.

| ||

| Or send a holding response | ||

| Explaining why you are not yet in a position to resolve the complaint and indicating when you will make further contact with the client. | ||

| Step 3 |

Within eight weeks

Send a final response | |

| As per the details in step 2 above. | ||

| Or a response explaining: | ||

|

-why you are

not able to respond;-when you expect

to provide a final response;-explaining that

the client is entitled to refer the complaint to the FOS if unhappy with the

delay;-the reasons

for the delay;-giving a copy

of the leaflet about the FOS - 'your complaint and the ombudsman'; and-the six-month

time limit for referrals to the FOS.

| ||

SIFA 11.1.12

See Notes

SIFA 11.1.13

See Notes

Exception to the rules: quick resolution of complaints

SIFA 11.1.14

See Notes

SIFA 11.1.15

See Notes

- 09/09/2005

Charging customers for handling their complaints

SIFA 11.1.16

See Notes

- 09/09/2005

SIFA 11.1.17

See Notes

- 09/09/2005

SIFA 11.1.18

See Notes

- 09/09/2005

Cooperation with the financial ombudsman service

SIFA 11.1.19

See Notes

- 09/09/2005

SIFA 11.1.20

See Notes

- 09/09/2005

Mortgage endowment complaints

SIFA 11.1.21

See Notes

www.fsa.gov.uk/pubs/ceo/ceo_letter_4apr02.pdf

www.fsa.gov.uk/pubs/ceo/ceo_letter_23jan04.pdf

- 09/09/2005

Where are the relevant Handbook sections?

SIFA 11.1.22

See Notes

- 09/09/2005

Record keeping requirements

SIFA 11.1.23

See Notes

| Information about a complaint that you should keep: | |

| The name of the complainant. | The substance of the complaint. |

| Copies of correspondence between your firm and the complainant. | Details of any redress offered by your firm. |

| Documentation relating to the referral of a complaint | |

| The following section of the Guide is also relevant: | |

| • | 'Complaints reporting to the FSA' - Chapter 11.2 |

| If you do mortgage or general insurance business you should also refer to MIGI 14. | |

- 09/09/2005

SIFA 11.2

Complaints reporting to the FSA

- 01/12/2004

SIFA 11.2.1

See Notes

Why do you need to submit a complaints report?

SIFA 11.2.2

See Notes

When are the reporting periods?

SIFA 11.2.3

See Notes

SIFA 11.2.4

See Notes

SIFA 11.2.5

See Notes

How do you submit a report?

SIFA 11.2.6

See Notes

Where are the relevant Handbook sections?

SIFA 11.2.7

See Notes

| The following sections of the Guide are also relevant: | |

| • | 'How to handle a complaint' - Chapter 11.1 |

| • | 'Reporting requirements' - Chapter 12.1 |

SIFA 12

Reporting and notifications

SIFA 12.1

Reporting requirements

- 01/12/2004

SIFA 12.1.1

See Notes

SIFA 12.1.2

See Notes

SIFA 12.1.3

See Notes

Submission of reports

SIFA 12.1.4

See Notes

| Report | Frequency report is required | Relevant section in the Handbook | Method of Reporting |

|

RMAR

Adequate information relating to the following activities (1)

Insurance mediation

(2)

mortgage mediation

(3)

retail investment

| Half yearly - 30 business days after reporting period end. The reporting periods are the six months following and the six months preceding the firm's accounting reference date. | SUP 16.7.76 R | via Firms Online |

Complaints report | Half yearly - 30 business days after reporting period end. The reporting periods are the six months following and the six months preceding the firm's accounting reference date. A nil return is required. | DISP 1.5.6 R | Via Firms Online (see chapter 11.2) |

SIFA 12.1.5

See Notes

Frequency and Timing of returns

SIFA 12.1.6

See Notes

SIFA 12.1.7

See Notes

SIFA 12.1.8

See Notes

A firm with an ARD of 31 March would have the following reporting periods:

SIFA 12.1.9

See Notes

SIFA 12.1.10

See Notes

Where Will You Find The Reports

SIFA 12.1.11

See Notes

Other Reports

SIFA 12.1.12

See Notes

| Report | Frequency report is required | Relevant section in the Handbook | Method of reporting |

|

Pension transfer and opt-outs

| Every six months - no specific start date. •A nil return not required.•There are related quarterly reports required.

| COB 5.3.26 R (1) and COB 5.3.26 R (1A) | No standard form - please write to us |

Pension Transfer and Opt-Out Report

SIFA 12.1.13

See Notes

SIFA 12.1.14

See Notes

SIFA 12.1.15

See Notes

Where are the relevant Handbook sections?

SIFA 12.1.16

See Notes

How do you submit the reports to us?

SIFA 12.1.17

See Notes

SIFA 12.1.18

See Notes

Other issues

SIFA 12.1.19

See Notes

| The following sections are also relevant: | |

| • | 'Complaints reporting to the FSA' - Chapter 11.2 |

| • | 'Notifications' - Chapter 12.2 |

| • | PRIN 2.1 in the Handbook |

| If you do mortgage or general insurance business you should also refer to MIGI 11. | |

SIFA 12.2

Notifications

- 01/12/2004

SIFA 12.2.1

See Notes

A. Matters having a serious regulatory impact:

| Your firm must let us know immediately when it becomes aware, or has information that reasonably suggests, that any of the following has occurred, may have occurred or may occur in the foreseeable future: | |

| 1. | If your firm fails to satisfy one or more of the threshold conditions (see paragraph 6.3.1 of the Guide). |

| 2. | Any matter that could have a significant adverse impact on your firm's reputation. |

| 3. | Any matter that could affect your firm's ability to continue providing adequate services to customers and which could result in serious detriment to a customer of the firm. |

| 4. | Any matter in respect of your firm that could result in serious financial consequences to the financial system or to other firms. |

B. Communications with us in line with Principle 11:

| Compliance with Principle 11 includes but is not limited to giving the FSA notice of: | |

| 1. Any proposed restructuring, reorganisation or business expansion, which could have a significant impact on your firm's risk profile or resources, including but not limited to: | |

| Starting to provide a new product or service (you may need to apply for a variation of Part IV permission). | Ceasing to undertake a regulated or ancillary activity, or significantly reducing the scope of such activities. (You may need to apply for a variation of Part IV permission). |

| Entering into, or significantly changing, a material outsourcing arrangement. | Any change in your firm's prudential category. |

| 2. Any significant failure of your firm's systems or controls (including those reported to your firm by your auditor - if applicable). | |

| 3. Any action that your firm proposes to take which would result in a material change in its capital adequacy or solvency including, but not limited to: | |

| Any action that would result in a material change in your firm's financial resources or financial resources requirement. | A material change resulting from the payment of a special or unusual dividend or the repayment of share capital or a subordinated loan. |

|

4. Significant breaches of rules or other requirements under FSMA.

| |

C. There are certain pieces of core information where we need you to give us reasonable advance notice if there is going to be a change:

| Notification | Supervision sourcebook (SUP) reference |

| A change in your firm's name. | SUP 15.5.1 R |

| A change in address (to the principal place of business). | SUP 15.5.4 R |

| A change to the legal status of your firm. (You may be required to send us a new application for Part IV permission). | SUP 15.5.5 R |

| A change to supervision by an overseas regulator. | SUP 15.5.7 R |

D. General notification requirements:

| Notification | Supervision sourcebook (SUP) reference |

| Breaches of rules and other requirements in or under FSMA. | SUP 15.3.11 R |

| Civil, criminal or disciplinary proceedings against a firm. | SUP 15.3.15 R |

| Fraud, errors and other irregularities. | SUP 15.3.17 R |

| Insolvency, bankruptcy and winding up. | SUP 15.3.21 R |

E. Other notification requirements:

| Notification | Handbook reference |

| Change of accounting reference date. | SUP 16.3.17 R |

| Change of controller. | SUP 11.3 |

| Approved persons: employees who start performing controlled functions (CFs), those who change or add CFs or those who cease performing CFs. (There are standard forms to use called 'Approved persons regime forms'). | SUP 10.11 - SUP 10.13 |

| Change of auditor. | SUP 3.3 |

| Financial issues, such as professional indemnity insurance cover being refused or cancelled. | IPRU(INV) 13.1.9 R |

When should you notify us?

SIFA 12.2.2

See Notes

How do you notify us?

SIFA 12.2.3

See Notes

SIFA 12.2.4

See Notes

SIFA 12.2.5

See Notes

SIFA 12.2.6

See Notes

Where are the relevant Handbook sections?

SIFA 12.2.7

See Notes

Other considerations

SIFA 12.2.8

See Notes

SIFA 12.2.9

See Notes

SIFA 12.2.10

See Notes

| The following sections are also relevant: | |

| • | 'Authorisation' - Chapter 6 |

| • | 'Complaints reporting to the FSA' - Chapter 11.2 |

| • | 'Reporting requirements' - Chapter 12.1 |

| • | Threshold Conditions sourcebook (COND) |

| • | PRIN 2.1 in the Handbook |

| If you do mortgage or general insurance business you should also refer to MIGI 11. | |

SIFA 12.3

Change of controller

- 09/09/2005

SIFA 12.3.1

See Notes

- 09/09/2005

SIFA 12.3.2

See Notes

- 09/09/2005

SIFA 12.3.3

See Notes

- 09/09/2005

SIFA 12.3.4

See Notes

- 09/09/2005

SIFA 12.3.5

See Notes

- 09/09/2005

SIFA 12.3.6

See Notes

- 09/09/2005

SIFA 12.3.7

See Notes

- 09/09/2005

SIFA 12.3.8

See Notes

- 09/09/2005

SIFA 12.4

Change in legal entity

- 09/09/2005

SIFA 12.4.1

See Notes

- 09/09/2005

SIFA 12.4.2

See Notes

- 09/09/2005

Export chapter as

SIFA 13

Record Keeping

SIFA 13.1

General requirement

- 01/12/2004

SIFA 13.1.1

See Notes

SIFA 13.1.2

See Notes

SIFA 13.1.3

See Notes

SIFA 13.1.4

See Notes

SIFA 13.1.5

See Notes

- 09/09/2005

SIFA 13.1.6

See Notes

| There are references to record keeping in the following chapters of the Guide: | |

| • | 'Authorisation' - Chapter 6 |

| • | 'Approved Persons' - Chapter 7 |

| • | 'Financial Resources and PII' -Chapter 8 |

| • | 'Conduct of Business' - Chapter 9 |

| • | 'Training and Competence' - Chapter 10 |

| • | 'Complaints Handling' - Chapter 11 |

| • | 'Reporting and Notifications' - Chapter 12 |

| • | 'Money Laundering' - Chapter 14 |

| If you do mortgage or general insurance business you should also refer to MIGI 13. | |

- 09/09/2005

SIFA 14

Money Laundering

SIFA 14.1

Money Laundering

- 01/12/2004

SIFA 14.1.1

See Notes

The Money Laundering sourcebook

SIFA 14.1.2

See Notes

| Our rules require your firm to: | ML ref. | |

| • |

appoint

an Approved Person to be the Money Laundering Reporting Officer (MLRO). The

MLRO is responsible for overseeing your firm's anti-money laundering activities.

They must produce a report to senior management, at least once every year

on any relevant money laundering issues and your firm's compliance with the

Money Laundering sourcebook. This report also needs to detail any necessary

remedial action; | 2.1 & 7.1 |

| • |

take reasonable steps to identify clients. The Joint

Money Laundering Steering Group Guidance Notes show how to comply with this

rule; | 3.1 & 3.2 |

| • |

have clear procedures for internal (made to the MLRO

at the firm) and external reporting (made

by the MLRO to NCIS) of suspicious activity; | 4.1 & 4.3 |

| • | obtain and make use of government or Financial Action Task Force findings; | 5.1 |

| • |

train staff who handle, or are managerially responsible for the

handling of, transactions which may involve money laundering at

least every 24 months in their anti-money laundering responsibilities; and | 6.2 & 6.3 |

| • | keep relevant records. | 7.3 |

SIFA 14.2

Further rules to take into consideration

- 09/09/2005

SIFA 14.2.1

See Notes

| The following sections of the Guide are also relevant: | |

| • | 'FSA Principles, Systems and Controls' - Chapter 5 |

| • | 'Know your customer' - Chapter 9.8 |

| If you do mortgage or general insurance business you should also refer to MIGI 15. | |

- 09/09/2005

SIFA 15

Variation and cancellation of permission

SIFA 15.1

Variation of permission (VOP)

- 01/12/2004

SIFA 15.1.1

See Notes

SIFA 15.1.2

See Notes

SIFA 15.1.3

See Notes

SIFA 15.1.4

See Notes

SIFA 15.1.5

See Notes

SIFA 15.1.6

See Notes

SIFA 15.1.7

See Notes

SIFA 15.1.8

See Notes

Application Procedure

SIFA 15.1.9

See Notes

SIFA 15.1.10

See Notes

SIFA 15.1.11

See Notes

SIFA 15.1.12

See Notes

| The following section of the Guide is also relevant: | |

| • | 'Cancellation of permission' - Chapter 15.2 |

| If you do mortgage or general insurance business you should refer to MIGI 16. | |

SIFA 15.2

Cancellation of permission

- 01/12/2004

SIFA 15.2.1

See Notes

SIFA 15.2.2

See Notes

SIFA 15.2.3

See Notes

SIFA 15.2.4

See Notes

SIFA 15.2.5

See Notes

Cancellation Procedure

SIFA 15.2.6

See Notes

SIFA 15.2.7

See Notes

SIFA 15.2.8

See Notes

SIFA 15.2.9

See Notes

SIFA 15.2.10

See Notes

- 09/09/2005

SIFA 15.2.11

See Notes

- 09/09/2005

SIFA 15.2.12

See Notes

| The following sections of the Guide are also relevant: | |

| • | 'Notifications'- Chapter 12.2 |

| • | 'Variation of permission (VOP)' - Chapter 15.1 |

| • | If you do mortgage or general insurance business you should also refer to MIGI 16. |

- 09/09/2005

SIFA 16

Waivers and rule modifications

SIFA 16.1

General approach

- 01/12/2004

SIFA 16.1.1

See Notes

SIFA 16.1.2

See Notes

SIFA 16.1.3

See Notes

SIFA 16.1.4

See Notes

SIFA 16.2

Application for a Waiver

- 09/09/2005

SIFA 16.2.1

See Notes

- 09/09/2005

SIFA 16.3

Waiver by Consent

- 09/09/2005

SIFA 16.3.1

See Notes

| If you do mortgage or general insurance business you should also refer to MIGI 17. |

- 09/09/2005

SIFA 17

Individual guidance, whistleblowing,

auditors

SIFA 17.1

Individual Guidance

- 09/09/2005

- Past version of SIFA 17.1 before 09/09/2005

SIFA 17.1.1

See Notes

SIFA 17.1.2

See Notes

SIFA 17.1.3

See Notes

SIFA 17.1.4

See Notes

SIFA 17.2

Whistleblowing

- 09/09/2005

SIFA 17.2.1

See Notes

- 09/09/2005

SIFA 17.2.2

See Notes

- 09/09/2005

SIFA 17.3

Auditors

- 09/09/2005

SIFA 17.3.1

See Notes

- 09/09/2005

SIFA 17.3.2

See Notes

- 09/09/2005

SIFA 17.3.3

See Notes

| The following section of the Guide is also relevant: | |

| • | 'Further information' - Chapter 19 |

| If you do mortgage or general insurance business you should also refer to MIGI 12 and MIGI 15. | |

- 09/09/2005

SIFA 18

Fees

SIFA 18.1

Fees

- 01/12/2004

SIFA 18.1.1

See Notes

SIFA 18.1.2

See Notes

SIFA 18.1.3

See Notes

SIFA 18.1.4

See Notes

SIFA 18.1.5

See Notes

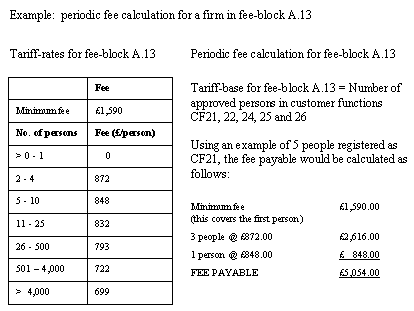

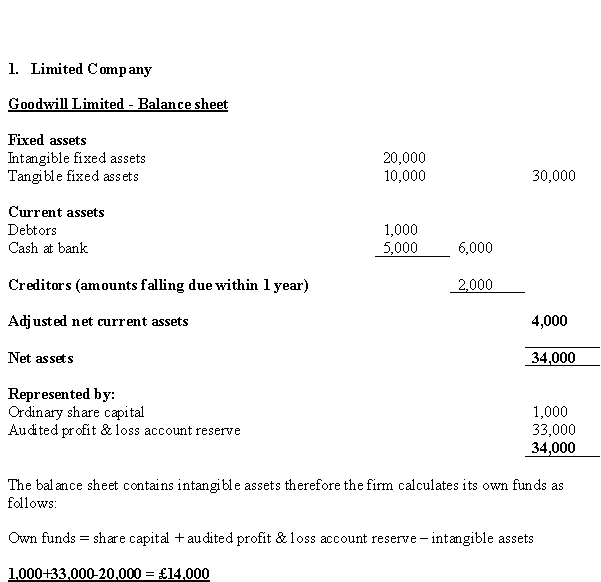

SIFA 18.2

Periodic Fees

- 09/09/2005

SIFA 18.2.1

See Notes

- 09/09/2005

SIFA 18.2.2

See Notes

- 09/09/2005

SIFA 18.2.3

See Notes

- 09/09/2005

SIFA 18.2.4

See Notes

- 09/09/2005

SIFA 18.2.5

See Notes

Periodic fee = (tariff-base data for firm) x (fee-block tariff-rates)

- 09/09/2005

SIFA 18.2.6

See Notes

- 09/09/2005

SIFA 18.2.7

See Notes

- 09/09/2005

SIFA 18.2.8

See Notes

- 09/09/2005

SIFA 18.3

Application Fees

- 09/09/2005

SIFA 18.3.1

See Notes

- 09/09/2005

SIFA 18.3.2

See Notes

- 09/09/2005

SIFA 18.3.3

See Notes

- 09/09/2005

SIFA 18.3.4

See Notes

- 09/09/2005

SIFA 18.3.5

See Notes

- 09/09/2005

SIFA 18.3.6

See Notes

- 09/09/2005

SIFA 18.4

Where Are The Relevant Handbook Sections?

- 09/09/2005

SIFA 18.4.1

See Notes

- 09/09/2005

SIFA 18.5

Further Information

- 09/09/2005

SIFA 18.5.1

See Notes

- 09/09/2005

SIFA 18.5.2

See Notes

- 09/09/2005

SIFA 18.5.3

See Notes

- 09/09/2005

SIFA 18.5.4

See Notes

- 09/09/2005

SIFA 18.5.5

See Notes

| The following sections of the Guide are also relevant: | |

| • | 'Authorisation' - Chapter 6 |

| • | 'Variation of permission (VOP)' - Chapter 15.1 |

| • | 'Further information' - Chapter 19. |

| • | If you do mortgage or general insurance business you should also refer to MIGI 19. |

- 09/09/2005

SIFA 19

Further information

SIFA 19.1

FSA contacts

- 01/12/2004

a) Handbook and publications

SIFA 19.1.1

See Notes

Technical queries on the CD-ROM: fsa@techindex.co.uk or 0134 440 4457.

Other comments on the CD-ROM contents: cdhelp@fsa.gov.uk

b) FSA website: www.fsa.gov.uk

SIFA 19.1.2

See Notes

SIFA 19.1.3

See Notes

SIFA 19.1.4

See Notes

c) FSA Industry Training Courses, FSA Events and Conferences

SIFA 19.1.5

See Notes

FSA Events and Conferences: Some information is on our website (listed above). Alternatively, contact the FSA Events team by phone on 020 7066 0098, by fax on 020 7676 0063 or email at events@fsa.gov.uk.

d) FSA Authorisation and Approved Persons

SIFA 19.1.6

See Notes

You can download the Application Pack and Guidance notes from our website free of charge (www.fsa.gov.uk/Pages/Doing/How/index.shtml) or you can order a printed copy from our Publications Helpline 0845 0608 2372 (at a charge).