MOGI 1

Introduction to Part II

MOGI 1.1

Using this Guide

- 01/12/2004

MOGI 1.1.1

See Notes

- 01/12/2004

MOGI 1.1.2

See Notes

- 01/12/2004

MOGI 1.1.3

See Notes

- 01/12/2004

MOGI 1.1.4

See Notes

- 01/12/2004

MOGI 1.1.5

See Notes

- 01/12/2004

MOGI 1.1.6

See Notes

- 01/12/2004

Key terms

MOGI 1.1.7

See Notes

- 01/12/2004

What does MCOB cover?

MOGI 1.1.8

See Notes

- 01/12/2004

MOGI 1.1.9

See Notes

- 01/12/2004

MOGI 1.1.10

See Notes

- 01/12/2004

Which activities does MCOB apply to?

MOGI 1.1.11

See Notes

- 31/05/2005

How to tell whether the chapters of MCOB apply to you

MOGI 1.1.12

See Notes

- 01/12/2004

MOGI 1.1.13

See Notes

| Chapter | Title | Does it apply to you? | What does it include? |

| MCOB 1 | Application and purpose | Yes | A

summary of how the MCOB rules

apply to firms. Guidance on the other parts of the FSA Handbook. |

| MCOB 2 | Conduct of business standards: general | Yes | General

requirements that apply throughout MCOB. Communications to consumers must be clear, fair and not misleading. Rules on inducements. |

| MCOB 3 | Financial promotions | Yes | Content

requirements for qualifying credit promotions. A ban on unsolicited real time promotions (cold calling) except in limited circumstances. Rules on the approval of promotions. |

| MCOB 4 | Advising and selling standards | Yes | The

initial disclosure document. The scope of service provided. Suitability of advice. Rules for non-advised sales. |

| MCOB 5 | Pre-application disclosure | Yes | Timing and content of the key facts illustration (KFI). |

| MCOB 6 | Disclosure at the offer stage | No | Content of the offer document. |

| MCOB 7 | Disclosure at start of contract and after sale | Partially | Information requirements for post-sale contract variations (such as further advances). |

| MCOB 8 | Lifetime mortgages - advising and selling standards | Only if you sell lifetime mortgages | A tailored regime for advising on and selling lifetime mortgages. |

| MCOB 9 | Lifetime mortgages - product disclosure | Only if you sell lifetime mortgages | Tailored product disclosure requirements for lifetime mortgages. |

| MCOB 10 | Annual percentage rate | Yes if you calculate APRs. | How to calculate the APR. |

| MCOB 11 | Responsible lending | No | Lenders must check the consumer's ability to repay. |

| MCOB 12 | Charges | Partially | Charges must not be excessive. |

| MCOB 13 | Arrears and repossessions | Generally no, unless you do any debt collection activity. | Rules on treatment of borrowers in arrears and facing repossession. |

- 31/05/2005

Example materials

MOGI 1.1.14

See Notes

- 01/12/2004

MOGI 1.1.15

See Notes

- 31/05/2005

Business lending

MOGI 1.1.16

See Notes

- 01/12/2004

General requirements

MOGI 1.1.17

See Notes

- 01/12/2004

Key facts logo

MOGI 1.1.18

See Notes

- 01/12/2004

Changes to disclosure requirements when your firm carries on regulated mortgage activities for another authorised firm or an AR.

MOGI 1.1.19

See Notes

The rule amendments allow a TPP (Firm A) undertaking regulated mortgage activities (or insurance mediation activities in relation to non-investment insurance contracts) on behalf of another authorised firm (Firm B) under an outsourcing contract, to disclose to customers that it is B where our rules would otherwise require A to disclose its real identity. The outsourcing agreement between the two firms must acknowledge that the firm outsourcing the activities (B) accepts responsibility for the activities carried on by the other firm (A) on its behalf. Changes have also been made to DISP and SUP as a result of the amendments made to MCOB and GEN.

- 31/05/2005

MOGI 1.1.20

See Notes

- 31/05/2005

MOGI 2

Mortgages: Conduct of Business Sourcebook (MCOB)

MOGI 2.1

Financial promotion (MCOB 3)

- 01/12/2004

Introduction

MOGI 2.1.1

See Notes

- 01/12/2004

What is the scope of the financial promotion rules?

MOGI 2.1.2

See Notes

- 01/12/2004

MOGI 2.1.3

See Notes

- 01/12/2004

Real time and non-real time qualifying credit promotions

MOGI 2.1.4

See Notes

- 01/12/2004

MOGI 2.1.5

See Notes

- 01/12/2004

Form and content of qualifying credit promotions

MOGI 2.1.6

See Notes

- 01/12/2004

MOGI 2.1.7

See Notes

- 01/12/2004

MOGI 2.1.8

See Notes

- 01/12/2004

Clear, fair and not misleading

MOGI 2.1.9

See Notes

- 01/12/2004

MOGI 2.1.10

See Notes

A specific warning must be used where the promotion is for a product where its price varies according to the specific circumstances of the borrower (MCOB 3.6.25 R).

If the APR can vary (for example because of the circumstances of the borrower), then you must include an APR that is representative of business expected to arise from the promotion (MCOB 3.6.22 R to MCOB 3.6.24 G). This means that at least 66% of consumers responding to the promotion and entering a qualifying credit agreement as a result must be charged an APR at or below the stated APR.

- 01/12/2004

Cold calling

MOGI 2.1.11

See Notes

- 01/12/2004

MOGI 2.1.12

See Notes

- 01/12/2004

MOGI 2.1.13

See Notes

- 01/12/2004

Confirming compliance of qualifying credit promotions

MOGI 2.1.14

See Notes

- 01/12/2004

Withdrawing compliance

MOGI 2.1.15

See Notes

- 01/12/2004

MOGI 2.2

Advising and selling standards (MCOB 4)

- 01/12/2004

Introduction

MOGI 2.2.1

See Notes

- 01/12/2004

What is the scope of service?

MOGI 2.2.2

See Notes

- 01/12/2004

MOGI 2.2.3

See Notes

- 01/12/2004

What must I do if I want to describe myself as 'independent'?

MOGI 2.2.4

See Notes

- 01/12/2004

MOGI 2.2.5

See Notes

- 01/12/2004

What must I tell consumers about my mortgage service?

MOGI 2.2.6

See Notes

- 01/12/2004

MOGI 2.2.7

See Notes

- 01/12/2004

MOGI 2.2.8

See Notes

- 01/12/2004

MOGI 2.2.9

See Notes

- 01/12/2004

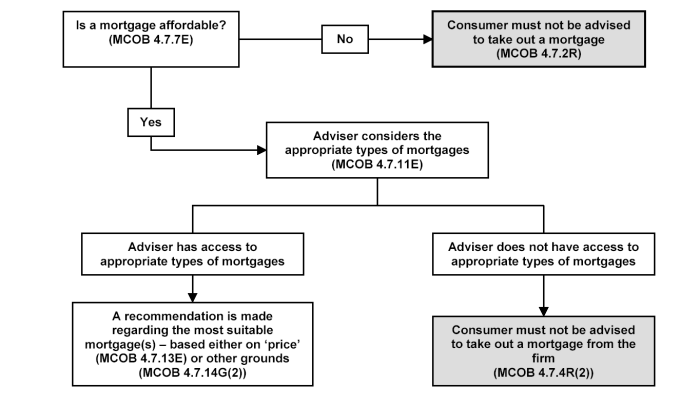

What are the requirements for advised sales?

MOGI 2.2.10

See Notes

- 01/12/2004

MOGI 2.2.11

See Notes

- 01/12/2004

MOGI 2.2.12

See Notes

- 31/05/2005

MOGI 2.2.13

See Notes

- 01/12/2004

MOGI 2.2.14

See Notes

- 01/12/2004

MOGI 2.2.15

See Notes

- 01/12/2004

MOGI 2.2.16

See Notes

- 01/12/2004

MOGI 2.2.17

See Notes

- 01/12/2004

MOGI 2.2.18

See Notes

- 01/12/2004

MOGI 2.2.19

See Notes

- 01/12/2004

MOGI 2.2.20

See Notes

- 01/12/2004

MOGI 2.2.21

See Notes

- 01/12/2004

What are the requirements for non-advised sales?

MOGI 2.2.22

See Notes

- 01/12/2004

MOGI 2.2.23

See Notes

- 01/12/2004

MOGI 2.2.24

See Notes

- 01/12/2004

MOGI 2.2.25

See Notes

- 01/12/2004

MOGI 2.3

Pre-sale disclosure (MCOB 5)

- 01/12/2004

Introduction

MOGI 2.3.1

See Notes

- 01/12/2004

Key facts illustration (KFI)

MOGI 2.3.2

See Notes

- 01/12/2004

MOGI 2.3.3

See Notes

- 01/12/2004

MOGI 2.3.4

See Notes

- 01/12/2004

When do you have to provide a KFI?

MOGI 2.3.5

See Notes

- 01/12/2004

MOGI 2.3.6

See Notes

- 01/12/2004

Who is responsible for the accuracy of the KFI?

MOGI 2.3.7

See Notes

- 01/12/2004

Can you provide cost information that is not in the form of a KFI?

MOGI 2.3.8

See Notes

- 01/12/2004

MOGI 2.3.9

See Notes

- 01/12/2004

MOGI 2.3.10

See Notes

- 01/12/2004

Can you use generic application forms?

MOGI 2.3.11

See Notes

- 01/12/2004

When can you obtain an approval in principle for a consumer?

MOGI 2.3.12

See Notes

- 01/12/2004

Content of the KFI

MOGI 2.3.13

See Notes

- 01/12/2004

Level of service

MOGI 2.3.14

See Notes

- 01/12/2004

Disclosure of fees

MOGI 2.3.15

See Notes

- 01/12/2004

Inclusion of insurance products or a repayment vehicle in the KFI

MOGI 2.3.16

See Notes

- 01/12/2004

Tied products

MOGI 2.3.17

See Notes

- 01/12/2004

MOGI 2.3.18

See Notes

- 01/12/2004

Commission disclosure

MOGI 2.3.19

See Notes

- 01/12/2004

MOGI 2.3.20

See Notes

- 01/12/2004

Unsure whether the mortgage is a regulated mortgage?

MOGI 2.3.21

See Notes

- 01/12/2004

MOGI 2.4

Disclosure at the offer stage (MCOB 6)

- 01/12/2004

Introduction

MOGI 2.4.1

See Notes

- 01/12/2004

When is an offer document required?

MOGI 2.4.2

See Notes

- 01/12/2004

What does the offer document contain?

MOGI 2.4.3

See Notes

- 01/12/2004

MOGI 2.5

Disclosure at start of contract and after sale

- 01/12/2004

Introduction

MOGI 2.5.1

See Notes

- 01/12/2004

Further advances

MOGI 2.5.2

See Notes

- 01/12/2004

Rate switches

MOGI 2.5.3

See Notes

- 01/12/2004

Addition or removal of a party to the contract

MOGI 2.5.4

See Notes

- 01/12/2004

Two changes at the same time

MOGI 2.5.5

See Notes

- 01/12/2004

MOGI 2.6

Lifetime mortgages: advising and selling standards (MCOB 8)

- 01/12/2004

Introduction

MOGI 2.6.1

See Notes

- 01/12/2004

MOGI 2.6.2

See Notes

- 01/12/2004

MOGI 2.6.3

See Notes

- 01/12/2004

Initial disclosure

MOGI 2.6.4

See Notes

- 01/12/2004

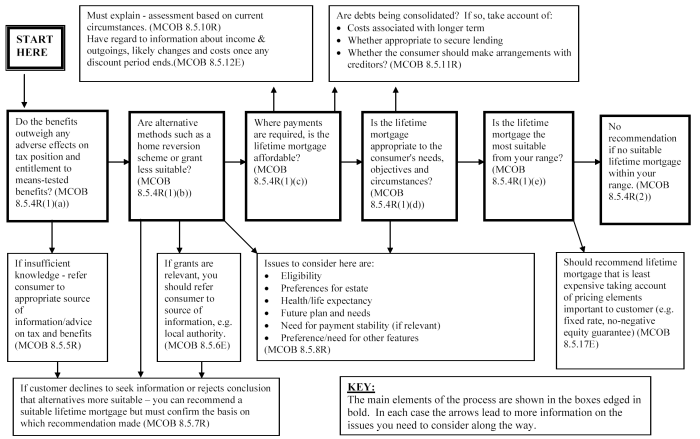

Advised sales

MOGI 2.6.5

See Notes

- 01/12/2004

MOGI 2.6.6

See Notes

- 01/12/2004

MOGI 2.6.7

See Notes

- 01/12/2004

Non-advised sales

MOGI 2.6.8

See Notes

- 01/12/2004

MOGI 2.6.9

See Notes

- 01/12/2004

MOGI 2.6.10

See Notes

- 01/12/2004

MOGI 2.7

Lifetime mortgages: product disclosure (MCOB 9)

- 01/12/2004

Introduction

MOGI 2.7.1

See Notes

- 01/12/2004

Pre-sale disclosure - general

MOGI 2.7.2

See Notes

- 01/12/2004

MOGI 2.7.3

See Notes

- 01/12/2004

Content of the key facts illustration

MOGI 2.7.4

See Notes

- 01/12/2004

MOGI 2.7.5

See Notes

- 01/12/2004

Post-sale disclosure

MOGI 2.7.6

See Notes

- 01/12/2004

MOGI 2.8

Annual percentage rate (MCOB 10)

- 01/12/2004

MOGI 2.8.1

See Notes

- 01/12/2004

MOGI 2.8.2

See Notes

- 01/12/2004

The calculation

MOGI 2.8.3

See Notes

- 01/12/2004

MOGI 2.8.4

See Notes

- 01/12/2004

MOGI 2.8.5

See Notes

- 01/12/2004

MOGI 2.8.6

See Notes

- 01/12/2004

MOGI 2.8.7

See Notes

- 01/12/2004

MOGI 2.9

Responsible lending (MCOB 11)

- 01/12/2004

Introduction

MOGI 2.9.1

See Notes

- 01/12/2004

Has account been taken of the consumer's ability to repay?

MOGI 2.9.2

See Notes

- 01/12/2004

MOGI 2.9.3

See Notes

- 01/12/2004

MOGI 2.9.4

See Notes

- 01/12/2004

MOGI 2.9.5

See Notes

- 01/12/2004

MOGI 2.10

Charges (MCOB 12)

- 01/12/2004

Introduction

MOGI 2.10.1

See Notes

- 01/12/2004

Excessive charges

MOGI 2.10.2

See Notes

- 01/12/2004

MOGI 2.11

Arrears and repossessions (MCOB 13)

- 01/12/2004

Introduction

MOGI 2.11.1

See Notes

- 01/12/2004

Fair treatment

MOGI 2.11.2

See Notes

- 31/05/2005

Information requirements

MOGI 2.11.3

See Notes

- 01/12/2004

MOGI 2.11.4

See Notes

- 01/12/2004

MOGI 3

Training and Competence sourcebook

MOGI 3.1

Training and Competence

- 01/12/2004

Introduction

MOGI 3.1.1

See Notes

- 01/12/2004

MOGI 3.1.2

See Notes

- 01/12/2004

General information on the Training and Competence sourcebook

MOGI 3.1.3

See Notes

- 01/12/2004

MOGI 3.1.4

See Notes

- 01/12/2004

Advising on standard mortgages

MOGI 3.1.5

See Notes

- 01/12/2004

MOGI 3.1.6

See Notes

- 01/12/2004

MOGI 3.1.7

See Notes

- 01/12/2004

MOGI 3.1.8

See Notes

- 01/12/2004

Non-advised sales of standard mortgages

MOGI 3.1.9

See Notes

- 01/12/2004

Advising on lifetime mortgages

MOGI 3.1.10

See Notes

- 01/12/2004

Non-advised sales of lifetime mortgages

MOGI 3.1.11

See Notes

- 01/12/2004

MOGI 3.1.12

See Notes

- 01/12/2004

Transitional arrangements

MOGI 3.1.13

See Notes

- 01/12/2004

MOGI 3.1.14

See Notes

- 01/12/2004

Proposed amendments to TC

MOGI 3.1.15

See Notes

- 01/12/2004

MOGI 3.1.16

See Notes

- 01/12/2004

MOGI App

Appendix A: brief description of terms in Part II

MOGI AppA

Appendix A: brief description of terms in Part II

- 01/12/2004

MOGI AppA 1.1

See Notes

| Defined term | Meaning |

| Arrears | A shortfall that a consumer has in payments due on his mortgage equivalent to two or more regular payments. |

| Distance contract | A contract concluded without any face-to-face contact with the consumer (by telephone, internet, email or post). |

| Durable medium | In a form that a consumer can keep and refer to as needed. It can include paper, disk and e-mail. |

| Financial promotion | An advertisement, brochure, mailshot, telemarketing or sales aid. |

| Illustration | The key facts illustration (KFI) describing the costs and features of a mortgage. |

| Lifetime mortgage | A mortgage aimed at older consumers and designed to release equity to provide a lump sum or income. |

| Mortgage adviser | A firm that advises on regulated mortgages. |

| Mortgage arranger | A firm that arranges regulated mortgages or makes arrangements with a view to regulated mortgages. |

| Mortgage intermediary | A firm that advises, arranges or makes arrangements with a view to regulated mortgages. |

| Mortgage mediation activity | Advising on, arranging or making arrangements with a view to regulated mortgages. |

| Non-real time qualifying credit promotion | A financial promotion relating to a mortgage that is not made in during a personal visit, telephone call or other interactive manner, for example a newspaper advertisement, TV commercial, leaflet or a mailshot. |

| Personal recommendation | A recommendation given to a specific person (or group or people) to take out or vary a particular regulated mortgage. |

| Qualifying credit | Any secured credit provided by a lender who is authorised for mortgage activities. |

| Real time qualifying credit promotion | A financial promotion made in the course of a telephone call, personal visit or any other interactive manner (but not including a financial promotion made by e-mail). |

| Regulated mortgage contract (RMC) | A loan to an individual secured by first charge on land in the UK, where the property is to be at least 40% used by the borrower or a member of his immediate family. Second charge loans are therefore not RMCs and buy-to-let mortgages are extremely unlikely to be RMCs. |

- 01/12/2004

MOGI AppB

Appendix B: Lifetime Mortgages: advising and selling - assessment of suitability

MOGI AppB 1

Lifetime Mortgages: advising and selling - assessment of suitability

- 01/12/2004

MOGI AppB 1.1

See Notes

- 01/12/2004