MIGI 8

Professional indemnity insurance ('PII')

MIGI 8.1

Introduction

- 01/12/2004

MIGI 8.1.1

See Notes

- 01/12/2004

MIGI 8.1.2

See Notes

- 01/12/2004

MIGI 8.1.3

See Notes

- 01/12/2004

MIGI 8.1.4

See Notes

- 01/12/2004

MIGI 8.2

The requirement to hold PII

- 01/12/2004

Which mortgage and insurance intermediaries need to hold PII?

MIGI 8.2.1

See Notes

- 01/12/2004

MIGI 8.2.2

See Notes

- 01/12/2004

MIGI 8.2.3

See Notes

- 01/12/2004

MIGI 8.3

What must your firm's PII policy cover?

- 01/12/2004

Mortgage mediation: what minimum level of cover must your firm's policy provide?

MIGI 8.3.1

See Notes

- 01/12/2004

Insurance mediation: what minimum level of cover must your firm's policy provide?

MIGI 8.3.2

See Notes

- 01/12/2004

MIGI 8.3.3

See Notes

- 01/12/2004

What counts towards your firm's annual income?

MIGI 8.3.4

See Notes

- 01/12/2004

MIGI 8.3.5

See Notes

- 01/12/2004

MIGI 8.3.6

See Notes

- 01/12/2004

MIGI 8.3.7

See Notes

- 01/12/2004

What level of excess should your firm's PII policy have?

MIGI 8.3.8

See Notes

- 01/12/2004

MIGI 8.3.9

See Notes

| Type of firm | Maximum permitted excess |

| Mortgage intermediary, insurance intermediary, or both that does not hold client money or client title documents | £2,500; or, if higher, 1.5% of annual income. |

| Mortgage intermediary, insurance intermediary, or both that does hold client money or client title documents. | £5,000 or, if higher, 3% of annual income. |

- 01/12/2004

MIGI 8.3.10

See Notes

- 01/12/2004

What risks must a PII policy cover?

MIGI 8.3.11

See Notes

- 01/12/2004

MIGI 8.3.12

See Notes

- 01/12/2004

MIGI 8.3.13

See Notes

- 01/12/2004

MIGI 8.3.14

See Notes

- 01/12/2004

MIGI 8.4

Obtaining PII cover

- 01/12/2004

Who can you get PII cover from?

MIGI 8.4.1

See Notes

- 01/12/2004

PII policies providing cover for more than one firm

MIGI 8.4.2

See Notes

- 01/12/2004

MIGI 8.4.3

See Notes

- 01/12/2004

MIGI 8.4.4

See Notes

- 01/12/2004

MIGI 8.4.5

See Notes

- 01/12/2004

MIGI 8.5

PII requirements: worked examples

- 01/12/2004

MIGI 8.5.1

See Notes

An insurance intermediary that does not hold client money, with annual income of £50,000 receives a quote for a PII policy that has a general excess of £5,000.

Minimum level of cover: €1,000,000 for a single claim AND €1,500,000 for aggregate claims.

The policy contains the following limits: £725,000 for a single claim AND £1,250,000 for aggregate claims.

Assuming an exchange rate of 1.4 when the terms of the policy are agreed, these levels of cover would be sufficient as they convert to €1,015,000 for a single claim and €1,750,000 for aggregate claims.

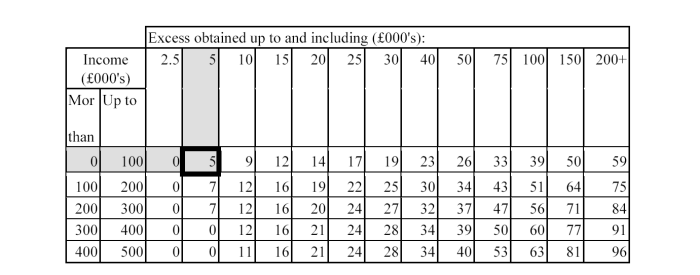

Excess levels: The maximum permitted excess level is £2,500 (as this is higher than 1.5% of annual income), so the excess on the policy is too high and the policy would not meet our requirements. Using the table in PRU 9.2.21 R shows that the firm would need to hold additional capital of £5,000. The extract from the table below shows how this is calculated.

- 01/12/2004

MIGI 8.5.2

See Notes

Two unconnected insurance intermediaries, who both hold client money, wish to be covered by the same policy. Firm A has annual income of £1,250,000 and Firm B has annual income of £14,750,000. The policy quote has a general excess of £50,000.

Minimum level of cover required: €1,000,000 for a single claim AND £1,600,000 for aggregate claims. (The policy must cover single claims for €1,000,000 and it must cover aggregate claims for 10% of combined annual income (i.e. £1.6m), as this is greater than €1,500,000 (approx £1,100,000).)

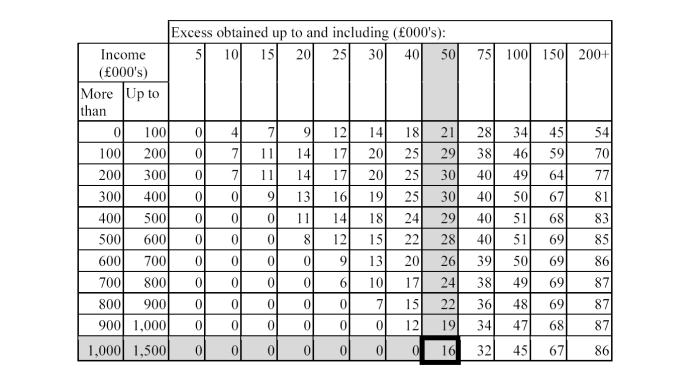

Excess levels: As the £50,000 excess level is less than 3% of the annual income of firm B, the excess is acceptable for firm B. For firm A, the maximum permitted excess level is £37,500 (3% of £1,250,000). So the excess on the policy is too high for firm A and the policy would not meet our requirements. Using the table in PRU 9.2.22 R shows that firm A would need to additional capital of £16,000. The extract from the table below shows how this is calculated.

- 01/12/2004

MIGI 8.5.3

See Notes

A mortgage intermediary, that does not handle client money, has annual income of £3,000,000, receives a quote for a PII policy that has a general excess of £2,500.

Minimum level of cover required: £300,000 for a single claim OR £500,000 for aggregate claims (The policy must either cover single claims for 10% of annual income (i.e. £300,000) as this is higher than £100,000 or it must cover aggregate claims for £500,000, as this is higher than 10% of annual income.)

Excess levels: As the £2,500 excess level is less than the maximum permitted (1.5% of £3 million), the firm would not need to hold additional capital.

- 01/12/2004