MIGI 7

Financial resources requirements

MIGI 7.1

Introduction

- 01/12/2004

MIGI 7.1.1

See Notes

- 01/12/2004

MIGI 7.1.2

See Notes

- 01/12/2004

MIGI 7.1.3

See Notes

- 01/12/2004

MIGI 7.1.4

See Notes

- 01/12/2004

MIGI 7.2

The capital resources requirements

- 01/12/2004

What are the capital resources requirements?

MIGI 7.2.1

See Notes

- 01/12/2004

MIGI 7.2.2

See Notes

- 01/12/2004

MIGI 7.2.3

See Notes

- 31/05/2005

MIGI 7.2.4

See Notes

- 01/12/2004

MIGI 7.2.5

See Notes

| Type of firm | Capital resources requirement |

| Mortgage intermediary, insurance intermediary, or both, that does not hold client money. | £5,000 or, if higher, 2.5% of the firm's annual income from regulated activity. |

| Mortgage intermediary that holds client money | £10,000 or, if higher, 5% of the firm's annual income from regulated activity. |

| Insurance

intermediary that holds client money in a statutory trust account Insurance intermediary that holds client money relating to transactions with commercial customers in a non-statutory trust account | £10,000 or, if higher, 5% of the firm's annual income from regulated activity. |

| Insurance intermediary that holds client money relating to transactions with retail customers in a non-statutory trust account | £50,000 or, if higher, 5% of the firm's annual income from regulated activity (CASS 5.4.4 R) |

- 31/05/2005

What counts towards your firm's annual income?

MIGI 7.2.6

See Notes

- 31/05/2005

MIGI 7.2.7

See Notes

- 31/05/2005

MIGI 7.2.8

See Notes

- 01/12/2004

MIGI 7.2.9

See Notes

- 01/12/2004

What counts towards your firm's capital resources?

MIGI 7.2.10

See Notes

- 01/12/2004

MIGI 7.2.11

See Notes

If your firm is a UK-incorporated company, the items eligible for inclusion in its capital resources are:

- 31/05/2005

MIGI 7.2.12

See Notes

If your firm is a sole trader, your capital resources are the net balances (according to the sole trader's most recent annual financial statement) on your capital account and current account, plus any eligible subordinated loans.

- 01/12/2004

MIGI 7.2.13

See Notes

If your firm is a partnership, your capital resources will normally consist of the net balances, (according to the partnership's most recent annual financial statement), on:

- 01/12/2004

MIGI 7.2.14

See Notes

If your firm is a limited liability partnership (LLP), your capital resources will normally consist of the net balances (according to the LLP's most recent annual financial statement) on the members' capital account and the members' reserves, plus any eligible subordinated loans.

- 01/12/2004

MIGI 7.2.15

See Notes

There is a limit on the amount of subordinated loans and redeemable preference shares that your firm may include in its capital resources if it holds client money or client title documents. For details of this restriction, see PRU 9.3.57 R.

- 01/12/2004

Deductions from capital resources

MIGI 7.2.16

See Notes

- 01/12/2004

What if my firm has a capital resources or solvency shortfall?

MIGI 7.2.17

See Notes

- 01/12/2004

MIGI 7.2.18

See Notes

| Type of firm | Options in the case of a shortfall |

| A sole trader or a partnership that does not hold client money or client title documents | Personal assets of the sole trader or of a partner may be used to make up the shortfall. This is provided that the personal assets in question are not needed to meet other liabilities arising from the sole trader or partner's personal activities or other business activities not regulated by us. Personal assets may include, for example, a car or a house. |

| A sole trader or a partnership that does hold client money or client title documents | Personal assets may not be used to make up a shortfall. Your firm will need to increase its capital resources. |

| A company, whether or not it holds client money or client title documents | Your firm will need to increase its capital resources. |

- 01/12/2004

MIGI 7.2.19

See Notes

| • | The Principles - Part I, Chapter 3.1 |

| • | Client money - Part III, Chapter 2 |

- 01/12/2004

MIGI 7.3

Summary flowchart and worked examples

- 01/12/2004

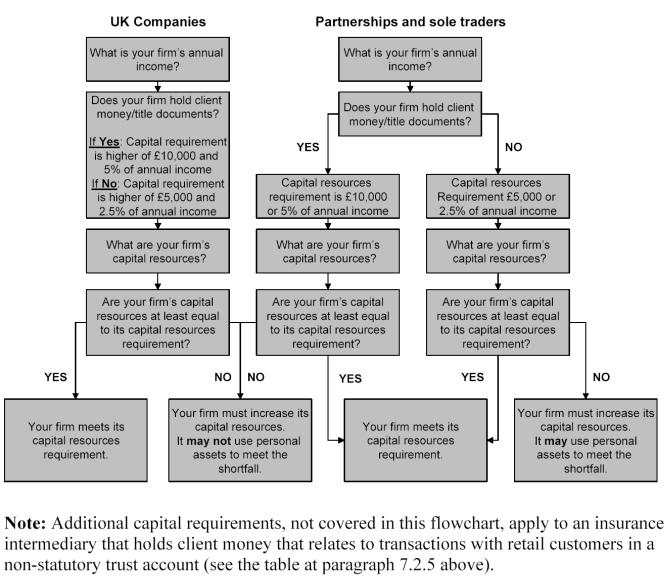

Summary flowchart: does your firm meet its capital resources requirement?

MIGI 7.3.1

See Notes

- 01/12/2004

MIGI 7.3.2

See Notes

- 01/12/2004

Financial resources requirements: worked examples

MIGI 7.3.3

See Notes

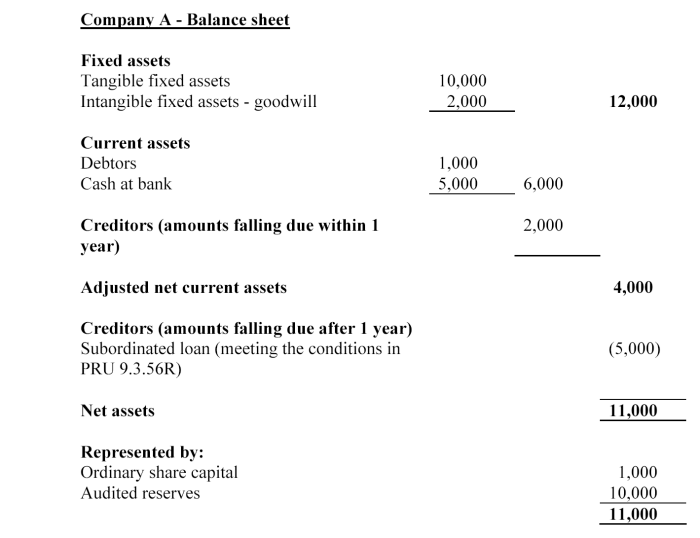

Company A has annual mortgage mediation income of £20,000, according to its last financial statements. Company A does not hold client money.

Company A's capital resources requirement is the higher of £5,000 and 2.5% of its annual mortgage mediation income, i.e. the higher of:

• £5,000; and

• 2.5% of £20,000 = £500

So company A must have capital resources of at least £5,000. Company A's capital resources = share capital + audited reserves + subordinated loan = £1,000 + £10,000 + £5,000 = £16,000.

So Company A meets its capital resources requirement.

Note: from 14 January 2008, Company A must deduct the goodwill on its balance sheet, so from that date, its capital resources will be £14,000, based on this balance sheet and assuming that the subordinated loan has not matured.

- 01/12/2004

MIGI 7.3.4

See Notes

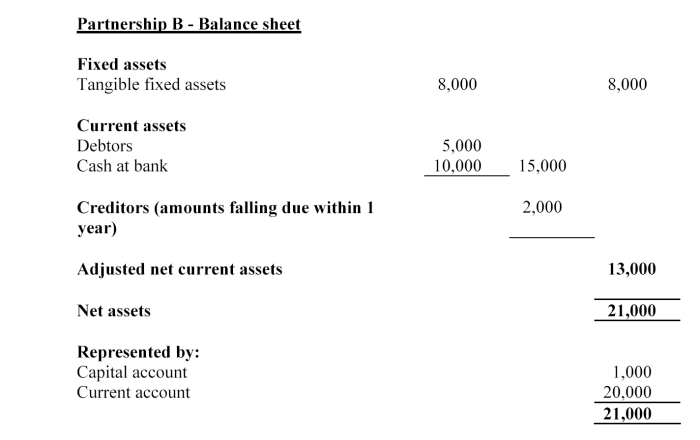

Partnership B, which holds client money in a statutory trust, has annual insurance mediation income of £210,000, according to its last annual financial statement.

Partnership B's capital resources requirement is the higher of £10,000 and 5% of its annual insurance mediation income, i.e. the higher of:

•£10,000; and

• 5% of £210,000 = £10,500.

So Partnership B must have capital resources of at least £10,500.

Partnership B's capital resources = current account + capital account

= £20,000 + £1,000 = £21,000.

So Partnership B meets its capital resources requirement.

- 01/12/2004

MIGI 7.3.5

See Notes

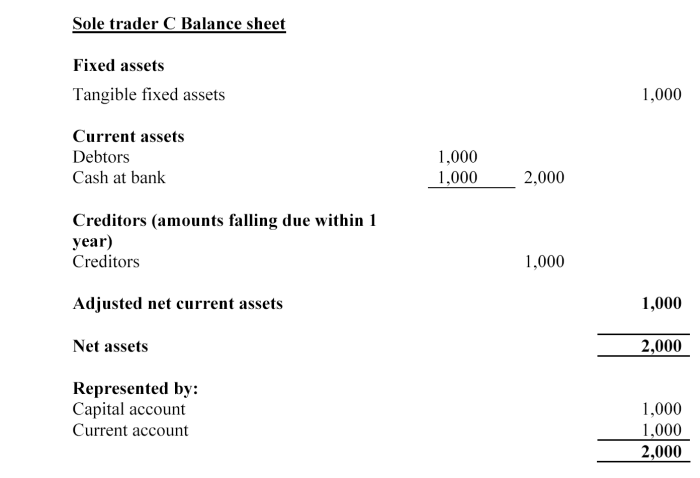

Sole trader C has annual mortgage mediation income of £40,000, according to its last financial statements. Sole trader C does not hold client money. In addition, Sole Trader C has personal assets of £30,000 and personal liabilities of £1,000.

Sole trader C's capital resources requirement is the higher of £5,000 and 2.5% of its annual mortgage mediation income, i.e. the higher of:

•£5,000; and

• 2.5% of £40,000 = £1,000.

So Sole Trader C must have capital resources of at least £5,000.

Sole trader C's capital resources = capital account + current account =

£1,000 + £1,000 = £2,000.

So Sole Trader C has a shortfall of £3,000 in meeting its capital resources requirement.

However, Sole Trader C has net personal assets of £29,000, so £3,000 of these may be used to make up this £2,000 shortfall.

- 01/12/2004