PRU 1

Application and general requirements

PRU 1.1

to follow

- 01/10/2005

PRU 1.2

Adequacy of financial resources

- 01/10/2005

Application

PRU 1.2.1

See Notes

- 31/12/2004

PRU 1.2.2

See Notes

- (1) In relation to liquidity risk only, this section applies to a firm in PRU 1.2.3 R unless PRU 1.2.7 R applies.

- (2) Liquidity risk includes the systems, processes and resources required by this section in respect of liquidity risk.

- 31/12/2004

PRU 1.2.3

See Notes

The firms referred to in PRU 1.2.2 R (1) are:

- (1) a building society;

- (2) a bank or an own account dealer (other than a venture capital firm) that is a UK firm;

- (3) an incoming EEA firm which:

- (a) is a full BCD credit institution; and

- (b) has a branch in the United Kingdom;

- (4) an overseas firm which is a bank or an own account dealer (other than a venture capital firm) but which is not:

- (a) an incoming EEA firm; or

- (b) a lead-regulated firm;

- (5) an overseas firm which:

- (a) is a bank;

- (b) is a lead-regulated firm;

- (c) is not an incoming EEA firm; and

- (d) has a branch in the United Kingdom.

- 31/12/2004

PRU 1.2.4

See Notes

- 31/12/2004

PRU 1.2.5

See Notes

- 31/12/2004

PRU 1.2.6

See Notes

If a firm carries on:

- (1) long-term insurance business; and

- (2) general insurance business;

this section applies separately to each type of business.

- 31/12/2004

PRU 1.2.7

See Notes

This section does not apply to:

- (1) a non-directive friendly society; or

- (2) a Swiss general insurer; or

- (3) an EEA-deposit insurer; or

- (4) a UCITS qualifier; or

- (5) an ICVC; or

- (6) an incoming EEA firm (unless PRU 1.2.3 R applies); or

- (7) an incoming Treaty firm.

- 31/12/2004

PRU 1.2.8

See Notes

- 31/12/2004

PRU 1.2.9

See Notes

- 31/12/2004

PRU 1.2.10

See Notes

- 31/12/2004

PRU 1.2.11

See Notes

- 31/12/2004

PRU 1.2.12

See Notes

- 31/12/2004

Purpose

PRU 1.2.14

See Notes

- 31/12/2004

PRU 1.2.15

See Notes

- 31/12/2004

PRU 1.2.16

See Notes

- 31/12/2004

PRU 1.2.17

See Notes

- 31/12/2004

Outline of other related provisions

PRU 1.2.18

See Notes

- 31/12/2004

PRU 1.2.19

See Notes

- 31/12/2004

PRU 1.2.20

See Notes

- 31/12/2004

PRU 1.2.21

See Notes

- 31/12/2004

Main Requirements

PRU 1.2.22

See Notes

- 31/12/2004

PRU 1.2.23

See Notes

- 31/12/2004

PRU 1.2.24

See Notes

- 31/12/2004

PRU 1.2.25

See Notes

- 31/12/2004

PRU 1.2.26

See Notes

- 31/12/2004

PRU 1.2.27

See Notes

- 31/12/2004

PRU 1.2.28

See Notes

- 31/12/2004

PRU 1.2.29

See Notes

- 31/12/2004

PRU 1.2.30

See Notes

- 31/12/2004

PRU 1.2.31

See Notes

The processes and systems required by PRU 1.2.26 R must enable the firm to identify the major sources of risk to its ability to meet its liabilities as they fall due, including the major sources of risk in each of the following categories:

- (1) credit risk;

- (2) market risk;

- (3) liquidity risk;

- (4) operational risk; and

- (5) insurance risk.

- 31/12/2004

PRU 1.2.32

See Notes

In PRU 1.2.31 R:

- (1) operational risk refers to the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events; and

- (2) insurance risk refers to the inherent uncertainties as to the occurrence, amount and timing of insurance liabilities.

- 31/12/2004

PRU 1.2.33

See Notes

- 31/12/2004

PRU 1.2.34

See Notes

- 31/12/2005

PRU 1.2.35

See Notes

For each of the major sources of risk identified in accordance with PRU 1.2.31 R, the firm must carry out stress tests and scenario analyses that are appropriate to the nature of those major sources of risk, as part of which the firm must:

- (1) take reasonable steps to identify an appropriate range of realistic adverse circumstances and events in which the risk identified crystallises; and

- (2) estimate the financial resources the firm would need in each of the circumstances and events considered in order to be able to meet its liabilities as they fall due.

- 31/12/2004

PRU 1.2.36

See Notes

- 31/12/2004

PRU 1.2.37

See Notes

A firm must make a written record of its assessment of the adequacy of its financial resources, including:

- (1) the major sources of risk identified in accordance with PRU 1.2.31 R;

- (2) how it intends to deal with those risks; and

- (3) details of the stress tests and scenario analyses carried out and the resulting financial resources estimated to be required in accordance with PRU 1.2.35 R.

- 31/12/2004

PRU 1.2.38

See Notes

- 31/12/2004

PRU 1.2.39

See Notes

- 31/12/2004

Stress tests and scenario analyses

PRU 1.2.40

See Notes

- 31/12/2004

PRU 1.2.41

See Notes

- 31/12/2004

PRU 1.2.42

See Notes

- 31/12/2004

PRU 1.2.43

See Notes

- 31/12/2004

PRU 1.2.44

See Notes

- 31/12/2004

PRU 1.2.45

See Notes

PRU 1.2.35 R requires a firm, as part of carrying out stress tests and scenario analyses, to take reasonable steps to identify an appropriate range of realistic circumstances and events in which a risk would crystallise. In particular:

- (1) a firm need only carry out stress tests and scenario analyses in so far as the circumstances or events are reasonably foreseeable, that is to say, their occurrence is not too remote a possibility; and

- (2) a firm should also take into account the relative costs and benefits of carrying out the stress tests and scenario analyses in respect of the circumstances and events identified.

- 31/12/2004

PRU 1.2.46

See Notes

- 31/12/2004

PRU 1.2.47

See Notes

Both stress testing and scenario analyses are prospective analysis techniques, which seek to anticipate possible losses that might occur if an identified risk crystallises. In applying them, a firm needs to decide how far forward to look. This should depend upon:

- (1) how quickly it would be able to identify events or changes in circumstances that might lead to a risk crystallising resulting in a loss; and

- (2) after it has identified the event or circumstance, how quickly and effectively it could act to prevent or mitigate any loss resulting from the risk crystallising and to reduce exposure to any further adverse event or change in circumstance.

- 31/12/2004

PRU 1.2.48

See Notes

The time horizon over which stress tests and scenario analysis would need to be carried out for the market risk arising from the holding of investments, for example, should depend upon:

- (1) the extent to which there is a regular, open and transparent market in those assets, which would allow fluctuations in the value of the investment to be more readily and quickly identified; and

- (2) the extent to which the market in those assets is liquid (and would remain liquid in the changed circumstances contemplated in the stress test or scenario analysis) which would allow the firm, if needed, to sell its holding so as to prevent or reduce exposure to future price fluctuations.

- 31/12/2004

PRU 1.2.49

See Notes

In identifying scenarios, and assessing their impact, a firm should take into account, where material, how changes in circumstances might impact upon:

- (1) the nature, scale and mix of its future activities; and

- (2) the behaviour of counterparties, and of the firm itself, including the exercise of choices (for example, options embedded in financial instruments or contracts of insurance).

- 31/12/2004

PRU 1.2.50

See Notes

In determining whether it would have adequate financial resources in the event of each identified realistic adverse scenario, a firm should:

- (1) only include financial resources that could reasonably be relied upon as being available in the circumstances of the identified scenario; and

- (2) take account of any legal or other restriction on the purposes for which financial resources may be used.

- 31/12/2004

PRU 1.2.51

See Notes

- 31/12/2004

PRU 1.2.52

See Notes

- 31/12/2004

PRU 1.2.53

See Notes

- 31/12/2004

PRU 1.2.54

See Notes

- 31/12/2004

PRU 1.2.55

See Notes

- 31/12/2004

PRU 1.3

Valuation

- 01/10/2005

Application

PRU 1.3.1

See Notes

PRU 1.3 applies to an insurer, unless it is:

- (1) a non-directive friendly society; or

- (2) an incoming EEA firm; or

- (3) an incoming Treaty firm.

- 31/12/2004

PRU 1.3.2

See Notes

- 31/12/2004

PRU 1.3.3

See Notes

- (1) PRU 1.3 applies to a firm in relation to the whole of its business.

- (2) Where a firm carries on both long-term insurance business and general insurance business, PRU 1.3 applies separately to each type of business.

- 31/12/2004

Purpose

PRU 1.3.4

See Notes

- 31/12/2004

General requirements: accounting principles to be applied

PRU 1.3.5

See Notes

Subject to PRU 1.3.5A R and PRU 1.3.5B R, except where a rule in PRU provides for a different method of recognition or valuation, whenever a rule in PRU refers to an asset, liability, equity or income statement item, a firm must, for the purpose of that rule, recognise the asset, liability, equity or income statement item and measure its value in accordance with:

- (1) the insurance accounts rules, or the Friendly Societies (Accounts and Related Provisions) Regulations 1994;

- (2) Financial Reporting Standards and Statements of Standard Accounting Practice issued or adopted by the Accounting Standards Board; and

- (3) Statements of Recommended Practice, issued by industry or sectoral bodies recognised for this purpose by the Accounting Standards Board; or

- (4) international accounting standards;

- 21/04/2005

PRU 1.3.5A

See Notes

- 21/04/2005

PRU 1.3.5B

See Notes

For the purposes of PRU, except where a rule in PRU provides for a different method of recognition or valuation, in respect of a defined benefit occupational pension scheme:

- (1) a firm must derecognise any defined benefit asset;

- (2) a firm may substitute for a defined benefit liability the firm's deficit reduction amount.

- 21/04/2005

PRU 1.3.5C

See Notes

- 21/04/2005

PRU 1.3.5D

See Notes

- 21/04/2005

PRU 1.3.6

See Notes

PRU 1.3.5 R provides that unless a rule in PRU provides for a different method of recognition or valuation, the applicable provisions of the Companies Act 1985, the Companies Act (Northern Ireland) Order 1986 or the Friendly Societies (Accounts and Related Provisions) Regulations 1994, as supplemented by Financial Reporting Standards, Statements of Standard Accounting Practice, and Statements of Recommended Accounting Practice, or, where applicable, international accounting standards, should be used to determine the recognition and valuation of assets, liabilities, equity and income statement items for the purposes of PRU, including:

- (1) whether, and when, to recognise or de-recognise an asset or liability;

- (2) the amount at which to value an asset, liability, equity or income statement item;

- (3) which description to place on an asset, liability, equity or income statement item.

- 21/04/2005

PRU 1.3.7

See Notes

In particular, unless an exception applies, PRU 1.3.5 R should be applied for the purposes of PRU to determine how to account for:

- (1) netting of amounts due to or from the firm;

- (2) the securitisation of assets and liabilities (see also PRU 1.3.8 G);

- (3) leased tangible assets;

- (4) assets transferred or received under a sale and repurchase or stock lending transaction; and

- (5) assets transferred or received by way of initial or variation margin under a derivative or similar transaction.

- 31/12/2004

PRU 1.3.8

See Notes

- 21/04/2005

PRU 1.3.9

See Notes

- 31/12/2004

PRU 1.3.10

See Notes

- 31/12/2004

Investments, derivatives and quasi-derivatives

PRU 1.3.11

See Notes

Subject to PRU 1.3.31 R, for the purposes of PRU, a firm must apply PRU 1.3.12 R to PRU 1.3.30 R in order to determine how to account for:

- (1) investments that are, or amounts owed arising from the disposal of:

- (a) debt securities, bonds and other money- and capital-market instruments; or

- (b) loans; or

- (c) shares and other variable yield participations; or

- (d) units in UCITS schemes, non-UCITS retail schemes, recognised schemes and any other collective investment scheme that invests only in admissible assets (including any derivatives or quasi-derivatives held by the scheme); and

- (2) derivatives and quasi-derivatives.

- 31/12/2004

Marking to market

PRU 1.3.12

See Notes

- 31/12/2004

PRU 1.3.13

See Notes

- 31/12/2004

PRU 1.3.14

See Notes

- 31/12/2004

Marking to model

PRU 1.3.15

See Notes

- 31/12/2004

PRU 1.3.16

See Notes

When the model used is developed by the firm, that model must be:

- (1) based on appropriate assumptions which have been assessed and challenged by suitably qualified parties independent of the development process; and

- (2) independently tested, including validation of the mathematics, assumptions, and software implementation.

- 31/12/2004

PRU 1.3.17

See Notes

- 31/12/2004

PRU 1.3.18

See Notes

- 31/12/2004

PRU 1.3.19

See Notes

- 31/12/2004

PRU 1.3.20

See Notes

- 31/12/2004

PRU 1.3.21

See Notes

- 31/12/2004

PRU 1.3.22

See Notes

- 31/12/2004

PRU 1.3.23

See Notes

- 31/12/2004

Independent price verification

PRU 1.3.24

See Notes

- 31/12/2004

PRU 1.3.25

See Notes

- 31/12/2004

Valuation adjustments or reserves

PRU 1.3.26

See Notes

- 31/12/2004

PRU 1.3.27

See Notes

- 31/12/2004

PRU 1.3.28

See Notes

- 31/12/2004

PRU 1.3.29

See Notes

The requirements referred to in PRU 1.3.26 R and PRU 1.3.28 R are:

- (1) a firm must consider the following adjustments or reserves: unearned credit spreads, close-out costs, operational risks, early termination, investing and funding costs, future administrative costs and, where appropriate, model risk; and

- (2) a firm must consider several factors when determining whether a valuation reserve is necessary for less liquid items. These factors include the amount of time it would take to hedge out the position/risks within the position; the average and volatility of bid/offer spreads; the availability of market quotes (number and identity of market makers); and the average and volatility of trading volumes.

- 31/12/2004

Valuation adjustments or reserves

PRU 1.3.30

See Notes

- 21/04/2005

Shares in, and debts due from, related undertakings

PRU 1.3.31

See Notes

PRU 1.3.11 R does not apply to shares in, and debts due from, a related undertaking that is:

- (1) a regulated related undertaking; or

- (2) an ancillary services undertaking; or

- (3) any other subsidiary undertaking, the shares of which a firm elects to value in accordance with PRU 1.3.35 R.

- 31/12/2004

PRU 1.3.32

See Notes

- 31/12/2004

PRU 1.3.33

See Notes

- 31/12/2004

PRU 1.3.34

See Notes

- 31/12/2004

PRU 1.3.35

See Notes

- 31/12/2004

PRU 1.3.36

See Notes

For the purposes of PRU 1.3.35 R (1), the regulatory surplus value of an undertaking referred to in PRU 1.3.31 R (1) or PRU 1.3.31R (3) is, subject to PRU 1.3.37 R, the sum of:

- (1) the total capital after deductions of the undertaking; less

- (2) the individual capital resources requirement of the undertaking.

- 31/12/2005

PRU 1.3.37

See Notes

- (1) Subject to PRU 1.3.38 R, for the purposes of PRU 1.3.36 R, only the relevant proportion of the:

- (a) total capital after deductions of the undertaking; and

- (b) individual capital resources requirement of the undertaking;

- is to be taken into account.

- (2) In (1), the relevant proportion is the proportion of the total number of shares issued by the undertaking held, directly or indirectly, by the firm.

- 31/12/2005

PRU 1.3.38

See Notes

- 31/12/2005

PRU 1.3.39

See Notes

For the purposes of PRU 1.3.35 R to PRU 1.3.38 R:

- (1) in relation to an undertaking referred to in PRU 1.3.31 R (1):

- (a) individual capital resources requirement has the meaning given by PRU 8.3.34 R;

- (b) total capital after deductions means:

- (i) when used in relation to a regulated related undertaking that is subject to PRU 2.2.14 R, the total capital after deductions (as calculated at stage M of the calculation in PRU 2.2.14 R) of the undertaking; and

- (ii) when used in relation to a regulated related undertaking that is not subject to PRU 2.2.14 R, the total capital after deductions calculated as if that undertaking were required to calculate its total capital after deductions in accordance with stage M of the calculation in PRU 2.2.14 R, but with such adjustments being made to secure that the undertaking's calculation of its total capital after deductions complies with the relevant sectoral rules applicable to it; and

- (c) ineligible surplus capital has the meaning given by PRU 8.3.67 R;

- (2) in relation to an undertaking referred to in PRU 1.3.31 R (3):

- (a) the individual capital resources requirement is zero; and

- (b) the total capital after deductions means the total capital after deductions of the undertaking calculated as if the undertaking were an insurance holding company required to calculate its total capital resources in accordance with PRU 2.2.14 R but with such adjustments being made to secure that the undertaking's calculation of its total capital after deductions complies with the sectoral rules for the insurance sector.

- (c) [deleted]

- 31/12/2005

PRU 1.3.40

See Notes

- 31/12/2004

PRU 1.3.41

See Notes

- 31/12/2004

PRU 1.3.42

See Notes

- 31/12/2004

Community co-insurance operations: general insurance business

PRU 1.3.43

See Notes

Where a relevant insurer determines the amount of a liability in order to make provision for outstanding claims under a Community co-insurance operation, then, if the leading insurer has informed the relevant insurer of the amount of the provision made by the leading insurer for such claims, the amount determined by the relevant insurer:

- (1) must be at least as great as the amount of the provision made by the leading insurer; or

- (2) in a case where it is not the practice in the United Kingdom to make such provision separately, must be sufficient, when all liabilities are taken into account, to include provision at least as great as that made by the leading insurer for such claims;

- 31/12/2004

PRU 1.4

Prudential risk management and associated systems and controls

- 01/10/2005

Application

PRU 1.4.1

See Notes

PRU 1.4 applies to an insurer unless it is:

- (1) a non-directive friendly society; or

- (2) an incoming EEA firm; or

- (3) an incoming Treaty firm.

- 31/12/2004

PRU 1.4.2

See Notes

PRU 1.4 applies to:

- (1) an EEA-deposit insurer; and

- (2) a Swiss general insurer;

only in respect of the activities of the firm carried on from a branch in the United Kingdom.

- 31/12/2004

Purpose

PRU 1.4.3

See Notes

- 31/12/2004

PRU 1.4.4

See Notes

- 31/12/2004

PRU 1.4.5

See Notes

- 31/12/2004

How to interpret PRU 1.4

PRU 1.4.6

See Notes

- 31/12/2004

PRU 1.4.7

See Notes

- 31/12/2004

PRU 1.4.8

See Notes

Appropriate systems and controls for the management of prudential risk will vary from firm to firm. Therefore most of the material in PRU 1.4 is guidance. In interpreting this guidance, a firm should have regard to its own particular circumstances. Following from SYSC 3.1.2 G, this should include considering the nature, scale and complexity of its business, which may be influenced by factors such as:

- (1) the diversity of its operations, including geographical diversity;

- (2) the volume and size of its transactions; and

- (3) the degree of risk associated with each area of its operation.

- 31/12/2004

PRU 1.4.9

See Notes

- 31/12/2004

The role of systems and controls in a prudential context

PRU 1.4.10

See Notes

- 31/12/2004

The prudential responsibilities of senior management and the apportionment of those responsibilities

PRU 1.4.11

See Notes

Ultimate responsibility for the management of prudential risks rests with a firm's governing body and relevant senior managers, and in particular with those individuals that undertake the firm's governing functions and the apportionment and oversight function. In particular, these responsibilities should include:

- (1) overseeing the establishment of an appropriate business plan and risk management strategy;

- (2) overseeing the development of appropriate systems for the management of prudential risks;

- (3) establishing adequate internal controls; and

- (4) ensuring that the firm maintains adequate financial resources.

- 31/12/2004

The delegation of responsibilities within the firm

PRU 1.4.12

See Notes

- 31/12/2004

PRU 1.4.13

See Notes

- 31/12/2004

Firms subject to risk management on a group basis

PRU 1.4.14

See Notes

Some firms organise the management of their prudential risks on a stand-alone basis. In some cases, however, the management of a firm's prudential risks may be entirely or largely subsumed within a whole group or sub-group basis.

- (1) The latter arrangement may still comply with the FSA's prudential policy on systems and controls if the firm's governing body formally delegates the functions that are to be carried out in this way to the persons or bodies that are to carry them out. Before doing so, however, the firm's governing body should have explicitly considered the arrangement and decided that it is appropriate and that it enables the firm to meet the FSA's prudential policy on systems and controls. The firm should notify the FSA if the management of its prudential risks is to be carried out in this way.

- (2) Where the management of a firm's prudential risks is largely, but not entirely, subsumed within a whole group or sub-group basis, the firm should ensure that any prudential issues that are specific to the firm are:

- (a) identified and adequately covered by those to whom it has delegated certain prudential risk management tasks; or

- (b) dealt with by the firm itself.

- 31/12/2004

PRU 1.4.15

See Notes

- 31/12/2004

PRU 1.4.16

See Notes

- 31/12/2004

Business planning and risk management

PRU 1.4.17

See Notes

- 31/12/2004

PRU 1.4.18

See Notes

- 31/12/2004

PRU 1.4.19

See Notes

When establishing and maintaining its business plan and prudential risk management systems, a firm must document:

- (1) an explanation of its overall business strategy, including its business objectives;

- (2) a description of, as applicable, its policies towards market, credit (including provisioning), liquidity, operational, insurance and group risk (that is, its risk policies), including its appetite or tolerance for these risks and how it identifies, measures or assesses, monitors and controls these risks;

- (3) the systems and controls that it intends to use in order to ensure that its business plan and risk policies are implemented correctly;

- (4) a description of how the firm accounts for assets and liabilities, including the circumstances under which items are netted, included or excluded from the firm's balance sheet and the methods and assumptions for valuation;

- (5) appropriate financial projections and the results of its stress testing and scenario analysis (see PRU 1.2 Adequacy of financial resources); and

- (6) details of, and the justification for, the methods and assumptions used in financial projections and stress testing and scenario analysis.

- 31/12/2004

PRU 1.4.20

See Notes

- 31/12/2004

PRU 1.4.21

See Notes

- 31/12/2004

PRU 1.4.22

See Notes

A firm's business plan and risk management systems should be:

- (1) effectively communicated so that all employees and contractors understand and adhere to the procedures related to their own responsibilities;

- (2) regularly updated and revised, in particular when there is significant new information or when actual practice or performance differs materially from the documented strategy, policy or systems.

- 31/12/2004

PRU 1.4.23

See Notes

- 31/12/2004

PRU 1.4.24

See Notes

- 31/12/2004

PRU 1.4.25

See Notes

- 31/12/2004

Internal controls: introduction

PRU 1.4.26

See Notes

- 31/12/2004

PRU 1.4.27

See Notes

- 31/12/2004

PRU 1.4.28

See Notes

The precise role and organisation of internal controls can vary from firm to firm. However, a firm's internal controls should normally be concerned with assisting its governing body and relevant senior managers to participate in ensuring that it meets the following objectives:

- (1) safeguarding both the assets of the firm and its customers, as well as identifying and managing liabilities;

- (2) maintaining the efficiency and effectiveness of its operations;

- (3) ensuring the reliability and completeness of all accounting, financial and management information; and

- (4) ensuring compliance with its internal policies and procedures as well as all applicable laws and regulations.

- 31/12/2004

PRU 1.4.29

See Notes

When determining the adequacy of its internal controls, a firm should consider both the potential risks that might hinder the achievement of the objectives listed in PRU 1.4.28 G, and the extent to which it needs to control these risks. More specifically, this should normally include consideration of:

- (1) the appropriateness of its reporting and communication lines (see SYSC 3.2.2 G);

- (2) how the delegation or contracting of functions or activities to employees, appointed representatives or other third parties (for example outsourcing) is to be monitored and controlled (see SYSC 3.2.3 G to SYSC 3.2.4 G, PRU 1.4.12 G to PRU 1.4.16 G and PRU 1.4.33 G; additional guidance on the management of outsourcing arrangements is also provided in SYSC 3A.9);

- (3) the risk that a firm's employees or contractors might accidentally or deliberately breach a firm's policies and procedures (see SYSC 3A.6.3 G);

- (4) the need for adequate segregation of duties (see SYSC 3.2.5 G and PRU 1.4.30 G to PRU 1.4.33 G);

- (5) the establishment and control of risk management committees (see PRU 1.4.34 G to PRU 1.4.37 G);

- (6) the need for risk assessment and the establishment of a risk assessment function (see SYSC 3.2.10 G and PRU 1.4.38 G to PRU 1.4.41 G); and

- (7) the need for internal audit and the establishment of an internal audit function and audit committee (see SYSC 3.2.15 G to SYSC 3.2.16 G and PRU 1.4.42 G to PRU 1.4.45 G).

- 31/12/2004

Internal controls: segregation of duties

PRU 1.4.30

See Notes

The effective segregation of duties is an important internal control in the prudential context. In particular, it helps to ensure that no one individual is completely free to commit a firm's assets or incur liabilities on its behalf. Segregation can also help to ensure that a firm's governing body receives objective and accurate information on financial performance, the risks faced by the firm and the adequacy of its systems. In this regard, a firm should ensure that there is adequate segregation of duties between employees involved in:

- (1) taking on or controlling risk (which could include risk mitigation);

- (2) risk assessment (which includes the identification and analysis of risk); and

- (3) internal audit.

- 31/12/2004

PRU 1.4.31

See Notes

- 31/12/2004

PRU 1.4.32

See Notes

- 31/12/2004

PRU 1.4.33

See Notes

Where a firm outsources a controlled function, such as internal audit, it should take reasonable steps to ensure that every individual involved in the performance of this service is independent from the individuals who perform its external audit. This should not prevent services from being undertaken by a firm's external auditors provided that:

- (1) the work is carried out under the supervision and management of the firm's own internal staff; and

- (2) potential conflicts of interest between the provision of external audit services and the provision of controlled functions are properly managed.

- 31/12/2004

Internal controls: risk management committees

PRU 1.4.34

See Notes

- 31/12/2004

PRU 1.4.35

See Notes

Where a firm decides to create one or more risk management committee(s), adequate internal controls should be put in place to ensure that these committees are effective and that their actions are consistent with the objectives outlined in PRU 1.4.28 G. This should normally include consideration of the following:

- (1) setting clear terms of reference, including membership, reporting lines and responsibilities of each committee;

- (2) setting limits on their authority;

- (3) agreeing routine reporting and non-routine escalation procedures;

- (4) agreeing the minimum frequency of committee meetings; and

- (5) reviewing the performance of these risk management committees.

- 31/12/2004

PRU 1.4.36

See Notes

- 31/12/2004

PRU 1.4.37

See Notes

The effective use of risk management committees can help to enhance a firm's internal controls. In establishing and maintaining its risk management committees, a firm should consider:

- (1) their membership, which should normally include relevant senior managers (such as the head of group risk, head of legal, and the heads of market, credit, liquidity and operational risk, etc.), business line managers, risk management personnel and other appropriately skilled people, for example, actuaries, lawyers, accountants, IT specialists, etc.;

- (2) using these committees to:

- (i) inform the decisions made by a firm's governing body regarding its appetite or tolerance for risk taking;

- (ii) highlight risk management issues that may require attention by the governing body;

- (iii) consider risk at the firm-wide level and, within delegated limits, to determine the allocation of risk limits and financial resources across business lines;

- (iv) consider how exposures may be unwound, hedged, or otherwise mitigated, as appropriate.

- 31/12/2004

Internal controls: risk assessment

PRU 1.4.38

See Notes

Risk assessment is the process through which a firm identifies and analyses (using both qualitative and quantitative methodologies) the risks that it faces. A firm's risk assessment activities should normally include consideration of:

- (1) its total exposure to risk at the firm-wide level (that is, its exposure across business lines and risk categories);

- (2) capital allocation and the need to calculate risk weighted returns for different business lines;

- (3) the potential correlations that can exist between the risks in different business lines; this should also include looking for risks to which a firm's business plan is particularly sensitive, such as interest rate risk, or multiple dealings with the same counterparty;

- (4) the use of stress tests and scenario analysis;

- (5) whether there are risks inherent in the firm's business that are not being addressed adequately;

- (6) the risk adjusted return that the firm is achieving; and

- (7) the adequacy and timeliness of management information on market, credit, insurance, liquidity, operational and group risks from the business lines, including risk limit utilisation.

- 31/12/2004

PRU 1.4.39

See Notes

- 31/12/2004

PRU 1.4.40

See Notes

- 31/12/2004

PRU 1.4.41

See Notes

- 31/12/2004

Internal audit

PRU 1.4.42

See Notes

A firm should ensure that it has appropriate mechanisms in place to assess and monitor the appropriateness and effectiveness of its systems and controls. This should normally include consideration of:

- (1) adherence to and effectiveness of, as appropriate, its market, credit, liquidity, operational, insurance, and group risk policies;

- (2) whether departures and variances from its documented systems and controls and risk policies have been adequately documented and appropriately reported, including whether appropriate pre-clearance authorisation has been sought for material departures and variances;

- (3) adherence to and effectiveness of its accounting policies, and whether accounting records are complete and accurate;

- (4) adherence to and effectiveness of its management reporting arrangements, including the timeliness of reporting, and whether information is comprehensive and accurate; and

- (5) adherence to FSA rules and regulatory prudential standards.

- 31/12/2004

PRU 1.4.43

See Notes

- 31/12/2004

PRU 1.4.44

See Notes

- 31/12/2004

PRU 1.4.45

See Notes

- 31/12/2004

Management information

PRU 1.4.46

See Notes

- 31/12/2004

PRU 1.4.47

See Notes

The role of management information should be to help a firm's governing body and senior managers to understand risk at a firm-wide level. In so doing, it should help them to:

- 31/12/2004

PRU 1.4.48

See Notes

A firm should consider what information needs to be made available to its governing body and senior managers. Some possible examples include:

- (1) firm-wide information such as the overall profitability and value of a firm and its total exposure to risk;

- (2) reports from committees to which the governing body has delegated risk management tasks, if applicable;

- (3) reports from a firm's internal audit and risk assessment functions, if applicable, including exception reports, where risk limits and policies have been breached or systems circumvented;

- (4) financial projections under expected and abnormal (that is, stressed) conditions;

- (5) reconciliation of actual profit and loss to previous financial projections and an analysis of any significant variances;

- (6) matters which require a decision from the governing body or senior managers, for example a significant variation to a business plan, amendments to risk limits, the creation of a new business line, etc;

- (7) compliance with FSA rules and regulatory prudential standards;

- (8) risk weighted returns; and

- (9) liquidity and funding requirements.

- 31/12/2004

PRU 1.4.49

See Notes

The management information that is provided to a firm's governing body and senior managers should have the following characteristics:

- (1) it should be timely, its frequency being determined by factors such as:

- (a) the volatility of the business in which the firm is engaged (that is, the speed at which its risks can change);

- (b) any time constraints on when action needs to be taken; and

- (c) the level of risk that the firm is exposed to, compared to its available financial resources and tolerance for risk;

- (2) it should be reliable, having regard to the fact that it may be necessary to sacrifice a degree of accuracy for timeliness; and

- (3) it should be presented in a manner that highlights any relevant issues on which those undertaking governing functions should focus particular attention.

- 31/12/2004

PRU 1.4.50

See Notes

- 31/12/2004

Record keeping

PRU 1.4.51

See Notes

SYSC 3.2.20 R requires a firm to take reasonable care to make and retain adequate records. The following policy on record keeping supplements SYSC 3.2.20 R by providing some additional rules and guidance on record keeping in a prudential context. The purpose of this policy is to:

- (1) facilitate the prudential supervision of a firm by ensuring that adequate information is available regarding its past/current financial situation and business activities (which includes the design and implementation of systems and controls); and

- (2) help the FSA to satisfy itself that a firm is operating in a prudent manner and is not prejudicing the interests of its customers or market confidence.

- 31/12/2004

PRU 1.4.52

See Notes

- 31/12/2004

PRU 1.4.53

See Notes

- (1) A firm must make and regularly update accounting and other records that are sufficient to enable the firm to demonstrate to the FSA:

- (a) that the firm is financially sound and has appropriate systems and controls;

- (b) the firm's financial position and exposure to risk (to a reasonable degree of accuracy); and

- (c) the firm's compliance with the rules in PRU.

- (2) The records in (1) must be retained for a minimum of three years, or longer as appropriate.

- 31/12/2004

PRU 1.4.54

See Notes

- 31/12/2004

PRU 1.4.55

See Notes

- 31/12/2004

PRU 1.4.56

See Notes

- 31/12/2004

PRU 1.4.57

See Notes

- 31/12/2004

PRU 1.4.58

See Notes

- 31/12/2004

PRU 1.4.59

See Notes

- 31/12/2004

PRU 1.4.60

See Notes

A firm must keep the records required in PRU 1.4.53 R in the United Kingdom, except where:

- (1) they relate to business carried on from an establishment in a country or territory that is outside the United Kingdom; and

- (2) they are kept in that country or territory.

- 31/12/2004

PRU 1.4.61

See Notes

- 31/12/2004

PRU 1.4.62

See Notes

- 31/12/2004

PRU 1.4.63

See Notes

- 31/12/2004

PRU 1.4.64

See Notes

- 31/12/2004

PRU 1.5

to follow

- 01/10/2005

PRU 1.6

to follow

- 01/10/2005

PRU 1.7

to follow

- 01/10/2005

PRU 1.8

Actions for damages

- 01/10/2005

PRU 2

Capital

PRU 2.1

Calculation of capital resources requirements

- 01/10/2005

Application

PRU 2.1.1

See Notes

PRU 2.1 applies to an insurer unless it is:

- (1) a non-directive friendly society; or

- (2) a Swiss general insurer; or

- (3) an EEA-deposit insurer; or

- (4) an incoming EEA firm; or

- (5) an incoming Treaty firm.

- 31/12/2004

PRU 2.1.2

See Notes

- 31/12/2004

PRU 2.1.3

See Notes

- (1) PRU 2.1 applies to a firm in relation to the whole of its business, except where a particular provision provides for a narrower scope.

- (2) Where a firm carries on both long-term insurance business and general insurance business, PRU 2.1 applies separately to each type of business.

- 31/12/2004

PRU 2.1.4

See Notes

- 31/12/2004

Purpose

PRU 2.1.6

See Notes

- 31/12/2004

PRU 2.1.7

See Notes

This section (PRU 2.1) sets capital resources requirements for a firm. PRU 2.2 sets out how, for the purpose of this, the amounts or values of capital, assets and liabilities are to be determined. More detailed rules relating to capital, assets and liabilities are also set out in the following chapters and sections:

PRU 2.1 and PRU 2.2 include appropriate cross-references to these chapters and sections.

- 31/12/2004

PRU 2.1.8

See Notes

- 31/12/2004

Main requirements

PRU 2.1.9

See Notes

- (1) A firm must maintain at all times capital resources equal to or in excess of its capital resources requirement (CRR).

- (2) A firm which is a participating insurance undertaking and, in relation to its own group capital resources, is in compliance with PRU 8.3.9 R, is deemed to comply with (1).

- 31/12/2004

PRU 2.1.10

See Notes

- 31/12/2004

PRU 2.1.11

See Notes

- 31/12/2004

PRU 2.1.12

See Notes

- 31/12/2004

PRU 2.1.13

See Notes

- 31/12/2004

Calculation of the CRR

PRU 2.1.14

See Notes

- 31/12/2004

PRU 2.1.15

See Notes

The CRR for any firm to which this rule applies (see PRU 2.1.16 R and PRU 2.1.17 R) is the higher of:

- (1) the MCR in PRU 2.1.22 R; and

- (2) the ECR in PRU 2.1.34 R.

- 31/12/2004

PRU 2.1.16

See Notes

Subject to PRU 2.1.17 R, PRU 2.1.15 R applies to a firm carrying on long-term insurance business, other than:

- (1) a non-directive mutual;

- (2) a firm which has no with-profits insurance liabilities; and

- (3) a firm which has with-profits insurance liabilities that are, and at all times since 31 December 2004 (the coming into force of PRU 2.1.15 R) have remained, less than £500 million.

- 31/12/2004

PRU 2.1.17

See Notes

PRU 2.1.15 R also applies to a firm of a type listed in PRU 2.1.16 R (3) if:

- (1) the firm makes an election that PRU 2.1.15 R is to apply to it; and

- (2) that election is made by written notice given to the FSA in a way that complies with the requirements for written notice in SUP 15.7.

- 31/12/2004

PRU 2.1.18

See Notes

- 31/12/2004

PRU 2.1.19

See Notes

- 31/12/2004

PRU 2.1.20

See Notes

- 31/12/2004

Calculation of the MCR

PRU 2.1.21

See Notes

For a firm carrying on general insurance business, the MCR in respect of that business is the higher of:

- (1) the base capital resources requirement for general insurance business applicable to that firm; and

- (2) the general insurance capital requirement.

- 31/12/2004

PRU 2.1.22

See Notes

For a firm carrying on long-term insurance business, the MCR in respect of that business is the higher of:

- (1) the base capital resources requirement for long-term insurance business applicable to that firm; and

- (2) the sum of:

- (a) the long-term insurance capital requirement; and

- (b) the resilience capital requirement.

- 31/12/2004

PRU 2.1.23

See Notes

- 31/12/2004

PRU 2.1.24

See Notes

- 31/12/2004

Calculation of the base capital resources requirement

PRU 2.1.25

See Notes

- 31/12/2005

PRU 2.1.26

See Notes

| Firm type | Amount: Currency equivalent of | |

| General insurance business | ||

| Liability insurer (classes 10-15) | Directive mutual | €2.25 million |

| Non-directive insurer | €300,000 | |

| Other | €3 million | |

| Other insurer | Directive mutual | €1.5 million |

|

Non-directive insurer

(classes 1 to 8, 16 or 18) | €225,000 | |

|

Non-directive insurer

(classes 9 or 17) | €150,000 | |

| Other | €2 million | |

| Long-term insurance business | ||

| Mutual | Directive | €2.25 million |

| Non-directive | €600,000 | |

| Any other insurer | €3 million | |

- 31/12/2005

PRU 2.1.27

See Notes

- 31/12/2005

PRU 2.1.28

See Notes

- 31/12/2004

PRU 2.1.29

See Notes

- 31/12/2004

Calculation of the general insurance capital requirement

PRU 2.1.30

See Notes

A firm must calculate its general insurance capital requirement as the highest of:

- (1) the premiums amount;

- (2) the claims amount; and

- (3) the brought forward amount.

- 31/12/2004

PRU 2.1.31

See Notes

- 31/12/2004

Calculation of the long-term insurance capital requirement

PRU 2.1.32

See Notes

A firm must calculate its long-term insurance capital requirement as the sum of:

- (1) the insurance death risk capital component;

- (2) the insurance health risk capital component;

- (3) the insurance expense risk capital component; and

- (4) the insurance market risk capital component.

- 31/12/2004

PRU 2.1.33

See Notes

- 31/12/2004

Calculation of the ECR

PRU 2.1.34

See Notes

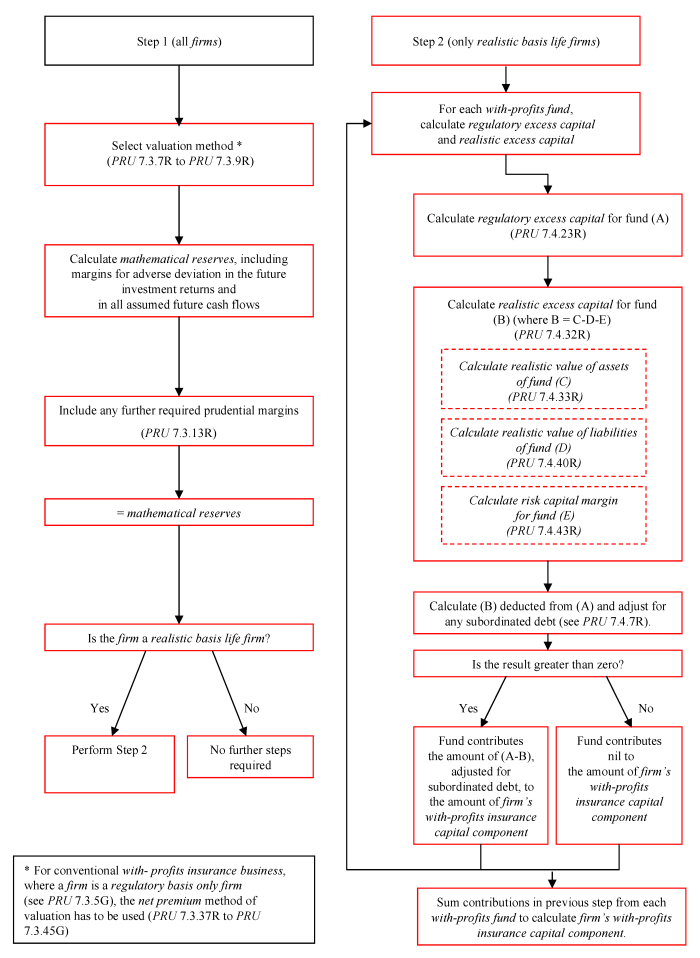

For a firm carrying on long-term insurance business, the ECR in respect of that business is the sum of:

- (1) the long-term insurance capital requirement;

- (2) the resilience capital requirement; and

- (3) the with-profits insurance capital component.

- 31/12/2004

PRU 2.1.35

See Notes

- 31/12/2004

Monitoring requirements

PRU 2.1.36

See Notes

- 31/12/2004

PRU 2.1.37

See Notes

- 31/12/2004

PRU 2.1.38

See Notes

- 31/12/2004

PRU 2.2

Capital resources

- 01/10/2005

Application

PRU 2.2.1

See Notes

PRU 2.2 applies to an insurer unless it is:

- (1) a non-directive friendly society; or

- (2) a Swiss general insurer; or

- (3) an EEA-deposit insurer; or

- (4) an incoming EEA firm; or

- (5) an incoming Treaty firm.

- 31/12/2004

Purpose

PRU 2.2.2

See Notes

- 31/10/2004

Principles underlying the definition of capital resources

PRU 2.2.3

See Notes

- 31/10/2004

PRU 2.2.4

See Notes

- 31/10/2004

Tier one capital

PRU 2.2.5

See Notes

Tier one capital typically has the following characteristics:

- (1) it is able to absorb losses;

- (2) it is permanent;

- (3) it ranks for repayment upon winding up after all other debts and liabilities; and

- (4) it has no fixed costs, that is, there is no inescapable obligation to pay dividends or interest.

- 31/10/2004

PRU 2.2.6

See Notes

- 31/10/2004

Upper and lower tier two capital

PRU 2.2.7

See Notes

Tier two capital includes forms of capital that do not meet the requirements for permanency and absence of fixed servicing costs that apply to tier one capital. Tier two capital includes, for example:

- (1) capital which is perpetual (that is, has no fixed term) but cumulative (that is, servicing costs cannot be waived at the issuer's option, although they may be deferred - for example cumulative preference shares); only perpetual capital instruments may be included in upper tier two capital; and

- (2) capital which is not perpetual (that is, it has a fixed term) or which may have fixed servicing costs that cannot generally be either waived or deferred, for example, most subordinated debt. Such capital should normally be of a medium to long-term maturity (that is, an original maturity of at least five years). Dated capital instruments are included in lower tier two capital.

- 31/12/2005

Deductions from capital

PRU 2.2.8

See Notes

- 31/10/2004

PRU 2.2.9

See Notes

- 31/12/2004

Calculation of capital resources

PRU 2.2.10

See Notes

- 31/10/2004

PRU 2.2.11

See Notes

| Liabilities | Assets | ||

| Borrowings | 100 | Admissible assets | 350 |

| Ordinary shares | 200 | Intangible assets | 100 |

| Profit and loss account and other reserves | 100 | Other inadmissible assets | 100 |

| Perpetual subordinated debt | 150 | ||

| Total | 550 | Total | 550 |

| Calculation of capital resources: eligible assets less foreseeable liabilities | |||

| Total assets | 550 | ||

| less intangible assets | (100) | ||

| less inadmissible assets | (100) | ||

| less liabilities (borrowings) | (100) | ||

| Capital resources | 250 | ||

| Calculation of capital resources: components of capital | |||

| Ordinary shares | 200 | ||

| Profit and loss account and other reserves | 100 | ||

| Perpetual subordinated debt | 150 | ||

| less intangible assets | (100) | ||

| less inadmissible assets | (100) | ||

| Capital resources | 250 | ||

- 31/10/2004

PRU 2.2.12

See Notes

- 31/10/2004

PRU 2.2.13

See Notes

- 31/10/2004

PRU 2.2.14

See Notes

| Related text | Included in the calculation of capital resources | |

| A √ denotes that the item is included in the calculation of a firm's capital resources: a x denotes that the item is not included in the calculation of a firm's capital resources. | ||

| (A) Core tier one capital: | ||

| Permanent share capital | PRU 2.2.36 R | √ |

| Profit and loss account and other reserves | PRU 2.2.76 R and PRU 2.2.77 R | √ |

| Share premium account | None | √ |

| Externally verified interim net profits | PRU 2.2.82 R | √ |

| Positive valuation differences | PRU 2.2.78 R | √ |

| Fund for future appropriations | PRU 2.2.81A R | √ |

| (B) Perpetual non-cumulative preference shares | ||

| Perpetual non-cumulative preference shares | PRU 2.2.50 R | √ |

| (C) Innovative tier one capital | ||

| Innovative tier one instruments | PRU 2.2.52 R to PRU 2.2.75 R | √ |

| (D) Total tier one capital before deductions = A + B + C | ||

| (E) Deductions from tier one capital: | ||

| Investments in own shares | None | √ |

| Intangible assets | PRU 2.2.84 R | √ |

| Amounts deducted from technical provisions for discounting and other negative valuation differences | PRU 2.2.78 R to PRU 2.2.81 R | √ |

| (F) Total tier one capital after deductions = D - E | ||

| (G) Upper tier two capital: | ||

| Perpetual cumulative preference shares | PRU 2.2.101 R to PRU 2.2.121 R | √ |

| Perpetual subordinated debt | PRU 2.2.101 R to PRU 2.2.121 R | √ |

| Perpetual subordinated securities | PRU 2.2.101 R to PRU 2.2.121 R | √ |

| (H) Lower tier two capital | ||

| Fixed term preference shares | PRU 2.2.108 R to PRU 2.2.124 R | √ |

| Fixed term subordinated debt | PRU 2.2.108 R to PRU 2.2.124 R | √ |

| Fixed term subordinated securities | PRU 2.2.108 R to PRU 2.2.124 R | √ |

| (I) Total tier two capital = G + H | ||

| (J) Positive adjustments for related undertakings | ||

| Related undertakings that are regulated related undertakings (other than insurance undertakings) | PRU 2.2.90 R | √ |

| (K) Total capital after positive adjustments for regulated related undertakings that are not insurance undertakings but before deductions = F + I + J | ||

| (L) Deductions from total capital | ||

| Inadmissible assets | PRU 2.2.86 R & PRU 2 Annex 1R | √ |

| Assets in excess of market risk and counterparty limits | PRU 3.2.22 R | √ |

| Related undertakings that are ancillary services undertakings | PRU 2.2.89 R | √ |

| Negative adjustments for related undertakings that are regulated related undertakings (other than insurance undertakings) | PRU 2.2.90 R | √ |

| (M) Total capital after deductions = K - L | ||

| (N) Other capital resources*: | ||

| Unpaid share capital or, in the case of a mutual, unpaid initial funds and calls for supplementary contributions | PRU 2.2.126 G to PRU 2.2.128 G | × |

| Implicit items | PRU 2 Annex 2 G | × |

| (O) Total capital resources after deductions = M + N | ||

| * Items in section (N) of the table can be included in capital resources if subject to a waiver under section 148 of the Act. | ||

- 31/12/2005

Limits on the use of different forms of capital

PRU 2.2.15

See Notes

- 31/10/2004

PRU 2.2.16

See Notes

At least 50% of a firm's MCR must be accounted for by the sum of:

- (1) the amount calculated at stage A of the calculation in PRU 2.2.14 R; and

- (2) notwithstanding PRU 2.2.20 R (1), the amount calculated at stage B of the calculation in PRU 2.2.14 R;

less the amount calculated at stage E of the calculation in PRU 2.2.14 R.

- 31/10/2004

PRU 2.2.17

See Notes

A firm carrying on long-term insurance business must meet the higher of:

- (1) 1/3 of the long-term insurance capital requirement; and

- (2) the base capital resources requirement;

with the sum of the items listed at stages A, B, G and H in PRU 2.2.14 R less the sum of the items listed at stage E in PRU 2.2.14 R.

- 31/12/2005

PRU 2.2.18

See Notes

A firm carrying on general insurance business must meet the higher of:

- (1) 1/3 of the general insurance capital requirement; and

- (2) the base capital resources requirement;

with the sum of the items listed at stages A, B, G and H in PRU 2.2.14 R less the sum of the items listed at stage E in PRU 2.2.14 R.

- 31/12/2005

PRU 2.2.18A

See Notes

In PRU 2.2.17 R and PRU 2.2.18 R:

- (1) items listed at stage B in PRU 2.2.14 R may be included notwithstanding PRU 2.2.20 R (1);

- (2) innovative tier one capital that meets the conditions (other than PRU 2.2.108 R (11)) for it to be included as upper tier two capital at stage G in PRU 2.2.14 R may be treated as an item listed at stage G; and

- (3) a firm must exclude from the calculation the higher of the following:

- (a) the amount (if any) by which the sum of the items listed at stages G and H in PRU 2.2.14 R exceeds the total (net of deductions) of the remaining constituents of adjusted stage M; and

- (b) the amount (if any) by which the sum of the items listed at stage H in PRU 2.2.14 R exceeds one-third of the total (net of deductions) of the remaining constituents of adjusted stage M;

- where adjusted stage M means the amount calculated at stage M of the calculation in PRU 2.2.14 R less the amount of any innovative tier one capital that is not treated as upper tier two capital for the purpose of PRU 2.2.17 R or PRU 2.2.18 R, as the case may be.

- 31/12/2005

PRU 2.2.19

See Notes

- 31/10/2004

PRU 2.2.20

See Notes

In relation to a firm's tier one capital resources calculated at stage F of the calculation in PRU 2.2.14 R:

- (1) at least 50% must be accounted for by core tier one capital; and

- (2) no more than 15% may be accounted for by innovative tier one capital.

- 31/10/2004

PRU 2.2.21

See Notes

- 31/10/2004

PRU 2.2.22

See Notes

- (1) A firm may, subject to the limits in PRU 2.2.23 R, include in its tier two capital resources any capital item excluded from its tier one capital resources under PRU 2.2.20 R which meets the conditions for it to be included as tier two capital at stage G or H in PRU 2.2.14 R.

- (2) For the purpose of (1), the requirement to obtain a legal opinion in PRU 2.2.108 R (11) does not apply.

- 31/12/2005

PRU 2.2.23

See Notes

Subject to PRU 2.2.24 R, a firm must exclude from the calculation of its capital resources the following:

- (1) the amount (if any) by which tier two capital resources exceed the amount calculated at stage F of the calculation in PRU 2.2.14 R; and

- (2) the amount (if any) by which lower tier two capital resources exceed 50% of the amount calculated at stage F of the calculation in PRU 2.2.14 R.

- 31/10/2004

PRU 2.2.24

See Notes

At least 75% of a firm's MCR must be accounted for by the sum of:

- (1) the amount calculated at stage A plus, notwithstanding PRU 2.2.20 R (1), the amount calculated at stage B less the amount calculated at stage E of the calculation in PRU 2.2.14 R; and

- (2) the amount calculated at stage G of the calculation in PRU 2.2.14 R.

- 31/12/2005

PRU 2.2.24A

See Notes

- 31/12/2005

PRU 2.2.25

See Notes

- 31/10/2004

PRU 2.2.26

See Notes

- 31/10/2004

Characteristics of tier one capital

PRU 2.2.27

See Notes

A firm may not include a share in, or another investment in, or external contribution to the capital of, that firm in its tier one capital resources unless it complies with the following conditions:

- (1) it is included in one of the categories in PRU 2.2.28 R;

- (2) it is not excluded by any of the rules in PRU 2.2; and

- (3) it complies with the conditions set out in PRU 2.2.29 R.

- 31/10/2004

PRU 2.2.28

See Notes

The categories referred to in PRU 2.2.27 R (1) are:

- (1) permanent share capital;

- (2) a perpetual non-cumulative preference share; and

- (3) an innovative tier one instrument.

- 31/10/2004

PRU 2.2.29

See Notes

Subject to PRU 2.2.30 R, an item of capital in a firm complies with PRU 2.2.27 R (3) if:

- (1) it is issued by the firm;

- (2) it is fully paid and the proceeds of issue are immediately and fully available to the firm;

- (3) it:

- (a) cannot be redeemed at all or can only be redeemed on a winding up of the firm; or

- (b) complies with the conditions in PRU 2.2.38 R and PRU 2.2.39 R;

- (4) any coupon is either non-cumulative or, if it is cumulative, it complies with PRU 2.2.40 R;

- (5) it is able to absorb losses to allow the firm to continue trading and in the case of an innovative tier one instrument it complies with PRU 2.2.56 R to PRU 2.2.58 R;

- (6) it ranks for repayment upon winding up no higher than a share of a company incorporated under the Companies Act 1985 or the Companies (Northern Ireland) Order 1986 (whether or not it is such a share);

- (7) the firm is under no obligation to pay a coupon on it in cash at any time; and

- (8) the description of its characteristics used in its marketing is consistent with the characteristics required to satisfy PRU 2.2.29 R (1) to PRU 2.2.29 R (7) and, where it applies, PRU 2.2.93 R.

- 31/12/2005

PRU 2.2.30

See Notes

- (1) An item of capital does not comply with PRU 2.2.27 R (3) if the issue of that item of capital by the firm is connected with one or more other transactions which, when taken together with the issue of that item, could produce the effect described in (2).

- (2) The effect referred to in (1) is a reduction in the economic benefit intended to be conferred on the firm by the issue of the item of capital which means that the item of capital no longer displays all of the characteristics set out in PRU 2.2.29 R (1) to (8).

- 31/10/2004

PRU 2.2.31

See Notes

- 31/12/2004

PRU 2.2.32

See Notes

- 31/10/2004

PRU 2.2.33

See Notes

- 31/10/2004

PRU 2.2.34

See Notes

- 31/12/2004

PRU 2.2.35

See Notes

A firm may not include a share in its tier one capital resources unless (in addition to complying with the other relevant rules in PRU 2.2):

- (1) (in the case of a firm that is a company as defined in the Companies Act 1985 or the Companies (Northern Ireland) Order 1986) it is "called-up share capital" within the meaning given to that term in that Act or, as the case may be, that Order; or

- (2) (in the case of any other firm) it is:

- (a) in economic terms; and

- (b) in its characteristics as capital (including loss absorbency, permanency, ranking for repayment and fixed costs);

- substantially the same as called-up share capital falling into (1).

- 31/10/2004

Core tier one capital: permanent share capital

PRU 2.2.36

See Notes

Permanent share capital means an item of capital which (in addition to satisfying PRU 2.2.29 R) meets the following conditions:

- (1) it is:

- (a) an ordinary share; or

- (b) a members' contribution; or

- (c) part of the initial fund of a mutual;

- (2) any coupon on it is not cumulative, and the firm is under no obligation to pay a coupon and has the right to choose the amount of any coupon that it pays; and

- (3) the terms upon which it is issued do not permit redemption and it is otherwise incapable of being redeemed to at least the degree of an ordinary share issued by a company incorporated under the Companies Act 1985 or the Companies (Northern Ireland) Order 1986 (whether or not it is such a share).

- 31/12/2005

PRU 2.2.37

See Notes

- 31/10/2004

Basic rules about redemption and cumulative coupons

PRU 2.2.38

See Notes

In relation to a perpetual non-cumulative preference share which is redeemable, a firm may not include it in its tier one capital resources unless its contractual terms are such that:

- (1) it is redeemable only at the option of the firm; and

- (2) the firm cannot exercise that redemption right:

- (a) before the fifth anniversary of its date of issue;

- (b) unless it has given notice to the FSA in accordance with PRU 2.2.72 R; and

- (c) unless at the time of exercise of that right it complies with PRU 2.1.9 R and will continue to do so after redemption.

- 31/12/2005

PRU 2.2.39

See Notes

In relation to an innovative tier one instrument which is redeemable and which, either:

- (1) is or may become subject to a step-up; or

- (2) satisfies PRU 2.2.54 R (2);

a firm may not include it in its tier one capital resources unless it complies with the conditions in PRU 2.2.38 R, except that in PRU 2.2.38 R (2)(a) "fifth anniversary" is replaced by "tenth anniversary".

- 31/10/2004

PRU 2.2.40

See Notes

- 31/10/2004

PRU 2.2.41

See Notes

- 31/12/2004

Further guidance on redemption

PRU 2.2.42

See Notes

The rules in PRU 2.2 about redemption of potential tier one instruments fall into three classes:

- (1) rules defining whether a firm's potential tier one instruments are eligible for inclusion in its tier one capital resources at all;

- (2) rules defining whether a firm's potential tier one instruments are eligible for inclusion in its permanent share capital; and

- (3) rules defining whether a firm's potential tier one instruments must be classified as innovative tier one instruments.

- 31/10/2004

PRU 2.2.43

See Notes

The rules about redemption that are relevant to deciding whether a firm's potential tier one instruments are eligible for inclusion in its tier one capital resources at all are as follows.

- (1) PRU 2.2.29 R (3) and PRU 2.2.39 R have the following provisions.

- (a) Any capital instrument that is redeemable at the option of the holder cannot form part of a firm's tier one capital resources. Instead, if it is redeemable at all, a capital instrument should only be redeemable at the option of the firm.

- (b) A redemption right should be exercisable no earlier than the fifth anniversary of the date of issue. However, if an instrument is an innovative tier one instrument which is subject to a step-up or any other economic incentive to redeem, any such redemption should be exercisable no earlier than the tenth anniversary.

- (c) Any redemption proceeds should be payable only in cash or in shares.

- (d) The terms of the capital instrument should provide that any redemption right should not be exercised unless and until the firm has given the notice to the FSA required under PRU 2.2.72 R.

- (e) Any redemption right should not be exercisable unless both before and after the redemption the firm complies with PRU 2.1.9 R (which requires that a firm has sufficient capital resources to meet its capital resources requirement).

- (2) Under PRU 2.2.70 R, a firm should not include a potential tier one instrument that is redeemable in whole or in part in permanent share capital in its tier one capital resources unless the firm has:

- (a) sufficient permanent share capital or sufficient authority to issue permanent share capital (and the authority to allot it) to meet any redemption obligations that have become due; and

- (b) a prudent reserve of permanent share capital or sufficient authority to issue permanent share capital (and the authority to allot it) to meet possible future redemption obligations.

- (3) PRU 2.2.65 R contains limits on the amount of permanent share capital that may be issued on a redemption of a potential tier one instrument redeemable in permanent share capital.

- 31/10/2004

PRU 2.2.44

See Notes

- 31/10/2004

PRU 2.2.45

See Notes

The rules about redemption that are relevant to deciding whether a firm's potential tier one instruments should be classified as innovative tier one instruments are as follows.

- (1) Under PRU 2.2.53 R, a redeemable potential tier one instrument is always treated as an innovative tier one instrument if the redemption proceeds are payable otherwise than in cash.

- (2) Under PRU 2.2.54 R, any feature of a tier one instrument that in conjunction with a call would make a firm more likely to redeem it or to have an incentive to do so will make it an innovative tier one instrument.

- (3) Under PRU 2.2.62 R a step-up coupled with a right of redemption results in a potential tier one instrument being treated as an innovative tier one instrument.

- 31/10/2004

Further guidance on coupons

PRU 2.2.46

See Notes

- 31/10/2004

PRU 2.2.47

See Notes

The rules about coupons that are relevant to deciding whether a firm's potential tier one instruments are eligible for inclusion in its tier one capital resources at all are as follows.

- (1) Under PRU 2.2.29 R (4) and PRU 2.2.40 R, any deferred cumulative coupon should only be payable in permanent share capital. If a cumulative coupon is payable on a potential tier one instrument in another form, it should not be included in the firm's tier one capital resources.

- (2) Under PRU 2.2.29 R (7), the firm is not obliged to pay a coupon in cash at any time.

- (3) PRU 2.2.63 R says that a potential tier one instrument that may be subject to a step-up that potentially exceeds defined limits should not be included in the firm's tier one capital resources. PRU 2.2.64 R says that any step-up should not arise before the tenth anniversary of the date of issue if it is to be included in the firm's tier one capital resources.

- (4) The provisions of PRU 2.2.70 R summarised in PRU 2.2.43 G (2) also apply to the payment of coupons.

- 31/12/2005

PRU 2.2.48

See Notes

- 31/12/2005

PRU 2.2.49

See Notes

The rules about coupons that are relevant to deciding whether a firm's potential tier one instruments should be classified as innovative tier one instruments are as follows:

- (1) Under PRU 2.2.60 R a potential tier one instrument with a cumulative coupon is an innovative tier one instrument.

- (2) Under PRU 2.2.40 R a potential tier one instrument with a coupon that if deferred must be paid in permanent share capital is an innovative tier one instrument.

- (3) Under PRU 2.2.62 R a step-up coupled with a right of redemption by the firm results in a potential tier one instrument being treated as an innovative tier one instrument.

- 31/10/2004

Perpetual non-cumulative preference shares

PRU 2.2.50

See Notes

A perpetual non-cumulative preference share may be included at stage B of the calculation in PRU 2.2.14 R if:

- (1) it complies with PRU 2.2.29 R, PRU 2.2.35 R and PRU 2.2.38 R;

- (2) any coupon on it is not cumulative, and the firm is under no obligation to pay a coupon in any circumstances;

- (3) it is not excluded from tier one capital resources by any of the rules in PRU 2.2; and

- (4) it is not an innovative tier one instrument.

- 31/12/2005

PRU 2.2.51

See Notes

- 31/10/2004

Innovative tier one instruments: general rules

PRU 2.2.52

See Notes

- 31/10/2004

PRU 2.2.53

See Notes

- 31/10/2004

PRU 2.2.54

See Notes

If a tier one instrument:

- (1) is redeemable; and

- (2) is issued on terms that are (or its terms are amended and the amended terms are) such that a reasonable person would (judging at or around the time of issue or amendment) think that:

- 31/10/2004

PRU 2.2.55

See Notes

- 31/10/2004

Innovative tier one instruments: loss absorbency

PRU 2.2.56

See Notes

A capital instrument may only be included in innovative tier one capital resources if a firm's obligations under the instrument either:

- (1) do not constitute a liability (actual, contingent or prospective) under section 123(2) of the Insolvency Act 1986; or

- (2) do constitute such a liability but the terms of the instrument are such that:

- (a) any such liability is not relevant for the purposes of deciding whether:

- (i) the firm is, or is likely to become, unable to pay its debts; or

- (ii) its liabilities exceed its assets;

- (b) a creditor (including, but not limited to, a holder of the instrument) is not able to petition for the winding up or administration of the firm on the grounds that the firm is or may become unable to pay any such liability; and

- (c) the firm is not obliged to take into account such a liability for the purposes of deciding whether or not the firm is, or may become, insolvent for the purposes of section 214 of the Insolvency Act 1986 (wrongful trading).

- 31/10/2004

PRU 2.2.57

See Notes

- 31/10/2004

PRU 2.2.58

See Notes

- 31/12/2005

PRU 2.2.59

See Notes

- 31/10/2004

Innovative tier one instruments: Coupons

PRU 2.2.60

See Notes

- 31/10/2004

PRU 2.2.61

See Notes

- 31/10/2004

Innovative tier one instruments and other tier one instruments: step-ups

PRU 2.2.62

See Notes

If:

- (1) a potential tier one instrument is or may become subject to a step-up; and

- (2) that potential tier one instrument is redeemable at any time (whether before, at or after the time of the step-up);

that potential tier one instrument is an innovative tier one instrument.

- 31/10/2004

PRU 2.2.63

See Notes

If a potential tier one instrument is or may become subject to a step-up, a firm must not include it in its tier one capital resources if the amount of the step-up as calculated as at the date of issue of the instrument exceeds or may exceed;

- (1) 100 basis points; and

- (2) 50% of the initial credit spread.

- 31/12/2005

PRU 2.2.64

See Notes

- 31/10/2004

Innovative tier one instruments: principal stock settlement

PRU 2.2.65

See Notes

A firm must not include a potential tier one instrument that is redeemable in whole or in part in permanent share capital in its tier one capital resources if:

- (1) the conversion ratio as at the date of redemption may be greater than the conversion ratio as at the time of issue by more than 200%; or

- (2) the issue or market price of the conversion instruments issued in relation to one unit of the original capital item (plus any cash element of the redemption) may be greater than the issue price (or, as the case may be, market price) of that original capital item.

- 31/10/2004

PRU 2.2.66

See Notes

In PRU 2.2.65 R to PRU 2.2.69 R:

- (1) the original capital item means the capital item that is being redeemed; and

- (2) the conversion instrument means the permanent share capital issued on its redemption.

- 31/10/2004

PRU 2.2.67

See Notes

In PRU 2.2.65 R to PRU 2.2.69 R, the conversion ratio means the ratio of:

- (1) the number of units of the conversion instrument that the firm must issue to satisfy its redemption obligation (so far as it is to be satisfied by the issue of conversion instruments) in respect of one unit of the original capital item; to

- (2) one unit of the original capital item.

- 31/10/2004

PRU 2.2.68

See Notes

- 31/10/2004

PRU 2.2.69

See Notes

- 31/12/2004

Requirement to have sufficient unissued stock

PRU 2.2.70

See Notes

- (1) This rule applies to a potential tier one instrument of a firm where either:

- (a) the redemption proceeds; or

- (b) any coupon on that capital item;

- can be satisfied by the issue of another tier one instrument.

- (2) A firm may only include an item of capital to which this rule applies in its tier one capital resources if the firm has authorised and unissued tier one instruments of the kind in question (and the authority to issue them):

- (a) that are sufficient to satisfy all such payments then due; and

- (b) are of such amount as is prudent in respect of such payments that could become due in the future.

- 31/10/2004

Notifying the FSA of the issue and redemption of tier one instruments

PRU 2.2.71

See Notes

- 31/10/2004

PRU 2.2.72

See Notes

- 31/12/2004

Non standard capital instruments

PRU 2.2.73

See Notes

- 31/10/2004

Step-ups

PRU 2.2.74

See Notes

In relation to a tier one instrument, a step-up means any change in the coupon rate on that instrument that results in an increase in the amount payable at any time, including a change already provided in the original terms governing those payments. A step-up:

- (1) includes (in the case of a fixed rate) an increase in that coupon rate;

- (2) includes (in the case of a floating rate calculated by adding a fixed amount to a fluctuating amount) an increase in that fixed amount;

- (3) includes (in the case of a floating rate) a change in the identity of the benchmark by reference to which the fluctuating element of the coupon is calculated that results in an increase in the absolute amount of the coupon;

- (4) does not include (in the case of a floating rate) an increase in the absolute amount of the coupon caused by fluctuations in the fluctuating figure by reference to which the absolute amount of the coupon floats.

- 31/10/2004

PRU 2.2.75

See Notes

- 31/10/2004

Profit and loss account and other reserves

PRU 2.2.76

See Notes

- 31/12/2005

PRU 2.2.77

See Notes

- 31/10/2004

Valuation differences

PRU 2.2.78

See Notes

- 31/10/2004

PRU 2.2.79

See Notes

- 21/04/2005

PRU 2.2.80

See Notes

- 21/04/2005

PRU 2.2.81

See Notes

A firm of a kind referred to in PRU 2.2.80 R must deduct from its capital resources the difference between the undiscounted technical provisions or technical provisions before deductions and the discounted technical provisions or technical provisions after deductions. This adjustment must be made for all general insurance business classes, except for risks listed under classes 1 and 2. For classes other than 1 and 2, no adjustment needs to be made in respect of the discounting of annuities included in technical provisions. For classes 1 and 2 (other than annuities), if the expected average interval between the settlement date of the claims being discounted and the accounting date is not at least four years, the firm must deduct:

- (1) the difference between the undiscounted technical provisions and the discounted technical provisions; or

- (2) where it can identify a subset of claims such that the expected average interval between the settlement date of the claims and the accounting date is at least four years, the difference between the undiscounted technical provisions and the discounted technical provisions for the other claims.

- 21/04/2005

Fund for future appropriations

PRU 2.2.81A

See Notes

- 31/12/2005

Externally verified interim net profits

PRU 2.2.82

See Notes

- 31/10/2004

PRU 2.2.83

See Notes

- 31/10/2004

Intangible assets

PRU 2.2.84

See Notes

- 31/10/2004

PRU 2.2.85

See Notes

- 31/10/2004

Inadmissible assets

PRU 2.2.86

See Notes

- 31/12/2005

PRU 2.2.87

See Notes

- 31/10/2004

PRU 2.2.88

See Notes

The list of admissible assets has been drawn with the aim of excluding assets:

- (1) for which a sufficiently objective and verifiable basis of valuation does not exist; or

- (2) whose realisability cannot be relied upon with sufficient confidence; or

- (3) whose nature presents an unacceptable custody risk; or

- (4) the holding of which may give rise to significant liabilities or onerous duties.

- 31/10/2004

Adjustments for related undertakings

PRU 2.2.89

See Notes

- 31/10/2004

PRU 2.2.90

See Notes

- 31/10/2004

PRU 2.2.91

See Notes

- 31/10/2004

PRU 2.2.92

See Notes

- 31/10/2004