PERG 4

Guidance on regulated activities connected with mortgages

PERG 4.1

Application and purpose

- 01/07/2005

Application

PERG 4.1.1

See Notes

- 01/07/2005

Purpose of guidance

PERG 4.1.2

See Notes

- 01/07/2005

Effect of guidance

PERG 4.1.3

See Notes

- 01/07/2005

PERG 4.1.4

See Notes

- 01/07/2005

PERG 4.1.5

See Notes

- 01/07/2005

Guidance on other activities

PERG 4.1.6

See Notes

- 01/07/2005

PERG 4.2

Introduction

- 01/07/2005

Requirement for authorisation or exemption

PERG 4.2.1

See Notes

In most cases, any person who carries on a regulated activity in the United Kingdom by way of business must either be an authorised person or an exempt person. Otherwise, the person commits a criminal offence and certain agreements may be unenforceable. PERG 2.2 (Introduction) contains further guidance on these consequences. In order to be authorised, a person must either:

- (1) hold a Part IV permission given by the FSA (see AUTH 1.3 (The Authorisation manual) and AUTH 3 (Application for Part IV permission)); or

- (2) qualify for authorisation (see AUTH 5 (Qualifying for authorisation under the Act)), for example if the person is an EEA firm or a Treaty firm.

- 01/07/2005

Professional firms

PERG 4.2.2

See Notes

- 01/07/2005

Questions to be considered to decide if authorisation is required

PERG 4.2.3

See Notes

If a person gets as far as question (8) and the answer to that question is 'no', that person requires authorisation and should refer to AUTH 3 (Applications for Part IV permission).

- 01/07/2005

PERG 4.2.4

See Notes

- 01/07/2005

Financial promotion

PERG 4.2.5

See Notes

- 01/07/2005

PERG 4.3

Regulated activities related to mortgages

- 01/07/2005

PERG 4.3.1

See Notes

- 01/07/2005

PERG 4.3.2

See Notes

- 01/07/2005

The business test

PERG 4.3.3

See Notes

- 01/07/2005

PERG 4.3.4

See Notes

- 01/07/2005

PERG 4.3.5

See Notes

| By way of business | Carrying on the business |

| Entering into a regulated mortgage contract (article 61(1)) | Arranging (bringing about) regulated mortgage contracts (article 25A(1)) |

| Administering a regulated mortgage contract (article 61(2)) (and the contract administered must have been entered into by way of business) | Making arrangements with a view to regulated mortgage contracts (article 25A(2)) |

| Advising on regulated mortgage contracts (article 53A) |

- 01/07/2005

PERG 4.3.6

See Notes

In the case of the 'carrying on the business' test, these factors will need to be considered having regard to all the activities together.

- 01/07/2005

PERG 4.3.7

See Notes

- 01/07/2005

PERG 4.3.8

See Notes

- 01/07/2005

PERG 4.3.9

See Notes

- 01/07/2005

PERG 4.4

What is a regulated mortgage contract?

- 01/07/2005

The definition of "regulated mortgage contract"

PERG 4.4.1

See Notes

- 01/07/2005

Provision of credit

PERG 4.4.1A

See Notes

- 01/07/2005

Which borrowers?

PERG 4.4.2

See Notes

- 01/07/2005

Date the contract is entered into

PERG 4.4.3

See Notes

- 01/07/2005

PERG 4.4.4

See Notes

- 01/07/2005

Land in the United Kingdom

PERG 4.4.5

See Notes

- 01/07/2005

Occupancy requirement

PERG 4.4.6

See Notes

- 01/07/2005

PERG 4.4.7

See Notes

- 01/07/2005

PERG 4.4.8

See Notes

- 01/07/2005

PERG 4.4.9

See Notes

- 01/07/2005

Purpose of the loan is irrelevant

PERG 4.4.10

See Notes

- 01/07/2005

Type of lending

PERG 4.4.11

See Notes

- 01/07/2005

PERG 4.4.12

See Notes

- 01/07/2005

Regulated mortgage contracts and contract variations

PERG 4.4.13

See Notes

- 01/07/2005

PERG 4.4.14

See Notes

- 01/07/2005

PERG 4.5

Arranging regulated mortgage contracts

- 01/07/2005

Definition of the regulated activities involving arranging

PERG 4.5.1

See Notes

- 01/07/2005

PERG 4.5.2

See Notes

The first activity (article 25A(1)) is referred to in this guidance as arranging (bringing about) regulated mortgage contracts. Various points arise:

- (1) It is not necessary for the potential borrower himself to be involved in making the arrangements.

- (2) This activity is carried on only if the arrangements bring about, or would bring about a regulated mortgage contract. This is because of the exclusion in article 26 (see PERG 4.5.4 G).

- (3) This activity therefore includes the activities of brokers who make arrangements on behalf of a borrower to enter into or vary a regulated mortgage contract where these arrangements go beyond merely introducing (see PERG 4.5.10 G) or advising (although giving advice may be the regulated activity of advising on regulated mortgage contracts). Such arrangements might include, for instance, negotiating the terms of the regulated mortgage contract with the eventual lender, on behalf of the borrower. It also includes the activities of certain so-called 'packagers' (see PERG 4.15 (Mortgage activities carried on by 'packagers'.)

- (4) PERG 4.6.2 G contains examples of variations that are, in the FSA's view, within the definition of advising on regulated mortgage contracts and would also be covered by article 25A(1) arrangements.

- 01/07/2005

PERG 4.5.3

See Notes

- 01/07/2005

Exclusion: article 25A(1) arrangements not causing a deal

PERG 4.5.4

See Notes

- 01/07/2005

Exclusion: article 25(A)2 arrangements enabling parties to communicate

PERG 4.5.5

See Notes

- 01/07/2005

PERG 4.5.6

See Notes

- 01/07/2005

Exclusion: article 25A(1) and (2) arranging of contracts to which the arranger is a party

PERG 4.5.7

See Notes

- 01/07/2005

Exclusion: article 25A(1) and (2) arrangements with or through authorised persons

PERG 4.5.8

See Notes

- 01/07/2005

Exclusion: article 25A(1)(b) arrangements made in the course of administration by authorised person

PERG 4.5.9

See Notes

- 01/07/2005

Exclusion: article 25A(2) arrangements and introducing

PERG 4.5.10

See Notes

- 01/07/2005

PERG 4.5.11

See Notes

The exclusion applies for introductions to:

- (1) an authorised person who has permission to carry on a regulated activity specified in article 25A (Arranging regulated mortgage contracts) or article 53A (Advising on regulated mortgage contracts) or article 61(1) (Entering into a regulated mortgage contract as lender); introducers can check the status of an authorised person and its permission by visiting the FSA's register at http://www.fsa.gov.uk/register/;

- (2) an appointed representative who is appointed to carry on a regulated activity specified in article 25A or article 53A of the Regulated Activities Order; introducers can check the status of an appointed representative by visiting the FSA's register at http://www.fsa.gov.uk/register/; the FSA would normally expect introducers to request and receive confirmation of the regulated activities that the appointed representative is appointed to carry on, prior to proceeding with an introduction; and

- (3) an overseas person who carries on a regulated activity specified in article 25A (Arranging regulated mortgage contracts) or article 53A (Advising on regulated mortgage contracts) or article 61(1) (Entering into a regulated mortgage contract).

- 01/07/2005

PERG 4.5.12

See Notes

- 01/07/2005

PERG 4.5.13

See Notes

- 01/07/2005

PERG 4.5.14

See Notes

- 01/07/2005

PERG 4.5.15

See Notes

- 01/07/2005

PERG 4.5.16

See Notes

- 01/07/2005

PERG 4.5.17

See Notes

- 01/07/2005

PERG 4.5.18

See Notes

- 01/07/2005

Other exclusions

PERG 4.5.19

See Notes

- 01/07/2005

PERG 4.6

Advising on regulated mortgage contracts

- 01/07/2005

Definition of 'advising on regulated mortgage contracts'

PERG 4.6.1

See Notes

- 01/07/2005

PERG 4.6.2

See Notes

Although advice on varying the terms of a regulated mortgage contract is not a regulated activity if the contract was entered into before 31 October 2004, there may be instances where the variation to the old contract is so fundamental that it amounts to entering into a new regulated mortgage contract (see PERG 4.4.4 G and PERG 4.4.13G (2)). In that case, giving the advice would be a regulated activity.

- 01/07/2005

PERG 4.6.3

See Notes

- 01/07/2005

PERG 4.6.4

See Notes

- 01/07/2005

Advice must relate to a particular regulated mortgage contract

PERG 4.6.5

See Notes

- 01/07/2005

PERG 4.6.6

See Notes

- 01/07/2005

PERG 4.6.7

See Notes

This table belongs to PERG 4.6.5 G and PERG 4.6.6 G.

| Recommendation | Regulated or not? |

| I recommend you take out the ABC Building Society 2 year fixed rate mortgage at 5%. | Yes. This is advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. |

| I recommend you do not take out the ABC Building Society 2 year fixed rate mortgage at 5%. | Yes. This is advice which steers the borrower away from a particular mortgage which the borrower could have entered into. |

| I recommend that you take out either the ABC Building Society 2 year fixed rate mortgage at 5% or the XYZ Bank standard variable rate mortgage. | Yes. This is advice which steers the borrower in the direction of more than one particular mortgage which the borrower could enter into. |

| I recommend you take out (or do not take out) an ABC Building Society fixed rate mortgage. | This will depend on the circumstances. If, for example, the society only offers one such mortgage, this would be a recommendation intended implicitly to steer the borrower in the direction of that particular mortgage which the borrower could enter into and therefore would be advice. |

| I suggest you take out (or do not take out) a mortgage with ABC Building Society. | No. This is not advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. However, if the society only offers one mortgage, this would be a recommendation intended implicitly to steer the borrower in the direction of that particular mortgage which the borrower could enter into and therefore would be advice. |

| I suggest you change (or do not change) your current mortgage from a variable rate to a fixed rate. | No in respect of the advice about rate type, as this does not steer the borrower in the direction of a particular mortgage which the borrower could enter into. Yes in respect of the advice about varying the terms of the particular mortgage that the borrower had already entered into. |

| I suggest you take out (or do not take out) a variable rate mortgage. | No. This is not advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. |

| I recommend you take out (or do not take out) a mortgage. | No. This is not advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. |

| I would always recommend buying a house and taking out a mortgage as opposed to renting a property. | No. This is an example of generic advice which does not steer the borrower in the direction of a particular mortgage that he could enter into. |

| I recommend you do not borrow more than you can comfortably afford. | No. This is an example of generic advice. |

| If you are looking for flexibility with your mortgage I would recommend you explore the possibilities of either a flexible mortgage or an off-set mortgage. There are a growing number of lenders offering both. | No. This is an example of generic advice. |

- 01/07/2005

PERG 4.6.8

See Notes

- 01/07/2005

PERG 4.6.9

See Notes

- 01/07/2005

Advice given to a person in his capacity as a borrower or potential borrower

PERG 4.6.10

See Notes

- 01/07/2005

PERG 4.6.11

See Notes

- 01/07/2005

PERG 4.6.12

See Notes

- 01/07/2005

Advice or information

PERG 4.6.13

See Notes

- 01/07/2005

PERG 4.6.14

See Notes

- 01/07/2005

PERG 4.6.15

See Notes

- 01/07/2005

PERG 4.6.16

See Notes

- 01/07/2005

Advice must relate to the merits (of entering into as borrower or varying)

PERG 4.6.17

See Notes

- 01/07/2005

PERG 4.6.18

See Notes

- 01/07/2005

PERG 4.6.19

See Notes

- 01/07/2005

PERG 4.6.20

See Notes

- 01/07/2005

Scripted questioning (including decision trees)

PERG 4.6.21

See Notes

- 01/07/2005

PERG 4.6.22

See Notes

- 01/07/2005

PERG 4.6.23

See Notes

- 01/07/2005

PERG 4.6.24

See Notes

- 01/07/2005

PERG 4.6.25

See Notes

- 01/07/2005

Medium used to give advice

PERG 4.6.26

See Notes

- 01/07/2005

PERG 4.6.27

See Notes

- 01/07/2005

PERG 4.6.28

See Notes

- 01/07/2005

PERG 4.6.29

See Notes

- 01/07/2005

Exclusion: periodical publications, broadcasts and websites

PERG 4.6.30

See Notes

This is explained in greater detail, together with the provisions on the granting of certificates, in PERG 7 (Periodical publications, news services and broadcasts: applications for certification).

- 01/07/2005

Exclusion: advice in the course of administration by authorised person

PERG 4.6.31

See Notes

- 01/07/2005

Other exclusions

PERG 4.6.32

See Notes

- 01/07/2005

PERG 4.7

Entering into a regulated mortgage contract

- 01/07/2005

Definition of 'entering into a regulated mortgage contract'

PERG 4.7.1

See Notes

- 01/07/2005

Exclusions

PERG 4.7.2

See Notes

- 01/07/2005

Transfer of lending obligations

PERG 4.7.3

See Notes

- 01/07/2005

PERG 4.8

Administering a regulated mortgage contract

- 01/07/2005

Definition of 'administering a regulated mortgage contract'

PERG 4.8.1

See Notes

- 01/07/2005

PERG 4.8.2

See Notes

- 01/07/2005

PERG 4.8.3

See Notes

but does not include merely having or exercising a right to take action to enforce the regulated mortgage contract, or to require that action is or is not taken.

- 01/07/2005

Exclusion: arranging administration by authorised persons

PERG 4.8.4

See Notes

Article 62 of the Regulated Activities Order provides that a person who is not an authorised person does not administer a regulated mortgage contract if he:

- (1) arranges for a firm with permission to administer a regulated mortgage contract (a 'mortgage administrator') to administer the contract; or

- (2) administers the regulated mortgage contract itself, provided that the period of administration is no more than one month after the arrangement in (1) has come to an end.

- 01/07/2005

PERG 4.8.5

See Notes

- 01/07/2005

PERG 4.8.6

See Notes

- 01/07/2005

Exclusion: administration pursuant to agreement with authorised person

PERG 4.8.7

See Notes

- 01/07/2005

Other exclusions

PERG 4.8.8

See Notes

- 01/07/2005

PERG 4.9

Agreeing to carry on a regulated activity

- 01/07/2005

PERG 4.9.1

See Notes

- 01/07/2005

PERG 4.9.2

See Notes

- 01/07/2005

PERG 4.10

Exclusions applying to more than one regulated activity

- 01/07/2005

Exclusion: Activities carried on in the course of a profession or non-investment business

PERG 4.10.1

See Notes

- 01/07/2005

PERG 4.10.2

See Notes

- 01/07/2005

PERG 4.10.3

See Notes

- 01/07/2005

PERG 4.10.4

See Notes

- 01/07/2005

Exclusion: Trustees, nominees and personal representatives

PERG 4.10.5

See Notes

- 01/07/2005

PERG 4.10.6

See Notes

- 01/07/2005

PERG 4.10.7

See Notes

- 01/07/2005

PERG 4.10.8

See Notes

- 01/07/2005

PERG 4.11

Link between activities and the United Kingdom

- 01/07/2005

Introduction

PERG 4.11.1

See Notes

- 01/07/2005

PERG 4.11.2

See Notes

- 01/07/2005

Legislative provisions: definition of "regulated mortgage contract"

PERG 4.11.3

See Notes

- 01/07/2005

Legislative provisions: section 418 of the Act

PERG 4.11.4

See Notes

- 01/07/2005

PERG 4.11.5

See Notes

- 01/07/2005

Legislative provisions: overseas persons exclusion

PERG 4.11.6

See Notes

- 01/07/2005

PERG 4.11.7

See Notes

- 01/07/2005

Territorial scenarios: general

PERG 4.11.8

See Notes

- 01/07/2005

PERG 4.11.9

See Notes

This table belongs to PERG 4.11.8 G

| Individual borrower resident and located: | |||

| in the UK | outside the UK | ||

| Service provider carrying on regulated activity from establishment: | in the UK | Yes | Yes |

| outside the UK | Yes | No | |

| Yes = authorisation or exemption required No = authorisation or exemption not required | |||

- 01/07/2005

Service provider in the United Kingdom

PERG 4.11.10

See Notes

- 01/07/2005

PERG 4.11.11

See Notes

- 01/07/2005

Service provider overseas: general

PERG 4.11.12

See Notes

The factors in (1), (3) and (4) are considered in relation to each regulated activity in PERG 4.11.13 G to PERG 4.11.20 G. The factor in (5) is considered in PERG 4.11.21 G.

- 01/07/2005

Service provider overseas: arranging regulated mortgage contracts

PERG 4.11.13

See Notes

- 01/07/2005

PERG 4.11.14

See Notes

In the case of arranging (bringing about) regulated mortgage contracts, the normal residence of the borrower at the time the arrangements are made is the determining factor, except in the case of arranging (bringing about) a variation of a contract, in which case it is the normal residence of the borrower at the time that the regulated mortgage contract was entered into. In the case of making arrangements with a view to regulated mortgage contracts, the normal residence of the borrower at the time he participates in the arrangements is the determining factor.

- 01/07/2005

Service provider overseas: advising on regulated mortgage contracts

PERG 4.11.15

See Notes

- 01/07/2005

Service provider overseas: entering into a regulated mortgage contract

PERG 4.11.16

See Notes

- 01/07/2005

PERG 4.11.17

See Notes

- 01/07/2005

Service provider overseas: administering a regulated mortgage contract

PERG 4.11.18

See Notes

- 01/07/2005

PERG 4.11.19

See Notes

- 01/07/2005

Service provider: agreeing to carry on a regulated activity

PERG 4.11.20

See Notes

- 01/07/2005

E-Commerce Directive

PERG 4.11.21

See Notes

- 01/07/2005

Distance marketing directive

PERG 4.11.22

See Notes

- 01/07/2005

PERG 4.12

Appointed representatives

- 01/07/2005

What is an appointed representative?

PERG 4.12.1

See Notes

- 01/07/2005

PERG 4.12.2

See Notes

- 01/07/2005

Business for which an appointed representative is exempt

PERG 4.12.3

See Notes

- 01/07/2005

Persons who are not already appointed representatives

PERG 4.12.4

See Notes

- 01/07/2005

Persons who are already appointed representatives

PERG 4.12.5

See Notes

- 01/07/2005

PERG 4.13

Other exemptions

- 01/07/2005

PERG 4.13.1

See Notes

- 01/07/2005

PERG 4.14

Mortgage activities carried on by professional firms

- 01/07/2005

Introduction

PERG 4.14.1

See Notes

- 01/07/2005

PERG 4.14.2

See Notes

- 01/07/2005

PERG 4.14.3

See Notes

- 01/07/2005

Part XX exemption: arranging regulated mortgage contracts

PERG 4.14.4

See Notes

- 01/07/2005

Part XX exemption: advising on regulated mortgage contracts

PERG 4.14.5

See Notes

- 01/07/2005

Part XX exemption: entering into and administering a regulated mortgage contract

PERG 4.14.6

See Notes

- 01/07/2005

PERG 4.15

Mortgage activities carried on by 'packagers'

- 01/07/2005

Introduction

PERG 4.15.1

See Notes

- 01/07/2005

Mortgage Clubs (sometimes called mortgage wholesalers)

PERG 4.15.2

See Notes

- 01/07/2005

Mortgage packaging companies

PERG 4.15.3

See Notes

- 01/07/2005

Broker packagers (sometimes called 'intermediary brokers')

PERG 4.15.4

See Notes

- 01/07/2005

PERG 4.16

Mortgage activities

- 01/07/2005

Introduction

PERG 4.16.1

See Notes

- 01/07/2005

PERG 4.16.2

See Notes

- 01/07/2005

Entering into a regulated mortgage contract

PERG 4.16.3

See Notes

- 01/07/2005

Administering, arranging and advising on a regulated mortgage contract

PERG 4.16.4

See Notes

- 01/07/2005

PERG 4.17

Interaction with the Consumer Credit Act

- 01/07/2005

Entering into and administering a regulated mortgage contract

PERG 4.17.1

See Notes

- 01/07/2005

PERG 4.17.2

See Notes

- 01/07/2005

PERG 4.17.3

See Notes

- 01/07/2005

PERG 4.17.4

See Notes

- 01/07/2005

PERG 4.17.5

See Notes

- 01/07/2005

Advising on and arranging a regulated mortgage contract

PERG 4.17.6

See Notes

- 01/07/2005

PERG 4.17.7

See Notes

- 01/07/2005

PERG 4.17.8

See Notes

- 01/07/2005

PERG 4.17.9

See Notes

- 01/07/2005

PERG 4.17.10

See Notes

- 01/07/2005

PERG 4.17.11

See Notes

- 01/07/2005

PERG 4.17.12

See Notes

- 01/07/2005

PERG 4.17.13

See Notes

- 01/07/2005

PERG 4.17.14

See Notes

- 01/07/2005

Financial Promotion and advertisements

PERG 4.17.15

See Notes

- 01/07/2005

PERG 4.17.16

See Notes

- 01/07/2005

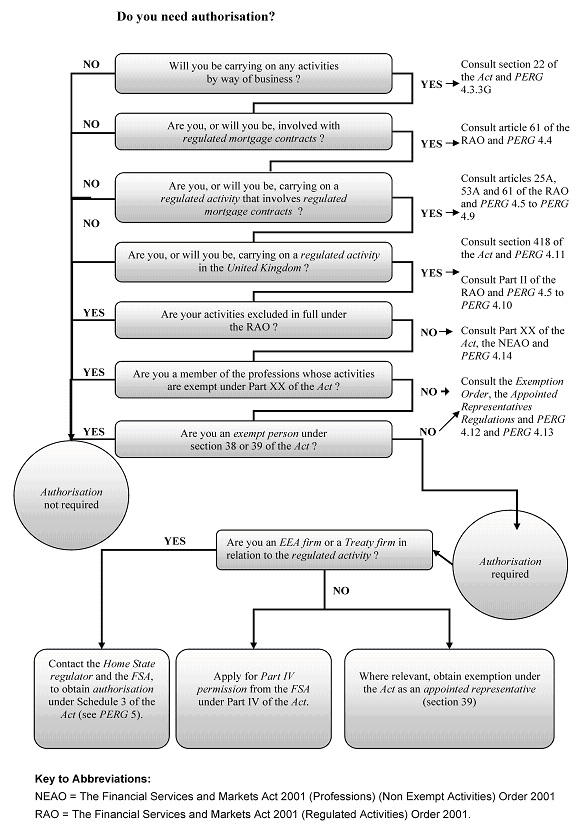

PERG 4.18

Regulated activities related to mortgages: flowchart

- 01/07/2005

Do you need authorisation?

PERG 4.18.1

- 01/07/2005