PERG 2

Authorisation and regulated activities

PERG 2.1

Application and purpose

- 01/07/2005

Application

PERG 2.1.1

See Notes

- 01/07/2005

Purpose

PERG 2.1.2

See Notes

- 01/07/2005

PERG 2.2

Introduction

- 01/07/2005

PERG 2.2.1

See Notes

- 06/10/2007

PERG 2.2.2

See Notes

- 01/07/2005

PERG 2.2.3

See Notes

- 06/02/2008

PERG 2.2.4

See Notes

- 01/11/2007

PERG 2.2.5

See Notes

- 06/10/2007

PERG 2.3

The business element

- 01/07/2005

PERG 2.3.1

See Notes

- 01/07/2005

PERG 2.3.2

See Notes

- 07/08/2009

PERG 2.3.3

See Notes

- 01/07/2005

PERG 2.4

Link between activities and the United Kingdom

- 01/07/2005

PERG 2.4.1

See Notes

- 01/07/2005

PERG 2.4.2

See Notes

- 01/07/2005

PERG 2.4.3

See Notes

- 01/11/2007

PERG 2.4.4

See Notes

- 01/07/2005

PERG 2.4.5

See Notes

- 01/07/2005

PERG 2.4.6

See Notes

- 01/07/2005

PERG 2.4.7

See Notes

- 01/07/2005

PERG 2.5

Investments and activities: general

- 01/07/2005

PERG 2.5.1

See Notes

- 01/07/2005

PERG 2.5.2

See Notes

- 01/07/2005

Modification of certain exclusions as a result of MiFIDand theInsurance Mediation Directives

PERG 2.5.3

See Notes

- 01/11/2007

Investment services and activities

PERG 2.5.4

See Notes

- 01/11/2007

PERG 2.5.4A

- 01/11/2007

PERG 2.5.5

See Notes

- 01/11/2007

Insurance mediation or reinsurance mediation

PERG 2.5.6

See Notes

- 01/07/2005

PERG 2.6

Specified investments: a broad outline

- 01/07/2005

PERG 2.6.1

See Notes

- 01/07/2005

Deposits

PERG 2.6.2

See Notes

- 01/07/2005

PERG 2.6.3

See Notes

- 01/07/2005

PERG 2.6.4

See Notes

- 01/07/2005

Electronic money

PERG 2.6.4A

See Notes

- 01/07/2005

Rights under a contract of insurance

PERG 2.6.5

See Notes

- 01/07/2005

PERG 2.6.6

See Notes

- 01/07/2005

PERG 2.6.7

See Notes

- 01/07/2005

PERG 2.6.8

See Notes

- 01/07/2005

Shares etc

PERG 2.6.9

See Notes

- 01/07/2005

PERG 2.6.10

See Notes

- 01/07/2005

Debt instruments

PERG 2.6.11

See Notes

An instrument cannot fall within both categories of specified investments relating to debt instruments. 'Instrument' is defined to include any record whether or not in the form of a document (see article 3(1) of the Regulated Activities Order).

- 01/07/2005

PERG 2.6.12

See Notes

- 01/07/2005

Warrants

PERG 2.6.13

See Notes

- 01/07/2005

PERG 2.6.14

See Notes

- 01/07/2005

Certificates representing securities

PERG 2.6.15

See Notes

- 01/07/2005

PERG 2.6.16

See Notes

- 01/07/2005

Units

PERG 2.6.17

See Notes

- 01/10/2005

PERG 2.6.18

See Notes

- 01/07/2005

Rights under a pension scheme

PERG 2.6.19

See Notes

- 06/04/2007

PERG 2.6.19A

See Notes

- 06/04/2007

PERG 2.6.19B

See Notes

- 06/04/2007

PERG 2.6.19C

See Notes

- 06/04/2007

Options

PERG 2.6.20

See Notes

- 01/11/2007

PERG 2.6.20A

See Notes

- 01/11/2007

Futures

PERG 2.6.21

See Notes

- 01/07/2005

PERG 2.6.22

See Notes

- 01/07/2005

PERG 2.6.22A

See Notes

- 01/11/2007

See article 84(1A)-(1D) of the Regulated Activities Order

PERG 2.6.22B

See Notes

- 01/11/2007

Contracts for differences

PERG 2.6.23

See Notes

- 01/11/2007

PERG 2.6.23A

See Notes

- 01/11/2007

PERG 2.6.24

See Notes

- 01/07/2005

Lloyd's investments

PERG 2.6.25

See Notes

- 01/07/2005

Rights under a funeral plan

PERG 2.6.26

See Notes

- 01/07/2005

Rights under a regulated mortgage contract

PERG 2.6.27

See Notes

Detailed guidance on this is set out in PERG 4.4 (Guidance on regulated activities connected with mortgages).

- 01/07/2005

Rights under a home reversion plan

PERG 2.6.27A

See Notes

- 06/04/2007

Rights under a home purchase plan

PERG 2.6.27B

See Notes

- 06/04/2007

PERG 2.6.28

See Notes

- 06/04/2007

PERG 2.6.29

See Notes

- 01/07/2005

PERG 2.7

Activities: a broad outline

- 01/07/2005

PERG 2.7.1

See Notes

- 01/07/2005

Accepting deposits

PERG 2.7.2

See Notes

- 01/07/2005

Issuing e-money

PERG 2.7.2A

See Notes

- 01/07/2005

Effecting or carrying out contracts of insurance as principal

PERG 2.7.3

See Notes

- 01/07/2005

PERG 2.7.4

See Notes

PERG 5 (Insurance mediation activities) has more guidance on these regulated activities where they are insurance mediation activities.

- 01/07/2005

Dealing in investments (as principal or agent)

PERG 2.7.5

See Notes

- 01/07/2005

PERG 2.7.6

See Notes

- 01/07/2005

PERG 2.7.6A

See Notes

- 01/07/2005

Arranging deals in investments and arranging a home finance transaction

PERG 2.7.7

See Notes

- 01/07/2005

PERG 2.7.7A

See Notes

- 06/04/2007

PERG 2.7.7B

See Notes

- 06/08/2009

PERG 2.7.7BA

See Notes

- 06/08/2009

PERG 2.7.7BB

See Notes

- 06/08/2009

PERG 2.7.7BC

See Notes

- 06/08/2009

PERG 2.7.7BD

See Notes

- 06/08/2009

PERG 2.7.7BE

See Notes

- 06/08/2009

PERG 2.7.7BF

See Notes

- 06/08/2009

PERG 2.7.7C

See Notes

- 06/04/2007

Operating a multilateral trading facility

PERG 2.7.7D

See Notes

- 01/11/2007

Managing investments

PERG 2.7.8

See Notes

- 01/07/2005

Assisting in the administration and performance of a contract of insurance

PERG 2.7.8A

See Notes

- 01/07/2005

Safeguarding and administering investments

PERG 2.7.9

See Notes

- 01/07/2005

PERG 2.7.10

See Notes

- 01/07/2005

Sending dematerialised instructions

PERG 2.7.11

See Notes

- 01/07/2005

Establishing etc collective investment schemes

PERG 2.7.12

See Notes

- 01/04/2009

PERG 2.7.13

See Notes

In addition, express provision is included in the Regulated Activities Order to make acting as trustee of an authorised unit trust scheme a regulated activity. The full picture for authorised schemes (that is, schemes that can be promoted to the public) is as follows:

- (1) Acting as trustee of an authorised unit trust scheme is expressly included as a regulated activity.

- (2) Acting as depositary of an open-ended investment company that is authorised under regulations made under section 262 of the Act (Open-ended investment companies), is a regulated activity.

- (3) Acting as a sole director of such a company is a regulated activity.

- (4) Managing an authorised unit trust scheme will amount to operating the scheme and so will be a regulated activity. A person acting as manager is also likely to be carrying on other regulated activities (such as dealing (see PERG 2.7.5 G) or managing investments (see PERG 2.7.8 G)).

- (5) An open-ended investment company will, once it is authorised under regulations made under section 262 of the Act, become an authorised person in its own right under Schedule 5 to the Act (Persons concerned in Collective Investment Schemes). Under ordinary principles, a company operates itself and an authorised open-ended investment company will be operating the collective investment scheme constituted by the company. It is not required to go through a separate process of authorisation as a person because it has already undergone the process of product authorisation.

- (6) Operators, trustees or depositaries of UCITS schemes constituted in other EEA States are also authorised persons under Schedule 5 of the Act if those schemes qualify as recognised collective investment schemes for the purposes of section 264 of the Act.

- 01/07/2005

PERG 2.7.13C

where, in either case, the scheme or company is a UCITS.

- 01/07/2005

Establishing etc pension schemes

PERG 2.7.14

See Notes

- 06/04/2007

Providing basic advice on stakeholder products

PERG 2.7.14A

See Notes

- 01/07/2005

PERG 2.7.14B

See Notes

- 01/07/2005

Advising on investments

PERG 2.7.15

See Notes

- 01/07/2005

PERG 2.7.16

See Notes

- 01/07/2005

PERG 2.7.16A

See Notes

- 01/07/2005

Advising on regulated mortgage contracts

PERG 2.7.16B

See Notes

Advice on varying terms as referred to in (2) comes within article 53A only where the borrower entered into the regulated mortgage contract on or after 31 October 2004 and the variation varies the borrower's obligations under the contract. Further guidance on the scope of the regulated activity under article 53A is in PERG 4.6 (Advising on regulated mortgage contracts).

- 01/07/2005

Advising on home reversion plans

PERG 2.7.16C

See Notes

- 06/04/2007

Advising on a home purchase plan

PERG 2.7.16D

See Notes

- 06/04/2007

Lloyd's activities

PERG 2.7.17

See Notes

- 01/07/2005

Entering funeral plan contracts

PERG 2.7.18

See Notes

- 01/07/2005

PERG 2.7.19

See Notes

- 01/07/2005

Entering into and administering a regulated mortgage contract

PERG 2.7.20

See Notes

- 01/07/2005

Entering into and administering a home reversion plan

PERG 2.7.20A

See Notes

- 06/04/2007

Entering into and administering a home purchase plan

PERG 2.7.20B

See Notes

- 06/04/2007

Dormant account funds

PERG 2.7.20C

See Notes

- 06/08/2009

Agreeing

PERG 2.7.21

See Notes

- 06/08/2009

PERG 2.8

Exclusions applicable to particular regulated activities

- 01/07/2005

PERG 2.8.1

See Notes

- 01/07/2005

Accepting deposits

PERG 2.8.2

See Notes

- 01/07/2005

Issuing e-money

PERG 2.8.2A

See Notes

- 01/07/2005

Effecting and carrying out contracts of insurance

PERG 2.8.3

See Notes

- 01/07/2005

Dealing in investments as principal

PERG 2.8.4

See Notes

The regulated activity of dealing in investments as principal applies to specified transactions relating to any security or to any contractually based investment (apart from rights under funeral plan contracts or rights to or interests in such contracts). The activity is cut back by exclusions as follows.

- (1) Of particular significance is the exclusion in article 15 of the Regulated Activities Order (Absence of holding out etc). This applies where dealing in investments as principal involves entering into transactions relating to any security or assigning rights under a life policy (or rights or interests in such a contract). In effect, it superimposes an additional condition that must be met before a person's activities become regulated activities. The additional condition is that a person must hold himself out as making a market in the relevant specified investments or as being in the business of dealing in them, or he must regularly solicit members of the public with the purpose of inducing them to deal. This exclusion does not apply to dealing activities that relate to any contractually based investment except the assigning of rights under a life policy.

- (2) Entering into a transaction relating to a contractually based investment is not regulated if the transaction is entered into by an unauthorised person and it takes place in either of the following circumstances (a transaction entered into by an authorised person would be caught). The first set of circumstances is where the person with whom the unauthorised person deals is either an authorised person or an exempt person who is acting in the course of a business comprising a regulated activity in relation to which he is exempt. The second set of circumstances is where the unauthorised person enters into a transaction through a non-UK office (which could be his own) and he deals with or through a person who is based outside the United Kingdom. This non-UK person must be someone who, as his ordinary business, carries on any of the activities relating to securities or contractually based investments that are generally treated as regulated activities.

- (3) A person (for example, a bank) who provides another person with finance for any purpose can accept an instrument acknowledging the debt (and as security for it) without risk of dealing as principal as a result.

- (4) A company does not deal as principal by issuing its own shares or share warrants and a person does not deal as principal by issuing his own debentures or debenture warrants.

- (4A) A company does not carry on the activity of dealing in investments as principal by purchasing its own shares where section 162A of the Companies Act 1985 (Treasury shares) applies to the shares purchased or by dealing in its own shares held as Treasury shares, in accordance with section 162D of that Act (Treasury shares: disposal and cancellation).

- (5) Risk-management activities involving options, futures and contracts for differences will not require authorisation if specified conditions are met. The conditions include the company's business consisting mainly of unregulated activities and the sole or main purpose of the risk management activities being to limit the impact on that business of certain kinds of identifiable risk.

- (6) A person will not be treated as carrying on the activity of dealing in investments as principal if, in specified circumstances (outlined in PERG 2.9), he enters as principal into a transaction:

- (a) while acting as bare trustee (or, in Scotland, as nominee);

- (b) in connection with the sale of goods or supply of services;

- (c) that takes place between members of a group or joint enterprise;

- (d) in connection with the sale of a body corporate;

- (e) in connection with an employee share scheme;

- (f) as an overseas person;

- (g) as an incoming ECA provider (see PERG 2.9.18 G).

- 01/07/2005

PERG 2.8.4A

See Notes

- 01/07/2005

PERG 2.8.4B

See Notes

- 01/07/2005

PERG 2.8.4C

See Notes

- 01/11/2007

Dealing in investments as agent

PERG 2.8.5

See Notes

More detailed guidance on the exclusions that relate to contracts of insurance is in PERG 5 (Insurance mediation activities).

- 06/10/2006

PERG 2.8.5A

See Notes

- 01/11/2007

Arranging deals in investments and arranging a home finance transaction

PERG 2.8.6

See Notes

- 06/04/2007

PERG 2.8.6A

See Notes

- 06/04/2007

PERG 2.8.6B

See Notes

- 01/11/2007

Managing investments

PERG 2.8.7

See Notes

- 01/11/2007

Assisting in the administration and performance of a contract of insurance

PERG 2.8.7A

See Notes

The term 'relevant insurer' is defined in article 39B(2).

- 01/07/2005

PERG 2.8.7B

See Notes

- 01/07/2005

Safeguarding and administering investments

PERG 2.8.8

See Notes

- 06/10/2006

Sending dematerialised instructions

PERG 2.8.9

See Notes

- 01/07/2005

Establishing etc collective investment schemes

PERG 2.8.10

See Notes

- 01/10/2005

Establishing etc pension schemes

PERG 2.8.11

See Notes

- 06/04/2007

Advising on investments

PERG 2.8.12

See Notes

- 06/04/2007

PERG 2.8.12A

See Notes

- 06/04/2007

PERG 2.8.12B

See Notes

- 01/11/2007

Lloyd's activities

PERG 2.8.13

See Notes

- 01/07/2005

Entering funeral plan contracts

PERG 2.8.14

See Notes

- 01/07/2005

Administering regulated mortgage contracts

PERG 2.8.14A

See Notes

- 06/04/2007

PERG 2.8.14B

See Notes

- 06/04/2007

Agreeing

PERG 2.8.15

See Notes

- 01/07/2005

PERG 2.8.16

See Notes

- 01/07/2005

PERG 2.9

Regulated activities: exclusions applicable in certain circumstances

- 01/07/2005

PERG 2.9.1

See Notes

- 06/04/2007

PERG 2.9.2

See Notes

- 01/07/2005

Trustees, nominees or personal representatives

PERG 2.9.3

See Notes

The exclusion is, however, disapplied where a person is carrying on insurance mediation or reinsurance mediation . This is due to article 4(4A) of the Regulated Activities Order. Guidance on exclusions relevant to insurance mediation activities is in PERG 5 (Insurance mediation activities).

- 06/04/2007

PERG 2.9.4

See Notes

- 06/04/2007

Professions or business not involving regulated activities

PERG 2.9.5

See Notes

The exclusion is, however, disapplied where a person is carrying on insurance mediation or reinsurance mediation. This is due to article 4(4A) of the Regulated Activities Order. Guidance on exclusions relevant to insurance mediation activities is in PERG 5 (Insurance mediation activities). The exclusion is also disapplied for persons who, when carrying on the relevant regulated activity, are MiFID investment firms or third country investment firms (see PERG 2.5.4 G to PERG 2.5.5 G (Investment services and activities)).

- 01/11/2007

PERG 2.9.6

See Notes

- 01/07/2005

Sale of goods and supply of services

PERG 2.9.7

See Notes

- 01/07/2005

PERG 2.9.8

See Notes

- 01/11/2007

Group and joint enterprises

PERG 2.9.9

See Notes

- 01/07/2005

PERG 2.9.10

See Notes

- 01/11/2007

Sale of body corporate

PERG 2.9.11

See Notes

- 01/07/2005

PERG 2.9.12

See Notes

These exclusions also apply to transactions that are entered into for the purposes of the above transactions (such as transactions involving the offer of securities in the offeror as consideration or part consideration for the sale of the shares in the body corporate). These exclusions do not have effect in relation to shares in an open-ended investment company. The exclusions in PERG 2.9.11G (2), (3) and (4) are disapplied where they concern a contract of insurance. Guidance on exclusions relevant to insurance mediation activities is in PERG 5 (Guidance on insurance mediation activities). The exclusions are also disapplied for persons who, when carrying on the relevant regulated activity, are MiFID investment firms or third country investment firms (see PERG 2.5.4 G to PERG 2.5.5 G (Investment services and activities)).

- 01/11/2007

PERG 2.9.12A

See Notes

- 01/10/2005

Employee share schemes

PERG 2.9.13

See Notes

- 01/07/2005

PERG 2.9.14

See Notes

- 01/11/2007

Overseas persons

PERG 2.9.15

See Notes

- 01/11/2007

PERG 2.9.16

See Notes

- 01/11/2007

PERG 2.9.17

See Notes

- 06/04/2007

PERG 2.9.17A

See Notes

- 06/04/2007

Incoming ECA providers

PERG 2.9.18

See Notes

- 01/11/2007

Insurance mediation activities

PERG 2.9.19

See Notes

Guidance on these and other exclusions relevant to insurance mediation activities is in PERG 5 (Insurance mediation activities).

- 01/01/2009

Business angel-led enterprise capital funds

PERG 2.9.20

See Notes

- 01/10/2005

PERG 2.9.21

See Notes

- 01/10/2005

PERG 2.9.21A

See Notes

- 01/11/2007

PERG 2.10

Persons carrying on regulated activities who do not need authorisation

- 01/07/2005

PERG 2.10.1

See Notes

- 01/07/2005

PERG 2.10.2

See Notes

- 01/07/2005

PERG 2.10.3

See Notes

- 01/07/2005

PERG 2.10.4

See Notes

- 01/07/2005

Appointed representatives

PERG 2.10.5

See Notes

- 01/07/2005

Recognised Investment Exchanges and Recognised Clearing Houses

PERG 2.10.6

See Notes

- 01/07/2005

Particular exempt persons

PERG 2.10.7

See Notes

- 01/07/2005

PERG 2.10.8

See Notes

- 01/07/2005

Members of Lloyd's

PERG 2.10.9

See Notes

- 01/07/2005

PERG 2.10.10

See Notes

- 01/07/2005

PERG 2.10.11

See Notes

- 01/07/2005

Members of the professions

PERG 2.10.12

See Notes

- 01/07/2005

PERG 2.10.13

See Notes

- 01/07/2005

PERG 2.10.14

See Notes

- 06/04/2007

PERG 2.10.15

See Notes

- 06/04/2007

PERG 2.10.16

See Notes

- 01/07/2005

PERG 2.11

What to do now ?

- 01/07/2005

PERG 2.11.1

See Notes

- 06/10/2007

PERG 2.11.2

See Notes

- 01/11/2007

PERG 2.11.3

See Notes

- 01/11/2007

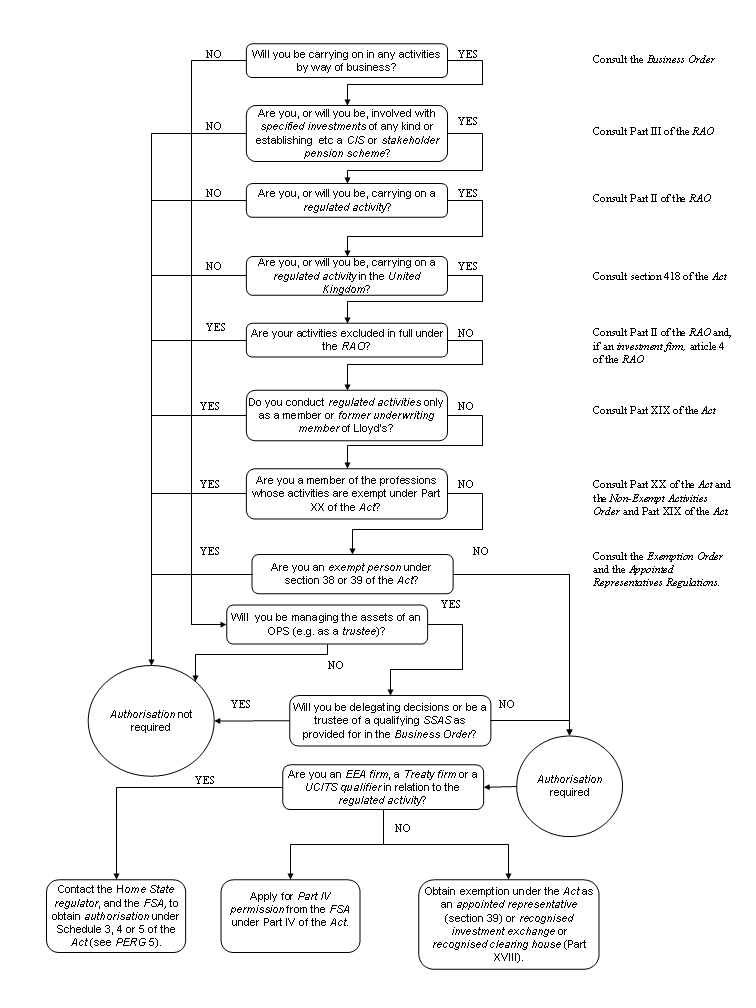

PERG 2 Annex 1

Authorisation and regulated activities

- 01/07/2005

PERG 2 Annex 1

See Notes

- 01/07/2005

PERG 2 Annex 2

Regulated activities and the permission regime

- 01/07/2005

See Notes

| 1.1 G | Table 1 is designed to relate the permission regime to regulated activities. Section 42(6)of the Act gives the FSA the power to describe the regulated activity or regulated activities for which it gives permission in such manner as the FSA considers appropriate. Table 1 details how the FSA has chosen to describe the regulated activities and specified investments for the purposes of the permission regime. | |

| 1.2 G | In an application for Part IV permission , an applicant will need to state the regulated activities it requires permission to carry on. This will involve an applicant identifying the regulated activities and the specified investments associated with those activities for which it requires Part IV permission. | |

1.3 G | Part II of the Regulated Activities Order (Specified activities) specifies the activities for the purposes of section 22 of the Act. This section states that an activity is a regulated activity if it is an activity of a specified kind which is carried on by way of business and: | |

| (1) | relates to an investment of a specified kind; or | |

| (2) | in the case of an activity specified for the purposes of section 22(1)(b) of the Act, is carried on in relation to property of any kind. | |

Part III of the Regulated Activities Order (Specified investments) specifies the investments referred to in (1). | ||

| 1.4 G | Column 1 of Table 1 lists the regulated activities and column 2 lists the associated specified investments. Descriptions of some categories of specified investments are expanded in Tables 2 and 3. There are notes to all three tables which provide further explanation where appropriate. | |

| 1.5 G | A reference to an article in the tables in PERG 2 Annex 2 G is to the relevant article in the Regulated Activities Order. | |

2 Table

3 Table

| Notes to Table 1 |

| Note 1: In addition to the regulated activities listed in Table 1, article 64 of the Regulated Activities Order specifies that agreeing to carry on a regulated activity is itself a regulated activity in certain cases. This applies in relation to all the regulated activities listed in Table 1 apart from: •accepting deposits (article 5);•issuing electronic money (article 9B);•effecting and carrying out contracts of insurance (article 10);•operating a multilateral trading facility (article 25D)•establishing, operating or winding up a collective investment scheme (article 51(1)(a));•acting as trustee of an authorised unit trust scheme (article 51(1)(b));•acting as the sole depositary or sole director of an open-ended investment company (article 51(1)(c));•establishing, operating or winding up a stakeholder pension schemeor establishing operating or winding up a personal pension scheme(article 52): and •the meeting of repayment claims and/or managing dormant account funds (including the investment of such funds) (article 63N). |

| Permission to carry on the activity of agreeing to carry on a regulated activity will be given automatically by the FSA in relation to those other regulated activities for which an applicant is given permission (other than those activities in articles 5,9B, 10,51 and 52 detailed above). |

| Note 1A: Funeral plan contracts are contractually based investments. Accordingly, the following are regulated activities when carried on in relation to a funeral plan contract: (a) arranging (bringing about) deals in investments, (b) making arrangements with a view to transactions in investments, (c) managing investments, (d) safeguarding and administering investments, (e) advising on investments, (f) sending dematerialised instructions and (g) causing dematerialised instructions to be sent (as well as agreeing to carry on each of the activities listed in (a) to (g)). However, they are not designated investment business. |

| Note 1B: Life policies are contractually based investments. Where the regulated activities listed as designated investment business in (e) to (g) and (j) are carried on in relation to a life policy, these activities also count as 'insurance mediation activities'. The full list of insurance mediation activities is set out in (pb) to (pf). The regulated activities of agreeing to carry on each of these activities will, if carried on in relation to a life policy, also come within both designated investment business and insurance mediation activities. |

| Note 2: For the purposes of the regulated activities of dealing in investments as principal (article 14) and dealing in investments as agent (article 21), the definition ofcontractually based investments [expanded in Table 3] excludes a funeral plan contract (article 87) and rights to or interests in funeral plan contracts. |

|

Note 2A: PERG 13 Ann 2 Table 2 contains a map indicating which securities and contractually based investments correspond to financial instruments. A firm'spermission should comprise each of the categories of security and contractually based investment in relation to which it carries on the activity of operating a multilateral trading facility. |

| Note 3: The regulated activities of managing investments (article 37) and safeguarding and administering investments (article 40) may apply in relation to any assets, in particular circumstances, if the assets being managed or safeguarded and administered include, (or may include), any security or contractually based investment. |

| Note 4: For the purposes of the permission regime, the activity in (j)(ii) of advising on pension transfers and pension opt-outs is carried on in respect of the following specified investments: unit (article 81);stakeholder pension scheme (article 82(1));personal pension scheme (article 82(2));life policy (explained in note 5); andrights to or interests in investments in so far as they relate to a unit, a stakeholder pension scheme, a personal pension scheme or a life policy. |

| Note 5: Article 4(2) of the Regulated Activities Order specifies the activities (m)to (p) for the purposes of section 22(1)(b) of the Act. That is, these activities will be regulated activities if carried on in relation to any property and are not expressed as relating to a specified investment. |

| Note 5A: Where they are carried on in relation to a life policy, the activities listed as insurance mediation activities in (pb) to (pf) (as well as the regulated activity of agreeing to carry on those activities) are also designated investment business. |

| Note 5B: In PERG, life policy is the term used in the Handbook to mean 'qualifying contract of insurance' (as defined in article 3(1) of the Regulated Activities Order). For the purpose of the permission regime, the term also includes a long-term care insurance contract which is a pure protection contract and a pension term assurance policy. |

| Note 5C: Non-investment insurance contract is the term used in firms permissions to mean pure protection contract or general insurance contract. Pure protection contract is the term used in the Handbook to mean a long-term insurance contract which is not a life policy. General insurance contract is the term used in the Handbook to mean contract of insurance within column 1 of Table 2. |

| Note 5D: [deleted] |

| Note 5E: For the purposes of the permission regime, the activity in (pf)(ii) of advising on pension transfers and pension opt-outs is carried on in respect of the following specified investments: life policy (explained in note 5A); andrights to or interests in investments in so far as they relate to a life policy. |

| Note 6: Section 315 of the Act (The Society: authorisation and permission) states that the Society of Lloyd's has permission to carry on the regulated activities referred to in that section, one of which is specified in article 58 of the Regulated Activities Order. This permission is unique to the Society of Lloyd's. |

| Note 7: A stakeholder product is defined in the Glossary as: an investment of a kind specified in the Stakeholder Regulations:a stakeholder pension scheme; anda stakeholder CTF. |

|

Note 8: Article 4(2) of the Regulated Activities Order specifies the activity at (ab) for the purposes of section 22(1)(b) of the Act, that is, these activities will be regulated activities if carried on in relation to any property and are not expressed as related to a specified investment. |

| Table 2: Contracts of insurance | ||

| Contract of insurance (article 75 of the RAO) | ||

| (a) general insurance contract (Part I of Schedule 1 to the Regulated Activities Order) | (b) long-term insurance contract (Part II of Schedule 1 to the Regulated Activities Order ) | |

| Number | ||

| 1 | Accident (paragraph 1) | life and annuity (paragraph I) |

| 2 | Sickness (paragraph 2) | marriage or the formation of a civil partnership and birth (paragraph II) |

| 3 | Land vehicles (paragraph 3) | linked long-term (paragraph III) |

| 4 | Railway rolling stock (paragraph 4) | permanent health (paragraph IV) |

| 5 | Aircraft (paragraph 5) | tontines (paragraph V) |

| 6 | Ships (paragraph 6) | capital redemption (paragraph VI) |

| 7 | Goods in transit (paragraph 7) | pension fund management (paragraph VII) |

| 8 | fire and natural forces (paragraph 8) | collective insurance (paragraph VIII) |

| 9 | damage to property (paragraph 9) | social insurance (paragraph IX) |

| 10 | motor vehicle liability (paragraph 10) | |

| 11 | aircraft liability (paragraph 11) | |

| 12 | liability of ships (paragraph 12) | |

| 13 | general liability (paragraph 13) | |

| 14 | credit (paragraph 14) | |

| 15 | suretyship (paragraph 15) | |

| 16 | miscellaneous financial loss (paragraph 16) | |

| 17 | legal expenses (paragraph 17) | |

| 18 | assistance (paragraph 18) | |

| Notes to Table 2 | ||

| Note 1: See IPRU(INS) Ann 10.2 Part II for the groups of classes of general insurance business from the Annex to the First non-Life Directive. | ||

| Note 2: See IPRU(INS) 11.8 and the definition of ancillary risks in IPRU(INS) for guidance on the treatment of supplementary and ancillary provisions in relation to contracts of insurance. | ||

| Table 3: Securities, contractually based investments and relevant investments [see notes 1 and 2 to Table 3] | ||

| Security (article 3(1)) | Contractually based investment (article 3(1)) | Relevant investments (article 3(1)) |

|

share (article 76) debenture (article 77) government and public security (article 78) warrant (article 79) certificate representing certain security (article 80) unit (article 81) stakeholder pension scheme (article 82(1)) personal pension scheme (article 82(2)); rights to or interests in investments (article 89) in so far as they relate to any of the above categories of security |

option (article 83) For the purposes of the permission regime, option is subdivided into: (i)option (excluding a commodity option and an option on a commodityfuture);(ii)commodity option and option on a commodity future. future (article 84) For the purposes of the permission regime, future is subdivided into: (i)future (excluding a commodity future and a rolling spot forex contract);(ii)commodity future;(iii)rolling spot forex contract. contract for differences (article 85) For the purposes of the permission regime, contract for differences is subdivided into: (i)contract for differences (excluding a spread bet and a rolling spot forex contract);(ii)spread bet;(iii)rolling spot forex contract. life policy (but excluding a long-term care insurance contract which is a pure protection contract) [see note 5B to Table 1] funeral plan contract (article 87) [see note 1A to Table 1] rights to or interests in investments (article 89) in so far as they relate to any of the above categories of contractually based investment. |

contractually based investments (article 3(1)) non-investment insurance contract [see note 5C to Table 1] |

| Notes to Table 3 | ||

| Note 1: Security, contractually based investment and relevant investment are not, in themselves, specified investments they are defined as including a number of specified investments as set out in Table 3. Relevant investments is the term that is used to cover contractually based investments together with rights under a general insurance contract and a pure protection contract. Note 2: For the purposes of the regulated activities of dealing in investments as principal (article 14) and dealing in investments as agent (article 21), the definition of contractually based investments excludes a funeral plan contract (article 87) and rights to or interests in funeral plan contracts. | ||

- 06/08/2009