PERG 10

Guidance on activities related to pension schemes

PERG 10.1

Background

- 06/05/2006

Q1. What is the purpose of these questions and answers ("Q&As") and who should be reading them?

These Q&As are aimed at persons involved in the establishment or running of a pension scheme or in providing services to such persons and should be read, in particular, by:

They are intended to help such persons understand:

The Q&As are primarily concerned with identifying the regulated activities (such as dealing or arranging deals in investments, managing investments or advising on investments) that may be carried on by persons (including trustees) who are involved with occupational pension schemes and personal pension schemes. They are also concerned, but only in relation to stakeholder pension schemes, with identifying when the regulated activity of operating such a scheme will be carried on (see Q26).

The Q&As complement the general guidance on regulated activities in Chapter 2 of our Perimeter Guidance Manual ("PERG"), the general guidance on insurance mediation activities in Chapter 5 of PERG (PERG 5) and the relevant legislation. In addition, Chapter 12 of PERG (PERG 12) has further guidance about the regulated activities relating to the operation and sale of personal pension schemes that come into force on 6 April 2007.

The Q&As that follow are set out in sections:

and are complemented by:

These Q&As are aimed at persons involved in the establishment or running of a pension scheme or in providing services to such persons and should be read, in particular, by:

•pension scheme trustees;

•those who provide services to pension schemes or their trustees; and

•employers or affinity groups who provide pension schemes for their employees or members.

They are intended to help such persons understand:

•whether they will be carrying on a regulated activity and so need to be an authorised or exempt person under section 19 of the Financial Services and Markets Act 2000; and

•whether their communications are financial promotions and, if so, whether they will be exempt from the restriction in section 21 of that Act.

The Q&As are primarily concerned with identifying the regulated activities (such as dealing or arranging deals in investments, managing investments or advising on investments) that may be carried on by persons (including trustees) who are involved with occupational pension schemes and personal pension schemes. They are also concerned, but only in relation to stakeholder pension schemes, with identifying when the regulated activity of operating such a scheme will be carried on (see Q26).

The Q&As complement the general guidance on regulated activities in Chapter 2 of our Perimeter Guidance Manual ("PERG"), the general guidance on insurance mediation activities in Chapter 5 of PERG (PERG 5) and the relevant legislation. In addition, Chapter 12 of PERG (PERG 12) has further guidance about the regulated activities relating to the operation and sale of personal pension schemes that come into force on 6 April 2007.

The Q&As that follow are set out in sections:

•general issues (PERG 10.2);

•issues for pension scheme trustees (PERG 10.3);

•issues for pension scheme service providers other than trustees (PERG 10.4);

•the application of EU Directives (PERG 10.4A); and

•issues for employers or affinity groups (PERG 10.5);

and are complemented by:

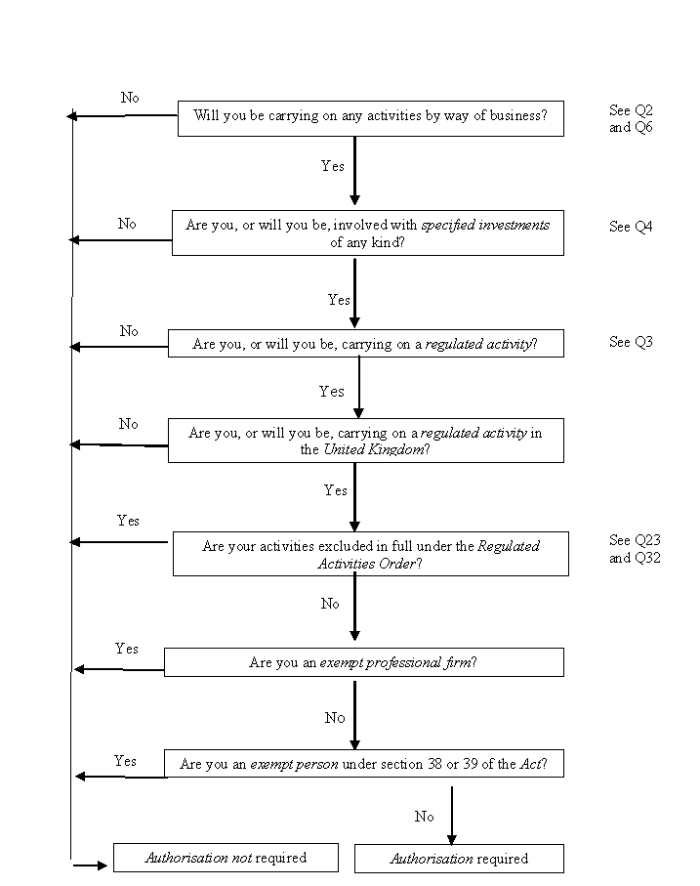

•Annex 1 : Flow chart showing the steps to be considered in deciding whether authorisation is needed;

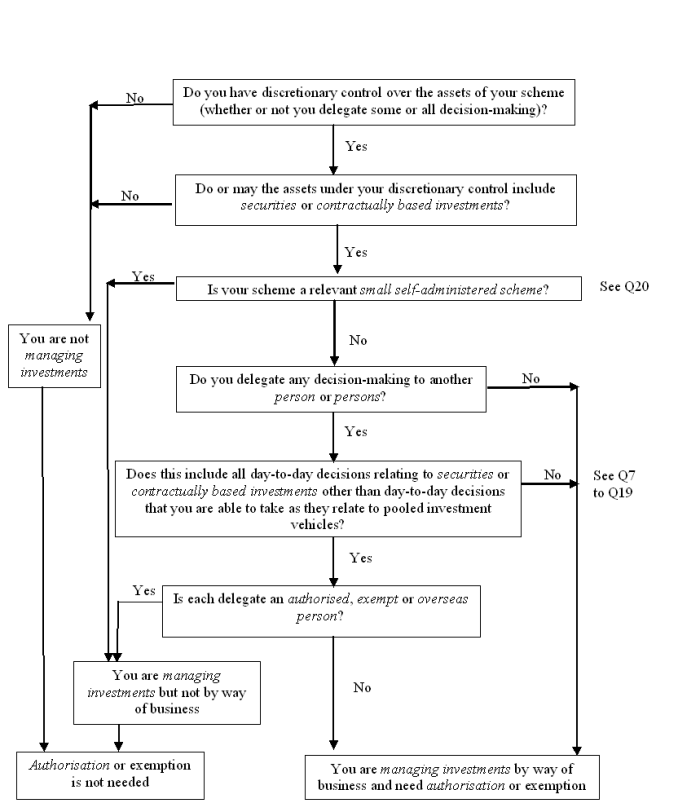

•Annex 2: Flow chart showing the additional steps to be considered by trustees of occupational pension schemes and other persons in deciding whether authorisation is needed for managing the assets of such a scheme;

•Annex 3: Table summarising the regulatory position of pension scheme trustees and service providers;

•Annex 4: Table summarising the regulatory position of employers and affinity groups; and

•Annex 5: Table summarising the regulatory position concerning financial promotions by trustees, employers and affinity groups.

- 06/10/2006

PERG 10.2

General issues

- 06/05/2006

Q2. I propose to provide services to a pension scheme - in what circumstances will I need to be authorised by the FSA or be an exempt person?

You will need to be an authorised or exempt person if you will:

Q3. How will I know if my proposed activities are regulated?

Regulated activities are specified in the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 ("the Regulated Activities Order"). They include:

But some activities are specifically excluded from the FSA's regulatory scope.

Q4. What kind of investments do these regulated activities relate to?

Securities, such as shares, debt securities, warrants or unit trusts, and contractually based investments such as options, futures and cash-settled instruments (contracts for differences) or long-term insurance policies with an investment element (such as unit-linked insurance or annuities). Some regulated activities, such as arranging and advising on investments, also relate to all contracts of insurance.

Q5. What exclusions are available?

There are various exclusions - some relate to a single activity and others relate to several. Further guidance on exclusions is given in the remaining questions.

Q6. How do I know if I am carrying on activities by way of business?

Whether a particular person will be carrying on a regulated activity by way of business (and so needs authorisation or exemption) will invariably depend on that person's individual circumstances. A number of factors need to be taken into account in determining whether the by-way-of-business test is met. These include:

Corporate pension scheme trustees and other persons who provide professional services to pension schemes are likely to be carrying on their activities by way of business. Unpaid individuals who act as trustees are not likely to be. Neither are in-house trustee companies set up by an employer to operate its occupational pension scheme ("OPS") or the employer if it acts as the trustee itself. In this respect, however, article 4 of the Financial Services and Markets Act 2000 (Carrying on Regulated Activities by Way of Business) Order 2001 ("the Business Order") amends this test for trustees and other persons who manage the assets of an OPS. The effect of the amendment is that a trustee will need to be authorised if he is managing the investments of an OPS, whether or not he would normally be regarded as doing so by way of business. This is unless certain conditions are met (as explained in questions 7 to 22).

In addition, article 3(4) of the Business Order provides that any person who carries on an insurance mediation activity by way of business must be remunerated for doing so. Guidance on the application of the by-way-of-business test to insurance mediation activities is in Chapter 5.4 of PERG.

You will need to be an authorised or exempt person if you will:

•be carrying on regulated activities;

•be doing so by way of business; and

•be doing so in the United Kingdom.

Q3. How will I know if my proposed activities are regulated?

Regulated activities are specified in the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 ("the Regulated Activities Order"). They include:

•

dealing (broadly, entering into a transaction as principal or agent to buy or sell certain investments);

•

arranging (broadly, bringing about an investment transaction between other parties or making arrangements to assist other persons to enter into such transactions);

•

managing investments (broadly, discretionary management of assets that include or may include certain investments);

•

assisting in the administration and performance of a contract of insurance (broadly, notifying and providing evidence in support of or negotiating claims on behalf of policyholders);

•

safeguarding and administering investments, being assets that include or may include certain investments (otherwise known as custody services);

•

advising on investments (broadly, advising an investor on the merits of his buying or selling certain particular investments);

But some activities are specifically excluded from the FSA's regulatory scope.

Q4. What kind of investments do these regulated activities relate to?

Securities, such as shares, debt securities, warrants or unit trusts, and contractually based investments such as options, futures and cash-settled instruments (contracts for differences) or long-term insurance policies with an investment element (such as unit-linked insurance or annuities). Some regulated activities, such as arranging and advising on investments, also relate to all contracts of insurance.

Q5. What exclusions are available?

There are various exclusions - some relate to a single activity and others relate to several. Further guidance on exclusions is given in the remaining questions.

Q6. How do I know if I am carrying on activities by way of business?

Whether a particular person will be carrying on a regulated activity by way of business (and so needs authorisation or exemption) will invariably depend on that person's individual circumstances. A number of factors need to be taken into account in determining whether the by-way-of-business test is met. These include:

•the degree of continuity;

•the existence of a commercial element;

•the scale of the activity;

•the proportion which the activity bears compared to other activities carried on by the same person which are not regulated; and

•the nature of the particular regulated activity that is carried on.

Corporate pension scheme trustees and other persons who provide professional services to pension schemes are likely to be carrying on their activities by way of business. Unpaid individuals who act as trustees are not likely to be. Neither are in-house trustee companies set up by an employer to operate its occupational pension scheme ("OPS") or the employer if it acts as the trustee itself. In this respect, however, article 4 of the Financial Services and Markets Act 2000 (Carrying on Regulated Activities by Way of Business) Order 2001 ("the Business Order") amends this test for trustees and other persons who manage the assets of an OPS. The effect of the amendment is that a trustee will need to be authorised if he is managing the investments of an OPS, whether or not he would normally be regarded as doing so by way of business. This is unless certain conditions are met (as explained in questions 7 to 22).

In addition, article 3(4) of the Business Order provides that any person who carries on an insurance mediation activity by way of business must be remunerated for doing so. Guidance on the application of the by-way-of-business test to insurance mediation activities is in Chapter 5.4 of PERG.

- 06/05/2006

PERG 10.3

Pension Scheme Trustees

- 06/05/2006

Q7. I am a trustee of an occupational pension scheme ("OPS") - will I need to be authorised if I also manage the investments held under my scheme?

Only if you are involved in the day-to-day management of the assets and your scheme is not a small self-administered scheme.

Occupational pension scheme trustees are subject to special treatment when they manage investments held under their scheme. This means that they may need to be authorised even though they are not carrying on their managing activities by way of business in the normal sense (they may be unpaid individuals for example).

That aside, and broadly speaking, you will not need to be authorised if:

Q8. What decisions can I make, as a trustee of an OPS (other than a small-self administered scheme), if I am not authorised?

You can make:

Q9. As an unauthorised OPS trustee, what decisions am I unable to make?

You will be unable to make most day-to-day decisions. Generally speaking, these will be:

Q10. As an OPS trustee, will I be making day-to-day decisions by implementing strategic decisions on a regular basis?

No. For example, you will not be making day-to-day decisions merely because the application of the method for rebalancing asset classes and permitted ranges of divergence result in mechanical changes being made regularly to the asset allocation policy. This is because the decisions are made at the time the method and frequency are set and not when those decisions result in a change to the policy.

Similarly, there may be occasions when you may determine that, in the absence of instructions from a member, his contributions will automatically be placed in a particular fund. Provided this follows a pre-determined procedure that is rigidly applied and not subject to frequent alteration, it may be regarded as the routine application of a strategic decision and not as a day-to-day decision in its own right.

Q11. As an OPS trustee, I need, from time to time, to sell investments to raise cash to meet obligations to scheme members. Is this likely to mean that I am making day-to-day decisions?

No, unless you are making regular decisions as to which particular investments to dispose of to release the necessary cash. This would not include situations where, in realising assets, you are merely applying pre-agreed strategic policy decisions with no element of discretion. In that situation, the decision is made at the time that the policy is set and is strategic.

Q12. Does the fact that, as an OPS trustee, I only infrequently make decisions about investments mean that the decisions I do make will not be regarded as day-to-day decisions?

No. The mere fact that a decision may be taken only infrequently does not, of itself, prevent that decision being a day-to-day decision. It is the nature of the decision that is important, not its frequency. For example, if you were responsible for the investment of scheme assets in a portfolio of Government stocks and debt securities, the fact that you might only occasionally need to make decisions about buying new, or selling existing, investments would not prevent those decisions being day-to-day decisions. Similarly, the fact that you may be the trustee of a small scheme where decisions about the investment of scheme assets arise only infrequently does not, of itself, prevent those decisions being day-to-day decisions.

Q13. As an OPS trustee, will I be making day-to-day decisions if I decide on the purchase of annuities to be held under the scheme?

Not in most circumstances. Typically, you may choose to select what you consider to be the most suitable annuity provider on each occasion that a decision has to be made. If this is the case, provided that you are not purchasing annuities on a frequent basis, it is unlikely that the decisions you make would be day-to-day decisions (on the basis that you are making strategic decisions about which provider to use rather than decisions about investment of the scheme assets). Less typically, your choice of annuity provider might be determined at the outset so that, each time an annuity has to be purchased, that chosen provider is used. If this occurs, you may be regarded as having made a strategic decision with regard to the most appropriate provider and then as carrying out that strategic decision on each occasion that an annuity is purchased.

But, even if your decision to purchase an annuity is a day-to-day decision, you can still make it. This is provided you meet the conditions for making decisions that involve taking and considering advice about investment in pooled investment vehicles (see Q8(3)).

Q14. As an OPS trustee, if I make decisions about the purchase of annuities on the winding-up of the scheme, am I making day-to-day decisions?

No. Decisions taken about annuities in such exceptional circumstances would not be regarded as day-to-day decisions. This also applies to decisions about annuities taken in the context of ensuring provision of benefits for a member's ex-spouse.

Q15. As an OPS trustee, I make investments on the instructions of members of the scheme. Does this mean that I have to be authorised as I have effectively delegated day-to-day decision-making to persons who are not authorised, exempt or overseas persons? What about the member - is he then managing the assets of an OPS so as to need authorisation?

No, on both points. You will not be regarded as managing investments (so that issues about delegation of day-to-day decision-making do not arise) provided the investment is to be purchased solely for the benefit of the member and you, in practice, invariably seek to match the scheme's obligations to the member by purchasing those investments. This includes where the member instructs you to purchase a particular annuity. But the position may be different should you choose not to match the obligations that the scheme incurs through the members' instructions by purchasing the relevant investments. If you then make decisions about what alternative investments to make, you are likely to be managing investments and the decisions you make may be day-to-day decisions.

The member would be regarded as managing assets that belong beneficially to him rather than assets that belong to another. So, he would not be regarded as managing investments either.

Q16. Am I going to be managing investments by exercising voting rights conferred by investments that I hold as trustee under my OPS? If so, will this be viewed as my taking a day-to-day decision?

No, you will not be managing investments unless the exercise of the rights would result in your buying, selling, subscribing for or underwriting securities or contractually based investments. This will not usually be the case. For example, voting to support a take-over offer to be made by a company in which the scheme holds shares would not involve managing investments as it would not result in your acquiring or disposing of investments. Neither would voting on the re-appointment of company directors or auditors or on whether a company in whom the scheme holds shares should make a rights issue (although deciding to subscribe to the rights issue when it is made would amount to managing investments).

Deciding to accept an offer to buy company shares held by you under the scheme, in the context of a proposed take-over of that company, would involve managing investments. But the decision you make would be viewed as strategic and not a day-to-day decision.

Q17. When may a decision I make as an OPS trustee that results in my investing in a pooled investment vehicle other than an annuity be regarded as a strategic decision?

This will arise where the decision:

Q18. When will a decision that I make as an OPS trustee be regarded as one to appoint a discretionary fund manager?

This will be the case when the decision:

Where the circumstances surrounding the appointment of a fund manager suggest that the decision is day-to-day, you may still be able to make that decision. This is provided you meet the conditions for making decisions that involve taking and considering advice about investment in pooled investment vehicles (see Q8(3)).

Q19. As an unauthorised OPS trustee, I have made a decision to invest in an investment vehicle which allows me to switch between various sub-funds. Can I make decisions about switching between those sub-funds?

Yes. However, taking decisions of this kind other than to implement strategic decisions on asset allocation is likely to involve taking day-to-day decisions. So, you would need to meet the conditions for making decisions that involve taking and considering advice about investment in pooled investment vehicles (see Q8(3)).

Q20. I understand that, as an unauthorised trustee of a small self-administered scheme (a "SSAS") I can make day-to-day investment decisions. What types of scheme qualify as a SSAS?

There are two kinds of scheme that qualify as a SSAS. These are:

Q21. My 12 relevant member SSAS requires that all day-to-day decisions are taken by the trustee beneficiaries. The SSAS has an independent trustee who is not a beneficiary or an authorised or exempt person. If the independent trustee takes a day-to-day decision in breach of the scheme's requirement, what effect does that have on him and on the relevant members?

The independent trustee's actions will not cause the trustee beneficiaries any regulatory difficulties, even though he has acted in breach of the requirements of the SSAS. This is because it is the existence of the requirement about day-to-day decision-making that is important and not whether it may be breached. The independent trustee may, as a result of having taken the decision, be regarded as managing the SSAS's investments. But whether or not this would be the case will depend on the particular circumstances in which the decision came to be made.

Q22. I am a trustee of a 12 relevant member SSAS but not a relevant member. My role requires me to monitor investments made by the scheme - won't I be drawn into making day-to-day decisions?

No. You should be able to perform your role in monitoring and, where necessary, objecting to particular transactions without needing authorisation. Merely operating a blocking vote where a certain proposed investment would, for whatever reason, be prohibited, would not be regarded as taking part in the decision to make, or to refrain from making, that investment. If you merely express a view as to whether or not a certain proposed investment would be permitted you would not, thereby, be making a decision to buy the investment. However, to reduce the risk of being drawn into making day-to-day decisions, you may wish to make a point of not participating in a vote except where the investment could not, in your view, be made without breaching the relevant requirements.

Q23. My company acts as the corporate trustee for a self-invested personal pension scheme ("SIPP"). Will it need to be authorised?

No, provided it is able to satisfy various exclusions. But note that, under government proposals for reforming the way in which personal pension schemes are permitted to be established and registered, it may need to be authorised by 6 April 2007 for operating a personal pension scheme - see HM Treasury's Consultation Document entitled "Proposed changes to the eligibility rules for establishing a pension scheme - A consultation document, September 2005". This is available on HM Treasury's website at: http://www.hm-treasury.gov.uk/consultations_and_legislation/pension_scheme/consult_pensionscheme_index.cfm. The document sets out several options and indicates that the Treasury's preferred option is to introduce a new regulated activity of establishing, operating or winding up a personal pension scheme other than a stakeholder pension scheme (where those activities are already regulated). The new regulated activity would come into force on 6 April 2007. At the same time, rights under a personal pension scheme would become an investment for the purposes of existing regulated activities such as dealing, arranging, managing investments and advising on investments. The FSA proposes to consult on further perimeter guidance about the changes to regulatory scope in this area during the course of 2006.Your company's position until April 2007will depend on a combination of the activities that it carries on and the availability of certain exclusions. These exclusions may also apply to trustees of pension schemes other than SIPPs with the exception of that for managing investments (which will not apply to a trustee of an OPS).

Q24. My company acts as corporate trustee of a trust-based stakeholder pension scheme . Does it need to be authorised?

This depends on the responsibilities that your company assumes as trustee. Establishing, operating or winding up a stakeholder pension schemeare regulated activities in their own right. These are functions that are oftencarried out by the trustees of a trust-based stakeholder pensionscheme other than where the trustees are mere bare trustees. This is apart from establishing a scheme which is a function that may often be carried out by a third party such as a product provider. See Q25 to Q28 for further guidance on these activities.

Q25. What does establishing a stakeholder pension scheme involve?

The establisher of a personal pension scheme is the person responsible for putting in place the arrangements founding the scheme and registering it with HM Revenue & Customs. With a trust-based scheme, this will usually be the person who executes the trust as principal. In a scheme established by deed poll, it will usually be the person who enters into the deed poll. There will usually only be one person who establishes the scheme. Any professional firms that he may employ to act as his agent (such as solicitors) would not be establishing the scheme. The establisher may also be the operator but need not be. An employer will not be establishing a stakeholder pension scheme purely as a result of his having designated such a scheme to meet the statutory requirement to do so.

Q26. What does operating a stakeholder pension scheme involve?

The 'operator' is the person responsible, under the scheme's constitution, for ensuring continuing compliance with the management and administration requirements in respect of the assets and income of, and the benefits payable under, the scheme as imposed under relevant pensions and tax legislation. For example, with a trust-based scheme, the trustees will often be the operator by virtue of the responsibilities they assume under the trust deed. In situations where the trustees' role is merely to act as a bare trustee holding the scheme assets,it may be the case that there is a third party who has responsibility for the management and administration of the scheme and its assets and who will be the scheme's. The scheme may be established by an authorised person who acts as a provider of investment products or services to the scheme. This does not make that person the operator of the scheme if, as a matter of fact, he has appointed another person (such as a trustee) to carryout all of the operator's functions in his place.

Q27. What is my position as the operator of a stakeholder pension scheme if I delegate day-to-day functions such as administration of the scheme or management of the scheme assets to another person?

A person who accepts responsibility, and remains responsible, for carrying on a regulated activity is carrying on that activity even though he may delegate or outsource the day-to-day carrying out of the functions to another person. So, if the operator of a scheme delegates some or all of his functions to another person, he will still be the regulated operator of the scheme. At the same time, none of the people to whom he delegates his activities will become an operator of the scheme. However, they may be carrying on other regulated activities in performing their delegated or outsourced tasks (such as arranging or managing investments), in which case they will be subject to regulation for those activities.

Q28. What does winding-up a stakeholder pension scheme involve?

The person who winds-up a stakeholder pension scheme will be the person who is responsible for putting in place the arrangements for bringing the scheme to an end in a way that complies with the relevant provisions of the instrument that established the scheme and any relevant rules under pensions or tax legislation. This will, more often than not, be the operator of the scheme.

Q29. I am one of several trustees of a pension scheme. Sometimes I arrange an investment transaction on behalf of all the trustees but another trustee actually signs the purchase agreement and becomes the registered owner of the trust asset - does this mean that I could be regarded as arranging deals in investments on behalf of my fellow trustee?

No. You will not be arranging in these circumstances. This is because the interest that you acquire as trustee in the investment means that you will be regarded as being a party to the transaction. Arrangements made by a person in relation to transactions of which he is to be a party as principal or agent are excluded from arranging.

Q30. [Deleted]

Only if you are involved in the day-to-day management of the assets and your scheme is not a small self-administered scheme.

Occupational pension scheme trustees are subject to special treatment when they manage investments held under their scheme. This means that they may need to be authorised even though they are not carrying on their managing activities by way of business in the normal sense (they may be unpaid individuals for example).

That aside, and broadly speaking, you will not need to be authorised if:

•you delegate day-to-day decision-making about securities or contractually based investments to an authorised, exempt or overseas person (typically a fund manager); or

•the only day-to-day decisions you take relate to pooled investment products and are only taken after you have obtained and considered advice from a regulated person; or

•your scheme is fully insured and you do not take or need to delegate any day-to-day decisions; or

•your scheme is a small self-administered scheme.

Q8. What decisions can I make, as a trustee of an OPS (other than a small-self administered scheme), if I am not authorised?

You can make:

(1)strategic decisions, such as decisions:

•about the adoption or revision of a statement of investment principles as required by relevant pensions legislation; or

•about the formulation of a general asset allocation policy; or

•about prescribing the method and frequency for rebalancing asset classes, and the permitted ranges of divergence, following the setting of the general asset allocation policy; or

•about the proportion of the assets that should constitute investments of particular kinds; or

•affecting the balance between income and growth; or

•about the appointment of fund managers; or

•as to which pooled investment products to make available for members to choose from under a money purchase scheme;

(2)decisions that are needed to be taken in exceptional circumstances, such as:

•in a take-over situation; or

•where the person managing the scheme's assets has a conflict of interest; or

•where the decision is sensitive (such as one relating to investments in the same market sector as the employer or in the employer's own securities); or

•where the decision raises sensitive policy considerations (such as investments in certain territories or markets or in ethical or green areas); or

•where the trustees are required to make decisions:

-about investments acquired purely as a result of a demutualisation by an insurer or building society in which the scheme holds investments or deposits; or

-following a change in fund managers which results in the scheme holding investments which the new fund manager is unable or unwilling to take on;

(3)day-to-day decisions about investment in pooled investment products, namely:

and

•

collective investment schemes such as unit trusts, limited partnerships, hedge funds or open-ended investment companies;

•shares or debt securities issued by an investment company such as an investment trust or a venture capital trust;

•contracts of insurance such as annuities or unit-linked investment policies;

(This is subject to the decisions being made only after you have taken and considered advice from an authorised, exempt or overseas person or an exempt professional firm (that is, a firm of solicitors, accountants or actuaries who can carry on incidental regulated activities without authorisation).);

(This is subject to the decisions being made only after you have taken and considered advice from an authorised, exempt or overseas person or an exempt professional firm (that is, a firm of solicitors, accountants or actuaries who can carry on incidental regulated activities without authorisation).);

and

(4)decisions of any kind about investing in assets that are not securities or contractually based investments - such as real property, cash or precious metals.

Q9. As an unauthorised OPS trustee, what decisions am I unable to make?

You will be unable to make most day-to-day decisions. Generally speaking, these will be:

•decisions to buy, sell or hold particular securities or contractually based investments such as a fund manager would be expected to make in his everyday management of a client's portfolio (other than day-to-day decisions about investment in pooled investment vehicles taken after obtaining advice as per Q8(3)); or

•decisions made as a result of regular or frequent interventions outside scheduled review meetings in the decision-making of external fund managers; or

•recommendations made to fund managers, on a regular basis, with a force amounting to direction relating to individual securities or contractually based investments.

Q10. As an OPS trustee, will I be making day-to-day decisions by implementing strategic decisions on a regular basis?

No. For example, you will not be making day-to-day decisions merely because the application of the method for rebalancing asset classes and permitted ranges of divergence result in mechanical changes being made regularly to the asset allocation policy. This is because the decisions are made at the time the method and frequency are set and not when those decisions result in a change to the policy.

Similarly, there may be occasions when you may determine that, in the absence of instructions from a member, his contributions will automatically be placed in a particular fund. Provided this follows a pre-determined procedure that is rigidly applied and not subject to frequent alteration, it may be regarded as the routine application of a strategic decision and not as a day-to-day decision in its own right.

Q11. As an OPS trustee, I need, from time to time, to sell investments to raise cash to meet obligations to scheme members. Is this likely to mean that I am making day-to-day decisions?

No, unless you are making regular decisions as to which particular investments to dispose of to release the necessary cash. This would not include situations where, in realising assets, you are merely applying pre-agreed strategic policy decisions with no element of discretion. In that situation, the decision is made at the time that the policy is set and is strategic.

Q12. Does the fact that, as an OPS trustee, I only infrequently make decisions about investments mean that the decisions I do make will not be regarded as day-to-day decisions?

No. The mere fact that a decision may be taken only infrequently does not, of itself, prevent that decision being a day-to-day decision. It is the nature of the decision that is important, not its frequency. For example, if you were responsible for the investment of scheme assets in a portfolio of Government stocks and debt securities, the fact that you might only occasionally need to make decisions about buying new, or selling existing, investments would not prevent those decisions being day-to-day decisions. Similarly, the fact that you may be the trustee of a small scheme where decisions about the investment of scheme assets arise only infrequently does not, of itself, prevent those decisions being day-to-day decisions.

Q13. As an OPS trustee, will I be making day-to-day decisions if I decide on the purchase of annuities to be held under the scheme?

Not in most circumstances. Typically, you may choose to select what you consider to be the most suitable annuity provider on each occasion that a decision has to be made. If this is the case, provided that you are not purchasing annuities on a frequent basis, it is unlikely that the decisions you make would be day-to-day decisions (on the basis that you are making strategic decisions about which provider to use rather than decisions about investment of the scheme assets). Less typically, your choice of annuity provider might be determined at the outset so that, each time an annuity has to be purchased, that chosen provider is used. If this occurs, you may be regarded as having made a strategic decision with regard to the most appropriate provider and then as carrying out that strategic decision on each occasion that an annuity is purchased.

But, even if your decision to purchase an annuity is a day-to-day decision, you can still make it. This is provided you meet the conditions for making decisions that involve taking and considering advice about investment in pooled investment vehicles (see Q8(3)).

Q14. As an OPS trustee, if I make decisions about the purchase of annuities on the winding-up of the scheme, am I making day-to-day decisions?

No. Decisions taken about annuities in such exceptional circumstances would not be regarded as day-to-day decisions. This also applies to decisions about annuities taken in the context of ensuring provision of benefits for a member's ex-spouse.

Q15. As an OPS trustee, I make investments on the instructions of members of the scheme. Does this mean that I have to be authorised as I have effectively delegated day-to-day decision-making to persons who are not authorised, exempt or overseas persons? What about the member - is he then managing the assets of an OPS so as to need authorisation?

No, on both points. You will not be regarded as managing investments (so that issues about delegation of day-to-day decision-making do not arise) provided the investment is to be purchased solely for the benefit of the member and you, in practice, invariably seek to match the scheme's obligations to the member by purchasing those investments. This includes where the member instructs you to purchase a particular annuity. But the position may be different should you choose not to match the obligations that the scheme incurs through the members' instructions by purchasing the relevant investments. If you then make decisions about what alternative investments to make, you are likely to be managing investments and the decisions you make may be day-to-day decisions.

The member would be regarded as managing assets that belong beneficially to him rather than assets that belong to another. So, he would not be regarded as managing investments either.

Q16. Am I going to be managing investments by exercising voting rights conferred by investments that I hold as trustee under my OPS? If so, will this be viewed as my taking a day-to-day decision?

No, you will not be managing investments unless the exercise of the rights would result in your buying, selling, subscribing for or underwriting securities or contractually based investments. This will not usually be the case. For example, voting to support a take-over offer to be made by a company in which the scheme holds shares would not involve managing investments as it would not result in your acquiring or disposing of investments. Neither would voting on the re-appointment of company directors or auditors or on whether a company in whom the scheme holds shares should make a rights issue (although deciding to subscribe to the rights issue when it is made would amount to managing investments).

Deciding to accept an offer to buy company shares held by you under the scheme, in the context of a proposed take-over of that company, would involve managing investments. But the decision you make would be viewed as strategic and not a day-to-day decision.

Q17. When may a decision I make as an OPS trustee that results in my investing in a pooled investment vehicle other than an annuity be regarded as a strategic decision?

This will arise where the decision:

•represents the initial decision to invest the scheme wholly or to a substantial amount, and on an ongoing basis, in a particular vehicle such as a life policy or unit trust scheme (on the basis that an initial decision of this kind is of such importance to the scheme that it may be regarded as strategic); or

•may be seen to be a decision to appoint a discretionary fund manager.

Q18. When will a decision that I make as an OPS trustee be regarded as one to appoint a discretionary fund manager?

This will be the case when the decision:

•seeks to implement a strategic decision to invest part of the scheme assets in a particular area or asset class (such as venture capital or emerging markets);

•is based principally on the suitability of appointing the fund manager to manage that part of the scheme assets; and

•to use a pooled investment vehicle rather than a segregated portfolio is secondary to the decision to appoint the fund manager.

Where the circumstances surrounding the appointment of a fund manager suggest that the decision is day-to-day, you may still be able to make that decision. This is provided you meet the conditions for making decisions that involve taking and considering advice about investment in pooled investment vehicles (see Q8(3)).

Q19. As an unauthorised OPS trustee, I have made a decision to invest in an investment vehicle which allows me to switch between various sub-funds. Can I make decisions about switching between those sub-funds?

Yes. However, taking decisions of this kind other than to implement strategic decisions on asset allocation is likely to involve taking day-to-day decisions. So, you would need to meet the conditions for making decisions that involve taking and considering advice about investment in pooled investment vehicles (see Q8(3)).

Q20. I understand that, as an unauthorised trustee of a small self-administered scheme (a "SSAS") I can make day-to-day investment decisions. What types of scheme qualify as a SSAS?

There are two kinds of scheme that qualify as a SSAS. These are:

(1)an "insured SSAS" - that is an OPS:

•that has no more than 50 members; and

•where:

-the contributions made by or for each member are used in the acquisition of a contract of insurance or an annuity on the life of that member;

-the only decision to be made is the selection of the relevant contract; and

-each member has been given the opportunity to make that choice himself, whether or not he chooses to do so; and

(2)a "12 relevant member SSAS" - that is an OPS:

•with no more than 12 relevant members (broadly speaking, 'relevant members' are existing or former employees for whom contributions are being or have been made and for whom benefits under the scheme are or may become payable);

•that is established under an irrevocable trust;

•where all the relevant members are trustees of the scheme (except those who are unfit to act or incapable of acting as trustee); and

•where all day-to-day decisions relating to the management of the assets of the scheme which are securities or contractually based investments (other than decisions that satisfy the conditions involving taking and considering advice about investment in pooled investment vehicles - see Q8(3)) are required to be taken by:

-all or a majority of the relevant members who are trustees; or

-an authorised person or exempt person, in each case acting either alone or jointly with all or a majority of the relevant members.

Q21. My 12 relevant member SSAS requires that all day-to-day decisions are taken by the trustee beneficiaries. The SSAS has an independent trustee who is not a beneficiary or an authorised or exempt person. If the independent trustee takes a day-to-day decision in breach of the scheme's requirement, what effect does that have on him and on the relevant members?

The independent trustee's actions will not cause the trustee beneficiaries any regulatory difficulties, even though he has acted in breach of the requirements of the SSAS. This is because it is the existence of the requirement about day-to-day decision-making that is important and not whether it may be breached. The independent trustee may, as a result of having taken the decision, be regarded as managing the SSAS's investments. But whether or not this would be the case will depend on the particular circumstances in which the decision came to be made.

Q22. I am a trustee of a 12 relevant member SSAS but not a relevant member. My role requires me to monitor investments made by the scheme - won't I be drawn into making day-to-day decisions?

No. You should be able to perform your role in monitoring and, where necessary, objecting to particular transactions without needing authorisation. Merely operating a blocking vote where a certain proposed investment would, for whatever reason, be prohibited, would not be regarded as taking part in the decision to make, or to refrain from making, that investment. If you merely express a view as to whether or not a certain proposed investment would be permitted you would not, thereby, be making a decision to buy the investment. However, to reduce the risk of being drawn into making day-to-day decisions, you may wish to make a point of not participating in a vote except where the investment could not, in your view, be made without breaching the relevant requirements.

Q23. My company acts as the corporate trustee for a self-invested personal pension scheme ("SIPP"). Will it need to be authorised?

No, provided it is able to satisfy various exclusions. But note that, under government proposals for reforming the way in which personal pension schemes are permitted to be established and registered, it may need to be authorised by 6 April 2007 for operating a personal pension scheme - see HM Treasury's Consultation Document entitled "Proposed changes to the eligibility rules for establishing a pension scheme - A consultation document, September 2005". This is available on HM Treasury's website at: http://www.hm-treasury.gov.uk/consultations_and_legislation/pension_scheme/consult_pensionscheme_index.cfm. The document sets out several options and indicates that the Treasury's preferred option is to introduce a new regulated activity of establishing, operating or winding up a personal pension scheme other than a stakeholder pension scheme (where those activities are already regulated). The new regulated activity would come into force on 6 April 2007. At the same time, rights under a personal pension scheme would become an investment for the purposes of existing regulated activities such as dealing, arranging, managing investments and advising on investments. The FSA proposes to consult on further perimeter guidance about the changes to regulatory scope in this area during the course of 2006.Your company's position until April 2007will depend on a combination of the activities that it carries on and the availability of certain exclusions. These exclusions may also apply to trustees of pension schemes other than SIPPs with the exception of that for managing investments (which will not apply to a trustee of an OPS).

(1)Your company is likely to be dealing in investments as principal in entering into investment transactions on behalf of the trust. However, in general terms, it would avoid this if either:

But you will not be dealing in investments as agent merely because you commit co-trustees to a transaction by entering into it on behalf of the scheme.

•it is a bare trustee acting on the instructions of the member or his agent and it does not hold itself out as someone who provides a dealing service (see article 66(1) of the Regulated Activities Order); or

•it does not hold itself out to the public as someone who carries on business as a market maker or dealer in securities and, if it buys or sells contractually based investments, it only does so with or through a regulated person (see articles 15 and 16 of the Regulated Activities Order).

But you will not be dealing in investments as agent merely because you commit co-trustees to a transaction by entering into it on behalf of the scheme.

(2)Your company should not be arranging because this activity does not apply where a person arranges transactions to which he is to be a party (see articles 25 and 26 of the Regulated Activities Order).

(3)Your company is likely to be managing investments if it has discretionary control over the assets held under the trust. But it will not be managing investments if:

•it is acting solely on instructions from the members or from a fund manager or other agent appointed to instruct it on their behalf; or

•it is not holding itself out as an investment manager and is not remunerated for managing investments in addition to what it is paid for acting as trustee (see article 66(3) of the Regulated Activities Order).

(4)As trustee, your company is likely to be responsible for safeguarding and administering investments held as scheme assets. If it makes use of a specialist custodian it will be arranging safeguarding and administration of assets. These are potentially regulated activities. But they will not be if:

•your company is not holding itself out as a custodian and is not remunerated for providing custody services in addition to what it is paid for acting as trustee (see article 66(4) of the Regulated Activities Order); or

•(as respects arranging for another person to provide custody services) it delegates custody to a suitably authorised or exempt person (see article 66(4A) of the Regulated Activities Order).

(5)Your company will not be advising on investments unless it advises a prospective member on the merits of his buying or selling interests in securities or relevant investments to be held under the trust. If it gives advice to its co-trustees about trust investments or to existing members about their interests under the trust, its advice will be excluded provided it is not remunerated for giving the advice in addition to what it is paid for acting as trustee (see article 66(6) of the Regulated Activities Order).

Q24. My company acts as corporate trustee of a trust-based stakeholder pension scheme . Does it need to be authorised?

This depends on the responsibilities that your company assumes as trustee. Establishing, operating or winding up a stakeholder pension schemeare regulated activities in their own right. These are functions that are oftencarried out by the trustees of a trust-based stakeholder pensionscheme other than where the trustees are mere bare trustees. This is apart from establishing a scheme which is a function that may often be carried out by a third party such as a product provider. See Q25 to Q28 for further guidance on these activities.

Q25. What does establishing a stakeholder pension scheme involve?

The establisher of a personal pension scheme is the person responsible for putting in place the arrangements founding the scheme and registering it with HM Revenue & Customs. With a trust-based scheme, this will usually be the person who executes the trust as principal. In a scheme established by deed poll, it will usually be the person who enters into the deed poll. There will usually only be one person who establishes the scheme. Any professional firms that he may employ to act as his agent (such as solicitors) would not be establishing the scheme. The establisher may also be the operator but need not be. An employer will not be establishing a stakeholder pension scheme purely as a result of his having designated such a scheme to meet the statutory requirement to do so.

Q26. What does operating a stakeholder pension scheme involve?

The 'operator' is the person responsible, under the scheme's constitution, for ensuring continuing compliance with the management and administration requirements in respect of the assets and income of, and the benefits payable under, the scheme as imposed under relevant pensions and tax legislation. For example, with a trust-based scheme, the trustees will often be the operator by virtue of the responsibilities they assume under the trust deed. In situations where the trustees' role is merely to act as a bare trustee holding the scheme assets,it may be the case that there is a third party who has responsibility for the management and administration of the scheme and its assets and who will be the scheme's. The scheme may be established by an authorised person who acts as a provider of investment products or services to the scheme. This does not make that person the operator of the scheme if, as a matter of fact, he has appointed another person (such as a trustee) to carryout all of the operator's functions in his place.

Q27. What is my position as the operator of a stakeholder pension scheme if I delegate day-to-day functions such as administration of the scheme or management of the scheme assets to another person?

A person who accepts responsibility, and remains responsible, for carrying on a regulated activity is carrying on that activity even though he may delegate or outsource the day-to-day carrying out of the functions to another person. So, if the operator of a scheme delegates some or all of his functions to another person, he will still be the regulated operator of the scheme. At the same time, none of the people to whom he delegates his activities will become an operator of the scheme. However, they may be carrying on other regulated activities in performing their delegated or outsourced tasks (such as arranging or managing investments), in which case they will be subject to regulation for those activities.

Q28. What does winding-up a stakeholder pension scheme involve?

The person who winds-up a stakeholder pension scheme will be the person who is responsible for putting in place the arrangements for bringing the scheme to an end in a way that complies with the relevant provisions of the instrument that established the scheme and any relevant rules under pensions or tax legislation. This will, more often than not, be the operator of the scheme.

Q29. I am one of several trustees of a pension scheme. Sometimes I arrange an investment transaction on behalf of all the trustees but another trustee actually signs the purchase agreement and becomes the registered owner of the trust asset - does this mean that I could be regarded as arranging deals in investments on behalf of my fellow trustee?

No. You will not be arranging in these circumstances. This is because the interest that you acquire as trustee in the investment means that you will be regarded as being a party to the transaction. Arrangements made by a person in relation to transactions of which he is to be a party as principal or agent are excluded from arranging.

Q30. [Deleted]

- 06/10/2006

PERG 10.4

Pension scheme service providers other than trustees

- 06/05/2006

Q31. I provide administration services to pension schemes. Will I require authorisation or exemption?

Yes, if your services include any of the following activities and you cannot make use of an exclusion.

Q32. What are the exclusions that might apply to me as a pensions administration service provider?

One or more of the following exclusions might be available to you depending on the nature and scope of the services you provide:

Q33. How would the exclusions for dealing or arranging with or through an authorised person in articles 22 and 29 apply to me as a pensions administration service provider?

The exclusions will apply to you if:

So, the exclusions can apply to a transaction involving any investment other than rights under a contract of insurance. Given that many pension schemes invest wholly or partly in contracts of insurance, there may be limited occasions where articles 22 or 29 will exclude all dealing or arranging activity of this kind.

The requirement that you do not receive any payment other than from your client does not prevent you receiving payment from the authorised person but you must then treat the sums paid to you as belonging to your client. There is nothing to prevent you then using the sums to offset payments due to you from your client for services rendered to him. This is provided that you have your client's agreement to do so.

Q34. When will regulated activities form a necessary part of my pension administration services so that I can use the exclusion in article 67?

Broadly speaking, a regulated activity will form a necessary part of your pension administration service if you could not reasonably expect to be able to provide your non-regulated administration services to the scheme trustee or member without conducting the regulated activity. This may apply where you are simply arranging for the payment of regular contributions that the broker or product provider will apply in line with standing instructions. This would, for example, apply to you if you were to be providing payroll services.

There are further conditions that must be met for the exclusion to apply:

So, the exclusion cannot apply to you if you are providing a service that involves assisting in the conclusion or the administration and performance of contracts of insurance. But it may apply where you are providing other services relating to contracts of insurance (for example, arranging post-conclusion transactions such as surrenders or switches) or to other investments such as shares or unit trusts.

Q35. I provide pension administration services to a corporate pension scheme trustee who is a member of the same group as me. Does this mean that the exclusion for services provided to other group members in article 69 will apply to me?

Yes, provided the services:

If the services do relate to contracts of insurance, you are still unlikely to need authorisation because you will only be carrying out insurance mediation activities by way of business if you are remunerated for providing services to third parties. Members of your group are not considered to be third parties.

Q36. As an administration service provider, I have authority over the pension scheme trustees' bank account. Does this mean I have to be authorised?

No. Holding or controlling money belonging to a client is not, of itself, a regulated activity. It is only if you are holding or controlling the money in connection with performing a regulated activity that you will need to be authorised. This may arise, for example, if you are arranging investment transactions on behalf of the trustees and have authority to settle the transaction using funds in the trustees' bank account.

Q37. The trustees authorise me, as administration service provider, to determine how much money should be transferred for investment each month to ensure that the scheme has enough cash available to meet its obligations. Does this have regulatory implications for me?

No, unless it results in your concluding that there is a need to realise funds and instructing a broker or product provider to liquidate investments to do so. Should that happen, you are likely to be dealing in investments as agent or arranging subject to the possible availability of an exclusion such as that in article 29 of the Regulated Activities Order (see Q33). If you are able to exercise delegated powers to determine, on the trustees' behalf, which particular investments should be sold or surrendered, you are likely to be managing investments and need to be an authorised or exempt person.

Q38. My services to the pension trustees include advising them on investments and investment strategy. Is this likely to be regulated advice and mean that I must be authorised or exempt?

Yes, if the advice:

Q39. I give advice to the members of a pension scheme. Is this likely to be regulated advice and mean that I must be authorised or exempt?

It may be if the advice concerns a personal pension schemebut probably not if it concerns an OPS. The same factors apply to advice given to a member as apply to advice given to trustees (see Q38). But a particular factor is likely tobe whether the member is himself buying or selling a security or relevant investment (a "regulated investment").

With a trust-based pension scheme, the trustees will usually hold the legal title to the scheme's investments with the members having a beneficial interest in those investments. These beneficial interests may themselves be regulated investments (under article 89 of the Regulated Activities Order) that can be bought or sold by the member.

So, for example, the interests which a member may acquire in units or life policies held under a SIPP will amount to a regulated investment held by the investor, even though the legal title to the investments is held by the trustees on the member's behalf. Advice to the member on the merits of acquiring or disposing of those interests will then be regulated advice. But advice on the merits of acquiring or disposing of interests in other assets such as real property or cash will not be regulated advice.

Where an OPS is concerned, the interests obtained by members are specifically excluded from being regulated investments (see article 89(2) of the Regulated Activities Order). This means that a member of anOPS does not acquire a regulated investment simply through having additional voluntary contributions held under the trust for his benefit. So, advice to the member on the merits of his making additional voluntary contributions will not be regulated advice.

The position with stakeholder pension schemesis different. The rights under such a scheme (whether it is trust-based or contractual) are a specific type of regulated investment. So, advice on the merits of joining or leavinga stakeholder pensionscheme will be regulated advice. This is the case even if the scheme is also an OPS.

The rights or interests that a person acquires under free-standing additional voluntary contribution arrangements will be regulated investments if and to the extent that the underlying investments are securities or contractually based investments. Where this is the case, advice on the merits of making free-standing additional voluntary contributions will be regulated advice.

If operating a personal pension scheme becomes a regulated activity in line with the government's proposals (see Q23), the rights that a member obtains under any such scheme (including a SIPP) will become regulated investments in their own right and so advice on the merits of buying or selling such rights would be regulated.

Q40. I provide administration services to the providers of pension products such as insurers . Is my position any different to that of a person who provides administration services to pension scheme trustees?

Potentially, yes. This is because:

Q41. Does the fact that I provide administration services to the providers of pension products such as insurers on an outsourced basis and act in their name affect my position?

No. The need for authorisation or exemption depends on the nature of the activities that you carry on. The mere fact that you may carry on the services under your authorised client's name does not, of itself, remove the need for you to be authorised or exempt in your own right if the services you perform involve regulated activities.

Yes, if your services include any of the following activities and you cannot make use of an exclusion.

(1)Receiving instructions from the trustees or members about the buying or selling of trust investments (being securities or relevant investments) and then instructing a broker or product provider to effect the transaction. This is because you are likely to be arranging. This will include arranging for investments such as units in a unit trust scheme or in a life policy managed fund to be realised or surrendered to raise cash.

(2)Entering into investment transactions concerning securities or relevant investments on behalf of the trustees. This is because you will be dealing in investments as agent.

(3)

Assisting in the administration and performance of contracts of insurance. This will only be likely to apply if you handle claims under policies held by the scheme on behalf of the trustees or other policyholders. For example, if you were making a claim for benefits payable on the death of a member under the 'death in service' benefits provided by a pension scheme. To be carrying on this regulated activity you must be assisting the trustees in both the administration and performance. Whilst dealing with claims on the death of a scheme member is likely to involve assisting in the administration of the contract of insurance, it will only involve assisting in the performance if you assist the trustees, as policyholders, to satisfy a contractual obligation that they have under it. This will typically include assisting the trustees to notify the claim in the manner specified in the policy. Detailed guidance on this regulated activity is available in Chapter 5.7 of PERG.

(4)Arranging the appointment of a custodian on behalf of the trustees. This is because you will be arranging safeguarding and administration of assets. But you will not be doing so simply because you instruct a fund manager to buy investments which the fund manager will then safeguard and administer in accordance with pre-existing arrangements.

Services that typically will not involve any regulated activities include:

Services that typically will not involve any regulated activities include:

•maintaining records;

•liaising with tax authorities;

•arranging actuarial advice;

•paying over contributions to a product provider or fund manager for investment in line with pre-agreed instructions; and

•paying out benefits.

Q32. What are the exclusions that might apply to me as a pensions administration service provider?

One or more of the following exclusions might be available to you depending on the nature and scope of the services you provide:

•

dealing in investments as agent and arranging with or through an authorised person (articles 22 and 29 of the Regulated Activities Order);

•

dealing in investments as agent, arranging and advising on investments as a necessary part of providing other non-regulated services (article 67 of the Regulated Activities Order); and

•services provided to a member of your group (article 69 of the Regulated Activities Order).

Q33. How would the exclusions for dealing or arranging with or through an authorised person in articles 22 and 29 apply to me as a pensions administration service provider?

The exclusions will apply to you if:

•you are an unauthorised person;

•you are dealing in investments as agent or arranging on behalf of the pension scheme trustee or member (your 'client');

•the transaction into which you are entering or which you are arranging is either with an authorised product provider such as a unit trust manager or is effected by an authorised intermediary such as a stockbroker;

•you do not advise your client on the merits of his entering into the transaction;

•you are not paid by anyone other than your client; and

•the transaction does not involve contracts of insurance.

So, the exclusions can apply to a transaction involving any investment other than rights under a contract of insurance. Given that many pension schemes invest wholly or partly in contracts of insurance, there may be limited occasions where articles 22 or 29 will exclude all dealing or arranging activity of this kind.

The requirement that you do not receive any payment other than from your client does not prevent you receiving payment from the authorised person but you must then treat the sums paid to you as belonging to your client. There is nothing to prevent you then using the sums to offset payments due to you from your client for services rendered to him. This is provided that you have your client's agreement to do so.

Q34. When will regulated activities form a necessary part of my pension administration services so that I can use the exclusion in article 67?

Broadly speaking, a regulated activity will form a necessary part of your pension administration service if you could not reasonably expect to be able to provide your non-regulated administration services to the scheme trustee or member without conducting the regulated activity. This may apply where you are simply arranging for the payment of regular contributions that the broker or product provider will apply in line with standing instructions. This would, for example, apply to you if you were to be providing payroll services.

There are further conditions that must be met for the exclusion to apply:

•you must not be remunerated for the regulated activity separately from the remuneration you get from providing pension administration services; and

•you must not be a person who is required to be regulated by the Insurance Mediation Directive.

So, the exclusion cannot apply to you if you are providing a service that involves assisting in the conclusion or the administration and performance of contracts of insurance. But it may apply where you are providing other services relating to contracts of insurance (for example, arranging post-conclusion transactions such as surrenders or switches) or to other investments such as shares or unit trusts.

Q35. I provide pension administration services to a corporate pension scheme trustee who is a member of the same group as me. Does this mean that the exclusion for services provided to other group members in article 69 will apply to me?

Yes, provided the services:

•may properly be regarded as being provided solely to the trustee (as will be the case where the trustee has delegated or outsourced the carrying out of regulated activities to you but remains responsible to the members for the performance of those activities) and not to the members; and

•do not relate to contracts of insurance.

If the services do relate to contracts of insurance, you are still unlikely to need authorisation because you will only be carrying out insurance mediation activities by way of business if you are remunerated for providing services to third parties. Members of your group are not considered to be third parties.

Q36. As an administration service provider, I have authority over the pension scheme trustees' bank account. Does this mean I have to be authorised?

No. Holding or controlling money belonging to a client is not, of itself, a regulated activity. It is only if you are holding or controlling the money in connection with performing a regulated activity that you will need to be authorised. This may arise, for example, if you are arranging investment transactions on behalf of the trustees and have authority to settle the transaction using funds in the trustees' bank account.

Q37. The trustees authorise me, as administration service provider, to determine how much money should be transferred for investment each month to ensure that the scheme has enough cash available to meet its obligations. Does this have regulatory implications for me?

No, unless it results in your concluding that there is a need to realise funds and instructing a broker or product provider to liquidate investments to do so. Should that happen, you are likely to be dealing in investments as agent or arranging subject to the possible availability of an exclusion such as that in article 29 of the Regulated Activities Order (see Q33). If you are able to exercise delegated powers to determine, on the trustees' behalf, which particular investments should be sold or surrendered, you are likely to be managing investments and need to be an authorised or exempt person.

Q38. My services to the pension trustees include advising them on investments and investment strategy. Is this likely to be regulated advice and mean that I must be authorised or exempt?

Yes, if the advice:

•relates to a particular security or relevant investment such as the ABC unit trust scheme or the XYZ unit-linked insurance policy - advice on investment strategy or the choice of fund managers or brokers is not regulated advice;

•is advice and not simply information - so, there must be a recommendation to buy, sell or hold on to the particular investments;

•relates to the merits (that is the pros or cons) of buying or selling the particular investment; and

•is given to a person who is acting as an investor or who would enter into transactions as agent for the investor - so, advice to trustees about scheme investments will be given to them in their capacity as investors.

Q39. I give advice to the members of a pension scheme. Is this likely to be regulated advice and mean that I must be authorised or exempt?

It may be if the advice concerns a personal pension schemebut probably not if it concerns an OPS. The same factors apply to advice given to a member as apply to advice given to trustees (see Q38). But a particular factor is likely tobe whether the member is himself buying or selling a security or relevant investment (a "regulated investment").

With a trust-based pension scheme, the trustees will usually hold the legal title to the scheme's investments with the members having a beneficial interest in those investments. These beneficial interests may themselves be regulated investments (under article 89 of the Regulated Activities Order) that can be bought or sold by the member.

So, for example, the interests which a member may acquire in units or life policies held under a SIPP will amount to a regulated investment held by the investor, even though the legal title to the investments is held by the trustees on the member's behalf. Advice to the member on the merits of acquiring or disposing of those interests will then be regulated advice. But advice on the merits of acquiring or disposing of interests in other assets such as real property or cash will not be regulated advice.

Where an OPS is concerned, the interests obtained by members are specifically excluded from being regulated investments (see article 89(2) of the Regulated Activities Order). This means that a member of anOPS does not acquire a regulated investment simply through having additional voluntary contributions held under the trust for his benefit. So, advice to the member on the merits of his making additional voluntary contributions will not be regulated advice.

The position with stakeholder pension schemesis different. The rights under such a scheme (whether it is trust-based or contractual) are a specific type of regulated investment. So, advice on the merits of joining or leavinga stakeholder pensionscheme will be regulated advice. This is the case even if the scheme is also an OPS.

The rights or interests that a person acquires under free-standing additional voluntary contribution arrangements will be regulated investments if and to the extent that the underlying investments are securities or contractually based investments. Where this is the case, advice on the merits of making free-standing additional voluntary contributions will be regulated advice.

If operating a personal pension scheme becomes a regulated activity in line with the government's proposals (see Q23), the rights that a member obtains under any such scheme (including a SIPP) will become regulated investments in their own right and so advice on the merits of buying or selling such rights would be regulated.

Q40. I provide administration services to the providers of pension products such as insurers . Is my position any different to that of a person who provides administration services to pension scheme trustees?

Potentially, yes. This is because:

•you are unlikely to be assisting in the administration and performance of a contract of insurance because of the exclusion in article 39B of the Regulated Activities Order for persons who manage claims on behalf of a regulated insurer; and

•although you are likely to be carrying on dealing or arranging activities if you handle such things as arranging new policies, additional payments, surrenders, switches or assignments, some of the exclusions may not apply to you, for example:

-the exclusions in articles 22 and 29 of the Regulated Activities Order (see Q33) will not apply because you will be remunerated by the authorised person rather than by the trustee; and

-the exclusion in article 69 of the Regulated Activities Order (see Q35) will not apply because, as a group company of the insurer, you will not be providing services solely to it but also providing services directly to the trustees on behalf of the insurer.

Q41. Does the fact that I provide administration services to the providers of pension products such as insurers on an outsourced basis and act in their name affect my position?

No. The need for authorisation or exemption depends on the nature of the activities that you carry on. The mere fact that you may carry on the services under your authorised client's name does not, of itself, remove the need for you to be authorised or exempt in your own right if the services you perform involve regulated activities.

- 06/05/2006

PERG 10.4A

The application of EU Directives

- 06/10/2006

Q41A. Are pension scheme trustees and administration service providers likely to be subject to authorisation under the Investment Services Directive or subject to the Capital Adequacy Directive?

This is possible, but in many instances it is likely that pension scheme trustees and service providers will either not be providing an investment service for the purposes of, or otherwise be exempt under article 2.2 of, the Investment Services Directive . The following table expands on this in broad terms.

As for the Capital Adequacy Directive , this will only apply to persons who are ISD investment firms or BCD credit institutions .

Q41B. Will the implementation of the Markets in Financial Instruments Directive be likely to affect the current position of pension scheme trustees and administration service providers under the Investment Services Directive and the Capital Adequacy Directive?