PERG 1

Introduction to the Perimeter Guidance manual

PERG 1.1

Application and purpose

- 01/07/2005

Application

PERG 1.1.1

See Notes

- 01/07/2005

Purpose

PERG 1.1.2

See Notes

- 01/07/2005

PERG 1.2

Introduction

- 01/07/2005

PERG 1.2.1

See Notes

- 01/07/2005

PERG 1.2.2

See Notes

- 01/07/2005

PERG 1.2.3

See Notes

- 01/11/2007

PERG 1.2.4

See Notes

- 01/07/2005

PERG 1.3

Status of guidance

- 01/07/2005

PERG 1.3.1

See Notes

- 01/07/2005

PERG 1.4

General guidance to be found in PERG

- 01/07/2005

PERG 1.4.1

See Notes

- 01/07/2005

PERG 1.4.2

See Notes

| Chapter: | Applicable to: | About: |

|

PERG 2: Authorisation and regulated activities |

•an unauthorised person wishing to find out whether he needs to be authorised or exempt• an authorised person wishing to know whether he needs to vary his

Part IV permission

|

• the regulatory scope of the Act• the Regulated Activities Order•the Exemption Order•the Business Order

|

|

PERG 3A: Guidance on the scope of the Electronic Money Regulations | a person who needs to know • whether a particular electronic payment product iselectronic money and whether the person issuing it needs to be authorised or registered under the Electronic Money Regulations |

• the scope of the

Electronic Money Regulations

|

|

PERG 4: Regulated activities connected with mortgages | any person who needs to know whether the activities he conducts in relation to mortgages are subject to

FSA

regulation. This is likely to include: •lenders•administration service providers•mortgage brokers and advisers | the scope of relevant orders (in particular, the Regulated Activities Order) as respects activities concerned with mortgages |

|

PERG 5: Insurance mediation activities | any person who needs to know whether he carries on insurance mediation activities and is, thereby, subject to

FSA

regulation. This is likely to include: •insurance brokers• insurance advisers•insurance undertakings• other persons involved in the sale or administration of contracts of insurance, where these activities are secondary to their main business. | the scope of relevant orders (in particular, the Regulated Activities Order) as respects activities concerned with the sale or administration of insurance |

|

PERG 6: Identification of contracts of insurance | any person who needs to know whether a contract with which he is involved is a contract of insurance | the general principles and range of specific factors that the

FSA

regards as relevant in deciding whether any arrangement is a contract of insurance |

|

PERG 7: Periodical publications, news services and broadcasts: application for certification | any person who needs to know whether he will be regulated for providing advice about investments through the medium of a periodical publication, a broadcast or a news service |

• the circumstances in which such persons will be carrying on the regulated activities of advising on investments or advising on regulated mortgage contracts (including where a request for a certificate may be appropriate)•how the

FSA

will exercise its power to grant certificates

|

|

PERG 8: Financial promotion and related activities | any person who needs to know •whether his communications are financial promotions or are subject to the restriction in section 21 of the Act or both•whether his activities in making or helping others to make financial promotions are regulated activities. |

•the scope of the restriction on financial promotion under section 21 of the Act and the main exemptions provided•the circumstances in which persons who are primarily involved in making or helping others to make financial promotions may themselves be conducting regulated activities requiring authorisation or exemption

|

|

PERG 9: Meaning of open-ended investment company | any person who needs to know whether a body corporate is an open-ended investment company as defined in section 236 of the Act (Open-ended investment companies) and is therefore a collective investment scheme. | the circumstances in which a body corporate will be an open-ended investment company |

|

PERG 10: Activities related to pension schemes | Any person who needs to know whether his activities in relation to pension schemes will amount to regulated activities or whether the restriction in section 21 of the Act will apply to any financial promotions he may make. |

•the regulated activities that arise in connection with the establishment and operation of pension schemes and any exclusions that may be relevant

•the circumstances in which financial promotions about pension schemes may be exempt from the restriction in section 21 of the Act

|

|

PERG 11: Property investment clubs and land investment schemes | Any person who needs to know whether his activities in relation to property investment clubs and land investment schemes will amount to regulated activities or whether the restriction in section 21 of the Act will apply to any financial promotions he may make. |

•the regulated activities that may arise in connection with the establishment and operation of property investment clubs and land investment schemes and any exclusions that may be relevant

|

|

PERG 12: Running or advising on personal pension schemes | any person who needs to know whether his activities in relation to establishing, running, advising on or marketing personal pension schemes will amount to regulated activities | the regulated activities that arise in connection with establishing, running, advising on or marketing personal pension schemes and any exclusions that may be relevant |

|

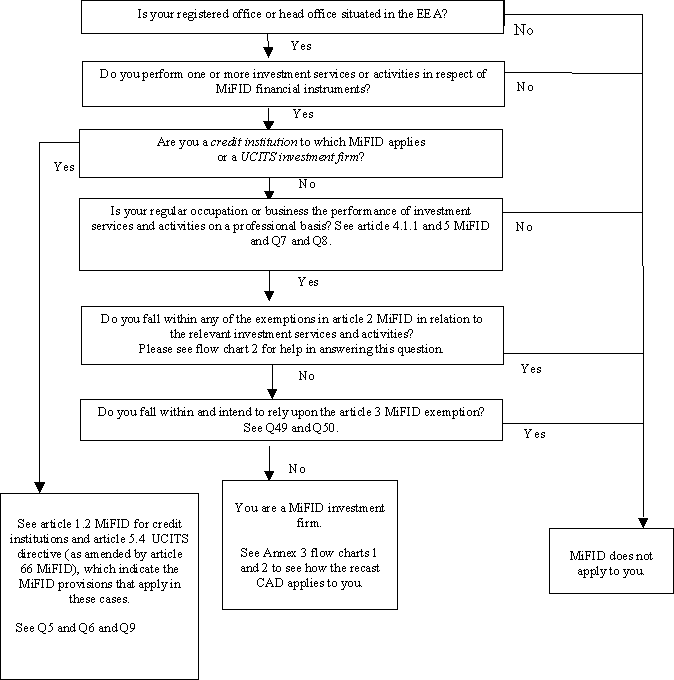

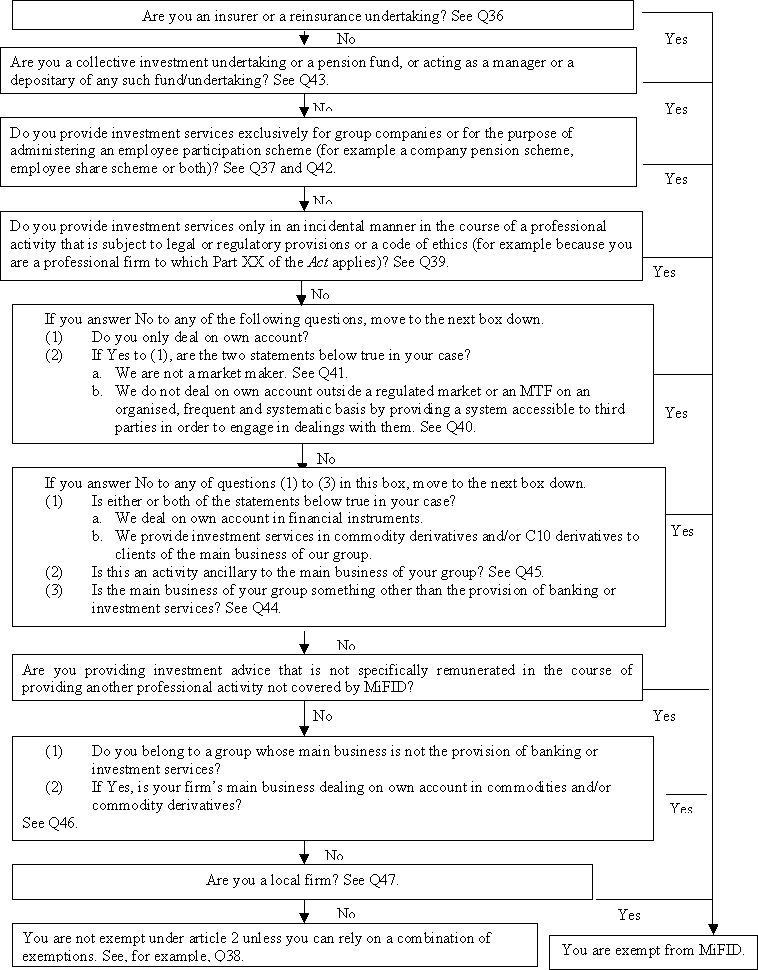

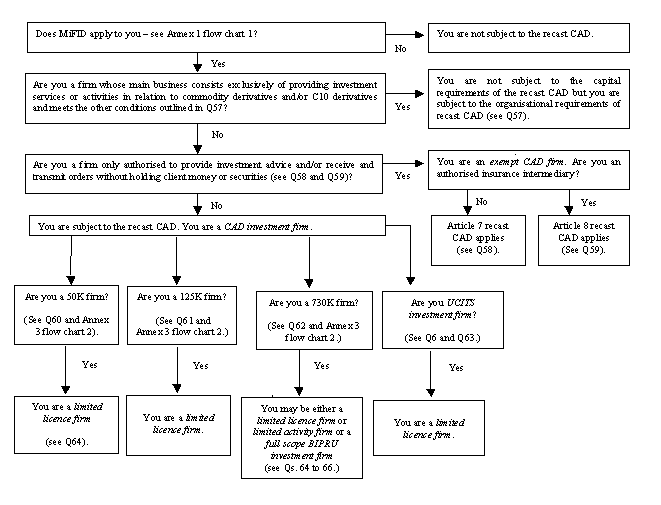

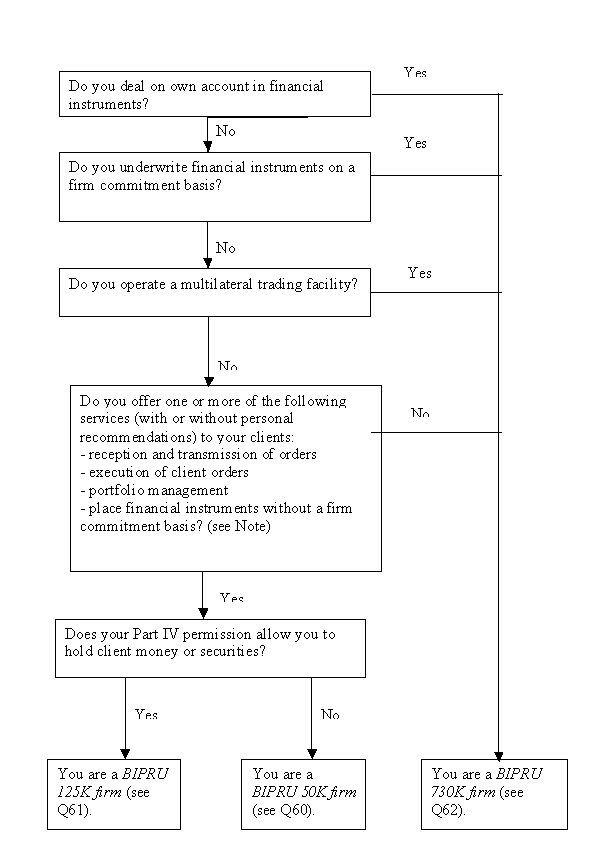

PERG 13: Guidance on the scope of the Markets in Financial Instruments Directive and the recast Capital Adequacy Directive | Any UKperson who needs to know whether MiFID or the recast CADas implemented in the UK apply to him | the scope of MiFID and the recast CAD |

|

PERG 14: Home reversion, home finance and regulated sale and rent back activities | Any person who needs to know whether his activities in relation to home reversion plans, home purchase plans or regulated sale and rent back agreementswill amount to regulated activities or whether the restriction in section 21 of the Act will apply to any financial promotions he may make. |

•the regulated activities that arise in connection with home reversion plans,

home purchase plans

and regulated sale and rent back agreementsand any exclusions that may be relevant•the circumstances in which financial promotions about home reversion plans,

home purchase plans

and regulated sale and rent back agreementsmay be made without breaching the restriction in section 21 of the Act

|

| PERG 15: Guidance on the scope of the Payment Services Regulations 2009 | Any person with an establishment in the UK who needs to know whether the Payment Services Directive, as transposed in UK legislation by the Payment Services Regulations 2009, applies to him. Q46 applies specifically to persons providing payment services from an establishment outside the EEA to persons located in the UK. | the scope of the PSD Regulations 2009. |

- 10/02/2011

PERG 1.5

What other guidance about the perimeter is available from the FSA?

- 01/07/2005

PERG 1.5.1

See Notes

- 06/10/2010

PERG 1.5.2

See Notes

- 01/07/2005

PERG 1.5.3

See Notes

- 01/07/2005

PERG 1.5.4

See Notes

- 01/07/2005

PERG 2

Authorisation and regulated activities

PERG 2.1

Application and purpose

- 01/07/2005

Application

PERG 2.1.1

See Notes

- 01/07/2005

Purpose

PERG 2.1.2

See Notes

- 01/07/2005

PERG 2.2

Introduction

- 01/07/2005

PERG 2.2.1

See Notes

- 06/10/2007

PERG 2.2.2

See Notes

- 01/07/2005

PERG 2.2.3

See Notes

- 06/02/2008

PERG 2.2.4

See Notes

- 01/11/2007

PERG 2.2.5

See Notes

- 06/10/2007

PERG 2.3

The business element

- 01/07/2005

PERG 2.3.1

See Notes

- 01/07/2005

PERG 2.3.2

See Notes

- 09/12/2011

PERG 2.3.3

See Notes

- 01/07/2005

PERG 2.4

Link between activities and the United Kingdom

- 01/07/2005

PERG 2.4.1

See Notes

- 01/07/2005

PERG 2.4.2

See Notes

- 01/07/2005

PERG 2.4.3

See Notes

- 01/11/2007

PERG 2.4.4

See Notes

- 01/07/2005

PERG 2.4.5

See Notes

- 01/07/2005

PERG 2.4.6

See Notes

- 01/07/2005

PERG 2.4.7

See Notes

- 01/07/2005

PERG 2.5

Investments and activities: general

- 01/07/2005

PERG 2.5.1

See Notes

- 01/07/2005

PERG 2.5.2

See Notes

- 01/07/2005

Modification of certain exclusions as a result of MiFIDand theInsurance Mediation Directives

PERG 2.5.3

See Notes

- 01/11/2007

Investment services and activities

PERG 2.5.4

See Notes

- 01/11/2007

PERG 2.5.4A

- 01/11/2007

PERG 2.5.5

See Notes

- 01/11/2007

Insurance mediation or reinsurance mediation

PERG 2.5.6

See Notes

- 01/07/2005

PERG 2.6

Specified investments: a broad outline

- 01/07/2005

PERG 2.6.1

See Notes

- 01/07/2005

Deposits

PERG 2.6.2

See Notes

- 01/07/2005

PERG 2.6.3

See Notes

- 10/02/2011

PERG 2.6.4

See Notes

- 01/07/2005

Electronic money

PERG 2.6.4A

See Notes

- 10/02/2011

Rights under a contract of insurance

PERG 2.6.5

See Notes

- 01/07/2005

PERG 2.6.6

See Notes

- 01/07/2005

PERG 2.6.7

See Notes

- 01/07/2005

PERG 2.6.8

See Notes

- 01/07/2005

Shares etc

PERG 2.6.9

See Notes

- 01/07/2005

PERG 2.6.10

See Notes

- 01/07/2005

Debt instruments

PERG 2.6.11

See Notes

An instrument cannot fall within both categories of specified investments relating to debt instruments. 'Instrument' is defined to include any record whether or not in the form of a document (see article 3(1) of the Regulated Activities Order).

- 01/07/2005

Alternative finance investment bonds

PERG 2.6.11A

See Notes

- 26/02/2010

PERG 2.6.11B

See Notes

- 26/02/2010

PERG 2.6.11C

See Notes

- 26/02/2010

PERG 2.6.11D

See Notes

- 26/02/2010

PERG 2.6.11E

See Notes

- 26/02/2010

PERG 2.6.11F

See Notes

- 26/02/2010

PERG 2.6.11G

See Notes

- 26/02/2010

PERG 2.6.11H

See Notes

| Example ABC Ltd is a property development company. It wishes to increase its portfolio on a short-term basis. It issues 5-year sukuk to investors and uses the proceeds to buy the head lease of a commercial property. The rental income from the lease is distributed to investors in proportion to their holdings without a cap on the level of return. After 5 years, the head lease is sold on at a profit and the proceeds shared between investors. In this example, the investors participate directly in the success or failure of the underlying property business. The sakk is not really in the nature of a debt instrument. It is unlikely to be an alternative debenture as: (a) additional payments under the arrangements would exceed a reasonable commercial return on a loan of the capital.

Further, where the return is not fixed at the outset, it is the maximum possible amount of the additional payments that must be considered. Here, the issue terms of the sukuk impose no upper limit on the amount of the periodic distributions: a sakk holder subscribing 1,000 may, in a year, get back 200 or 2,000 or nothing depending on the rental market. The maximum potential return is clearly in excess of a reasonable commercial return on a loan of 1,000; and (b) the arrangements have not been admitted to an official list or admitted to trading on a regulated market or recognised investment exchange (see PERG 2.6.11CG (6)). |

- 26/02/2010

PERG 2.6.12

See Notes

- 26/02/2010

Warrants

PERG 2.6.13

See Notes

- 26/02/2010

PERG 2.6.14

See Notes

- 01/07/2005

Certificates representing securities

PERG 2.6.15

See Notes

- 01/07/2005

PERG 2.6.16

See Notes

- 01/07/2005

Units

PERG 2.6.17

See Notes

- 01/10/2005

PERG 2.6.18

See Notes

- 01/07/2005

Rights under a pension scheme

PERG 2.6.19

See Notes

- 06/04/2007

PERG 2.6.19A

See Notes

- 06/04/2007

PERG 2.6.19B

See Notes

- 06/04/2007

PERG 2.6.19C

See Notes

- 06/04/2007

Options

PERG 2.6.20

See Notes

- 01/11/2007

PERG 2.6.20A

See Notes

- 01/11/2007

Futures

PERG 2.6.21

See Notes

- 01/07/2005

PERG 2.6.22

See Notes

- 01/07/2005

PERG 2.6.22A

See Notes

- 01/11/2007

See article 84(1A)-(1D) of the Regulated Activities Order

PERG 2.6.22B

See Notes

- 01/11/2007

Contracts for differences

PERG 2.6.23

See Notes

- 01/11/2007

PERG 2.6.23A

See Notes

- 01/11/2007

PERG 2.6.24

See Notes

- 01/07/2005

Lloyd's investments

PERG 2.6.25

See Notes

- 01/07/2005

Rights under a funeral plan

PERG 2.6.26

See Notes

- 01/07/2005

Rights under a regulated mortgage contract

PERG 2.6.27

See Notes

Detailed guidance on this is set out in PERG 4.4 (Guidance on regulated activities connected with mortgages).

- 01/07/2005

Rights under a home reversion plan

PERG 2.6.27A

See Notes

- 06/04/2007

Rights under a home purchase plan

PERG 2.6.27B

See Notes

- 06/04/2007

Rights under a regulated sale and rent back agreement

PERG 2.6.27C

See Notes

but excluding any arrangement that is a regulated home reversion plan.

Detailed guidance on this is set out in PERG 14.4A (Activities relating to regulated sale and rent back agreements).

- 30/06/2010

PERG 2.6.28

See Notes

- 06/04/2007

PERG 2.6.29

See Notes

- 01/07/2005

PERG 2.7

Activities: a broad outline

- 01/07/2005

PERG 2.7.1

See Notes

- 01/07/2005

Accepting deposits

PERG 2.7.2

See Notes

- 01/07/2005

Issuing electronic money

PERG 2.7.2A

See Notes

- 10/02/2011

Effecting or carrying out contracts of insurance as principal

PERG 2.7.3

See Notes

- 01/07/2005

PERG 2.7.4

See Notes

PERG 5 (Insurance mediation activities) has more guidance on these regulated activities where they are insurance mediation activities.

- 01/07/2005

Dealing in investments (as principal or agent)

PERG 2.7.5

See Notes

- 01/07/2005

PERG 2.7.6

See Notes

- 01/07/2005

PERG 2.7.6A

See Notes

- 01/07/2005

Arranging deals in investments and arranging a home finance transaction

PERG 2.7.7

See Notes

- 01/07/2005

PERG 2.7.7A

See Notes

- 30/06/2010

PERG 2.7.7B

See Notes

- 30/06/2010

PERG 2.7.7BA

See Notes

- 06/08/2009

PERG 2.7.7BB

See Notes

- 06/08/2009

PERG 2.7.7BC

See Notes

- 06/08/2009

PERG 2.7.7BD

See Notes

- 06/08/2009

PERG 2.7.7BE

See Notes

- 06/08/2009

PERG 2.7.7BF

See Notes

- 06/08/2009

PERG 2.7.7C

See Notes

- 06/04/2007

Operating a multilateral trading facility

PERG 2.7.7D

See Notes

- 01/11/2007

Managing investments

PERG 2.7.8

See Notes

- 01/07/2005

Assisting in the administration and performance of a contract of insurance

PERG 2.7.8A

See Notes

- 01/07/2005

Safeguarding and administering investments

PERG 2.7.9

See Notes

- 01/07/2005

PERG 2.7.10

See Notes

- 01/07/2005

Sending dematerialised instructions

PERG 2.7.11

See Notes

- 01/07/2005

Establishing etc collective investment schemes

PERG 2.7.12

See Notes

- 01/04/2009

PERG 2.7.13

See Notes

In addition, express provision is included in the Regulated Activities Order to make acting as trustee of an authorised unit trust scheme a regulated activity. The full picture for authorised schemes (that is, schemes that can be promoted to the public) is as follows:

- (1) Acting as trustee of an authorised unit trust scheme is expressly included as a regulated activity.

- (2) Acting as depositary of an open-ended investment company that is authorised under regulations made under section 262 of the Act (Open-ended investment companies), is a regulated activity.

- (3) Acting as a sole director of such a company is a regulated activity.

- (4) Managing an authorised unit trust scheme will amount to operating the scheme and so will be a regulated activity. A person acting as manager is also likely to be carrying on other regulated activities (such as dealing (see PERG 2.7.5 G) or managing investments (see PERG 2.7.8 G)).

- (5) An open-ended investment company will, once it is authorised under regulations made under section 262 of the Act, become an authorised person in its own right under Schedule 5 to the Act (Persons concerned in Collective Investment Schemes). Under ordinary principles, a company operates itself and an authorised open-ended investment company will be operating the collective investment scheme constituted by the company. It is not required to go through a separate process of authorisation as a person because it has already undergone the process of product authorisation.

- (6) Operators, trustees or depositaries of UCITS schemes constituted in other EEA States are also authorised persons under Schedule 5 of the Act if those schemes qualify as recognised collective investment schemes for the purposes of section 264 of the Act.

- 01/07/2005

PERG 2.7.13C

where, in either case, the scheme or company is a UCITS.

- 01/07/2005

Establishing etc pension schemes

PERG 2.7.14

See Notes

- 06/04/2007

Providing basic advice on stakeholder products

PERG 2.7.14A

See Notes

- 01/07/2005

PERG 2.7.14B

See Notes

- 01/07/2005

Advising on investments

PERG 2.7.15

See Notes

- 01/07/2005

PERG 2.7.16

See Notes

- 01/07/2005

PERG 2.7.16A

See Notes

- 01/07/2005

Advising on regulated mortgage contracts

PERG 2.7.16B

See Notes

Advice on varying terms as referred to in (2) comes within article 53A only where the borrower entered into the regulated mortgage contract on or after 31 October 2004 and the variation varies the borrower's obligations under the contract. Further guidance on the scope of the regulated activity under article 53A is in PERG 4.6 (Advising on regulated mortgage contracts).

- 01/07/2005

Advising on home reversion plans

PERG 2.7.16C

See Notes

- 06/04/2007

Advising on a home purchase plan

PERG 2.7.16D

See Notes

- 06/04/2007

Advising on regulated sale and rent back agreements

PERG 2.7.16E

See Notes

- 30/06/2010

Lloyd's activities

PERG 2.7.17

See Notes

- 01/07/2005

Entering funeral plan contracts

PERG 2.7.18

See Notes

- 01/07/2005

PERG 2.7.19

See Notes

- 01/07/2005

Entering into and administering a regulated mortgage contract

PERG 2.7.20

See Notes

- 01/07/2005

Entering into and administering a home reversion plan

PERG 2.7.20A

See Notes

- 06/04/2007

Entering into and administering a home purchase plan

PERG 2.7.20B

See Notes

- 06/04/2007

Entering into and administering a regulated sale and rent back agreement

PERG 2.7.20BA

See Notes

- 30/06/2010

Dormant account funds

PERG 2.7.20C

See Notes

- 06/08/2009

Agreeing

PERG 2.7.21

See Notes

- 10/02/2011

PERG 2.8

Exclusions applicable to particular regulated activities

- 01/07/2005

PERG 2.8.1

See Notes

- 01/07/2005

Accepting deposits

PERG 2.8.2

See Notes

- 01/07/2005

Effecting and carrying out contracts of insurance

PERG 2.8.3

See Notes

- 01/07/2005

Dealing in investments as principal

PERG 2.8.4

See Notes

The regulated activity of dealing in investments as principal applies to specified transactions relating to any security or to any contractually based investment (apart from rights under funeral plan contracts or rights to or interests in such contracts). The activity is cut back by exclusions as follows.

- (1) Of particular significance is the exclusion in article 15 of the Regulated Activities Order (Absence of holding out etc). This applies where dealing in investments as principal involves entering into transactions relating to any security or assigning rights under a life policy (or rights or interests in such a contract). In effect, it superimposes an additional condition that must be met before a person's activities become regulated activities. The additional condition is that a person must hold himself out as making a market in the relevant specified investments or as being in the business of dealing in them, or he must regularly solicit members of the public with the purpose of inducing them to deal. This exclusion does not apply to dealing activities that relate to any contractually based investment except the assigning of rights under a life policy.

- (2) Entering into a transaction relating to a contractually based investment is not regulated if the transaction is entered into by an unauthorised person and it takes place in either of the following circumstances (a transaction entered into by an authorised person would be caught). The first set of circumstances is where the person with whom the unauthorised person deals is either an authorised person or an exempt person who is acting in the course of a business comprising a regulated activity in relation to which he is exempt. The second set of circumstances is where the unauthorised person enters into a transaction through a non-UK office (which could be his own) and he deals with or through a person who is based outside the United Kingdom. This non-UK person must be someone who, as his ordinary business, carries on any of the activities relating to securities or contractually based investments that are generally treated as regulated activities.

- (3) A person (for example, a bank) who provides another person with finance for any purpose can accept an instrument acknowledging the debt (and as security for it) without risk of dealing as principal as a result.

- (4) A company does not deal as principal by issuing its own shares or share warrants and a person does not deal as principal by issuing his own debentures, alternative debentures or debenture warrants or alternative debenture warrants.

- (4A) A company does not carry on the activity of dealing in investments as principal by purchasing its own shares where section 162A of the Companies Act 1985 (Treasury shares) applies to the shares purchased or by dealing in its own shares held as Treasury shares, in accordance with section 162D of that Act (Treasury shares: disposal and cancellation).

- (5) Risk-management activities involving options, futures and contracts for differences will not require authorisation if specified conditions are met. The conditions include the company's business consisting mainly of unregulated activities and the sole or main purpose of the risk management activities being to limit the impact on that business of certain kinds of identifiable risk.

- (6) A person will not be treated as carrying on the activity of dealing in investments as principal if, in specified circumstances (outlined in PERG 2.9), he enters as principal into a transaction:

- (a) while acting as bare trustee (or, in Scotland, as nominee);

- (b) in connection with the sale of goods or supply of services;

- (c) that takes place between members of a group or joint enterprise;

- (d) in connection with the sale of a body corporate;

- (e) in connection with an employee share scheme;

- (f) as an overseas person;

- (g) as an incoming ECA provider (see PERG 2.9.18 G).

- 26/02/2010

PERG 2.8.4A

See Notes

- 01/07/2005

PERG 2.8.4B

See Notes

- 01/07/2005

PERG 2.8.4C

See Notes

- 01/11/2007

Dealing in investments as agent

PERG 2.8.5

See Notes

More detailed guidance on the exclusions that relate to contracts of insurance is in PERG 5 (Insurance mediation activities).

- 06/10/2006

PERG 2.8.5A

See Notes

- 01/11/2007

Arranging deals in investments and arranging a home finance transaction

PERG 2.8.6

See Notes

- 30/06/2010

PERG 2.8.6A

See Notes

- 30/06/2010

PERG 2.8.6B

See Notes

- 01/11/2007

Managing investments

PERG 2.8.7

See Notes

- 01/11/2007

Assisting in the administration and performance of a contract of insurance

PERG 2.8.7A

See Notes

The term 'relevant insurer' is defined in article 39B(2).

- 01/07/2005

PERG 2.8.7B

See Notes

- 01/07/2005

Safeguarding and administering investments

PERG 2.8.8

See Notes

- 06/10/2006

Sending dematerialised instructions

PERG 2.8.9

See Notes

- 01/07/2005

Establishing etc collective investment schemes

PERG 2.8.10

See Notes

- 01/10/2005

Establishing etc pension schemes

PERG 2.8.11

See Notes

- 06/04/2007

Advising on investments

PERG 2.8.12

See Notes

- 30/06/2010

PERG 2.8.12A

See Notes

- 30/06/2010

PERG 2.8.12B

See Notes

- 01/11/2007

Lloyd's activities

PERG 2.8.13

See Notes

- 01/07/2005

Entering funeral plan contracts

PERG 2.8.14

See Notes

- 01/07/2005

Administering regulated mortgage contracts

PERG 2.8.14A

See Notes

- 30/06/2010

PERG 2.8.14B

See Notes

- 30/06/2010

Agreeing

PERG 2.8.15

See Notes

- 01/07/2005

PERG 2.8.16

See Notes

- 01/07/2005

PERG 2.9

Regulated activities: exclusions applicable in certain circumstances

- 01/07/2005

PERG 2.9.1

See Notes

- 10/02/2011

PERG 2.9.2

See Notes

- 01/07/2005

Trustees, nominees or personal representatives

PERG 2.9.3

See Notes

The exclusion is, however, disapplied where a person is carrying on insurance mediation or reinsurance mediation . This is due to article 4(4A) of the Regulated Activities Order. Guidance on exclusions relevant to insurance mediation activities is in PERG 5 (Insurance mediation activities).

- 06/04/2007

PERG 2.9.4

See Notes

- 30/06/2010

Professions or business not involving regulated activities

PERG 2.9.5

See Notes

The exclusion is, however, disapplied where a person is carrying on insurance mediation or reinsurance mediation. This is due to article 4(4A) of the Regulated Activities Order. Guidance on exclusions relevant to insurance mediation activities is in PERG 5 (Insurance mediation activities). The exclusion is also disapplied for persons who, when carrying on the relevant regulated activity, are MiFID investment firms or third country investment firms (see PERG 2.5.4 G to PERG 2.5.5 G (Investment services and activities)).

- 01/11/2007

PERG 2.9.6

See Notes

- 01/07/2005

Sale of goods and supply of services

PERG 2.9.7

See Notes

- 01/07/2005

PERG 2.9.8

See Notes

- 01/11/2007

Group and joint enterprises

PERG 2.9.9

See Notes

- 01/07/2005

PERG 2.9.10

See Notes

- 01/11/2007

Sale of body corporate

PERG 2.9.11

See Notes

- 01/07/2005

PERG 2.9.12

See Notes

These exclusions also apply to transactions that are entered into for the purposes of the above transactions (such as transactions involving the offer of securities in the offeror as consideration or part consideration for the sale of the shares in the body corporate). These exclusions do not have effect in relation to shares in an open-ended investment company. The exclusions in PERG 2.9.11G (2), (3) and (4) are disapplied where they concern a contract of insurance. Guidance on exclusions relevant to insurance mediation activities is in PERG 5 (Guidance on insurance mediation activities). The exclusions are also disapplied for persons who, when carrying on the relevant regulated activity, are MiFID investment firms or third country investment firms (see PERG 2.5.4 G to PERG 2.5.5 G (Investment services and activities)).

- 01/11/2007

PERG 2.9.12A

See Notes

- 01/10/2005

Employee share schemes

PERG 2.9.13

See Notes

- 01/07/2005

PERG 2.9.14

See Notes

- 01/11/2007

Overseas persons

PERG 2.9.15

See Notes

- 01/11/2007

PERG 2.9.16

See Notes

- 01/11/2007

PERG 2.9.17

See Notes

- 06/04/2007

PERG 2.9.17A

See Notes

- 30/06/2010

Incoming ECA providers

PERG 2.9.18

See Notes

- 01/11/2007

Insurance mediation activities

PERG 2.9.19

See Notes

Guidance on these and other exclusions relevant to insurance mediation activities is in PERG 5 (Insurance mediation activities).

- 01/01/2009

Business angel-led enterprise capital funds

PERG 2.9.20

See Notes

- 01/10/2005

PERG 2.9.21

See Notes

- 01/10/2005

PERG 2.9.21A

See Notes

- 01/11/2007

PERG 2.10

Persons carrying on regulated activities who do not need authorisation

- 01/07/2005

PERG 2.10.1

See Notes

- 01/07/2005

PERG 2.10.2

See Notes

- 01/07/2005

PERG 2.10.3

See Notes

- 01/07/2005

PERG 2.10.4

See Notes

- 01/07/2005

Appointed representatives

PERG 2.10.5

See Notes

- 01/07/2005

Recognised Investment Exchanges, Recognised Clearing Houses and Recognised Auction Platforms

PERG 2.10.6

See Notes

- 22/12/2011

Particular exempt persons

PERG 2.10.7

See Notes

- 01/07/2005

PERG 2.10.8

See Notes

- 01/07/2005

Members of Lloyd's

PERG 2.10.9

See Notes

- 01/07/2005

PERG 2.10.10

See Notes

- 01/07/2005

PERG 2.10.11

See Notes

- 01/07/2005

Members of the professions

PERG 2.10.12

See Notes

- 01/07/2005

PERG 2.10.13

See Notes

- 01/07/2005

PERG 2.10.14

See Notes

- 06/04/2007

PERG 2.10.15

See Notes

- 06/04/2007

PERG 2.10.16

See Notes

- 01/07/2005

PERG 2.11

What to do now ?

- 01/07/2005

PERG 2.11.1

See Notes

- 06/10/2007

PERG 2.11.2

See Notes

- 01/11/2007

PERG 2.11.3

See Notes

- 01/11/2007

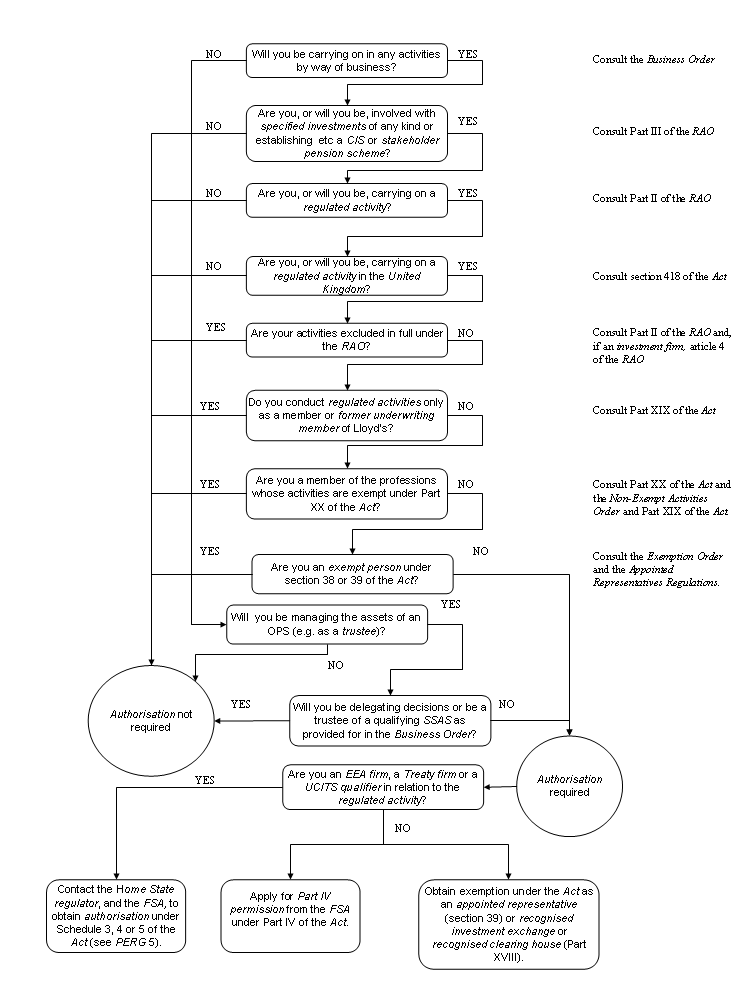

PERG 2 Annex 1

Authorisation and regulated activities

- 01/07/2005

PERG 2 Annex 1

See Notes

- 01/07/2005

PERG 2 Annex 2

Regulated activities and the permission regime

- 01/07/2005

See Notes

| 1.1 G | Table 1 is designed to relate the permission regime to regulated activities. Section 42(6)of the Act gives the FSA the power to describe the regulated activity or regulated activities for which it gives permission in such manner as the FSA considers appropriate. Table 1 details how the FSA has chosen to describe the regulated activities and specified investments for the purposes of the permission regime. | |

| 1.2 G | In an application for Part IV permission , an applicant will need to state the regulated activities it requires permission to carry on. This will involve an applicant identifying the regulated activities and the specified investments associated with those activities for which it requires Part IV permission. | |

1.3 G | Part II of the Regulated Activities Order (Specified activities) specifies the activities for the purposes of section 22 of the Act. This section states that an activity is a regulated activity if it is an activity of a specified kind which is carried on by way of business and: | |

| (1) | relates to an investment of a specified kind; or | |

| (2) | in the case of an activity specified for the purposes of section 22(1)(b) of the Act, is carried on in relation to property of any kind. | |

Part III of the Regulated Activities Order (Specified investments) specifies the investments referred to in (1). | ||

| 1.4 G | Column 1 of Table 1 lists the regulated activities and column 2 lists the associated specified investments. Descriptions of some categories of specified investments are expanded in Tables 2 and 3. There are notes to all three tables which provide further explanation where appropriate. | |

| 1.5 G | A reference to an article in the tables in PERG 2 Annex 2 G is to the relevant article in the Regulated Activities Order. | |

2 Table

3 Table

| Notes to Table 1 |

| Note 1: In addition to the regulated activities listed in Table 1, article 64 of the Regulated Activities Order specifies that agreeing to carry on a regulated activity is itself a regulated activity in certain cases. This applies in relation to all the regulated activities listed in Table 1 apart from: •accepting deposits (article 5);•issuing electronic money (article 9B);•effecting and carrying out contracts of insurance (article 10);•operating a multilateral trading facility (article 25D)•establishing, operating or winding up a collective investment scheme (article 51(1)(a));•acting as trustee of an authorised unit trust scheme (article 51(1)(b));•acting as the sole depositary or sole director of an open-ended investment company (article 51(1)(c));•establishing, operating or winding up a stakeholder pension schemeor establishing operating or winding up a personal pension scheme(article 52): and •the meeting of repayment claims and/or managing dormant account funds (including the investment of such funds) (article 63N). |

| Permission to carry on the activity of agreeing to carry on a regulated activity will be given automatically by the FSA in relation to those other regulated activities for which an applicant is given permission (other than those activities in articles 5,9B, 10,51 and 52 detailed above). |

| Note 1A: Funeral plan contracts are contractually based investments. Accordingly, the following are regulated activities when carried on in relation to a funeral plan contract: (a) arranging (bringing about) deals in investments, (b) making arrangements with a view to transactions in investments, (c) managing investments, (d) safeguarding and administering investments, (e) advising on investments, (f) sending dematerialised instructions and (g) causing dematerialised instructions to be sent (as well as agreeing to carry on each of the activities listed in (a) to (g)). However, they are not designated investment business. |

| Note 1B: Life policies are contractually based investments. Where the regulated activities listed as designated investment business in (e) to (g) and (j) are carried on in relation to a life policy, these activities also count as 'insurance mediation activities'. The full list of insurance mediation activities is set out in (pb) to (pf). The regulated activities of agreeing to carry on each of these activities will, if carried on in relation to a life policy, also come within both designated investment business and insurance mediation activities. |

| Note 2: For the purposes of the regulated activities of dealing in investments as principal (article 14) and dealing in investments as agent (article 21), the definition ofcontractually based investments [expanded in Table 3] excludes a funeral plan contract (article 87) and rights to or interests in funeral plan contracts. |

|

Note 2A: PERG 13 Ann 2 Table 2 contains a map indicating which securities and contractually based investments correspond to financial instruments. A firm'spermission should comprise each of the categories of security and contractually based investment in relation to which it carries on the activity of operating a multilateral trading facility. |

| Note 3: The regulated activities of managing investments (article 37) and safeguarding and administering investments (article 40) may apply in relation to any assets, in particular circumstances, if the assets being managed or safeguarded and administered include, (or may include), any security or contractually based investment. |

| Note 4: For the purposes of the permission regime, the activity in (j)(ii) of advising on pension transfers and pension opt-outs is carried on in respect of the following specified investments: unit (article 81);stakeholder pension scheme (article 82(1));personal pension scheme (article 82(2));life policy (explained in note 5); andrights to or interests in investments in so far as they relate to a unit, a stakeholder pension scheme, a personal pension scheme or a life policy. |

| Note 5: Article 4(2) of the Regulated Activities Order specifies the activities (m)to (p) for the purposes of section 22(1)(b) of the Act. That is, these activities will be regulated activities if carried on in relation to any property and are not expressed as relating to a specified investment. |

| Note 5A: Where they are carried on in relation to a life policy, the activities listed as insurance mediation activities in (pb) to (pf) (as well as the regulated activity of agreeing to carry on those activities) are also designated investment business. |

| Note 5B: In PERG, life policy is the term used in the Handbook to mean 'qualifying contract of insurance' (as defined in article 3(1) of the Regulated Activities Order). For the purpose of the permission regime, the term also includes a long-term care insurance contract which is a pure protection contract and a pension term assurance policy. |

| Note 5C: Non-investment insurance contract is the term used in firms permissions to mean pure protection contract or general insurance contract. Pure protection contract is the term used in the Handbook to mean a long-term insurance contract which is not a life policy. General insurance contract is the term used in the Handbook to mean contract of insurance within column 1 of Table 2. |

| Note 5D: [deleted] |

| Note 5E: For the purposes of the permission regime, the activity in (pf)(ii) of advising on pension transfers and pension opt-outs is carried on in respect of the following specified investments: life policy (explained in note 5A); andrights to or interests in investments in so far as they relate to a life policy. |

| Note 6: Section 315 of the Act (The Society: authorisation and permission) states that the Society of Lloyd's has permission to carry on the regulated activities referred to in that section, one of which is specified in article 58 of the Regulated Activities Order. This permission is unique to the Society of Lloyd's. |

| Note 7: A stakeholder product is defined in the Glossary as: an investment of a kind specified in the Stakeholder Regulations:a stakeholder pension scheme; anda stakeholder CTF. |

|

Note 8: Article 4(2) of the Regulated Activities Order specifies the activity at (ab) for the purposes of section 22(1)(b) of the Act, that is, these activities will be regulated activities if carried on in relation to any property and are not expressed as related to a specified investment. |

| Table 2: Contracts of insurance | ||

| Contract of insurance (article 75 of the RAO) | ||

| (a) general insurance contract (Part I of Schedule 1 to the Regulated Activities Order) | (b) long-term insurance contract (Part II of Schedule 1 to the Regulated Activities Order ) | |

| Number | ||

| 1 | Accident (paragraph 1) | life and annuity (paragraph I) |

| 2 | Sickness (paragraph 2) | marriage or the formation of a civil partnership and birth (paragraph II) |

| 3 | Land vehicles (paragraph 3) | linked long-term (paragraph III) |

| 4 | Railway rolling stock (paragraph 4) | permanent health (paragraph IV) |

| 5 | Aircraft (paragraph 5) | tontines (paragraph V) |

| 6 | Ships (paragraph 6) | capital redemption (paragraph VI) |

| 7 | Goods in transit (paragraph 7) | pension fund management (paragraph VII) |

| 8 | fire and natural forces (paragraph 8) | collective insurance (paragraph VIII) |

| 9 | damage to property (paragraph 9) | social insurance (paragraph IX) |

| 10 | motor vehicle liability (paragraph 10) | |

| 11 | aircraft liability (paragraph 11) | |

| 12 | liability of ships (paragraph 12) | |

| 13 | general liability (paragraph 13) | |

| 14 | credit (paragraph 14) | |

| 15 | suretyship (paragraph 15) | |

| 16 | miscellaneous financial loss (paragraph 16) | |

| 17 | legal expenses (paragraph 17) | |

| 18 | assistance (paragraph 18) | |

| Notes to Table 2 | ||

| Note 1: See IPRU(INS) Ann 10.2 Part II for the groups of classes of general insurance business from the Annex to the First non-Life Directive. | ||

| Note 2: See IPRU(INS) 11.8 and the definition of ancillary risks in IPRU(INS) for guidance on the treatment of supplementary and ancillary provisions in relation to contracts of insurance. | ||

| Table 3: Securities, contractually based investments and relevant investments [see notes 1 and 2 to Table 3] | ||

| Security (article 3(1)) | Contractually based investment (article 3(1)) | Relevant investments (article 3(1)) |

|

share (article 76) debenture (article 77) alternative debenture (article 77A) government and public security (article 78) warrant (article 79) certificate representing certain security (article 80) unit (article 81) stakeholder pension scheme (article 82(1)) personal pension scheme (article 82(2)); rights to or interests in investments (article 89) in so far as they relate to any of the above categories of security |

option (article 83) For the purposes of the permission regime, option is subdivided into: (i)option (excluding a commodity option and an option on a commodityfuture);(ii)commodity option and option on a commodity future. future (article 84) For the purposes of the permission regime, future is subdivided into: (i)future (excluding a commodity future and a rolling spot forex contract);(ii)commodity future;(iii)rolling spot forex contract. contract for differences (article 85) For the purposes of the permission regime, contract for differences is subdivided into: (i)contract for differences (excluding a spread bet and a rolling spot forex contract);(ii)spread bet;(iii)rolling spot forex contract. life policy (but excluding a long-term care insurance contract which is a pure protection contract) [see note 5B to Table 1] funeral plan contract (article 87) [see note 1A to Table 1] rights to or interests in investments (article 89) in so far as they relate to any of the above categories of contractually based investment. |

contractually based investments (article 3(1)) non-investment insurance contract [see note 5C to Table 1] |

| Notes to Table 3 | ||

| Note 1: Security, contractually based investment and relevant investment are not, in themselves, specified investments they are defined as including a number of specified investments as set out in Table 3. Relevant investments is the term that is used to cover contractually based investments together with rights under a general insurance contract and a pure protection contract. Note 2: For the purposes of the regulated activities of dealing in investments as principal (article 14) and dealing in investments as agent (article 21), the definition of contractually based investments excludes a funeral plan contract (article 87) and rights to or interests in funeral plan contracts. | ||

- 30/06/2010

PERG 3A

Guidance on the scope of the Electronic

Money Regulations 2011

PERG 3A.1

Introduction

- 10/02/2011

The purpose of these Q&As is to help persons to consider whether they fall within the scope of the Electronic Money Directive which repealed and replaced an earlier Electronic Money Directive (2000/46/EC). The Electronic Money Directive is given effect in the United Kingdom by the Electronic Money Regulations. The Q&As are intended to help these persons consider whether they need to be authorised or registered for the purposes of electronic money issuance in the United Kingdom.

The Electronic Money Regulations create a separate authorisation and registration regime for issuers of electronic money that are not full credit institutions, credit unions or municipal banks:

A reference in this chapter to:

The Q&As that follow are set out in the following sections:

- 10/02/2011

PERG 3A.2

General issues

- 10/02/2011

It matters because if you issue electronic money in the United Kingdom and do not fall within an exclusion or exemption you must be:

Otherwise you risk committing a criminal offence under regulation 63.

Q3. How much can we rely on these Q&As?

The answers given in these Q&As represent the FSA's views but the interpretation of financial services legislation is ultimately a matter for the courts. How the scope of Electronic Money Regulations affects the regulatory position of any particular person will depend on their individual circumstances. If you have doubts about your position after reading these Q&As, you may wish to seek legal advice. The Q&As do not purport to be exhaustive and are not a substitute for reading the relevant legislation. In addition to FSA guidance, some of the Electronic Money Directive provisions may be the subject of guidance or communications by the European Commission.

Q4. As an electronic money issuer am I carrying on the regulated activity of accepting deposits when I receive a sum in exchange for electronic money?

No, provided the sum paid over is exchanged immediately for electronic money; see article 9A of the Regulated Activities Order.

Some electronic money products may be charged up by means of scratch cards that can be purchased from shops. The price paid for the card is the monetary value of the electronic money. The card contains a number. The purchaser then enters the number on a web site to activate the electronic money account. There is thus a delay between the payment for the electronic money and its use by the holder. In our view, this delay does not make the payment for the electronic money a deposit. This is because the means of spending the electronic money is put into the hands of the purchaser when they purchase the card.

Q5. I intend to issue electronic money in the United Kingdom. How does the authorisation and registration process apply to me?

It depends on a number of factors:

Transitional arrangements may also be relevant, see PERG 3A.7.

Q6. We are a payment institution. How will the Electronic Money Regulations apply to us?

If you are a payment institution that does not intend to issue electronic money or act as agent for an electronic money institution the Electronic Money Regulations are unlikely to apply to you.

If you are a payment institution that wishes to also issue electronic money then, in our view, you should cancel your authorisation or registration as a payment institution and apply to be an electronic money institution. An electronic money institution does not need to be authorised or registered under the Payment Services Regulations to provide payment services.

Q7. As an electronic money institution how will the Payment Services Regulations apply to us?

The issuance of electronic money is not itself a payment service but it is likely to entail the provision of payment services. For example, issuing a payment instrument is a payment service and electronic money is likely to be issued on a payment instrument in order to make a payment transaction. See Q20 at PERG 15 for more detail on what amounts to issuing payment instruments.

As an electronic money institution you are permitted to engage in the provision of payment services as well as other activities, see regulation 32 and Q19 below, without needing to be separately authorised or registered under the Payment Services Regulations.

The conduct of business requirements in Parts 5 and 6 of the Payment Services Regulations apply to all payment service providers, including electronic money issuers.

- 10/02/2011

PERG 3A.3

The definition of electronic money

- 10/02/2011

The definition in the Electronic Money Regulations mirrors that in the Electronic Money Directive. Electronic money means monetary value as represented by a claim on the issuer which is:

and is not otherwise excluded by the Electronic Money Regulations, see PERG 3A.5.

Electronic money is an electronic payment product. The value is held electronically or magnetically on the payment instrument itself (either locally or remotely) and payments using the value are made electronically. So, for example, monetary value stored on a:

may all fall within the definition if the value is intended to be used for the purposes of making payment transactions.

Q9. Does the electronic money definition only apply to card-based schemes?

No. Any electronic payment scheme that involves prepaid monetary value that can be used to purchase goods and services directly from third party merchants is capable of being electronic money. This would include account-based schemes.

Recital (7) of the Electronic Money Directive states that the intention is to introduce a definition of electronic money in order to make it technically neutral so as to cover all situations where the payment service provider issues pre-paid stored value in exchange for funds. Hence the definition expressly captures both electronically and magnetically stored value and there is no longer a reference to there needing to be an 'electronic device' on which the electronic money is stored. These changes make it clear that electronic money stored on computers hard drives or account-based schemes are caught.

Q10. Can you explain why pre-payment is a necessary ingredient of electronic money?

The definition of electronic money says that for a product to be electronic money, it must be issued on receipt of funds. This part of the definition means that electronic money is a prepaid product. That is, unlike credit provided through a credit card, the customer pays for the spending power in advance. This is why credit cards are excluded from the definition of electronic money. This does not mean that electronic money paid for with a credit card falls outside the definition. The purchase of the electronic money represents the purchase of monetary value. The fact that the purchaser is lent the funds to buy the electronic money does not affect this. There are two contracts, one for the sale of electronic money and one for credit.

Value on a debit card may be electronic money or a deposit. Guidance on this is given in Q15.

Q11. Does it matter that the device on which electronic value is held may be used for other purposes?

No. The fact that the device on which monetary value is stored is made available, for example, on a plastic card that also functions as a debit or credit card or is a mobile phone does not stop that monetary value from being electronic money.

Q12. Does it matter that the monetary value can be spent with the issuer and third parties?

No. If monetary value can be spent with third parties, it does not stop being electronic money just because the electronic money can also be spent with the issuer. This is so even if in practice most of the electronic money is spent with the issuer and only a small portion spent with third parties.

Q13. Are electronic travellers cheques electronic money?

An electronic travellers cheque is a product, based on a plastic card, designed to replace paper travellers cheques. There are two types of electronic travellers cheques:

The plastic card is loaded with value, the holder pays for the value on issue and uses the value to purchase goods and services. It is likely then to meet the first three conditions in the definition of electronic money listed at Q8. The remaining condition is whether the value is accepted as a means of payment by persons other than the issuer.

An electronic travellers cheque falling into (1) above is likely to be electronic money as it can be used to purchase goods from third parties.

An electronic travellers cheque falling into (2) is unlikely to be electronic money provided that:

Q14. If I use a trust account to store monetary value in respect of funds I have accepted payment for, will I be issuing electronic money?

Putting monetary value into a trust account does not, of itself, prevent the person who accepts the payment for electronic value from issuing electronic money.

Q15. How does electronic money differ from deposits?

Recital (13) of the Electronic Money Directive provides that electronic money does not constitute a deposit-taking activity under the BCD "in view of its specific character as an electronic surrogate for coins and banknotes, which is used for making payments, usually of limited amount and not as a means of saving."

In distinguishing electronic money and deposits, relevant factors include the following:

In other words, a deposit involves the creation of a debtor-creditor relationship under which the person who accepts the deposit stores value for eventual return. Electronic money, in contrast, involves the purchase of a means of payment.

Q16. What sort of factors will the FSA take into account in deciding whether a particular scheme might be electronic money?

In considering this question relevant factors include:

Therefore artificial features of a scheme that disguise, or try to disguise, the payment function as the supply of another sort of service are not likely to prevent the scheme from involving the issuance of electronic money.

- 10/02/2011

PERG 3A.4

Small electronic money institutions, mixed businesses, distributors, agents and exempt bodies

- 10/02/2011

The relevant conditions are set out at regulation 13 and include the following:

Q18. We satisfy the conditions for registration as a small electronic money institution - does that mean we have to register as one?

Not necessarily, there are other options available to you.

If you register as a small electronic money institution, you cannot acquire passport rights under the Electronic Money Directive. So you may wish to become an authorised electronic money institution if you wish to take advantage of a passport.

If your business does not currently exceed the thresholds referred to in the first two bullets at Q17, but you expect that it will, you may also wish to apply for authorisation rather than registration.

Q19. We are a firm providing non-financial products and services to the general public. Would it be possible for us to obtain authorisation as an electronic money institution?

Yes. One of the changes made by the Electronic Money Regulations is to allow electronic money institutions to undertake mixed business. So, electronic money institutions may, in addition to issuing electronic money, engage in the following activities:

Q20. We are a branch of a firm which has its head office outside the EEA. If we became an electronic money institution can we also engage in mixed business?

Yes, but you can only provide payment services that are linked to the issuance of electronic money. You cannot undertake any of the other payment services.

Q21. We act as agent for an electronic money institution. What is the scope of our activities under the regulations?

As such an agent you may provide payment services on behalf of your principal, but only if you are registered by them on the FSA Register . You may also distribute or redeem electronic money for your principal. You cannot however issue electronic money on their behalf.

Q22. We distribute and redeem electronic money. What is the scope of our activities under the regulations?

In some electronic money schemes an originator creates electronic money and then sells it to banks and other distributors. The latter then sell the electronic money to the public. In our view reference to the issuer of electronic money in the Electronic Money Regulations is a reference to the originator and not the distributor.

So, provided you are not:

you do not need to be authorised or registered under the Electronic Money Regulations. However, the electronic money institution that is acting as your principal should notify the FSA that you are acting as a distributor, see regulations 26 and 37 and Schedule 1.

You should also bear in mind that if, in distributing and redeeming electronic money, your activities amount to payment services you will need to consider whether you are required to be authorised or registered under the Payment Services Directive, see PERG 15 for further guidance.

Q23. We have been registered by one of our principals as an agent under the Payment Services Regulations. If we wish to act as agent for an electronic money institution as well will we need to be registered again?

Yes. If your principal is an electronic money institution, it is its responsibility to apply for registration on your behalf even if you have been registered as agent under the Payment Services Regulations. Assuming your principal is not an EEA firm, you are required to be registered on the FSA Register before you provide payment services for your principal, subject to any relevant transitional provisions which may delay or avoid the need for registration. If your principal is an EEA firm, your principal will need to comply with the relevant Home State legislation relating to your appointment, and your Home State competent authority will need to notify the FSA .

Q24. We are a credit union. Are we exempt from the regulations?

Yes, in part. You are exempt from the authorisation and registration requirements in the regulations. However, if you wish to issue electronic money you must ensure you have the relevant Part IV permission . You will also be subject to the safeguarding requirements in Part 3 and the redeemability provision in Part 5 of the Electronic Money Regulations.

Q25. We are a municipal bank. Are we exempt from the regulations?

Save that you are not subject to the safeguarding requirements in Part 3 of the regulations, your position is identical to that of credit unions, see Q24.

- 10/02/2011

PERG 3A.5

Exclusions

- 10/02/2011

Yes. The Electronic Money Regulations have two express exclusions:

Q27. We offer branded prepaid cards which consumers can use to purchase goods in a particular shopping mall. Are we issuing electronic money?

Yes, it is likely that you will be issuing electronic money unless you are able to fall within an exclusion. The most likely exclusion is if the card is only used to purchase goods and services in your premises or within a limited network of service providers. In our view you will only be able to take advantage of this exclusion here if:

Q28. For the purposes of the second exclusion referred to at Q26, can you explain when goods or services are "used through" a telecommunication, digital or IT device ("a relevant device")?

It is important to realise that it is the good or service purchased on a relevant device that must be used through that device for the purposes of this exclusion.

So, for example, where a person purchases travel or cinema tickets using prepaid credit on a mobile phone and the ticket is sent to this phone and then used to gain entry onto a transport system or into a cinema, what is being purchased are rights to travel or to watch a film. The ticket itself is a form of receipt confirming the purchase of such rights. Accordingly, as the travel rights or the visit to the cinema cannot be experienced on a relevant device, such a purchase is likely to fail the "used through" part of the regulation 3(b) exclusion.

Examples of the sorts of goods and services that could meet the "used through" part of the regulation 3(b) exclusion are music, online newspaper or video content, electronic books and mobile phone applications. This is because these products are all capable of being enjoyed through the relevant device they have been delivered to.

For more guidance on this exclusion see PERG 15, Q23 and 24.

- 10/02/2011

PERG 3A.6

Territorial scope

- 10/02/2011

Yes. You may apply to be an authorised electronic money institution if you are a body corporate (regulation 6(4)(b)). However, you cannot apply to be a small electronic money institution unless your head office is in the United Kingdom (regulation 13(9)).

- 10/02/2011

PERG 3A.7

Transitional arrangements

- 10/02/2011

No. Provided that you:

regulation 74 will apply to grant you deemed authorisation under regulation 9.

If you are granted such a deemed authorisation you must, before 1 July 2011:

We will then consider whether to include you on the FSA Register as an authorised electronic money institution or a small electronic money institution. If we do then your deemed authorisation will cease at that time. If we do not then your deemed authorisation will cease when the period for a reference to the Tribunal has elapsed without a reference being made or, if the matter is referred, at such time as the Tribunal may direct.

If, by 1 July 2011, you do not tell us what type of electronic money institution you wish to be, or you notify us that you do not wish to be an electronic money institution, your deemed authorisation will cease on 30 October 2011 or, if your Part IV permission is cancelled before that date, on the cancellation of that permission.

Q31. We are currently a small e-money issuer. Do we need to have applied for authorisation under the regulations prior to 30 April 2011?

No, under regulation 76, provided:

However, Part 5 and 6 of the regulations will apply to you as will Articles 9C to 9I and 9K of the Regulated Activities Order.

- 06/04/2011

PERG 4

Guidance on regulated activities connected with mortgages

PERG 4.1

Application and purpose

- 01/07/2005

Application

PERG 4.1.1

See Notes

- 01/07/2005

Purpose of guidance

PERG 4.1.2

See Notes

- 01/07/2005

Effect of guidance

PERG 4.1.3

See Notes

- 01/07/2005

PERG 4.1.4

See Notes

- 01/07/2005

PERG 4.1.5

See Notes

- 01/07/2005

Guidance on other activities

PERG 4.1.6

See Notes

- 30/06/2010

PERG 4.2

Introduction

- 01/07/2005

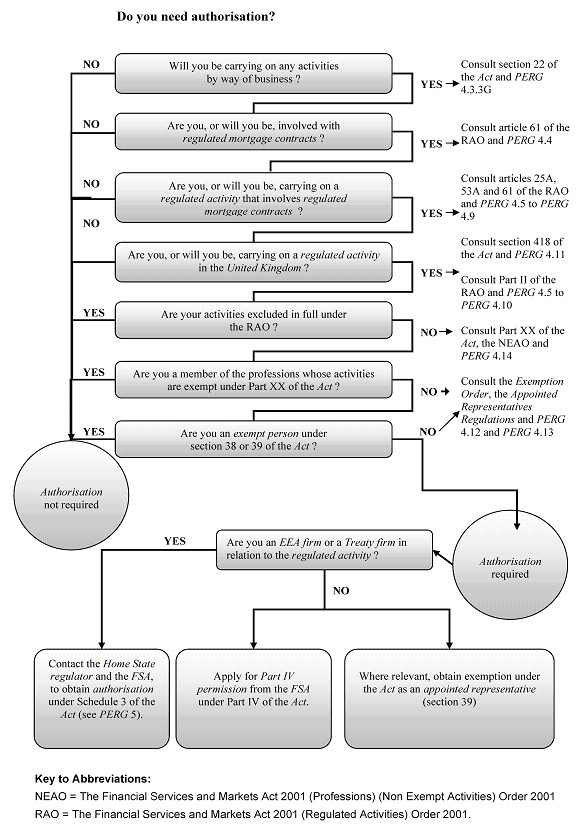

Requirement for authorisation or exemption

PERG 4.2.1

See Notes

- 06/10/2007

Professional firms

PERG 4.2.2

See Notes

- 01/07/2005

Questions to be considered to decide if authorisation is required

PERG 4.2.3

See Notes

If a person gets as far as question (8) and the answer to that question is 'no', that person requires authorisation and should refer to the FSA website "How do I get authorised": http://www.fsa.gov.uk/Pages/Doing/how/index.shtml for details of the application process.

- 06/10/2007

PERG 4.2.4

See Notes

- 01/07/2005

Financial promotion

PERG 4.2.5

See Notes

- 01/07/2005

PERG 4.3

Regulated activities related to mortgages

- 01/07/2005

PERG 4.3.1

See Notes

- 01/07/2005

PERG 4.3.2

See Notes

- 01/07/2005

The business test

PERG 4.3.3

See Notes

- 01/07/2005

PERG 4.3.4

See Notes

- 01/07/2005

PERG 4.3.5

See Notes

| By way of business | Carrying on the business |

| Entering into a regulated mortgage contract (article 61(1)) | Arranging (bringing about) regulated mortgage contracts (article 25A(1)) |

| Administering a regulated mortgage contract (article 61(2)) (and the contract administered must have been entered into by way of business) | Making arrangements with a view to regulated mortgage contracts (article 25A(2)) |

| Advising on regulated mortgage contracts (article 53A) |

- 01/07/2005

PERG 4.3.6

See Notes

In the case of the 'carrying on the business' test, these factors will need to be considered having regard to all the activities together.

- 01/07/2005

PERG 4.3.7

See Notes

- 01/07/2005

PERG 4.3.8

See Notes

- 01/07/2005

PERG 4.3.9

See Notes

- 01/07/2005

PERG 4.4

What is a regulated mortgage contract?

- 01/07/2005

The definition of "regulated mortgage contract"

PERG 4.4.1

See Notes

- 06/04/2007

Provision of credit

PERG 4.4.1A

See Notes

- 01/07/2005

Which borrowers?

PERG 4.4.2

See Notes

- 01/07/2005

Date the contract is entered into

PERG 4.4.3

See Notes

- 01/07/2005

PERG 4.4.4

See Notes

- 01/07/2005

Land in the United Kingdom

PERG 4.4.5

See Notes

- 01/07/2005

Occupancy requirement

PERG 4.4.6

See Notes

- 01/07/2005

PERG 4.4.7

See Notes

- 01/07/2005

PERG 4.4.8

See Notes

- 01/07/2005

PERG 4.4.9

See Notes

- 05/12/2005

Purpose of the loan is irrelevant

PERG 4.4.10

See Notes

- 01/07/2005

Type of lending

PERG 4.4.11

See Notes

- 01/07/2005

PERG 4.4.12

See Notes

- 01/07/2005

Regulated mortgage contracts and contract variations

PERG 4.4.13

See Notes

- 01/07/2005

PERG 4.4.14

See Notes

- 01/07/2005

PERG 4.5

Arranging regulated mortgage contracts

- 01/07/2005

Definition of the regulated activities involving arranging

PERG 4.5.1

See Notes

- 01/07/2005

PERG 4.5.2

See Notes

The first activity (article 25A(1)) is referred to in this guidance as arranging (bringing about) regulated mortgage contracts. Various points arise:

- (1) It is not necessary for the potential borrower himself to be involved in making the arrangements.

- (2) This activity is carried on only if the arrangements bring about, or would bring about a regulated mortgage contract. This is because of the exclusion in article 26 (see PERG 4.5.4 G).

- (3) This activity therefore includes the activities of brokers who make arrangements on behalf of a borrower to enter into or vary a regulated mortgage contract where these arrangements go beyond merely introducing (see PERG 4.5.10 G) or advising (although giving advice may be the regulated activity of advising on regulated mortgage contracts). Such arrangements might include, for instance, negotiating the terms of the regulated mortgage contract with the eventual lender, on behalf of the borrower. It also includes the activities of certain so-called 'packagers' (see PERG 4.15 (Mortgage activities carried on by 'packagers'.)

- (4) PERG 4.6.2 G contains examples of variations that are, in the FSA's view, within the definition of advising on regulated mortgage contracts and would also be covered by article 25A(1) arrangements.

- 01/07/2005

PERG 4.5.3

See Notes

- 01/07/2005

Exclusion: article 25A(1) arrangements not causing a deal

PERG 4.5.4

See Notes

- 01/07/2005

Exclusion: article 25(A)2 arrangements enabling parties to communicate

PERG 4.5.5

See Notes

- 01/07/2005

PERG 4.5.6

See Notes

- 01/07/2005

Exclusion: article 25A(1) and (2) arranging of contracts to which the arranger is a party

PERG 4.5.7

See Notes

- 01/07/2005

Exclusion: article 25A(1) and (2) arrangements with or through authorised persons

PERG 4.5.8

See Notes

- 01/07/2005

Exclusion: article 25A(1)(b) arrangements made in the course of administration by authorised person

PERG 4.5.9

See Notes

- 01/07/2005

Exclusion: article 25A(2) arrangements and introducing

PERG 4.5.10

See Notes

- 01/07/2005

PERG 4.5.11

See Notes

The exclusion applies for introductions to:

- (1) an authorised person who has permission to carry on a regulated activity specified in article 25A (Arranging regulated mortgage contracts) or article 53A (Advising on regulated mortgage contracts) or article 61(1) (Entering into a regulated mortgage contract as lender); introducers can check the status of an authorised person and its permission by visiting the FSA's register at http://www.fsa.gov.uk/register/;

- (2) an appointed representative who is appointed to carry on a regulated activity specified in article 25A or article 53A of the Regulated Activities Order; introducers can check the status of an appointed representative by visiting the FSA's register at http://www.fsa.gov.uk/register/; the FSA would normally expect introducers to request and receive confirmation of the regulated activities that the appointed representative is appointed to carry on, prior to proceeding with an introduction; and

- (3) an overseas person who carries on a regulated activity specified in article 25A (Arranging regulated mortgage contracts) or article 53A (Advising on regulated mortgage contracts) or article 61(1) (Entering into a regulated mortgage contract).

- 01/07/2005

PERG 4.5.12

See Notes

- 01/07/2005

PERG 4.5.13

See Notes

- 01/07/2005

PERG 4.5.14

See Notes

- 01/07/2005

PERG 4.5.15

See Notes

- 01/07/2005

PERG 4.5.16

See Notes

- 01/07/2005

PERG 4.5.17

See Notes

- 01/07/2005

PERG 4.5.18

See Notes

- 01/07/2005

Other exclusions

PERG 4.5.19

See Notes

- 01/07/2005

PERG 4.6

Advising on regulated mortgage contracts

- 01/07/2005

Definition of 'advising on regulated mortgage contracts'

PERG 4.6.1

See Notes

- 01/07/2005

PERG 4.6.2

See Notes

Although advice on varying the terms of a regulated mortgage contract is not a regulated activity if the contract was entered into before 31 October 2004, there may be instances where the variation to the old contract is so fundamental that it amounts to entering into a new regulated mortgage contract (see PERG 4.4.4 G and PERG 4.4.13G (2)). In that case, giving the advice would be a regulated activity.

- 01/07/2005

PERG 4.6.3

See Notes

- 01/07/2005

PERG 4.6.4

See Notes

- 01/07/2005

Advice must relate to a particular regulated mortgage contract

PERG 4.6.5

See Notes

- 01/07/2005

PERG 4.6.6

See Notes

- 01/07/2005

PERG 4.6.7

See Notes

This table belongs to PERG 4.6.5 G and PERG 4.6.6 G.

| Recommendation | Regulated or not? |

| I recommend you take out the ABC Building Society 2 year fixed rate mortgage at 5%. | Yes. This is advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. |

| I recommend you do not take out the ABC Building Society 2 year fixed rate mortgage at 5%. | Yes. This is advice which steers the borrower away from a particular mortgage which the borrower could have entered into. |

| I recommend that you take out either the ABC Building Society 2 year fixed rate mortgage at 5% or the XYZ Bank standard variable rate mortgage. | Yes. This is advice which steers the borrower in the direction of more than one particular mortgage which the borrower could enter into. |

| I recommend you take out (or do not take out) an ABC Building Society fixed rate mortgage. | This will depend on the circumstances. If, for example, the society only offers one such mortgage, this would be a recommendation intended implicitly to steer the borrower in the direction of that particular mortgage which the borrower could enter into and therefore would be advice. |

| I suggest you take out (or do not take out) a mortgage with ABC Building Society. | No. This is not advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. However, if the society only offers one mortgage, this would be a recommendation intended implicitly to steer the borrower in the direction of that particular mortgage which the borrower could enter into and therefore would be advice. |

| I suggest you change (or do not change) your current mortgage from a variable rate to a fixed rate. | No in respect of the advice about rate type, as this does not steer the borrower in the direction of a particular mortgage which the borrower could enter into. Yes in respect of the advice about varying the terms of the particular mortgage that the borrower had already entered into. |

| I suggest you take out (or do not take out) a variable rate mortgage. | No. This is not advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. |

| I recommend you take out (or do not take out) a mortgage. | No. This is not advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. |

| I would always recommend buying a house and taking out a mortgage as opposed to renting a property. | No. This is an example of generic advice which does not steer the borrower in the direction of a particular mortgage that he could enter into. |

| I recommend you do not borrow more than you can comfortably afford. | No. This is an example of generic advice. |

| If you are looking for flexibility with your mortgage I would recommend you explore the possibilities of either a flexible mortgage or an off-set mortgage. There are a growing number of lenders offering both. | No. This is an example of generic advice. |

- 01/07/2005

PERG 4.6.8

See Notes

- 01/07/2005

PERG 4.6.9

See Notes

- 01/07/2005

Advice given to a person in his capacity as a borrower or potential borrower

PERG 4.6.10

See Notes

- 01/07/2005

PERG 4.6.11

See Notes

- 01/07/2005

PERG 4.6.12

See Notes

- 01/07/2005

Advice or information

PERG 4.6.13

See Notes

- 01/07/2005

PERG 4.6.14

See Notes

- 01/07/2005

PERG 4.6.15

See Notes

- 01/07/2005

PERG 4.6.16

See Notes

- 01/07/2005

Advice must relate to the merits (of entering into as borrower or varying)

PERG 4.6.17

See Notes

- 01/07/2005

PERG 4.6.18

See Notes

- 01/07/2005

PERG 4.6.19

See Notes

- 01/07/2005

PERG 4.6.20

See Notes

- 01/07/2005

Scripted questioning (including decision trees)

PERG 4.6.21

See Notes

- 01/07/2005

PERG 4.6.22

See Notes

- 01/07/2005

PERG 4.6.23

See Notes

- 01/07/2005

PERG 4.6.24

See Notes

- 01/07/2005

PERG 4.6.25

See Notes

- 06/10/2007

Medium used to give advice

PERG 4.6.26

See Notes

- 01/07/2005

PERG 4.6.27

See Notes

- 01/07/2005

PERG 4.6.28

See Notes

- 01/07/2005

PERG 4.6.29

See Notes

- 01/07/2005

Exclusion: periodical publications, broadcasts and websites

PERG 4.6.30

See Notes

This is explained in greater detail, together with the provisions on the granting of certificates, in PERG 7 (Periodical publications, news services and broadcasts: applications for certification).

- 01/07/2005

Exclusion: advice in the course of administration by authorised person

PERG 4.6.31

See Notes

- 01/07/2005

Other exclusions

PERG 4.6.32

See Notes

- 01/07/2005

PERG 4.7

Entering into a regulated mortgage contract

- 01/07/2005

Definition of 'entering into a regulated mortgage contract'

PERG 4.7.1

See Notes

- 01/07/2005

Exclusions

PERG 4.7.2

See Notes

- 01/07/2005

Transfer of lending obligations

PERG 4.7.3

See Notes

- 01/07/2005

PERG 4.8

Administering a regulated mortgage contract

- 01/07/2005

Definition of 'administering a regulated mortgage contract'

PERG 4.8.1

See Notes

- 01/07/2005

PERG 4.8.2

See Notes

- 01/07/2005

PERG 4.8.3

See Notes

but does not include merely having or exercising a right to take action to enforce the regulated mortgage contract, or to require that action is or is not taken.

- 01/07/2005

Exclusion: arranging administration by authorised persons

PERG 4.8.4

See Notes