PRU 9

Insurance

mediation & mortgage mediation, lending and administration

PRU 9.1

Responsibility for insurance mediation activity

- 01/12/2004

Application

PRU 9.1.1

See Notes

- 31/10/2004

Purpose

PRU 9.1.2

See Notes

- 31/10/2004

Responsibility for insurance mediation activity

PRU 9.1.3

See Notes

- 31/10/2004

PRU 9.1.4

See Notes

The firm may allocate the responsibility for its insurance mediation activity under PRU 9.1.3 R to an approved person (or persons) performing:

- (1) a governing function (other than the non-executive director function); or

- (2) the apportionment and oversight function; or

- (3) the significant management (other business operations) function.

- 14/01/2005

PRU 9.1.5

See Notes

- (1) Typically an insurance intermediary will appoint a person performing a governing function (other than the non-executive director function) to direct its insurance mediation activity. Where this responsibility is allocated to a person performing another function, the person performing the apportionment and oversight function with responsibility for the apportionment of responsibilities under SYSC 2.1.1 R must ensure that the firm's insurance mediation activity under PRU 9.1.3 R is appropriately allocated.

- (2) The descriptions of significant influence functions, other than the required functions, do not extend to activities carried on by an insurance intermediary with permission only to carry on insurance mediation activity and whose principal purpose is to carry on activities other than regulated activities (see SUP 10.1.21 R). In this case, the firm may allocate the responsibility for the firm's insurance mediation activity under PRU 9.1.3 R to one or more of the persons performing the apportionment and oversight function who will be required to be an approved person.

- (3) In the case of a sole trader, the sole trader will be responsible for the firm's insurance mediation activity, whether or not he is himself a person approved to perform the sole trader function.

- 14/01/2005

PRU 9.1.6

See Notes

- 31/10/2004

PRU 9.1.7

See Notes

- 14/01/2005

Knowledge, ability and good repute

PRU 9.1.8

See Notes

An insurance intermediary must establish on reasonable grounds that:

- (1) a reasonable proportion of the persons within its management structure who are responsible for insurance mediation activity; and

- (2) all other persons directly involved in its insurance mediation activity;

- (3) all the persons in its management structure and any staff directly involved in insurance mediation activity are of good repute.

- 31/10/2004

PRU 9.1.9

See Notes

In determining a person's knowledge and ability under PRU 9.1.8 R (1) and PRU 9.1.8 R (2), the firm should have regard to matters including, but not limited to, whether the person:

- (1) has demonstrated by experience and training to be able, or that he will be able, to perform his duties related to the firm's insurance mediation activity; and

- (2) satisfies the relevant requirements of the FSA's Training and Competence sourcebook (TC).

- 31/10/2004

PRU 9.1.10

See Notes

In considering a person's repute under PRU 9.1.8 R (3), the firm must ensure that the person:

- (1) has not been convicted of any serious criminal offences linked to crimes against property or other crimes related to financial activities (other than spent convictions under the Rehabilitation of Offenders Act 1974 or any other national equivalent); and

- (2) has not been adjudged bankrupt (unless the bankruptcy has been discharged);

- 31/10/2004

PRU 9.1.11

See Notes

- 31/10/2004

PRU 9.1.12

See Notes

- 31/10/2004

PRU 9.1.13

See Notes

- 31/10/2004

PRU 9.2

Professional indemnity insurance requirements for insurance and mortgage mediation activities

- 01/12/2004

Application

PRU 9.2.1

See Notes

- (1) This section applies to a firm with Part IV permission to carry on any of the activities in (2) unless (3), (4), (5) or (6) applies.

- (2) The activities are:

- (3)

- (a) In relation to insurance mediation activity, this section does not apply to a firm if another authorised person which has net tangible assets of more than ?10 million provides a comparable guarantee.

- (b) If the firm is a member of a group in which there is an authorised person with net tangible assets of more than ?10 million, the comparable guarantee must be from that person.

- (c) A 'comparable guarantee' means a written agreement on terms at least equal to those in PRU 9.2.10 R to finance the claims that might arise as a result of a breach by the firm of its duties under the regulatory system or civil law.

- (4) In relation to mortgage mediation activity, this section does not apply to a firm if:

- (a) it has net tangible assets of more than ?1 million; or

- (b) the comparable guarantee provisions of (3) apply (as if the firm was carrying on insurance mediation activity) but substituting ?1 million for ?10 million in (a) and (b).

- (5) In relation to all the activities in (2), this section does not apply to:

- (a) an insurer; or

- (b) a managing agent; or

- (c) a firm to which IPRU(INV) 13.1.4(1) (Financial resource requirements for personal investment firms: requirement to hold professional indemnity insurance) applies.

- (6) In relation to mortgage mediation activity, this section does not apply to an authorised professional firm:

- (a) which is subject to IPRU(INV) 2.3.1 (Professional indemnity insurance requirements for authorised professional firms); and

- (b) whose mortgage mediation activity is incidental to its main business.

- 31/10/2004

PRU 9.2.2

See Notes

- 31/10/2004

Purpose

PRU 9.2.3

See Notes

The purposes of this section are to:

- (1) implement article 4.3 of the Insurance Mediation Directive in so far as it requires insurance intermediaries to hold professional indemnity insurance, or some other comparable guarantee, against any liability that might arise from professional negligence; and

- (2) meet the regulatory objectives of consumer protection and maintaining market confidence by ensuring that firms have adequate resources to protect themselves, and their customers, against losses arising from breaches in its duties under the regulatory system or civil law.

- 31/10/2004

PRU 9.2.4

See Notes

- 31/10/2004

PRU 9.2.5

See Notes

- 31/10/2004

PRU 9.2.6

See Notes

- 31/10/2004

Requirement to hold professional indemnity insurance

PRU 9.2.7

See Notes

A firm must take out and maintain professional indemnity insurance that is at least equal to the requirements of PRU 9.2.10 R from:

- (1) an insurance undertaking authorised to transact professional indemnity insurance in the EEA; or

- (2) a person of equivalent status in:

- (i) a Zone A country; or

- (ii) the Channel Islands, Gibraltar, Bermuda or the Isle of Man.

- 31/10/2004

PRU 9.2.8

See Notes

- 14/01/2005

PRU 9.2.9

See Notes

- 31/10/2004

Terms to be incorporated in the insurance

PRU 9.2.10

See Notes

In relation to the activities referred to in PRU 9.2.1 R (2), the contract of professional indemnity insurance must incorporate terms which make provision for:

- (1) cover in respect of claims for which a firm may be liable as a result of the conduct of itself, its employees and its appointed representatives (acting within the scope of their appointment);

- (2) the minimum limits of indemnity as set out in PRU 9.2.13 R (in relation to insurance mediation activity) and PRU 9.2.15 R (in relation to mortgage mediation activity);

- (3) an excess as set out in PRU 9.2.17 R to PRU 9.2.22 R;

- (4) appropriate cover in respect of legal defence costs;

- (5) continuous cover in respect of claims arising from work carried out from the date on which the firm was given Part IV permission in relation to any of the activities referred to in (2); and

- (6) cover in respect of Ombudsman awards made against the firm.

- 31/10/2004

PRU 9.2.11

See Notes

- 31/10/2004

PRU 9.2.12

See Notes

- 31/10/2004

Minimum limits of indemnity: insurance intermediary

PRU 9.2.13

See Notes

If the firm is an insurance intermediary, then the minimum limits of indemnity referred to in PRU 9.2.10 R (2) are:

- (1) for a single claim, ?1 million; and

- (2) in aggregate, ?1.5 million or, if higher, 10% of annual income (see PRU 9.3.42 R) up to ?30 million.

- 14/01/2005

PRU 9.2.14

See Notes

- 31/10/2004

Minimum limits of indemnity: mortgage intermediary

PRU 9.2.15

See Notes

If the firm is a mortgage intermediary, then the minimum limit of indemnity referred to in PRU 9.2.10 R (2) is the higher of 10% of annual income (see PRU 9.3.42 R) up to ?1 million, and:

- (1) for a single claim, ?100,000; or

- (2) in aggregate, ?500,000.

- 14/01/2005

Excess

PRU 9.2.16

See Notes

- 31/10/2004

PRU 9.2.17

See Notes

For a firm which does not hold client money or other client assets, the excess referred to in PRU 9.2.10 R (3) is not more than the higher of:

- (1) ?2,500; and

- (2) 1.5% of annual income (see PRU 9.3.42 R).

- 31/10/2004

PRU 9.2.18

See Notes

For a firm which holds client money or other client assets, the excess referred to in PRU 9.2.10 R (3) is not more than the higher of:

- (1) ?5,000; and

- (2) 3% of annual income (see PRU 9.3.42 R).

- 31/10/2004

Policies covering more than one firm

PRU 9.2.19

See Notes

If a policy provides cover to more than one firm, then in relation to PRU 9.2.13 R, PRU 9.2.14 R and PRU 9.2.15 R:

- (1) the limits of indemnity must be calculated on the combined annual income (see PRU 9.3.42 R) of all the firms named in the policy; and

- (2) each firm named in the policy must have the benefit of the minimum limits of indemnity as required in PRU 9.2.13 R or PRU 9.2.15 R.

- 31/10/2004

Additional capital

PRU 9.2.20

See Notes

- 31/10/2004

PRU 9.2.21

See Notes

| Income | Excess obtained up to and including: | |||||||||||||

| More than | Up to | 2.5 | 5 | 10 | 15 | 20 | 25 | 30 | 40 | 50 | 75 | 100 | 150 | 200+ |

| 0 | 100 | 0 | 5 | 9 | 12 | 14 | 17 | 19 | 23 | 26 | 33 | 39 | 50 | 59 |

| 100 | 200 | 0 | 7 | 12 | 16 | 19 | 22 | 25 | 30 | 34 | 43 | 51 | 64 | 75 |

| 200 | 300 | 0 | 7 | 12 | 16 | 20 | 24 | 27 | 32 | 37 | 47 | 56 | 71 | 84 |

| 300 | 400 | 0 | 0 | 12 | 16 | 21 | 24 | 28 | 34 | 39 | 50 | 60 | 77 | 91 |

| 400 | 500 | 0 | 0 | 11 | 16 | 21 | 24 | 28 | 34 | 40 | 53 | 63 | 81 | 96 |

| 500 | 600 | 0 | 0 | 10 | 16 | 20 | 24 | 28 | 35 | 41 | 54 | 65 | 84 | 100 |

| 600 | 700 | 0 | 0 | 0 | 15 | 20 | 24 | 28 | 35 | 41 | 55 | 67 | 87 | 104 |

| 700 | 800 | 0 | 0 | 0 | 14 | 19 | 24 | 28 | 35 | 42 | 56 | 68 | 89 | 107 |

| 800 | 900 | 0 | 0 | 0 | 13 | 18 | 23 | 27 | 35 | 42 | 56 | 69 | 91 | 109 |

| 900 | 1,000 | 0 | 0 | 0 | 0 | 17 | 22 | 27 | 34 | 41 | 57 | 70 | 92 | 111 |

| 1,000 | 1,500 | 0 | 0 | 0 | 0 | 0 | 21 | 26 | 34 | 41 | 57 | 71 | 97 | 118 |

| 1,500 | 2,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 30 | 38 | 56 | 71 | 98 | 121 |

| 2,000 | 2,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 24 | 33 | 53 | 69 | 99 | 126 |

| 2,500 | 3,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 28 | 50 | 68 | 101 | 130 |

| 3,000 | 3,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 47 | 67 | 101 | 132 |

| 3,500 | 4,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 43 | 65 | 101 | 133 |

| 4,000 | 4,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 39 | 62 | 101 | 134 |

| 4,500 | 5,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 58 | 99 | 134 |

| 5,000 | 6,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 54 | 97 | 133 |

| 6,000 | 7,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 91 | 131 |

| 7,000 | 8,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 84 | 126 |

| 8,000 | 9,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 75 | 120 |

| 9,000 | 10,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 113 |

| 10,000 | 100,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 100,000 | n/a | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

- 31/10/2004

PRU 9.2.22

See Notes

| Income | Excess obtained up to and including: | ||||||||||||

| More than | Up to | 5 | 10 | 15 | 20 | 25 | 30 | 40 | 50 | 75 | 100 | 150 | 200+ |

| 0 | 100 | 0 | 4 | 7 | 9 | 12 | 14 | 18 | 21 | 28 | 34 | 45 | 54 |

| 100 | 200 | 0 | 7 | 11 | 14 | 17 | 20 | 25 | 29 | 38 | 46 | 59 | 70 |

| 200 | 300 | 0 | 7 | 11 | 14 | 17 | 20 | 25 | 30 | 40 | 49 | 64 | 77 |

| 300 | 400 | 0 | 0 | 9 | 13 | 16 | 19 | 25 | 30 | 40 | 50 | 67 | 81 |

| 400 | 500 | 0 | 0 | 0 | 11 | 14 | 18 | 24 | 29 | 40 | 51 | 68 | 83 |

| 500 | 600 | 0 | 0 | 0 | 8 | 12 | 15 | 22 | 28 | 40 | 51 | 69 | 85 |

| 600 | 700 | 0 | 0 | 0 | 0 | 9 | 13 | 20 | 26 | 39 | 50 | 69 | 86 |

| 700 | 800 | 0 | 0 | 0 | 0 | 6 | 10 | 17 | 24 | 38 | 49 | 69 | 87 |

| 800 | 900 | 0 | 0 | 0 | 0 | 0 | 7 | 15 | 22 | 36 | 48 | 69 | 87 |

| 900 | 1,000 | 0 | 0 | 0 | 0 | 0 | 0 | 12 | 19 | 34 | 47 | 68 | 87 |

| 1,000 | 1,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 16 | 32 | 45 | 67 | 86 |

| 1,500 | 2,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 18 | 34 | 59 | 81 |

| 2,000 | 2,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 19 | 48 | 71 |

| 2,500 | 3,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 6 | 37 | 64 |

| 3,000 | 3,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 26 | 55 |

| 3,500 | 4,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 14 | 45 |

| 4,000 | 4,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 33 |

| 4,500 | 5,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 21 |

| 5,000 | 6,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 8 |

| 6,000 | 7,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 7,000 | 8,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 8,000 | 9,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 9,000 | 10,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 10,000 | 100,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 100,000 | n/a | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

- 31/10/2004

PRU 9.2.23

See Notes

- 31/10/2004

PRU 9.3

Capital resources for insurance and mortgage mediation activity and mortgage lending and administration

- 01/12/2004

Application

PRU 9.3.1

See Notes

- (1) This section applies to a firm with Part IV permission to carry on any of the activities in (2) unless any of PRU 9.3.4 R to PRU 9.3.11 R applies.

- (2) The activities are:

- (a) insurance mediation activity;

- (b) mortgage mediation activity;

- (c) entering into a regulated mortgage contract (that is, mortgage lending);

- (d) administering a regulated mortgage contract (that is, mortgage administration).

- 31/10/2004

PRU 9.3.2

See Notes

- 31/10/2004

PRU 9.3.3

See Notes

- 31/10/2004

Application: banks, building societies, insurers and friendly societies

PRU 9.3.4

See Notes

This section does not apply to:

- (1) a bank; or

- (2) a building society; or

- (3) a solo consolidated subsidiary of a bank or a building society; or

- (4) an insurer; or

- (5) a friendly society.

- 31/10/2004

PRU 9.3.5

See Notes

- 31/10/2004

Application: firms carrying on designated investment business only

PRU 9.3.6

See Notes

- 31/10/2004

PRU 9.3.7

See Notes

- 31/10/2004

Application: credit unions

PRU 9.3.8

See Notes

This section does not apply to:

- (1) a 'small credit union', that is one with:

- (a) assets of ?5 million or less; and

- (b) a total number of members of 5,000 or less (see CRED 8.3.14 R); or

- (2) a credit union whose Part IV permission includes mortgage lending or mortgage administration (or both) and no other activities in PRU 9.3.1 R (2).

- 31/10/2004

PRU 9.3.9

See Notes

- (1) For credit unions to which this section applies and which are not CTF providers, the capital requirements will be the higher of the requirements in this section and in CRED (see PRU 9.3.25 R).

- (2) For credit unions to which this section applies and which are CTF providers with permission to carry on designated investment business, the capital requirements will be the highest of the requirements in this section, those in CRED and of IPRU(INV) Chapter 8 (see PRU 9.3.25 R).

- 01/12/2004

Application: professional firms

PRU 9.3.10

See Notes

- (1) This section does not apply to an authorised professional firm:

- (a) whose main business is the practice of its profession; and

- (b) whose regulated activities in PRU 9.3.1 R (2) are incidental to its main business.

- (2) A firm's main business is the practice of its profession if the proportion of income it derives from professional fees is, during its annual accounting period, at least 50% of the firm's total income (a temporary variation of not more than 5% may be disregarded for this purpose).

- (3) Professional fees are fees, commissions and other receipts receivable in respect of legal, accountancy or actuarial services provided to clients but excluding any items receivable in respect of regulated activities.

- 31/10/2004

Application: Lloyd's managing agents

PRU 9.3.11

See Notes

- 31/10/2004

PRU 9.3.12

See Notes

- 31/10/2004

Application: social housing firms

PRU 9.3.13

See Notes

- 31/10/2004

Purpose

PRU 9.3.14

See Notes

- 31/10/2004

PRU 9.3.15

See Notes

- 31/10/2004

PRU 9.3.16

See Notes

- 31/10/2004

PRU 9.3.17

See Notes

- 31/10/2004

Purpose: social housing firms

PRU 9.3.18

See Notes

- 31/10/2004

PRU 9.3.19

See Notes

- 31/10/2004

Capital resources: general rules

PRU 9.3.20

See Notes

- 31/10/2004

PRU 9.3.21

See Notes

- 31/10/2004

Capital resources: relevant accounting principles

PRU 9.3.22

See Notes

- 21/04/2005

Capital resources: client assets

PRU 9.3.23

See Notes

- 31/10/2004

Capital resources requirement: firms carrying on regulated activities including designated investment business

PRU 9.3.24

See Notes

The capital resources requirement for a firm (other than a credit union) carrying on regulated activities, including designated investment business, is the higher of:

- (1) the requirement which is applied by this section according to the activity or activities of the firm (treating the relevant rules as applying to the firm by disregarding its designated investment business); and

- (2) the financial resource requirement which is applied by IPRU(INV).

- 01/12/2004

Capital resources requirement: credit unions

PRU 9.3.25

See Notes

The capital resources requirement for a credit union to which this section applies (see PRU 9.3.8 R) is the highest of:

- (1) the requirement which is applied by PRU 9.3.30 R (Capital resources requirement: mediation activity only) treating that rule as applying to the credit union by disregarding activities which are not insurance mediation activity or mortgage mediation activity;

- (2) the amount which is applied by CRED 8 (Capital requirements); and

- (3) if the credit union is a CTF provider that has a permission to carry on designated investment business, the amount which is applied by IPRU(INV) Chapter 8.

- 01/12/2004

Capital resources requirement: social housing firms

PRU 9.3.26

See Notes

The capital resources requirement for a social housing firm whose Part IV permission is limited to carrying on the regulated activities of:

- (1) mortgage lender; or

- (2) mortgage administration (or both);

is that the firm's net tangible assets must be greater than zero.

- 31/10/2004

PRU 9.3.27

See Notes

- 31/10/2004

Capital resources requirement: application according to regulated activities

PRU 9.3.28

See Notes

- 31/10/2004

PRU 9.3.29

See Notes

| Regulated activities | Provisions | |

| 1. | and no other regulated activity. | PRU 9.3.30 R |

| 2. | and no other regulated activity. | PRU 9.3.31 R to PRU 9.3.36 E |

| 3. | mortgage administration; and no other regulated activity. |

PRU 9.3.37 R to PRU 9.3.38 R |

| 4. | insurance mediation activity; and | PRU 9.3.39 R |

| 5. | mortgage mediation activity; and | PRU 9.3.40 R |

| 6. | Any combination of regulated activities not within rows 1 to 5. | PRU 9.3.41 R |

- 31/10/2004

Capital resources requirement: mediation activity only

PRU 9.3.30

See Notes

- (1) If a firm (carrying on the activities in row 1 of the table in PRU 9.3.29 R) does not hold client money or other client assets in relation to its insurance mediation activity or mortgage mediation activity, its capital resources requirement is the higher of:

- (a) ?5,000; and

- (b) 2.5% of the annual income (see PRU 9.3.42 R) from its insurance mediation activity or mortgage mediation activity (or both).

- (2) If a firm (carrying on the activities in row 1 of the table in PRU 9.3.29 R) holds client money or other client assets in relation to its insurance mediation activity or mortgage mediation activity, its capital resources requirement is the higher of:

- (a) ?10,000; and

- (b) 5% of the annual income (see PRU 9.3.42 R) from its insurance mediation activity or mortgage mediation activity (or both).

- 31/10/2004

Capital resources requirement: mortgage lending and administration (but not mortgage administration only)

PRU 9.3.31

See Notes

- (1) The capital resources requirement of a firm (carrying on the activities in row 2 of the table at PRU 9.3.29 R) is the higher of:

- (a) ?100,000; and

- (b) 1% of:

- (i) its total assets plus total undrawn commitments; less:

- (ii) loans excluded by PRU 9.3.33 R plus intangible assets (see Note 1 in the table in PRU 9.3.53 R).

- (2) Undrawn commitments in (1)(b)(i) means the total of those amounts which a borrower has the right to draw down from the firm but which have not yet been drawn down, excluding those under an agreement:

- (a) which has an original maturity of up to one year; or

- (b) which can be unconditionally cancelled at any time by the lender.

- 31/10/2004

PRU 9.3.32

See Notes

- 31/10/2004

PRU 9.3.33

See Notes

When calculating total assets for the purposes of PRU 9.3.31 R, the firm may exclude a loan which has been transferred to a third party only if it meets the following conditions:

- (1) the loan must have been transferred in a legally effective manner by one of the following means:

- (a) novation; or

- (b) legal or equitable assignment; or

- (c) sub-participation; or

- (d) declaration of trust; and

- (2) the lender:

- (a) retains no material economic interest in the loan; and

- (b) has no material exposure to losses arising from it.

- 31/10/2004

PRU 9.3.34

See Notes

- (1) When seeking to rely on the condition in PRU 9.3.33 R (2), a firm should ensure that the loan qualifies for the 'linked presentation' accounting treatment under Financial Reporting Standard 5 (Reporting the substance of transactions) issued in April 1994, and amended in December 1994 and September 1998 (if applicable to the firm).

- (2) Compliance with (1) may be relied upon as tending to establish compliance with PRU 9.3.33 R (2).

- 31/10/2004

PRU 9.3.35

See Notes

- 31/10/2004

PRU 9.3.36

See Notes

- (1) When seeking to rely on the condition in PRU 9.3.33 R (2), a firm should not provide material credit enhancement in respect of the loan unless it deducts the amount of the credit enhancement from its capital resources before meeting its capital resources requirement.

- (2) Credit enhancement includes:

- (a) any holding of subordinated loans or notes in a transferee that is a special purpose vehicle; or

- (b) over collateralisation by transferring loans to a larger aggregate value than the securities to be issued; or

- (c) any other arrangement with the transferee to cover a part of any subsequent losses arising from the transferred loan.

- (3) Contravention of (1) may be relied upon as tending to establish contravention of PRU 9.3.33 R (2).

- 31/10/2004

Capital resources requirement: mortgage administration only

PRU 9.3.37

See Notes

- 31/10/2004

PRU 9.3.38

See Notes

The capital resources requirement of a firm (carrying on the activities in row 3 of the table in PRU 9.3.29 R), which has all the regulated mortgage contracts that it administers off its balance sheet, is the higher of:

- (1) £100,000; and

- (2) 10% of its annual income (see PRU 9.3.42 R and PRU 9.3.48 R).

- 31/10/2004

Capital resources requirement: insurance mediation activity and mortgage lending or mortgage administration

PRU 9.3.39

See Notes

The capital resources requirement for a firm (carrying on the activities in row 4 of the table in PRU 9.3.29 R) is the sum of the requirements which are applied to the firm by:

- (1) PRU 9.3.30 R; and

- (2)

- (a) PRU 9.3.31 R; or

- (b) if, in addition to its insurance mediation activity, the firm carries on only mortgage administration and has all the assets that it administers off balance sheet, PRU 9.3.38 R.

- 31/10/2004

Capital resources requirement: mortgage mediation activity and mortgage lending or mortgage administration

PRU 9.3.40

See Notes

- (1) If a firm (carrying on the activities in row 5 of the table in PRU 9.3.29 R) does not hold client money or other client assets in relation to its mortgage mediation activity, the capital requirement is the amount applied to a firm, according to the activities carried on by the firm, by:

- (a) PRU 9.3.31 R; or

- (b) if, in addition to its mortgage mediation activity, the firm carries on only mortgage administration and has all the assets that it administers off balance sheet, PRU 9.3.38 R.

- (2) If a firm (carrying on the activities in row 5 of the table in PRU 9.3.29 R) holds client money or other client assets in relation to its mortgage mediation activity, the capital resources requirement is:

- (a) the amount calculated under (1); plus

- (b) the amount which is applied to a firm by PRU 9.3.30 R (2).

- 31/10/2004

Capital resources requirement: other combinations of activities

PRU 9.3.41

See Notes

- 31/10/2004

Annual income

PRU 9.3.42

See Notes

PRU 9.3.43 R to PRU 9.3.50 R contain provisions relating to the calculation of annual income for the purposes of:

- (1) PRU 9.2.13 R (2), PRU 9.2.15 R, PRU 9.2.17 R (2) and PRU 9.2.18 R (2) (all concerning the limits of indemnity for professional indemnity insurance); and

- (2) PRU 9.3.30 R (1)(b) and PRU 9.3.30 R (2)(b), and PRU 9.3.38 R (2).

- 31/10/2004

PRU 9.3.43

See Notes

- 31/10/2004

PRU 9.3.44

See Notes

- 31/10/2004

PRU 9.3.45

See Notes

- (1) The purpose of PRU 9.3.44 R is to ensure that the capital resources requirement is calculated on the basis only of brokerage and other amounts earned by a firm which are its own income.

- (2) For the purposes of PRU 9.3.43 R and PRU 9.3.44 R, a firm's annual income includes commissions and other amounts the firm may have agreed to pay to other persons involved in a transaction, such as sub-agents or other intermediaries.

- (3) A firm's annual income does not, however, include any amounts due to another person (for example, the product provider) which the firm has collected on behalf of that other person.

- 14/01/2005

PRU 9.3.46

See Notes

- 31/10/2004

PRU 9.3.47

See Notes

- 31/10/2004

Annual income for mortgage administration

PRU 9.3.48

See Notes

For the purposes of PRU 9.3.38 R (2) (Mortgage administration only) annual income is the sum of:

- (1) revenue (that is, commissions, fees, net interest income, dividends, royalties and rent); and

- (2) gains;

- (3) arising in the course of the ordinary activities of the firm, less profit:

- (a) on the sale or termination of an operation;

- (b) arising from a fundamental reorganisation or restructuring having a material effect on the nature and focus of the firm's operation; and

- (c) on the disposal of fixed assets, including investments held in a long-term portfolio.

- 31/10/2004

Annual income: periods of less than 12 months

PRU 9.3.49

See Notes

- 31/10/2004

Annual income: no financial statement

PRU 9.3.50

See Notes

- 31/10/2004

The calculation of a firm's capital resources

PRU 9.3.51

See Notes

- (1) A firm must calculate its capital resources only from the items in PRU 9.3.52 R from which it must deduct the items in PRU 9.3.53 R.

- (2) If the firm is subject to IPRU(INV) or CRED, the capital resources are the higher of:

- 31/10/2004

PRU 9.3.52

See Notes

| Item | Additional explanation | ||||

| 1. | Share capital | This must be fully paid and may include: | |||

| (1) | ordinary share capital; or | ||||

| (2) | preference share capital (excluding preference shares redeemable by shareholders within two years). | ||||

| 2. | Capital other than share capital (for example, the capital of a sole trader, partnership or limited liability partnership) | The capital of a sole trader is the net balance on the firm's capital account and current account. The capital of a partnership is the capital made up of the partners': |

|||

| (1) | capital account, that is the account: | ||||

| (a) | into which capital contributed by the partners is paid; and | ||||

| (b) | from which, under the terms of the partnership agreement, an amount representing capital may be withdrawn by a partner only if: | ||||

| (i) | he ceases to be a partner and an equal amount is transferred to another such account by his former partners or any person replacing him as their partner; or | ||||

| (ii) | the partnership is otherwise dissolved or wound up; and | ||||

| (2) | current accounts according to the most recent financial statement. | ||||

| For the purpose of the calculation of capital resources, in respect of a defined benefit occupational pension scheme: | |||||

| (1) | a firm must derecognise any defined benefit asset; | ||||

| (2) | a firm may substitute for a defined benefit liability the firm's deficit reduction amount, provided that the election is applied consistently in respect of any one financial year. | ||||

| 3. | Audited reserves | These are the audited accumulated profits retained by the firm (after deduction of tax, dividends and proprietors' or partners' drawings) and other reserves created by appropriations of share premiums and similar realised appropriations. Reserves also include gifts of capital, for example, from a parent undertaking. | |||

| For the purposes of calculating capital resources, a firm must make the following adjustments to its audited reserves, where appropriate: | |||||

| (1) | a firm must deduct any unrealised gains or, where applicable, add back in any unrealised losses on debt instruments held in the available-for-sale financial assets category; | ||||

| (2) | a firm must deduct any unrealised gains or, where applicable, add back in any unrealised losses on cash flow hedges of financial instruments measured at cost or amortised cost; | ||||

| (3) | in respect of a defined benefit occupational pension scheme: | ||||

| (a) | a firm must derecognise any defined benefit asset; | ||||

| (b) | a firm may substitute for a defined benefit liability the firm's deficit reduction amount, provided that the election is applied consistently in respect of any one financial year. | ||||

| 4. | Interim net profits | If a firm seeks to include interim net profits in the calculation of its capital resources, the profits have to be verified by the firm's external auditor, net of tax, anticipated dividends or proprietors' drawings and other appropriations. | |||

| 5. | Revaluation reserves | ||||

| 6. | General/collective provisions | These are provisions that a firm carrying on mortgage lending or mortgage administration holds against potential losses that have not yet been identified but which experience indicates are present in the firm's portfolio of assets. Such provisions must be freely available to meet these unidentified losses wherever they arise. General/collective provisions must be verified by external auditors and disclosed in the firm's annual report and accounts. | |||

| 7. | Subordinated loans | Subordinated loans must be included in capital on the basis of the provisions in PRU 9.3.56 R and PRU 9.3.57 R. | |||

- 21/04/2005

PRU 9.3.52A

See Notes

- 21/04/2005

PRU 9.3.53

See Notes

| 1 | Investments in own shares |

| 2 | Intangible assets (Note 1) |

| 3 | Interim net losses (Note 2) |

| 4 | Excess of drawings over profits for a sole trader or a partnership (Note 2) |

| Notes 1. Intangible assets are the full balance sheet value of goodwill (but not until 14 January 2008 - see transitional provision 2), capitalised development costs, brand names, trademarks and similar rights and licences. 2. The interim net losses in row 3, and the excess of drawings in row 4, are in relation to the period following the date as at which the capital resources are being computed. |

|

- 31/10/2004

Personal assets

PRU 9.3.54

See Notes

In relation to a sole trader's firm or a firm which is a partnership, the sole trader or a partner in the firm may use personal assets to meet the requirements of PRU 9.3.20 R or PRU 9.3.21 R, or both, to the extent necessary to make up any shortfall in meeting those requirements, unless:

- (1) those assets are needed to meet other liabilities arising from:

- (a) personal activities; or

- (b) another business activity not regulated by the FSA; or

- (2) the firm holds client money or other client assets.

- 31/10/2004

PRU 9.3.55

See Notes

- 31/10/2004

Subordinated loans

PRU 9.3.56

See Notes

In row 7 in the table at PRU 9.3.52 R, subordinated debt must not form part of the capital resources of the firm unless it meets the following conditions:

- (1) (for a firm which carries on insurance mediation activity or mortgage mediation activity (or both) but not mortgage lending or mortgage administration) it has an original maturity of:

- (a) at least two years; or

- (b) it is subject to two years' notice of repayment;

- (2) (for all other firms) it has an original maturity of:

- (a) at least five years; or

- (b) it is subject to five years' notice of repayment;

- (3) the claims of the subordinated creditors must rank behind those of all unsubordinated creditors;

- (4) the only events of default must be non-payment of any interest or principal under the debt agreement or the winding up of the firm;

- (5) the remedies available to the subordinated creditor in the event of non-payment or other default in respect of the subordinated debt must be limited to petitioning for the winding up of the firm or proving the debt and claiming in the liquidation of the firm;

- (6) the subordinated debt must not become due and payable before its stated final maturity date except on an event of default complying with (4);

- (7) the agreement and the debt are governed by the law of England and Wales, or of Scotland or of Northern Ireland;

- (8) to the fullest extent permitted under the rules of the relevant jurisdiction, creditors must waive their right to set off amounts they owe the firm against subordinated amounts owed to them by the firm;

- (9) the terms of the subordinated debt must be set out in a written agreement or instrument that contains terms that provide for the conditions set out in (1) to (8); and

- (10) the debt must be unsecured and fully paid up.

- 31/10/2004

PRU 9.3.57

See Notes

- (1) This rule applies to a firm which:

- (a) carries on:

- (i) insurance mediation activity; or

- (ii) mortgage mediation activity (or both); and

- (b) in relation to those activities, holds client money or other client assets;

- but is not carrying on mortgage lending or mortgage administration.

- (2) In calculating its capital resources under PRU 9.3.51 R (1), the firm must exclude any amount by which the aggregate amount of its subordinated loans and its redeemable preference shares exceeds the amount calculated under (3).

- (3) The calculation for (2) is:

four times (a - b - c);

where

a = items 1 to 5 in the Table at PRU 9.3.52 R

b = the firm's redeemable preference shares; and

c = the amount of its intangible assets (but not goodwill until 14 January 2008 - see transitional provision 2).

- 31/10/2004

PRU 9.3.58

See Notes

- 31/10/2004

PRU 9.4

Insurance undertakings and mortgage lenders using insurance or mortgage mediation services

- 01/12/2004

Application

PRU 9.4.1

See Notes

This section applies to a firm with a Part IV permission to carry on:

- (1) insurance business; or

- (2) mortgage lending;

- (3) and which uses, or proposes to use, the services of another person consisting of:

- (a) insurance mediation; or

- (b) insurance mediation activity; or

- (c) mortgage mediation activity.

- 31/10/2004

Purpose

PRU 9.4.2

See Notes

- 31/10/2004

PRU 9.4.3

See Notes

- 31/10/2004

Use of intermediaries

PRU 9.4.4

See Notes

A firm must not use, or propose to use, the services of another person consisting of:

- (1) insurance mediation; or

- (2) insurance mediation activity; or

- (3) mortgage mediation activity;

unless the conditions in PRU 9.4.5 R and PRU 9.4.7 R are satisfied.

- 31/10/2004

PRU 9.4.5

See Notes

The first condition in PRU 9.4.4 R is that the person, in relation to the activity:

- (1) has permission; or

- (2) is an exempt person; or

- (3) is an exempt professional firm; or

- (4) is registered in another EEA State for the purposes of the IMD; or

- (5) in relation to insurance mediation activity, is not carrying this activity on in the EEA; or

- (6) in relation to mortgage mediation activity, is not carrying this activity on in the United Kingdom.

- 31/10/2004

PRU 9.4.6

See Notes

- (1) A firm should:

- (a) before using the services of the intermediary, check:

- (i) the FSA Register; or

- (ii) in relation to insurance mediation carried on by an EEA firm, the register of its Home State regulator;

- for the status of the person; and

- (b) use the services of that person only if the relevant register indicates that the person is registered for that purpose.

- (2)

- (a) Compliance with (1)(a)(i) and (b) may be relied on as tending to establish compliance with:

- (i) PRU 9.4.5 R (1); or

- (ii) in relation to insurance mediation activity, also PRU 9.4.5 R (2) and PRU 9.4.5R (3).

- (b) Compliance with (1)(a)(ii) and (b) may be relied on as tending to establish compliance with PRU 9.4.5 R (4).

- 31/10/2004

PRU 9.4.7

See Notes

The second condition in PRU 9.4.4 R is that the firm takes all reasonable steps to ensure that the person in PRU 9.4.5 R in relation to the activity, is not, directly or indirectly, carrying out the activity as a consequence of the activities of another person which:

- 14/01/2005

PRU 9.4.8

See Notes

In order to comply with PRU 9.4.7 R, a firm may rely on a confirmation provided by the other person in writing if:

- (1) the confirmation is provided by a person within PRU 9.4.5 R;

- (2) the firm checked that this is the case; and

- (3) the firm is not aware that the confirmation is inaccurate and has no grounds for reasonably being aware that the confirmation is inaccurate.

- 31/10/2004

PRU 9.4.9

See Notes

- 31/10/2004

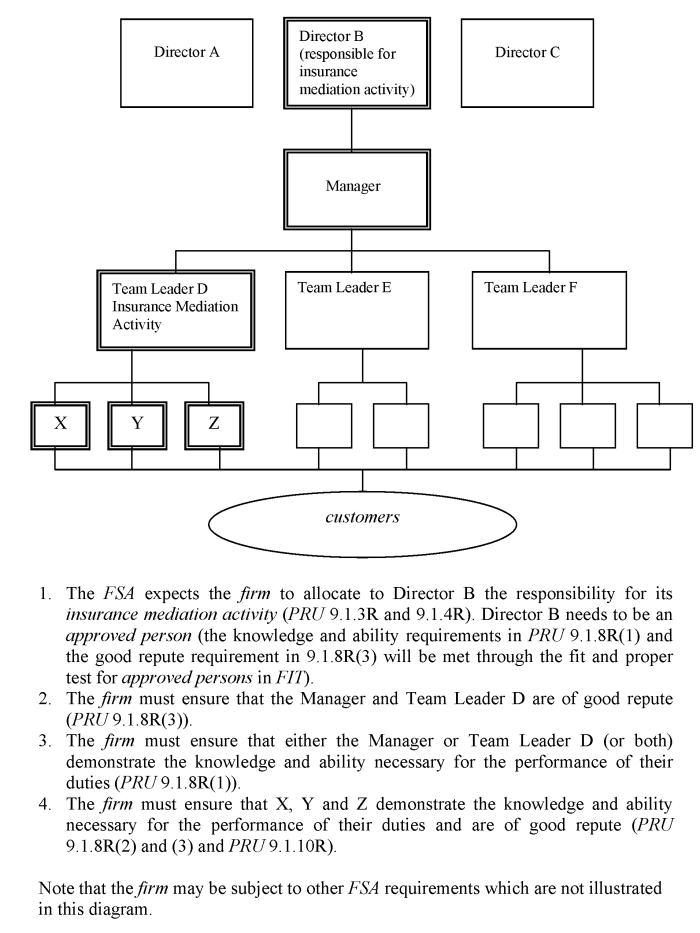

PRU 9 Annex 1

Example of the application of PRU 9.1.3 R, PRU 9.1.4 R, PRU 9.1.8 R and PRU 9.1.10 R

- 01/12/2004

See Notes

- 31/10/2004