PRU 8

Group risk

PRU 8.1

Group risk systems and controls requirement

- 01/01/2005

Application

PRU 8.1.1

See Notes

Subject to PRU 8.1.3 R to PRU 8.1.5 R, PRU 8.1 applies to each of the following which is a member of a group:

- (1) a firm that falls into any of the following categories:

- (a) a regulated entity;

- (b) a bank, ELMI or building society;

- (c) an insurer;

- (d) an own account dealer;

- (e) a matched principal broker;

- (f) a UCITS investment firm; and

- (g) a broker/manager or an arranger that satisfies the following conditions:

- (i) it is an ISD investment firm; and

- (ii) it is not an exempt CAD firm;

- (2) a UCITS firm, but only if its group contains a firm falling into (1); and

- (3) the Society.

- 01/01/2005

PRU 8.1.2

See Notes

Except as set out in PRU 8.1.5 R, PRU 8.1 applies with respect to different types of group as follows:

- (1) PRU 8.1.9 R and PRU 8.1.11 R apply with respect to all groups, including FSA regulated EEA financial conglomerates, other financial conglomerates and groups dealt with in PRU 8.1.14 R and PRU 8.1.15 R;

- (2) the additional requirements set out in PRU 8.1.12 R and PRU 8.1.13 R only apply with respect to FSA regulated EEA financial conglomerates; and

- (3) the additional requirements set out in PRU 8.1.14 R and PRU 8.1.15 R only apply with respect to groups of the kind dealt with by whichever of those rules apply.

- 01/01/2005

PRU 8.1.3

See Notes

PRU 8.1 does not apply to:

- (1) an incoming EEA firm; or

- (2) an incoming Treaty firm; or

- (3) a UCITS qualifier; or

- (4) an ICVC.

- 01/01/2005

PRU 8.1.4

See Notes

- 01/01/2005

PRU 8.1.5

See Notes

- (1) This rule applies to:

- (a) PRU 8.1.9 R (2);

- (b) PRU 8.1.11 R (1), so far as it relates to PRU 8.1.9 R (2);

- (c) PRU 8.1.11 R (2); and

- (d) PRU 8.1.12 R to PRU 8.1.14 R.

- (2) The rules referred to in (1):

- (a) only apply with respect to a financial conglomerate if it is an FSA regulated EEA financial conglomerate;

- (b) (so far as they apply with respect to a group that is not a financial conglomerate) do not apply with respect to a group for which a competent authority in another EEA state is lead regulator;

- (c) (so far as they apply with respect to a financial conglomerate) do not apply to a firm with respect to a financial conglomerate of which it is a member if the interest of the financial conglomerate in that firm is no more than a participation;

- (d) (so far as they apply with respect to other groups) do not apply to a firm with respect to a group of which it is a member if the only relationship of the kind set out in paragraph (3) of the definition of group between it and the other members of the group is nothing more than a participation; and

- (e) do not apply with respect to a third-country group.

- 01/01/2005

PRU 8.1.6

See Notes

- 01/01/2005

Purpose

PRU 8.1.7

See Notes

- 01/01/2005

PRU 8.1.8

See Notes

- 01/01/2005

General rules

PRU 8.1.9

See Notes

A firm must:

- (1) have adequate, sound and appropriate risk management processes and internal control mechanisms for the purpose of assessing and managing its own exposure to group risk, including sound administrative and accounting procedures; and

- (2) ensure that its group has adequate, sound and appropriate risk management processes and internal control mechanisms at the level of the group, including sound administrative and accounting procedures.

- 01/01/2005

PRU 8.1.10

See Notes

- 01/01/2005

PRU 8.1.11

See Notes

The internal control mechanisms referred to in PRU 8.1.9 R must include:

- (1) mechanisms that are adequate for the purpose of producing any data and information which would be relevant for the purpose of monitoring compliance with any prudential requirements (including any reporting requirements and any requirements relating to capital adequacy, solvency and large exposures):

- (a) to which the firm is subject with respect to its membership of a group; or

- (b) that apply to or with respect to that group or part of it; and

- (2) mechanisms that are adequate to monitor funding within the group.

- 01/01/2005

Financial conglomerates

PRU 8.1.12

See Notes

Where PRU 8.1 applies with respect to a financial conglomerate, the risk management processes referred to in PRU 8.1.9 R (2) must include:

- (1) sound governance and management processes, which must include the approval and periodic review by the appropriate managing bodies within the financial conglomerate of the strategies and policies of the financial conglomerate in respect of all the risks assumed by the financial conglomerate, such review and approval being carried out at the level of the financial conglomerate;

- (2) adequate capital adequacy policies at the level of the financial conglomerate, one of the purposes of which must be to anticipate the impact of the business strategy of the financial conglomerate on its risk profile and on the capital adequacy requirements to which it and its members are subject;

- (3) adequate procedures for the purpose of ensuring that the risk monitoring systems of the financial conglomerate and its members are well integrated into their organisation; and

- (4) adequate procedures for the purpose of ensuring that the systems and controls of the members of the financial conglomerate are consistent and that the risks can be measured, monitored and controlled at the level of the financial conglomerate.

- 01/01/2005

PRU 8.1.13

See Notes

Where PRU 8.1 applies with respect to a financial conglomerate, the internal control mechanisms referred to in PRU 8.1.9 R (2) must include:

- (1) mechanisms that are adequate to identify and measure all material risks incurred by members of the financial conglomerate and appropriately relate capital in the financial conglomerate to risks; and

- (2) sound reporting and accounting procedures for the purpose of identifying, measuring, monitoring and controlling intra-group transactions and risk concentrations.

- 01/01/2005

Credit institutions and investment firms

PRU 8.1.14

See Notes

In the case of a firm that:

- (1) is a credit institution or investment firm; and

- (2) has a mixed-activity holding company as a parent undertaking;

the risk management processes and internal control mechanisms referred to in PRU 8.1.9 R must include sound reporting and accounting procedures and other mechanisms that are adequate to identify, measure, monitor and control transactions between the firm's parent undertaking mixed-activity holding company and any of the mixed-activity holding company's subsidiary undertakings.

- 01/01/2005

Insurance undertakings

PRU 8.1.15

See Notes

- 01/01/2005

PRU 8.1.16

See Notes

- 01/01/2005

Nature and extent of requirements and allocation of responsibilities within the group

PRU 8.1.17

See Notes

- 01/01/2005

PRU 8.1.18

See Notes

- 01/01/2005

PRU 8.1.19

See Notes

- 01/01/2005

PRU 8.1.20

See Notes

- 01/01/2005

PRU 8.1.21

See Notes

- 01/01/2005

PRU 8.2

to follow

- 31/12/2004

PRU 8.3

Group Risk: Insurance Groups

- 31/12/2004

Application

PRU 8.3.1

See Notes

PRU 8.3 applies to an insurer that is:

- (1) a participating insurance undertaking; or

- (2) a member of an insurance group (which is not a participating insurance undertaking).

- 31/12/2004

PRU 8.3.2

See Notes

PRU 8.3 does not apply to:

- (1) a non-directive friendly society; or

- (2) a Swiss general insurer; or

- (3) an EEA-deposit insurer; or

- (4) an incoming EEA firm; or

- (5) an incoming Treaty firm.

- 31/12/2004

PRU 8.3.3

See Notes

- (1) on a solo basis, as an adjusted solo calculation, where that firm is a participating insurance undertaking; and

- (2) on a group basis where that firm is a member of an insurance group.

- 31/12/2004

PRU 8.3.4

See Notes

- 31/12/2004

Purpose

PRU 8.3.5

See Notes

- 31/12/2004

PRU 8.3.6

See Notes

PRU 8.3 sets out the sectoral rules for insurers for:

- (1) firms that are participating insurance undertakings carrying out an adjusted solo calculation as contemplated by PRU 2.1.9 R (2);

- (2) insurance groups; and

- (3) insurance conglomerates.

- 31/12/2004

PRU 8.3.7

See Notes

- 31/12/2004

Requirement to calculate GCR and GCRR

PRU 8.3.8

See Notes

- 31/12/2004

Requirement to maintain group capital

PRU 8.3.9

See Notes

- 31/12/2004

PRU 8.3.10

See Notes

A firm that is both:

- (1) a composite firm; and

- (2) an undertaking referred to in PRU 8.3.17 R (1)(c) or PRU 8.3.17 R (2);

must comply with PRU 8.3.9 R separately in respect of its long-term insurance business and its general insurance business.

- 31/12/2004

PRU 8.3.11

See Notes

- 31/12/2004

PRU 8.3.12

See Notes

- 31/12/2004

PRU 8.3.13

See Notes

In order to comply with PRU 8.3.10 R, a composite firm will need to:

- (1) establish the group capital resources requirement of its general insurance business and its long-term insurance business separately; and

- (2) allocate its group capital resources between its general insurance business and its long-term insurance business so that:

- (a) the group capital resources allocated to its general insurance business are equal to or in excess of the group capital resources requirement of its general insurance business; and

- (b) the group capital resources allocated to its long-term insurance business are equal to or in excess of the group capital resources requirement of its long-term insurance business.

- 31/12/2004

PRU 8.3.14

See Notes

- 31/12/2004

PRU 8.3.16

See Notes

- 31/12/2004

Scope - undertakings whose group capital is to be calculated and maintained

PRU 8.3.17

See Notes

The undertakings referred to in PRU 8.3.8 R, PRU 8.3.9 R, PRU 8.3.10 R and PRU 8.3.15 Rare:

- (1) for any firm that is not within (2), each of the following:

- (a) its ultimate insurance parent undertaking;

- (b) its ultimate EEA insurance parent undertaking (if different); and

- (c) the firm itself, if it is a participating insurance undertaking; and

- (2) the firm itself, where the firm is a participating insurance undertaking and is:

- (a) a pure reinsurer; or

- (b) a non-EEA insurer; or

- (c) a friendly society.

- 31/12/2004

PRU 8.3.18

See Notes

Article 3(3) of the Insurance Groups Directive allows an undertaking to be excluded from supplementary supervision if:

- (1) its head office is in a non-EEA State where there are legal impediments to the transfer of the necessary information; or

- (2) in the opinion of the competent authority responsible for exercising supplementary supervision, having regard to the objectives of supplementary supervision:

- (a) its inclusion would be inappropriate or misleading; or

- (b) it is of neglible interest.

- 31/12/2004

PRU 8.3.19

See Notes

- 31/12/2004

PRU 8.3.20

See Notes

- 31/12/2004

PRU 8.3.21

See Notes

- 31/12/2004

PRU 8.3.22

See Notes

- 31/12/2004

Optional alternative method of calculation for firms subject to supplementary supervision by another EEA competent authority

PRU 8.3.23

See Notes

- 31/12/2004

PRU 8.3.24

See Notes

- 31/12/2004

Non-EEA ultimate insurance parent undertakings

PRU 8.3.25

See Notes

Where the ultimate insurance parent undertaking of a firm has its head office in a non-EEA State, the firm may:

- (1) calculate the group capital resources and the group capital resources requirement of its ultimate insurance parent undertaking in accordance with accounting practice applicable for the purposes of the regulation of insurance undertakings in the state or territory of the head office of the ultimate insurance parent undertaking adapted as necessary to apply the general principles set out in Annex I (1) paragraphs B, C and D of the Insurance Groups Directive; and

- (2) elect (see PRU 8.3.26 R) to carry out the calculation referred to in (1) in accordance with the accounting consolidation method set out in Annex I (3) of the Insurance Groups Directive.

- 31/12/2004

PRU 8.3.26

See Notes

- 31/12/2004

PRU 8.3.27

See Notes

- 31/12/2004

Proportional holdings

PRU 8.3.28

See Notes

Subject to PRU 8.3.30 R and PRU 8.3.31 R, when calculating group capital resources and the group capital resources requirement of an undertaking in PRU 8.3.17 R, a firm must take only the relevant proportion of the following items ("calculation items") into account:

- (1) the solo capital resources of a regulated related undertaking;

- (2) the assets of a regulated related undertaking which are required to be deducted as part of the calculation of group capital resources; and

- (3) the individual capital resources requirement of a regulated related undertaking.

- 31/12/2004

PRU 8.3.29

See Notes

In PRU 8.3.28 R, the relevant proportion is either:

- (1) the proportion of the total number of issued shares in the regulated related undertaking held, directly or indirectly, by the undertaking in PRU 8.3.17 R; or

- (2) where a consolidation Article 12(1) relationship exists between related undertakings within the insurance group, such proportion as the FSA determines in accordance with Article 28(5) of the Financial Groups Directive and Regulation 15 of the Financial Groups Directive Regulations.

- 31/12/2004

PRU 8.3.30

See Notes

- 31/12/2004

PRU 8.3.31

See Notes

- 31/12/2004

PRU 8.3.32

See Notes

For the purposes of PRU 8.3.10 R, where a composite firm that is an undertaking in PRU 8.3.17 R (1)(c) or (2):

- (1) holds directly or indirectly shares in a regulated related undertaking; and

- (2) the shares in (1) are held partly by its long-term insurance business and partly by its general insurance business;

- (3) the relevant proportion of the calculation items calculated in accordance with PRU 8.3.29 R, subject to PRU 8.3.30 R and PRU 8.3.31 R, must be allocated between the long-term and general insurance business in proportion to their respective holdings, directly or indirectly, in the shares in that regulated related undertaking.

- 31/12/2004

Calculation of the GCRR

PRU 8.3.33

See Notes

- 31/12/2004

PRU 8.3.34

See Notes

For the purposes of PRU 8.3, an individual capital resources requirement is:

- (1) in respect of an insurer that is not within (2):

- (a) its capital resources requirement calculated in accordance with PRU 2.1; less

- (b) where the capital resources requirements of both the insurer and its insurance parent undertaking that is an insurer include with-profits insurance capital components, any element of double-counting that may arise from the aggregation of the individual capital resources requirements for the purposes of PRU 8.3.33 R;

- (2) in respect of an insurer that is either a pure reinsurer or whose main business otherwise consists of reinsurance, and whose head office is in the United Kingdom, the capital resources requirement that would apply to the firm in accordance with PRU 2.1 if its insurance business was not restricted to reinsurance;

- (3) in respect of an insurance undertaking that is not within (1) or (2) and whose main business is reinsurance and whose head office is in a designated State or territory, either:

- (a) the proxy capital resources requirement that would apply to it if, in connection with its reinsurance activities, the permissions on the basis of which that proxy capital resources requirement is calculated were permissions to carry on insurance business that is not restricted to reinsurance; or

- (b) the solo capital resources requirement that would apply to it if, in connection with its reinsurance activities, the insurance undertaking were a regulated insurance entity whose insurance business is not restricted to reinsurance for the purposes of calculating the solo capital resources requirement in accordance with the relevant sectoral rules of the designated State or territory;

- (4) in respect of an insurance undertaking that is not within (1) to (3) and whose main business is reinsurance, the proxy capital resources requirement that would apply to it if, in connection with its reinsurance activities, the permissions on the basis of which that proxy capital resources requirement is calculated were permissions to carry on insurance business that is not restricted to reinsurance;

- (5) in respect of an EEA insurer, the equivalent of the capital resources requirement as calculated in accordance with the applicable requirements in its Home State;

- (6) in respect of an insurance undertaking that is not within (1) to (5) and whose head office is in a designated State or territory, either:

- (a) the solo capital resources requirement applicable to it in that designated State or territory; or

- (b) its proxy capital resources requirement;

- (7) in respect of an insurance undertaking that is not within (1) to (6), its proxy capital resources requirement;

- (8) in respect of a regulated entity with its head office in the EEA (excluding an insurance undertaking), its solo capital resources requirement calculated in accordance with the sectoral rules for the financial sector applicable to it in the EEA State in which it has its head office;

- (9) in respect of a regulated entity not within (8) (excluding an insurance undertaking), its solo capital resources requirement;

- (10) in respect of an asset management company, the solo capital resources requirement that would apply to it if, in connection with its activities, it were treated as an investment firm for the purposes of calculating the solo capital resources requirement;

- (11) in respect of a financial institution that is not a regulated entity (including a financial holding company), the solo capital resources requirement that would apply to it if, in connection with its activities, it were treated as being within the banking sector; and

- (12) in respect of an insurance holding company, zero.

- 31/12/2004

PRU 8.3.35

See Notes

The Insurance Groups Directive defines reinsurers in terms of the 'main business' they carry on. Under the directive, the individual capital resources requirements for reinsurers (including those whose head office is in the United Kingdom) are to be calculated on the basis of requirements analogous to those applicable to direct insurers (that is, insurers carrying on insurance business that is not restricted to reinsurance). Although insurers that are pure reinsurers are already subject to PRU, there are a number of respects in which the capital regime that applies to them differs from that applicable to insurers who are direct insurers. The effect of PRU 8.3.34 R (2) to (4) is to calculate the individual capital resources requirement for all reinsurers as if they were carrying on direct insurance. This applies to:

- (1) pure reinsurers whose head office is in the United Kingdom;

- (2) insurers whose head office is in the United Kingdom and whose main business is reinsurance (because an insurer that is not a pure reinsurer with their business restricted to reinsurance may nevertheless in principle still have reinsurance as its main business);

- (3) reinsurers whose head office is in another EEA State;

- (4) reinsurers whose head office is in a designated State or territory (other than an EEA State); and

- (5) reinsurers whose head office is outside the EEA.

- 31/12/2004

Calculation of GCR

PRU 8.3.36

See Notes

- 31/12/2004

PRU 8.3.37

See Notes

For the purposes of PRU 8.3, the following expressions when used in relation to either an undertaking in PRU 8.3.17 R or a regulated related undertaking which is not subject to PRU 2.2.14 R, are to be construed as if that undertaking were required to calculate its capital resources in accordance with PRU 2.2.14 R, but with such adjustments being made to secure that the undertaking's calculation of its solo capital resources complies with the relevant sectoral rules applicable to it:

- 31/12/2004

PRU 8.3.38

See Notes

For the purposes of PRU 8.3.37 R, the sectoral rules applicable to:

- (1) an insurance holding company are the sectoral rules that would apply to it if, in connection with its activities, it were treated as an insurer;

- (2) an asset management company are the sectoral rules that would apply to it if, in connection with its activities, it were treated as an investment firm; and

- (3) subject to PRU 8.3.39 R, a financial institution, that is not a regulated entity, are the sectoral rules that would apply to it if, in connection with its activities, it were treated as being within the banking sector.

- 31/12/2004

PRU 8.3.39

See Notes

Where a financial institution, that is not a regulated entity, has invested in tier one capital or tier two capital issued by a parent undertaking that is:

- (1) an insurance holding company; or

- (2) an insurer;

the sectoral rules that apply to that financial institution are the sectoral rules for the insurance sector.

- 31/12/2004

PRU 8.3.40

See Notes

For the purposes of PRU 8.3.36 R, the capital resources of a financial institution within PRU 8.3.39 R that can be included in the calculations in PRU 8.3.48 R (2), PRU 8.3.50 R (2), PRU 8.3.53 R (2), PRU 8.3.55 R (2) and PRU 8.3.57 R (2) are:

- (1) the issued tier one capital or tier two capital of that financial institution held, directly or indirectly, by its parent undertaking referred to in PRU 8.3.39 R; and

- (2) the lower of:

- (a) the tier one capital or tier two capital issued by the parent undertaking referred to in PRU 8.3.39 R pursuant to the investment by the financial institution; and

- (b) the tier one capital or tier two capital issued by the financial institution to raise funds for its investment in the capital resources of the parent undertaking referred to in (a).

- 31/12/2004

PRU 8.3.41

See Notes

- (1) In calculating group capital resources, a firm must exclude the restricted assets of a regulated related undertaking except insofar as those assets are available to meet the individual capital resources requirement of that regulated related undertaking.

- (2) In (1), "restricted assets" means assets of a regulated related undertaking which are subject to a legal restriction or other requirement having the effect that those assets cannot be transferred or otherwise made available to another regulated related undertaking for the purposes of meeting its individual capital resources requirement without causing a breach of that legal restriction or requirement.

- 31/12/2004

PRU 8.3.42

See Notes

- 31/12/2004

PRU 8.3.43

See Notes

| Stage | Related text | |

| Total group tier one capital | A | PRU 8.3.48 R |

| Total group tier two capital | B | PRU 8.3.50 R |

| Group capital resources before deductions | C=(A+B) | |

| Total deductions of inadmissible assets | D | PRU 8.3.59 R |

| Total deductions under the requirement deduction method from group capital resources | E | PRU 8.3.62 R |

| Total deductions of ineligible surplus capital* | F | PRU 8.3.65 R |

| Deduction of assets in excess of market risk and counterparty exposure limits* | G | PRU 8.3.70 R |

| Group capital resources | H=(C-(D+E+F*+G*)) | |

| * = section (F) of the table (the deductions for ineligible surplus capital) and section (G) of the table (assets in excess of market risk and counterparty exposure limits) only apply and are required to be calculated for the purposes of the adjusted solo calculation of an undertaking in PRU 8.3.17 R that is a participating insurance undertaking. | ||

- 31/12/2004

Calculation of GCR - Limits on the use of different forms of capital

PRU 8.3.44

See Notes

- 31/12/2004

PRU 8.3.45

See Notes

- (1) For the purposes of PRU 8.3.9 R, PRU 8.3.10 R and PRU 8.3.15 R, a firm must ensure that at all times its tier one capital resources and tier two capital resources are of such an amount that the group capital resources of the undertaking in PRU 8.3.17 R comply with the following limits:

- (a) (P - Q) > ½ (R - S);

- (b) (P - Q + T - W) > ¾ (R - S);

- (c) V > ½ P;

- (d) Q < 15% of P;

- (e) T < P; and

- (f) W < ½ P

- (2) For the purposes of PRU 8.3.9 R and PRU 8.3.10 R, a firm must ensure that at all times its tier one capital resources and tier two capital resources are of such an amount that its group capital resources comply with the following limit:

- (P - Q + T) > 1/3 X + (R - S - U - X).

- (3) For the purposes of (1) and (2):

- (a) P is the total group tier one capital of the undertaking in PRU 8.3.17 R;

- (b) Q is the sum of the innovative tier one capital resources calculated in accordance with PRU 8.3.53 R;

- (c) R is the group capital resources requirement of the undertaking in PRU 8.3.17 R;

- (d) S is the sum of all the with-profits insurance capital components of an undertaking in PRU 8.3.17 R that is an insurer and each of its regulated related undertakings that is an insurer;

- (e) T is the total group tier two capital of the undertaking in PRU 8.3.17 R;

- (f) U is the sum of all the resilience capital requirements of an undertaking in PRU 8.3.17 R that is an insurer and each of its regulated related undertakings that is an insurer;

- (g) V is the sum of all the core tier one capital calculated in accordance with PRU 8.3.55 R;

- (h) W is the sum of the lower tier two capital resources calculated in accordance with PRU 8.3.57 R; and

- (i) X is the MCR of the firm less its resilience capital requirement, if any.

- 31/12/2004

PRU 8.3.46

See Notes

- 31/12/2004

PRU 8.3.47

See Notes

- 31/12/2004

Calculation of GCR - Total group tier one capital

PRU 8.3.48

See Notes

For the purposes of PRU 8.3.43 R, the total group tier one capital of an undertaking in PRU 8.3.17 R is the sum of:

- (1) the tier one capital resources of the undertaking in PRU 8.3.17 R; and

- (2) subject to PRU 8.3.40 R, the tier one capital resources of each of the related undertakings of that undertaking that is a regulated related undertaking after the deduction in PRU 8.3.49 R.

- 31/12/2004

PRU 8.3.49

See Notes

The deduction referred to in PRU 8.3.48 R is the sum of:

- (1) the book value of the investment by the undertaking in PRU 8.3.17 R in the tier one capital resources of each of its related undertakings that is a regulated related undertaking; and

- (2) the book value of the investments by related undertakings of the undertaking in PRU 8.3.17 R in the tier one capital resources of the undertaking in PRU 8.3.17 R and each of its related undertakings that is a regulated related undertaking.

- 31/12/2004

Calculation of GCR - Total group tier two capital

PRU 8.3.50

See Notes

For the purposes of PRU 8.3.43 R, the total group tier two capital of an undertaking in PRU 8.3.17 R is the sum of:

- (1) the upper tier two capital resources and the lower tier two capital resources of that undertaking; and

- (2) subject to PRU 8.3.40 R, the upper tier two capital resources and the lower tier two capital resources of each of the related undertakings of that undertaking that is a regulated related undertaking after the deduction in PRU 8.3.51 R.

- 31/12/2004

PRU 8.3.51

See Notes

The deduction referred to in PRU 8.3.50 R is the sum of:

- (1) the book value of the investments by the undertaking in PRU 8.3.17 R in the upper tier two capital resources and the lower tier two capital resources of each of its related undertakings that is a regulated related undertaking; and

- (2) the book value of the investments by related undertakings of the undertaking in PRU 8.3.17 R in the upper tier two capital resources and the lower tier two capital resources of the undertaking in PRU 8.3.17 R and each of its related undertakings that is a regulated related undertaking.

- 31/12/2004

PRU 8.3.52

See Notes

- 31/12/2004

Calculation of GCR - Innovative tier one capital resources, lower tier two capital resources and core tier one capital

PRU 8.3.53

See Notes

For the purposes of PRU 8.3.45R (3)(b), the innovative tier one capital resources is the sum of:

- (1) the innovative tier one capital resources of the undertaking in PRU 8.3.17 R; and

- (2) subject to PRU 8.3.40 R, the innovative tier one capital resources of each of the related undertakings of that undertaking that is a regulated related undertaking after the deduction in PRU 8.3.54 R.

- 31/12/2004

PRU 8.3.54

See Notes

The deduction referred to in PRU 8.3.53 R is the sum of:

- (1) the book value of the investments by the undertaking in PRU 8.3.17 R in the innovative tier one capital resources of each of its related undertakings that is a regulated related undertaking; and

- (2) the book value of the investments by related undertakings of the undertaking in PRU 8.3.17 R in the innovative tier one capital resources of the undertaking in PRU 8.3.17 R and each of its related undertakings that is a regulated related undertaking.

- 31/12/2004

PRU 8.3.55

See Notes

For the purposes of PRU 8.3.45R (3)(g), the core tier one capital is the sum of:

- (1) the core tier one capital of the undertaking of PRU 8.3.17 R; and

- (2) subject to PRU 8.3.40 R, the core tier one capital of each of the related undertakings of that undertaking that is a regulated related undertaking after the deduction in PRU 8.3.56 R.

- 31/12/2004

PRU 8.3.56

See Notes

The deduction referred to in PRU 8.3.55 R is the sum of:

- (1) the book value of the investments by the undertaking in PRU 8.3.17 R in the core tier one capital of each of its related undertakings that is a regulated related undertaking; and

- (2) the book value of the investments by related undertakings of the undertaking in PRU 8.3.17 R in the core tier one capital of the undertaking in PRU 8.3.17 R and each of its related undertakings that is a regulated related undertaking.

- 31/12/2004

PRU 8.3.57

See Notes

For the purposes of PRU 8.3.45R (3)(h), the lower tier two capital resources is the sum of:

- (1) the lower tier two capital resources of the undertaking in PRU 8.3.17 R; and

- (2) subject to PRU 8.3.40 R, the lower tier two capital resources of each of the related undertakings of that undertaking that is a regulated related undertaking after the deduction in PRU 8.3.58 R.

- 31/12/2004

PRU 8.3.58

See Notes

The deduction referred to in PRU 8.3.57 R is the sum of:

- (1) the book value of the investments by the undertaking in PRU 8.3.17 R in the lower tier two capital resources of each of its related undertakings that is a regulated related undertaking; and

- (2) the book value of the investments by related undertakings of the undertaking in PRU 8.3.17 R in the lower tier two capital resources of the undertaking in PRU 8.3.17 R and each of its related undertakings that is a regulated related undertaking.

- 31/12/2004

Calculation of GCR - Inadmissible assets

PRU 8.3.59

See Notes

- 31/12/2004

PRU 8.3.60

See Notes

For the purposes of PRU 8.3.59 R, an asset is not an admissible asset if:

- (1) in respect of a regulated related undertaking or undertaking in PRU 8.3.17 R that is an insurer, it is not an admissible asset as listed in PRU 2 Annex 1R;

- (2) in respect of a regulated related undertaking or undertaking in PRU 8.3.17 R that is not an insurer, it is an asset of the undertaking that is not admissible for the purpose of calculating that undertaking's solo capital resources in accordance with the sectoral rules applicable to it.

- 31/12/2004

PRU 8.3.61

See Notes

For the purposes of PRU 8.3.60 R (2), the sectoral rules applicable to:

- (1) an asset management company are the sectoral rules that would apply to it if, in connection with its activities, it were treated as an investment firm; and

- (2) a financial institution that is not a regulated entity are the sectoral rules that would apply to it if, in connection with its activities, it were treated as being within the banking sector.

- 31/12/2004

Calculation of GCR - Deductions under requirement deduction method from group capital resources

PRU 8.3.62

See Notes

- 31/12/2004

PRU 8.3.63

See Notes

- 31/12/2004

PRU 8.3.64

See Notes

For the purposes of PRU 8.3.63 R, the notional capital resources requirement is:

- (1) for an ancillary insurance services undertaking, zero;

- (2) for any other ancillary services undertaking, the capital resources requirement that would apply to that undertaking, if it were a regulated related undertaking, in accordance with the sectoral rules applicable to a regulated related undertaking whose activities are closest in nature and scope to the activities of that undertaking.

- 31/12/2004

Calculation of GCR - Deductions of ineligible surplus capital

PRU 8.3.65

See Notes

- 31/12/2004

PRU 8.3.66

See Notes

The purpose of PRU 8.3.65 R is to ensure that, where the undertaking in PRU 8.3.17 R is a firm, group capital resources are not overstated by the inclusion of capital that, although surplus to the requirements of the relevant regulated related undertaking that is an insurance undertaking, cannot practically be transferred to support requirements arising elsewhere in the group. Therefore, ineligible surplus capital in a regulated related undertaking that is an insurance undertaking is deducted in arriving at group capital resources. Surplus capital in such a regulated related undertaking is regarded as transferable only to the extent that:

- (1) it can be transferred without the regulated related undertaking breaching its own limits on the use of different forms of capital;

- (2) it does not contain assets that are restricted within the meaning of PRU 8.3.41 R; and

- (3) in the case of a regulated related undertaking that has a long-term insurance business, it does not contain any assets allocated to the capital resources of that undertaking for the purposes of the capital resources of its long-term insurance business meeting the capital resources requirement of its long-term insurance business.

- 31/12/2004

PRU 8.3.67

See Notes

- (1) For the purposes of PRU 8.3.65 R, the ineligible surplus capital of a regulated related undertaking that is an insurance undertaking is calculated by deducting B from A where:

- (a) A is the regulatory surplus value of that insurance undertaking less any restricted assets of the insurance undertaking that have been excluded under PRU 8.3.41 R; and

- (b) B is the transferable capital of that undertaking.

- (2) If A minus B is negative, the ineligible surplus capital is zero.

- 31/12/2004

PRU 8.3.68

See Notes

For the purposes of PRU 8.3.67 R (1)(b), the transferable capital is calculated by deducting the sum of the following from the tier one capital resources of the regulated related undertaking that is an insurance undertaking:

- (1) any restricted assets of that insurance undertaking that have been excluded under PRU 8.3.41 R;

- (2) any tier one capital resources of that insurance undertaking that have been allocated towards meeting the individual capital resources requirement of its long-term insurance business; and

- (3) the higher of:

- (a) 50% of the individual capital resources requirement of the general insurance business of that insurance undertaking; and

- (b) the individual capital resources requirement of the general insurance business of that insurance undertaking less the difference between E and F where:

- (i) E is its tier two capital resources; and

- (ii) F is the amount of its tier two capital resources that have been allocated towards meeting the individual capital resources requirement of its long-term insurance business.

- 31/12/2004

PRU 8.3.69

See Notes

Examples of transferable and ineligible surplus capital:

Example 1

| Share capital | Audited reserves | FFA | Tier two | Requirement |

| 30 | 20 | 0 | 40 | 50 |

- (i) Under PRU 8.3.68 R, transferable capital = tier one capital resources of 50, less the sum of:

- (1) restricted assets excluded under PRU 8.3.41 R = (none);

- (2) tier one capital resources allocated to the long-term insurance business = (none); and

- (3) higher of (50% of 50 = 25 and 50 - 40 = 10) = (25) = (50 - 25) = 25

- (2) Under PRU 8.3.67 R, ineligible surplus capital = regulatory surplus value (40) less restricted assets excluded under PRU 8.3.41 R (0) less transferable capital (25) = 15.

Example 2

| Share capital | Audited reserves | FFA (of which 5 is restricted) | Tier two | Requirement (of which 4 relates to the long-term insurance business) |

| 30 | 20 | 10 | 40 | 50 |

- (i) Under PRU 8.3.68 R, transferable capital = tier one capital resources of 60, less the sum of:

- (1) restricted assets excluded under PRU 8.3.41 R = (5);

- (2) tier one capital resources allocated to the long-term insurance business = (5); and

- (3) the higher of (50% of 45 = 22.5; and 45 - 40 = 5) = (22.5)= 60 - 32.5 = 27.5

- (ii) Under PRU 8.3.67 R, ineligible surplus capital = regulatory surplus value (50) - restricted assets excluded under PRU 8.3.41 R of (5) - transferable capital (27.5) = 17.5.

Example 3

| Share capital | Audited reserves | FFA (of which 0 is restricted) | Tier two (40, of which 5 is excluded at the solo level - see below) | Requirement (of which 25 relates to the long-term insurance business) |

| 20 | 10 | 20 | 35 | 50 |

The requirement relating to the long-term insurance business is met by the FFA of 20 and tier two capital resources of 5. Of the remaining tier two capital resources of 35, 5 is excluded at the solo level because the tier one capital resources allocated to the general insurance business are 30.

- (i) Under PRU 8.3.68 R, transferable capital = tier one capital resources of 50, less the sum of:

- (1) restricted assets excluded under PRU 8.3.41 R = (none);

- (2) tier one capital resources allocated to the long-term insurance business = (20); and

- (3) the higher of (50% of 25 = 12.5; and 25 - (35 - 5) = -5) = (12.5)= 50 - 32.5 = 17.5.

- (ii) Under PRU 8.3.67 R, ineligible surplus capital = regulatory surplus value (35) - restricted assets excluded under PRU 8.3.41 R of (0) - transferable capital (17.5) = 17.5.

- 31/12/2004

Calculation of GCR - Assets in excess of market risk and counterparty exposure limits

PRU 8.3.70

See Notes

- 31/12/2004

PRU 8.3.71

See Notes

- 31/12/2004

PRU 8.3.72

See Notes

The firm (A) must, subject to PRU 8.3.73 R, include in the calculation in PRU 8.3.74 R each related undertaking (B) that is:

- (1) a regulated related undertaking that is a subsidiary undertaking; or

- (2) a related undertaking where the firm has elected to value the shares held in that undertaking by the firm in accordance with PRU 1.3.35 R for the purposes of calculating the tier one capital resources of the firm.

- 31/12/2004

PRU 8.3.73

See Notes

The related undertakings in PRU 8.3.72 R need only be included in the calculation in PRU 8.3.74 R if:

- (1) where B is a regulated related undertaking, the solo capital resources of that undertaking exceed its individual capital resources requirement; or

- (2) where B is an undertaking in PRU 8.3.72 R (2), its assets that fall within one or more of the categories in PRU 2 Annex 1R exceed its accounting liabilities.

- 31/12/2004

PRU 8.3.74

See Notes

A's assets in excess of the market risk and counterparty exposure limits are calculated as follows:

- (1) Subject to (2), a firm must apply the market risk and counterparty exposure limits in PRU 3.2.22 R (3) to:

- (a) where B is an insurer, the admissible assets of B;

- (b) where B is a regulated related undertaking that is not an insurer, the assets of that undertaking less those assets identified in PRU 8.3.60 R (2) as not being admissible assets.

- (2) The market risk and counterparty exposure limits do not need to be applied to an undertaking in PRU 8.3.72 R (2).

- (3) Where the assets of B in PRU 8.3.74 R (1) exceed the limits in PRU 3.2.22 R (3), the assets of B in excess of the limits must be deducted by the firm from B's solo capital resources for the purposes of PRU 8.3.30 R.

- (4) After the application of (1) and (2), the surplus assets of B are aggregated with the admissible assets of A, where the surplus assets of B are:

- (a) where B is a firm, the admissible assets of B that represent the amount by which the capital resources of B exceed its capital resources requirement, subject to PRU 8.3.77 R, and limited to the amount of transferable capital calculated in accordance with PRU 8.3.68 R;

- (b) where B is a regulated related undertaking that is not a firm, the assets of the undertaking in PRU 8.3.74 R (1)(b) that represent the amount by which the solo capital resources of B exceed its individual capital resources requirement and, where B is an insurance undertaking that is not a firm, limited to the amount of transferable capital calculated in accordance with PRU 8.3.68 R; and

- (c) where B is an undertaking in PRU 8.3.72 R (2), the assets of the undertaking which represent those assets that fall within one or more of the categories in PRU 2 Annex 1R which exceed its accounting liabilities.

- (5) The market risk and counterparty exposure limits are then applied to the aggregate of A's admissible assets and the surplus assets in PRU 8.3.74 R (4).

- 31/12/2004

PRU 8.3.75

See Notes

- 31/12/2004

PRU 8.3.76

See Notes

In relation to any of its regulated related undertakings that is not an insurer, A may modify the calculation in PRU 8.3.74 R by:

- (1) omitting the calculation in PRU 8.3.74 R (1) and (3); and

- (2) aggregating all of the assets of B identified in PRU 8.3.74 R (1)(b) as admissible assets with the admissible assets of A in PRU 8.3.74 R (4).

- 31/12/2004

PRU 8.3.77

See Notes

- 31/12/2004

PRU 8.3.78

See Notes

- 31/12/2004

PRU 8.4

Cross sector groups

- 01/12/2004

Application

PRU 8.4.1

See Notes

- (1) PRU 8.4 applies to every firm that is a member of a financial conglomerate other than:

- (a) an incoming EEA firm;

- (b) an incoming Treaty firm;

- (c) a UCITS qualifier; and

- (d) an ICVC.

- (2) PRU 8.4 does not apply to a firm with respect to a financial conglomerate of which it is a member if the interest of the financial conglomerate in that firm is no more than a participation.

- (3) PRU 8.4.25 R (Capital adequacy requirements: high level requirement), PRU 8.4.26 R (Capital adequacy requirements: application of Method 4 from Annex I of the Financial Groups Directive), PRU 8.4.29 R (Capital adequacy requirements: application of Methods 1, 2 or 3 from Annex I of the Financial Groups Directive) and PRU 8.4.35 R (Risk concentration and intra group transactions: the main rule) do not apply with respect to a third-country financial conglomerate.

- 11/08/2004

Purpose

PRU 8.4.2

See Notes

PRU 8.4 implements the Financial Groups Directive. However, material on the following topics is to be found elsewhere in the Handbook as follows:

- (1) further material on third-country financial conglomerates can be found in PRU 8.5;

- (2) SUP 15.9 contains notification rules for members of financial conglomerates;

- (3) material on reporting obligations can be found in SUP 16.7.73 R and SUP 16.7.74 R; and

- (4) material on systems and controls in financial conglomerates can be found in PRU 8.1.

- 11/08/2004

Introduction: identifying a financial conglomerate

PRU 8.4.3

See Notes

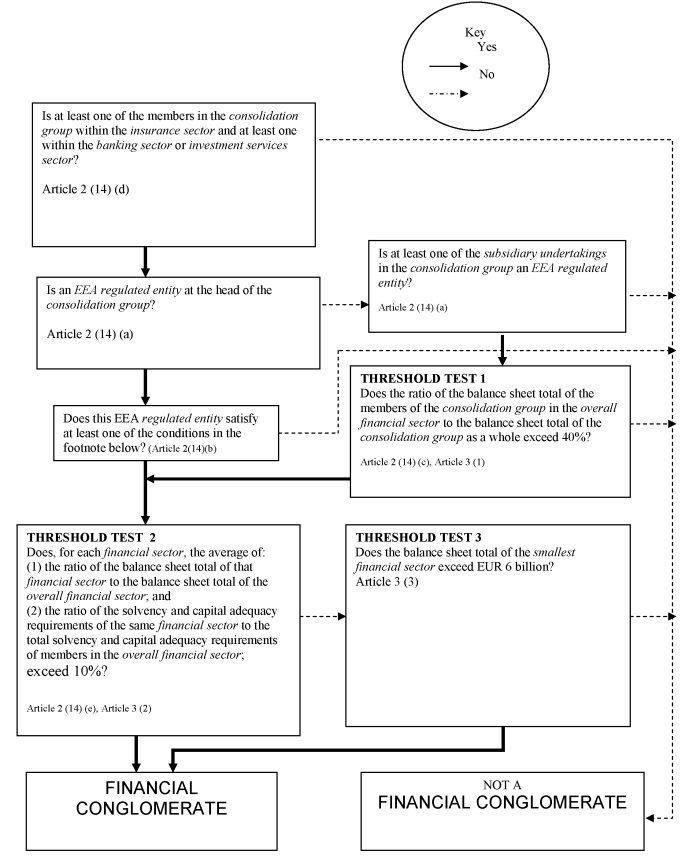

- (1) In general the process in (2) to (8) applies for identifying financial conglomerates.

- (2) Competent authorities that have authorised regulated entities should try to identify any consolidation group that is a financial conglomerate. If a competent authority is of the opinion that a regulated entity authorised by that competent authority is a member of a consolidation group which may be a financial conglomerate it should communicate its view to the other competent authorities concerned.

- (3) A competent authority may start (as described in (2)) the process of deciding whether a group is a financial conglomerate even if it would not be the coordinator.

- (4) A member of a group may also start that process by notifying one of the competent authorities that have authorised group members that its group may be a financial conglomerate, for example by notification under SUP 15.9.

- (5) If a group member gives a notification in accordance with (4), that does not automatically mean that the group should be treated as a financial conglomerate. The process described in (6) to (9) still applies.

- (6) The competent authority that would be coordinator will take the lead in establishing whether a group is a financial conglomerate once the process has been started as described in (2) and (3).

- (7) The process of establishing whether a group is a financial conglomerate will normally involve discussions between the financial conglomerate and the competent authorities concerned.

- (8) A financial conglomerate should be notified by its coordinator that it has been identified as a financial conglomerate and of the appointment of the coordinator. The notification should be given to the parent undertaking at the head of the group or, in the absence of a parent undertaking, the regulated entity with the largest balance sheet total in the most important financial sector. That notification does not of itself make a group into a financial conglomerate; whether or not a group is a financial conglomerate is governed by the definition of financial conglomerate as set out in PRU 8.4.

- (9) PRU 8 Ann 4R is a questionnaire (together with its explanatory notes) that the FSA asks groups that may be financial conglomerates to fill out in order to decide whether or not they are.

- 11/08/2004

Introduction: The role of other competent authorities

PRU 8.4.4

See Notes

- 11/08/2004

Definition of financial conglomerate: basic definition

PRU 8.4.5

See Notes

- 31/12/2004

Definition of financial conglomerate: sub-groups

PRU 8.4.6

See Notes

A consolidation group is not prevented from being a financial conglomerate because it is part of a wider:

- (1) consolidation group; or

- (2) financial conglomerate; or

- (3) group of persons linked in some other way.

- 11/08/2004

Definition of financial conglomerate: the financial sectors: general

PRU 8.4.7

See Notes

For the purpose of the definition of financial conglomerate, there are two financial sectors as follows:

- (1) the banking sector and the investment services sector, taken together; and

- (2) the insurance sector.

- 11/08/2004

PRU 8.4.8

See Notes

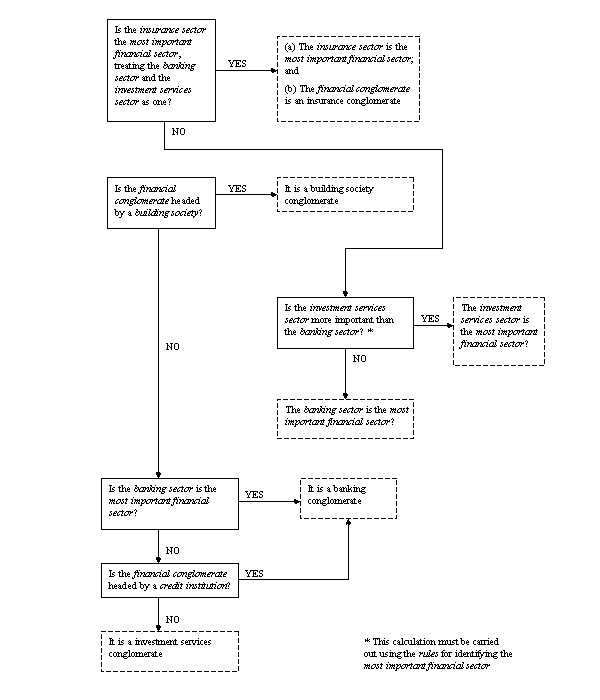

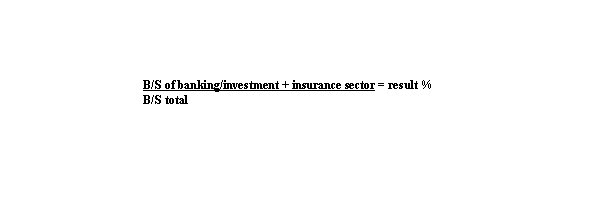

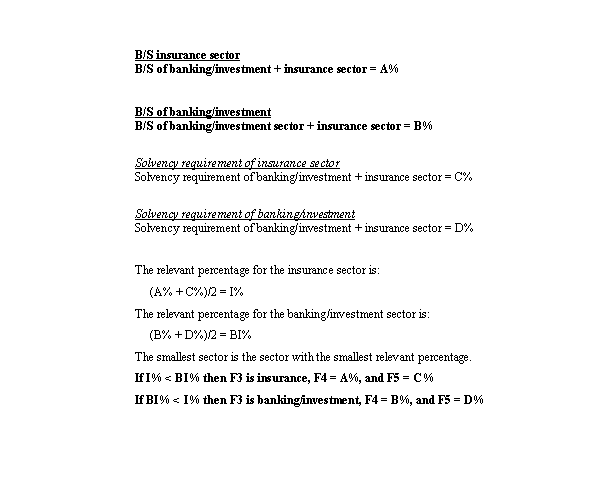

- (1) This rule applies for the purpose of the definition of financial conglomerate and the financial conglomerate definition decision tree.

- (2) Any mixed financial holding company is considered to be outside the overall financial sector for the purpose of the tests set out in the boxes titled Threshold Test 1, Threshold Test 2 and Threshold Test 3 in the financial conglomerate definition decision tree.

- (3) Determining whether the tests set out in the boxes titled Threshold Test 2 and Threshold Test 3 in the financial conglomerate definition decision tree are passed is based on considering the consolidated and/or aggregated activities of the members of the consolidation group within the insurance sector and the consolidated and/or aggregated activities of the members of the consolidation group within the banking sector and the investment services sector.

- 11/08/2004

Definition of financial conglomerate: adjustment of the percentages

PRU 8.4.9

See Notes

Once a financial conglomerate has become a financial conglomerate and subject to supervision in accordance with the Financial Groups Directive, the figures in the financial conglomerate definition decision tree are altered as follows:

- (1) the figure of 40% in the box titled Threshold Test 1 is replaced by 35%;

- (2) the figure of 10% in the box titled Threshold Test 2 is replaced by 8%; and

- (3) the figure of six billion Euro in the box titled Threshold Test 3 is replaced by five billion Euro.

- 11/08/2004

PRU 8.4.10

See Notes

The alteration in PRU 8.4.9 R only applies to a financial conglomerate during the period that:

- (1) begins when the financial conglomerate would otherwise have stopped being a financial conglomerate because it does not meet one of the unaltered thresholds referred to in PRU 8.4.9 R; and

- (2) covers the three years following that date.

- 11/08/2004

Definition of financial conglomerate: balance sheet totals

PRU 8.4.11

See Notes

- 11/08/2004

Definition of financial conglomerate: solvency requirement

PRU 8.4.12

See Notes

- 11/08/2004

Definition of financial conglomerate: discretionary changes to the definition

PRU 8.4.13

See Notes

Articles 3(3) to 3(6), Article 5(4) and Article 6(5) of the Financial Groups Directive allow competent authorities, on a case by case basis, to:

- (1) change the definition of financial conglomerate and the obligations applying with respect to a financial conglomerate;

- (2) apply the scheme in the Financial Groups Directive to EEA regulated entities in specified kinds of group structures that do not come within the definition of financial conglomerate; and

- (3) exclude a particular entity in the scope of capital adequacy requirements that apply with respect to a financial conglomerate.

- 11/08/2004

Capital adequacy requirements: introduction

PRU 8.4.14

See Notes

- 11/08/2004

PRU 8.4.15

See Notes

- 11/08/2004

PRU 8.4.16

See Notes

- 11/08/2004

PRU 8.4.17

See Notes

Annex I of the Financial Groups Directive lays down four methods for calculating capital adequacy at the level of a financial conglomerate. Those four methods are implemented as follows:

- (1) Method 1 calculates capital adequacy using accounting consolidation. It is implemented by PRU 8.4.29 R to PRU 8.4.31 R and Part 1 of PRU 8 Ann 1R G.

- (2) Method 2 calculates capital adequacy using a deduction and aggregation approach. It is implemented by PRU 8.4.29 R to PRU 8.4.31 R and Part 2 of PRU 8 Ann 1R 1.

- (3) Method 3 calculates capital adequacy using book values and the deduction of capital requirements. It is implemented by PRU 8.4.29 R to PRU 8.4.31 R and Part 3 of PRU 8 Ann 1R G.

- (4) Method 4 consists of a combination of Methods 1, 2 and 3 from Annex I of the Financial Groups Directive, or a combination of two of those Methods. It is implemented by PRU 8.4.26 R to PRU 8.4.28 R, PRU 8.4.30 R and Part 4 of PRU 8 Ann 1R G.

- 11/08/2004

PRU 8.4.18

See Notes

Part 4 of PRU 8 Ann 1R G (Use of Method 4 from Annex I of the Financial Conglomerates Directive) applies the FSA's sectoral rules with respect to the financial conglomerate as a whole, with some adjustments. Where Part 4 of PRU 8 Ann 1R G applies the FSA's sectoral rules for:

- (1) the insurance sector, that involves a combination of Methods 2 and 3; and

- (2) the banking sector and the investment services sector, that involves a combination of Methods 1 and 3.

- 11/08/2004

PRU 8.4.19

See Notes

- 11/08/2004

PRU 8.4.20

See Notes

- (1) In the following cases, the FSA (acting as coordinator) may choose which of the four methods for calculating capital adequacy laid down in Annex I of the Financial Groups Directive should apply:

- (a) where a financial conglomerate is headed by a regulated entity that has been authorised by the FSA; or

- (b) the only relevant competent authority for the financial conglomerate is the FSA.

- (2) PRU 8.4.28 R automatically applies Method 4 from Annex I of the Financial Groups Directive in these circumstances except in the cases set out in PRU 8.4.28 R (1)(e) and PRU 8.4.28 R (1)(f). The process in PRU 8.4.22 G does not apply.

- 11/08/2004

PRU 8.4.21

See Notes

- 11/08/2004

PRU 8.4.22

See Notes

- 11/08/2004

PRU 8.4.23

See Notes

- 11/08/2004

PRU 8.4.24

See Notes

- 11/08/2004

Capital adequacy requirements: high level requirement

PRU 8.4.25

See Notes

- (1) A firm that is a member of a financial conglomerate must at all times have capital resources of such an amount and type that results in the capital resources of the financial conglomerate taken as a whole being adequate.

- (2) This rule does not apply with respect to any financial conglomerate until notification has been made that it has been identified as a financial conglomerate as contemplated by Article 4(2) of the Financial Groups Directive.

- 01/01/2005

Capital adequacy requirements: application of Method 4 from Annex I of the Financial Groups Directive

PRU 8.4.26

See Notes

If this rule applies under PRU 8.4.27 R to a firm with respect to a financial conglomerate of which it is a member, the firm must at all times have capital resources of an amount and type:

- (1) that ensure that the financial conglomerate has capital resources of an amount and type that comply with the rules applicable with respect to that financial conglomerate under Part 4 of PRU 8 Ann 1R G (as modified by that annex); and

- (2) that as a result ensure that the firm complies with those rules (as so modified) with respect to that financial conglomerate.

- 01/01/2005

PRU 8.4.27

See Notes

PRU 8.4.26 R applies to a firm with respect to a financial conglomerate of which it is a member if one of the following conditions is satisfied:

- (1) the condition in PRU 8.4.28 R is satisfied; or

- (2) this rule is applied to the firm with respect to that financial conglomerate as described in PRU 8.4.30 R.

- 01/01/2005

Capital adequacy requirements: compulsory application of Method 4 from Annex I of the Financial Groups Directive

PRU 8.4.28

See Notes

- (1) The condition in this rule is satisfied for the purpose of PRU 8.4.27 R (1) with respect to a firm and a financial conglomerate of which it is a member (with the result that PRU 8.4.26 R automatically applies to that firm) if:

- (a) notification has been made in accordance with regulation 2 of the Financial Groups Directive Regulations that the financial conglomerate is a financial conglomerate and that the FSA is coordinator of that financial conglomerate;

- (b) the financial conglomerate is not part of a wider FSA regulated EEA financial conglomerate;

- (c) the financial conglomerate is not an FSA regulated EEA financial conglomerate under another rule or under paragraph (b) of the definition of FSA regulated EEA financial conglomerate (application of supplementary supervision through a firm's Part IV permission);

- (d) one of the following conditions is satisfied:

- (i) the financial conglomerate is headed by a regulated entity that is a UK domestic firm; or

- (ii) the only relevant competent authority for that financial conglomerate is the FSA;

- (e) this rule is not disapplied under paragraph 5.5 of PRU 8 Ann 1R G (No capital ties); and

- (f) the financial conglomerate meets the condition set out in the box titled Threshold Test 2 (10% average of balance sheet and solvency requirements) in the financial conglomerate definition decision tree.

- (2) Once PRU 8.4.26 R applies to a firm with respect to a financial conglomerate of which it is a member under PRU 8.4.27 R (1), (1)(f) ceases to apply with respect to that financial conglomerate. Therefore the fact that the financial conglomerate subsequently ceases to meet the condition in (1)(f) does not mean that the condition in this rule is not satisfied.

- 01/01/2005

Capital adequacy requirements: application of Methods 1, 2 or 3 from Annex I of the Financial Groups Directive

PRU 8.4.29

See Notes

- 01/01/2005

Capital adequacy requirements: use of Part IV permission to apply Annex I of the Financial Groups Directive

PRU 8.4.30

See Notes

With respect to a firm and a financial conglomerate of which it is a member:

- (1) PRU 8.4.26 R (Method 4 from Annex I of the Financial Groups Directive) is applied to the firm with respect to that financial conglomerate for the purposes of PRU 8.4.27 R (2); or

- (2) PRU 8.4.29 R (Methods 1 to 3 from Annex I of the Financial Groups Directive) is applied to the firm with respect to that financial conglomerate;

if the firm's Part IV permission contains a requirement obliging the firm to comply with PRU 8.4.26 R or, as the case may be, PRU 8.4.29 R.

- 01/01/2005

PRU 8.4.31

See Notes

- 01/01/2005

Risk concentration and intra-group transactions: introduction

PRU 8.4.32

See Notes

- 11/08/2004

PRU 8.4.33

See Notes

- 11/08/2004

Risk concentration and intra-group transactions: application

PRU 8.4.34

See Notes

PRU 8.4.35 R applies to a firm with respect to a financial conglomerate of which it is a member if:

- (1) the condition in Articles 7(4) and 8(4) of the Financial Groups Directive is satisfied (the financial conglomerate is headed by a mixed financial holding company); and

- (2) that financial conglomerate is an FSA regulated EEA financial conglomerate.

- 01/01/2005

Risk concentration and intra group transactions: the main rule

PRU 8.4.35

See Notes

- 01/01/2005

Risk concentration and intra-group transactions: Table of applicable sectoral rules

PRU 8.4.36

See Notes

Application of sectoral rules

This table belongs to PRU 8.4.35 R

| The most important financial sector | Applicable sectoral rules | |

| Risk concentration | Intra-group transactions | |

| Banking sector | Rules 3.3.13, 3.3.19 and 3.3.21 of chapter GN of IPRU(BANK) (as they apply to large exposures on a consolidated basis) | Rules 3.3.13, 3.3.19 and 3.3.21 of chapter GN of IPRU(BANK) (as they apply to large exposures on a solo basis) |

| Insurance sector | None | Rule 9.39 of IPRU(INS) |

| Investment services sector | Rule 14.3.2 in Chapter 14 of IPRU(INV) | Rule 10-190 in Chapter 10 of IPRU(INV) as it applies on a solo basis |

| Note: | The rules as applied in column three apply without any concession or exemption for exposures to other group members. | |

| Note | The decision tree in paragraph 4.5 of PRU 8 Ann 1R G applies for the purpose of identifying the most important financial sector. | |

- 01/01/2005

PRU 8.4.37

See Notes

The material in IPRU(BANK) that has particular application to the rules in IPRU(BANK) referred to in the table in PRU 8.4.36 R is:

- (1) (in the case of column 2) Chapter LE as it applies on a consolidated basis;

- (2) (in the case of column 3) Chapter LE as it applies on a solo basis.

- 01/01/2005

PRU 8.4.38

See Notes

- 01/01/2005

The financial sectors: asset management companies

PRU 8.4.39

See Notes

- (1) In accordance with Article 30 of the Financial Groups Directive (Asset management companies), this rule deals with the inclusion of an asset management company that is a member of a financial conglomerate in the scope of regulation of financial conglomerates. This rule does not apply to the definition of financial conglomerate.

- (2) An asset management company is in the overall financial sector and is a regulated entity for the purpose of:

- (a) PRU 8.4.26 R to PRU 8.4.36 R;

- (b) PRU 8 Ann 1R G (Capital adequacy calculations for financial conglomerates) and PRU 8 Ann 2R (Prudential rules for third country groups); and

- (c) any other provision of the Handbook relating to the supervision of financial conglomerates.

- (3) In the case of a financial conglomerate for which the FSA is the coordinator, all asset management companies must be allocated to one financial sector for the purposes in (2), being either the investment services sector or the insurance sector. But if that choice has not been made in accordance with (4) and notified to the FSA in accordance with (4)(d), an asset management company must be allocated to the investment services sector.

- (4) The choice in (3):

- (a) must be made by the undertaking in the financial conglomerate holding the position referred to in Article 4(2) of the Financial Groups Directive (group member to whom notice must be given that the group has been found to be a financial conglomerate);

- (b) applies to all asset management companies that are members of the financial conglomerate from time to time;

- (c) cannot be changed; and

- (d) must be notified to the FSA as soon as reasonably practicable after the notification in (4)(a).

- 11/08/2004

PRU 8.5

Third-country groups

- 31/12/2004

Application

PRU 8.5.1

See Notes

PRU 8.5 applies to every firm that is a member of a third-country group. But it does not apply to:

- (1) an incoming EEA firm; or

- (2) an incoming Treaty firm; or

- (3) a UCITS qualifier; or

- (4) an ICVC.

- 11/08/2004

Purpose

PRU 8.5.2

See Notes

- 11/08/2004

Equivalence

PRU 8.5.3

See Notes

- 11/08/2004

Other methods: General

PRU 8.5.4

See Notes

- 11/08/2004

Supervision by analogy: introduction

PRU 8.5.5

See Notes

- 11/08/2004

PRU 8.5.6

See Notes

- 11/08/2004

PRU 8.5.7

See Notes

- 11/08/2004

Supervision by analogy: rules for third-country conglomerates

PRU 8.5.8

See Notes

- 01/01/2005

Supervision by analogy: rules for third-country banking and investment groups

PRU 8.5.9

See Notes

- 01/01/2005

PRU 8 Ann 1R

PRU 8 Ann 1R

- 31/12/2004

- 31/12/2004

PRU 8 Ann 1R 1

| Capital resources | 1.1 | The conglomerate capital resources of a financial conglomerate calculated in accordance with this Part are the capital of that financial conglomerate, calculated on an accounting consolidation basis, that qualifies under paragraph 1.2. | |

| 1.2 | The elements of capital that qualify for the purposes of paragraph 1.1 are those that qualify in accordance with the applicable sectoral rules, in accordance with the following: | ||

| (1) | the conglomerate capital resources requirement is divided up in accordance with the contribution of each financial sector to it; and | ||

| (2) | the portion of the conglomerate capital resources requirement attributable to a particular financial sector must be met by capital resources that are eligible in accordance with the applicable sectoral rules for that financial sector. | ||

| Capital resources requirement | 1.3 | The conglomerate capital resources requirement of a financial conglomerate calculated in accordance with this Part is equal to the sum of the capital adequacy and solvency requirements for each financial sector calculated in accordance with the applicable sectoral rules for that financial sector. | |

| Consolidation | 1.4 | The information required for the purpose of establishing whether or not a firm is complying with PRU 8.4.29 R (insofar as the definitions in this Part are applied for the purpose of that rule) must be based on the consolidated accounts of the financial conglomerate, together with such other sources of information as appropriate. | |

| 1.5 | The applicable sectoral rules that are applied under this Part are the applicable sectoral consolidation rules. Other applicable sectoral rules must be applied if required. | ||

- 31/12/2004

PRU 8 Ann 1R 2

| Capital resources | 2.1 | The conglomerate capital resources of a financial conglomerate calculated in accordance with this Part are equal to the sum of the following amounts (so far as they qualify under paragraph 2.3) for each member of the overall financial sector: | ||

| (1) | (for the person at the head of the financial conglomerate) its solo capital resources; | |||

| (2) | (for any other member): | |||

| (a) | its solo capital resources; less | |||

| (b) | the book value of the financial conglomerate's investment in that member. | |||

| 2.2 | The deduction in paragraph 2.1(2) must be carried out separately for each type of capital represented by the financial conglomerate's investment in the member concerned. | |||

| 2.3 | The elements of capital that qualify for the purposes of paragraph 2.1 are those that qualify in accordance with the applicable sectoral rules. In particular, the portion of the conglomerate capital resources requirement attributable to a particular member of a financial sector must be met by capital resources that would be eligible under the sectoral rules that apply to the calculation of its solo capital resources. | |||

| Capital resources requirement | 2.4 | The conglomerate capital resources requirement of a financial conglomerate calculated in accordance with this Part is equal to the sum of the solo capital resources requirement for each member of the financial conglomerate that is in the overall financial sector. | ||

| Partial inclusion | 2.5 | The capital resources and capital resources requirements of a member of the financial conglomerate in the overall financial sector must be included proportionally. If however the member is a subsidiary undertaking and it has a solvency deficit, they must be included in full. | ||

| Accounts | 2.6 | The information required for the purpose of establishing whether or not a firm is complying with PRU 8.4.29 R (insofar as the definitions in this Part are applied for the purpose of that rule) must be based on the individual accounts of members of the financial conglomerate, together with such other sources of information as appropriate. | ||

- 31/12/2004

PRU 8 Ann 1R 3

| Capital resources | 3.1 | The conglomerate capital resources of a financial conglomerate calculated in accordance with this Part are equal to the capital resources of the person at the head of the financial conglomerate that qualify under paragraph 3.2. | ||

| 3.2 | The elements of capital that qualify for the purposes of paragraph 3.1 are those that qualify in accordance with the applicable sectoral rules. In particular, the portion of the conglomerate capital resources requirement attributable to a particular member of a financial sector must be met by capital resources that would be eligible under the sectoral rules that apply to the calculation of its solo capital resources. | |||

| Capital resources requirement | 3.3 | The conglomerate capital resources requirement of a financial conglomerate calculated in accordance with this Part is equal to the sum of the following amounts for each member of the overall financial sector: | ||

| (1) | (in the case of the person at the head of the financial conglomerate) its solo capital resources requirement; | |||

| (2) | (in the case of any other member) the higher of the following two amounts: | |||

| (a) | its solo capital resources requirement; and | |||

| (b) | the book value of the interest of the person at the head of the financial conglomerate in that member. | |||

| 3.4 | A participation may be valued using the equity method of accounting. | |||

| Partial inclusion | 3.5 | The capital resources requirement of a member of the financial conglomerate in the overall financial sector must be included proportionally. If however the member has a solvency deficit and is a subsidiary undertaking, it must be included in full. | ||

| Accounts | 3.6 | The information required for the purpose of establishing whether or not a firm is complying with PRU 8.4.29 R (insofar as the definitions in this Part are applied for the purpose of that rule) must be based on the individual accounts of members of the financial conglomerate, together with such other sources of information as appropriate. | ||

- 31/12/2004

PRU 8 Ann 1R 4

| Applicable sectoral rules | 4.1 | The rules that apply with respect to a particular financial conglomerate under PRU 8.4.26 R are those relating to capital adequacy and solvency set out in the table in paragraph 4.2. |

- 31/12/2004

PRU 8 Ann 1R 5

| Type of financial conglomerate | Applicable sectoral consolidation rules |

| Banking conglomerate | IPRU(BANK) Chapter GN rule 3.3.13 (as it applies on a consolidated basis), subject to paragraph 4.7. |

| Insurance conglomerate | PRU 8.3 amended in accordance with Part 5. |

| Building society conglomerate | IPRU(BSOC) (Volume 1) Chapter 1, rule 1.2.1 (as it applies on a consolidated basis). |

| Investment services conglomerate | Chapter 14 of IPRU(INV). |

- 31/12/2004

PRU 8 Ann 1G 6

| How to apply chapter 14 of IPRU(INV) | 4.3 | Where chapter 14 of IPRU(INV) applies: | ||

| (1) | the main investment services undertaking is treated as being the main firm for the purpose of rule 14.4.2 of chapter 14 of IPRU(INV); | |||

| (2) | if the main investment services undertaking is not subject to any of the FSA's sectoral rules applied by chapter 14 of IPRU(INV), then the FSA's sectoral rules that are applied are those that would do so if: | |||

| (a) | it were a UK domestic firm; and | |||

| (b) | it had a permission that includes all the regulated activities that it would need to have in its Part IV permission if it carried on all its activities in the United Kingdom. | |||

| The different types of financial conglomerate | 4.4 | (1) | The decision tree in paragraph 4.5: | |

| (a) | decides into which of the categories listed in the table in paragraph 4.2 a financial conglomerate falls; and | |||

| (b) | modifies the definition of the most important financial sector for the purposes of PRU 8 Ann 1R G and for the purposes of any other provision in PRU 8 (Group risk) that applies that decision tree. | |||

| (2) | Paragraph 6.1(2) (financial institution allocated to the banking sector) and paragraph 6.1(3) (allocation of asset management companies) apply for the purpose of 4.4 and the table in paragraph 4.5. | |||

- 31/12/2004

PRU 8 Ann 1.7

See Notes

- 31/12/2004

PRU 8 Ann 1.8

See Notes

| A mixed financial holding company | 4.6 | A mixed financial holding company must be treated in the same way as: | |

| (1) | a financial holding company (if the rules in IPRU(BANK) or IPRU(INV)) are applied; or | ||

| (2) | an insurance holding company (if the rules in PRU 8.3 are applied). | ||

| E-money | 4.7 | If there are no full credit institutions or investment firms in a banking conglomerate but there are one or more e-money issuers, the sectoral rules in IPRU(BANK) are amended as follows : | |

| (1) | the rules in ELM that apply on a solo basis must be used to establish the capital requirement for the e-money issuers; and | ||

| (2) | for the purpose of (1), those rules in ELM shall be amended by calculating the amount of the deductions in respect of ownership shares and capital falling into ELM 2.4.17 R (6) in accordance with paragraph 3.3(2). | ||

- 31/12/2004

PRU 8 Ann 1R 9

See Notes

| Transferability of capital | 5.1 | Capital may not be included in: | ||

| (1) | a firm's conglomerate capital resources under PRU 8.4.29 R; or | |||

| (2) | in the capital resources of the financial conglomerate for the purposes of PRU 8.4.26 R; | |||

| if the effectiveness of the transferability and availability of the capital across the different members of the financial conglomerate is insufficient, given the objectives (as referred to in the third unnumbered sub-paragraph of paragraph 2(ii) of Annex I of the Financial Groups Directive (Technical principles)) of the capital adequacy rules for financial conglomerates. | ||||

| Double counting | 5.2 | Capital must not be included in: | ||

| (1) | a firm's conglomerate capital resources under PRU 8.4.29 R; or | |||

| (2) | the capital resources of the financial conglomerate for the purposes of PRU 8.4.26 R; | |||

| if: | ||||

| (3) | it would involve double counting or multiple use of the same capital; or | |||

| (4) | it results from any inappropriate intra-group creation of capital. | |||

| Cross sectoral capital | 5.3 | In accordance with the second sub-paragraph of paragraph 2(ii) of Section I of Annex I of the Financial Groups Directive (Other technical principles and insofar as not already required in Parts 1-3): | ||

| (1) | the solvency requirements for each different financial sector represented in a financial conglomerate required by PRU 8.4.26 R or, as the case may be, PRU 8.4.29 R must be covered by own funds elements in accordance with the corresponding applicable sectoral rules; and | |||

| (2) | if there is a deficit of own funds at the financial conglomerate level, only cross sectoral capital (as referred to in that sub-paragraph) shall qualify for verification of compliance with the additional solvency requirement required by PRU 8.4.26 R or, as the case may be, PRU 8.4.29 R. | |||

| Application of sectoral rules | 5.4 | The following adjustments apply to the applicable sectoral rules as they are applied by the rules in this annex. | ||

| (1) | The scope of those rules will be extended to cover any mixed financial holding company and each other member of the overall financial sector. | |||

| (2) | If any of those rules would otherwise not apply to a situation in which they are applied by PRU 8 Ann 1R G, those rules nevertheless still apply (and in particular, any of those rules that would otherwise have the effect of disapplying consolidated supervision (or, in the case of the insurance sector, supplementary supervision) do not apply). | |||

| (3) | (If it would not otherwise have been included) an ancillary investment services undertaking is included in the investment services sector. | |||

| (4) | (If it would not otherwise have been included) an ancillary insurance services undertaking is included in the insurance sector. | |||

| (5) | (In relation to the insurance sector) to the extent that: | |||

| (a) | those rules merely require a report on whether or not a specified level of solvency is met (a soft limit); or | |||

| (b) | the requirements in those rules concern having certain net assets of an amount at or above certain levels; | |||

| those requirements are restated so as to include an obligation at all times actually to have capital at or above that level (a hard limit), thereby turning a soft limit drafted by reference to assets and liabilities into a hard limit requiring capital to be held at or above specified levels. If those rules apply both a hard and a soft limit, and the level of the soft limit is higher, that soft limit is applied under this annex, but translated into a hard limit in accordance with the earlier provisions of (5). | ||||

| (6) | The scope of the those rules is amended so as to remove restrictions relating to where members of the financial conglomerate are incorporated or have their head office, so that the scope covers every member of the financial conglomerate that would have been included in the scope of those rules if those members had their head offices in an EEA State. | |||

| (7) | (For the purposes of Parts 1 to 3) those rules must be adjusted, if necessary, when calculating the capital resources, capital resources requirements or solvency requirements for a particular financial sector to exclude those for a member of another financial sector. | |||

| No capital ties | 5.5 | (1) | This rule deals with a financial conglomerate in which some of the members are not linked by capital ties at the time of the notification referred to in PRU 8.4.28 R (1) (Capital adequacy requirements: Compulsory application of Method 4 from Annex I of the Financial Groups Directive). | |

| (2) | If: | |||

| (a) | PRU 8.4.26 R (Capital adequacy requirements: Application of Method 4 from Annex I of the Financial Groups Directive) would otherwise apply with respect to a financial conglomerate under PRU 8.4.28 R; and | |||