PRU 8

PRU 8

PRU 8.4

Cross sector groups

- 01/12/2004

Application

PRU 8.4.1

See Notes

- (1) PRU 8.4 applies to every firm that is a member of a financial conglomerate other than:

- (a) an incoming EEA firm;

- (b) an incoming Treaty firm;

- (c) a UCITS qualifier; and

- (d) an ICVC.

- (2) PRU 8.4 does not apply to a firm with respect to a financial conglomerate of which it is a member if the interest of the financial conglomerate in that firm is no more than a participation.

- (3) PRU 8.4.25 R (Capital adequacy requirements: high level requirement), PRU 8.4.26 R (Capital adequacy requirements: application of Method 4 from Annex I of the Financial Groups Directive), PRU 8.4.29 R (Capital adequacy requirements: application of Methods 1, 2 or 3 from Annex I of the Financial Groups Directive) and PRU 8.4.35 R (Risk concentration and intra group transactions: the main rule) do not apply with respect to a third-country financial conglomerate.

- 11/08/2004

Purpose

PRU 8.4.2

See Notes

PRU 8.4 implements the Financial Groups Directive. However, material on the following topics is to be found elsewhere in the Handbook as follows:

- (1) further material on third-country financial conglomerates can be found in PRU 8.5;

- (2) SUP 15.9 contains notification rules for members of financial conglomerates;

- (3) material on reporting obligations can be found in SUP 16.7.73 R and SUP 16.7.74 R; and

- (4) material on systems and controls in financial conglomerates can be found in PRU 8.1.

- 11/08/2004

Introduction: identifying a financial conglomerate

PRU 8.4.3

See Notes

- (1) In general the process in (2) to (8) applies for identifying financial conglomerates.

- (2) Competent authorities that have authorised regulated entities should try to identify any consolidation group that is a financial conglomerate. If a competent authority is of the opinion that a regulated entity authorised by that competent authority is a member of a consolidation group which may be a financial conglomerate it should communicate its view to the other competent authorities concerned.

- (3) A competent authority may start (as described in (2)) the process of deciding whether a group is a financial conglomerate even if it would not be the coordinator.

- (4) A member of a group may also start that process by notifying one of the competent authorities that have authorised group members that its group may be a financial conglomerate, for example by notification under SUP 15.9.

- (5) If a group member gives a notification in accordance with (4), that does not automatically mean that the group should be treated as a financial conglomerate. The process described in (6) to (9) still applies.

- (6) The competent authority that would be coordinator will take the lead in establishing whether a group is a financial conglomerate once the process has been started as described in (2) and (3).

- (7) The process of establishing whether a group is a financial conglomerate will normally involve discussions between the financial conglomerate and the competent authorities concerned.

- (8) A financial conglomerate should be notified by its coordinator that it has been identified as a financial conglomerate and of the appointment of the coordinator. The notification should be given to the parent undertaking at the head of the group or, in the absence of a parent undertaking, the regulated entity with the largest balance sheet total in the most important financial sector. That notification does not of itself make a group into a financial conglomerate; whether or not a group is a financial conglomerate is governed by the definition of financial conglomerate as set out in PRU 8.4.

- (9) PRU 8 Ann 4R is a questionnaire (together with its explanatory notes) that the FSA asks groups that may be financial conglomerates to fill out in order to decide whether or not they are.

- 11/08/2004

Introduction: The role of other competent authorities

PRU 8.4.4

See Notes

- 11/08/2004

Definition of financial conglomerate: basic definition

Definition of financial conglomerate: sub-groups

PRU 8.4.6

See Notes

A consolidation group is not prevented from being a financial conglomerate because it is part of a wider:

- (1) consolidation group; or

- (2) financial conglomerate; or

- (3) group of persons linked in some other way.

- 11/08/2004

Definition of financial conglomerate: the financial sectors: general

PRU 8.4.7

See Notes

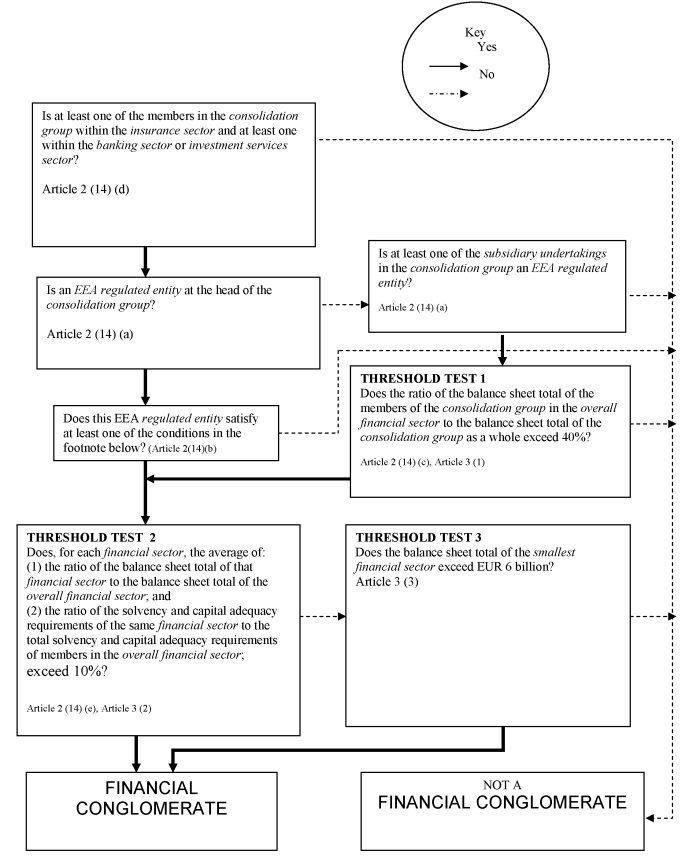

For the purpose of the definition of financial conglomerate, there are two financial sectors as follows:

- (1) the banking sector and the investment services sector, taken together; and

- (2) the insurance sector.

- 11/08/2004

PRU 8.4.8

See Notes

- (1) This rule applies for the purpose of the definition of financial conglomerate and the financial conglomerate definition decision tree.

- (2) Any mixed financial holding company is considered to be outside the overall financial sector for the purpose of the tests set out in the boxes titled Threshold Test 1, Threshold Test 2 and Threshold Test 3 in the financial conglomerate definition decision tree.

- (3) Determining whether the tests set out in the boxes titled Threshold Test 2 and Threshold Test 3 in the financial conglomerate definition decision tree are passed is based on considering the consolidated and/or aggregated activities of the members of the consolidation group within the insurance sector and the consolidated and/or aggregated activities of the members of the consolidation group within the banking sector and the investment services sector.

- 11/08/2004

Definition of financial conglomerate: adjustment of the percentages

PRU 8.4.9

See Notes

Once a financial conglomerate has become a financial conglomerate and subject to supervision in accordance with the Financial Groups Directive, the figures in the financial conglomerate definition decision tree are altered as follows:

- (1) the figure of 40% in the box titled Threshold Test 1 is replaced by 35%;

- (2) the figure of 10% in the box titled Threshold Test 2 is replaced by 8%; and

- (3) the figure of six billion Euro in the box titled Threshold Test 3 is replaced by five billion Euro.

- 11/08/2004

PRU 8.4.10

See Notes

The alteration in PRU 8.4.9 R only applies to a financial conglomerate during the period that:

- (1) begins when the financial conglomerate would otherwise have stopped being a financial conglomerate because it does not meet one of the unaltered thresholds referred to in PRU 8.4.9 R; and

- (2) covers the three years following that date.

- 11/08/2004

Definition of financial conglomerate: balance sheet totals

PRU 8.4.11

See Notes

- 11/08/2004

Definition of financial conglomerate: solvency requirement

PRU 8.4.12

See Notes

- 11/08/2004

Definition of financial conglomerate: discretionary changes to the definition

PRU 8.4.13

See Notes

Articles 3(3) to 3(6), Article 5(4) and Article 6(5) of the Financial Groups Directive allow competent authorities, on a case by case basis, to:

- (1) change the definition of financial conglomerate and the obligations applying with respect to a financial conglomerate;

- (2) apply the scheme in the Financial Groups Directive to EEA regulated entities in specified kinds of group structures that do not come within the definition of financial conglomerate; and

- (3) exclude a particular entity in the scope of capital adequacy requirements that apply with respect to a financial conglomerate.

- 11/08/2004

Capital adequacy requirements: introduction

PRU 8.4.14

See Notes

- 11/08/2004

PRU 8.4.15

See Notes

- 11/08/2004

PRU 8.4.16

See Notes

- 11/08/2004

PRU 8.4.17

See Notes

Annex I of the Financial Groups Directive lays down four methods for calculating capital adequacy at the level of a financial conglomerate. Those four methods are implemented as follows:

- (1) Method 1 calculates capital adequacy using accounting consolidation. It is implemented by PRU 8.4.29 R to PRU 8.4.31 R and Part 1 of PRU 8 Ann 1R G.

- (2) Method 2 calculates capital adequacy using a deduction and aggregation approach. It is implemented by PRU 8.4.29 R to PRU 8.4.31 R and Part 2 of PRU 8 Ann 1R 1.

- (3) Method 3 calculates capital adequacy using book values and the deduction of capital requirements. It is implemented by PRU 8.4.29 R to PRU 8.4.31 R and Part 3 of PRU 8 Ann 1R G.

- (4) Method 4 consists of a combination of Methods 1, 2 and 3 from Annex I of the Financial Groups Directive, or a combination of two of those Methods. It is implemented by PRU 8.4.26 R to PRU 8.4.28 R, PRU 8.4.30 R and Part 4 of PRU 8 Ann 1R G.

- 11/08/2004

PRU 8.4.18

See Notes

Part 4 of PRU 8 Ann 1R G (Use of Method 4 from Annex I of the Financial Conglomerates Directive) applies the FSA's sectoral rules with respect to the financial conglomerate as a whole, with some adjustments. Where Part 4 of PRU 8 Ann 1R G applies the FSA's sectoral rules for:

- (1) the insurance sector, that involves a combination of Methods 2 and 3; and

- (2) the banking sector and the investment services sector, that involves a combination of Methods 1 and 3.

- 11/08/2004

PRU 8.4.19

See Notes

- 11/08/2004

PRU 8.4.20

See Notes

- (1) In the following cases, the FSA (acting as coordinator) may choose which of the four methods for calculating capital adequacy laid down in Annex I of the Financial Groups Directive should apply:

- (a) where a financial conglomerate is headed by a regulated entity that has been authorised by the FSA; or

- (b) the only relevant competent authority for the financial conglomerate is the FSA.

- (2) PRU 8.4.28 R automatically applies Method 4 from Annex I of the Financial Groups Directive in these circumstances except in the cases set out in PRU 8.4.28 R (1)(e) and PRU 8.4.28 R (1)(f). The process in PRU 8.4.22 G does not apply.

- 11/08/2004

PRU 8.4.21

See Notes

- 11/08/2004

PRU 8.4.22

See Notes

- 11/08/2004

PRU 8.4.23

See Notes

- 11/08/2004

PRU 8.4.24

See Notes

- 11/08/2004

PRU 8.4.32

See Notes

- 11/08/2004

PRU 8.4.33

See Notes

- 11/08/2004

The financial sectors: asset management companies

PRU 8.4.39

See Notes

- (1) In accordance with Article 30 of the Financial Groups Directive (Asset management companies), this rule deals with the inclusion of an asset management company that is a member of a financial conglomerate in the scope of regulation of financial conglomerates. This rule does not apply to the definition of financial conglomerate.

- (2) An asset management company is in the overall financial sector and is a regulated entity for the purpose of:

- (a) PRU 8.4.26 R to PRU 8.4.36 R;

- (b) PRU 8 Ann 1R G (Capital adequacy calculations for financial conglomerates) and PRU 8 Ann 2R (Prudential rules for third country groups); and

- (c) any other provision of the Handbook relating to the supervision of financial conglomerates.

- (3) In the case of a financial conglomerate for which the FSA is the coordinator, all asset management companies must be allocated to one financial sector for the purposes in (2), being either the investment services sector or the insurance sector. But if that choice has not been made in accordance with (4) and notified to the FSA in accordance with (4)(d), an asset management company must be allocated to the investment services sector.

- (4) The choice in (3):

- (a) must be made by the undertaking in the financial conglomerate holding the position referred to in Article 4(2) of the Financial Groups Directive (group member to whom notice must be given that the group has been found to be a financial conglomerate);

- (b) applies to all asset management companies that are members of the financial conglomerate from time to time;

- (c) cannot be changed; and

- (d) must be notified to the FSA as soon as reasonably practicable after the notification in (4)(a).

- 11/08/2004

Application

PRU 8.5.1

See Notes

PRU 8.5 applies to every firm that is a member of a third-country group. But it does not apply to:

- (1) an incoming EEA firm; or

- (2) an incoming Treaty firm; or

- (3) a UCITS qualifier; or

- (4) an ICVC.

- 11/08/2004

Purpose

PRU 8.5.2

See Notes

- 11/08/2004

Equivalence

PRU 8.5.3

See Notes

- 11/08/2004

Other methods: General

PRU 8.5.4

See Notes

- 11/08/2004

Supervision by analogy: introduction

PRU 8.5.5

See Notes

- 11/08/2004

PRU 8.5.6

See Notes

- 11/08/2004

PRU 8.5.7

See Notes

- 11/08/2004

PRU 8 Ann 2R

PRU 8 Ann 2R

- 01/12/2004

- 11/08/2004

PRU 8 Ann 2R 1

| 1.1 | This Part of this annex sets out the rules with which a firm must comply under PRU 8.5.8 R with respect to a financial conglomerate of which it is a member. |

| 1.2 | A firm must comply, with respect to the financial conglomerate referred to in paragraph 1.1, with whichever of PRU 8.4.26 R and PRU 8.4.29 R is applied under paragraph 1.3. |

| 1.3 | For the purposes of paragraph 1.2:

(1) the rule in PRU 8.4 that applies as referred to in paragraph 1.2 is the one that is specified by the requirement referred to in PRU 8.5.8 R;

(2) (where PRU 8.4.29 R is applied) the definitions of conglomerate capital resources and conglomerate capital resources requirement that apply for the purposes of that rule are the ones from whichever of Part 1, Part 2 or Part 3 of PRU 8 Ann 1R G is specified in that requirement; and (3) the rules so applied (including those in PRU 8 Ann 1R G) are adjusted in accordance with paragraph 3.1. |

| 1.4 | If the condition in Articles 7(4) and 8(4) of the Financial Groups Directive is satisfied (the financial conglomerate is headed by a mixed financial holding company) with respect to the financial conglomerate referred to in paragraph 1.1 the firm must also comply with PRU 8.4.35 R (as adjusted in accordance with paragraph 3.1) with respect to that financial conglomerate. |

| 1.5 | A firm must comply with the following with respect to the financial conglomerate referred to in paragraph 1.1:

(1) PRU 8.1 (as it applies to financial conglomerates and as adjusted under paragraph 3.1); and

(2) PRU 8.4.25 R. |

- 11/08/2004

PRU 8 Ann 2R 2

See Notes

| 2.1 | This Part of this annex sets out the rules with which a firm must comply under PRU 8.5.9 R with respect to a third-country banking and investment group of which it is a member. |

| 2.2 | A firm must comply with one of the sets of rules specified in paragraph 2.3 as adjusted under paragraph 3.1 with respect to the third-country banking and investment group referred to in paragraph 2.1. |

| 2.3 | The rules referred to in paragraph 2.2 are as follows:

(1) the applicable sectoral consolidation rules in IPRU(BANK); or

(2) the applicable sectoral consolidation rules for the investment services sector; or (3) the rules in ELM 7. |

| 2.4 | The set of rules from paragraph 2.3 that apply with respect to a particular third-country banking and investment group (as referred to in paragraph 2.1) are those that would apply if they were adjusted in accordance with paragraph 3.1. |

| 2.5 | The sectoral rules applied by Part 2 of this annex cover all prudential rules applying on a consolidated basis including those relating to large exposures. |

| 2.6 | A firm must comply with PRU 8.1 (as it applies to banking and investment groups and as adjusted under paragraph 3.1) with respect to the third-country banking and investment group referred to in paragraph 2.1. |

- 11/08/2004

PRU 8 Ann 2R 3

See Notes

| 3.1 | The adjustments that must be carried out under this paragraph are that the scope of the rules referred in Part 1 or Part 2 of this annex, as the case may be, are amended:

(1) so as to remove any provisions disapplying those rules for third-country groups;

(2) so as to remove all limitations relating to where a member of the third-country group is incorporated or has its head office; and (3) so that the scope covers every member of the third-country group that would have been included in the scope of those rules if those members had their head offices in, and were incorporated in, an EEA State. |

- 11/08/2004

PRU 8 Ann 3G

Guidance Notes for Classification of Groups

- 01/12/2004

See Notes

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- (a) are managed on a unified basis; or

- (b) have common management.

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- (a) Branches should be included as part of the parent entity.

- (b) Include in the calculations overseas entities owned by the relevant group or sub-group.

- (c) There are only two sectors for this purpose: banking/investment and insurance.

- (d) You will need to assign non-regulated financial entities to one of these sectors:

- • banking/investment activities are listed in - IPRU Banks CS 10 Appendix A

- • insurance activities are listed in - IPRU Insurers Annex 11.1 and 11.2 p 163-168.

- • Any operator of a UCITS scheme, insurance intermediary, mortgage broker and mixed financial holding company does not fall into the directive definitions of either financial sector or insurance sector.

- They should therefore be ignored for the purposes of these calculations.

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

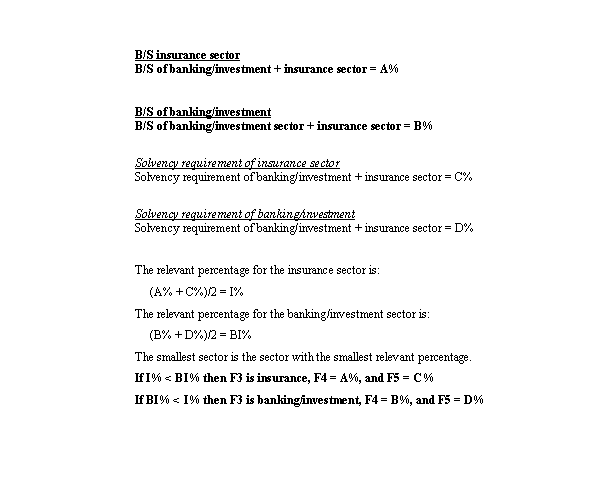

- 11/08/2004

- (i) Off-balance-sheet items should be excluded.

- (ii) Where off-balance sheet treatment of funds under management and on-balance sheet treatment of policy holders' funds may distort the threshold calculation, groups should consult the FSA on the appropriateness of using other measures under article 3.5 of the Financial Groups Directive.

- (iii) If consolidated accounts exist for a sub-group consisting of financial entities from only one of the two sectors, these consolidated accounts should be used to measure the balance-sheet total of the sub-group (i.e. total assets less investments in entities in the other sector). If consolidated accounts do not exist, intra-group balances should be netted out when calculating the balance sheet total of a single sector (but cross-sector intra-group balances should not be netted out).

- (iv) Where consolidated accounts are used, minority interests should be excluded and goodwill should be included.

- (v) Where accounting standards differ between entities, groups should consult the FSA if they believe this is likely materially to affect the threshold calculation.

- (vi) Where there is a subsidiary or participation in the opposite sector from its parent (i.e. insurance sector for a banking/investment firm parent and vice versa), the balance sheet amount of the subsidiary or participation should be allocated to its sector using its individual accounts.

- (vii) The balance-sheet total of the parent entity/sub-group is measured as total assets of the parent/sub-group less the book value of its subsidiaries or participations in the other sector (i.e. the value of the subsidiary or participation in the parent's consolidated accounts is deducted from the parent's consolidated assets).

- (viii) The cross-sector subsidiaries or participations referred to above, valued according to their own accounts, are allocated pro-rata, according to the aggregated share owned by the parent/sub-group, to their own sector.

- (ix) If the cross-sector entities above themselves own group entities in the first sector (i.e. that of the top parent/sub-group) these should (in accordance with the methods above) be excluded from the second sector and added to the first sector using individual accounts.

- 11/08/2004

- 11/08/2004

- 11/08/2004

- (i) If you complete a solvency return for a sub-group consisting of financial entities from only one of the two sectors, the total solvency requirement for the sub-group should be used.

- (ii) Solvency requirements taken must include any deductions from available capital so as to allow the appropriate aggregation of requirements.

- (iii) Where there is a regulated subsidiary or participation in the opposite sector from its parent/sub-group, the solvency requirement of the subsidiary or participation should be from its individual regulatory return. If there is an identifiable contribution to the parent's solvency requirement in respect of the cross-sector subsidiary or participation, the parent's solvency requirement may be adjusted to exclude this.

- (iv) Where there is an unregulated financial undertaking in the opposite sector from its parent/sub-group, the solvency requirement of the subsidiary or participation should be one of the following:

- (a) (a) as if the entity were regulated by the FSA under the appropriate sectoral rules;

- (b) (b) using EU minimum requirements for the appropriate sector; or

- (c) (c) using non-EU local requirements* for the appropriate sector.

- Please note on the form which of these options you have used, according to the country and sector, and whether this is the same treatment as in your latest overall group solvency calculation.

- (v) For banking/investment requirements, use the total amount of capital required.

- (vi) For insurance requirements, use the Required Minimum Margin:

- (a) (a) UK firms, Form 9: for general insurance business = capital resources requirement [line 29]; for long-term insurance business = capital resources requirement (higher of Minimum Capital Requirement and Enhanced Capital Resources Requirement) [line 52].

- (b) (b) Overseas firms, either:

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

PRU 8 Ann 4R

PRU 8 Ann 4 (see PRU 8.4.5 R)

- 01/12/2004

PRU 8 Ann 4.1R

- 11/08/2004

- 11/08/2004