PRU 7

Insurance risk

PRU 7.1

Insurance risk systems and controls

- 31/12/2004

Application

PRU 7.1.1

See Notes

PRU 7.1 applies to an insurer unless it is:

- (1) a non-directive friendly society; or

- (2) an incoming EEA firm; or

- (3) an incoming Treaty firm.

- 31/12/2004

PRU 7.1.2

See Notes

PRU 7.1 applies to:

- (1) an EEA-deposit insurer; and

- (2) a Swiss general insurer;

only in respect of the activities of the firm carried on from a branch in the United Kingdom.

- 31/12/2004

Purpose

PRU 7.1.3

See Notes

- 31/12/2004

PRU 7.1.4

See Notes

Insurance risk concerns the FSA in a prudential context because inadequate systems and controls for its management can create a threat to the regulatory objectives of market confidence and consumer protection. Inadequately managed insurance risk may result in:

- (1) the inability of a firm to meet its contractual insurance liabilities as they fall due; and

- (2) the inability of a firm to treat its policyholders fairly consistent with the firm's obligations under Principle 6 (for example, in relation to bonus payments).

- 31/12/2004

PRU 7.1.5

See Notes

- 31/12/2004

PRU 7.1.6

See Notes

- 31/12/2004

PRU 7.1.7

See Notes

- 31/12/2004

General requirements

PRU 7.1.8

See Notes

High level rules and guidance for prudential systems and controls for insurance risk are set out in PRU 1.4. In particular:

- (1) PRU 1.4.18 R requires a firm to take reasonable steps to establish and maintain a business plan and appropriate risk management systems;

- (2) PRU 1.4.19R (2) requires a firm to document its policy for insurance risk, including its risk appetite and how it identifies, measures, monitors and controls that risk; and

- (3) PRU 1.4.27 R requires a firm to take reasonable steps to establish and maintain adequate internal controls to enable it to assess and monitor the effectiveness and implementation of its business plan and prudential risk management systems.

- 31/12/2004

Insurance risk policy

PRU 7.1.9

See Notes

A firm's insurance risk policy should outline its objectives in carrying out insurance business, its appetite for insurance risk and its policies for identifying, measuring, monitoring and controlling insurance risk. The insurance risk policy should cover any activities that are associated with the creation or management of insurance risk. For example, underwriting, claims management and settlement, assessing technical provisions in the balance sheet, risk mitigation and risk transfer, record keeping and management reporting. Specific matters that should normally be in a firm's insurance risk policy include:

- (1) a statement of the firm's willingness and capacity to accept insurance risk;

- (2) the classes and characteristics of insurance business that the firm is prepared to accept;

- (3) the underwriting criteria that the firm intends to adopt, including how these can influence its rating and pricing decisions;

- (4) its approach to limiting significant aggregations of insurance risk, for example, by setting limits on the amount of business that can be underwritten in one region or with one policyholder;

- (5) where relevant, the firm's approach to pricing long-term insurance contracts, including the determination of the appropriate level of any reviewable premiums;

- (6) the firm's policy for identifying, monitoring and managing risk when it has delegated underwriting authority to another party (additional guidance on the management of outsourcing arrangements is provided in SYSC 3A.9);

- (7) the firm's approach to managing its expense levels, including acquisition costs, recurring costs, and one-off costs, taking account of the margins available in both the prices for products and in the technical provisions in the balance sheet;

- (8) the firm's approach to the exercise of any discretion (e.g. on charges or the level of benefits payable) that is available in its long-term insurance contracts, in the context also of the legal and regulatory constraints existing on the application of this discretion;

- (9) the firm's approach to the inclusion of options within new long-term insurance contracts and to the possible exercise by policyholders of options on existing contracts;

- (10) the firm's approach to managing persistency risk;

- (11) the firm's approach to managing risks arising from timing differences in taxation or from changes in tax laws;

- (12) the firm's approach to the use of reinsurance or the use of some other means of risk transfer;

- (13) how the firm intends to assess the effectiveness of its risk transfer arrangements and manage the residual or transformed risks (for example, how it intends to handle disputes over contract wordings, potential payout delays and counterparty performance risks);

- (14) a summary of the data and information to be collected and reported on underwriting, claims and risk control (including internal accounting records), management reporting requirements and external data for risk assessment purposes;

- (15) the risk measurement and analysis techniques to be used for setting underwriting premiums, technical provisions in the balance sheet, and assessing capital requirements; and

- (16) the firm's approach to stress testing and scenario analysis, as required by PRU 1.2 (Adequacy of financial resources), including the methods adopted, any assumptions made and the use that is to be made of the results.

- 31/12/2004

PRU 7.1.10

See Notes

- 31/12/2004

Risk identification

PRU 7.1.11

See Notes

- 31/12/2004

PRU 7.1.12

See Notes

The identification of insurance risk should normally include:

- (1) in connection with the firm's business plan:

- (a) processes for identifying the types of insurance risks that may be associated with a new product and for comparing the risk types that are present in different classes of business (in order to identify possible aggregations in particular insurance risks); and

- (b) processes for identifying business environment changes (for example landmark legal rulings) and for collecting internal and external data to test and modify business plans;

- (2) at the point of sale, processes for identifying the underwriting risks associated with a particular policyholder or a group of policyholders (for example, processes for identifying potential claims for mis-selling and for collecting information on the claims histories of policyholders, including whether they have made any potentially false or inaccurate claims, to identify possible adverse selection or moral hazard problems);

- (3) after the point of sale, processes for identifying potential and emerging claims for the purposes of claims management and claims provisioning; this could include:

- (a) identifying possible judicial rulings;

- (b) keeping up to date with developments in market practice; and

- (c) collecting information on industry wide initiatives and settlements.

- 31/12/2004

PRU 7.1.13

See Notes

- 31/12/2004

Risk measurement

PRU 7.1.14

See Notes

- 31/12/2004

PRU 7.1.15

See Notes

A firm should ensure that the data it collects and the measurement methodologies that it uses are sufficient to enable it to evaluate, as appropriate:

- (1) its exposure to insurance risk at all relevant levels, for example, by contract, policyholder, product line or insurance class;

- (2) its exposure to insurance risk across different geographical areas and time horizons;

- (3) its total, firm-wide, exposure to insurance risk and any other risks that may arise out of the contracts of insurance that it issues;

- (4) how changes in the volume of business (for example via changes in premium levels or the number of new contracts that are underwritten) may influence its exposure to insurance risk;

- (5) how changes in policy terms may influence its exposure to insurance risk; and

- (6) the effects of specific loss scenarios on the insurance liabilities of the firm.

- 31/12/2004

PRU 7.1.16

See Notes

- 31/12/2004

PRU 7.1.17

See Notes

- 31/12/2004

PRU 7.1.18

See Notes

- 31/12/2004

PRU 7.1.19

See Notes

- 31/12/2004

PRU 7.1.20

See Notes

- 31/12/2004

PRU 7.1.21

See Notes

A firm should have the capability to measure its exposure to insurance risk on a regular basis. In deciding on the frequency of measurement, a firm should consider:

- (1) the time it takes to acquire and process all necessary data;

- (2) the speed at which exposures could change; and

- (3) that it may need to measure its exposure to certain types of insurance risk on a daily basis (for example, weather catastrophes).

- 31/12/2004

Risk monitoring

PRU 7.1.22

See Notes

A firm should provide regular and timely information on its insurance risks to the appropriate level of management. This could include providing reports on the following:

- (1) a statement of the firm's profits or losses for each class of business that it underwrites (with an associated analysis of how these have arisen for any long-term insurance contracts), including a variance analysis detailing any deviations from budget or changes in the key performance indicators that are used to assess the success of its business plan for insurance;

- (2) the firm's exposure to insurance risk at all relevant levels (see PRU 7.1.15 G (1)), as well as across different geographical areas and time zones (see PRU 7.1.15 G (2)), also senior management should be kept informed of the firm's total exposure to insurance risk (see PRU 7.1.15 G (3));

- (3) an analysis of any internal or external trends that could influence the firm's exposure to insurance risk in the future (e.g. new weather patterns, socio-demographic changes, expense overruns etc);

- (4) any new or emerging developments in claims experience (e.g. changes in the type of claims, average claim amounts or the number of similar claims);

- (5) the results of any stress testing or scenario analyses;

- (6) the amount and details of new business written and the amount of business that has lapsed or been cancelled;

- (7) identified fraudulent claims;

- (8) a watch list, detailing, for example, material/catastrophic events that could give rise to significant numbers of new claims or very large claims, contested claims, client complaints, legal and other developments;

- (9) the performance of any reinsurance/risk transfer arrangements; and

- (10) progress reports on matters that have previously been referred under escalation procedures (see PRU 7.1.23 G).

- 31/12/2004

PRU 7.1.23

See Notes

A firm should establish and maintain procedures for the escalation of appropriate matters to the relevant level of management. Such matters may include:

- (1) any significant new exposures to insurance risk, including for example any landmark rulings in the courts;

- (2) a significant increase in the size or number of claims;

- (3) any breaches of the limits set out in PRU 7.1.27 G and PRU 7.1.28 G, in particular senior management should be informed where any maximum limits have been breached (see PRU 7.1.29 G); and

- (4) any unauthorised deviations from its insurance risk policy (including those by a broker, appointed representative or other delegated authority).

- 31/12/2004

PRU 7.1.24

See Notes

- 31/12/2004

PRU 7.1.25

See Notes

- 31/12/2004

Risk control

PRU 7.1.26

See Notes

- 31/12/2004

PRU 7.1.27

See Notes

A firm should consider setting limits for its exposure to insurance risk, which trigger action to be taken to control exposure. Periodically these limits should be amended in the light of new information (e.g. on the expected number or size of claims). For example, limits could be set for:

- (1) the firm's aggregate exposure to a single source of insurance risk or for events that may be the result of a number of different sources;

- (2) the firm's exposure to specific geographic areas or any other groupings of risks whose outcomes may be positively correlated;

- (3) the number of fraudulent claims;

- (4) the number of very large claims that could arise;

- (5) the number of unauthorised deviations from its insurance risk policy;

- (6) the amount of insurance risk than can be transferred to a particular reinsurer;

- (7) the level of expenses incurred in respect of each relevant business area; and

- (8) the level of persistency by product line or distribution channel.

- 31/12/2004

PRU 7.1.28

See Notes

- 31/12/2004

PRU 7.1.29

See Notes

- 31/12/2004

PRU 7.1.30

See Notes

A firm should pay close attention to the wording of its policy documentation to ensure that these wordings do not expose it to more, or higher, claims than it is expecting. In so doing, the firm should consider:

- (1) whether it has adequate in-house legal resources;

- (2) the need for periodic independent legal review of policy documentation;

- (3) the use of standardised documentation and referral procedures for variation of terms;

- (4) reviewing the documentation used by other insurance companies;

- (5) revising documentation for new policies in the light of past experience; and

- (6) the operation of law in the jurisdiction of the policyholder.

- 31/12/2004

PRU 7.1.31

See Notes

- 31/12/2004

PRU 7.1.32

See Notes

- 31/12/2004

PRU 7.1.33

See Notes

- 31/12/2004

Reinsurance and other forms of risk transfer

PRU 7.1.34

See Notes

Before entering into or significantly changing a reinsurance agreement, or any other form of insurance risk transfer agreement, a firm should:

- (1) analyse how the proposed reinsurance/risk transfer agreement will affect its exposure to insurance risk, its underwriting strategy and its ability to meet its regulatory obligations;

- (2) ensure there are adequate legal checking procedures in respect of the draft agreement;

- (3) conduct an appropriate due diligence of the reinsurer's financial stability (that is, solvency) and expertise; and

- (4) understand the nature and limits of the agreement (particular attention should be given to the wording of contracts to ensure that all of the required risks are covered, that the level of available cover is appropriate, and that all the terms, conditions and warranties are unambiguous and understood).

- 31/12/2004

PRU 7.1.35

See Notes

In managing its reinsurance agreements, or any other form of insurance risk transfer agreement, a firm should have in place appropriate systems that allow it to maintain its desired level of cover. This could involve systems for:

- (1) monitoring the risks that are covered (that is, the scope of cover) by these agreements and the level of available cover;

- (2) keeping underwriting staff informed of any changes in the scope or level of cover;

- (3) properly co-ordinating all reinsurance/risk transfer activities so that, in aggregate, the desired level and scope of cover is maintained;

- (4) ensuring that the firm does not become overly reliant on any one reinsurer or other risk transfer provider;

- (5) conducting regular stress testing and scenario analysis to assess the resilience of its reinsurance and risk transfer programmes to catastrophic events that may give rise to large and or numerous claims.

- 31/12/2004

PRU 7.1.36

See Notes

In making a claim on a reinsurance contract (that is, its reinsurance recoveries) or some other risk transfer contract a firm should ensure:

- (1) that it is able to identify and recover any money that it is due in a timely manner; and

- (2) that it makes adequate financial provision for the risk that it is unable to recover any money that it expected to be due, as a result of either a dispute with or a default by the reinsurer/risk transfer provider. Additional guidance on credit risk in reinsurance/risk transfer contracts is provided in PRU 3.2 (Credit risk in insurance).

- 31/12/2004

PRU 7.1.37

See Notes

- 31/12/2004

Record keeping

PRU 7.1.38

See Notes

The FSA's high level rules and guidance for record keeping are outlined in SYSC 3.2.20 R (Records). Additional rules and guidance in relation to the prudential context are set out in PRU 1.4.51 G to PRU 1.4.64G. In complying with these rules and guidance, a firm should retain an appropriate record of its insurance risk management activities. This may, for example, include records of:

- (1) each new risk that is underwritten (noting that these records may be held by agents or cedants, rather than directly by the firm provided that the firm has adequate access to those records);

- (2) any material aggregation of exposure to risk from a single source, or of the same kind or to the same potential catastrophe or event;

- (3) each notified claim including the amounts notified and paid, precautionary notices and any re-opened claims;

- (4) policy and contractual documents and any relevant representations made to policyholders;

- (5) other events or circumstances relevant to determining the risks and commitments that arise out of contracts of insurance (including discretionary benefits and charges under any long-term insurance contracts);

- (6) the formal wordings of reinsurance contracts; and

- (7) any other relevant information on the firm's reinsurance or other risk-transfer arrangements, including the extent to which they:

- 31/12/2004

PRU 7.1.39

See Notes

- 31/12/2004

PRU 7.2

Capital resources requirements and technical provisions for insurance business

- 31/12/2004

Application

PRU 7.2.1

See Notes

PRU 7.2 applies to an insurer unless it is:

- (1) a non-directive friendly society; or

- (2) an incoming EEA firm; or

- (3) an incoming Treaty firm.

- 31/12/2004

PRU 7.2.2

See Notes

- (1) This section applies to a firm in relation to the whole of its business, except where a particular provision provides for a narrower scope.

- (2) Where a firm carries on both long-term insurance business and general insurance business, this section applies separately to each type of business.

- 31/12/2004

PRU 7.2.3

See Notes

- 31/12/2004

PRU 7.2.4

See Notes

- 31/12/2004

PRU 7.2.5

See Notes

- 31/12/2004

PRU 7.2.6

See Notes

- 31/12/2004

Purpose

PRU 7.2.7

See Notes

- 31/12/2004

PRU 7.2.8

See Notes

- 31/12/2004

PRU 7.2.9

See Notes

This section implements requirements of the Insurance Directives for both general insurance business and long-term insurance business with regard to the technical provisions. The relevant articles of the Directives include:

- (1) article 15 of the First Non-Life Directive, as substituted by article 17 of the Third Non-Life Directive; and

- (2) article 20 of the Consolidated Life Directive (this Directive consolidates the provisions of the previous First, Second and Third Life Directives).

- 31/12/2004

PRU 7.2.10

See Notes

This section also sets out detailed rules and guidance on the calculation of the following elements of a firm's capital resources requirement (CRR) (see PRU 2.1):

- (1) the general insurance capital requirement; and

- (2) the long-term insurance capital requirement.

- 31/12/2004

PRU 7.2.11

See Notes

- 31/12/2004

Establishing technical provisions

PRU 7.2.12

See Notes

For general insurance business, a firm must establish adequate technical provisions:

- (1) in accordance with the rules in PRU 7.5 for equalisation provisions; and

- (2) otherwise, in accordance with PRU 1.3.5R.

- 31/12/2004

PRU 7.2.13

See Notes

- 31/12/2004

PRU 7.2.14

See Notes

- 31/12/2004

PRU 7.2.15

See Notes

- 31/12/2004

PRU 7.2.16

See Notes

For long-term insurance business, a firm must establish adequate technical provisions:

- (1) for its long-term insurance contracts, in accordance with the rules and guidance in PRU 7.3 relating to mathematical reserves, and with due regard to generally accepted actuarial practice; and

- (2) for long-term insurance liabilities which have fallen due, in accordance with PRU 1.3.5R.

- 31/12/2004

PRU 7.2.17

See Notes

- 31/12/2004

PRU 7.2.18

See Notes

- 31/12/2004

PRU 7.2.19

See Notes

- 31/12/2004

Assets of a value sufficient to cover technical provisions

PRU 7.2.20

See Notes

- 31/12/2004

PRU 7.2.21

See Notes

A composite firm must ensure that:

- (1) its separately identified long-term insurance assets have a value at least equal to the amount of:

- (a) its technical provisions for long-term insurance liabilities; and

- (b) any other liabilities connected with long-term insurance business; and

- (2) that it has other admissible assets of a value at least equal to the amount of its technical provisions for general insurance liabilities.

- 31/12/2004

PRU 7.2.22

See Notes

- 31/12/2004

PRU 7.2.23

See Notes

When valuing assets for the purposes of PRU 7.2.20 R and PRU 7.2.21 R, a firm should bear in mind:

- (1) that the technical provisions should be covered by admissible assets (see PRU 2 Annex 1 RR); and

- (2) the market and counterparty limits set out in PRU 3.2 (Credit risk in insurance). PRU 3.2 requires that a firm restrict to prudent levels its exposure to reinsurer and other counterparties, and, in particular, that for the purpose of its balance sheet, a firm must not take into account any exposure which exceeds the large exposure limits.

- 31/12/2004

PRU 7.2.24

See Notes

- 31/12/2004

PRU 7.2.25

See Notes

For the purpose of determining the value of assets available to meet long-term insurance liabilities in accordance with PRU 7.2.20 R, PRU 7.2.21 R, PRU 7.2.27 R and PRU 7.2.28 R, no value is to be attributed to debts and claims other than in respect of:

- (1) amounts that have already fallen due;

- (2) tax recoveries and claims against compensation funds to the extent not already offset in mathematical reserves.

- 31/12/2004

PRU 7.2.26

See Notes

- 31/12/2004

PRU 7.2.27

See Notes

- 31/12/2004

PRU 7.2.28

See Notes

- 31/12/2004

PRU 7.2.29

See Notes

- 31/12/2004

Localisation (UK firms only)

PRU 7.2.30

See Notes

- (1) Subject to (2), a UK firm must hold admissible assets held pursuant to PRU 4.2.53R:

- (a) (where the admissible assets cover technical provisions in pounds sterling), in any EEA State; and

- (b) (where the admissible assets cover technical provisions in any currency other than pounds sterling), in any EEA State or in the country of that currency.

- (2) In the case of a community co-insurance operation and a relevant insurer, the admissible assets covering technical provisions must be held in any EEA State.

- 31/12/2004

PRU 7.2.31

See Notes

- 31/12/2004

PRU 7.2.32

See Notes

PRU 7.2.30 R does not apply to:

- (1) a pure reinsurer; or

- (2) debts owed by reinsurers; or

- (3) insurance business carried on by a UK firm outside the EEA States; or

- (4) general insurance business class groups 3 and 4 in IPRU(Ins), Annex 11.2, Part II.

- 31/12/2004

PRU 7.2.33

See Notes

For the purposes of PRU 7.2.30 R:

- (1) a tangible asset is to be treated as held in the country or territory where it is situated;

- (2) an admissible asset consisting of a claim against a debtor is to be treated as held in any country or territory where it can be enforced by legal action;

- (3) a listed security is to be treated as held in any country or territory where there is a regulated market on which the security is dealt; and

- (4) a security which is not a listed security is to be treated as held in the country or territory in which the issuer has its head office.

- 31/12/2004

Matching of assets and liabilities

PRU 7.2.34

See Notes

- (1) Subject to (4), the assets held by a firm to cover its technical provisions (see PRU 7.2.20 R and PRU 7.2.21 R) must:

- (a) have characteristics of safety, yield and marketability which are appropriate to the type of business carried on by the firm;

- (b) be diversified and adequately spread; and

- (c) comply with (2).

- (2) The assets referred to in (1) must, in addition to meeting the criteria set out in (1)(a) and (b), be of a sufficient amount, and of an appropriate currency and term, to ensure that the cash inflows from those assets will meet the expected cash outflows from the firm's insurance liabilities as they become due.

- (3) For the purpose of (2), a firm must take into consideration in determining expected cash outflows any options which exist in the firm's contracts of insurance.

- (4) (1) does not apply to assets held to cover index-linked liabilities or property-linked liabilities, except that where the linked long-term contract of insurance in question includes a guarantee of investment performance or some other guaranteed benefit, (1) will nevertheless apply to assets held to cover that guaranteed element.

- 31/12/2004

PRU 7.2.35

See Notes

- 31/12/2004

PRU 7.2.36

See Notes

For the purpose of PRU 7.2.34 R (2), the relevant cash inflows are those which the firm reasonably expects to receive from the admissible assets which it holds to cover its technical provisions. A firm may receive cash inflows as a result of:

- (1) selling assets or closing out transactions;

- (2) holding assets that generate dividends, interest or other income; and

- (3) receiving future premiums for existing business.

- 31/12/2004

PRU 7.2.37

See Notes

- 31/12/2004

PRU 7.2.38

See Notes

- 31/12/2004

PRU 7.2.39

See Notes

- 31/12/2004

PRU 7.2.40

See Notes

- 31/12/2004

Premiums for new business

PRU 7.2.41

See Notes

A firm must not enter into a long-term insurance contract unless it is satisfied on reasonable actuarial assumptions that:

- (1) the premiums receivable and the investment income expected to be earned from those premiums; and

- (2) the reinsurance arrangements made in respect of the risk or risks covered by that new contract;

- are sufficient to enable it, when taken together with the firm's other resources, to:

- (a) establish adequate technical provisions as required by PRU 7.2.16 R;

- (b) hold admissible assets of a value at least equal to the amount of the technical provisions as required by PRU 7.2.20 R to PRU 7.2.28 R; and

- (c) maintain adequate overall financial resources as required by PRU 1.2.22R.

- 31/12/2004

PRU 7.2.42

See Notes

- 31/12/2004

Capital requirements for insurers

PRU 7.2.43

See Notes

- (1) PRU 2.1.9R requires a firm to maintain capital resources equal to or in excess of its capital resources requirement (CRR). PRU 2.1 sets out the overall framework of the CRR; in particular, PRU 2.1.14 R requires that for a firm carrying on general insurance business the CRR is equal to the minimum capital requirement (MCR). PRU 2.1.15 R requires that for realistic basis life firms the CRR is the higher of the MCR and the ECR. PRU 2.1.20 R requires that for regulatory basis only life firms the CRR is equal to the MCR.

- (2) For non-life firms the MCR represents the minimum capital requirement (or margin of solvency) prescribed by the Insurance Directives. PRU 2.1.21 R provides that, for a firm carrying on general insurance business, the MCR in respect of that business is the higher of the base capital resources requirement for general insurance business applicable to that firm and the general insurance capital requirement. PRU 2.1.22 R provides that, for a firm carrying on long-term insurance business, the MCR in respect of that business is the higher of the base capital resources requirement for long-term insurance business applicable to that firm and the sum of the long-term insurance capital requirement and the resilience capital requirement. As specified in PRU 2.1.10 R, a firm carrying on both general insurance business and long-term insurance business must apply PRU 2.1.9R (referred to in paragraph (1) above) separately to its general insurance business and its long-term insurance business.

- (3) The calculation of the general insurance capital requirement is set out in PRU 7.2.44 G to PRU 7.2.72 R below. PRU 7.2.73 G to PRU 7.2.79 R set out the calculation of the insurance-related capital requirement for non-life firms. The calculation of the long-term insurance capital requirement is set out in PRU 7.2.80 G to PRU 7.2.91 R below.

- 31/12/2004

General insurance capital requirement

PRU 7.2.44

See Notes

In relation to the MCR (see PRU 7.2.43 G), PRU 2.1.30 R requires a firm to calculate its general insurance capital requirement (GICR) as the highest of the premiums amount, the claims amount, and the brought forward amount. The elements for this computation are set out in PRU 7.2 as follows:

- (1) the premiums amount in PRU 7.2.45 R;

- (2) the claims amount in PRU 7.2.47 R; and

- (3) the brought forward amount in PRU 7.2.51 R.

- 31/12/2004

The premiums amount

PRU 7.2.45

See Notes

The premiums amount is:

- (1) 18% of the gross adjusted premiums amount; less 2% of the amount, if any, by which the gross adjusted premiums amount exceeds €50 million; multiplied by

- (2) the reinsurance ratio set out in PRU 7.2.54 R.

- 31/12/2004

PRU 7.2.46

See Notes

- 31/12/2004

The claims amount

PRU 7.2.47

See Notes

The claims amount is:

- (1) 26% of the gross adjusted claims amount; less 3% of the amount, if any, by which the gross adjusted claims amount exceeds € 35 million; multiplied by

- (2) the reinsurance ratio set out in PRU 7.2.54 R.

- 31/12/2004

PRU 7.2.48

See Notes

- 31/12/2004

PRU 7.2.49

See Notes

- (1) Subject to (2) and (3), the Euro amounts specified in PRU 7.2.45 R (1) and PRU 7.2.47 R (1) will increase each year, starting on the first review date of 20 September 2005 (and annually after that), by the percentage change in the European index of consumer prices (comprising all European Union member states, as published by Eurostat) from 20 March 2002 to the relevant review date, rounded up to a multiple of €100,000.

- (2) In any year, if the percentage change since the last increase is less than 5%, then there will be no increase.

- (3) The increase will take effect 30 days after the EU Commission has informed the European Parliament and Council of its review and the relevant percentage change.

- 31/12/2004

PRU 7.2.50

See Notes

- 31/12/2004

The brought forward amount

PRU 7.2.51

See Notes

The brought forward amount is the general insurance capital requirement (GICR) for the prior financial year, multiplied, if the ratio is less than one, by the ratio (expressed as a percentage) of:

- (1) the technical provisions (calculated net of reinsurance) for claims outstanding at the end of the prior financial year, determined in accordance with PRU 7.2.12 R; to

- (2) the technical provisions (calculated net of reinsurance) for claims outstanding at the beginning of the prior financial year, determined in accordance with PRU 7.2.12 R.

- 31/12/2004

PRU 7.2.52

See Notes

- 31/12/2004

PRU 7.2.53

See Notes

- 31/12/2004

Reinsurance ratio used in calculating the premiums amount and the claims amount

PRU 7.2.54

See Notes

The reinsurance ratio referred to in PRU 7.2.45 R (2) and PRU 7.2.47 R (2) is:

- (1) if the ratio lies between 50% and 100%, the ratio (expressed as a percentage) of:

- (a) the claims incurred (net of reinsurance) in the financial year in question and the two previous financial years; to

- (b) the gross claims incurred in that three-year period;

- (2) 50%, if the ratio calculated in (a) and (b) of (1) is 50% or less; and

- (3) 100%, if the ratio calculated in (a) and (b) of (1) is 100% or more.

- 31/12/2004

PRU 7.2.55

See Notes

- 31/12/2004

Gross adjusted premiums amount used in calculating the premiums amount

PRU 7.2.56

See Notes

For the purpose of PRU 7.2.45 R, the gross adjusted premiums amount is the higher of the written and earned gross premiums (as determined in accordance with PRU 7.2.66 R) for the financial year in question, adjusted by:

- (1) except for a pure reinsurer that does not have permission under the Act to effect contracts of insurance, increasing by 50% the amount included in respect of the premiums for general insurance business classes 11, 12 and 13;

- (2) deducting 66.7% of the premiums for actuarial health insurance that meets the conditions set out in PRU 7.2.72 R; and

- (3) multiplying the resulting figure by 12 and dividing by the number of months in the financial year. For the purposes of this calculation, the number of months in the financial year is the number of complete calendar months in the financial year plus any fractions of a month at the beginning and the end of the financial year.

- 31/12/2004

PRU 7.2.57

See Notes

- 31/12/2004

PRU 7.2.58

See Notes

- 31/12/2004

PRU 7.2.59

See Notes

- 31/12/2004

Gross adjusted claims amount used in calculating the claims amount

PRU 7.2.60

See Notes

For the purpose of PRU 7.2.47 R and subject to PRU 7.2.62 R, the gross adjusted claims amount is the amount of gross claims incurred (as determined in accordance with PRU 7.2.66 R) over the reference period (as specified in PRU 7.2.63 R) and adjusted by:

- (1) except for a pure reinsurer that does not have permission under the Act to effect contracts of insurance, increasing by 50% the amount included in respect of the claims incurred for general insurance business classes 11, 12 and 13;

- (2) deducting 66.7% of the claims for actuarial health insurance that meets the conditions set out in PRU 7.2.72 R; and

- (3) multiplying the resulting figure by 12 and dividing by the number of months in the reference period. For the purposes of this calculation, the number of months in the reference period is the number of complete calendar months in the reference period plus any fractions of a month at the beginning and the end of the reference period.

- 31/12/2004

PRU 7.2.61

See Notes

- 31/12/2004

PRU 7.2.62

See Notes

- 31/12/2004

PRU 7.2.63

See Notes

- (1) Except in those cases where paragraph (2) applies, the reference period to be used in PRU 7.2.60 R and PRU 7.2.62 R must be:

- (a) the financial year in question and the two previous financial years; or

- (b) the period the firm had been in existence at the end of the financial year in question, if shorter.

- (2) In the case of a firm which underwrites only one or more of the general insurance business risks of credit, storm, hail or frost (including other business written in connection with such risks), the reference period to be used must be:

- (a) the financial year in question and the six previous financial years; or

- (b) the period the firm had been in existence at the end of the financial year in question, if shorter.

- 31/12/2004

PRU 7.2.64

See Notes

- 31/12/2004

PRU 7.2.65

See Notes

- 31/12/2004

Accounting for premiums and claims

PRU 7.2.66

See Notes

For the purposes of PRU 7.2.54 R, PRU 7.2.56 R, PRU 7.2.60 R and PRU 7.2.62 R, amounts of premiums and claims must be:

- (1) determined in accordance with PRU 1.3 (Valuation); and

- (2) adjusted for transfers that were approved by the relevant authority (or became effective where approval by an authority was not required) before the end of the financial year in question:

- (a) to exclude any amount included in, or adjustment made to, premiums and claims to reflect the consideration for a transfer of contracts of insurance to or from the firm;

- (b) to exclude premiums and claims which arose from contracts of insurance that have been transferred by the firm to another body; and

- (c) to account for premiums and claims which arose from contracts of insurance that have been transferred to the firm from another body as if they were receivable by or payable to the firm.

- 31/12/2004

PRU 7.2.67

See Notes

- 31/12/2004

PRU 7.2.68

See Notes

- 31/12/2004

PRU 7.2.69

See Notes

- 31/12/2004

PRU 7.2.70

See Notes

- 31/12/2004

PRU 7.2.71

See Notes

- 31/12/2004

Actuarial health insurance

PRU 7.2.72

See Notes

The conditions referred to in PRU 7.2.56 R (2) and PRU 7.2.60 R (2) are that:

- (1) the health insurance is underwritten on a similar technical basis to that of life insurance;

- (2) the premiums paid are calculated on the basis of sickness tables according to the mathematical method applied in insurance;

- (3) a provision is set up for increasing age;

- (4) an additional premium is collected in order to set up a safety margin of an appropriate amount;

- (5) it is not possible for the firm to cancel the contract after the end of the third year of insurance; and

- (6) the contract provides for the possibility of increasing premiums or reducing payments even for current contracts.

- 31/12/2004

Insurance-related capital requirement (general insurance business only)

PRU 7.2.73

See Notes

- 31/12/2004

PRU 7.2.74

See Notes

The insurance-related capital requirement is a measure of the capital that a firm should hold against the risk of:

- (1) an adverse movement in the value of a firm's liabilities, to recognise that there may be substantial volatility in claims and other technical provisions made by the firm. Such variations may be due to inflationary increases, interest rate changes, movements in the underlying provisions themselves, changes in expense costs, inadequate rate pricing or premium collections (or both) from intermediaries differing from projected assumptions; and

- (2) the premiums a firm charges in respect of particular business not being adequate to fund future liabilities arising from that business.

- 31/12/2004

PRU 7.2.75

See Notes

- 31/12/2004

Calculation of the insurance-related capital requirement

PRU 7.2.76

See Notes

- 31/12/2004

PRU 7.2.77

See Notes

- (1) The value of:

- (a) the net written premiums; and

- (b) the technical provisions;

- in respect of each class of business listed in the table in PRU 7.2.79 R must be multiplied by the corresponding capital charge factor.

- (2) If any amount which is to be multiplied by a capital charge factor is a negative amount, that amount shall be treated as zero.

- (3) The amounts resulting from multiplying the net written premiums in respect of each such class of business by the corresponding capital charge factor must be aggregated.

- (4) The amounts resulting from multiplying the technical provisions in respect of each such class of business by the corresponding capital charge factor must be aggregated.

- (5) The insurance-related capital requirement is the sum of the amounts calculated in accordance with (3) and (4).

- 31/12/2004

PRU 7.2.78

See Notes

In PRU 7.2.77 R references to technical provisions comprise:

- (1) outstanding claims;

- (2) provisions for incurred but not reported (IBNR) claims;

- (3) provisions for incurred but not enough reported (IBNER) claims;

- (4) unearned premium reserves less deferred acquisition costs; and

- (5) unexpired risk reserves;

in each case net of reinsurance receivables.

- 31/12/2004

PRU 7.2.79

See Notes

| Class of Business | Net Written Premium capital charge factor | Technical provision capital charge factor |

| Reporting Group: Direct Personal Motor | ||

| Private motor - comprehensive | 10.0% | 9.0% |

| Private motor - non-comprehensive | 10.0% | 9.0% |

| Motor cycle | 10.0% | 9.0% |

| Reporting Group: Direct Commercial Motor | ||

| Fleets | 10.0% | 9.0% |

| Commercial vehicles (non-fleet) | 10.0% | 9.0% |

| Reporting Group: Direct Accident & Health | ||

| Private medical insurance | 5.0% | 7.5% |

| HealthCare cash plans | 5.0% | 7.5% |

| Personal accident or sickness | 5.0% | 7.5% |

| Travel | 5.0% | 7.5% |

| Reporting Group: Direct Personal Lines Property | ||

| Household and domestic all risks | 10.0% | 10.0% |

| Reporting Group: Direct Personal Lines Pecuniary Loss | ||

| Assistance | 25.0% | 14.0% |

| Creditor | 25.0% | 14.0% |

| Extended warranty | 25.0% | 14.0% |

| Legal expenses | 25.0% | 14.0% |

| Reporting Group: Direct Commercial Lines Property | ||

| Commercial property damage and theft | 10.0% | 10.0% |

| Engineering all risks | 10.0% | 10.0% |

| Contractors all risks | 10.0% | 10.0% |

| Energy | 10.0% | 10.0% |

| Mixed commercial package | 10.0% | 10.0% |

| Reporting Group: Direct Commercial Lines Liability | ||

| Employers liability | 14.0% | 14.0% |

| Product liability | 14.0% | 14.0% |

| Public liability | 14.0% | 14.0% |

| Professional indemnity | 14.0% | 14.0% |

| Reporting Group: Direct Commercial Lines Pecuniary Loss | ||

| Fidelity and contract guarantee | 25.0% | 14.0% |

| Mortgage indemnity | 25.0% | 14.0% |

| Credit | 25.0% | 14.0% |

| Consequential loss | 25.0% | 14.0% |

| Suretyship | 25.0% | 14.0% |

| Reporting Group: Direct Aviation | ||

| Aviation liability | 32.0% | 14.0% |

| Aviation hull | 32.0% | 14.0% |

| Space and satellite | 32.0% | 14.0% |

| Reporting Group: Direct Marine | ||

| Marine liability | 22.0% | 17.0% |

| Marine hull | 22.0% | 17.0% |

| Yacht | 22.0% | 17.0% |

| War risks | 22.0% | 17.0% |

| Protection and Indemnity | 22.0% | 17.0% |

| Freight demurrage and defence | 22.0% | 17.0% |

| Reporting Group: Direct Transport | ||

| Goods in transit | 12.0% | 14.0% |

| Reporting Group: Direct Miscellaneous | ||

| Miscellaneous direct business | 25.0% | 14.0% |

| Reporting Group: Non-Proportional Treaty | ||

| Non-proportional accident & health | 35.0% | 16.0% |

| Non-proportional motor | 10.0% | 14.0% |

| Non-proportional transport | 16.0% | 15.0% |

| Non-proportional aviation | 61.0% | 16.0% |

| Non-proportional marine | 38.0% | 17.0% |

| Non-proportional property non-catastrophe | 53.0% | 12.0% |

| Non-proportional property catastrophe | 53.0% | 12.0% |

| Non-proportional liability (non-motor) | 14.0% | 14.0% |

| Non-proportional pecuniary loss | 39.0% | 14.0% |

| Non-proportional aggregate cover | 53.0% | 12.0% |

| Reporting Group: Proportional Treaty | ||

| Proportional assumed accident & health | 12.0% | 16.0% |

| Proportional assumed motor | 10.0% | 12.0% |

| Proportional transport | 12.0% | 15.0% |

| Proportional aviation | 33.0% | 16.0% |

| Proportional marine | 22.0% | 17.0% |

| Proportional property | 23.0% | 12.0% |

| Proportional liability (non-motor) | 14.0% | 14.0% |

| Proportional pecuniary loss | 25.0% | 14.0% |

| Proportional aggregate cover | 23.0% | 12.0% |

| Reporting Group: Facultative Reinsurance Categories | ||

| Facultative accident & health | 5.0% | 7.5% |

| Facultative motor | 10.0% | 9.0% |

| Facultative personal property | 10.0% | 10.0% |

| Facultative personal financial loss | 25.0% | 14.0% |

| Facultative commercial property | 10.0% | 10.0% |

| Facultative commercial liability | 14.0% | 14.0% |

| Facultative commercial financial loss | 25.0% | 14.0% |

| Facultative marine | 22.0% | 17.0% |

| Facultative aviation | 32.0% | 14.0% |

| Facultative transport | 12.0% | 14.0% |

| Reporting Group: Miscellaneous Reinsurance | ||

| Miscellaneous reinsurance accepted business | 39.0% | 14.0% |

- 31/12/2004

Long-term insurance capital requirement

PRU 7.2.80

See Notes

- 31/12/2004

Insurance death risk capital component

PRU 7.2.81

See Notes

The insurance death risk capital component is the aggregate of the amounts which represent the fractions specified by PRU 7.2.82 R of the capital at risk, defined in PRU 7.2.83 R, for those contracts where the capital at risk is not a negative figure, multiplied by the higher of:

- (1) 50%; and

- (2) the ratio as at the end of the preceding financial year of:

- (a) the aggregate capital at risk net of reinsurance cessions; to

- (b) the aggregate capital at risk gross of reinsurance cessions.

- 31/12/2004

PRU 7.2.82

See Notes

For the purpose of PRU 7.2.81 R, the fraction is:

- (1) for long-term insurance business classes I, II and IX, except for a pure reinsurer:

- (a) 0.1% for temporary insurance on death where the original term of the contract is three years or less;

- (b) 0.15% for temporary insurance on death where the original term of the contract is five years or less but more than three years; and

- (c) 0.3% in any other case;

- (2) 0.3% for long-term insurance business classes III, VII and VIII, except for a pure reinsurer; and

- (3) 0.1% for a pure reinsurer.

- 31/12/2004

PRU 7.2.83

See Notes

For the purpose of PRU 7.2.81 R, the capital at risk is:

- (1) where the benefit under a contract of insurance payable as a result of death includes periodic or deferred payments, the present value of the benefits payable; and

- (2) in any other case, the amount payable as a result of death;

less, in either case, the mathematical reserves for the contract.

- 31/12/2004

PRU 7.2.84

See Notes

- 31/12/2004

Insurance health risk capital component

PRU 7.2.85

See Notes

The insurance health risk capital component is the highest of:

- (1) the premiums amount (determined in accordance with PRU 7.2.45 R);

- (2) the claims amount (determined in accordance with PRU 7.2.47 R); and

- (3) the brought forward amount (determined in accordance with PRU 7.2.51 R);

- in respect of:

- (a) contracts of insurance falling in long-term insurance business class IV (see PRU 7.2.86 R); and

- (b) risks falling in general insurance business classes 1 or 2 that are written as part of a long-term insurance contract.

- 31/12/2004

PRU 7.2.86

See Notes

- 31/12/2004

PRU 7.2.87

See Notes

- 31/12/2004

Insurance expense risk capital component

PRU 7.2.88

See Notes

The insurance expense risk capital component is:

- (1) in respect of long-term insurance business classes III, VII and VIII, an amount equivalent to 25% of the net administrative expenses in the preceding financial year relevant to the business of each of those classes, in so far as the firm bears no investment risk and the allocation to cover management expenses in the contract of insurance does not have a fixed upper limit which is effective as a limit for a period exceeding 5 years from the commencement of the contract;

- (2) in respect of any tontine (long-term insurance business class V), 1% of the assets of the tontine;

- (3) in the case of any other long-term insurance business, 1% of the "adjusted mathematical reserves" (as defined in PRU 7.2.90 R and PRU 7.2.91 R).

- 31/12/2004

Insurance market risk capital component

PRU 7.2.89

See Notes

The insurance market risk capital component is 3% of the "adjusted mathematical reserves" (as defined in PRU 7.2.90 R and PRU 7.2.91 R) for all contracts of insurance except those which:

- (1) fall in long-term insurance business classes III, VII or VIII and in respect of which the firm does not bear any investment risk; or

- (2) fall in long-term insurance business class V.

- 31/12/2004

PRU 7.2.90

See Notes

For the purpose of PRU 7.2.88 R and PRU 7.2.89 R, the "adjusted mathematical reserves" is the amount of mathematical reserves (gross of reinsurance cessions), multiplied by the higher of:

- (1) 85% or, in the case of a pure reinsurer, 50%; and

- (2) the ratio as at the end of the preceding financial year of:

- (a) the mathematical reserves net of reinsurance cessions; to

- (b) the mathematical reserves gross of reinsurance cessions.

- 31/12/2004

PRU 7.2.91

See Notes

The "adjusted mathematical reserves" do not include:

- (1) for the purposes of PRU 7.2.88 R (3) and PRU 7.2.89 R, amounts arising from tontines (long-term insurance business class V);

- (2) for the purposes of PRU 7.2.88 R (3), amounts arising from insurance business in classes III, VII or VIII, to the extent that such business meets the conditions in PRU 7.2.88 R (1);

- (3) for the purposes of PRU 7.2.89 R, amounts arising from insurance business in classes III, VII or VIII, to the extent that such business meets the conditions in PRU 7.2.89 R (1).

- 31/12/2004

PRU 7.3

Mathematical reserves

- 31/12/2004

Application

PRU 7.3.1

See Notes

PRU 7.3 applies to a long-term insurer unless it is:

- (1) a non-directive friendly society; or

- (2) an incoming EEA firm; or

- (3) an incoming Treaty firm.

- 31/12/2004

Purpose

PRU 7.3.2

See Notes

- 31/12/2004

PRU 7.3.3

See Notes

- 31/12/2004

PRU 7.3.4

See Notes

- 31/12/2004

PRU 7.3.5

See Notes

- 31/12/2004

PRU 7.3.6

See Notes

- 31/12/2004

Basic valuation method

PRU 7.3.7

See Notes

- (1) Subject to (2), a firm must establish its mathematical reserves using a prospective actuarial valuation on prudent assumptions of all future cash flows expected to arise under, or in respect of, each of its long-term insurance contracts.

- (2) But a firm may use a retrospective actuarial valuation where:

- (a) a prospective method cannot be applied to a particular type of contract; or

- (b) the firm can demonstrate that the resulting amount of the mathematical reserves would be no lower than would be required by a prudent prospective actuarial valuation.

- 31/12/2004

PRU 7.3.8

See Notes

A prospective valuation sets the mathematical reserves at the present value of future net cash flows. A retrospective method typically sets the mathematical reserves at the level of premiums received (and accumulated with investment return), less claims and expenses paid. A prospective valuation is preferred because it takes account of circumstances that might have arisen since the premium rate was set and of changes in the perception of future experience. Circumstances in which a retrospective valuation might be appropriate include:

- (1) where the assumptions initially made in determining the premium rate were sufficiently prudent at inception and have not been overtaken by subsequent events; and

- (2) where the liability depends on the emerging experience.

- 31/12/2004

PRU 7.3.9

See Notes

- 31/12/2004

Methods and assumptions

PRU 7.3.10

See Notes

In the actuarial valuation under PRU 7.3.7 R, a firm must use methods and prudent assumptions which:

- (1) are appropriate to the business of the firm;

- (2) are consistent from year to year without arbitrary changes (see PRU 7.3.11 G);

- (3) are consistent with the method of valuing assets (see PRU 1.3);

- (4) include appropriate margins for adverse deviation of relevant factors (see PRU 7.3.12 G);

- (5) recognise the distribution of profits (that is, emerging surplus) in an appropriate way over the duration of each contract of insurance;

- (6) take into account its regulatory duty to treat its customers fairly (see Principle 6); and

- (7) are in accordance with generally accepted actuarial practice.

- 31/12/2004

PRU 7.3.11

See Notes

- 31/12/2004

PRU 7.3.12

See Notes

- 31/12/2004

Margins for adverse deviation

PRU 7.3.13

See Notes

- 31/12/2004

PRU 7.3.14

See Notes

- 31/12/2004

PRU 7.3.15

See Notes

- 31/12/2004

PRU 7.3.16

See Notes

When setting the margins for adverse deviation required by PRU 7.3.10 R (4) in relation to a particular contract, a firm should consider, where appropriate:

- (1) the margin for adverse deviation included in the premium for similar long-term insurance contracts, if any, newly issued by the firm; and

- (2) where a sufficiently developed and diversified market for transferring a risk exists, the risk premium that would be required by an unconnected party to assume the risk in respect of the contract.

The margin for adverse deviation of a risk should generally be greater than or equal to the relevant market price for that risk.

- 31/12/2004

PRU 7.3.17

See Notes

- 31/12/2004

PRU 7.3.18

See Notes

- 31/12/2004

PRU 7.3.19

See Notes

Further detailed rules and guidance on margins for adverse deviation are included in PRU 7.3.32 G to PRU 7.3.91 G . In particular, the cross-references for the different assumptions used in calculating the mathematical reserves are as follows:

- (1) expenses (PRU 7.3.50 R to PRU 7.3.58 G);

- (2) mortality and morbidity (PRU 7.3.59 R to PRU 7.3.61 G);

- (3) options (PRU 7.3.62 R to PRU 7.3.72 G);

- (4) persistency (PRU 7.3.73 G to PRU 7.3.77 G); and

- (5) reinsurance ( PRU 7.3.78 G to PRU 7.3.91 G).

The rules and guidance on margins for adverse deviation in respect of future investment returns, which are also required in the calculation of mathematical reserves, are set out in PRU 4.2.28 R to PRU 4.2.48 G.

- 31/12/2004

Record keeping

PRU 7.3.20

See Notes

A firm must make, and retain for an appropriate period, a record of:

- (1) the methods and assumptions used in establishing its mathematical reserves, including the margins for adverse deviation, and the reasons for their use; and

- (2) the nature of, reasons for, and effect of, any change in approach, including the amount by which the change in approach increases or decreases its mathematical reserves.

- 31/12/2004

PRU 7.3.21

See Notes

PRU 1.4.53 R requires firms to maintain accounting and other records for a minimum of three years, or longer as appropriate. For the purposes of PRU 7.3.20 R, a period of longer than three years will be appropriate for a firm's long-term insurance business. In determining an appropriate period, a firm should have regard to:

- (1) the detailed rules and guidance on record keeping in PRU 1.4.51 G - PRU 1.4.64 G;

- (2) the nature and term of the firm's long-term insurance business; and

- (3) any additional provisions or statutory requirements applicable to the firm or its records.

- 31/12/2004

Valuation of individual contracts

PRU 7.3.22

See Notes

- (1) Subject to (2) and (3), a firm must determine the amount of the mathematical reserves separately for each long-term insurance contract.

- (2) Approximations or generalisations may be made where they are likely to provide the same, or a higher, result.

- (3) A firm must set up additional mathematical reserves on an aggregated basis for general risks that are not specific to individual contracts.

- 31/12/2004

PRU 7.3.23

See Notes

- 31/12/2004

Contracts not to be treated as assets

PRU 7.3.24

See Notes

- 31/12/2004

PRU 7.3.25

See Notes

- 31/12/2004

Avoidance of future valuation strain

PRU 7.3.26

See Notes

- (1) A firm must establish mathematical reserves for a contract of insurance which are sufficient to ensure that, at any subsequent date, the mathematical reserves then required are covered solely by:

- (a) the assets covering the current mathematical reserves; and

- (b) the resources arising from those assets and from the contract itself.

- (2) For the purposes of (1), the firm must assume that:

- (a) the assumptions adopted for the current valuation of liabilities remain unaltered and are met; and

- (b) discretionary benefits and charges will be set so as to fulfil its regulatory duty to treat its customers fairly.

- (3) (1) may be applied to a group of similar contracts instead of to the individual contracts within that group.

- 31/12/2004

PRU 7.3.27

See Notes

- 31/12/2004

Cash flows to be valued

PRU 7.3.28

See Notes

In a prospective valuation, a firm must include the following in the cash flows to be valued:

- (1) future premiums (see PRU 7.3.35 G to PRU 7.3.47 G);

- (2) expenses, including commissions (see PRU 7.3.50 R to PRU 7.3.58 G);

- (3) benefits payable (see PRU 7.3.29 R); and

- (4) amounts to be received or paid in respect of the long-term insurance contracts under contracts of reinsurance or analogous non-reinsurance financing agreements (PRU 7.3.78 G to PRU 7.3.91 G).

- 31/12/2004

PRU 7.3.29

See Notes

For the purpose of PRU 7.3.28 R (3), benefits payable include:

- (1) all guaranteed benefits including guaranteed surrender values and paid-up values;

- (2) vested, declared and allotted bonuses to which the policyholder is entitled;

- (3) all options available to the policyholder under the terms of the contract; and

- (4) discretionary benefits payable in accordance with the firm's regulatory duty to treat its customers fairly.

- 31/12/2004

PRU 7.3.30

See Notes

- 31/12/2004

PRU 7.3.31

See Notes

- 31/12/2004

Valuation assumptions: detailed rules and guidance

PRU 7.3.32

See Notes

- 31/12/2004

Valuation rates of interest

PRU 7.3.33

See Notes

- 31/12/2004

PRU 7.3.34

See Notes

- 31/12/2004

Future premiums

PRU 7.3.35

See Notes

- 31/12/2004

PRU 7.3.36

See Notes

- 31/12/2004

Future premiums: firms reporting only on a regulatory basis

PRU 7.3.37

See Notes

- 31/12/2004

PRU 7.3.38

See Notes

- (1) This rule applies to with-profits insurance contracts except accumulating with-profits policies written on a recurring single premium basis.

- (2) The value attributed to a premium due in any future financial year (a future premium) must not exceed the lower of the value of:

- (a) the actual premium payable under the contract; and

- (b) the net premium.

- (3) The net premium may be increased for deferred acquisition costs in accordance with PRU 7.3.43 R.

- 31/12/2004

PRU 7.3.39

See Notes

- 31/12/2004

PRU 7.3.40

See Notes

- 31/12/2004

PRU 7.3.41

See Notes

A firm must treat the change referred to in PRU 7.3.40 R as if either:

- (1) it had been included in the original contract but came into effect from the time the change became effective; or

- (2) the original contract were cancelled and replaced by a new contract (with an initial premium paid on the new contract equal to the liability under the original contract immediately prior to the change); or

- (3) it gave rise to two separate contracts where:

- (a) all premiums are payable under the first contract and that contract provides only for such benefits as those premiums could have purchased from the firm at the date the change became effective; and

- (b) no premiums are payable under the second contract and that contract provides for all the other benefits.

- 31/12/2004

PRU 7.3.42

See Notes

- 31/12/2004

Future net premiums: adjustment for deferred acquisition costs

PRU 7.3.43

See Notes

- (1) The amount of any increase to the net premium for deferred acquisition costs must not exceed the equivalent of the recoverable acquisition expenses spread over the period of premium payments and calculated in accordance with the rates of interest, mortality and morbidity assumed in calculating the mathematical reserves.

- (2) For the purpose of (1), recoverable acquisition expenses means the amount of expenses, after allowing for the effects of taxation, which it is reasonable to expect will be recovered from future premiums payable under the contract.

- (3) The recoverable acquisition expenses in (1) must not exceed the lower of:

- (a) the value of the excess of actual premiums over net premiums; and

- (b) 3.5% of the relevant capital sum.

- (4) Recoverable acquisition expenses may be calculated as the average for a group of similar contracts weighted by the relevant capital sum for each contract.

- 31/12/2004

PRU 7.3.44

See Notes

- 31/12/2004

PRU 7.3.45

See Notes

- 31/12/2004

Future premiums: firms also reporting with-profits insurance liabilities on a realistic basis

PRU 7.3.46

See Notes

- (1) Subject to (2), for a realistic basis life firm, the future premiums to be valued in the calculation of the mathematical reserves for its with-profits insurance contracts must not be greater than the gross premiums payable by the policyholder.

- (2) This rule does not apply to accumulating with-profits policies written on a recurring single premium basis (see PRU 7.3.48 R).

- 31/12/2004

PRU 7.3.47

See Notes

- 31/12/2004

Future premiums: accumulating with-profits policies

PRU 7.3.48

See Notes

- (1) This rule applies to accumulating with-profits policies written on a recurring single premium basis.

- (2) A firm must not attribute any value to a future premium under the contract.

- (3) Any liability arising only upon the payment of that premium may be ignored except to the extent that the value of that liability upon payment would exceed the amount of that premium.

- 31/12/2004

PRU 7.3.49

See Notes

- 31/12/2004

Expenses

PRU 7.3.50

See Notes

- (1) A firm must make provision for expenses, either implicitly or explicitly, in its mathematical reserves of an amount which is not less than the amount expected, on prudent assumptions, to be incurred in fulfilling its long-term insurance contracts.

- (2) For the purpose of (1), expenses must be valued:

- (a) after taking account of the effect of taxation;

- (b) having regard to the firm's actual expenses in the last 12 months before the actuarial valuation date and any increases in expenses expected to occur in the future;

- (c) after making prudent assumptions as to the effects of inflation on future increases in prices and earnings; and

- (d) at no less than the level that would be incurred if the firm were to cease to transact new business 12 months after the actuarial valuation date.

- (3) A firm must not rely upon an implicit provision arising from the method of valuing future premiums except to the extent that:

- 31/12/2004

PRU 7.3.51

See Notes

- 31/12/2004

PRU 7.3.52

See Notes

- 31/12/2004

PRU 7.3.53

See Notes

- 31/12/2004

PRU 7.3.54

See Notes

- 31/12/2004

PRU 7.3.55

See Notes

The provisions for expenses (whether implicit or explicit) required by PRU 7.3.50 R must be sufficient to cover all the expenses of running off the firm's existing long-term insurance business including:

- (1) all discontinuance costs (for example, redundancy costs and closure costs) that would arise if the firm were to cease transacting new business 12 months after the actuarial valuation date in circumstances where (and to the extent that) the discontinuance costs exceed the projected surplus available to meet such costs;

- (2) all costs of continuing to service the existing business taking into account the loss of economies of scale from, and any other likely consequences of, ceasing to transact new business at that time; and

- (3) the lower of:

- (a) any projected valuation strain from writing new business for the 12 months following the actuarial valuation date to the extent the actual amount of that strain exceeds the projected surplus on prudent assumptions from existing business in the 12 months following the actuarial valuation date; and

- (b) any projected new business expense overrun from writing new business for the 12 months following the actuarial valuation date to the extent the projected expenses exceed the expenses that the new business can support on a prudent basis.

- 31/12/2004

PRU 7.3.56

See Notes

The provision for future expenses, whether implicit or explicit, should include a prudent margin for adverse deviation in the level and timing of expenses (see PRU 7.3.13 R to PRU 7.3.19 G). The margin should cover the risk of underestimating expenses whether due to, for example, initial under-calculation or subsequent increases in the amount of expenses. In setting the amount of the margin, the firm should take into account the extent to which:

- (1) an appropriately validated method based on reliable data is used to allocate expenses by product type, by distribution channel and as between acquisition and non-acquisition expenses;

- (2) the volume of existing and new business and its distribution by product type or distribution channel is stable or predictable;

- (3) costs vary in the short, medium or long term dependent upon the volume of existing or new business and its distribution by product type or distribution channel; and

- (4) cost control is well-managed.

- 31/12/2004

PRU 7.3.57

See Notes

In setting the margin, the firm should also take into account:

- (1) the length of the period over which it is necessary to project costs;

- (2) the extent to which it is reasonable to expect inflation to be stable or predictable over that period; and

- (3) whether, if inflation is higher than expected, it is reasonable to expect that the excess would be offset by increases in investment returns.

- 31/12/2004

PRU 7.3.58

See Notes

- 31/12/2004

Mortality and Morbidity

PRU 7.3.59

See Notes

- 31/12/2004

PRU 7.3.60

See Notes

The rates of mortality or morbidity should contain prudent margins for adverse deviation (see PRU 7.3.13 R to PRU 7.3.19 G). In setting those rates, a firm should take account of:

- (1) the systems and controls applied in underwriting long-term insurance contracts and whether they provide adequate protection against anti-selection (that is, selection against the firm) including:

- (a) adequately defining and identifying non-standard risks; and

- (b) where such risks are underwritten, allocating to them an appropriate weighting;

- (2) the nature of the contractual exposure to mortality or morbidity risk including:

- (a) whether lower mortality increases or decreases the firm's liability;

- (b) the period of cover and whether risk charges can be varied during that period and, if so, how quickly; and

- (c) whether the options in the contract give rise to a significant risk of anti-selection (for example, opportunities for voluntary discontinuance, guaranteed renewal at the option of the policyholder and rights for conversion of benefits);

- (3) the credibility of the firm's actual experience as a basis for projecting future experience including:

- (a) whether there is sufficient data (especially for medical or financial risks and for new types of benefit or new methods of distribution); and

- (b) whether the data is reliable and has been appropriately validated;

- (4) the availability and reliability of:

- (a) any published tables of mortality or morbidity for the country or territory of residence of the person whose life or health is insured; and

- (b) any other information as to the industry-wide insurance experience for that country or territory;

- (5) anticipated or possible future trends in experience including, but only where they increase the liability:

- (a) anticipated improvements in mortality;

- (b) changes arising from improved detection of morbidity (including critical illnesses);

- (c) diseases the impact of which may not yet be reflected fully in current experience; and

- (d) changes in market segmentation (such as impaired life annuities) which, in the light of developing experience, may require different assumptions for different parts of the policy class.

- 31/12/2004

PRU 7.3.61

See Notes

- 31/12/2004

Options

PRU 7.3.62

See Notes

- 31/12/2004

PRU 7.3.63

See Notes

An option exists where a policyholder is given a choice between alternative forms of benefit, for example, a choice between receiving a cash benefit upon maturity or an annuity at a guaranteed rate. In some cases, the contract may designate one or other of these alternatives as the principal benefit and any other as an option. This designation, in itself, is not one of substance in the context of reserving since it does not affect the policyholder's choices. Other forms of option include:

- (1) the right to convert to a different contract on guaranteed terms;

- (2) the right to increase cover on guaranteed terms;

- (3) the right to a specified amount on surrender; and

- (4) the right to a paid up value.

- 31/12/2004

PRU 7.3.64

See Notes

- 31/12/2004

PRU 7.3.65

See Notes

- 31/12/2004

PRU 7.3.66

See Notes

- 31/12/2004

PRU 7.3.67

See Notes

- 31/12/2004

PRU 7.3.68

See Notes

- 31/12/2004

PRU 7.3.69

See Notes

- 31/12/2004

PRU 7.3.70

See Notes

- (1) Where a policyholder may opt to be paid a cash amount, or a series of cash payments, the mathematical reserves for the contract of insurance established under PRU 7.3.7 R must be sufficient to ensure that the payment or payments could be made solely from:

- (a) the assets covering those mathematical reserves; and

- (b) the resources arising from those assets and from the contract itself.

- (2) In (1) references to a cash amount or a series of cash payments include the amount or amounts likely to be paid on a voluntary discontinuance.

- (3) For the purposes of (1), the firm must assume that:

- (a) the assumptions adopted for the current valuation remain unaltered and are met; and

- (b) discretionary benefits and charges will be set so as to fulfil the firm's regulatory duty to treat its customers fairly.

- (4) (1) may be applied to a group of similar contracts instead of to the individual contracts within that group.

- 31/12/2004

PRU 7.3.71

See Notes

For the purposes of PRU 7.3.70 R, a firm must assume that the amount of a cash payment secured by the exercise of an option is:

- (1) in the case of an accumulating with-profits policy, the lower of:

- (a) the amount which the policyholder would reasonably expect to be paid if the option were exercised, having regard to the representations made by the firm and including any expectations of a final bonus; and

- (b) that amount, disregarding all discretionary adjustments;

- (2) in the case of any other policy, the amount which the policyholder would reasonably expect to be paid if the option were exercised, having regard to the representations made by the firm, without taking into account any expectations regarding future distributions of profits or the granting of discretionary additions in respect of an established surplus.

- 31/12/2004

PRU 7.3.72

See Notes

- 31/12/2004

Persistency assumptions

PRU 7.3.73

See Notes

- 31/12/2004

PRU 7.3.74

See Notes

- 31/12/2004

PRU 7.3.75

See Notes

- 31/12/2004

PRU 7.3.76

See Notes

- 31/12/2004

PRU 7.3.77

See Notes

- 31/12/2004

PRU 7.3.78

See Notes

- 31/12/2004

PRU 7.3.79

See Notes

A firm must value reinsurance cash flows using methods and assumptions which are at least as prudent as the methods and assumptions used to value the underlying contracts of insurance which have been reinsured. In particular:

- (1) reinsurance recoveries must not be recognised unless the underlying liabilities to which they relate have also been recognised;

- (2) reinsurance cash outflows that are unambiguously linked to the emergence as surplus of margins included in the valuation of existing contracts of insurance or to the exercise by a reinsurer of its rights under a termination clause need not be valued (see PRU 7.3.85 R); and

- (3) reinsurance cash inflows that are contingent on factors or conditions other than the insurance risks that are reinsured must not be valued.

- 31/12/2004

PRU 7.3.80

See Notes

In valuing reinsurance cash flows, a firm should establish prudent margins for adverse deviation (see PRU 7.3.13 R to PRU 7.3.19 G) including margins in respect of:

- (1) any uncertainty as to the amount or timing of amounts to be paid or received; and

- (2) the risk of credit default by the reinsurer.

- 31/12/2004

PRU 7.3.81

See Notes

- 31/12/2004

PRU 7.3.82

See Notes

- 31/12/2004

PRU 7.3.83

See Notes

- 31/12/2004

PRU 7.3.84

See Notes

- 31/12/2004

PRU 7.3.85

See Notes

- 31/12/2004

PRU 7.3.86

See Notes

- 31/12/2004

PRU 7.3.87

See Notes

- 31/12/2004

PRU 7.3.88

See Notes

- 31/12/2004

PRU 7.3.89

See Notes

- 31/12/2004

PRU 7.3.90

See Notes

- 31/12/2004

PRU 7.3.91

See Notes

- 31/12/2004

PRU 7.4

With-profits insurance capital component

- 31/12/2004

Application

PRU 7.4.1

See Notes

- 31/12/2004

PRU 7.4.2

See Notes

- 31/12/2004

Purpose

PRU 7.4.3

See Notes

- 31/12/2004

PRU 7.4.4

See Notes

- 31/12/2004

PRU 7.4.5

See Notes

- 31/12/2004

Main requirements

PRU 7.4.6

See Notes

- 31/12/2004

PRU 7.4.7

See Notes

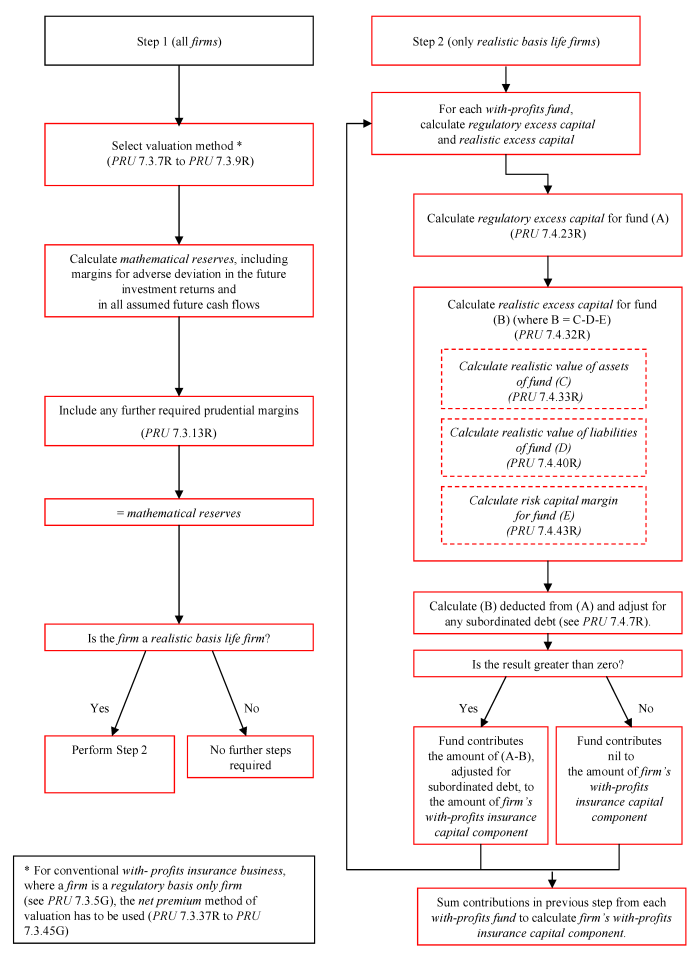

- (1) The with-profits insurance capital component for a firm is the aggregate of any amounts that:

- (a) result from the calculations specified in (2) and (3); and

- (b) are greater than zero.

- (2) Subject to (3), in relation to each with-profits fund within the firm, the firm must deduct B from A, where:

- (a) A is the amount of the regulatory excess capital for that fund (see PRU 7.4.23 R); and

- (b) B is the amount of the realistic excess capital for that fund (see PRU 7.4.32 R).

- (3) Where a capital instrument that can be included in the firm's capital resources in accordance with PRU 2.2 has been attributed wholly or partly to a with-profits fund and that instrument meets the requirements of PRU 2.2.93 R, the firm must add to the amount calculated under (2) for that fund the result, subject to a minimum of zero, of deducting D from C where:

- (a) C is the outstanding face amount of the instrument to the extent attributed to the fund; and

- (b) D is the realistic value of the instrument to the extent attributed to the fund in the single event that determines the risk capital margin under PRU 7.4.43 R.

- 31/12/2004

PRU 7.4.8

See Notes

- 31/12/2004

PRU 7.4.9

See Notes

SUP 4 (Actuaries) sets out the role and responsibilities of the actuarial function and of the with-profits actuary.

- (1) As part of his duties under SUP 4.3.13 R, the actuary appointed by the firm to perform the actuarial function must calculate the firm's mathematical reserves and, in the context of the calculation of the with-profits insurance capital component, must also:

- (a) advise the firm's governing body on the methods and assumptions to be used in the calculation of the firm's with-profits insurance capital component;

- (b) perform that calculation in accordance with the methods and assumptions determined by the firm's governing body; and

- (c) report to the firm's governing body on the results of that calculation.