PRU 1

PRU 1

PRU 2

PRU 2

Purpose

PRU 2.2.2

See Notes

- 31/10/2004

PRU 2.2.3

See Notes

- 31/10/2004

PRU 2.2.4

See Notes

- 31/10/2004

PRU 2.2.5

See Notes

Tier one capital typically has the following characteristics:

- (1) it is able to absorb losses;

- (2) it is permanent;

- (3) it ranks for repayment upon winding up after all other debts and liabilities; and

- (4) it has no fixed costs, that is, there is no inescapable obligation to pay dividends or interest.

- 31/10/2004

PRU 2.2.6

See Notes

- 31/10/2004

Upper and lower tier two capital

PRU 2.2.7

See Notes

Tier two capital includes forms of capital that do not meet the requirements for permanency and absence of fixed servicing costs that apply to tier one capital. Tier two capital includes, for example:

- (1) capital which is perpetual (that is, has no fixed term) but cumulative (that is, servicing costs cannot be waived at the issuer's option, although they may be deferred - for example cumulative preference shares); perpetual capital instruments may be included in upper tier two capital; and

- (2) capital which is not perpetual (that is, it has a fixed term) and which may have fixed servicing costs that cannot generally be either waived or deferred, for example subordinated debt. Such capital should normally be of a medium to long-term maturity (that is, an original maturity of at least five years). Dated capital instruments are included in lower tier two capital.

- 31/10/2004

PRU 2.2.8

See Notes

- 31/10/2004

PRU 2.2.10

See Notes

- 31/10/2004

PRU 2.2.11

See Notes

| Liabilities | Assets | ||

| Borrowings | 100 | Admissible assets | 350 |

| Ordinary shares | 200 | Intangible assets | 100 |

| Profit and loss account and other reserves | 100 | Other inadmissible assets | 100 |

| Perpetual subordinated debt | 150 | ||

| Total | 550 | Total | 550 |

| Calculation of capital resources: eligible assets less foreseeable liabilities | |||

| Total assets | 550 | ||

| less intangible assets | (100) | ||

| less inadmissible assets | (100) | ||

| less liabilities (borrowings) | (100) | ||

| Capital resources | 250 | ||

| Calculation of capital resources: components of capital | |||

| Ordinary shares | 200 | ||

| Profit and loss account and other reserves | 100 | ||

| Perpetual subordinated debt | 150 | ||

| less intangible assets | (100) | ||

| less inadmissible assets | (100) | ||

| Capital resources | 250 | ||

- 31/10/2004

PRU 2.2.12

See Notes

- 31/10/2004

PRU 2.2.13

See Notes

- 31/10/2004

PRU 2.2.14

See Notes

| Related text | Included in the calculation of capital resources | |

| A √ denotes that the item is included in the calculation of a firm's capital resources: a x denotes that the item is not included in the calculation of a firm's capital resources. | ||

| (A) Core tier one capital: | ||

| Permanent share capital | PRU 2.2.36 R | √ |

| Profit and loss account and other reserves | PRU 2.2.76 R and PRU 2.2.77 R | √ |

| Share premium account | None | √ |

| Externally verified interim net profits | PRU 2.2.82 R | √ |

| Positive valuation differences | PRU 2.2.78 R | √ |

| Fund for future appropriations | None | √ |

| (B) Perpetual non-cumulative preference shares | ||

| Perpetual non-cumulative preference shares | PRU 2.2.50 R | √ |

| (C) Innovative tier one capital | ||

| Innovative tier one instruments | PRU 2.2.52 R to PRU 2.2.75 R | √ |

| (D) Total tier one capital before deductions = A + B + C | ||

| (E) Deductions from tier one capital: | ||

| Investments in own shares | None | √ |

| Intangible assets | PRU 2.2.84 R | √ |

| Amounts deducted from technical provisions for discounting and other negative valuation differences | PRU 2.2.78 R to PRU 2.2.81 R | √ |

| (F) Total tier one capital after deductions = D - E | ||

| (G) Upper tier two capital: | ||

| Perpetual cumulative preference shares | PRU 2.2.101 R | √ |

| Perpetual subordinated debt | PRU 2.2.101 R | √ |

| Perpetual subordinated securities | PRU 2.2.101 R | √ |

| (H) Lower tier two capital | ||

| Fixed term preference shares | PRU 2.2.108 R | √ |

| Fixed term subordinated debt | PRU 2.2.108 R | √ |

| Fixed term subordinated securities | PRU 2.2.108 R | √ |

| (I) Total tier two capital = G + H | ||

| (J) Positive adjustments for related undertakings | ||

| Related undertakings that are regulated related undertakings (other than insurance undertakings) | PRU 2.2.90 R | √ |

| (K) Total capital after positive adjustments for regulated related undertakings that are not insurance undertakings but before deductions = F + I + J | ||

| (L) Deductions from total capital | ||

| Inadmissible assets | PRU 2.2.86 R & PRU 2 Annex 1R | √ |

| Assets in excess of market risk and counterparty limits | PRU 3.2.22 R | √ |

| Related undertakings that are ancillary services undertakings | PRU 2.2.89 R | √ |

| Negative adjustments for related undertakings that are regulated related undertakings (other than insurance undertakings) | PRU 2.2.90 R | √ |

| (M) Total capital after deductions = K - L | ||

| (N) Other capital resources*: | ||

| Unpaid share capital or, in the case of a mutual, unpaid initial funds and calls for supplementary contributions | PRU 2.2.126 G to PRU 2.2.128 G | × |

| Implicit items | PRU 2 Annex 2 G | × |

| (O) Total capital resources after deductions = M + N | ||

| * Items in section (N) of the table can be included in capital resources if subject to a waiver under section 148 of the Act. | ||

- 31/10/2004

PRU 2.2.15

See Notes

- 31/10/2004

PRU 2.2.16

See Notes

At least 50% of a firm's MCR must be accounted for by the sum of:

- (1) the amount calculated at stage A of the calculation in PRU 2.2.14 R; and

- (2) notwithstanding PRU 2.2.20 R (1), the amount calculated at stage B of the calculation in PRU 2.2.14 R;

- 31/10/2004

PRU 2.2.17

See Notes

A firm carrying on long-term insurance business must meet the higher of:

- (1) 1/3 of the long-term insurance capital requirement; and

- (2) the base capital resources requirement;

with the sum of the items listed at stages A, B, G and H less the sum of the items listed at stage E in PRU 2.2.14 R.

- 31/10/2004

PRU 2.2.18

See Notes

A firm carrying on general insurance business must meet the higher of:

- (1) 1/3 of the general insurance capital requirement; and

- (2) the base capital resources requirement;

with the sum of the items listed at stages A, B, G and H less the sum of the items listed at stage E in PRU 2.2.14 R.

- 31/10/2004

PRU 2.2.19

See Notes

- 31/10/2004

PRU 2.2.20

See Notes

In relation to a firm's tier one capital resources calculated at stage F of the calculation in PRU 2.2.14 R:

- (1) at least 50% must be accounted for by core tier one capital; and

- (2) no more than 15% may be accounted for by innovative tier one capital.

- 31/10/2004

PRU 2.2.21

See Notes

- 31/10/2004

PRU 2.2.22

See Notes

- 31/10/2004

PRU 2.2.23

See Notes

Subject to PRU 2.2.24 R, a firm must exclude from the calculation of its capital resources the following:

- (1) the amount (if any) by which tier two capital resources exceed the amount calculated at stage F of the calculation in PRU 2.2.14 R; and

- (2) the amount (if any) by which lower tier two capital resources exceed 50% of the amount calculated at stage F of the calculation in PRU 2.2.14 R.

- 31/10/2004

PRU 2.2.24

See Notes

At least 75% of a firm's MCR must be accounted for by the sum of:

- (1) the amount calculated at stage A plus stage B less stage E of the calculation in PRU 2.2.14 R; and

- (2) the amount calculated at stage G of the calculation in PRU 2.2.14 R.

- 31/10/2004

PRU 2.2.25

See Notes

- 31/10/2004

PRU 2.2.26

See Notes

- 31/10/2004

PRU 2.2.27

See Notes

A firm may not include a share in, or another investment in, or external contribution to the capital of, that firm in its tier one capital resources unless it complies with the following conditions:

- (1) it is included in one of the categories in PRU 2.2.28 R;

- (2) it is not excluded by any of the rules in PRU 2.2; and

- (3) it complies with the conditions set out in PRU 2.2.29 R.

- 31/10/2004

PRU 2.2.28

See Notes

The categories referred to in PRU 2.2.27 R (1) are:

- (1) permanent share capital;

- (2) a perpetual non-cumulative preference share; and

- (3) an innovative tier one instrument.

- 31/10/2004

PRU 2.2.29

See Notes

Subject to PRU 2.2.30 R, an item of capital in a firm complies with PRU 2.2.27 R (3) if:

- (1) it is issued by the firm;

- (2) it is fully paid and the proceeds of issue are immediately and fully available to the firm;

- (3) it:

- (a) cannot be redeemed at all or can only be redeemed on a winding up of the firm; or

- (b) complies with the conditions in PRU 2.2.38 R and PRU 2.2.39 R;

- (4) any coupon is either non-cumulative or, if it is cumulative, it complies with PRU 2.2.40 R;

- (5) it is able to absorb losses to allow the firm to continue trading and in the case of an innovative tier one instrument it complies with PRU 2.2.56 R to PRU 2.2.58 R;

- (6) it ranks for repayment upon winding up no higher than a share of a company incorporated under the Companies Act 1985 or the Companies (Northern Ireland) Order 1986 (whether or not it is such a share);

- (7) the firm has the right to choose whether or not to pay a coupon on it in cash at any time;

- (8) the description of its characteristics used in its marketing is consistent with the characteristics required to satisfy PRU 2.2.29 R (1) to PRU 2.2.29 R (7).

- 31/10/2004

PRU 2.2.30

See Notes

- (1) An item of capital does not comply with PRU 2.2.27 R (3) if the issue of that item of capital by the firm is connected with one or more other transactions which, when taken together with the issue of that item, could produce the effect described in (2).

- (2) The effect referred to in (1) is a reduction in the economic benefit intended to be conferred on the firm by the issue of the item of capital which means that the item of capital no longer displays all of the characteristics set out in PRU 2.2.29 R (1) to (8).

- 31/10/2004

PRU 2.2.32

See Notes

- 31/10/2004

PRU 2.2.33

See Notes

- 31/10/2004

PRU 2.2.35

See Notes

A firm may not include a share in its tier one capital resources unless (in addition to complying with the other relevant rules in PRU 2.2):

- (1) (in the case of a firm that is a company as defined in the Companies Act 1985 or the Companies (Northern Ireland) Order 1986) it is "called-up share capital" within the meaning given to that term in that Act or, as the case may be, that Order; or

- (2) (in the case of any other firm) it is:

- (a) in economic terms; and

- (b) in its characteristics as capital (including loss absorbency, permanency, ranking for repayment and fixed costs);

- substantially the same as called-up share capital falling into (1).

- 31/10/2004

PRU 2.2.36

See Notes

Permanent share capital means an item of capital which (in addition to satisfying PRU 2.2.29 R) meets the following conditions:

- (1) it is:

- (a) an ordinary share; or

- (b) a members' contribution; or

- (c) part of the initial fund of a mutual;

- (2) any coupon on it is not cumulative, and the firm has both the right to choose whether or not to pay a coupon and the right to choose the amount of that coupon ; and

- (3) the terms upon which it is issued do not permit redemption and it is otherwise incapable of being redeemed to at least the degree of an ordinary share issued by a company incorporated under the Companies Act 1985 or the Companies (Northern Ireland) Order 1986 (whether or not it is such a share).

- 31/10/2004

PRU 2.2.37

See Notes

- 31/10/2004

PRU 2.2.38

See Notes

In relation to a perpetual non-cumulative preference share which is redeemable, a firm may not include it in its tier one capital resources unless its contractual terms are such that:

- (1) it is redeemable only at the option of the firm; and

- (2) the firm cannot exercise that redemption right:

- (a) on or before the fifth anniversary of its date of issue;

- (b) unless it has given notice to the FSA in accordance with PRU 2.2.72 R; and

- (c) unless at the time of exercise of that right it complies with PRU 2.1.9 R and will continue to do so after redemption.

- 31/10/2004

PRU 2.2.39

See Notes

In relation to an innovative tier one instrument which is redeemable and which, either:

- (1) is or may become subject to a step-up; or

- (2) satisfies PRU 2.2.54 R (2);

a firm may not include it in its tier one capital resources unless it complies with the conditions in PRU 2.2.38 R, except that in PRU 2.2.38 R (2)(a) "fifth anniversary" is replaced by "tenth anniversary".

- 31/10/2004

PRU 2.2.40

See Notes

- 31/10/2004

PRU 2.2.42

See Notes

The rules in PRU 2.2 about redemption of potential tier one instruments fall into three classes:

- (1) rules defining whether a firm's potential tier one instruments are eligible for inclusion in its tier one capital resources at all;

- (2) rules defining whether a firm's potential tier one instruments are eligible for inclusion in its permanent share capital; and

- (3) rules defining whether a firm's potential tier one instruments must be classified as innovative tier one instruments.

- 31/10/2004

PRU 2.2.43

See Notes

The rules about redemption that are relevant to deciding whether a firm's potential tier one instruments are eligible for inclusion in its tier one capital resources at all are as follows.

- (1) PRU 2.2.29 R (3) and PRU 2.2.39 R have the following provisions.

- (a) Any capital instrument that is redeemable at the option of the holder cannot form part of a firm's tier one capital resources. Instead, if it is redeemable at all, a capital instrument should only be redeemable at the option of the firm.

- (b) A redemption right should be exercisable no earlier than the fifth anniversary of the date of issue. However, if an instrument is an innovative tier one instrument which is subject to a step-up or any other economic incentive to redeem, any such redemption should be exercisable no earlier than the tenth anniversary.

- (c) Any redemption proceeds should be payable only in cash or in shares.

- (d) The terms of the capital instrument should provide that any redemption right should not be exercised unless and until the firm has given the notice to the FSA required under PRU 2.2.72 R.

- (e) Any redemption right should not be exercisable unless both before and after the redemption the firm complies with PRU 2.1.9 R (which requires that a firm has sufficient capital resources to meet its capital resources requirement).

- (2) Under PRU 2.2.70 R, a firm should not include a potential tier one instrument that is redeemable in whole or in part in permanent share capital in its tier one capital resources unless the firm has:

- (a) sufficient permanent share capital or sufficient authority to issue permanent share capital (and the authority to allot it) to meet any redemption obligations that have become due; and

- (b) a prudent reserve of permanent share capital or sufficient authority to issue permanent share capital (and the authority to allot it) to meet possible future redemption obligations.

- (3) PRU 2.2.65 R contains limits on the amount of permanent share capital that may be issued on a redemption of a potential tier one instrument redeemable in permanent share capital.

- 31/10/2004

PRU 2.2.44

See Notes

- 31/10/2004

PRU 2.2.45

See Notes

The rules about redemption that are relevant to deciding whether a firm's potential tier one instruments should be classified as innovative tier one instruments are as follows.

- (1) Under PRU 2.2.53 R, a redeemable potential tier one instrument is always treated as an innovative tier one instrument if the redemption proceeds are payable otherwise than in cash.

- (2) Under PRU 2.2.54 R, any feature of a tier one instrument that in conjunction with a call would make a firm more likely to redeem it or to have an incentive to do so will make it an innovative tier one instrument.

- (3) Under PRU 2.2.62 R a step-up coupled with a right of redemption results in a potential tier one instrument being treated as an innovative tier one instrument.

- 31/10/2004

PRU 2.2.46

See Notes

- 31/10/2004

PRU 2.2.47

See Notes

The rules about coupons that are relevant to deciding whether a firm's potential tier one instruments are eligible for inclusion in its tier one capital resources at all are as follows.

- (1) Under PRU 2.2.29 R (4) and PRU 2.2.40 R, any deferred cumulative coupon should only be payable in permanent share capital. If a cumulative coupon is payable on a potential tier one instrument in another form, it should not be included in the firm's tier one capital resources.

- (2) Under PRU 2.2.29 R (7), the firm has the right not to pay a coupon in cash at any time.

- (3) PRU 2.2.63 R says that a potential tier one instrument that may be subject to a step-up that potentially exceeds defined limits should not be included in the firm's tier one capital resources. PRU 2.2.64 R says that any step-up should not arise before the tenth anniversary of the date of issue if it is to be included in the firm's tier one capital resources.

- (4) The provisions of PRU 2.2.70 R summarised in PRU 2.2.43 G (2) also apply to the payment of coupons.

- 31/10/2004

PRU 2.2.48

See Notes

- 31/10/2004

PRU 2.2.49

See Notes

The rules about coupons that are relevant to deciding whether a firm's potential tier one instruments should be classified as innovative tier one instruments are as follows:

- (1) Under PRU 2.2.60 R a potential tier one instrument with a cumulative coupon is an innovative tier one instrument.

- (2) Under PRU 2.2.40 R a potential tier one instrument with a coupon that if deferred must be paid in permanent share capital is an innovative tier one instrument.

- (3) Under PRU 2.2.62 R a step-up coupled with a right of redemption by the firm results in a potential tier one instrument being treated as an innovative tier one instrument.

- 31/10/2004

PRU 2.2.50

See Notes

A perpetual non-cumulative preference share may be included at stage B of the calculation in PRU 2.2.14 R if:

- (1) it complies with PRU 2.2.29 R, PRU 2.2.35 R and PRU 2.2.38 R;

- (2) any coupon on it is not cumulative, and the firm has the right to choose whether or not to pay a coupon in all circumstances;

- (3) it is not excluded from tier one capital resources by any of the rules in PRU 2.2; and

- (4) it is not an innovative tier one instrument.

- 31/10/2004

PRU 2.2.51

See Notes

- 31/10/2004

PRU 2.2.52

See Notes

- 31/10/2004

PRU 2.2.53

See Notes

- 31/10/2004

PRU 2.2.54

See Notes

If a tier one instrument:

- (1) is redeemable; and

- (2) is issued on terms that are (or its terms are amended and the amended terms are) such that a reasonable person would (judging at or around the time of issue or amendment) think that:

- 31/10/2004

PRU 2.2.55

See Notes

- 31/10/2004

Innovative tier one instruments: loss absorbency

PRU 2.2.56

See Notes

A capital instrument may only be included in innovative tier one capital resources if a firm's obligations under the instrument either:

- (1) do not constitute a liability (actual, contingent or prospective) under section 123(2) of the Insolvency Act 1986; or

- (2) do constitute such a liability but the terms of the instrument are such that:

- (a) any such liability is not relevant for the purposes of deciding whether:

- (i) the firm is, or is likely to become, unable to pay its debts; or

- (ii) its liabilities exceed its assets;

- (b) a creditor (including, but not limited to, a holder of the instrument) is not able to petition for the winding up or administration of the firm on the grounds that the firm is or may become unable to pay any such liability; and

- (c) the firm is not obliged to take into account such a liability for the purposes of deciding whether or not the firm is, or may become, insolvent for the purposes of section 214 of the Insolvency Act 1986 (wrongful trading).

- 31/10/2004

PRU 2.2.57

See Notes

- 31/10/2004

PRU 2.2.58

See Notes

- 31/10/2004

PRU 2.2.59

See Notes

- 31/10/2004

PRU 2.2.60

See Notes

- 31/10/2004

PRU 2.2.61

See Notes

- 31/10/2004

PRU 2.2.62

See Notes

If:

- (1) a potential tier one instrument is or may become subject to a step-up; and

- (2) that potential tier one instrument is redeemable at any time (whether before, at or after the time of the step-up);

- 31/10/2004

PRU 2.2.63

See Notes

If a potential tier one instrument is or may become subject to a step-up, a firm must not include it in its tier one capital resources if the amount of the step-up exceeds or may exceed;

- (1) 100 basis points; and

- (2) 50% of the initial credit spread.

- 31/10/2004

PRU 2.2.64

See Notes

- 31/10/2004

PRU 2.2.65

See Notes

A firm must not include a potential tier one instrument that is redeemable in whole or in part in permanent share capital in its tier one capital resources if:

- (1) the conversion ratio as at the date of redemption may be greater than the conversion ratio as at the time of issue by more than 200%; or

- (2) the issue or market price of the conversion instruments issued in relation to one unit of the original capital item (plus any cash element of the redemption) may be greater than the issue price (or, as the case may be, market price) of that original capital item.

- 31/10/2004

PRU 2.2.66

See Notes

In PRU 2.2.65 R to PRU 2.2.69 R:

- (1) the original capital item means the capital item that is being redeemed; and

- (2) the conversion instrument means the permanent share capital issued on its redemption.

- 31/10/2004

PRU 2.2.67

See Notes

In PRU 2.2.65 R to PRU 2.2.69 R, the conversion ratio means the ratio of:

- (1) the number of units of the conversion instrument that the firm must issue to satisfy its redemption obligation (so far as it is to be satisfied by the issue of conversion instruments) in respect of one unit of the original capital item; to

- (2) one unit of the original capital item.

- 31/10/2004

PRU 2.2.68

See Notes

- 31/10/2004

PRU 2.2.70

See Notes

- (1) This rule applies to a potential tier one instrument of a firm where either:

- (a) the redemption proceeds; or

- (b) any coupon on that capital item;

- can be satisfied by the issue of another tier one instrument.

- (2) A firm may only include an item of capital to which this rule applies in its tier one capital resources if the firm has authorised and unissued tier one instruments of the kind in question (and the authority to issue them):

- (a) that are sufficient to satisfy all such payments then due; and

- (b) are of such amount as is prudent in respect of such payments that could become due in the future.

- 31/10/2004

PRU 2.2.71

See Notes

- 31/10/2004

PRU 2.2.73

See Notes

- 31/10/2004

PRU 2.2.74

See Notes

In relation to a tier one instrument, a step-up means any change in the coupon rate on that instrument that results in an increase in the amount payable at any time, including a change already provided in the original terms governing those payments. A step-up:

- (1) includes (in the case of a fixed rate) an increase in that coupon rate;

- (2) includes (in the case of a floating rate calculated by adding a fixed amount to a fluctuating amount) an increase in that fixed amount;

- (3) includes (in the case of a floating rate) a change in the identity of the benchmark by reference to which the fluctuating element of the coupon is calculated that results in an increase in the absolute amount of the coupon;

- (4) does not include (in the case of a floating rate) an increase in the absolute amount of the coupon caused by fluctuations in the fluctuating figure by reference to which the absolute amount of the coupon floats.

- 31/10/2004

PRU 2.2.75

See Notes

- 31/10/2004

PRU 2.2.76

See Notes

- 31/10/2004

PRU 2.2.77

See Notes

- 31/10/2004

PRU 2.2.78

See Notes

- 31/10/2004

PRU 2.2.79

See Notes

- 31/10/2004

PRU 2.2.80

See Notes

- 31/10/2004

PRU 2.2.81

See Notes

- 31/10/2004

PRU 2.2.82

See Notes

- 31/10/2004

PRU 2.2.83

See Notes

- 31/10/2004

PRU 2.2.84

See Notes

- 31/10/2004

PRU 2.2.85

See Notes

- 31/10/2004

PRU 2.2.86

See Notes

- 31/10/2004

PRU 2.2.87

See Notes

- 31/10/2004

PRU 2.2.88

See Notes

The list of admissible assets has been drawn with the aim of excluding assets:

- (1) for which a sufficiently objective and verifiable basis of valuation does not exist; or

- (2) whose realisability cannot be relied upon with sufficient confidence; or

- (3) whose nature presents an unacceptable custody risk; or

- (4) the holding of which may give rise to significant liabilities or onerous duties.

- 31/10/2004

PRU 2.2.89

See Notes

- 31/10/2004

PRU 2.2.90

See Notes

- 31/10/2004

PRU 2.2.91

See Notes

- 31/10/2004

PRU 2.2.92

See Notes

- 31/10/2004

PRU 2.2.93

See Notes

A firm carrying on with-profits insurance business must, in addition to the other requirements in respect of capital resources elsewhere in PRU 2.2, meet the following conditions before a capital instrument can be included in the firm's capital resources:

- (1) the firm must manage the with-profits fund so that discretionary benefits under a with-profits insurance contract are calculated and paid disregarding, insofar as is necessary for its customers to be treated fairly, any liability the firm may have to make payments under the capital instrument;

- (2) the intention to manage the with-profits fund on the basis set out in PRU 2.2.93 R (1) must be disclosed in the firm's Principles and Practices of Financial Management; and

- (3) no amounts, whether interest, principal, or other amounts, must be payable by the firm under the capital instrument if the firm's assets would then be insufficient to enable it to declare and pay under a with-profits insurance contract discretionary benefits that are consistent with the firm's obligations under Principle 6.

- 31/10/2004

PRU 2.2.94

See Notes

- 31/10/2004

PRU 2.2.95

See Notes

- 31/10/2004

PRU 2.2.96

See Notes

- 31/10/2004

PRU 2.2.97

See Notes

- (1) Upper tier two instruments must meet the requirements of PRU 2.2.101 R (3) which goes beyond the requirement in PRU 2.2.93 R (3) since it requires a firm to have the option to defer payments in all circumstances, not just if necessary to treat customers fairly. However, for lower tier two instruments, PRU 2.2.93 R (3) represents an additional requirement since a failure to pay amounts of interest or principal on a due date must not constitute an event of default under PRU 2.2.108 R (2) for firms carrying on with-profits insurance business.

- (2) For firms which are realistic basis life firms compliance with PRU 2.2.93 R (3) would usually be achieved if the capital instrument provides that no amounts will be payable under it unless the firm's capital resources exceed its capital resources requirement. However, such firms should ensure that the terms of the capital instrument refer to FSA capital resources requirements in force from time to time, including the current realistic reserving requirements and are not restricted to former minimum capital requirements based only on the Insurance Directives' required minimum margin of solvency. For firms which are not realistic basis life firms, compliance with PRU 2.2.93 R (3) will probably require specific reference to be made to treating customers fairly in the terms of the capital instrument.

- 31/10/2004

PRU 2.2.98

See Notes

- 31/10/2004

PRU 2.2.99

See Notes

- 31/10/2004

PRU 2.2.100

See Notes

Examples of capital instruments which may be eligible to count in upper tier two capital resources include the following:

- (1) perpetual cumulative preference shares;

- (2) perpetual subordinated debt; and

- (3) other instruments that have the same economic characteristics as (1) or (2).

- 31/10/2004

PRU 2.2.101

See Notes

A capital instrument must meet the following conditions before it can be included in a firm's upper tier two capital resources:

- (1) it must meet the general conditions described in PRU 2.2.108 R;

- (2) it must have no fixed maturity date;

- (3) the contractual terms of the instrument must provide for the firm to have the option to defer any interest payment in cash on the debt; and

- (4) the contractual terms of the instrument must provide for the loss-absorption capacity of the debt and unpaid interest, whilst enabling the firm to continue its business.

- 31/10/2004

PRU 2.2.102

See Notes

- 31/10/2004

PRU 2.2.103

See Notes

A capital instrument may only be included in upper tier two capital resources if a firm's obligations under the instrument either:

- (1) do not constitute a liability (actual, contingent or prospective) under section 123(2) of the Insolvency Act 1986; or

- (2) do constitute such a liability but the terms of the instrument are such that:

- (a) any such liability is not relevant for the purposes of deciding whether:

- (i) the firm is, or is likely to become, unable to pay its debts; or

- (ii) its liabilities exceed its assets;

- (b) a creditor (including but not limited to a holder of the instrument) is not able to petition for the winding up or administration of the firm on the grounds that the firm is or may become unable to pay any such liability; and

- (c) the firm is not obliged to take into account such a liability for the purposes of deciding whether or not the firm is, or may become, insolvent for the purposes of section 214 of the Insolvency Act 1986 (wrongful trading).

- 31/10/2004

PRU 2.2.104

See Notes

- 31/10/2004

PRU 2.2.105

See Notes

- 31/10/2004

PRU 2.2.106

See Notes

- 31/10/2004

Lower tier two capital

PRU 2.2.107

See Notes

- 31/10/2004

General conditions for eligibility as tier two capital

PRU 2.2.108

See Notes

A capital instrument must not form part of the tier two capital resources of a firm unless it meets the following conditions:

- (1) the claims of the creditors must rank behind those of all unsubordinated creditors;

- (2) the only events of default must be non-payment of any amount falling due under the terms of the capital instrument or the winding-up of the firm;

- (3) the remedies available to the subordinated creditor in the event of non-payment or other breach of the written agreement or instrument must be limited to petitioning for the winding-up of the firm or proving for the debt and claiming in the liquidation of the firm;

- (4) any events of default and any remedy described in (3) must not prejudice the matters in (1) and (2);

- (5) in addition to the requirement about repayment in (1), the debt must not become due and payable before its stated final maturity date (if any) except on an event of default complying with (2)

- (6) the debt agreement or terms of the capital instrument are governed by the law of England and Wales, or of Scotland or of Northern Ireland;

- (7) to the fullest extent permitted under the laws of the relevant jurisdictions, creditors must waive their right to set off amounts they owe the firm against subordinated amounts included in the firm's capital resources owed to them by the firm;

- (8) the terms of the capital instrument must be set out in a written agreement that contains terms that provide for the conditions set out in (1) to (7);

- (9) the debt must be unsecured and fully paid up;

- (10) the description of its characteristics used in its marketing is consistent with the characteristics required to satisfy (1) to (9); and

- (11) the firm has obtained a properly reasoned external legal opinion stating that the requirements in (1) to (10) have been met.

- 31/10/2004

PRU 2.2.109

See Notes

- 31/10/2004

PRU 2.2.110

See Notes

- 31/10/2004

PRU 2.2.111

See Notes

- 31/10/2004

PRU 2.2.112

See Notes

- 31/10/2004

PRU 2.2.113

See Notes

- (1) An item of capital does not comply with PRU 2.2.101 R or PRU 2.2.108 R if the issue of that item of capital by the firm is connected with one or more other transactions which, when taken together with the issue of that item, could produce the effect described in (2).

- (2) The effect referred to in (1) is a reduction in the economic benefit intended to be conferred on the firm by the issue of the item of capital which means that the item of capital no longer displays all of the characteristics set out in PRU 2.2.101 R or PRU 2.2.108 R.

- 31/10/2004

PRU 2.2.114

See Notes

- 31/10/2004

PRU 2.2.116

See Notes

A firm must not amend the terms of the debt and the documents referred to in PRU 2.2.108 R (8) unless:

- (1) at least one month before the amendment is due to take effect, the firm has given the FSA notice in writing of the proposed amendment and the FSA has not objected; and

- (2) that notice includes confirmation that the legal opinions referred to in PRU 2.2.108 R (11) and, if applicable, PRU 2.2.105 R and PRU 2.2.111 R, continue in full force and effect in relation to the terms of the debt and documents, notwithstanding any proposed amendment.

- 31/10/2004

PRU 2.2.117

See Notes

- 31/10/2004

PRU 2.2.118

See Notes

In relation to a tier two instrument, a step-up in a coupon rate means:

- (1) (in the case of a fixed rate) an increase in that rate;

- (2) (in any other case) any change in the way that the interest or other payment is calculated that may result in an increase in the amount payable at any time, including a change already provided in the original terms governing those payments.

- 31/10/2004

PRU 2.2.119

See Notes

Where a tier two instrument is subject to one or more step-ups, the first date that a step-up can take effect must be treated, for the purposes of this section, as the instrument's final maturity date if its actual maturity date occurs after that, unless the effect of the step-up or step-ups is to increase the coupon rate at which payments are to be made by no more than:

- (1) 50 basis points in the first ten years of the life of the debt; or

- (2) 100 basis points over the whole life of the debt.

- 31/10/2004

PRU 2.2.120

See Notes

- 31/10/2004

PRU 2.2.121

See Notes

- 31/10/2004

PRU 2.2.122

See Notes

- 31/10/2004

PRU 2.2.123

See Notes

- 31/10/2004

PRU 2.2.124

See Notes

- 31/10/2004

PRU 2.2.125

See Notes

- 31/10/2004

PRU 2.2.126

See Notes

- 31/10/2004

PRU 2.2.128

See Notes

- 31/10/2004

PRU 3

PRU 3

PRU 4

PRU 4

PRU 5

PRU 5

PRU 6

PRU 6

PRU 7

PRU 7

PRU 8

PRU 8

PRU 8.4

Cross sector groups

- 01/12/2004

Application

PRU 8.4.1

See Notes

- (1) PRU 8.4 applies to every firm that is a member of a financial conglomerate other than:

- (a) an incoming EEA firm;

- (b) an incoming Treaty firm;

- (c) a UCITS qualifier; and

- (d) an ICVC.

- (2) PRU 8.4 does not apply to a firm with respect to a financial conglomerate of which it is a member if the interest of the financial conglomerate in that firm is no more than a participation.

- (3) PRU 8.4.25 R (Capital adequacy requirements: high level requirement), PRU 8.4.26 R (Capital adequacy requirements: application of Method 4 from Annex I of the Financial Groups Directive), PRU 8.4.29 R (Capital adequacy requirements: application of Methods 1, 2 or 3 from Annex I of the Financial Groups Directive) and PRU 8.4.35 R (Risk concentration and intra group transactions: the main rule) do not apply with respect to a third-country financial conglomerate.

- 11/08/2004

Purpose

PRU 8.4.2

See Notes

PRU 8.4 implements the Financial Groups Directive. However, material on the following topics is to be found elsewhere in the Handbook as follows:

- (1) further material on third-country financial conglomerates can be found in PRU 8.5;

- (2) SUP 15.9 contains notification rules for members of financial conglomerates;

- (3) material on reporting obligations can be found in SUP 16.7.73 R and SUP 16.7.74 R; and

- (4) material on systems and controls in financial conglomerates can be found in PRU 8.1.

- 11/08/2004

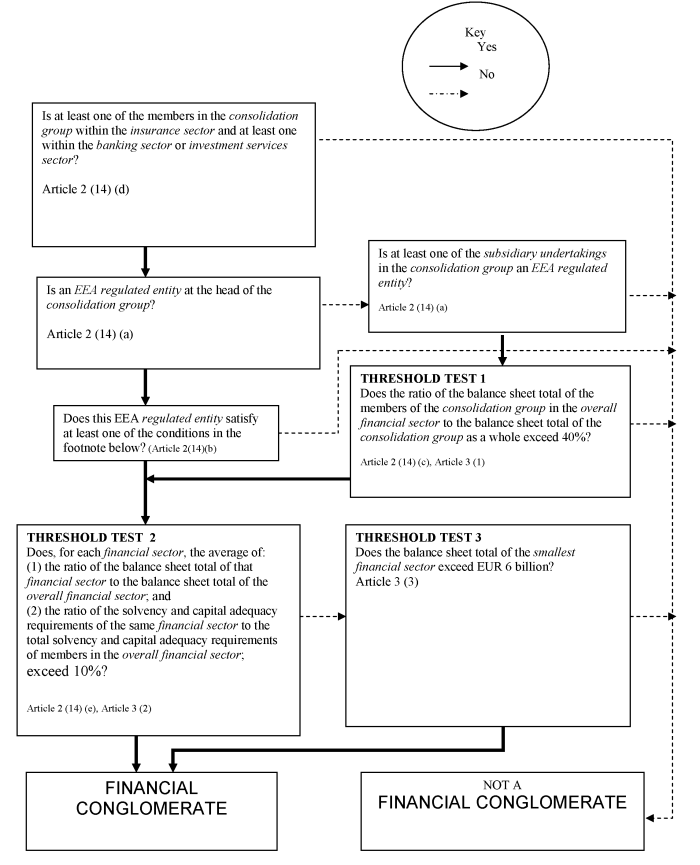

Introduction: identifying a financial conglomerate

PRU 8.4.3

See Notes

- (1) In general the process in (2) to (8) applies for identifying financial conglomerates.

- (2) Competent authorities that have authorised regulated entities should try to identify any consolidation group that is a financial conglomerate. If a competent authority is of the opinion that a regulated entity authorised by that competent authority is a member of a consolidation group which may be a financial conglomerate it should communicate its view to the other competent authorities concerned.

- (3) A competent authority may start (as described in (2)) the process of deciding whether a group is a financial conglomerate even if it would not be the coordinator.

- (4) A member of a group may also start that process by notifying one of the competent authorities that have authorised group members that its group may be a financial conglomerate, for example by notification under SUP 15.9.

- (5) If a group member gives a notification in accordance with (4), that does not automatically mean that the group should be treated as a financial conglomerate. The process described in (6) to (9) still applies.

- (6) The competent authority that would be coordinator will take the lead in establishing whether a group is a financial conglomerate once the process has been started as described in (2) and (3).

- (7) The process of establishing whether a group is a financial conglomerate will normally involve discussions between the financial conglomerate and the competent authorities concerned.

- (8) A financial conglomerate should be notified by its coordinator that it has been identified as a financial conglomerate and of the appointment of the coordinator. The notification should be given to the parent undertaking at the head of the group or, in the absence of a parent undertaking, the regulated entity with the largest balance sheet total in the most important financial sector. That notification does not of itself make a group into a financial conglomerate; whether or not a group is a financial conglomerate is governed by the definition of financial conglomerate as set out in PRU 8.4.

- (9) PRU 8 Ann 4R is a questionnaire (together with its explanatory notes) that the FSA asks groups that may be financial conglomerates to fill out in order to decide whether or not they are.

- 11/08/2004

Introduction: The role of other competent authorities

PRU 8.4.4

See Notes

- 11/08/2004

Definition of financial conglomerate: basic definition

Definition of financial conglomerate: sub-groups

PRU 8.4.6

See Notes

A consolidation group is not prevented from being a financial conglomerate because it is part of a wider:

- (1) consolidation group; or

- (2) financial conglomerate; or

- (3) group of persons linked in some other way.

- 11/08/2004

Definition of financial conglomerate: the financial sectors: general

PRU 8.4.7

See Notes

For the purpose of the definition of financial conglomerate, there are two financial sectors as follows:

- (1) the banking sector and the investment services sector, taken together; and

- (2) the insurance sector.

- 11/08/2004

PRU 8.4.8

See Notes

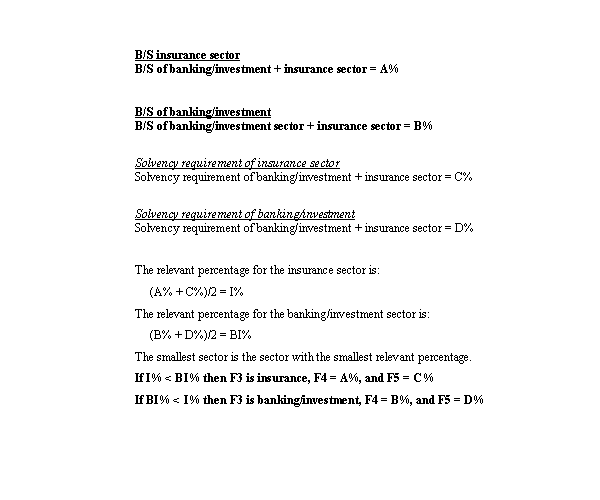

- (1) This rule applies for the purpose of the definition of financial conglomerate and the financial conglomerate definition decision tree.

- (2) Any mixed financial holding company is considered to be outside the overall financial sector for the purpose of the tests set out in the boxes titled Threshold Test 1, Threshold Test 2 and Threshold Test 3 in the financial conglomerate definition decision tree.

- (3) Determining whether the tests set out in the boxes titled Threshold Test 2 and Threshold Test 3 in the financial conglomerate definition decision tree are passed is based on considering the consolidated and/or aggregated activities of the members of the consolidation group within the insurance sector and the consolidated and/or aggregated activities of the members of the consolidation group within the banking sector and the investment services sector.

- 11/08/2004

Definition of financial conglomerate: adjustment of the percentages

PRU 8.4.9

See Notes

Once a financial conglomerate has become a financial conglomerate and subject to supervision in accordance with the Financial Groups Directive, the figures in the financial conglomerate definition decision tree are altered as follows:

- (1) the figure of 40% in the box titled Threshold Test 1 is replaced by 35%;

- (2) the figure of 10% in the box titled Threshold Test 2 is replaced by 8%; and

- (3) the figure of six billion Euro in the box titled Threshold Test 3 is replaced by five billion Euro.

- 11/08/2004

PRU 8.4.10

See Notes

The alteration in PRU 8.4.9 R only applies to a financial conglomerate during the period that:

- (1) begins when the financial conglomerate would otherwise have stopped being a financial conglomerate because it does not meet one of the unaltered thresholds referred to in PRU 8.4.9 R; and

- (2) covers the three years following that date.

- 11/08/2004

Definition of financial conglomerate: balance sheet totals

PRU 8.4.11

See Notes

- 11/08/2004

Definition of financial conglomerate: solvency requirement

PRU 8.4.12

See Notes

- 11/08/2004

Definition of financial conglomerate: discretionary changes to the definition

PRU 8.4.13

See Notes

Articles 3(3) to 3(6), Article 5(4) and Article 6(5) of the Financial Groups Directive allow competent authorities, on a case by case basis, to:

- (1) change the definition of financial conglomerate and the obligations applying with respect to a financial conglomerate;

- (2) apply the scheme in the Financial Groups Directive to EEA regulated entities in specified kinds of group structures that do not come within the definition of financial conglomerate; and

- (3) exclude a particular entity in the scope of capital adequacy requirements that apply with respect to a financial conglomerate.

- 11/08/2004

Capital adequacy requirements: introduction

PRU 8.4.14

See Notes

- 11/08/2004

PRU 8.4.15

See Notes

- 11/08/2004

PRU 8.4.16

See Notes

- 11/08/2004

PRU 8.4.17

See Notes

Annex I of the Financial Groups Directive lays down four methods for calculating capital adequacy at the level of a financial conglomerate. Those four methods are implemented as follows:

- (1) Method 1 calculates capital adequacy using accounting consolidation. It is implemented by PRU 8.4.29 R to PRU 8.4.31 R and Part 1 of PRU 8 Ann 1R G.

- (2) Method 2 calculates capital adequacy using a deduction and aggregation approach. It is implemented by PRU 8.4.29 R to PRU 8.4.31 R and Part 2 of PRU 8 Ann 1R 1.

- (3) Method 3 calculates capital adequacy using book values and the deduction of capital requirements. It is implemented by PRU 8.4.29 R to PRU 8.4.31 R and Part 3 of PRU 8 Ann 1R G.

- (4) Method 4 consists of a combination of Methods 1, 2 and 3 from Annex I of the Financial Groups Directive, or a combination of two of those Methods. It is implemented by PRU 8.4.26 R to PRU 8.4.28 R, PRU 8.4.30 R and Part 4 of PRU 8 Ann 1R G.

- 11/08/2004

PRU 8.4.18

See Notes

Part 4 of PRU 8 Ann 1R G (Use of Method 4 from Annex I of the Financial Conglomerates Directive) applies the FSA's sectoral rules with respect to the financial conglomerate as a whole, with some adjustments. Where Part 4 of PRU 8 Ann 1R G applies the FSA's sectoral rules for:

- (1) the insurance sector, that involves a combination of Methods 2 and 3; and

- (2) the banking sector and the investment services sector, that involves a combination of Methods 1 and 3.

- 11/08/2004

PRU 8.4.19

See Notes

- 11/08/2004

PRU 8.4.20

See Notes

- (1) In the following cases, the FSA (acting as coordinator) may choose which of the four methods for calculating capital adequacy laid down in Annex I of the Financial Groups Directive should apply:

- (a) where a financial conglomerate is headed by a regulated entity that has been authorised by the FSA; or

- (b) the only relevant competent authority for the financial conglomerate is the FSA.

- (2) PRU 8.4.28 R automatically applies Method 4 from Annex I of the Financial Groups Directive in these circumstances except in the cases set out in PRU 8.4.28 R (1)(e) and PRU 8.4.28 R (1)(f). The process in PRU 8.4.22 G does not apply.

- 11/08/2004

PRU 8.4.21

See Notes

- 11/08/2004

PRU 8.4.22

See Notes

- 11/08/2004

PRU 8.4.23

See Notes

- 11/08/2004

PRU 8.4.24

See Notes

- 11/08/2004

PRU 8.4.32

See Notes

- 11/08/2004

PRU 8.4.33

See Notes

- 11/08/2004

The financial sectors: asset management companies

PRU 8.4.39

See Notes

- (1) In accordance with Article 30 of the Financial Groups Directive (Asset management companies), this rule deals with the inclusion of an asset management company that is a member of a financial conglomerate in the scope of regulation of financial conglomerates. This rule does not apply to the definition of financial conglomerate.

- (2) An asset management company is in the overall financial sector and is a regulated entity for the purpose of:

- (a) PRU 8.4.26 R to PRU 8.4.36 R;

- (b) PRU 8 Ann 1R G (Capital adequacy calculations for financial conglomerates) and PRU 8 Ann 2R (Prudential rules for third country groups); and

- (c) any other provision of the Handbook relating to the supervision of financial conglomerates.

- (3) In the case of a financial conglomerate for which the FSA is the coordinator, all asset management companies must be allocated to one financial sector for the purposes in (2), being either the investment services sector or the insurance sector. But if that choice has not been made in accordance with (4) and notified to the FSA in accordance with (4)(d), an asset management company must be allocated to the investment services sector.

- (4) The choice in (3):

- (a) must be made by the undertaking in the financial conglomerate holding the position referred to in Article 4(2) of the Financial Groups Directive (group member to whom notice must be given that the group has been found to be a financial conglomerate);

- (b) applies to all asset management companies that are members of the financial conglomerate from time to time;

- (c) cannot be changed; and

- (d) must be notified to the FSA as soon as reasonably practicable after the notification in (4)(a).

- 11/08/2004

Application

PRU 8.5.1

See Notes

PRU 8.5 applies to every firm that is a member of a third-country group. But it does not apply to:

- (1) an incoming EEA firm; or

- (2) an incoming Treaty firm; or

- (3) a UCITS qualifier; or

- (4) an ICVC.

- 11/08/2004

Purpose

PRU 8.5.2

See Notes

- 11/08/2004

Equivalence

PRU 8.5.3

See Notes

- 11/08/2004

Other methods: General

PRU 8.5.4

See Notes

- 11/08/2004

Supervision by analogy: introduction

PRU 8.5.5

See Notes

- 11/08/2004

PRU 8.5.6

See Notes

- 11/08/2004

PRU 8.5.7

See Notes

- 11/08/2004

PRU 8 Ann 2R

PRU 8 Ann 2R

- 01/12/2004

- 11/08/2004

PRU 8 Ann 2R 1

| 1.1 | This Part of this annex sets out the rules with which a firm must comply under PRU 8.5.8 R with respect to a financial conglomerate of which it is a member. |

| 1.2 | A firm must comply, with respect to the financial conglomerate referred to in paragraph 1.1, with whichever of PRU 8.4.26 R and PRU 8.4.29 R is applied under paragraph 1.3. |

| 1.3 | For the purposes of paragraph 1.2:

(1) the rule in PRU 8.4 that applies as referred to in paragraph 1.2 is the one that is specified by the requirement referred to in PRU 8.5.8 R;

(2) (where PRU 8.4.29 R is applied) the definitions of conglomerate capital resources and conglomerate capital resources requirement that apply for the purposes of that rule are the ones from whichever of Part 1, Part 2 or Part 3 of PRU 8 Ann 1R G is specified in that requirement; and (3) the rules so applied (including those in PRU 8 Ann 1R G) are adjusted in accordance with paragraph 3.1. |

| 1.4 | If the condition in Articles 7(4) and 8(4) of the Financial Groups Directive is satisfied (the financial conglomerate is headed by a mixed financial holding company) with respect to the financial conglomerate referred to in paragraph 1.1 the firm must also comply with PRU 8.4.35 R (as adjusted in accordance with paragraph 3.1) with respect to that financial conglomerate. |

| 1.5 | A firm must comply with the following with respect to the financial conglomerate referred to in paragraph 1.1:

(1) PRU 8.1 (as it applies to financial conglomerates and as adjusted under paragraph 3.1); and

(2) PRU 8.4.25 R. |

- 11/08/2004

PRU 8 Ann 2R 2

See Notes

| 2.1 | This Part of this annex sets out the rules with which a firm must comply under PRU 8.5.9 R with respect to a third-country banking and investment group of which it is a member. |

| 2.2 | A firm must comply with one of the sets of rules specified in paragraph 2.3 as adjusted under paragraph 3.1 with respect to the third-country banking and investment group referred to in paragraph 2.1. |

| 2.3 | The rules referred to in paragraph 2.2 are as follows:

(1) the applicable sectoral consolidation rules in IPRU(BANK); or

(2) the applicable sectoral consolidation rules for the investment services sector; or (3) the rules in ELM 7. |

| 2.4 | The set of rules from paragraph 2.3 that apply with respect to a particular third-country banking and investment group (as referred to in paragraph 2.1) are those that would apply if they were adjusted in accordance with paragraph 3.1. |

| 2.5 | The sectoral rules applied by Part 2 of this annex cover all prudential rules applying on a consolidated basis including those relating to large exposures. |

| 2.6 | A firm must comply with PRU 8.1 (as it applies to banking and investment groups and as adjusted under paragraph 3.1) with respect to the third-country banking and investment group referred to in paragraph 2.1. |

- 11/08/2004

PRU 8 Ann 2R 3

See Notes

| 3.1 | The adjustments that must be carried out under this paragraph are that the scope of the rules referred in Part 1 or Part 2 of this annex, as the case may be, are amended:

(1) so as to remove any provisions disapplying those rules for third-country groups;

(2) so as to remove all limitations relating to where a member of the third-country group is incorporated or has its head office; and (3) so that the scope covers every member of the third-country group that would have been included in the scope of those rules if those members had their head offices in, and were incorporated in, an EEA State. |

- 11/08/2004

PRU 8 Ann 3G

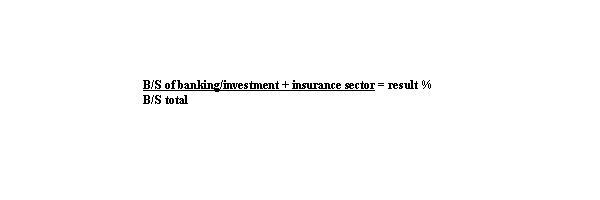

Guidance Notes for Classification of Groups

- 01/12/2004

See Notes

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- (a) are managed on a unified basis; or

- (b) have common management.

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- (a) Branches should be included as part of the parent entity.

- (b) Include in the calculations overseas entities owned by the relevant group or sub-group.

- (c) There are only two sectors for this purpose: banking/investment and insurance.

- (d) You will need to assign non-regulated financial entities to one of these sectors:

- • banking/investment activities are listed in - IPRU Banks CS 10 Appendix A

- • insurance activities are listed in - IPRU Insurers Annex 11.1 and 11.2 p 163-168.

- • Any operator of a UCITS scheme, insurance intermediary, mortgage broker and mixed financial holding company does not fall into the directive definitions of either financial sector or insurance sector.

- They should therefore be ignored for the purposes of these calculations.

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- (i) Off-balance-sheet items should be excluded.

- (ii) Where off-balance sheet treatment of funds under management and on-balance sheet treatment of policy holders' funds may distort the threshold calculation, groups should consult the FSA on the appropriateness of using other measures under article 3.5 of the Financial Groups Directive.

- (iii) If consolidated accounts exist for a sub-group consisting of financial entities from only one of the two sectors, these consolidated accounts should be used to measure the balance-sheet total of the sub-group (i.e. total assets less investments in entities in the other sector). If consolidated accounts do not exist, intra-group balances should be netted out when calculating the balance sheet total of a single sector (but cross-sector intra-group balances should not be netted out).

- (iv) Where consolidated accounts are used, minority interests should be excluded and goodwill should be included.

- (v) Where accounting standards differ between entities, groups should consult the FSA if they believe this is likely materially to affect the threshold calculation.

- (vi) Where there is a subsidiary or participation in the opposite sector from its parent (i.e. insurance sector for a banking/investment firm parent and vice versa), the balance sheet amount of the subsidiary or participation should be allocated to its sector using its individual accounts.

- (vii) The balance-sheet total of the parent entity/sub-group is measured as total assets of the parent/sub-group less the book value of its subsidiaries or participations in the other sector (i.e. the value of the subsidiary or participation in the parent's consolidated accounts is deducted from the parent's consolidated assets).

- (viii) The cross-sector subsidiaries or participations referred to above, valued according to their own accounts, are allocated pro-rata, according to the aggregated share owned by the parent/sub-group, to their own sector.

- (ix) If the cross-sector entities above themselves own group entities in the first sector (i.e. that of the top parent/sub-group) these should (in accordance with the methods above) be excluded from the second sector and added to the first sector using individual accounts.

- 11/08/2004

- 11/08/2004

- 11/08/2004

- (i) If you complete a solvency return for a sub-group consisting of financial entities from only one of the two sectors, the total solvency requirement for the sub-group should be used.

- (ii) Solvency requirements taken must include any deductions from available capital so as to allow the appropriate aggregation of requirements.

- (iii) Where there is a regulated subsidiary or participation in the opposite sector from its parent/sub-group, the solvency requirement of the subsidiary or participation should be from its individual regulatory return. If there is an identifiable contribution to the parent's solvency requirement in respect of the cross-sector subsidiary or participation, the parent's solvency requirement may be adjusted to exclude this.

- (iv) Where there is an unregulated financial undertaking in the opposite sector from its parent/sub-group, the solvency requirement of the subsidiary or participation should be one of the following:

- (a) (a) as if the entity were regulated by the FSA under the appropriate sectoral rules;

- (b) (b) using EU minimum requirements for the appropriate sector; or

- (c) (c) using non-EU local requirements* for the appropriate sector.

- Please note on the form which of these options you have used, according to the country and sector, and whether this is the same treatment as in your latest overall group solvency calculation.

- (v) For banking/investment requirements, use the total amount of capital required.

- (vi) For insurance requirements, use the Required Minimum Margin:

- (a) (a) UK firms, Form 9: for general insurance business = capital resources requirement [line 29]; for long-term insurance business = capital resources requirement (higher of Minimum Capital Requirement and Enhanced Capital Resources Requirement) [line 52].

- (b) (b) Overseas firms, either:

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

- 11/08/2004

PRU 8 Ann 4R

PRU 8 Ann 4 (see PRU 8.4.5 R)

- 01/12/2004

PRU 8 Ann 4.1R

- 11/08/2004

- 11/08/2004

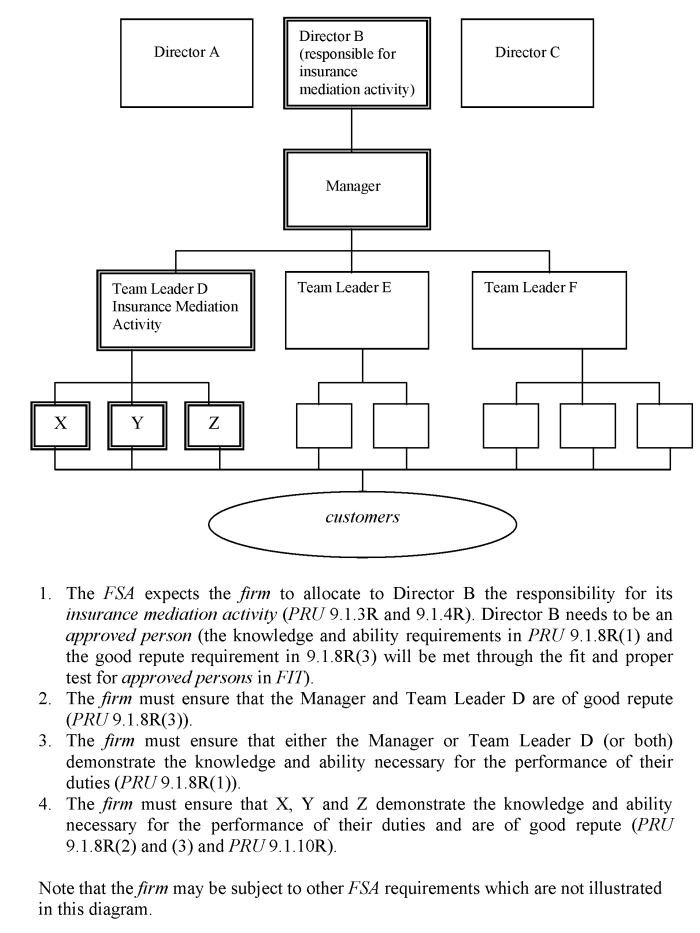

PRU 9

Insurance

mediation & mortgage mediation, lending and administration

PRU 9.1

Responsibility for insurance mediation activity

- 01/12/2004

Application

PRU 9.1.1

See Notes

- 31/10/2004

Purpose

PRU 9.1.2

See Notes

- 31/10/2004

Responsibility for insurance mediation activity

PRU 9.1.3

See Notes

- 31/10/2004

PRU 9.1.4

See Notes

The firm may allocate the responsibility for its insurance mediation activity under PRU 9.1.3 R to an approved person (or persons) performing:

- (1) a governing function; or

- (2) the apportionment and oversight function; or

- (3) the significant management (other business operations) function.

- 31/10/2004

PRU 9.1.5

See Notes

- (1) Typically an insurance intermediary will appoint a person performing a governing function to direct its insurance mediation activity. Where this responsibility is allocated to a person performing another function, the person performing the apportionment and oversight function with responsibility for the apportionment of responsibilities under SYSC 2.1.1 R must ensure that the firm's insurance mediation activity under PRU 9.1.3 R is appropriately allocated.

- (2) The descriptions of significant influence functions, other than the required functions, do not extend to activities carried on by an insurance intermediary with permission only to carry on insurance mediation activity and whose principal purpose is to carry on activities other than regulated activities (see SUP 10.1.21 R). In this case, the firm may allocate the responsibility for the firm's insurance mediation activity under PRU 9.1.3 R to one or more of the persons performing the apportionment and oversight function who will be required to be an approved person.

- (3) In the case of a sole trader, the sole trader will be responsible for the firm's insurance mediation activity.

- 31/10/2004

PRU 9.1.6

See Notes

- 31/10/2004

PRU 9.1.7

See Notes

- 31/10/2004

Knowledge, ability and good repute

PRU 9.1.8

See Notes

An insurance intermediary must establish on reasonable grounds that:

- (1) a reasonable proportion of the persons within its management structure who are responsible for insurance mediation activity; and

- (2) all other persons directly involved in its insurance mediation activity;

- (3) all the persons in its management structure and any staff directly involved in insurance mediation activity are of good repute.

- 31/10/2004

PRU 9.1.9

See Notes

In determining a person's knowledge and ability under PRU 9.1.8 R (1) and PRU 9.1.8 R (2), the firm should have regard to matters including, but not limited to, whether the person:

- (1) has demonstrated by experience and training to be able, or that he will be able, to perform his duties related to the firm's insurance mediation activity; and

- (2) satisfies the relevant requirements of the FSA's Training and Competence sourcebook (TC).

- 31/10/2004

PRU 9.1.10

See Notes

In considering a person's repute under PRU 9.1.8 R (3), the firm must ensure that the person:

- (1) has not been convicted of any serious criminal offences linked to crimes against property or other crimes related to financial activities (other than spent convictions under the Rehabilitation of Offenders Act 1974 or any other national equivalent); and

- (2) has not been adjudged bankrupt (unless the bankruptcy has been discharged);

- 31/10/2004

PRU 9.1.11

See Notes

- 31/10/2004

PRU 9.1.12

See Notes

- 31/10/2004

PRU 9.1.13

See Notes

- 31/10/2004

PRU 9 Ann 1

See Notes

- 31/10/2004

PRU 9.2

Professional indemnity insurance requirements for insurance and mortgage mediation activities

- 01/12/2004

Application

PRU 9.2.1

See Notes

- (1) This section applies to a firm with Part IV permission to carry on any of the activities in (2) unless (3), (4), (5) or (6) applies.

- (2) The activities are:

- (3)

- (a) In relation to insurance mediation activity, this section does not apply to a firm if another authorised person which has net tangible assets of more than ?10 million provides a comparable guarantee.

- (b) If the firm is a member of a group in which there is an authorised person with net tangible assets of more than ?10 million, the comparable guarantee must be from that person.

- (c) A 'comparable guarantee' means a written agreement on terms at least equal to those in PRU 9.2.10 R to finance the claims that might arise as a result of a breach by the firm of its duties under the regulatory system or civil law.

- (4) In relation to mortgage mediation activity, this section does not apply to a firm if:

- (a) it has net tangible assets of more than ?1 million; or

- (b) the comparable guarantee provisions of (3) apply (as if the firm was carrying on insurance mediation activity) but substituting ?1 million for ?10 million in (a) and (b).

- (5) In relation to all the activities in (2), this section does not apply to:

- (a) an insurer; or

- (b) a managing agent; or

- (c) a firm to which IPRU(INV) 13.1.4(1) (Financial resource requirements for personal investment firms: requirement to hold professional indemnity insurance) applies.

- (6) In relation to mortgage mediation activity, this section does not apply to an authorised professional firm:

- (a) which is subject to IPRU(INV) 2.3.1 (Professional indemnity insurance requirements for authorised professional firms); and

- (b) whose mortgage mediation activity is incidental to its main business.

- 31/10/2004

PRU 9.2.2

See Notes

- 31/10/2004

Purpose

PRU 9.2.3

See Notes

The purposes of this section are to:

- (1) implement article 4.3 of the Insurance Mediation Directive in so far as it requires insurance intermediaries to hold professional indemnity insurance, or some other comparable guarantee, against any liability that might arise from professional negligence; and

- (2) meet the regulatory objectives of consumer protection and maintaining market confidence by ensuring that firms have adequate resources to protect themselves, and their customers, against losses arising from breaches in its duties under the regulatory system or civil law.

- 31/10/2004

PRU 9.2.4

See Notes

- 31/10/2004

PRU 9.2.5

See Notes

- 31/10/2004

PRU 9.2.6

See Notes

- 31/10/2004

Requirement to hold professional indemnity insurance

PRU 9.2.7

See Notes

A firm must take out and maintain professional indemnity insurance that is at least equal to the requirements of PRU 9.2.10 R from:

- (1) an insurance undertaking authorised to transact professional indemnity insurance in the EEA; or

- (2) a person of equivalent status in:

- (i) a Zone A country; or

- (ii) the Channel Islands, Gibraltar, Bermuda or the Isle of Man.

- 31/10/2004

PRU 9.2.8

See Notes

- 31/10/2004

PRU 9.2.9

See Notes

- 31/10/2004

Terms to be incorporated in the insurance

PRU 9.2.10

See Notes

In relation to the activities referred to in PRU 9.2.1 R (2), the contract of professional indemnity insurance must incorporate terms which make provision for:

- (1) cover in respect of claims for which a firm may be liable as a result of the conduct of itself, its employees and its appointed representatives (acting within the scope of their appointment);

- (2) the minimum limits of indemnity as set out in PRU 9.2.13 R (in relation to insurance mediation activity) and PRU 9.2.15 R (in relation to mortgage mediation activity);

- (3) an excess as set out in PRU 9.2.17 R to PRU 9.2.22 R;

- (4) appropriate cover in respect of legal defence costs;

- (5) continuous cover in respect of claims arising from work carried out from the date on which the firm was given Part IV permission in relation to any of the activities referred to in (2); and

- (6) cover in respect of Ombudsman awards made against the firm.

- 31/10/2004

PRU 9.2.11

See Notes

- 31/10/2004

PRU 9.2.12

See Notes

- 31/10/2004

Minimum limits of indemnity: insurance intermediary

PRU 9.2.13

See Notes

In relation to insurance mediation activity,the minimum limits of indemnity referred to in PRU 9.2.10 R (2) are:

- (1) for a single claim, ?1 million; and

- (2) in aggregate, ?1.5 million or, if higher, 10% of annual income (see PRU 9.3.42 R) up to ?30 million.

- 31/10/2004

PRU 9.2.14

See Notes

- 31/10/2004

Minimum limits of indemnity: mortgage mediation activity

PRU 9.2.15

See Notes

In relation to mortgage mediation activity, the minimum limit of indemnity referred to in PRU 9.2.10 R (2) is the higher of 10% of annual income (see PRU 9.3.42 R) up to ?1 million, and:

- (1) for a single claim, ?100,000; or

- (2) in aggregate, ?500,000.

- 31/10/2004

Excess

PRU 9.2.16

See Notes

- 31/10/2004

PRU 9.2.17

See Notes

For a firm which does not hold client money or other client assets, the excess referred to in PRU 9.2.10 R (3) is not more than the higher of:

- (1) ?2,500; and

- (2) 1.5% of annual income (see PRU 9.3.42 R).

- 31/10/2004

PRU 9.2.18

See Notes

For a firm which holds client money or other client assets, the excess referred to in PRU 9.2.10 R (3) is not more than the higher of:

- (1) ?5,000; and

- (2) 3% of annual income (see PRU 9.3.42 R).

- 31/10/2004

Policies covering more than one firm

PRU 9.2.19

See Notes

If a policy provides cover to more than one firm, then in relation to PRU 9.2.13 R, PRU 9.2.14 R and PRU 9.2.15 R:

- (1) the limits of indemnity must be calculated on the combined annual income (see PRU 9.3.42 R) of all the firms named in the policy; and

- (2) each firm named in the policy must have the benefit of the minimum limits of indemnity as required in PRU 9.2.13 R or PRU 9.2.15 R.

- 31/10/2004

Additional capital

PRU 9.2.20

See Notes

- 31/10/2004

PRU 9.2.21

See Notes

| Income | Excess obtained up to and including: | |||||||||||||

| More than | Up to | 2.5 | 5 | 10 | 15 | 20 | 25 | 30 | 40 | 50 | 75 | 100 | 150 | 200+ |

| 0 | 100 | 0 | 5 | 9 | 12 | 14 | 17 | 19 | 23 | 26 | 33 | 39 | 50 | 59 |

| 100 | 200 | 0 | 7 | 12 | 16 | 19 | 22 | 25 | 30 | 34 | 43 | 51 | 64 | 75 |

| 200 | 300 | 0 | 7 | 12 | 16 | 20 | 24 | 27 | 32 | 37 | 47 | 56 | 71 | 84 |

| 300 | 400 | 0 | 0 | 12 | 16 | 21 | 24 | 28 | 34 | 39 | 50 | 60 | 77 | 91 |

| 400 | 500 | 0 | 0 | 11 | 16 | 21 | 24 | 28 | 34 | 40 | 53 | 63 | 81 | 96 |

| 500 | 600 | 0 | 0 | 10 | 16 | 20 | 24 | 28 | 35 | 41 | 54 | 65 | 84 | 100 |

| 600 | 700 | 0 | 0 | 0 | 15 | 20 | 24 | 28 | 35 | 41 | 55 | 67 | 87 | 104 |

| 700 | 800 | 0 | 0 | 0 | 14 | 19 | 24 | 28 | 35 | 42 | 56 | 68 | 89 | 107 |

| 800 | 900 | 0 | 0 | 0 | 13 | 18 | 23 | 27 | 35 | 42 | 56 | 69 | 91 | 109 |

| 900 | 1,000 | 0 | 0 | 0 | 0 | 17 | 22 | 27 | 34 | 41 | 57 | 70 | 92 | 111 |

| 1,000 | 1,500 | 0 | 0 | 0 | 0 | 0 | 21 | 26 | 34 | 41 | 57 | 71 | 97 | 118 |

| 1,500 | 2,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 30 | 38 | 56 | 71 | 98 | 121 |

| 2,000 | 2,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 24 | 33 | 53 | 69 | 99 | 126 |

| 2,500 | 3,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 28 | 50 | 68 | 101 | 130 |

| 3,000 | 3,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 47 | 67 | 101 | 132 |

| 3,500 | 4,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 43 | 65 | 101 | 133 |

| 4,000 | 4,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 39 | 62 | 101 | 134 |

| 4,500 | 5,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 58 | 99 | 134 |

| 5,000 | 6,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 54 | 97 | 133 |

| 6,000 | 7,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 91 | 131 |

| 7,000 | 8,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 84 | 126 |

| 8,000 | 9,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 75 | 120 |

| 9,000 | 10,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 113 |

| 10,000 | 100,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 100,000 | n/a | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

- 31/10/2004

PRU 9.2.22

See Notes

| Income | Excess obtained up to and including: | ||||||||||||

| More than | Up to | 5 | 10 | 15 | 20 | 25 | 30 | 40 | 50 | 75 | 100 | 150 | 200+ |

| 0 | 100 | 0 | 4 | 7 | 9 | 12 | 14 | 18 | 21 | 28 | 34 | 45 | 54 |

| 100 | 200 | 0 | 7 | 11 | 14 | 17 | 20 | 25 | 29 | 38 | 46 | 59 | 70 |

| 200 | 300 | 0 | 7 | 11 | 14 | 17 | 20 | 25 | 30 | 40 | 49 | 64 | 77 |

| 300 | 400 | 0 | 0 | 9 | 13 | 16 | 19 | 25 | 30 | 40 | 50 | 67 | 81 |

| 400 | 500 | 0 | 0 | 0 | 11 | 14 | 18 | 24 | 29 | 40 | 51 | 68 | 83 |

| 500 | 600 | 0 | 0 | 0 | 8 | 12 | 15 | 22 | 28 | 40 | 51 | 69 | 85 |

| 600 | 700 | 0 | 0 | 0 | 0 | 9 | 13 | 20 | 26 | 39 | 50 | 69 | 86 |

| 700 | 800 | 0 | 0 | 0 | 0 | 6 | 10 | 17 | 24 | 38 | 49 | 69 | 87 |

| 800 | 900 | 0 | 0 | 0 | 0 | 0 | 7 | 15 | 22 | 36 | 48 | 69 | 87 |

| 900 | 1,000 | 0 | 0 | 0 | 0 | 0 | 0 | 12 | 19 | 34 | 47 | 68 | 87 |

| 1,000 | 1,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 16 | 32 | 45 | 67 | 86 |

| 1,500 | 2,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 18 | 34 | 59 | 81 |

| 2,000 | 2,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 19 | 48 | 71 |

| 2,500 | 3,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 6 | 37 | 64 |

| 3,000 | 3,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 26 | 55 |

| 3,500 | 4,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 14 | 45 |

| 4,000 | 4,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 33 |

| 4,500 | 5,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 21 |

| 5,000 | 6,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 8 |

| 6,000 | 7,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 7,000 | 8,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 8,000 | 9,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 9,000 | 10,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 10,000 | 100,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 100,000 | n/a | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

- 31/10/2004

PRU 9.2.23

See Notes

- 31/10/2004

PRU 9.3

Capital resources for insurance and mortgage mediation activity and mortgage lending and administration

- 01/12/2004

Application

PRU 9.3.1

See Notes

- (1) This section applies to a firm with Part IV permission to carry on any of the activities in (2) unless any of PRU 9.3.4 R to PRU 9.3.11 R applies.

- (2) The activities are:

- (a) insurance mediation activity;

- (b) mortgage mediation activity;

- (c) entering into a regulated mortgage contract (that is, mortgage lending);

- (d) administering a regulated mortgage contract (that is, mortgage administration).

- 31/10/2004

PRU 9.3.2

See Notes

- 31/10/2004

PRU 9.3.3

See Notes

- 31/10/2004

Application: banks, building societies, insurers and friendly societies

PRU 9.3.4

See Notes

This section does not apply to:

- (1) a bank; or

- (2) a building society; or

- (3) a solo consolidated subsidiary of a bank or a building society; or

- (4) an insurer; or

- (5) a friendly society.

- 31/10/2004

PRU 9.3.5

See Notes

- 31/10/2004

Application: firms carrying on designated investment business only

PRU 9.3.6

See Notes

- 31/10/2004

PRU 9.3.7

See Notes

- 31/10/2004

Application: credit unions

PRU 9.3.8

See Notes

This section does not apply to:

- (1) a 'small credit union', that is one with:

- (a) assets of ?5 million or less; and

- (b) a total number of members of 5,000 or less (see CRED 8.3.14 R); or

- (2) a credit union whose Part IV permission includes mortgage lending or mortgage administration (or both) and no other activities in PRU 9.3.1 R (2).

- 31/10/2004

PRU 9.3.9

See Notes

- (1) For credit unions to which this section applies and which are not CTF providers, the capital requirements will be the higher of the requirements in this section and in CRED (see PRU 9.3.25 R).

- (2) For credit unions to which this section applies and which are CTF providers with permission to carry on designated investment business, the capital requirements will be the highest of the requirements in this section, those in CRED and of IPRU(INV) Chapter 8 (see PRU 9.3.25 R).

- 01/12/2004

Application: professional firms

PRU 9.3.10

See Notes

- (1) This section does not apply to an authorised professional firm:

- (a) whose main business is the practice of its profession; and

- (b) whose regulated activities in PRU 9.3.1 R (2) are incidental to its main business.

- (2) A firm's main business is the practice of its profession if the proportion of income it derives from professional fees is, during its annual accounting period, at least 50% of the firm's total income (a temporary variation of not more than 5% may be disregarded for this purpose).

- (3) Professional fees are fees, commissions and other receipts receivable in respect of legal, accountancy or actuarial services provided to clients but excluding any items receivable in respect of regulated activities.

- 31/10/2004

Application: Lloyd's managing agents

PRU 9.3.11

See Notes

- 31/10/2004

PRU 9.3.12

See Notes

- 31/10/2004

Application: social housing firms

PRU 9.3.13

See Notes

- 31/10/2004

Purpose

PRU 9.3.14

See Notes

- 31/10/2004

PRU 9.3.15

See Notes

- 31/10/2004

PRU 9.3.16

See Notes

- 31/10/2004

PRU 9.3.17

See Notes

- 31/10/2004

Purpose: social housing firms

PRU 9.3.18

See Notes

- 31/10/2004

PRU 9.3.19

See Notes

- 31/10/2004

Capital resources: general rules

PRU 9.3.20

See Notes

- 31/10/2004

PRU 9.3.21

See Notes

- 31/10/2004

Capital resources: UK GAAP

PRU 9.3.22