ENF 14

Sanctions

for market abuse

ENF 14.1

Application and purpose

- 01/12/2004

Application

ENF 14.1.1

See Notes

This chapter applies to any person, whether regulated or not, who may be the subject of a financial penalty or public statement on the basis that the FSA suspects the person:

- (1) is or has engaged in market abuse; or

- (2) by taking or refraining from taking any action has required or encouraged another person or persons to engage in behaviour which, had he engaged in it himself, would amount to market abuse.

- 01/12/2004

ENF 14.1.2

See Notes

- 01/12/2004

Purpose

ENF 14.1.3

See Notes

- 01/12/2004

ENF 14.1.4

See Notes

- 01/12/2004

ENF 14.2

Introduction

- 01/12/2004

ENF 14.2.1

See Notes

Section 124 of the Act (Statement of policy) states that the FSA must prepare and issue a statement of its policy on:

- (1) the imposition of penalties under section 123 (Power to impose penalties in cases of market abuse);

- (2) the amount of penalties under that section; and

- (3) the circumstances in which the FSA is to be expected to regard a person as:

- (a) having a reasonable belief that his behaviour did not amount to market abuse; or

- (b) having taken reasonable precautions and exercised due diligence to avoid engaging in market abuse.

This chapter is the FSA's statement of policy under section 124 of the Act. However, the FSA may at any time change or replace this statement of policy after consultation.

- 01/12/2004

ENF 14.2.2

See Notes

- 01/12/2004

ENF 14.2.3

See Notes

- 01/12/2004

ENF 14.3

Financial penalties and public statements in market abuse cases

- 01/12/2004

Financial penalties

ENF 14.3.1

See Notes

Under section 123(1)(a) and section 123(1)(b) of the Act (Power to impose penalties in cases of market abuse), the FSA may impose a financial penalty where a person (A):

- (1) is or has engaged in market abuse; or

- (2) by taking or refraining from taking any action has required or encouraged another person or persons to engage in behaviour which, had it been engaged in by A, would amount to market abuse.

See ENF 14.5.1 G for the factors the FSA may take into account when determining whether either of these two conditions is met.

- 01/12/2004

ENF 14.3.2

See Notes

- 01/12/2004

ENF 14.3.3

See Notes

- 01/12/2004

Public statements

ENF 14.3.4

See Notes

- 01/12/2004

ENF 14.4

Factors relevant to determining whether to take action in market abuse cases

- 01/12/2004

ENF 14.4.1

See Notes

- 01/12/2004

ENF 14.4.2

See Notes

When it decides whether to take action for behaviour appearing to the FSA to amount to market abuse or requiring or encouraging, the FSA may take into account a number of factors. The following list is not exhaustive: not all of these factors may be relevant in a particular case, and there may be other factors that are relevant.

- (1) The nature and seriousness of the suspected behaviour, including:

- (a) the nature and seriousness of any breach of the Code of Market Conduct;

- (b) whether the behaviour was deliberate or reckless;

- (c) the duration and frequency of the behaviour;

- (d) the impact of the behaviour on prescribed markets, including whether public confidence in those markets has been damaged; and

- (e) the amount of any benefit gained or loss avoided as a result of the behaviour; and

- (f) the loss or risk of loss caused to consumers or other market users.

- (2) The conduct of the person concerned after the behaviour was identified, including the following.

- (a) How quickly, effectively and completely the person brought the behaviour to the attention of the FSA or another relevant regulatory authority.

- (b) The degree of cooperation the person showed during the FSA's investigation of the behaviour of concern or during those of any other regulatory authority (for example, the Takeover Panel or an RIE) which is allowed to share information obtained during an investigation with the FSA. In this context, persons are reminded that they may have a duty to co-operate with other regulatory authorities. For example, MAR 4.3.4 G requires firms to whom that rule applies to assist the Takeover Panel in certain circumstances. However, a person will not necessarily avoid action for market abuse or requiring or encouraging merely by fulfilling a duty to co-operate.

- (c) Any remedial steps that the person has taken to address the behaviour, whether on his own initiative or in meeting the requirement of another regulatory authority, and how promptly that person has taken those steps. This might include identifying those who have suffered loss and compensating them, taking disciplinary action against staff (where appropriate), and taking action designed to ensure that similar problems do not arise in the future. It might also include (for example, in the context of a takeover bid) any steps taken to correct a misleading statement or misleading impression or distortion of the market. However, a person will not necessarily avoid a penalty merely by fulfilling a duty to take remedial action.

- (d) Whether the person concerned has complied with any requirements or rulings of another regulatory authority relating to his behaviour (for example, where relevant, those of the Takeover Panel or an RIE).

- (e) The nature and extent of any false or inaccurate information given by the person and whether the information appears to have been given in an attempt knowingly to mislead the FSA.

- (3) The degree of sophistication of the users of the market in question, the size and liquidity of the market, and the susceptibility of the market to market abuse. For example, where the users of a market are generally not market professionals, and they have suffered loss as a result of the behaviour and that loss has not been promptly or adequately compensated for by the person concerned, this may be a factor in favour of the imposition of a penalty (this does not, however, mean that the FSA will not take action to impose financial penalties on persons whose behaviour falls within the market abuse provisions where only market professionals have suffered).

- (4) Action taken by other regulatory authorities. Where other regulatory authorities propose to take action in respect of the behaviour which is under consideration by the FSA, the FSA will consider whether their action would be adequate to address the FSA's concerns, or whether it would be appropriate for the FSA to take its own action. For example, the FSA has powers to impose unlimited financial penalties, whereas an RIE's powers may be more limited in a particular case. Where the behaviour of the person concerned is also, in the opinion of the Takeover Panel, a breach of that person's responsibilities under the Takeover Code, the FSA would not expect to use its powers under the market abuse regime against that person, except in the circumstances described in ENF 14.9.6 G. If the FSA considers that using its powers may be appropriate in those circumstances, it will not take action during the bid except in the circumstances described in ENF 14.9.7 G.

- (5) Action taken by the FSA in previous similar cases. The FSA will take account of action it has taken previously in market abuse cases where the behaviour has been the same or similar.

- (6) The impact, having regard to the nature of the behaviour, that any financial penalty or public statement may have on the financial markets or on the interests of consumers:

- (a) a penalty may show that high standards of market conduct are being enforced in the financial markets, and may bolster market confidence;

- (b) a penalty may protect the interests of consumers by deterring future market abuse and improving standards of conduct in a market;

- (c) in the context of a takeover bid, the FSA may consider that the impact of the use of its powers is likely to have an adverse effect on the timing or outcome of that bid, and therefore it would not be in the interests of financial markets or consumers to take action for market abuse during the takeover bid. If the FSA considers that the proposed use of its powers may have that effect, it will consult the Takeover Panel and give due weight to its views.

- (7) The likelihood that the same type of behaviour (whether on the part of the person concerned or others) will happen again if no action is taken.

- (8) The disciplinary record and general compliance history of the person, including:

- (a) whether the FSA has taken any previous action against the person for market abuse or requiring or encouraging which resulted in adverse findings;

- (b) whether the conduct of the person in relation to the markets has caused concern to another regulatory authority or been the subject of a warning or other action by a regulatory authority;

- (c) whether the person has previously given any undertakings to the FSA not to engage in particular behaviour; and

- (d) the general compliance history of the person, such as previous private warnings (see ENF 11.3).

- 01/12/2004

ENF 14.5

Factors determining whether the FSA may impose a financial penalty in market abuse cases

- 01/12/2004

ENF 14.5.1

See Notes

The factors which the FSA may take into account when deciding whether either of the two conditions in ENF 14.3.2 G is met, include, but are not limited to:

- (1) in relation to whether the person concerned reasonably believed that his behaviour did not amount to market abuse or requiring or encouraging

- (a) whether, and if so to what extent, the person concerned took reasonable precautions to avoid engaging in market abuse or requiring or encouraging (see (2));

- (b) whether, and if so to what extent, the behaviour in question was or was not analogous to behaviour described in the Code of Market Conduct (see MAR 1) as amounting or not amounting to market abuse or requiring or encouraging;

- (c) whether the FSA has issued any guidance on the behaviour in question and if so, the extent to which the person sought to follow that guidance (see the Reader's Guide part of the Handbook regarding the status of guidance);

- (d) whether, and if so to what extent, the behaviour complied with the rules of any relevant prescribed market or any other relevant market or other regulatory requirements (including the Takeover Code) or any relevant codes of conduct or best practice;

- (e) the level of knowledge, skill and experience to be expected of the person concerned; and

- (f) whether, and if so to what extent, the person can demonstrate that the behaviour was engaged in for a legitimate purpose and in a proper way;

- (2) in relation to whether the person concerned took all reasonable precautions and exercised all due diligence to avoid engaging in market abuse or requiring or encouraging:

- (a) whether, and if so to what extent, the person followed internal consultation and escalation procedures in relation to the behaviour (for example, did the person discuss the behaviour with internal line management and/or internal legal or compliance departments);

- (b) whether, and if so the extent to which, the person sought any appropriate expert legal or other expert professional advice and followed that advice;

- (c) whether, and if so to what extent, the person sought advice from the market authorities of any relevant prescribed market or, where relevant, consulted the Takeover Panel, and followed the advice received;

- (d) whether the FSA has issued any guidance on the behaviour in question and if so, the extent to which the person has sought to follow that guidance (see the Reader's Guide part of the Handbook regarding the status of guidance); and

- (e) whether, and if so to what extent, the behaviour complied with the rules of any relevant prescribed market or any other relevant market or other regulatory requirements (including the Takeover Code) or any relevant codes of conduct or best practice.

- 06/02/2007

ENF 14.5.2

See Notes

- 01/12/2004

ENF 14.6

FSA's choice of powers: financial penalties/public statements

- 01/12/2004

ENF 14.6.1

See Notes

- 01/12/2004

ENF 14.6.2

See Notes

When considering whether a public statement is more appropriate than a financial penalty the FSA will take into account all the circumstances of the case. In particular, the FSA may have regard to factors similar to those in ENF 12.3.3 G. Those factors include the following.

- (1) If the person has made a profit or avoided a loss as a result of the behaviour, this may be a factor in favour of a financial penalty, on the basis that a person should not be allowed to benefit from market abuse or requiring or encouraging.

- (2) If the behaviour is serious in nature or degree, this may be a factor in favour of a financial penalty, on the basis that the sanction should reflect the seriousness of the behaviour (other things being equal, the more serious the behaviour, the more likely the FSA is to impose a financial penalty).

- (3) If the person has admitted the behaviour and provides full and immediate cooperation to the FSA, and takes steps to ensure that those who have suffered loss due to the behaviour are fully compensated, this may be a factor in favour of a public statement, rather than a financial penalty, depending on the nature and seriousness of the behaviour.

- (4) The FSA's approach in similar previous cases. The FSA will seek to achieve a consistent approach to its decisions on whether to impose a financial penalty or issue a public statement.

- (5) If the person has a poor compliance history. For example, where the FSA has previously taken action against the person for behaviour amounting to market abuse or requiring or encouraging which resulted in adverse findings, this may be a factor in favour of a financial penalty.

- (6) The impact of a financial penalty on the person concerned. In exceptional cases, if the person has inadequate means (excluding any manipulation or attempted manipulation of their assets) to pay the financial penalty which the behaviour would otherwise attract, this may be a factor in favour of a lower level of penalty or a public statement. Circumstances in which the FSA may be willing to issue a public statement include where there is verifiable evidence that the person would suffer serious financial hardship if it imposed a financial penalty.

- 01/12/2004

ENF 14.6.3

See Notes

- 01/12/2004

ENF 14.7

Determining the level of a financial penalty in a market abuse case

- 01/12/2004

ENF 14.7.1

See Notes

- 01/12/2004

ENF 14.7.2

See Notes

- 01/12/2004

ENF 14.7.3

See Notes

- 01/12/2004

ENF 14.7.4

See Notes

The FSA considers that the factors which may be relevant when it sets the amount of a penalty in market abuse cases include, the following.

- (1) Adverse effect on markets and the seriousness of that effect.

- A financial penalty must be in proportion to the nature and seriousness of the abuse in question. The following may be relevant:

- (a) the loss or risk of loss caused to consumers or other market users;

- (b) the duration and frequency of the behaviour; and

- (c) the impact of the behaviour on the orderliness of prescribed markets including whether confidence in those markets has been damaged.

- (2) The extent to which the behaviour was deliberate or reckless.In determining whether the behaviour was deliberate or reckless, the FSA will take into account all the circumstances of the behaviour which resulted in the market abuse or requiring or encouraging. For example, the FSA may have regard to whether the person intended or foresaw the consequences of their behaviour, or gave any consideration to the consequences of their behaviour. If the FSA decides that the behaviour was deliberate or reckless, it would be more likely to impose a higher penalty on a person than would otherwise be the case.

- (3) Whether the person on whom the penalty is to be imposed is an individual.This will include having regard to the financial resources and other circumstances of the individual and may include whether there is verifiable evidence of serious financial hardship or financial difficulties if the individual were to pay the financial penalty that would, in the absence of this consideration, be imposed (see also the discussion of this factor in ENF 13.3.3 G (3)).

- (4) The amount of profits accrued or loss avoided.The FSA may have regard to the amount of profits accrued or loss avoided as a result of the behaviour, for example:

- (a) the FSA will propose a penalty that is consistent with the principle that a person should not benefit from behaviour amounting to market abuse or requiring or encouraging; and

- (b) the penalty should also act as an incentive to the person and others to comply with required standards of market conduct.

- (5) Conduct following the behaviour of concern.The FSA may take into account:

- (a) the conduct of the person in bringing (or failing to bring) the behaviour to the FSA's attention (or the attention of other regulatory authorities, where relevant) quickly, effectively and completely;

- (b) the degree of co-operation the person showed during the investigation of the behaviour by the FSA or any other regulatory authority allowed to share information with the FSA, such as an RIE or the Takeover Panel. (In this context, persons are reminded that they may have a duty to co-operate with other regulatory authorities; for example, MAR 4.3.4 G requires firms to whom that rule applies to assist the Takeover Panel in certain circumstances). Where a person has fully cooperated with an investigation, this will be a factor tending to reduce the level of financial penalty;

- (c) any remedial steps taken by the person since the behaviour was identified (whether on their own initiative or that of the FSA or another regulatory authority) including correcting any misleading statement or impression, identifying whether consumers or other market users have suffered loss and compensating them, taking disciplinary action against staff involved (if appropriate), and taking steps to ensure similar problems do not happen in the future; and

- (d) whether the person concerned has complied with any requirements or rulings of another regulatory authority relating to his behaviour (for example, where relevant, those of the Takeover Panel).

- (6) Disciplinary record and compliance history.The disciplinary record and general compliance history of the person may be taken into account, including whether the FSA has previously taken any action against the person for behaviour amounting to market abuse or requiring or encouraging which resulted in adverse findings. For example, the compliance history of a person could lead to the FSA increasing the penalty where the person has engaged in behaviour falling within ENF 14.3.1 G (1) or ENF 14.3.1 G (2). In assessing the relevance of a person's compliance history, the age of the previous behaviour will be taken into account, although a long-standing matter may still be relevant. However, in undertaking this assessment, private warnings will not be taken into account.

- (7) Previous action taken by the FSA.The action the FSA has taken over previous similar behaviour may be taken into account. The FSA will seek to ensure consistency when it determines the appropriate level of penalty. For example, any disciplinary action taken in relation to similar market abuse cases will clearly be a relevant factor. However, as stated at ENF 14.7.2 G, the FSA does not intend to set up a tariff system and there may be other relevant factors which could increase or decrease the seriousness of the matter.

- (8) Action taken by other regulatory authorities.Action taken or to be taken by other regulatory authorities (for example, the Takeover Panel or an RIE) in relation to the behaviour may be relevant. The degree to which any remedial or compensatory steps required by other regulatory authorities have been taken (and whether taken promptly) may also be relevant.

- (9) The timing of any agreement as to the amount of the penalty for market abuse. The FSA and the person on whom a penalty is to be imposed may seek to agree the amount of any financial penalty and other terms. In recognition of the benefits of such agreements in disciplinary actions, ENF 13.7 provides that the amount of the penalty which might otherwise have been payable will be reduced to reflect the stage at which the FSA and the person concerned reach an agreement. The same regime is to apply to agreements as to the amount of the penalty in market abuse cases.

- 20/10/2005

ENF 14.7.5

See Notes

- 01/12/2004

ENF 14.7.6

See Notes

- 01/02/2003

ENF 14.8

Market abuse and breaches of the FSA Principles

- 01/12/2004

ENF 14.8.1

See Notes

- 01/12/2004

ENF 14.8.2

See Notes

- 01/12/2004

ENF 14.9

Action involving other UK regulatory authorities

- 01/12/2004

ENF 14.9.1

See Notes

- 06/02/2007

ENF 14.9.2

See Notes

- 06/02/2007

ENF 14.9.3

See Notes

- 01/12/2004

ENF 14.9.4

See Notes

- 06/02/2007

ENF 14.9.5

See Notes

- 06/02/2007

ENF 14.9.6

See Notes

Where the behaviour of a person which amounts to market abuse is behaviour to which the Takeover Code is relevant, the use of the Takeover Panel's powers will often be sufficient to address the relevant concerns. In cases where this is not so, the FSA will need to consider, against the background of this manual, whether it is appropriate to use any of its own powers under the market abuse regime. The principal circumstances in which the FSA is likely to consider such exercise are:

- (1) where the behaviour falls within sections 118(2), 118(3) or 118(4) of the Act;

- (2) where the FSA's approach in previous similar cases (which may have happened otherwise than in the context of a takeover bid) suggests that a financial penalty should be imposed (see ENF 14.6.2 G (4));

- (3) where the behaviour extends to securities or a class of securities which may be outside the Takeover Panel's jurisdiction;

- (4) where the behaviour threatens or has threatened the stability of the financial system; and

- (5) where for any other reason the Takeover Panel asks the FSA to consider the use of any of its powers referred to in ENF 14.9.2 G.

- 06/02/2007

ENF 14.9.7

See Notes

- 06/02/2007

ENF 14.9.8

See Notes

- 01/12/2004

ENF 14.9.9

See Notes

- 01/12/2004

ENF 14.11

Action involving overseas authorities

- 01/12/2004

ENF 14.11.1

See Notes

- 01/12/2004

ENF 14.11.2

See Notes

- 01/12/2004

ENF 14.11.3

See Notes

- 01/12/2004

ENF 14.12

Decision making procedure and publication of sanctions

- 01/12/2004

ENF 14.12.1

See Notes

- 01/12/2004

ENF 14.12.2

See Notes

- 01/12/2004

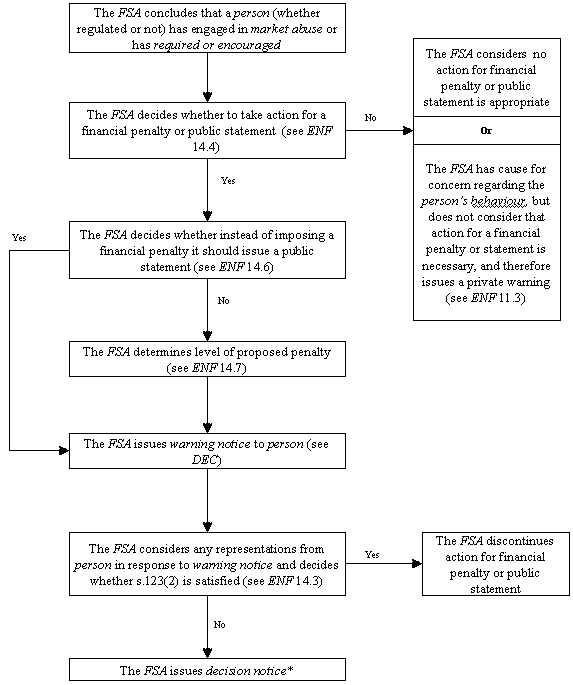

ENF 14 Annex 1

Action for financial penalties or public statements in market abuse cases

- 01/12/2004

See Notes

- 01/12/2004