COLL 4

Investor Relations

COLL 4.1

Introduction

- 01/12/2004

Application

COLL 4.1.1

See Notes

- 01/04/2004

Purpose

COLL 4.1.2

See Notes

- 01/04/2004

COLL 4.2

Pre-sale notifications

- 01/12/2004

Application

COLL 4.2.1

See Notes

- 01/04/2004

Publishing the prospectus

COLL 4.2.2

See Notes

- 01/04/2004

Provision and filing of the prospectus

COLL 4.2.3

See Notes

- 01/07/2011

Provision and filing of the prospectus of a master UCITS

COLL 4.2.3A

See Notes

- 01/07/2011

False or misleading prospectus

COLL 4.2.4

See Notes

- 01/04/2004

Table: contents of the prospectus

COLL 4.2.5

See Notes

| Document status | |||

| 1 | A statement that the document is the prospectus of the authorised fund valid as at a particular date (which shall be the date of the document). | ||

| Authorised fund | |||

| 2 | A description of the authorised fund including: | ||

| (a) | its name; | ||

| (b) | whether it is an ICVC or an AUT; | ||

| (ba) | whether it is a UCITS scheme or a non-UCITS retail scheme; | ||

| (bb) | a statement that unitholders are not liable for the debts of the authorised fund. | ||

| (c) | for an ICVC, the address of its head office and the address of the place in the United Kingdom for service on the ICVC of notices or other documents required or authorised to be served on it; | ||

| (d) | the effective date of the authorisation order made by the FSA and relevant details of termination, if the duration of the authorised fund is limited; | ||

| (e) | its base currency; | ||

| (f) | for an ICVC, the maximum and minimum sizes of its capital; and | ||

| (g) | the circumstances in which it may be wound up under the rules and a summary of the procedure for, and the rights of unitholders under, such a winding up | ||

| Umbrella ICVCs | |||

| 2A | For an ICVC which is an umbrella, a statement that: | ||

| (a) | its sub-funds are segregated portfolios of assets and, accordingly, the assets of a sub-fund belong exclusively to that sub-fund and shall not be used to discharge directly or indirectly the liabilities of, or claims against, any other person or body, including the umbrella, or any other sub-fund, and shall not be available for any such purpose; and | ||

| (b) | while the provisions of the OEIC Regulations provide for segregated liability between sub-funds, the concept of segregated liability is relatively new. Accordingly, where claims are brought by local creditors in foreign courts or under foreign law contracts, it is not yet known how those foreign courts will react to regulations 11A and 11B of the OEIC Regulations. | ||

| Investment objectives and policy | |||

| 3 | The following particulars of the investment objectives and policy of the authorised fund: | ||

| (a) | the investment objectives, including its financial objectives; | ||

| (b) | the authorised fund's investment policy for achieving those investment objectives, including the general nature of the portfolio and, if appropriate, any intended specialisation; | ||

| (c) | an indication of any limitations on that investment policy; | ||

| (d) | the description of assets which the capital property may consist of; | ||

| (e) | the proportion of the capital property which may consist of an asset of any description; | ||

| (f) | the description of transactions which may be effected on behalf of the authorised fund and an indication of any techniques and instruments or borrowing powers which may be used in the management of the authorised fund; | ||

| (g) | a list of the eligible markets through which the authorised fund may invest or deal in accordance with COLL 5.2.10 R (2)(b) (Eligible markets: requirements); | ||

| (h) | for an ICVC, a statement as to whether it is intended that the scheme will have an interest in any immovable property or movable property ((in accordance with COLL 5.6.4 R (2) (Investment powers: general) or COLL 5.2.8 R (2) (UCITS schemes: general)) for the direct pursuit of the ICVC's business; | ||

| (i) | where COLL 5.2.12 R (3) (Spread: government and public securities) applies, a prominent statement as to the fact that more than 35% of the scheme property is or may be invested in government and public securities and the names of the individual states, local authorities or public international bodies in whose securities the authorised fund may invest more than 35% of the scheme property; | ||

| (j) | the policy in relation to the exercise of borrowing powers by the authorised fund; | ||

| (k) | for an authorised fund which may invest in other schemes, the extent to which the scheme property may be invested in the units of schemes which are managed by the authorised fund manager or by its associate; | ||

| (ka) | where a scheme is a feeder scheme (other than a feeder UCITS), which (in respect of investment in units in collective investment schemes) is dedicated to units in a single collective investment scheme, details of the master scheme and the minimum (and, if relevant, maximum) investment that the feeder scheme may make in it; | ||

| (l) | where a scheme invests principally in scheme units, deposits or derivatives, or replicates an index in accordance with COLL 5.2.31 R or COLL 5.6.23 R (Schemes replicating an index), a prominent statement regarding this investment policy; | ||

| (m) | where derivatives transactions may be used in a scheme, a prominent statement as to whether these transactions are for the purposes of efficient portfolio management (includinghedging) or meeting the investment objectives or both and the possible outcome of the use of derivatives on the risk profile of the scheme; | ||

| (n) | information concerning the profile of the typical investor for whom the scheme is designed; | ||

| (o) | information concerning the historical performance of the scheme presented in accordance with COBS 4.6.2 R (the rules on past performance); | ||

| (p) | for a non-UCITS retail scheme which invests in immovables, a statement of the countries or territories of situation of land or buildings in which the authorised fund may invest; | ||

| (q) | for a UCITS scheme which invests a substantial portion of its assets in other schemes, a statement of the maximum level of management fees that may be charged to that UCITS scheme and to the schemes in which it invests; | ||

| (qa) | where the authorised fund is a qualifying money market fund, short-term money market fund or money market fund, a statement identifying it as such a fund and a statement that the authorised fund's investment objectives and policies will meet the conditions specified in the definition of qualifying money market fund, short-term money market fund or money market fund, as appropriate; | ||

| (r) | where the net asset value of a UCITS scheme is likely to have high volatility owing to its portfolio composition or the portfolio management techniques that may be used, a prominent statement to that effect; | ||

| (s) | for a UCITS scheme, a statement that any unitholder may obtain on request the types of information (which must be listed) referred to in COLL 4.2.3R (3) (Availability of prospectus and long report); and | ||

| (t) | for a UCITS scheme that is or is intended to be a master UCITS, a statement that it is not a feeder UCITS and will not hold units of a feeder UCITS. | ||

| Reporting, distributions and accounting dates | |||

| 4 | Relevant details of the reporting, accounting and distribution information which includes: | ||

| (a) | the accounting and distribution dates; | ||

| (b) | procedures for: | ||

| (i) | determining and applying income (including how any distributable income is paid); | ||

| (ii) | unclaimed distributions; and | ||

| (iii) | if relevant, calculating, paying and accounting for income equalisation; | ||

| (c) | the accounting reference date and when the long report will be published in accordance with COLL 4.5.14 R (Publication and availability of annual and half-yearly long report); and | ||

| (d) | when the short report will be sent to unitholders in accordance with COLL 4.5.13 R (Provision of short report). | ||

| Characteristics of the units | |||

| 5 | Information as to: | ||

| (a) | where there is more than one class of unit in issue or available for issue, the name of each such class and the rights attached to each class in so far as they vary from the rights attached to other classes; | ||

| (b) | where the instrument constituting the scheme provides for the issue of bearer certificates, that fact and what procedures will operate for them; | ||

| (c) | how unitholders may exercise their voting rights and what these amount to; | ||

| (d) | where a mandatory redemption, cancellation or conversion of units from one class to another may be required, in what circumstances it may be required; and | ||

| (e) | for an AUT, the fact that the nature of the right represented by units is that of a beneficial interest under a trust. | ||

| Authorised fund manager | |||

| 6 | The following particulars of the authorised fund manager: | ||

| (a) | its name; | ||

| (b) | the nature of its corporate form; | ||

| (c) | the date of its incorporation; | ||

| (d) | the address of its registered office; | ||

| (e) | the address of its head office, if that is different from the address of its registered office; | ||

| (f) | if neither its registered office nor its head office is in the United Kingdom, the address of its principal place of business in the United Kingdom; | ||

| (g) | if the duration of its corporate status is limited, when that status will or may cease; and | ||

| (h) | the amount of its issued share capital and how much of it is paid up. | ||

| Directors of an ICVC, other than the ACD | |||

| 7 | Other than for the ACD: | ||

| (a) | the names and positions in the ICVC of any other directors (if any); and | ||

| (b) | the manner, amount and calculation of the remuneration of such directors. | ||

| Depositary | |||

| 8 | The following particulars of the depositary: | ||

| (a) | its name; | ||

| (b) | the nature of its corporate form; | ||

| (c) | the address of its registered office; | ||

| (d) | the address of its head office, if that is different from the address of its registered office; | ||

| (e) | if neither its registered office nor its head office is in the United Kingdom, the address of its principal place of business in the United Kingdom; and | ||

| (f) | a description of its principal business activity. | ||

| Investment adviser | |||

| 9 | If an investment adviser is retained in connection with the business of an authorised fund: | ||

| (a) | its name; and | ||

| (b) | where it carries on a significant activity other than providing services to the authorised fund as an investment adviser, what that significant activity is. | ||

| Auditor | |||

| 10 | The name of the auditor of the authorised fund. | ||

| Contracts and other relationships with parties | |||

| 11 | The following relevant details: | ||

| (a) | for an ICVC: | ||

| (i) | a summary of the material provisions of the contract between the ICVC and the ACD which may be relevant to unitholders including provisions (if any) relating to remuneration, termination, compensation on termination and indemnity; | ||

| (ii) | the main business activities of each of the directors (other than those connected with the business of the ICVC) where these are of significance to the ICVC's business; | ||

| (iii) | if any director is a body corporate in a group of which any other corporate director of the ICVC is a member, a statement of that fact; | ||

| (iv) | the main terms of each contract of service between the ICVC and a director in summary form; and | ||

| (v) | for an ICVC that does not hold annual general meetings, a statement that copies of contracts of service between the ICVC and its directors, including the ACD, will be provided to a unitholder on request; | ||

| (b) | the names of the directors of the authorised fund manager and the main business activities of each of the directors (other than those connected with the business of the authorised fund) where these are of significance to the authorised fund's business; | ||

| (c) | a summary of the material provisions of the contract between the ICVC or the manager of the AUT and the depositary which may be relevant to unitholders, including provisions relating to the remuneration of the depositary; | ||

| (d) | if an investment adviser retained in connection with the business of the authorised fund is a body corporate in a group of which any director of the ICVC or the manager of the AUT is a member, that fact; | ||

| (e) | a summary of the material provisions of any contract between the authorised fund manager or the ICVC and any investment adviser which may be relevant to unitholders; | ||

| (f) | if an investment adviser retained in connection with the business of the authorised fund has the authority of the authorised fund manager or the ICVC to make decisions on behalf of the authorised fund manager or the ICVC, that fact and a description of the matters in relation to which it has that authority; | ||

| (g) | a list of: | ||

| (i) | the functions which the authorised fund manager has delegated in accordance with FSA rules or, for an EEA UCITS management company, in accordance with applicable Home State measures implementing article 13 of the UCITS Directive; and | ||

| (ii) | the person to whom such functions have been delegated; and | ||

| (h) | in what capacity (if any), the authorised fund manager acts in relation to any other regulated collective investment schemes and the name of such schemes. | ||

| Register of unitholders | |||

| 12 | Details of: | ||

| (a) | the address in the United Kingdom where the register of unitholders, and where relevant the plan register is kept and can be inspected by unitholders; and | ||

| (b) | the registrar's name and address. | ||

| Payments out of scheme property | |||

| 13 | In relation to each type of payment from the scheme property, details of: | ||

| (a) | who the payment is made to; | ||

| (b) | what the payment is for; | ||

| (c) | the rate or amount where available; | ||

| (d) | how it will be calculated and accrued; | ||

| (e) | when it will be paid; and | ||

| (f) | where a performance fee is taken, examples of its operation in plain English and the maximum it can amount to. | ||

| Allocation of payments | |||

| 14 | If, in accordance with COLL 6.7.10 R (Allocation of payments to income or capital), the authorised fund manager and the depositary have agreed that all or part of any income expense payments may be treated as a capital expense: | ||

| (a) | that fact; | ||

| (b) | the policy for allocation of these payments; and | ||

| (c) | a statement that this policy may result in capital erosion or constrain capital growth. | ||

| Moveable and immovable property (ICVC only) | |||

| 15 | An estimate of any expenses likely to be incurred by the ICVC in respect of movable and immovable property in which the ICVC has an interest. | ||

| Valuation and pricing of scheme property | |||

| 16 | In relation to the valuation of scheme property and pricing of units: | ||

| (a) | either: | ||

| (i) | in the case of a single-priced authorised fund, a provision that there must be only a single price for any unit as determined from time to time by reference to a particular valuation point; or | ||

| (ii) | in the case of a dual-priced authorised fund, the authorised fund manager's policy for determining prices for the sale and redemption of units by reference to a particular valuation point and an explanation of how those prices may differ; | ||

| (b) | details of: | ||

| (i) | how the value of the scheme property is to be determined in relation to each purpose for which the scheme property must be valued; | ||

| (ii) | how frequently and at what time or times of the day the scheme property will be regularly valued for dealing purposes and a description of any circumstance in which the scheme property may be specially valued; | ||

| (iii) | where relevant, how the price of units of each class will be determined for dealing purposes; | ||

| (iv) | where and at what frequency the most recent prices will be published; and | ||

| (v) | where relevant in the case of a dual-priced authorised fund, the authorised fund manager's policy in relation to large deals; and | ||

| (c) | if provisions in (a) and (b) do not take effect when the instrument constituting the scheme or (where appropriate) supplemental trust deed takes effect, a statement of the time from which those provisions are to take effect or how it will be determined. | ||

| Dealing | |||

| 17 | The following particulars: | ||

| (a) | the procedures, the dealing periods and the circumstances in which the authorised fund manager will effect: | ||

| (i) | the sale and redemption of units and the settlement of transactions (including the minimum number or value of units which one person may hold or which may be subject to any transaction of sale or redemption) for each class of unit in the authorised fund; and | ||

| (ii) | any direct issue or cancellation of units by an ICVC or by the trustee (as appropriate) through the authorised fund manager in accordance with COLL 6.2.7R (2) (Issue and cancellation of units through an authorised fund manager); | ||

| (b) | the circumstances in which the redemption of units may be suspended; | ||

| (c) | whether certificates will be issued in respect of registered units; | ||

| (d) | the circumstances in which the authorised fund manager may arrange for, and the procedure for the issue or cancellation of units in specie; | ||

| (e) | the investment exchanges (if any) on which units in the scheme are listed or dealt; | ||

| (f) | the circumstances and conditions for issuing units in an authorised fund which limit the issue of any class of units in accordance with COLL 6.2.18 R (Limited issue); | ||

| (g) | the circumstances and procedures for the limitation or deferral of redemptions in accordance with COLL 6.2.19 R (Limited redemption) or COLL 6.2.21 R (Deferred redemption); | ||

| (h) | in a prospectus available during the period of any initial offer: | ||

| (i) | the length of the initial offer period; | ||

| (ii) | the initial price of a unit, which must be in the base currency; | ||

| (iii) | the arrangements for issuing units during the initial offer, including the authorised fund manager's intentions on investing the subscriptions received during the initial offer; | ||

| (iv) | the circumstances when the initial offer will end; | ||

| (v) | whether units will be sold or issued in any other currency; and | ||

| (vi) | any other relevant details of the initial offer; and | ||

| (i) | whether a unitholder may effect transfer of title to units on the authority of an electronic communication and if so the conditions that must be satisfied in order to effect a transfer. | ||

| Dilution | |||

| 18 | In the case of a single-priced authorised fund, details of what is meant by dilution including: | ||

| (a) | a statement explaining: | ||

| (i) | that it is not possible to predict accurately whether dilution is likely to occur; and | ||

| (ii) | which of the policies the authorised fund manager is adopting under COLL 6.3.8 (1) (Dilution) together with an explanation of how this policy may affect the future growth of the authorised fund; and | ||

| (b) | if the authorised fund manager may require a dilution levy or make a dilution adjustment, a statement of: | ||

| (i) | the authorised fund manager's policy in deciding when to require a dilution levy, including the authorised fund manager's policy on large deals, or when to make a dilution adjustment; | ||

| (ii) | the estimated rate or amount of any dilution levy or dilution adjustment based either on historical data or future projections; and | ||

| (iii) | the likelihood that the authorised fund manager may require a dilution levy or make a dilution adjustment and the basis (historical or projected) on which the statement is made. | ||

| SDRT provision | |||

| 19 | An explanation of: | ||

| (a) | what is meant by stamp duty reserve tax, SDRT provision and large deals; and | ||

| (b) | the authorised fund manager's policy on imposing an SDRT provision including its policy on large deals, and the occasions, and the likely frequency of the occasions, in which an SDRT provision may be imposed and the maximum rate of it (a usual rate may also be stated). | ||

| Forward and historic pricing | |||

| 20 | The authorised fund manager's normal basis of pricing under COLL 6.3.7 (Forward and historic pricing). | ||

| Preliminary charge | |||

| 21 | Where relevant, a statement authorising the authorised fund manager to make a preliminary charge and specifying the basis for and current amount or rate of that charge. | ||

| Redemption charge | |||

| 22 | Where relevant, a statement authorising the authorised fund manager to deduct a redemption charge out of the proceeds of redemption; and if the authorised fund manager makes a redemption charge: | ||

| (a) | the current amount of that charge or if it is variable, the rate or method of calculating it; | ||

| (b) | if the amount, rate or method has been changed, that details of any previous amount, rate or method may be obtained from the authorised fund manager on request; and | ||

| (c) | how the order in which units acquired at different times by a unitholder is to be determined so far as necessary for the purposes of the imposition of the redemption charge. | ||

| Property Authorised Investment Funds | |||

| 22A | For a property authorised investment fund, a statement that: | ||

| (1) | it is a property authorised investment fund; | ||

| (2) | no body corporate may seek to obtain or intentionally maintain a holding of more that10% of the net asset value of the fund; and | ||

| (3) | in the event that the authorised fund manager reasonably considers that a body corporate holds more than 10% of the net asset value of the fund, the authorised fund manager is entitled to delay any redemption or cancellation of units if the authorised fund manager reasonably considers such action to be: | ||

| (a) | necessary in order to enable an orderly reduction of the holding to below 10%; and | ||

| (b) | in the interests of the unitholders as a whole. | ||

| Funds of alternative investment funds | |||

| 22B | For a non-UCITS retail scheme operating as a FAIF, a statement that it is a fund of alternative investment funds. | ||

| General information | |||

| 23 | Details of: | ||

| (a) | the address at which copies of the instrument constituting the scheme, any amending instrument and the most recent annual and half-yearly long reports may be inspected and from which copies may be obtained; | ||

| (b) | the manner in which any notice or document will be served on unitholders; | ||

| (c) | the extent to which and the circumstances in which: | ||

| (i) | the scheme is liable to pay or suffer tax on any appreciation in the value of the scheme property or on the income derived from the scheme property; and | ||

| (ii) | deductions by way of withholding tax may be made from distributions of income to unitholders and payments made to unitholders on the redemption of units; | ||

| (d) | for a UCITS scheme, any possible fees or expenses not described in paragraphs 13 to 22, distinguishing between those to be paid by a unitholder and those to be paid out of scheme property; and | ||

| (e) | for an ICVC, whether or not annual general meetings will be held. | ||

| Information on the umbrella | |||

| 24 | In the case of a scheme which is an umbrella with two or more sub-funds, the following information: | ||

| (a) | that a unitholder is entitled to exchange units in one sub-fund for units in any other sub-fund (other than a sub-fund which has limited the issue of units); | ||

| (b) | that an exchange of units in one sub-fund for units in any other sub-fund is treated as a redemption and sale and will, for persons subject to United Kingdom taxation, be a realisation for the purposes of capital gains taxation; | ||

| (c) | that in no circumstances will a unitholder who exchanges units in one sub-fund for units in any other sub-fund be given a right by law to withdraw from or cancel the transaction; | ||

| (d) | the policy for allocating between sub-funds any assets of, or costs, charges and expenses payable out of, the scheme property which are not attributable to any particular sub-fund; | ||

| (e) | what charges, if any, may be made on exchanging units in one sub-fund for units in any other sub-fund; and | ||

| (f) | for each sub-fund, the currency in which the scheme property allocated to it will be valued and the price of units calculated and payments made, if this currency is not the base currency of the scheme which is an umbrella. | ||

| (g) | [deleted] | ||

| Application of the prospectus contents to an umbrella | |||

| 25 | For a scheme which is an umbrella, information required must be stated: | ||

| (a) | in relation to each sub-fund where the information for any sub-fund differs from that for any other; and | ||

| (b) | for the umbrella as a whole, but only where the information is relevant to the umbrella as a whole. | ||

| Information on a feeder UCITS | |||

| 25A | In the case of a feeder UCITS, the following information: | ||

| (a) | a declaration that the feeder UCITS is a feeder of a particular master UCITS and as such permanently invests at least 85% in value of the scheme property in units of that master UCITS; | ||

| (b) | the investment objective and policy, including the risk profile; and whether the performance records of the feeder UCITS and the master UCITS are identical, or to what extent and for which reasons they differ, including a description of how the balance of the scheme property which is not invested in units of the master UCITS is invested in accordance with COLL 5.8.3 R (Balance of scheme property: investment restrictions on a feeder UCITS); | ||

| (c) | a brief description of the master UCITS, its organisation, its investment objective and policy, including the risk profile, and an indication of how the prospectus of the master UCITS may be obtained; | ||

| (d) | a summary of the master-feeder agreement or where applicable, the internal conduct of business rules referred to in COLL 11.3.2 R (2) (Master-feeder agreement and internal conduct of business rules); | ||

| (e) | how the unitholders may obtain further information on the master UCITS and the master-feeder agreement; | ||

| (f) | a description of all remuneration or reimbursement of costs payable by the feeder UCITS by virtue of its investment in units of the master UCITS, as well as the aggregate charges of the feeder UCITS and the master UCITS; and | ||

| (g) | a description of the tax implications of the investment into the master UCITS for the feeder UCITS. | ||

| [Note: article 63(1) of the UCITS Directive] | |||

| Marketing in another EEA state | |||

| 26 | A prospectus of a UCITS scheme which is prepared for the purpose of marketing units in a EEA State other than the United Kingdom, must give details as to: | ||

| (a) | what special arrangements have been made: | ||

| (i) | for paying in that EEA State amounts distributable to unitholders resident in that EEA State; | ||

| (ii) | for redeeming in that EEA State the units of unitholders resident in that EEA State; | ||

| (iii) | for inspecting and obtaining copies in that EEA State of the instrument constituting the scheme and amendments to it, the prospectus and the annual and half-yearly long report; and | ||

| (iv) | for making public the price of units of each class; and | ||

| (b) | how the ICVC or the manager of an AUT will publish in that EEA State notice: | ||

| (i) | that the annual and half-yearly long report are available for inspection; | ||

| (ii) | that a distribution has been declared; | ||

| (iii) | of the calling of a meeting of unitholders; and | ||

| (iv) | of the termination of the authorised fund or the revocation of its authorisation. | ||

| Investment in overseas property through an intermediate holding vehicle | |||

| 26A | If investment in an overseas immovable is to be made through an intermediate holding vehicle or a series of intermediate holding vehicles, a statement disclosing the existence of that intermediate holding vehicle or series of intermediate holding vehicles and confirming that the purpose of that intermediate holding vehicle or series of intermediate holding vehicle is to enable the holding of overseas immovables by the scheme. | ||

| Additional information | |||

| 27 | Any other material information which is within the knowledge of the directors of an ICVC or the manager of an AUT, or which the directors or manager would have obtained by making reasonable enquiries, including but not confined to, the following matters: | ||

| (a) | information which investors and their professional advisers would reasonably require, and reasonably expect to find in the prospectus, for the purpose of making an informed judgement about the merits of investing in the authorised fund and the extent and characteristics of the risks accepted by so participating; | ||

| (b) | a clear and easily understandable explanation of any risks which investment in the authorised fund may reasonably be regarded as presenting for reasonably prudent investors of moderate means; | ||

| (c) | if there is any arrangement intended to result in a particular capital or income return from a holding of units in the authorised fund or any investment objective of giving protection to the capital value of, or income return from, such a holding: | ||

| (i) | details of that arrangement or protection; | ||

| (ii) | for any related guarantee, sufficient details about the guarantor and the guarantee to enable a fair assessment of the value of the guarantee; | ||

| (iii) | a description of the risks that could affect achievement of that return or protection; and | ||

| (iv) | details of the arrangements by which the authorised fund manager will notify unitholders of any action required by the unitholders to obtain the benefit of the guarantee; and | ||

| (d) | whether any notice has been given to unitholders of the authorised fund manager intention to propose a change to the scheme and if so, its particulars. | ||

- 21/12/2011

Guidance on contents of the prospectus

COLL 4.2.6

See Notes

- 06/03/2010

COLL 4.3

Approvals and notifications

- 01/12/2004

Application

COLL 4.3.1

See Notes

- 01/04/2004

Explanation

COLL 4.3.2

See Notes

- 01/04/2004

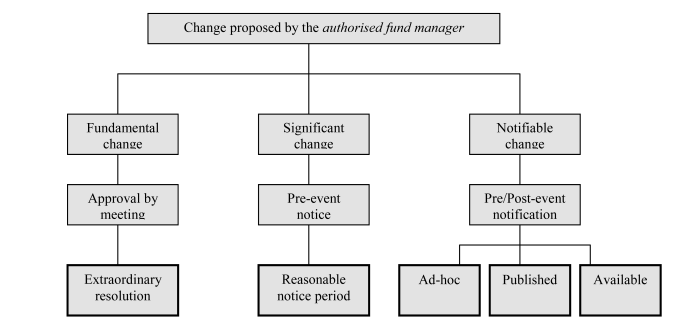

Diagram: Change event

COLL 4.3.3

See Notes

- 01/04/2004

Fundamental change requiring prior approval by meeting

COLL 4.3.4

See Notes

- 01/04/2004

Guidance on fundamental changes

COLL 4.3.5

See Notes

- 01/04/2004

Significant change requiring pre-event notification

COLL 4.3.6

See Notes

- 01/04/2004

Appointment of a new ACD or manager

COLL 4.3.6A

See Notes

- 01/07/2011

Guidance on significant changes

COLL 4.3.7

See Notes

- 01/07/2011

Notifiable changes

COLL 4.3.8

See Notes

- 01/04/2004

Guidance on notifiable changes

COLL 4.3.9

See Notes

- 01/04/2004

Appointment of an AFM without prior written notice to unitholders

COLL 4.3.10

See Notes

- 01/07/2011

Change events relating to feeder UCITS

COLL 4.3.11

See Notes

- 01/07/2011

COLL 4.3.12

See Notes

- 01/07/2011

COLL 4.3.13

See Notes

- 01/07/2011

COLL 4.4

Meetings of unitholders and service of notices

- 01/12/2004

Application

COLL 4.4.1

See Notes

- 01/04/2004

General meetings

COLL 4.4.2

See Notes

- 01/04/2004

Class meetings

COLL 4.4.3

See Notes

- 01/04/2004

Special meaning of unitholder in COLL 4.4

COLL 4.4.4

See Notes

- 01/04/2004

Notice of general meetings

COLL 4.4.5

See Notes

- 01/04/2004

Quorum

COLL 4.4.6

See Notes

- 01/04/2004

Resolutions

COLL 4.4.7

See Notes

- 06/04/2006

Voting rights

COLL 4.4.8

See Notes

- 06/04/2006

Right to demand a poll

COLL 4.4.9

See Notes

- 01/04/2004

Proxies

COLL 4.4.10

See Notes

- 01/04/2004

Chairman, adjournment and minutes

COLL 4.4.11

See Notes

adjourn the meeting from time to time and from place to place.

- 06/04/2006

Notices to unitholders

COLL 4.4.12

See Notes

- 06/04/2006

Other notices

COLL 4.4.13

See Notes

- 06/03/2009

References to writing and electronic documents

COLL 4.4.14

See Notes

- 01/04/2004

Service of notice Regulations

COLL 4.4.15

See Notes

- 01/04/2004

COLL 4.5

Reports and accounts

- 01/12/2004

Application

COLL 4.5.1

See Notes

- 01/04/2004

Explanation

COLL 4.5.2

See Notes

- 01/04/2004

Preparation of long and short reports

COLL 4.5.3

See Notes

- 06/10/2006

ICVC requirements

COLL 4.5.4

See Notes

- 01/04/2004

Contents of a short report

COLL 4.5.5

See Notes

- 01/07/2011

Significant information to be contained in the short report

COLL 4.5.6

See Notes

- 22/03/2012

Contents of the annual long report

COLL 4.5.7

See Notes

[Note: article 63(2) of the UCITS Directive]

- 01/07/2011

Contents of the half-yearly long report

COLL 4.5.8

See Notes

- 01/07/2011

Annual and half-yearly long reports for sub-funds of an umbrella

COLL 4.5.8A

See Notes

- 06/04/2006

Signing of annual and half-yearly reports

COLL 4.5.8B

See Notes

- 06/03/2010

Authorised fund manager's report

COLL 4.5.9

See Notes

- 21/12/2011

Comparative table

COLL 4.5.10

See Notes

- 01/04/2004

Report of the depositary

COLL 4.5.11

See Notes

- 06/03/2010

Report of the auditor

COLL 4.5.12

See Notes

- 06/03/2010

Provision of short report

COLL 4.5.13

See Notes

- 06/04/2006

Publication and availability of annual and half-yearly long report

COLL 4.5.14

See Notes

- 01/07/2011

Provision of annual and half-yearly long reports for master and feeder UCITS

COLL 4.5.15

See Notes

- 01/07/2011

COLL 4.6

Simplified Prospectus provisions

- 01/11/2007

Application

COLL 4.6.1

See Notes

- 01/11/2007

Production and publication of simplified prospectus

COLL 4.6.2

See Notes

- 01/11/2007

Revision of simplified prospectus

COLL 4.6.3

See Notes

- 01/11/2007

COLL 4.6.4

See Notes

- 01/11/2007

Filing requirements

COLL 4.6.5

See Notes

- 01/11/2007

UK firms exercising passporting rights in respect of UCITS scheme

COLL 4.6.6

See Notes

- 01/11/2007

COLL 4.6.7

See Notes

- 01/11/2007

Contents of the simplified prospectus

COLL 4.6.8

See Notes

Contents of simplified prospectus

| Note: | By reproducing schedule C (Contents of the simplified prospectus) to the UCITS Directive (as amplified by Commission Recommendation (2004/384/EC)) and cross-referring to other relevant material, this annex details the facts or matters that must included in a simplified prospectus. | |||

| Brief presentation of the simplified prospectus scheme (in this Table referred to as "the scheme"). | ||||

| (1) | when the scheme was created and an indication of the EEA State where the scheme has been registered or incorporated; | |||

| (2) | in the case of a scheme having different investment compartments (sub-funds), the indication of this circumstance; | |||

| (3) | the name and contact details of the operator (when applicable); | |||

| (4) | the expected period of existence of the scheme (when applicable); | |||

| (5) | the name and contact details of the depositary; | |||

| (6) | the name and contact details of the auditors; | |||

| (7) | the name and brief details of the financial group (e.g. a bank) promoting the scheme; | |||

| Investment information | ||||

| (8) | a short description of the scheme's objectives including: | |||

| (a) | a concise and appropriate description of the outcomes sought for any investment in the scheme; | |||

| (b) | a clear statement of any guarantees offered by third parties to protect investors and any restrictions on those guarantees; | |||

| (c) | a statement, where relevant, that the scheme is intended to track an index or indices, and sufficient information to enable investors both to identify the relevant index or indices and to understand the extent or degree of tracking pursued; and | |||

| (d) | where the scheme is a qualifying money market fund, short-term money market fund or money market fund, a statement identifying it as such a fund and a statement that the scheme's investment objectives and policies will meet the conditions in the definition of qualifying money market fund, short-term money market fund or money market fund, as appropriate; | |||

| Notes: | 1. | Information on (8)(a) should include a statement as to whether there is any arrangement intended to result in a particular capital or income return from the units or any investment objective of giving protection to their capital value or income return and, if so, details of that arrangement or protection. | ||

| 2. | The information disclosed under (8)(b) should include an explanation of what is to happen when an investment is encashed before the expiry of any related guarantee or protection. | |||

| (9) | the scheme's investment policy, including: | |||

| (a) | the main categories of eligible financial instruments which are the object of investment; | |||

| (b) | whether the scheme has a particular strategy in relation to any industrial, geographic or other market sectors or specific classes of assets, e.g. investments in emerging countries' financial instruments; | |||

| (c) | where relevant, a warning that, whilst the actual portfolio composition is required to comply with the broad legal and statutory rules and limits, risk-concentration may occur in regard of certain tighter asset classes, economic and geographic sectors; | |||

| (d) | if the scheme invests in bonds, an indication of whether they are corporate or government, their duration and the ratings requirements; | |||

| (e) | if the scheme uses financial derivative instruments, an indication of whether this is done in pursuit of the scheme's objectives, or for hedging purposes only; | |||

| (f) | whether the scheme's management style makes some reference to a benchmark; and in particular whether the scheme has an 'index tracking' objective, with an indication of the strategy to be pursued to achieve this; and | |||

| (g) | whether the scheme's management style is based on a tactical asset allocation with high frequency portfolio adjustments; | |||

| provided the information is material and relevant; | ||||

| Note: | The information referred to in paragraphs (8) and (9) may be set out as a single item in the simplified prospectus (e.g. for the information on index tracking), provided that the information so combined does not lead to confusion of the objectives and policies of the scheme. The order of the information items may be adapted to reflect the scheme's specific investment objectives and policy. | |||

| (10) | a brief assessment of the scheme's risk profile by investment compartment or sub-fund, including: | |||

| (a) | overall structure of the information provided: | |||

| (i) | a statement to the effect that the value of investments may fall as well as rise and that investors may get back less than they put in; | |||

| (ii) | a statement that details of all the risks actually mentioned in the simplified prospectus may be found in the full prospectus; | |||

| (iii) | a description in words of any risk investors have to face in relation to their investment, but only where such risk is relevant and material, based on risk impact and probability; and | |||

| (b) | details regarding the description (in words) of the following risks: | |||

| (i) | specific risks: | |||

| The description referred to in paragraph (10)(a)(iii) should include a brief and understandable explanation of any specific risk arising from particular investment policies or strategies or associated with specific markets or assets relevant to the scheme such as: | ||||

| A | the risk that the entire market of an asset class will decline thus affecting the prices and values of the assets (market risk); | |||

| B | the risk that an issuer or a counterparty will default (credit risk); | |||

| C | only where strictly relevant, the risk that a settlement in a transfer system does not take place as expected because a counterparty does not pay or deliver on time or as expected (settlement risk); | |||

| D | the risk that a position cannot be liquidated in a timely manner at a reasonable price (liquidity risk); | |||

| E | the risk that the investment's value will be affected by changes in exchange rates (exchange or currency risk); | |||

| F | only where strictly relevant, the risk of loss of assets held in custody that could result from the insolvency, negligence or fraudulent action of the custodian or of a subcustodian (custody risk); and | |||

| G | risks related to a concentration of assets or markets; and | |||

| (ii) | horizontal risk factors: | |||

| The description referred to in paragraph (10)(a)(iii) should also mention, where relevant and material, the following factors that may affect the product: | ||||

| A | performance risk, including the variability of risk levels depending on individual fund selections, and the existence, absence of, or restrictions on any guarantees given by third parties; | |||

| B | risks to capital, including potential risk of erosion resulting from withdrawals/cancellations of units and distributions in excess of investment returns; | |||

| C | exposure to the performance of the provider/third-party guarantor, where investment in the product involves direct investment in the provider, rather than assets held by the provider; | |||

| D | inflexibility, both within the product (including early surrender risk) and constraints on switching to other providers; | |||

| E | inflation risk; and | |||

| F | lack of certainty that environmental factors, such as a tax regime, will persist; | |||

| (iii) | possible prioritisation of information disclosure: | |||

| In order to avoid conveying a misleading image of the relevant risks, the information items should be presented so as to prioritise, based on scale and materiality, the risks so as to better highlight the individual risk profile of the scheme; | ||||

| (11) | the historical performance of the scheme (where applicable) and a warning that this is not an indicator of future performance (which may be either included in or attached to the simplified prospectus), including: | |||

| (a) | disclosure of past performance: | |||

| (i) | the scheme's past performance, as presented using a bar chart showing annual returns for the last ten full consecutive years. If the scheme has been in existence for fewer than ten years but at least for a period of one year, it is recommended that the annual returns, calculated net of tax and charges, be given for as many years as are available; and | |||

| (ii) | if a scheme is managed according to a benchmark or if its cost structure includes a performance fee depending on a benchmark, the information on the past performance of the scheme should include a comparison with the past performance of the benchmark according to which the scheme is managed or the performance fee is calculated; | |||

| Note: | Comparison should be achieved by representing the past performance of the benchmark and that of the scheme through the use of appropriate graphs to assist the reader to make the comparison. | |||

| (b) | disclosure of cumulative performance: | |||

| Disclosure should be made of the cumulative performance of the scheme over the ten year period referred to in paragraph (11)(a)(i). A comparison should also be made with the cumulative performance (where relevant) of a benchmark, when comparison to a benchmark is required in accordance with paragraph (11)(a)(ii); | ||||

| Note: | Where the scheme has been in existence for fewer than ten years but at least for a period of one year, disclosure of the past cumulative performance should be made for as many years as are available. | |||

| (c) | exclusion of subscription and redemption fees, subject to appropriate disclosure: | |||

| A statement should be made that past performance of the scheme does not include the effect of subscription and redemption fees. | ||||

| Notes: | 1. | Where a comparison is being made with the cumulative performance of a benchmark as required by paragraph (11)(b), the comparison should be achieved by representing the past performance of the benchmark and that of the scheme through the use of appropriate graphs to assist the reader to make the comparison. | ||

| 2. | The scheme's historical performance may be produced as a separate attachment to the simplified prospectus. | |||

| (12) | a profile of the typical investor the scheme is designed for; | |||

| Economic information | ||||

| (13) | the scheme's applicable tax regime, including: | |||

| (a) | the tax regime applicable to the scheme in the UK; and | |||

| (b) | a statement which explains that the regime of taxation of the income or capital gains received by individual investors depends on the tax law applicable to the personal situation of each individual investor and/or to the place where the capital is invested and that if investors are unclear as to their fiscal position, they should seek professional advice or information from local organisations, where available; | |||

| Note: | This information should include a statement in relation to SDRT provision, explaining how the scheme may suffer stamp duty reserve tax as a result of transactions in units and whether the operator's policy is such that an SDRT provision may be imposed. | |||

| (14) | details of any entry and exit commissions relating to the scheme and details of the scheme's other possible expenses or fees, distinguishing between those to be paid by the unitholder and those to be paid from the scheme's or the sub-fund's assets, including: | |||

| (a) | overall contents of the information provided: | |||

| (i) | disclosure of a total expense ratio (TER), calculated as indicated in Annex 1 to this chapter, except for a newly created fund where a TER cannot yet be calculated; | |||

| (ii) | on an ex ante basis, disclosure of the expected cost structure, that is an indication of all costs available according to the list set forth in Annex 1 to this chapter so as to provide investors, in so far as possible, with a reasonable estimate of expected costs; | |||

| (iii) | all entry and exit commissions and other expenses directly paid by the investor; | |||

| (iv) | an indication of all the other costs not included in the TER, including disclosure of transaction costs; | |||

| (v) | as an additional indicator of the importance of transaction costs, the portfolio turnover rate, calculated as shown in Annex 2 to this chapter; and | |||

| (vi) | an indication of the existence of fee-sharing agreements and soft commissions; | |||

| Note: | 1. | In explaining the function of the TER to the reader, appropriate wording should be used in the simplified prospectus. For example, TER might be explained in the following terms: "The TER shows the annual operating expenses of the scheme - it does not include transaction expenses. All European funds highlight the TER to help you compare the annual operating expenses of different schemes." | ||

| 2. | It is the FSA's understanding that the disclosure of a reasonable estimate of expected costs on an ex ante basis, as required by paragraph (14)(a)(ii), only applies to new schemes where a TER cannot yet be calculated. Where a TER can be calculated for a simplified prospectus scheme, there is no need to have to disclose a reasonable estimate of expected costs on an ex ante basis in accordance with paragraph (14)(a)(ii), in addition to the TER. | |||

| 3. | Paragraph (14)(a)(vi)) should not be interpreted as a general validation of the compliance of any individual agreement or commission with the provisions of the Handbook . Taking into account current market practice, consideration should be given as to how far the scheme's existing fee-sharing agreements and comparable fee arrangements are for the exclusive benefit of the scheme. | |||

| 4. | The simplified prospectus should make a reference to the full prospectus for detailed information on these kinds of arrangements, which should allow any investor to understand to whom expenses are to be paid and how possible conflicts of interest will be resolved in his/her best interest. The information provided in the simplified prospectus should remain concise in this respect. | |||

| 5. | Details of entry and exit commissions relating to the scheme and details of the scheme's other possible expenses or fees, must be presented in the simplified prospectus in the form required by COBS 4.6.9 R (Charges and reduction in yield). | |||

| (b) | information about 'fee sharing agreements' and 'soft commissions': | |||

| (i) | identification of 'fee-sharing agreements'; | |||

| Note: | For the purposes of paragraph (14)(b)(i), fee-sharing agreements should be taken as those agreements whereby a party remunerated, either directly or indirectly, out of the assets of a scheme agrees to split its remuneration with another party and which result in that other party meeting expenses through this fee-sharing agreement that should normally be met, either directly or indirectly, out of the assets of the scheme. | |||

| (ii) | identification of soft commissions; | |||

| Note: | For the purposes of paragraph (14) (b) (ii), soft commissions should be regarded as any economic benefit, other than clearing and execution services, that an asset manager receives in connection with the scheme's payment of commissions on transactions that involve the scheme's portfolio securities. Soft commissions are typically obtained from, or through, the executing broker. | |||

| (c) | presentation of TER and portfolio turnover rate; | |||

| Note: | Both the TER and the portfolio turnover rate may be either included in or attached to the simplified prospectus in the same paper as information on past performance. | |||

| Commercial information | ||||

| (15) | how to buy the units; | |||

| Note: | This should include an explanation of any relevant right to cancel or withdraw from the purchase, or, where it is the case, that such rights do not apply. | |||

| (16) | how to sell the units; | |||

| (17) | in the case of a scheme having different investment compartments (sub-funds), an explanation of how to switch from one investment compartment into another and any charges applicable in such cases; | |||

| (18) | when and how dividends on units or shares of the scheme (if applicable) are distributed; | |||

| (19) | when and where prices of units are published or made available; | |||

| Additional information | ||||

| (20) | A statement that, on request, the full prospectus and the annual and half-yearly reports of the scheme may be obtained free of charge before the conclusion of the contract and afterwards, together with details of how they may be obtained or how a person may gain access to them; | |||

| (21) | the name and contact details of the FSA as being the competent authority which has authorised or registered the scheme; | |||

| (22) | details of a contact point (person or department, and, if appropriate the times of day etc.) where additional information may be obtained if needed; | |||

| (23) | the date of publication of the simplified prospectus. | |||

| General Note: | ||||

| In making the disclosures required by paragraphs (8) to (19) of this Table, the information must be presented in the form of questions and answers. This format is designed to assist the comprehension of the reader. This requirement will not apply in relation to a simplified prospectus that is to be used to market the units of the scheme in another EEA state or in relation to a simplified prospectus that is to be used to market the units of the scheme exclusively to persons who are not retail clients . | ||||

- 01/07/2011

Charges and reduction in yield

COLL 4.6.9

See Notes

- 06/11/2008

Composite documents for several schemes, sub-funds and classes

COLL 4.6.10

See Notes

- 01/11/2007

Multiclass schemes: use of representative class

COLL 4.6.11

See Notes

- 01/11/2007

COLL 4.6.12

See Notes

- 01/11/2007

Use of the "keyfacts" logo within a simplified prospectus

COLL 4.6.13

See Notes

"The Financial Services Authority is the independent financial services regulator. It requires us, [provider name], to give you this important information to help you to decide whether our [product name] is right for you. You should read this document carefully so that you understand what you are buying, and then keep it safe for future reference".

- 01/11/2007

COLL 4.7

Key investor information and marketing communications

- 01/07/2011

Application

COLL 4.7.1

See Notes

- 01/07/2011

Key investor information

COLL 4.7.2

See Notes

- 01/07/2011

Form and content of a key investor information document

COLL 4.7.3

See Notes

- 01/07/2011

Translation of a key investor information document

COLL 4.7.4

See Notes

- 01/07/2011

Pre-contractual information

COLL 4.7.5

See Notes

- 01/07/2011

COLL 4.7.6

See Notes

- 01/07/2011

Revision and filing of key investor information

COLL 4.7.7

See Notes

- 01/07/2011

Synthetic risk and reward indicators and ongoing charges disclosures in the KII

COLL 4.7.8

See Notes

Methodology for the calculation of the synthetic risk and reward indicator in the KII (CESR/10-673)

www.esma.europa.eu/index.php?page=document_details&id=6961&from_id=28

Methodology for the calculation of the ongoing charges figure in the KII (CESR/10-674)

www.esma.europa.eu/index.php?page=document_details&id=6962&from_id=28

- 01/07/2011

COLL 4.7.9

See Notes

Guidelines - Selection and presentation of performance scenarios in the Key Investor Information document (KII) for structured UCITS (CESR/10-1318)

www.esma.europa.eu/index.php?page=document_details&id=7333&from_id=28

Guidelines - Transition from the Simplified Prospectus to the Key Investor Information document (CESR/10-1319)

www.esma.europa.eu/index.php?page=document_details&id=7334&from_id=28

CESR's guide to clear language and layout for the Key Investor Information document (CESR/10-1320)

www.esma.europa.eu/index.php?page=document_details&id=7335&from_id=28

CESR's template for the Key Investor Information document (CESR/10-1321)

www.esma.europa.eu/index.php?page=document_details&id=7336&from_id=28

CESR's guidelines on a common definition of European money market funds, which refer to matters that should be included in the key investor information for money market funds and short-term money market funds (CESR/10-049)

www.esma.europa.eu/index.php?page=document_details&id=6638&from_id=28

- 01/07/2011

Marketing communications

COLL 4.7.10

See Notes

- 01/07/2011

COLL 4.8

Notifications for UCITS master-feeder arrangements

- 01/07/2011

Application

COLL 4.8.1

See Notes

- 01/07/2011

Purpose

COLL 4.8.2

See Notes

- 01/07/2011

Information to be provided to unitholders

COLL 4.8.3

See Notes

- 01/07/2011

Method of providing information

COLL 4.8.4

See Notes

- 01/07/2011

COLL 4 Annex 1

Total expense ratio calculation

- 01/11/2007

See Notes

| Total expense ratio (TER) | |||

| 1. | Definition of the TER | ||

| The total expense ratio (TER) of a simplified prospectus scheme is the ratio of the scheme's total operating costs to its average net assets calculated according to paragraph 3. | |||

| 2. | Included/excluded costs | ||

| (a) | The total operating costs are all the expenses which come in deduction of a simplified prospectus scheme's assets. These costs are usually shown in a scheme's statement of operation for the relevant fiscal period. They are assessed on an 'all taxes included' basis, which means that the gross value of expenses should be used. | ||

| (b) | Total operating costs include any legitimate expenses of the simplified prospectus scheme, whatever their basis of calculation (e.g. flat-fee, asset-based, transaction-based - see note 2 above), such as: | ||

| - | management costs including performance fees; | ||

| - | administration costs; | ||

| - | fees linked to depositary duties; | ||

| - | audit fees; | ||

| - | payments to shareholder services providers including payments to the simplified prospectus scheme's transfer agent and payments to broker-dealers that are record owners of the scheme's shares and that provide sub-accounting services for the beneficial owners of the scheme's shares; | ||

| - | payments to lawyers; | ||

| - | any distribution or unit cancellation costs charged to the scheme; | ||

| - | registration fees, regulatory fees and similar charges; | ||

| - | any additional remuneration of the management company (or any other party) corresponding to certain fee-sharing agreements in accordance with paragraph 4 below. | ||

| (c) | The total operating costs do not include: | ||

| - | transaction costs which are costs incurred by a simplified prospectus scheme in connection with transactions on its portfolio. They include brokerage fees, taxes and linked charges and the market impact of the transaction taking into account the remuneration of the broker and the liquidity of the concerned assets; | ||

| - | interest on borrowing; | ||

| - | payments incurred because of financial derivative instruments; | ||

| - | entry/exit commissions or any other fees paid directly by the investor; | ||

| - | soft commissions in accordance with paragraph 4. | ||

| 3. | Calculation method and disclosure | ||

| (a) | The TER is calculated at least once a year on an ex post basis, generally with reference to the fiscal year of the simplified prospectus scheme. For specific purposes it may also be calculated for other time periods. The simplified prospectus should in any case include a clear reference to an information source (e.g. the scheme's website) where the investor may obtain previous years'/periods' TER figures. | ||

| (b) | The average net assets must be calculated using figures that are based on the scheme's net assets at each calculation of the net asset value (NAV), e.g. daily NAVs where this is the normal frequency of NAV calculation as approved by the simplified prospectus scheme'scompetent authorities. Further circumstances or events which could lead to misleading figures have equally to be taken into consideration. | ||

| Tax relief should not be taken into account. | |||

| The calculation method of the TER must be validated by the simplified prospectus scheme's auditors and/or competent authorities. | |||

| 4. | Fee-sharing agreements and soft commissions | ||

| It regularly results from fee-sharing agreements on expenses that are generally not included in the TER, that the management company or another party is actually meeting, in all or in part, operating costs that should normally be included in the TER. They should therefore be taken into account when calculating the TER, by adding to the total operating costs any remuneration of the management company (or another party) that derives from such fee-sharing agreements. | |||

| There is no need to take into account fee-sharing arrangements on expenses that are already in the scope of the TER. Soft commissions should also be left outside the scope of the TER. | |||

| Thus: | |||

| - | the remuneration of a management company through a fee-sharing agreement with a broker on transaction costs and with other fund management companies in the case of funds of funds (if this remuneration has not already been taken into account in the synthetic TER (see paragraph 6 below) or through other costs already charged to the fund and therefore directly included into the TER) should anyway be taken into account in the TER, | ||

| - | conversely, the remuneration of a management company through a fee-sharing agreement with a scheme (except when this remuneration falls under the scope of the specific fund-of-fund case covered in the previous indent) should not be taken into account. | ||

| 5. | Performance fees: | ||

| Performance fees should be included in the TER and should also be disclosed separately as a percentage of the average net asset value. | |||

| 6. | Simplified prospectus scheme investing in UCITS scheme or in non-UCITS scheme: | ||

| When a simplified prospectus scheme invests at least 10% of its net asset value in UCITS schemes or in schemes that are not UCITS schemes which publish a TER in accordance with this Annex, a synthetic TER corresponding to that investment should be disclosed. | |||

| The synthetic TER is equal to the ratio of: | |||

| - | the simplified prospectus scheme's total operating costs expressed by its TER and all the costs borne by the scheme through holdings in underlying funds (i.e. those expressed by the TER of the underlying funds weighted on the basis of the simplified prospectus scheme's investment proportion), plus the subscription and redemption fees of these underlying funds, divided by | ||

| - | the average net assets of the scheme. | ||

| As mentioned in the previous subparagraph, subscription fees and redemption fees of the underlying funds should be included in the TER. Subscription and redemption fees may not be charged when the underlying funds belong to the same group in accordance with Article 24 (3) of the UCITS Directive. | |||

| When any of the underlying schemes that are not UCITS schemes does not publish a TER in accordance with this Annex, disclosure of costs should be adapted in the following way: | |||

| - | the impossibility of calculating the synthetic TER for that fraction of the investment must be disclosed, | ||

| - | the maximum proportion of management fees charged to the underlying fund(s) must be disclosed in the simplified prospectus, | ||

| - | a synthetic figure of total expected costs must be disclosed, by calculating: | ||

| - | a truncated synthetic TER incorporating the TER of each of those underlying funds for which the TER is calculated according to this Annex, weighted on the basis of the simplified prospectus scheme's investment proportion, and | ||

| - | by adding, for each of the other underlying funds, the subscription and redemption fees plus the best available maximum estimate of TER-eligible costs. This should include the maximum management fee and the last available performance fee for that fund, weighted on the basis of the simplified prospectus scheme's investment proportion. | ||

| 7. | Umbrella funds/multiclass funds: | ||

| In the case of umbrella funds, the TER should be calculated for each sub-fund. If, in the case of multiclass funds, the TER differs between different share classes, a separate TER should be calculated and disclosed for each share class. Furthermore, in keeping with the principle of equality among investors, where there are differences in fees and expenses across classes, these different fees/expenses should be disclosed separately in the simplified prospectus. An additional statement should indicate that the objective criteria (e.g. the amount of subscription), on which these differences are based, are available in the full prospectus. | |||

| Notes: | |

| 1. | This Annex sets out the requirements in relation to the TER. It reproduces, and adapts where appropriate for the purposes of the Simplified Prospectus provisions, Annex 1 to Commission Recommendation (2004/384/EC), amplifying Schedule C (Contents of the simplified prospectus) to the Management Company Directive (2004/107/EC). |

| 2. | The non-exhaustive typology of calculation bases referred to in paragraph 2(b) below reflects the diversity of recent commercial practice across Member States (at the end of 2003) and should not be interpreted as a general validation of the compliance of any individual agreement or commission with the provisions of the Handbook. |

- 01/11/2007

COLL 4 Annex 2

Portfolio turnover calculation

- 01/11/2007

See Notes

| This Annex belongs to the rule on the contents of the simplified prospectus in this chapter. | |

| Note: | This Annex sets out the requirements in relation to the portfolio turnover rate. It reproduces Annex II to Commission Recommendation (2004/384/EC), amplifying Schedule C (Contents of the simplified prospectus) to the Management Company Directive (2004/107/EC). This table also includes other material which the FSA considers should be included. |

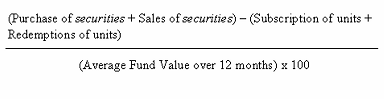

| Portfolio turnover rate | |

| A simplified prospectus scheme's or, where relevant, a compartment's (sub-fund's) portfolio turnover rate must be calculated in the following way: | |

| Purchases of securities = X | |

| Sales of securities = Y | |

| Total 1 = total of transactions in securities = X + Y | |

| Issues/Subscriptions of units of the scheme = S | |

| Cancellations/Redemptions of units of the scheme = T | |

| Total 2 = Total transactions in units of the scheme = S + T | |

| Reference average of total net assets = M | |

| Turnover = [(Total 1 - Total 2)/M]*100 | |

| The reference average of total net assets corresponds to the average of net asset values calculated with the same frequency as under Annex 1 to this chapter. The portfolio turnover rate disclosed should correspond to the period(s) for which a TER is disclosed. The simplified prospectus should in any case include a clear reference to an information source (e.g. the scheme's website) where the investor may obtain previous periods' performance. | |

| Note | |

| Firms should note that inclusion of the portfolio turnover rate in the simplified prospectus is mandatory. The rate must be calculated according to the formula which is prescribed above. However, because the rate includes both purchases and sales of securities, readers may find it difficult to understand. Consequently firms should consider including an explanation of the formula, such as: | |

- 01/11/2007