CIS 1

Introduction - Collective investment

schemes sourcebook

CIS 1.1

Application

- 01/12/2004

CIS 1.1.1

See Notes

- 01/12/2004

Right to elect to comply with COLL

CIS 1.1.1A

See Notes

- 01/04/2004

Operators of recognised schemes

CIS 1.1.1B

See Notes

- 01/04/2004

Purpose

CIS 1.1.2

See Notes

- 01/12/2004

The products covered

CIS 1.1.3

See Notes

- 01/12/2004

ICVCs

CIS 1.1.4

See Notes

- 01/12/2004

CIS 1.1.5

See Notes

- 01/12/2004

AUTs

CIS 1.1.6

See Notes

- 01/12/2004

Recognised schemes

CIS 1.1.7

See Notes

- 01/12/2004

Functions of the CIS sourcebook

CIS 1.1.8

See Notes

- 01/12/2004

CIS 1.1.9

See Notes

- 01/12/2004

CIS 1.2

Arrangement of this sourcebook and definitions

- 01/12/2004

CIS 1.2.1

See Notes

- 01/12/2004

Outline of the content of this sourcebook

CIS 1.2.2

See Notes

- 01/04/2004

CIS 1.2.3

See Notes

- 01/12/2004

CIS 1.2.4

See Notes

- 01/12/2004

CIS 1.2.5

See Notes

- 01/11/2002

CIS 1.2.6

See Notes

- 01/12/2004

CIS 1.2.7

See Notes

- 01/12/2004

CIS 1.2.8

See Notes

- 01/12/2004

CIS 1.2.9

See Notes

- 01/12/2004

CIS 1.2.10

See Notes

- 01/12/2004

CIS 1.2.11

See Notes

- 01/12/2004

CIS 1.2.12

See Notes

- 01/12/2004

CIS 1.2.13

See Notes

- 01/12/2004

CIS 1.2.14

See Notes

- 01/12/2004

CIS 1.2.15

See Notes

- 01/12/2004

CIS 1.2.16

See Notes

- 01/12/2004

CIS 1.2.17

See Notes

- 17/01/2002

CIS 1.2.18

See Notes

- 17/01/2002

Related sourcebooks

CIS 1.2.19

See Notes

- 01/01/2004

CIS 1.2.20

See Notes

- 01/12/2004

CIS 1.2.21

See Notes

- 01/12/2004

CIS 1.2.22

See Notes

- 01/12/2004

CIS 1.2.23

See Notes

- 01/11/2002

CIS 2

Constitution

CIS 2.1

Introduction

- 01/12/2004

Application

CIS 2.1.2

See Notes

- 01/12/2004

CIS 2.1.3

See Notes

- 01/11/2002

Types of authorised fund

CIS 2.1.4

See Notes

- 01/11/2002

Types of authorised fund - explanation.

CIS 2.1.4A

See Notes

- 01/11/2002

CIS 2.1.5

See Notes

Table of application

This table belongs to CIS 2.1.2 G

| Handbook provision: | Relevance for: ICVCs | AUTs |

| 2.1.1R - 2.1.4AR, 2.2.1R | X | X |

| 2.2.2R - 2.2.4R | X | |

| 2.2.5R - 2.2.8R | X | |

| 2.3.1R - 2.3.4G | X | X |

| 2.4.1R - 2.4.6R | X | |

| 2.5.1R - 2.5.4R | X | |

| 2.6.1R - 2.6.4R | X | |

| 2.7.1R - 2.8.2R | X | X |

| Note: "X" means "applies". | ||

- 01/11/2002

CIS 2.2

The instrument constituting the scheme

- 01/12/2004

Application

CIS 2.2.1

See Notes

- 01/12/2004

The instrument of incorporation for ICVCs: matters which must be included in the instrument of incorporation

CIS 2.2.2

See Notes

- 13/02/2004

The instrument of incorporation for ICVCs: matters which may be included in the instrument of incorporation

CIS 2.2.3

See Notes

- 01/12/2004

Relationship between instrument of incorporation and the rules in this chapter

CIS 2.2.4

See Notes

- 01/12/2004

The trust deed for AUTs

CIS 2.2.5

See Notes

- 01/12/2004

Matters that must be included in the trust deed

CIS 2.2.6

See Notes

- 13/02/2004

Provisions that may be included in the trust deed

CIS 2.2.7

See Notes

- (1) There are a number of provisions in this sourcebook that only apply to the extent that they are provided for in the trust deed. Sub-paragraphs (a) to (n) include some provisions that may be contained in the trust deed for this purpose.

- (a) Duration of the AUT: if the AUT is to terminate after a particular period expires, a statement to that effect;

- (b) Manager's preliminary charge: a statement

- (i) authorising the manager to make a preliminary charge; and

- (ii) specifying a maximum to that charge, expressed either as a fixed amount in the base currency or as a percentage of the price (or in the case of a dual-priced AUT, the issue price of a unit);

- (c) Manager's periodic charge: a statement authorising the manager to make a periodic charge payable out of the scheme property; any statement under this paragraph should:

- (i) provide for the charge to be expressed as an annual percentage (to be specified in the prospectus and taken in accordance with the rules in CIS 8 (Charges and expenses)) of the value of the scheme property (and the statement may provide for the addition to the charge of value added tax, if any, payable on it);

- (ii) specify the accrual intervals and how the charge is to be paid; and

- (iii) specify a maximum to that charge, expressed as an annual percentage of the scheme property value;

- (d) Manager's charge on an exchange of units: for an AUT that is an umbrella scheme, a statement authorising the manager to make a percentage charge or a charge of a fixed amount on the exchange of units in one sub-fund for units in another (other than the first such exchange by a unitholder in any one annual accounting period) and specifying what the maximum of that percentage or amount may be;

- (e) Manager's charge on redemption: a statement authorising the manager to deduct a redemption charge out of the proceeds of redemption;

- (f) Trustee's remuneration: a statement authorising any payments to the trustee by way of remuneration for its services to be paid (in whole or in part) out of the scheme property and specifying the basis on which that remuneration is to be determined and how it should accrue and be paid;

- (g) Constituents of property, permitted transactions and borrowing powers: a statement of any of:

- (i) the description of assets which the capital property may consist of;

- (ii) the proportion of the capital property which may consist of an asset of any description;

- (iii) the descriptions of transactions which may be effected on behalf of the AUT;

- (iv) the borrowing powers exercisable in relation to the AUT;

- where they are narrower than those permitted for the type of authorised fund to which the AUT belongs under CIS 5 or CIS 5A (Investment and borrowing powers);

- (h) Restricted economic or geographic objectives: a statement of any restrictions on the geographic areas or economic sectors in which the capital property of the AUT may be invested;

- (i) Classes of units: a statement specifying which of the following classes of unit may be issued:

- (i) income units;

- (ii) accumulation units;

- (iii) limited issue units that are also income units;

- (iv) limited issue units that are also accumulation units.

- (j) Limited categories of unitholder: a provision that holders of units in the AUT apart from the manager must be persons who hold units such that any gain accruing upon the disposal of the units at any time will be wholly exempt from capital gains tax and corporation tax in the United Kingdom other than by reason of residence;

- (k) Certificates

- (i) a provision authorising the issue of bearer certificates, accompanied by a statement of how the holders of bearer certificates are to identify themselves;

- (ii) a provision authorising the trustee to charge a fee for issuing any document recording, or for amending, an entry on the register, other than on the issue or sale of units;

- (l) Income equalisation: a provision for income equalisation including a statement of how income equalisation is to be calculated, paid and accounted for;

- (m) Relevant pension schemes: for a scheme formed with the intention of it being a relevant pension scheme, additional provisions included with a view to the scheme's satisfying the requirements of HM Revenue and Customs (Pension Schemes Office and National Insurance Contributions Office), or those of any agency which may regulate a relevant pension scheme from time to time;

- (n) Relevant charitable schemes: for an AUT formed with the intention of it being a relevant charitable scheme, additional provisions included with a view to the AUT qualifying as a relevant charitable scheme and to the maintenance of its tax status after it has qualified.

- (2) The trust deed of an AUT may also include any provision:

- (a) dealing with a matter not referred to in CIS 2.2.6 R (Matters that must be included in the trust deed) or this guidance (CIS 2.2.7 G) the inclusion of which serves to enable the AUT, the manager or the trustee to obtain any privilege or power conferred by the rules in this sourcebook; or

- (b) which is expressly contemplated in this sourcebook.

- 21/04/2005

Relationship between trust deed and rules in this sourcebook

CIS 2.2.8

See Notes

- 01/11/2002

CIS 2.3

UCITS obligations

- 01/12/2004

Application

UCITS schemes

CIS 2.3.2

See Notes

- 01/11/2002

Requirements

CIS 2.3.3

See Notes

- 01/12/2004

Outward passporting of UCITS schemes

CIS 2.3.4

See Notes

- 01/12/2004

CIS 2.4

Share classes

- 01/12/2004

Application

Classes of shares in an ICVC

CIS 2.4.2

See Notes

- 01/11/2002

Classes of shares other than those listed in CIS 2.4.2 G

CIS 2.4.3

See Notes

- 01/12/2004

What are currency class shares?

CIS 2.4.4

See Notes

- 01/12/2004

Currency class shares: requirements

CIS 2.4.5

See Notes

- 01/12/2004

What are limited issue shares?

CIS 2.4.5A

See Notes

- 01/11/2002

Limited issue shares: requirements

CIS 2.4.5B

See Notes

- 01/11/2002

Rights of share classes

CIS 2.4.6

See Notes

- 01/12/2004

CIS 2.5

Denomination of shares and their sub-division and consolidation

- 01/12/2004

Application

CIS 2.5.1

See Notes

- 01/12/2004

Characteristics of larger and smaller denomination shares

CIS 2.5.2

See Notes

- 01/12/2004

Requirement

CIS 2.5.3

See Notes

- 01/12/2004

Sub-division and consolidation of shares

CIS 2.5.4

See Notes

- 01/12/2004

CIS 2.6

Units and classes of units in AUTs

- 01/12/2004

CIS 2.6.1

See Notes

- 01/11/2002

CIS 2.6.2

See Notes

- 01/11/2002

What are limited issue units?

CIS 2.6.3

See Notes

- 01/11/2002

Limited issue units: requirements

CIS 2.6.4

See Notes

- 01/11/2002

CIS 2.7

Undesirable and misleading names

- 01/12/2004

CIS 2.7.1

See Notes

- 01/11/2002

CIS 2.7.2

See Notes

- 01/11/2002

CIS 2.7.3

See Notes

- 01/11/2002

CIS 2.7.4

See Notes

- 01/11/2002

CIS 2.8

Guarantees and Capital Protection

- 01/12/2004

Application

CIS 2.8.1

See Notes

- 01/11/2002

Conflicts of interest

CIS 2.8.2

See Notes

- 01/11/2002

CIS 3

Prospectus

CIS 3.1

Introduction

- 01/12/2004

Application

CIS 3.1.1

See Notes

- 01/12/2004

CIS 3.1.2

See Notes

- 01/12/2004

Purpose

CIS 3.1.3

See Notes

- 13/02/2004

CIS 3.2

Drawing up and availability of prospectus

- 01/12/2004

Drawing up of prospectus

CIS 3.2.1

See Notes

- 13/02/2004

Availability of prospectus

CIS 3.2.2

See Notes

- 13/02/2004

CIS 3.3

False or misleading prospectus

- 01/12/2004

Requirement

CIS 3.3.1

See Notes

- 01/12/2004

CIS 3.4

Revision of and changes to prospectus

- 01/12/2004

Revision of prospectus

CIS 3.4.1

See Notes

- 01/12/2004

Changes to prospectus

CIS 3.4.2

See Notes

- 01/08/2002

CIS 3.5

Information to be contained in the prospectus

- 01/12/2004

Matters to be included in the prospectus

CIS 3.5.1

See Notes

- 01/12/2004

CIS 3.5.2

See Notes

Contents of the prospectus

This table belongs to CIS 3.5.2 R

| 1 | A prominent statement that this document is the prospectus or scheme particulars, of the authorised fund valid as at (and dated). | |||

| 2 | Description of the authorised fund Information detailing: |

|||

| (1) | the name of the authorised fund; | |||

| (2) | that the authorised fund is either an ICVC or an AUT; | |||

| (3) | the relevant category of authorised fund; | |||

| (4) | that the shareholders of an ICVC are not liable for the debts of the authorised fund; | |||

| (5) | the registered number of the ICVC; | |||

| (6) | the address of the ICVC's head office; | |||

| (7) | the effective date of the authorisation order made by the FSA; | |||

| (8) | if the duration of the authorised fund is not unlimited, when it will or may terminate; | |||

| (9) | the address of the place in the United Kingdom for service on the ICVC of notices or other documents required or authorised to be served on it; | |||

| (10) | the base currency for the authorised fund; | |||

| (11) | the maximum and minimum sizes of the ICVC's capital; and | |||

| (12) | the circumstances in which the authorised fund may be wound up under the rules in this sourcebook and a summary of the procedure for, and the rights of holders under, such a winding up. | |||

| 3 | Investment objectives and policy | |||

| (1) | Sufficient information to enable a holder to ascertain: | |||

| (a) | the investment objectives of the authorised fund or of each sub-fund of an umbrella scheme; | |||

| (b) | the authorised fund's investment policy for achieving those investment objectives, including the general nature of the portfolio and any intended specialisation; and | |||

| (c) | the extent (if any) to which that policy does not envisage remaining fully invested at all times. | |||

| (2) | Where, in accordance with CIS 8.3.5 R (Allocation of payments to capital or income - for ICVCs) or CIS 8.5.7 R (Allocation of payments to capital or income - for AUTs), all or any part of any payments permitted by CIS 8.2.3 R (Payments by an ICVC to an ACD) or CIS 8.5.1 R (Managers periodic charge) and any other charges or expenses of the authorised fund are is to be treated as a capital expense, a statement that this may constrain capital growth. | |||

| (3) | A description of any restrictions in the assets in which investment may be made, including restrictions in the extent to which the authorised fund may invest in any category of asset, indicating (where appropriate) where the restrictions are tighter than those imposed by CIS 5 or CIS 5A (Investment and borrowing powers), whichever is relevant to the scheme. | |||

| (4) | A list of any individual eligiblesecurities and derivatives markets through which the authorised fund may invest or deal in accordance with CIS 5.2.12 R or CIS 5A.3.3 R (Eligible markets: requirements), whichever is relevant to that scheme. Any securities or derivatives market in a EEA State which is eligible in accordance with CIS 5.2.12 R (1) or CIS 5A.3.3 R (1) (whichever is relevant to that scheme) may be included in the list or referred to in general terms. | |||

| (5) | For an authorised fund that is not a property scheme, state whether it is intended that the scheme will have an interest in any immovable property or tangible movable property. | |||

| (6) | The names of the States, local authorities or public international bodies in whose securities the authorised fund may invest more than 35% of its assets. | |||

| (7) | The policy in relation to the exercise of borrowing powers by the authorised fund and to transactions for the purpose of efficient portfolio management. | |||

| (8) | In the case of an authorised fund which may invest in other collective investment schemes, the extent to which the scheme property may be invested in the units of collective investment schemes which are managed by the authorised fund manager or by an associate of the authorised fund manager. | |||

| (9) | In the case of a property scheme: | |||

| (a) | the maximum extent to which the scheme property may be invested in: | |||

| (i) | immovables; | |||

| (ii) | property related assets; | |||

| (b) | where the directors of an ICVC or the manager of an AUT expect that the scheme property will be invested (during the period when that version of the prospectus may be in circulation) in government and public securities: | |||

| (i) | the fact that the scheme property may be so invested; and | |||

| (ii) | the maximum limit for such investment; | |||

| (c) | the countries or territories of situation of land or buildings in which the authorised fund may invest; | |||

| (d) | the policy of the authorised fund manager in relation to insurance of immovables forming part of the scheme property; and | |||

| (e) | in a prospectus available during the period of the initial offer, the consequences of failure to obtain £5 million (or the equivalent in base currency) as set out in CIS 12.3.4 R (Failure to obtain minimum subscriptions). | |||

| (10) | Where the net asset value of a UCITS scheme is likely to have high volatility owing to its portfolio composition or the portfolio management techniques used, a prominent statement to that effect. | |||

| (11) | Where a UCITS scheme invests principally in collective investment schemeunits, deposits, or derivatives or replicates an index in accordance with CIS 5.2.32 R (Schemes replicating an index) a prominent statement regarding this investment policy. | |||

| (12) | Where derivatives transactions may be used in a UCITS scheme, a prominent statement as to whether these transactions are for the purposes of hedging or meeting the investment objectives or both and the possible outcome of the use of derivatives on the risk profile of the scheme. | |||

| (13) | In the case of a UCITS scheme which invests a substantial proportion of its assets in other collective investment schemes, a statement of the maximum level of management fees that may be charged to that UCITS scheme and to the collective investment schemes in which it invests. | |||

| (14) | In the case of a UCITS scheme, a statement that the investor may obtain on request the types of information (which must be listed) referred to in CIS 3.2.2 R (3). | |||

| (15) | In the case of a UCITS scheme, information concerning the historical performance of the scheme presented in accordance with COB 3.8.11 R (specific non real time financial promotions: past performance). | |||

| (16) | In the case of a UCITS scheme, the profile of the typical investor for whom the scheme is designed. | |||

| 4 | Distributions Information as to: |

|||

| (1) | the date on which the authorised fund'sannual accounting period is to end in each year; | |||

| (2) | if there are interim accounting periods, what they are, and the policy in relation to interim distributions (for example, whether interim distributions will be made and, if so, the policy on smoothing of income distributions within an annual accounting period); | |||

| (3) | the date or dates in each year on or before which payment or accumulation of income is to be made or take place and, if there are holders of bearer certificates, how they are to identify themselves for the purposes of receiving payment of income; | |||

| (4) | if applicable, the policy on payment of income equalisation; | |||

| (5) | how distributable income is determined and paid; and | |||

| (6) | if applicable, that unclaimed distributions may be forfeited and a statement how such unclaimed distributions will be dealt with. | |||

| 5 | The characteristics of units in the authorised fund Give information as to: |

|||

| (1) | where there is more than one class of unit in issue or available for issue, the name of each such class and the rights attached to each class in so far as they vary from the rights attached to other classes; | |||

| (2) | where the instrument constituting the scheme provides for the issue of bearer certificates, that fact and, in the case of an ICVC, in what multiples bearer certificates may be issued; | |||

| (3) | how holders may exercise their voting rights and what these are; | |||

| (4) | where a mandatory redemption, cancellation or conversion of units from one class to another may be required (for instance, if an investor does not satisfy the residence condition for income to be paid or accumulated without tax being deducted), in what circumstances it may be required; | |||

| (5) | in the case of an AUT, the fact that the nature of the right represented by units is that of a beneficial interest under a trust; and | |||

| (6) | in the case of a class of limited issue shares or limited issue units, the restrictions on the issue and sale of those shares or units. | |||

| 6 | The authorised fund manager The following particulars of the authorised fund manager: |

|||

| (1) | its name; | |||

| (2) | the nature of its corporate form; | |||

| (3) | the country or territory of its incorporation; | |||

| (4) | the date of its incorporation; | |||

| (5) | if it is a subsidiary, the name of its ultimate holding company and the country or territory in which that holding company is incorporated; | |||

| (6) | the address of its registered office; | |||

| (7) | the address of its head office if that is different from the address of its registered office; | |||

| (8) | if neither its registered office nor its head office is in the United Kingdom, the address of its principal place of business in the United Kingdom; | |||

| (9) | if the duration of its corporate status is limited, when that status will or may cease; | |||

| (10) | the amount of its issued share capital and how much of it is paid up; | |||

| (11) | in what capacity, if any, it acts in relation to any other regulated collective investment schemes and the name of such schemes; | |||

| (12) | in the case of an ICVC, a summary of the material provisions of the contract between the ICVC and the authorised fund manager which may be relevant to shareholders including provisions (if any) relating to termination, compensation on termination and indemnity; and | |||

| (13) | in the case of an AUT, the names of the directors of the manager and, in each case, any significant business activities of the director not connected with the business of the manager. | |||

| (14) | In the case of a UCITS scheme, which functions the authorised fund manager may delegate. | |||

| 7 | Directors of an ICVC, other than the ACD Other than for the ACD: |

|||

| (1) | the names and positions in the ICVC of the directors; | |||

| (2) | the main business activities of each of the directors (other than those connected with the business of the ICVC) where these are significant to the ICVC's business; | |||

| (3) | the manner, amount and calculation of the remuneration of directors; | |||

| (4) | the main terms of each contract of service between the ICVC and a director in summary form; and | |||

| (5) | if the director is a body corporate in a group of which any other corporate director of the ICVC is a member, a statement of that fact. | |||

| 8 | The depositary The following particulars of the depositary: |

|||

| (1) | its name; | |||

| (2) | the nature of its corporate form; | |||

| (3) | the country or territory of its incorporation; | |||

| (4) | if it is a subsidiary, the name of its ultimate holding company and the country or territory in which that holding company is incorporated; | |||

| (5) | the address of its registered office; | |||

| (6) | the address of its head office if that is different from the address of its registered office; | |||

| (7) | if neither its registered office nor its head office is in the United Kingdom, the address of its principal place of business in the United Kingdom; | |||

| (8) | a description of its principal business activity; and | |||

| (9) | a summary of the material provisions of the contract between the ICVC or the manager of the AUT and the depositary which may be relevant to unitholders, including provisions relating to the remuneration of the depositary. | |||

| 9 | The investment adviser If an investment adviser is retained in connection with the business of the authorised fund: |

|||

| (1) | its name; | |||

| (2) | whether or not it is authorised by the FSA; | |||

| (3) | if it is a body corporate in a group of which any director of the ICVC or the manager of the AUT is a member; | |||

| (4) | where its principal activity is not providing services to the authorised fund as an investment adviser, what the principal activity is; | |||

| (5) | a summary of the material provisions of any contract between the authorised fund manager or the ICVC and any investment adviser which may be relevant to holders and, if the investment adviser has the authority of the authorised fund manager or the ICVC to make decisions on behalf of the authorised fund manager or the ICVC, that fact and a description of the matters in relation to which it has that authority. | |||

| 10 | The auditor Details of the name and address of the auditor of the authorised fund. |

|||

| 11 | The register of holders Details of: |

|||

| (1) | the address in the United Kingdom where the register of holders is kept and can be inspected by holders and the address where the plan register can be inspected; and | |||

| (2) | in the case of an AUT, (unless the depositary is the registrar), the registrar's name and address. | |||

| 12 | Payments to the authorised fund manager The payments that may be made to the authorised fund manager (whether as such or in any other capacity) out of the scheme property whether by way of remuneration for its services, or reimbursement of expenses. For each category of remuneration, specify: |

|||

| (1) | the maximum and current rates or amounts of such remuneration; | |||

| (2) | how it will be calculated and accrue and when it will be paid; | |||

| (3) | if notice has been given to holders of the authorised fund manager's intention to introduce a new category of remuneration for its services or to increase any rate or amount currently charged, particulars of that introduction or increase and when it will take place; | |||

| (4) | if, in accordance with CIS 8.3.5 R (Allocation of payments to capital or to income (for ICVCs)) or CIS 8.5.7 R (Allocation of payments to capital or to income (for AUTs)), all or part of the remuneration is to be treated as a capital charge: | |||

| (a) | that fact; and | |||

| (b) | the actual or maximum amount of the charge which may be so treated; and | |||

| (5) | if notice has been given to holders of an intention to propose an increase in the maximum amount of that charge at a meeting of holders, particulars of that proposal. | |||

| 13 | Other payments out of the scheme property Provide details of: |

|||

| (1) | any payment to be made out of the scheme property to reimburse costs incurred by the depositary, any of the directors of an ICVC or any third party; | |||

| (2) | any remuneration (including a statement of the maximum level currently permitted) payable out of the scheme property to the depositary or any third party; | |||

| (3) | any remuneration (including a statement of the maximum level currently permitted) to which (2) does not apply, payable out of the scheme property for services provided by an affected person; | |||

| (4) | the types of any other charges and expenses that may be taken out of the scheme property; and | |||

| (5) | if, in accordance with CIS 8.3.5 R (4) (Allocation of payments to capital or income (for ICVCs)) or CIS 8.5.7 R (4) (Allocation of payments to capital or income (for AUTs)), the authorised fund manager and the depositary have agreed that all or part of any payments permitted (excluding any stated under CIS 3.5.2 R(12)(4) (Payments to the authorised fund manager)) and any other charges or expenses of the authorised fund may be treated as a capital expense: | |||

| (a) | that fact; and | |||

| (b) | the policy for the amount of the payments which may be so treated. | |||

| 14 | Movable and immovable property (ICVC only) Give an estimate of any expenses likely to be incurred by the ICVC in respect of movable and immovable property in which the ICVC has an interest. |

|||

| 15 | Amortisation (ICVC only) As at the date of the prospectus: |

|||

| (1) | the amount of any set-up costs (including any of the type described in CIS 8.3.4 R (Set-up costs) remaining to be reimbursed out of the scheme property whether to the ACD or any other person, and | |||

| (2) | the amount of any costs remaining to be amortised under CIS 8.3.4 R and the method of amortisation. | |||

| 16 | Sale and redemption of units Details as to: |

|||

| (1) | the dealing days and times in the dealing day on which the authorised fund manager will be available to receive requests for the sale and redemption of units; | |||

| (2) | the procedures for effecting the sale and redemption of units and the settlement of transactions; | |||

| (3) | whether certificates will be issued in respect of registered units; | |||

| (4) | the steps required to be taken by a holder in redeeming units before he can receive the proceeds; | |||

| (5) | the circumstances in which the redemption of units may be suspended; | |||

| (6) | the days and times in the day on which recalculation of the price will commence; | |||

| (7) | the amounts of the following minima (if they apply) for each class of unit in the authorised fund: | |||

| (a) | the minimum number or value of units which any one person may hold; and | |||

| (b) | the minimum number or value of units which may be the subject of any one transaction of sale or redemption; | |||

| (8) | the circumstances in which the authorised fund manager may arrange for, and the procedure for, a cancellation of units in specie; | |||

| (9) | where and at what frequency the most recent prices will be published; | |||

| (10) | the investment exchanges (if any) on which units in the scheme are listed or dealt; and | |||

| (11) | for a dual-priced scheme or a scheme being valued on an historic price basis, the amount which constitutes a large deal in units. | |||

| 17 | Valuation of scheme property Details as to: |

|||

| (1) | how frequently and at what time or times of the day the scheme property will be regularly valued for the purpose of determining the price at which units in the scheme may be purchased from or redeemed by the authorised fund manager and a description of any circumstance in which the scheme property may be specially valued; | |||

| (2) | in relation to each purpose for which the scheme property must be valued, the basis on which it will be valued; and | |||

| (3) | (in the case of an ICVC) how the price of units of each class will be determined. | |||

| 18 | Dilution In the case of an ICVC or a single-priced AUT: |

|||

| (1) | what is meant by: (a) dilution, (b) dilution levy or dilution adjustment (as the case may be) and (c) for the purposes of (4)(a), large deals; | |||

| (2) | a statement that it is not possible to predict accurately whether dilution would occur at any point in time; | |||

| (3) | a statement of which one of the following policies the authorised fund manager is adopting: (a) it may require a dilution levy; or (b) it may make a dilution adjustment; or (c) it will not require a dilution levy or make a dilution adjustment; together with an explanation of how this policy may affect the future growth of the authorised scheme; and |

|||

| (4) | if the authorised fund manager may require a dilution levy or make a dilution adjustment: (a) a statement of the authorised fund manager's policy in deciding when to require dilution levy, including the authorised fund manager's policy on large deals, or to make a dilution adjustment; (b) a statement, based either on historical data or future projections, of the estimated rate or amount of any dilution levy or dilution adjustment; and (c) a statement as to the likelihood that the authorised fund manager may require a dilution levy or make a dilution adjustment and the basis (that is, historical or projected) on which the statement is made. |

|||

| 19 | SDRT provision Details as to: |

|||

| (1) | what is meant by stamp duty reserve tax, SDRT provision and, for the purposes of (2), by large deal; and | |||

| (2) | the authorised fund manager's policy on imposing an SDRT provision including its policy on large deals, and the occasions, and the likely frequency of the occasions, in which an SDRT provision may be imposed and the maximum rate of it; a usual rate may also be stated. | |||

| 20 | Forward and historic pricing The authorised fund manager's normal basis of dealing (whether at a forward price, or at an historic price, or on the basis of a switch from the latter to the former in every dealing period). |

|||

| 21 | Preliminary charge If the authorised fund manager makes a preliminary charge: |

|||

| (1) | the maximum amount of that charge, expressed either as a fixed amount or as a percentage of the issue price; | |||

| (2) | the current rate or amount of preliminary charge, if different from the maximum amount or rate; and | |||

| (3) | if notice has been given to unitholders of the authorised fund manager's intention to introduce a preliminary charge or to increase the rate or amount currently charged, particulars of that introduction or increase and when it will take effect. | |||

| 22 | Redemption charge If the authorised fund manager may make a redemption charge: |

|||

| (1) | the amount of that charge or, if it is variable, the rate or method of arriving at it; | |||

| (2) | if the amount or rate or method has been changed, that details of any previous amount or rate or method may be obtained from the authorised fund manager on request; | |||

| (3) | if notice has been given of an intention to introduce a redemption charge or to propose a change in the amount or rate or method which is adverse to holders, particulars of that proposal; and | |||

| (4) | how the order in which units acquired at different times by a unitholder is to be determined so far as necessary for the purposes of the imposition of the redemption charge. | |||

| 23 | General information Details as to: |

|||

| (1) | when annual and half-yearly reports will be published and, if the directors of the ICVC or the manager of the AUT have determined that the accounts contained in the report should be short form accounts, a statement that a report containing the full accounts is available on request; | |||

| (1A) | if the authorised fund manager determined that short form reports are to be prepared for the purposes of CIS 10.5.2R (2A)(2), a statement when the short report will be sent to the unitholders. | |||

| (2) | the address at which copies of the instrument constituting the scheme, any amending instrument and the most recent annual and half-yearly reports may be inspected and from which copies may be obtained; | |||

| (3) | (in the case of dual-priced AUTs only) that the cancellationprice last notified to the trustee is available on request; | |||

| (4) | how the ICVC or the manager of an AUT will publish, for the benefit of holders of bearer certificates, notice: | |||

| (a) | of the fact that annual and half-yearly reports are available for inspection and how copies may be obtained; | |||

| (b) | when a distribution of income will become payable and how it may be collected; | |||

| (c) | of the calling of meetings; | |||

| (d) | of the winding up of the authorised fund (or the termination of a sub-fund of an umbrella scheme) or the revocation of its authorisation; | |||

| (e) | that amendments have been made to the instrument constituting the scheme; | |||

| (f) | that a significant alteration has been made to the prospectus; and | |||

| (g) | of any sub-division or consolidation of units (other than a consolidation of smaller denomination shares into larger denomination shares); and | |||

| (5) | the extent to which and the circumstances in which: | |||

| (a) | the scheme is liable to pay or suffer tax on any appreciation in the value of the scheme property or on the income derived from the scheme property; and | |||

| (b) | deductions by way of withholding tax may be made from distributions of income to holders and payments made to holders on the redemption of units. | |||

| (6) | In the case of a UCITS scheme, any possible fees or expenses not described in paragraphs 12-22, distinguishing between those to be paid by a holder and those to be paid out of scheme property. | |||

| 24 | Umbrella scheme | |||

| (1) | In the case of an umbrella scheme: | |||

| (a) | that a holder is entitled to exchange units in one sub-fund for units in any other sub-fund (other than limited issue units or limited issue shares); | |||

| (b) | that an exchange of units in one sub-fund for units in any other sub-fund is treated as a redemption and sale and will, for persons subject to United Kingdom taxation, be a realisation for the purposes of capital gains taxation; | |||

| (c) | that in no circumstances will a holder who exchanges units in one sub-fund for units in any other sub-fund be given a right by law to withdraw from or cancel the transaction; | |||

| (d) | what charges, if any, may be made on exchanging units in one sub-fund for units in any other sub-fund; | |||

| (e) | the policy for allocating between sub-funds any assets of, or costs, charges and expenses payable out of, the scheme property which are not attributable to any particular sub-fund; | |||

| (f) | (for ICVCs only) how the method of amortisation of any costs to be amortised under CIS 8.3.4 R (Set-up costs), or any reimbursement of set-up costs may be affected by the introduction or termination of a sub-fund; | |||

| (g) | (for ICVCs only) in respect of each sub-fund, the currency in which the scheme property allocated to it will be valued and the price of units calculated and payments made, if this currency is not the base currency of the umbrella scheme; and | |||

| (h) | if there are units for less than two sub-funds in issue, the effect of CIS 12.5.5 R (An ICVC with only one sub-fund). | |||

| (2) | In the application of these rules to an umbrella scheme, information required: | |||

| (a) | must be stated in relation to each sub-fund where the information for any sub-fund differs from that for any other; | |||

| (b) | must be stated for the umbrella scheme as a whole, but only where the information is relevant to the umbrella scheme as a whole; and | |||

| (c) | must, in the case of an ICVC, contain a statement to the effect that the sub-funds of an umbrella scheme are not "ring fenced" and in the event of an umbrella scheme being unable to meet liabilities attributable to any particular sub-fund out of the assets attributable to that sub-fund, the remaining liabilities may have to be met out of the assets attributable to other sub-funds. | |||

| 25 | Marketing in another EEA State A prospectus of a UCITS scheme which is prepared for the purpose of marketingunits in a EEA State other than the United Kingdom must give details as to: |

|||

| (1) | what special arrangements have been made: | |||

| (a) | for paying in that EEA State amounts distributable to holders resident in that EEA State; | |||

| (b) | for redeeming in that EEA State the units of holders resident in that EEA State; | |||

| (c) | for inspecting and obtaining copies in that EEA State of the instrument constituting the scheme and amendments to it, of the prospectus and of the annual and half-yearly reports; and | |||

| (d) | for making public the price or prices of units of each class; | |||

| (2) | how the ICVC or the manager of an AUT will publish in that EEA State notice: | |||

| (a) | that annual and half-yearly reports are available for inspection; | |||

| (b) | that a distribution has been declared; | |||

| (c) | of the calling of a meeting of holders; and | |||

| (d) | of the termination of the authorised fund or the revocation of its authorisation. | |||

| 26 | Additional information Any other material information which is within the knowledge of the directors of an ICVC or the manager of an AUT, or which the directors or manager would have obtained by the making of reasonable enquiries: |

|||

| (1) | which investors and their professional advisers would reasonably require, and reasonably expect to find in the prospectus, for the purpose of making an informed judgement about the merits of investing in the authorised fund and the extent and characteristics of the risks accepted by so participating; | |||

| (2) | including a statement of any risks which investment in the authorised fund may reasonably be regarded as presenting for reasonably prudent investors of moderate means; and | |||

| (3) | including, if there is any arrangement intended to result in a particular capital or income return from a holding of units in the authorised fund, or any investment objective of giving protection to the capital value of, or income return from, such a holding: | |||

| (a) | details of that arrangement or protection; | |||

| (b) | for any related guarantee, sufficient details about the guarantor and the guarantee to enable a fair assessment of the value of the guarantee; | |||

| (c) | a description of the risks that could affect achievement of that return or protection; and | |||

| (d) | details of the arrangements by which the authorised fund manager will notify holders of any action required by the holders to obtain the benefit of the guarantee, if appropriate; these arrangements must provide for notice to be given a reasonable amount of time before the action is required. | |||

- 01/04/2005

CIS 4

Single-pricing and dealing

CIS 4.1

Introduction

- 01/12/2004

Application

CIS 4.1.1

See Notes

- 01/11/2002

Persons to whom the provisions apply

CIS 4.1.2

See Notes

- 01/12/2004

Purpose

CIS 4.1.3

See Notes

- 01/08/2002

Explanation of this chapter

CIS 4.1.4

See Notes

- 01/08/2002

CIS 4.2

Initial offers

- 01/12/2004

Application

CIS 4.2.1

See Notes

- 01/12/2004

Purpose

CIS 4.2.2

See Notes

- 01/12/2004

Period of initial offer

CIS 4.2.3

See Notes

- 01/12/2004

Issue of units: initial offer

CIS 4.2.4

See Notes

- 01/12/2004

Compulsory termination of initial offer

CIS 4.2.5

See Notes

- 01/08/2002

CIS 4.3

Issue and cancellation

- 01/12/2004

Application

CIS 4.3.1

See Notes

- 01/12/2004

Purpose

CIS 4.3.2

See Notes

- 01/12/2004

Issue and cancellation of shares by an ICVC

CIS 4.3.3

See Notes

- 01/12/2004

Issue and cancellation of units in an AUT

CIS 4.3.4

See Notes

- 01/12/2004

Trustee's refusal to issue or cancel units

CIS 4.3.5

See Notes

- 01/11/2002

Instructions or notifications between the manager and trustee

CIS 4.3.6

See Notes

- 01/12/2004

Payment for units issued

CIS 4.3.7

See Notes

- 01/12/2004

Box management errors

CIS 4.3.8

See Notes

- 01/12/2004

Issue of units to meet authorised fund manager's obligation to sell

CIS 4.3.9

See Notes

- 01/12/2004

Cancellation and payment for cancelled units

CIS 4.3.10

See Notes

- 01/11/2002

Price of a unit

CIS 4.3.11

See Notes

- 01/08/2002

Modification to number of units issued or cancelled

CIS 4.3.12

See Notes

- 01/12/2004

CIS 4.4

Sale and redemption

- 01/12/2004

Application

CIS 4.4.1

See Notes

- 01/12/2004

Purpose

CIS 4.4.2

See Notes

- 01/12/2004

Authorised fund manager's obligation to sell

CIS 4.4.3

See Notes

- 01/04/2004

Authorised fund manager's obligation to redeem

CIS 4.4.4

See Notes

- 01/12/2004

Payment on redemption

CIS 4.4.5

See Notes

- 01/12/2004

Proceeds of redemption

CIS 4.4.6

See Notes

- 01/12/2004

Notification of price to the depositary

CIS 4.4.7

See Notes

- 01/08/2002

Publication of prices

CIS 4.4.8

See Notes

- 01/04/2005

Manner of price publication

CIS 4.4.9

See Notes

- 01/04/2005

CIS 4.5

Issues and cancellations through the authorised fund manager and in specie cancellations

- 01/12/2004

Application

CIS 4.5.1

See Notes

- 01/12/2004

Purpose

CIS 4.5.2

See Notes

- 01/12/2004

Issues and cancellations through the authorised fund manager

CIS 4.5.3

See Notes

- 01/11/2002

In specie redemption

CIS 4.5.4

See Notes

- 01/12/2004

CIS 4.6

Dilution and SDRT provision

- 01/12/2004

Application

CIS 4.6.1

See Notes

- 01/12/2004

Purpose

CIS 4.6.2

See Notes

- 01/08/2002

Dilution levy and SDRT provision

CIS 4.6.3

See Notes

- 01/08/2002

Dilution adjustment

CIS 4.6.4

See Notes

- 01/08/2002

Dilution adjustment guidance

CIS 4.6.5

See Notes

- 01/08/2002

CIS 4.7

Forward and historic pricing

- 01/12/2004

Application

CIS 4.7.1

See Notes

- 01/12/2004

Purpose

CIS 4.7.2

See Notes

- 01/12/2004

Explanation

CIS 4.7.3

See Notes

- 01/12/2004

Forward and historic pricing

CIS 4.7.4

See Notes

- 01/12/2004

CIS 4.7.5

See Notes

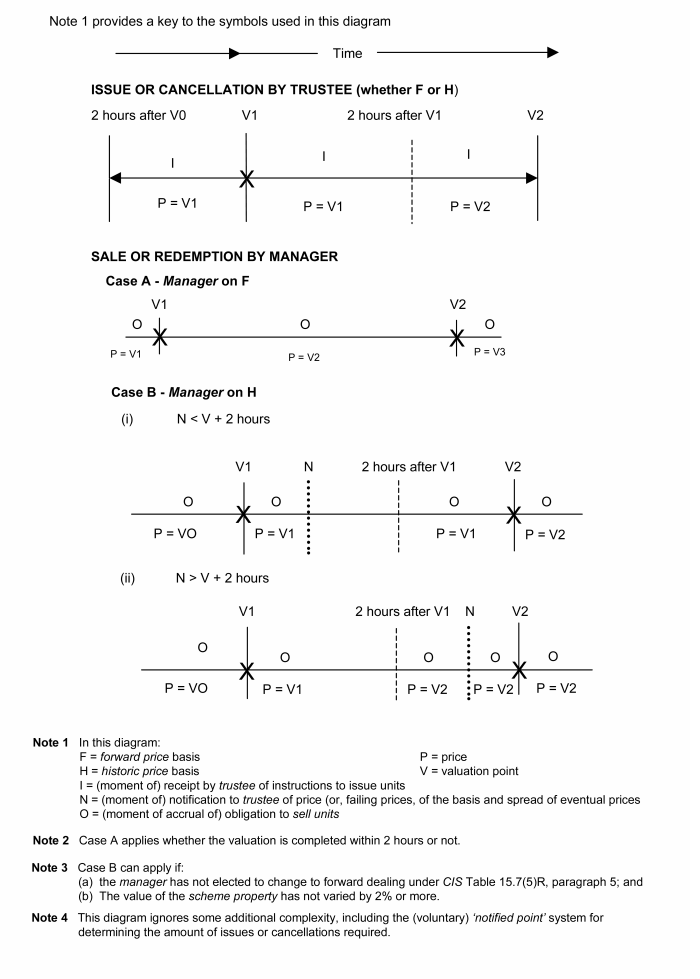

Forward or historic pricing

This table belongs to CIS 4.7.4 R

| Forward or historic pricing | |

| Part 1: General Dealing | |

| 1. | Authorised fund manager's choice. The prospectus must state the authorised fund manager's choice for H or else for F Only. |

| 2. | If the authorised fund manager's current choice under 1. is F Only, all its deals must be at a forward price. |

| 3. | An authorised fund manager must not choose H if its normal arrangements for valuation envisage valuations more than one business day apart. |

| 4. | The remainder of this table applies to an authorised fund manager with a current choice of H. |

| 5. | It may at any time elect for F Only in respect of the rest of the then current dealing period. |

| 6. | If the authorised fund manager binds itself to switch from H to F only at a certain point in each dealing period this must be stated in the prospectus |

| 7. | An election for (or switch to) F Only will last until the end of the dealing period and will then lapse. |

| 8. | For general dealing purposes, redemptions must be on the same basis as sales. |

| Part 2: General Dealing - Duty to adopt forward pricing | |

| 9. | Market movement. F Only applies once the authorised fund manager knows or has reason to believe that there would be a difference of 2% or more between the current value of the scheme property, if immediately valued, and its last calculated value (taking that as 100% for this purpose), but decides not to carry out an additional valuation under CIS 4.8.6 R (Additional valuation points). |

| 10. | Valuation taking over 2 hours. F Only applies if a new price for units of each class has not been notified to the depositary after 2 hours (or such longer period as the depositary may agree with the authorised fund manager generally or in any specific case) from the valuation point. |

| 11. | F Only under 9 and 10 will start when the relevant moment arrives, will last until the end of the dealing period and will then lapse. |

| Part 3: Individual Deviations | |

| 12. | Paragraphs 13 to 16 apply to an individual transaction without affecting the general position arrived at under Parts 1 and 2. |

| 13. | Request. F only applies if the applicant for sale or redemption so requests. |

| 14. | Large deals: F only applies, if the authorised fund manager so decides, for a large deal. |

| 15. | Postal deals: F only applies if the order or offer reaches the authorised fund manager through the post or by any similar form of one-way communication. |

| 16. | Issue or cancellation through the authorised fund manager F Only applies in the case of an issue or cancellation under CIS 4.5.3 R (Issues and cancellations through the authorised fund manager). |

| Part 4: Notification to Depositary | |

| 17. | The authorised fund manager must notify the depositary of the fact and time of any adoption of F only under 5 or Part 2. |

- 01/12/2001

CIS 4.8

Valuation

- 01/12/2004

Application

CIS 4.8.1

See Notes

- 01/12/2004

Purpose

CIS 4.8.2

See Notes

- 01/12/2004

Valuation: requirements

CIS 4.8.3

See Notes

- 01/04/2004

Valuation: method

CIS 4.8.4

See Notes

- 01/12/2004

Regular valuation points

CIS 4.8.5

See Notes

- 01/12/2004

Additional valuation points

CIS 4.8.6

See Notes

- 01/12/2004

Market movement

CIS 4.8.7

See Notes

- 01/12/2004

CIS 5

Investment and borrowing powers

CIS 5.1

Introduction

- 01/12/2004

Application

CIS 5.1.1

See Notes

- 01/11/2002

Application guidance

CIS 5.1.2

See Notes

- 01/11/2002

Purpose

CIS 5.1.3

See Notes

- 01/11/2002

Explanation of this chapter

CIS 5.1.4

See Notes

- 01/11/2002

Distinct meaning of certain terms

CIS 5.1.5

See Notes

- 01/11/2002

CIS 5.1.6

See Notes

Indicative overview of investment and borrowing powers

This table belongs to CIS 5.1.4 G.

| UCITS Scheme Investments and investment techniques | Limits |

| Approved securities | Yes |

| Transferable but not approved securities | 10% |

| Government and public securities | Yes |

| Units | Yes |

| Warrants | Yes |

| Investment trusts | Yes |

| Deposits | Yes |

| Derivatives | Yes |

| Immovables | No |

| Gold | No |

| Hedging | Yes |

| Stocklending | Yes |

| Underwriting | Yes |

| Borrowing | 10% |

| Cash and near cash | Yes |

| Note | Meaning of terms used |

| "Yes" | Can be invested in without specific upper limit (though there may be limits of other kinds). |

| "No" | Not available for investment. |

| A percentage | An upper limit (though there may be limits of other kinds). |

- 01/11/2002

CIS 5.2

General investment powers and limits for UCITS schemes

- 01/12/2004

Application

CIS 5.2.1

See Notes

- 01/11/2002

Explanation of CIS 5.2

CIS 5.2.2

See Notes

- 01/11/2002

Prudent spread of risk

CIS 5.2.3

See Notes

- 01/11/2002

Investment powers: general

CIS 5.2.4

See Notes

- 01/11/2002

Valuation

CIS 5.2.5

See Notes

- (1) In this chapter, the value of the scheme property of an authorised fund means the net value of the scheme property determined in accordance with CIS 4.8 (Valuation) (for ICVCs and single-priced AUTs) or CIS 15.8 (Valuation) (for dual-priced AUTs), after deducting any outstanding borrowings, whether immediately due to be repaid or not.

- (2) When valuing the scheme property for this chapter:

- (a) the time as at which the valuation is being carried out ("the relevant time") is treated as if it were a valuation point, but the valuation and the relevant time do not count as a valuation or a valuation point for the purposes of CIS 4 (for ICVCs and single-priced AUTs) and CIS 15 (for dual-priced AUTs);

- (b) initial outlay is regarded as remaining part of the scheme property;

- (c) if the authorised fund manager, having taken reasonable care, determines that the authorised fund will become entitled to any unrealised profit which has been made on account of a transaction in derivatives, that prospective entitlement is regarded as part of the scheme property; and

- (d) for a dual-priced AUTs, when applying CIS 15.8.4 R (Valuation):

- (i) the cancellation basis only is required; and

- (ii) paragraphs 1 to 8, 11 and 23 are not applicable.

- 01/11/2002

Valuation

CIS 5.2.6

See Notes

- 01/11/2002

Chapter to be construed as a whole

CIS 5.2.7

See Notes

- 01/11/2002

Examples

CIS 5.2.8

See Notes

- 01/11/2002

Transferable securities

CIS 5.2.9

See Notes

- 01/11/2002

UCITS schemes: general

CIS 5.2.10

See Notes

- 01/11/2002

Eligible markets regime: purpose

CIS 5.2.11

See Notes

- 01/11/2002

Eligible markets regime

CIS 5.2.12

See Notes

- (1) A market is eligible for the purposes of the rules in this sourcebook if it is:

- (a) a regulated market; or

- (b) a market in an EEA State which is regulated, operates regularly and is open to the public.

- (2) A market not falling within (1) is eligible for the purposes of the rules in this sourcebook if:

- (a) the authorised fund manager, after consultation and notification with the depositary (and in the case of an ICVC, any other directors), decides that market is appropriate for investment of, or dealing in, the scheme property;

- (b) the market is included in a list in the prospectus; and

- (c) the depositary has taken reasonable care to determine that:

- (i) adequate custody arrangements can be provided for the investment dealt in on that market; and

- (ii) all reasonable steps have been taken by the authorised fund manager in deciding whether that market is eligible.

- (3) In (2), a market must not be considered appropriate unless it:

- (a) is regulated;

- (b) operates regularly;

- (c) is recognised;

- (d) is open to the public;

- (e) is adequately liquid; and

- (f) has adequate arrangements for unimpeded transmission of income and capital to or to the order of investors.

- 01/11/2002

Spread: general

CIS 5.2.13

See Notes

- 01/03/2005

Guidance on spread: general

CIS 5.2.13A

See Notes

- 01/03/2005

Spread: government and public securities

CIS 5.2.14

See Notes

- 01/04/2004

Investment in collective investment schemes

CIS 5.2.15

See Notes

- 01/04/2004

Qualifying non-UCITS collective investment schemes

CIS 5.2.16

See Notes

- 01/04/2004

Investment in associated collective investment schemes

CIS 5.2.17

See Notes

- 01/12/2004

Investment in other group schemes

CIS 5.2.18

See Notes

- 01/11/2002

Investment in warrants and nil and partly paid securities

CIS 5.2.19

See Notes

- 01/04/2004

Investment in money market instruments

CIS 5.2.20

See Notes

- 01/04/2004

Derivatives: general

CIS 5.2.21

See Notes

- 01/11/2002

Permitted transactions (derivatives and forwards)

CIS 5.2.22

See Notes

- 01/04/2004

Transactions for the purchase of property

CIS 5.2.23

See Notes

- 01/11/2002

Requirement to cover sales

CIS 5.2.24

See Notes

- 01/11/2002

Guidance on requirement to cover sales

CIS 5.2.24A

See Notes

- 01/03/2005

OTC transactions in derivatives

CIS 5.2.25

See Notes

Any transaction in an OTC derivative under CIS 5.2.22 R (1)(b) must be:

- (1) in a future or an option or a contract for differences;

- (2) with an approved counterparty; a counterparty to a transaction in derivatives is approved only if the counterparty is:

- (a) an eligible institution or an approved bank; or

- (b) a person whose permission (including any requirements or limitations), as published in the FSA Register or whose Home State authorisation, permits it to enter into the transaction as principal off-exchange;

- (3) on approved terms; the terms of the transaction in derivatives are approved only if, before the transaction is entered into, the depositary is satisfied that the counterparty has agreed with the ICVC or the manager:

- (a) to provide a reliable and verifiable valuation in respect of that transaction (which, for dual-priced AUTs should be on a buying and selling basis) at least daily and at any other time at the request of the ICVC or manager; and

- (b) that it will, at the request of the ICVC or manager, enter into a further transaction to close out that transaction at any time, at a fair value arrived at under the pricing model or other reliable basis agreed under (4); and

- (4) capable of valuation; a transaction in derivatives is capable of valuation only if the authorised fund manager having taken reasonable care determines that, throughout the life of the derivative (if the transaction is entered into), it will be able to value the investment concerned with reasonable accuracy:

- (a) on the basis of the pricing model which has been agreed between the authorised fund manager and the depositary; or

- (b) on some other reliable basis reflecting an up-to-date market value which has been so agreed.

- 01/11/2002

Risk management: derivatives

CIS 5.2.26

See Notes

- 01/04/2004

Risk management process

CIS 5.2.27

See Notes

- 01/03/2005

Investment in deposits

CIS 5.2.28

See Notes

- 01/11/2002

Significant influence for ICVCs

CIS 5.2.29

See Notes

- 01/11/2002

Significant influence for managers of AUTs

CIS 5.2.30

See Notes

- 01/11/2002

Concentration

CIS 5.2.31

See Notes

- 01/11/2002

Schemes replicating an index

CIS 5.2.32

See Notes

- 01/11/2002

Index replication

CIS 5.2.33

See Notes

- 01/11/2002

Relevant indices

CIS 5.2.34

See Notes

- 01/11/2002

CIS 5.3

Derivative exposure

- 01/12/2004

Application

CIS 5.3.1

See Notes

- 01/11/2002

Introduction

CIS 5.3.2

See Notes

- 01/11/2002

Cover for transactions in derivatives and forward transactions

CIS 5.3.3

See Notes

- 01/03/2005

Borrowing

CIS 5.3.4

See Notes

- 01/09/2003

Continuing nature of limits and requirements

CIS 5.3.5

See Notes

- 01/11/2002

CIS 5.4

Stock lending

- 01/12/2004

Application

CIS 5.4.1

See Notes

- 01/11/2002

Stock lending permitted under this section (CIS 5.4)

CIS 5.4.2

See Notes

- 01/11/2002

Stock lending: general

CIS 5.4.3

See Notes

- 01/11/2002

Permitted stock lending

CIS 5.4.4

See Notes

- 01/04/2004

Stock lending: treatment of collateral

CIS 5.4.5

See Notes

- 01/04/2004

Treatment of collateral

CIS 5.4.6

See Notes

- 01/11/2002

Limitation by value

CIS 5.4.7

See Notes

- 01/11/2002

CIS 5.5

Cash, borrowing, lending and other provisions

- 01/12/2004

Application

CIS 5.5.1

See Notes

- 01/11/2002

Cash and near cash

CIS 5.5.2

See Notes

- 01/11/2002

General power to borrow

CIS 5.5.3

See Notes

- 01/11/2002

Borrowing limits

CIS 5.5.4

See Notes

- 01/11/2002

CIS 5.5.5

See Notes

- 01/11/2002

Restrictions on lending of property other than money

CIS 5.5.6

See Notes

- 01/11/2002

General power to accept or underwrite placings

CIS 5.5.7

See Notes

- 01/11/2002

Guarantees and indemnities

CIS 5.5.8

See Notes

- 01/11/2002

Guidance on restricting payments

CIS 5.5.9

See Notes

- 01/11/2002

CIS 5A

Investment and borrowing powers

CIS 5A.1

Introduction

- 01/12/2004

Application

CIS 5A.1.1

See Notes

- 01/11/2002

Application guidance

CIS 5A.1.2

See Notes

- 01/11/2002

Purpose

CIS 5A.1.3

See Notes

- 01/12/2004

Explanation of this chapter

CIS 5A.1.4

See Notes

- 01/11/2002

Distinct meaning of certain terms

CIS 5A.1.5

See Notes

- 01/11/2002

CIS 5A.2

General investment powers and limits for authorised funds

- 01/12/2004

Application

CIS 5A.2.1

See Notes

- 01/12/2004

Explanation of CIS 5A.2

CIS 5A.2.2

See Notes

- 01/12/2004

Prudent spread of risk

CIS 5A.2.3

See Notes

- 01/12/2004

Investment powers: general

CIS 5A.2.4

See Notes

- 01/12/2004

Valuation

CIS 5A.2.5

See Notes

- (1) In this chapter, the value of the scheme property of an authorised fund means the net value of the scheme property determined in accordance with CIS 4.8 (Valuation) (for ICVCs and single-priced AUTs) or CIS 15.8 (Valuation) (for dual-priced AUTs), after deducting any outstanding borrowings (including, in the case of a property scheme, any capital outstanding on a mortgage of an immovable), whether immediately due to be repaid or not.

- (2) When valuing the scheme property for this chapter:

- (a) the time as at which the valuation is being carried out ("the relevant time") is treated as if it were a valuation point, but the valuation and the relevant time do not count as a valuation or a valuation point for the purposes of CIS 4 (for ICVCs and single-priced AUTs) and CIS 15 (for dual-priced AUTs);

- (b) initial outlay is regarded as remaining part of the scheme property;

- (c) if the authorised fund manager having taken reasonable care determines that the authorised fund will become entitled to any unrealised profit which has been made on account of a transaction in derivatives, that prospective entitlement is regarded as part of the scheme property; and

- (d) for a dual-priced AUT, CIS 15.8.4 R (Valuation) applies to any valuation of the scheme property for the purposes of this chapter, and in applying CIS 15.8.4 R (Valuation):

- (i) the cancellation basis only is required; and

- (ii) paragraphs 1 to 8, 11 and 23 are not applicable.

- 01/12/2004

Valuation

CIS 5A.2.6

See Notes

- 01/12/2004

Chapter to be construed as a whole

CIS 5A.2.7

See Notes

- (1) Where a rule in this chapter allows a transaction to be entered into or an investment to be retained only if possible obligations arising out of the investment transactions or out of the retention would not cause any breach of any limits in this chapter:

- (a) it must be assumed that the maximum possible liability of the authorised fund under any other of those rules has also to be provided for; and

- (b) the scheme property must be valued in accordance with CIS 4.8 (Valuation) (for ICVCs and single-priced AUTs) or CIS 15.8 (Valuation) (for dual-priced AUT).

- (2) Where a rule in this chapter permits an investment transaction to be entered into or an investment to be retained only if that investment transaction, or the retention, or other similar transactions, are covered:

- (a) it must be assumed that in applying any of those rules, the authorised fund must also simultaneously satisfy any other obligation relating to cover; and

- (b) no element of cover must be used more than once.

- 01/12/2004

Examples

CIS 5A.2.8

See Notes

- 01/12/2004

Transferable securities

CIS 5A.2.9

See Notes

- 01/12/2004

Investment in associated collective investment schemes

CIS 5A.2.10

See Notes

- 01/12/2004

Investment in other group schemes

CIS 5A.2.11

See Notes

- (1) An authorised fund must not invest in or dispose of units in another collective investment scheme (the second scheme), which is managed or operated by (or in the case of an ICVC, whose ACD is):

- (a) the authorised fund manager of such authorised fund; or

- (b) an associate of that authorised fund manager;

- unless the authorised fund manager of the authorised fund is under a duty to pay to the authorised fund by the close of business on the fourth business day next after the agreement to buy or to sell the amount referred to in (2) and (3).

- (2) On investment, either:

- (a) any amount by which the consideration paid by the authorised fund for the units in the second scheme exceeds the price that would have been paid for the benefit of the second scheme had the units been newly issued or sold by it; or

- (b) if such price cannot be ascertained by the authorised fund manager of the authorised fund, the maximum amount of any charge permitted to be made by the seller of units in the second scheme.

- (3) On disposal, the amount of any charge made for the account of the authorised fund manager or operator of the second scheme or an associate of any of them in respect of the disposal.

- (4) In (1), (2) and (3):

- (a) any addition to or deduction from the consideration paid on the acquisition or disposal of units in the second scheme, which is applied for the benefit of the second scheme and is, or is like, a dilution levy made in accordance with CIS 4.6.3 R (for ICVCs and single-priced AUTs) or SDRT provision made in accordance with CIS 4.6.3 R (for ICVCs and single-priced AUTs) or CIS 15.6.3 R (for dual-priced AUTs) is to be treated as part of the price of the units and not as part of any charge; and

- (b) any charge made in respect of an exchange of units in one sub-fund or separate part of the second scheme for units in another sub-fund or separate part of that scheme is to be included as part of the consideration paid for the units.

- 01/12/2004

Investment in other collective investment schemes: interpretation

CIS 5A.2.12

See Notes

- 01/11/2002

Significant influence for ICVCs

CIS 5A.2.13

See Notes

- 01/12/2004

Significant influence for managers of AUTs

CIS 5A.2.14

See Notes

- 01/12/2004

Concentration

CIS 5A.2.15

See Notes

- 01/12/2004

CIS 5A.2.16

See Notes

- 01/12/2004

CIS 5A.3

Eligible markets regime

- 01/12/2004

Application

CIS 5A.3.1

See Notes

- 01/12/2004

Purpose

CIS 5A.3.2

See Notes

- 01/12/2004

Eligible markets: requirements

CIS 5A.3.3

See Notes

- (1) A securities market is eligible for the purposes of the rules in this sourcebook if it is a market established in an EEA State on which transferable securities admitted to the official list in the EEA State are dealt in or traded.

- (2) A securities market not falling within (1) or a derivatives market is, at any time, eligible for the purposes of the rules in this sourcebook if:

- (a) the authorised fund manager, after consultation with the depositary (and in the case of an ICVC, any directors in addition to the ACD), has decided to choose that market as one which is appropriate for the purpose of investment of, or dealing in, the scheme property beyond, where appropriate, any limit which under the rules in this chapter would otherwise apply;

- (b) the decision is notified in writing to the depositary and has not been revoked;

- (c) the market is included in a list in the prospectus; and

- (d) the depositary has taken reasonable care to determine that:

- (i) adequate custody arrangements can be provided for the investments dealt in on the market in question; and

- (ii) all reasonable steps have been taken by the authorised fund manager in deciding whether the market in question is eligible.

- (3) In (2), a market must not be considered appropriate unless it:

- (a) is regulated (CIS 5A.3.5 G);

- (b) operates regularly (CIS 5A.3.6 G);

- (c) is recognised (CIS 5A.3.7 G); and

- (d) is open to the public (CIS 5A.3.8 G).

- (4) In exercising the choice in (2), the authorised fund manager must have regard to:

- (a) whether the market is adequately liquid (CIS 5A.3.9 G); and

- (b) the arrangements relevant to the market for unimpeded transmission of income and capital to or to the order of investors.

- 01/07/2005

Guidance on eligible markets: introduction

CIS 5A.3.4

See Notes

- (1) CIS 5A.3.3 R (Eligible markets: requirement) will involve authorised fund managers exercising integrity and competence in making a judgement as to what constitutes an eligible market.

- (2) The guidance paragraphs in this section (CIS 5A.3) are indicative of the matters that authorised fund managers will need to take into account, using such information as is available to them, making inquiries as necessary, and taking advice as appropriate, in order to have taken reasonable care to determine that a market is eligible.

- (3) The items listed in the guidance paragraphs are not necessarily exhaustive, nor are they in any particular order of relative importance. An overall view will need to be taken on each market.

- 01/12/2004

Regulated

CIS 5A.3.5

See Notes

- (1) In considering whether a market is regulated, the authorised fund manager should assess whether the market is subject to supervision by an authority which is a statutory body, an agency of a national or State government, a department of a national government or another body designated for the purpose by one of these.

- (2) In addition, the authorised fund manager should take account of any of (a) to (i):

- (a) the degree to which persons who are bound by rules of the market are subject to formal supervision by the market or another body, and in particular whether that supervision includes level of capital;

- (b) the powers of the market, or the supervising body, or both, to intervene in the business of persons who are bound by the rules of the market in the event of misconduct, financial difficulties or otherwise, including the power to reject applicants, terminate membership and de-list a security;

- (c) the initial listing standards and ongoing supervision of securities traded on the market including the publication of prospectuses and audited annual financial statements;

- (d) the everyday availability of current information about securities, derivatives, quotations, transactions, prices and spreads;

- (e) requirements for the issue of contract notes (or their equivalents);

- (f) whether there is a requirement for trade reporting to the market or other supervisory body of the securities or derivatives the authorised fund manager is intending to buy;

- (g) whether the clearance and settlements arrangements normally used for transactions on the market are prompt and secure;

- (h) the risk of loss in the event of insolvency of a person who is bound by the rules of the market; and

- (i) how the market investigates and deals with complaints.

- 01/12/2004

Operating regularly

CIS 5A.3.6

See Notes

- (1) In considering whether a market is operating regularly, the authorised fund manager should assess whether the market has regular trading hours during which the investments listed or admitted to dealing may be dealt in.

- (2) In addition, the authorised fund manager should take account of:

- (a) the availability and timing of price and volume information and the way it is distributed; and

- (b) in respect of securities, the degree to which, and the speed at which, companies listed on the market must release price-sensitive information, and the medium through which that information is distributed.

- 01/12/2004

Recognised

CIS 5A.3.7

See Notes

- 01/12/2004

Open to the public

CIS 5A.3.8

See Notes

- (1) In considering whether a market is open to the public, the authorised fund manager should assess whether investments listed or admitted to dealing on the market are freely available for trading by the public directly, or through members of the market, during normal trading hours.

- (2) In addition, the authorised fund manager should take account of the extent to which overseas investors are permitted to hold securities listed on the market.

- 01/12/2004

Liquidity and repatriation of funds

CIS 5A.3.9

See Notes

In considering whether a market is adequately liquid, the authorised fund manager should assess:

- (1) the overall liquidity of the market or exchange; whether securities or derivatives or both can be bought and sold in a reasonable time, at best execution and in adequate amounts; and

- (2) the procedures and restrictions (if they exist) on the repatriation of funds to the United Kingdom, bearing in mind in particular the open-ended nature of a collective investment scheme and the requirement that the authorised fund manager must at all times during the dealing day be willing to redeem units, including large redemptions, at a price arrived at in accordance with CIS 4 (Single-pricing and dealing) or CIS 15 (Dual-pricing and dealing).

- 01/12/2004

Responsibility of authorised fund manager

CIS 5A.3.10

See Notes

- (1) The authorised fund manager should, after consultation with the depositary about safe custody:

- (a) for any particular market, consider all the characteristics mentioned in CIS 5A.3.3 R(3) and CIS 5A.3.3 R(4) of that market or the lack of them, and any other characteristics which are relevant, in order to reach a view on whether that market or exchange should be an eligible market, for approved securities and approved derivative investment purposes; and

- (b) continue to take reasonable care to ensure that the market continues to exhibit the characteristics which led to it being considered eligible and that there are no events or characteristics which undermine that eligibility.

- (2) Where a market ceases to be eligible, investments on that market will cease to be approved securities. The 10% restriction in CIS 5A.4.2 R(2) (Securities schemes: general) applies and, if necessary, the level of investment on that market must be reduced to ensure that this 10% limit is not exceeded. Exceeding the 10% limit because a market ceases to be eligible will generally be regarded as an inadvertent breach under CIS 7.5.3 R (Duties of the ACD and depositary: investment and borrowing powers) (in the case of an ICVC) and CIS 7.10.3 R (Duties of the manager and trustee: investment and borrowing powers). In addition, no new derivatives exposures on the investments that cease to be approved securities should be created.

- 01/12/2004

CIS 5A.4

Securities schemes

- 01/12/2004

Application

CIS 5A.4.1

See Notes

- 01/12/2004

Securities schemes: general

CIS 5A.4.2

See Notes

- (1) The scheme property of a securities scheme must, except where otherwise provided in the rules in this chapter, only consist of transferable securities.

- (2) Not more than 10% in value of the scheme property of a securities scheme is to consist of transferable securities which are not approved securities, but there is no limit on the value of the scheme property which is to consist of approved securities.

- (3) Not more than 5% in value of the scheme property is to consist of transferable securities which are units in collective investment schemes, and those units must fall within CIS 5A.4.5 R (Securities Schemes : Investment in collective investment schemes).

- (4) Investment under (3) counts towards the limit in (2) (except where the units are approved securities).

- (5) CIS 5A.4.3 R (Spread: general) and CIS 5A.4.4 R (Spread: government and public securities) do not apply until the earlier of:

- (a) the expiry of a period of six months after the date of effect of the authorisation order in respect of the authorised fund (or on which the initial offer commenced if later); or

- (b) the date when the value of the scheme property of the securities scheme first exceeds £2 million (or the equivalent in the base currency of the securities scheme).

- (6) The following sections also apply to securities schemes:

- (a) CIS 5A.2 (General investment powers and limits for authorised funds);

- (b) CIS 5A.13 (Efficient portfolio management);