BIPRU 8

Group risk consolidation

BIPRU 8.1

Application

- 01/01/2007

BIPRU 8.1.1

See Notes

This chapter applies to:

- (1) a BIPRU firm that is a member of a UK consolidation group;

- (2) a BIPRU firm that is a member of a non-EEA sub-group; and

- (3) [deleted]

- (4) a firm that is not a BIPRU firm and is a parent financial holding company in a Member State in a UK consolidation group.

- 30/04/2011

BIPRU 8.1.2

See Notes

- 01/01/2007

Purpose

BIPRU 8.1.3

See Notes

- 01/01/2007

How this chapter is organised

BIPRU 8.1.4

See Notes

- 01/01/2007

BIPRU 8.1.5

See Notes

- 01/01/2007

BIPRU 8.1.6

See Notes

- 01/01/2007

BIPRU 8.1.7

See Notes

- 01/01/2007

BIPRU 8.1.8

See Notes

- 01/01/2007

BIPRU 8.1.9

See Notes

- 01/01/2007

BIPRU 8.1.10

See Notes

- 01/01/2007

BIPRU 8.1.11

See Notes

- 01/01/2007

Consolidation requirements for BIPRU firms elsewhere in the Handbook

BIPRU 8.1.12

See Notes

- 01/01/2007

BIPRU 8.1.13

See Notes

- 01/01/2007

BIPRU 8.1.14

See Notes

- 01/01/2007

BIPRU 8.1.15

See Notes

- 01/01/2007

BIPRU 8.1.16

See Notes

- 01/01/2007

BIPRU 8.2

Scope and basic consolidation requirements for UK consolidation groups

- 01/01/2007

Main consolidation rule for UK consolidation groups

BIPRU 8.2.1

See Notes

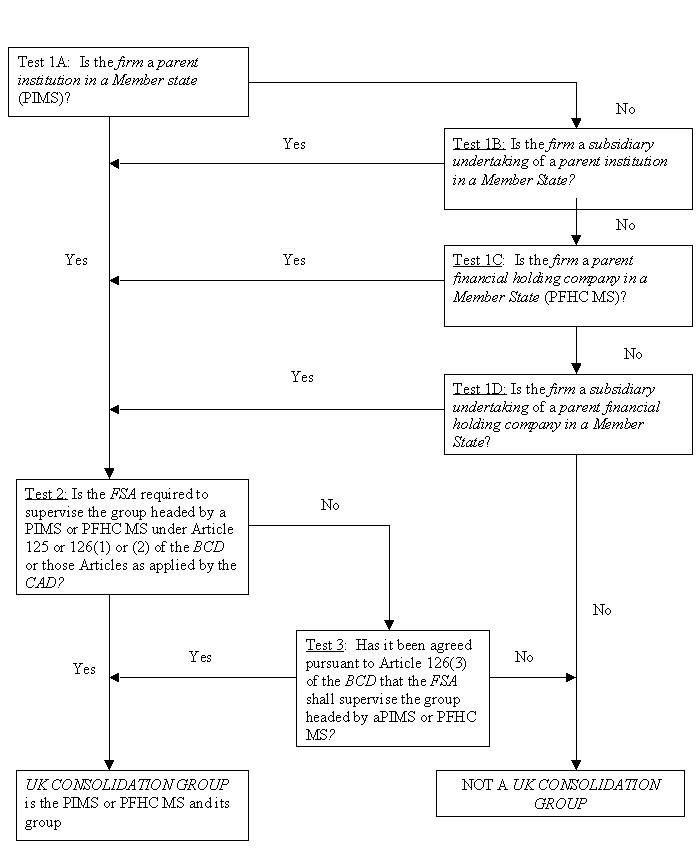

A firm that is a member of a UK consolidation group must comply, to the extent and in the manner prescribed in BIPRU 8.5, with the obligations laid down in GENPRU 1.2 (Adequacy of financial resources), the main BIPRU firm Pillar 1 rules (but not the base capital resources requirement) and BIPRU 10 (Large exposures requirements) on the basis of the consolidated financial position of:

- (1) where either Test 1A or Test 1B in BIPRU 8 Annex 1 (Decision tree identifying a UK consolidation group) apply, the parent institution in a Member State in the UK consolidation group; or

- (2) where either Test 1C or Test 1D in BIPRU 8 Annex 1 apply, the parent financial holding company in a Member State.

- 01/01/2011

BIPRU 8.2.2

See Notes

- 01/01/2007

BIPRU 8.2.3

See Notes

- 01/01/2007

Definition of UK consolidation group

BIPRU 8.2.4

See Notes

A firm's UK consolidation group means a group that is identified as a UK consolidation group in accordance with the decision tree in BIPRU 8 Annex 1 R (Decision tree identifying a UK consolidation group); the members of that group are:

- (1) where either Test 1A or Test 1B in BIPRU 8 Annex 1 R apply, the members of the consolidation group made up of the sub-group of the parent institution in a Member State identified in BIPRU 8 Annex 1 R together with any other person who is a member of that consolidation group because of a consolidation Article 12(1) relationship or an Article 134 relationship; or

- (2) where either Test 1C or Test 1D in BIPRU 8 Annex 1 R apply, the members of the consolidation group made up of the sub-group of the parent financial holding company in a Member State identified in BIPRU 8 Annex 1 R together with any other person who is a member of that consolidation group because of a consolidation Article 12(1) relationship or an Article 134 relationship;

in each case only persons included under BIPRU 8.5 (Basis of consolidation) are included in the UK consolidation group.

- 06/04/2007

BIPRU 8.2.5

See Notes

- 01/01/2007

BIPRU 8.2.6

See Notes

- 01/01/2007

BIPRU 8.2.7

See Notes

- 01/01/2007

BIPRU 8.3

Scope and basic consolidation requirements for non-EEA sub-groups

- 01/01/2007

Main consolidation rule for non-EEA sub-groups

BIPRU 8.3.1

See Notes

- (1) A BIPRU firm that is a subsidiary undertaking of a BIPRU firm or of a financial holding company must apply the requirements laid down in GENPRU 1.2 (Adequacy of financial resources), the main BIPRU firm Pillar 1 rules (but not the base capital resources requirement) and BIPRU 10 (Large exposures requirements) on a sub-consolidated basis if the BIPRU firm, or the parent undertaking where it is a financial holding company, have a third country banking or investment services undertaking as a subsidiary undertaking or hold a participation in such an undertaking.

- (2) (1) only applies if the FSA is required by the Banking Consolidation Directive or the Capital Adequacy Directive to supervise the group established under (1) under Article 73(2) of the Banking Consolidation Directive (Non-EEA sub-groups).

- 31/12/2010

BIPRU 8.3.2

See Notes

- 01/01/2007

BIPRU 8.3.3

See Notes

- 01/01/2007

BIPRU 8.3.4

See Notes

- 01/01/2007

How to identify a non-EEA sub-group

BIPRU 8.3.5

See Notes

- 01/01/2007

BIPRU 8.3.6

See Notes

- 01/01/2007

BIPRU 8.3.7

See Notes

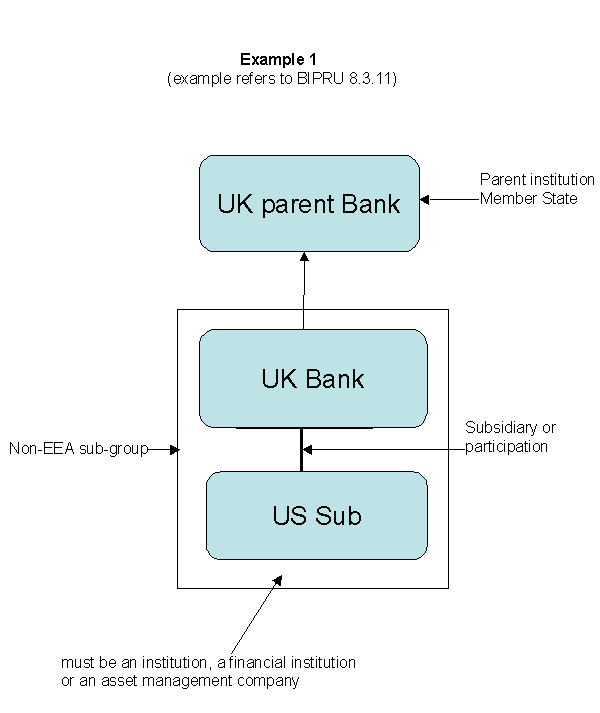

A firm will not be a member of a non-EEA sub-group unless it is also a member of a UK consolidation group. So the first step is to identify each undertaking in the firm's UK consolidation group that satisfies the following conditions:

- (1) it is an institution, financial institution or asset management company whose head office is outside the EEA (a third country banking or investment services undertaking);

- (2) one of the following applies:

- (a) it is a subsidiary undertaking of a BIPRU firm in that UK consolidation group; or

- (b) a BIPRU firm in that UK consolidation group holds a participation in it; and

- (3) that BIPRU firm is not a parent institution in a Member State.

- 01/01/2007

BIPRU 8.3.8

See Notes

- 01/01/2007

BIPRU 8.3.9

See Notes

- 01/01/2007

BIPRU 8.3.10

See Notes

- 01/01/2007

BIPRU 8.3.11

See Notes

- 01/01/2007

BIPRU 8.3.12

See Notes

The firm should then identify each undertaking in the firm's UK consolidation group that satisfies the following conditions:

- (1) it is an institution, financial institution or asset management company whose head office is outside the EEA (a third country banking or investment services undertaking);

- (2) one of the following applies:

- (a) it is a subsidiary undertaking of a financial holding company in that UK consolidation group; or

- (b) a financial holding company in that UK consolidation group holds a participation in it;

- (3) the head office of that financial holding company is in the United Kingdom; and

- (4) that financial holding company has a subsidiary undertaking that is a BIPRU firm.

- 01/01/2007

BIPRU 8.3.13

See Notes

- 01/01/2007

BIPRU 8.3.14

See Notes

- 01/01/2007

BIPRU 8.3.15

See Notes

- 01/01/2007

BIPRU 8.3.16

See Notes

- 01/01/2007

BIPRU 8.3.17

See Notes

- 01/01/2007

BIPRU 8.3.18

See Notes

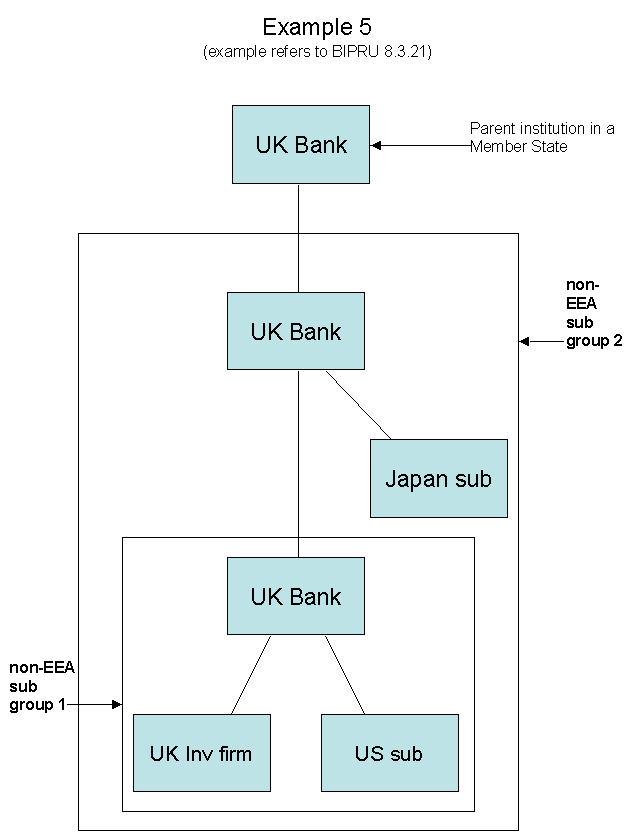

Having identified potential non-EEA sub-groups for each third country banking or investment services undertaking in its UK consolidation group the firm should then eliminate overlapping potential non-EEA sub-groups in the following way. If:

- (1) one potential non-EEA sub-group is contained within a wider potential non-EEA sub-group; and

- (2) the third country banking or investment services undertakings in the two potential non-EEA sub-groups are the same;

then the smaller potential non-EEA sub-group is eliminated.

- 01/01/2007

BIPRU 8.3.19

See Notes

- 01/01/2007

BIPRU 8.3.20

See Notes

- 01/01/2007

BIPRU 8.3.21

See Notes

- 01/01/2007

BIPRU 8.3.22

See Notes

- 01/01/2007

BIPRU 8.3.23

See Notes

- 01/01/2007

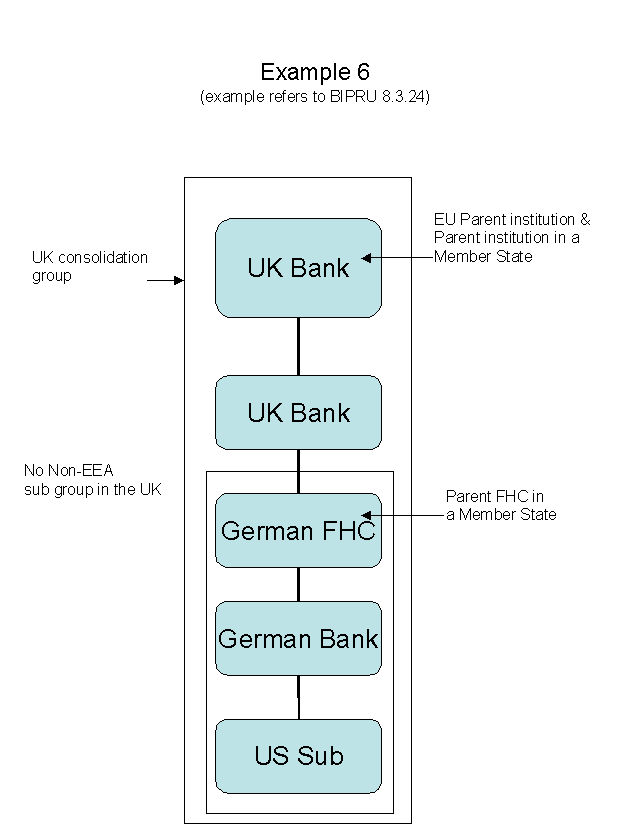

BIPRU 8.3.24

See Notes

- 01/01/2007

BIPRU 8.4

CAD Article 22 groups and investment firm consolidation waiver

- 01/01/2007

Application

BIPRU 8.4.1

See Notes

- 01/01/2007

The effect of an investment firm consolidation waiver and the conditions for getting one

BIPRU 8.4.2

See Notes

- 01/01/2007

BIPRU 8.4.3

See Notes

- 01/01/2007

BIPRU 8.4.4

See Notes

The FSA will not grant an investment firm consolidation waiver unless:

- (1) the UK consolidation group or non-EEA sub-group meets the conditions for being a CAD Article 22 group;

- (2) the FSA is satisfied that each BIPRU firm in the UK consolidation group or non-EEA sub-group will be able to meet its capital requirements using the calculation of capital resources in GENPRU 2 Annex 6 (Capital resources table for a BIPRU investment firm with a waiver from consolidated supervision); and

- (3) the firm demonstrates that the requirements in BIPRU 8.4.11 R to BIPRU 8.4.18 R will be met.

- 01/01/2007

BIPRU 8.4.5

See Notes

- 01/01/2007

BIPRU 8.4.6

See Notes

- 01/01/2007

Meeting the terms of an investment firm consolidation waiver

BIPRU 8.4.7

See Notes

- 01/01/2007

BIPRU 8.4.8

See Notes

- 01/01/2007

Definition of a CAD Article 22 group

BIPRU 8.4.9

See Notes

- (1) A CAD Article 22 group means a UK consolidation group or non-EEA sub-group that meets the conditions in this rule.

- (2) There must be no bank, building society or credit institution in the UK consolidation group or non-EEA sub-group.

- (3) Each CAD investment firm in the UK consolidation group or non-EEA sub-group which is an EEA firm must use the definition of own funds given in the CRD implementation measure of its EEA State for Article 16 of the Capital Adequacy Directive.

- (4) Each CAD investment firm in the UK consolidation group or non-EEA sub-group must be a:

- (a) limited activity firm; or

- (b) limited licence firm.

- (5) Each CAD investment firm in the UK consolidation group or non-EEA sub-group which is an EEA firm must:

- (a) meet the requirements imposed by the CRD implementation measures of its EEA State for Articles 18 and Article 20 of the Capital Adequacy Directive on an individual basis; and

- (b) deduct from its own funds any contingent liability in favour of other members of the UK consolidation group or non-EEA sub-group.

- (6) Each BIPRU investment firm in the UK consolidation group or non-EEA sub-group must comply with the main BIPRU firm Pillar 1 rules on an individual basis.

- 01/01/2007

BIPRU 8.4.10

See Notes

- 01/01/2007

Capital adequacy obligations relating to a CAD Article 22 group: General rule

BIPRU 8.4.11

See Notes

If a firm has an investment firm consolidation waiver, it must ensure that any financial holding company in the UK consolidation group or the non-EEA sub-group that is the UK parent financial holding company in a Member State of a CAD investment firm in the UK consolidation group or non-EEA sub-group has capital resources, calculated under BIPRU 8.4.12 R, in excess of the sum of the following (or any higher amount specified in the investment firm consolidation waiver):

- (1) the sum of the solo notional capital resources requirements for each CAD investment firm, financial institution, asset management company and ancillary services undertaking in the UK consolidation group or the non-EEA sub-group, as calculated in accordance with BIPRU 8.4.13 R; and

- (2) the total amount of any contingent liability in favour of CAD investment firms, financial institutions, asset management companies and ancillary services undertakings in the UK consolidation group or non-EEA sub-group.

- 01/01/2007

Capital adequacy obligations relating to a CAD Article 22 group: Capital resources

BIPRU 8.4.12

See Notes

A firm must calculate the capital resources of the parent financial holding company in a Member State for the purpose of BIPRU 8.4.11 R as follows:

- (1) the capital resources are the sum of capital resources calculated at stages D (Total tier one capital before deductions) and I (Total tier two capital) of the version of the capital resources table in GENPRU 2 Annex 4 (Capital resources table for a BIPRU investment firm deducting material holdings) as adjusted in accordance with this rule;

- (2) capital resources at stage D must not include innovative tier one capital resources, but they may be included at stage I if (5) allows this;

- (3) the amount of the items which may be included at stage I must not exceed the amount calculated at stage D of the capital resources table;

- (4) the amount of the items which may be included in lower tier two capital in stage I must not exceed 50% of the amount calculated at stage D of the capital resources table; and

- (5) GENPRU 2.2.25 R (Limits on the use of different forms of capital: Use of higher tier capital in lower tiers) and GENPRU 2.2.27 R (Use of innovative tier one capital in lower stages of capital) apply.

- 01/01/2007

Capital adequacy obligations relating to a CAD Article 22 group: Capital resources requirement

BIPRU 8.4.13

See Notes

The solo notional capital resources requirement as referred to in BIPRU 8.4.11R (1) is calculated in the same way as:

- (1) (if each CAD investment firm in the UK consolidation group or non-EEA sub-group is a limited licence firm) the capital resources requirement for a BIPRU limited licence firm; or

- (2) (in any other case) the capital resources requirement for a BIPRU limited activity firm.

- 01/01/2007

BIPRU 8.4.14

See Notes

- 01/01/2007

BIPRU 8.4.15

See Notes

- 01/01/2007

BIPRU 8.4.16

See Notes

- 01/01/2007

Capital adequacy obligations relating to a CAD Article 22 group: Advanced prudential calculation approaches

BIPRU 8.4.17

See Notes

- 01/01/2007

Additional rules that apply to a firm with an investment firm consolidation waiver

BIPRU 8.4.18

See Notes

If a firm has an investment firm consolidation waiver, it must:

- (1) ensure that each CAD investment firm in the UK consolidation group or non-EEA sub-group which is a firm or an EEA firm has in place systems to monitor and control the sources of capital and funding of all the members in the UK consolidation group or non-EEA sub-group;

- (2) notify the FSA of any serious risk that could undermine the financial stability of the UK consolidation group or non-EEA sub-group, as soon as the firm becomes aware of that risk, including those associated with the composition and sources of the capital and funding of members of the UK consolidation group or non-EEA sub-group;

- (3) report the amount of the consolidated capital resources and consolidated capital resources requirement of the UK consolidation group or non-EEA sub-group on a periodic basis as set out in the investment firm consolidation waiver;

- (4) report any large exposures risks of members of the UK consolidation group or non-EEA sub-group including any undertakings not located in an EEA State on a periodic basis set out in the investment firm consolidation waiver;

- (5) notify the FSA immediately it becomes aware that the UK consolidation group or non-EEA sub-group has ceased to meet the conditions for being a CAD Article 22 group; and

- (6) notify the FSA immediately it becomes aware of any breach of BIPRU 8.4.11 R.

- 01/01/2007

BIPRU 8.4.19

See Notes

- 01/01/2007

BIPRU 8.5

Basis of consolidation

- 01/01/2007

Undertakings to be included in consolidation

BIPRU 8.5.1

See Notes

A firm must include only the following types of undertaking in a UK consolidation group or non-EEA sub-group for the purposes of this chapter:

- (1) a BIPRU firm;

- (2) an institution;

- (3) a financial institution;

- (4) an asset management company;

- (5) a financial holding company; and

- (6) an ancillary services undertaking.

- 01/01/2007

BIPRU 8.5.2

See Notes

- 01/01/2007

BIPRU 8.5.3

See Notes

- 01/01/2007

Basis of inclusion of undertakings in consolidation

BIPRU 8.5.4

See Notes

- 01/01/2007

BIPRU 8.5.5

See Notes

In carrying out the calculations for the purposes of this chapter a firm must only include the relevant proportion of an undertaking that is a member of the UK consolidation group or non-EEA sub-group:

- (1) by virtue of a consolidation Article 12(1) relationship;

- (2) by virtue of an Article 134 relationship; or

- (3) because the group holds a participation in it.

- 01/01/2007

BIPRU 8.5.6

See Notes

In BIPRU 8.5.5 R, the relevant proportion is either:

- (1) (in the case of a participation) the proportion of shares issued by the undertaking held by the UK consolidation group or the non-EEA sub-group; or

- (2) (in the case of a consolidation Article 12(1) relationship or an Article 134 relationship), such proportion (if any) as stated in the Part IV permission of the firm.

- 01/01/2007

Basis of inclusion of UCITS investment firms in consolidation

BIPRU 8.5.7

See Notes

- 31/12/2010

BIPRU 8.5.8

See Notes

- 01/01/2007

Exclusion of undertakings from consolidation: Balance sheet size

BIPRU 8.5.9

See Notes

A firm may, having first notified the FSA in writing in accordance with SUP 15.7 (Form and method of notification), exclude an institution, asset management company, financial institution or ancillary services undertaking that is a subsidiary undertaking in, or an undertaking in which a participation is held by, the UK consolidation group or non-EEA sub-group if the balance sheet total of that undertaking is less than the smaller of the following two amounts:

- (1) 10 million Euros;

- (2) 1% of the balance sheet total of the parent undertaking or the undertaking that holds the participation.

- 01/01/2007

BIPRU 8.5.10

See Notes

- 01/01/2007

Exclusion of undertakings from consolidation: Other reasons

BIPRU 8.5.11

See Notes

Article 73(1) of the Banking Consolidation Directive allows the FSA to decide to exclude an institution, financial institution, asset management company or ancillary services undertaking that is a subsidiary undertaking in, or an undertaking in which a participation is held by, the UK consolidation group or non-EEA sub-group for the purposes of this chapter in the following circumstances:

- (1) where the head office of the undertaking concerned is situated in a country outside the EEA where there are legal impediments to the transfer of the necessary information; or

- (2) where, in the opinion of the FSA, the undertaking concerned is of negligible interest only with respect to the objectives of monitoring institutions; or

- (3) where, in the opinion of the FSA, the consolidation of the financial situation of the undertaking concerned would be inappropriate or misleading as far as the objectives of the supervision of institutions are concerned.

- 01/01/2007

BIPRU 8.5.12

See Notes

- 01/01/2007

BIPRU 8.5.13

See Notes

- 01/01/2007

Information about excluded undertakings

BIPRU 8.5.14

See Notes

- 01/01/2007

BIPRU 8.6

Consolidated capital resources

- 01/01/2007

General

BIPRU 8.6.1

See Notes

- 01/01/2007

Limits on the use of different forms of capital

BIPRU 8.6.2

See Notes

- 01/01/2007

BIPRU 8.6.3

See Notes

- 01/01/2007

BIPRU 8.6.4

See Notes

- 01/01/2007

BIPRU 8.6.5

See Notes

- 01/01/2007

Calculation of consolidated capital resources if there is a building society in the group

BIPRU 8.6.6

See Notes

- 01/01/2007

Calculation of consolidated capital resources if there is a bank or credit institution in the group

BIPRU 8.6.7

See Notes

- 01/01/2007

Calculation of consolidated capital resources for an investment firm group

BIPRU 8.6.8

See Notes

- 01/01/2007

BIPRU 8.6.9

See Notes

- 01/01/2007

Treatment of minority interests

BIPRU 8.6.10

See Notes

- (1) This rule sets out how to determine whether minority interests in an undertaking in a UK consolidation group or non-EEA sub-group may be included in tier one capital, tier two capital or tier three capital for the purpose of calculating consolidated capital resources (each referred to as a "tier" of capital in this rule).

- (2) A firm must identify the item of capital of the undertaking in question that gives rise to that minority interest.

- (3) A firm must include the minority interest in the tier of capital in which that undertaking would have to include the capital referred to in (2) if it were a firm calculating its capital resources on a solo basis under whichever method applies to the group under BIPRU 8.6.6 R to BIPRU 8.6.8 R.

- (4) This rule does not apply to a minority interest created by consolidated indirectly issued capital.

- 01/01/2007

Indirectly issued capital and group capital resources

BIPRU 8.6.11

See Notes

- 01/01/2007

BIPRU 8.6.12

See Notes

Consolidated indirectly issued capital means any capital instrument issued by a member of the UK consolidation group or non-EEA sub-group where:

- (1) some or all of the following conditions are satisfied:

- (a) that capital is issued to an SPV; or

- (b) that capital is issued by an SPV; or

- (c) the subscription for the capital issued by the member of the group in question is funded directly or indirectly by an SPV; and

- (2) any of the SPVs referred to in (1) is a member of the UK consolidation group or non-EEA sub-group or a subsidiary undertaking of any member of the UK consolidation group or non-EEA sub-group.

- 01/01/2007

BIPRU 8.6.13

See Notes

A firm may only include consolidated indirectly issued capital in the consolidated capital resources of its UK consolidation group or non-EEA sub-group if:

- (1) it is issued by an SPV that is a member of the UK consolidation group or non-EEA sub-group to persons who are not members of the UK consolidation group or non-EEA sub-group; and

- (2) the conditions in BIPRU 8.6.16 R to BIPRU 8.6.18 R are satisfied.

- 01/01/2007

BIPRU 8.6.14

See Notes

- 01/01/2007

BIPRU 8.6.15

See Notes

For the purposes of this section, an undertaking is an SPV if the main activity of the SPV is to raise funds for undertakings in:

- (1) (in the case of a UK consolidation group) that UK consolidation group; or

- (2) (in the case of a non-EEA sub-group) that non-EEA sub-group or any UK consolidation group of which it forms part.

- 01/01/2007

BIPRU 8.6.16

See Notes

The SPV referred to in BIPRU 8.6.13 R must satisfy the conditions in GENPRU 2.2.127 R (Conditions that an SPV has to satisfy if indirectly issued capital is to be included in capital resources on a solo basis) as modified by the following:

- (1) references in GENPRU 2.2.127R (1) to being controlled by the firm are to being controlled by a member of the firm's UK consolidation group or non-EEA sub-group as the case may be; and

- (2) references to the firm's group are to the firm's UK consolidation group or non-EEA sub-group as the case may be.

- 01/01/2007

BIPRU 8.6.17

See Notes

The capital issued by the SPV referred to in BIPRU 8.6.13 R must satisfy the conditions in GENPRU 2.2.129 R (Conditions that capital issued by an SPV has to satisfy if indirectly issued capital is to be included in capital resources on a solo basis) as modified by the following:

- (1) references to the firm's group are to the firm's UK consolidation group or non-EEA sub-group as the case may be;

- (2) the substitution obligation in GENPRU 2.2.129R (2) need not be the firm's but may apply to any member of the UK consolidation group or non-EEA sub-group as the case may be; and

- (3) that substitution obligation applies if the consolidated capital resources of the UK consolidation group or non-EEA sub-group, as the case may be, fall, or are likely to fall, below its consolidated capital resources requirement.

- 01/01/2007

BIPRU 8.6.18

See Notes

The SPV referred to in BIPRU 8.6.13 R must invest the funds raised from the issue of capital by the SPV by subscribing for capital resources issued by an undertaking that is a member of the UK consolidation group or non-EEA sub-group. Those capital resources must satisfy the following conditions:

- (1) those capital resources must at least comply with the requirements for lower tier two capital; and

- (2) the first call date or fixed maturity date (if any) of those capital resources must not arise before the first call date on the instrument issued by the SPV.

- 01/01/2007

BIPRU 8.6.19

See Notes

- 01/01/2007

BIPRU 8.6.20

See Notes

- 01/01/2007

Venture Capital Investments

BIPRU 8.6.21

See Notes

| Deductions from the totals of tier one and tier two | (M) | |||

| ... | ... | ... | ||

| ... Investments in subsidiary undertakings and participations excluding: |

... GENPRU 2.2.216A G |

(Part 2 of stage M) | ||

| (1) | any amount which is already deducted as material holdings or qualifying holdings; and | |||

| (2) | any investment in an undertaking that meets the following conditions: | |||

| (a) | the investment has been made by a Venture Capital Investor and the firm is entitled to ignore (i) the Venture Capital Investor making that investment in accordance with GENPRU 2.2.209R (2) or (ii) the Venture Capital Holding Company (or a proportion of it) which holds the Venture Capital Investor in accordance with GENPRU 2.2.209R (3) for the purposes of determining whether there is a material holding; | |||

| (b) | the investment is a venture capital investment; and | |||

| (c) | the undertaking is not (i) a credit institution or (ii) financial institution the principal activity of which is to perform any activity other than the acquisition of holdings in other undertakings. | |||

- 01/08/2011

BIPRU 8.7

Consolidated capital resources requirements

- 01/01/2007

General approach

BIPRU 8.7.1

See Notes

- 01/01/2007

BIPRU 8.7.2

See Notes

- 01/01/2007

BIPRU 8.7.3

See Notes

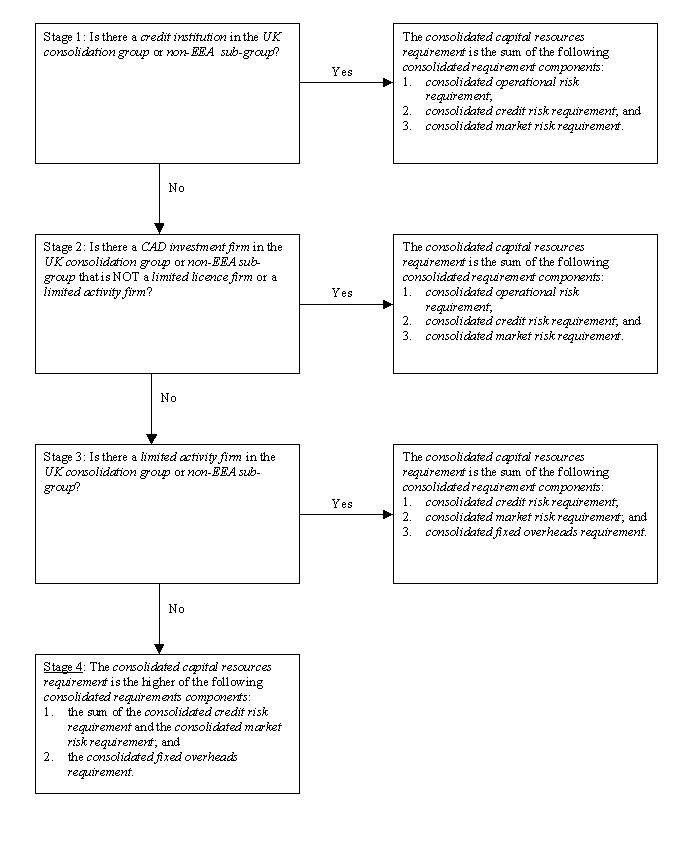

The first step is for a firm to identify what sort of group it belongs to as the calculation of the consolidated capital resources requirement differs between different types of groups. This is set out in BIPRU 8 Annex 5 (Decision tree for identifying the consolidated capital resources requirement of a UK consolidation group or a non-EEA sub-group). BIPRU 8 Annex 5 shows, for each type of group:

- (1) which of the consolidated requirement components apply and which do not; and

- (2) how to add up the different consolidated requirement components to reach the overall consolidated capital resources requirement.

- 01/01/2007

BIPRU 8.7.4

See Notes

- 01/01/2007

BIPRU 8.7.5

See Notes

- 01/01/2007

BIPRU 8.7.6

See Notes

- 01/01/2007

BIPRU 8.7.7

See Notes

- 01/01/2007

BIPRU 8.7.8

See Notes

- 01/01/2007

BIPRU 8.7.9

See Notes

- 01/01/2007

Method of calculation to be used

BIPRU 8.7.10

See Notes

- 01/01/2007

Calculation of the consolidated requirement components

BIPRU 8.7.11

See Notes

- 01/01/2007

BIPRU 8.7.12

See Notes

This table belongs to BIPRU 8.7.11 R

- 01/01/2007

Choice of consolidation method

BIPRU 8.7.13

See Notes

- (1) A firm must calculate a consolidated requirement component by using one of the methods in this rule.

- (2) Under the first method a firm must:

- (a) apply the risk capital requirement set out in BIPRU 8.7.12 R to each undertaking in the UK consolidation group or non-EEA sub-group; and

- (b) add the risk capital requirements together.

- (3) Under the second method a firm must:

- (a) treat the whole UK consolidation group or non-EEA sub-group as a single undertaking; and

- (b) apply the risk capital requirement set out in BIPRU 8.7.12 R to the group on an accounting consolidation basis.

- (4) The third method is a mixture of methods one and two. Under the third method a firm must:

- (a) treat one or more parts of the UK consolidation group or non-EEA sub-group as separate single undertakings;

- (b) apply the risk capital requirement set out in BIPRU 8.7.12 R to each such part of the group on an accounting consolidation basis;

- (c) apply the risk capital requirement set out in BIPRU 8.7.12 R to each of the remaining undertakings in the UK consolidation group or non-EEA sub-group (if any); and

- (d) add the risk capital requirements together.

- (5) A firm may use different methods for different consolidated requirement components.

- 01/01/2007

BIPRU 8.7.14

See Notes

- 01/01/2007

BIPRU 8.7.15

See Notes

- 01/01/2007

Notifying the FSA of the choice of consolidation technique

BIPRU 8.7.16

See Notes

- 01/01/2007

Special rules for the consolidated credit risk requirement

BIPRU 8.7.17

See Notes

- 01/01/2007

BIPRU 8.7.18

See Notes

- 31/12/2010

BIPRU 8.7.20

See Notes

- 01/01/2007

BIPRU 8.7.21

See Notes

- 01/01/2007

BIPRU 8.7.22

See Notes

- 01/01/2007

BIPRU 8.7.23

See Notes

- (1) A firm may only treat an exposure as exempt under BIPRU 3.2.25 R (Zero risk-weighting for intra-group exposures) as applied on a consolidated basis if the member of the UK consolidation group or non-EEA sub-group that has the exposure:

- (a) is a BIPRU firm and that exposure is exempt under BIPRU 3.2.25 R as it applies to that BIPRU firm on a solo basis; or

- (b) meets the conditions in BIPRU 3.2.25 R (1)(d) (Condition relating to establishment in the UK) and that exposure would be exempt under (a) if that member was a BIPRU firm.

- (2) The notification obligation in BIPRU 3.2.35 R applies.

- 01/01/2007

Special rules for the consolidated market risk requirement

BIPRU 8.7.24

See Notes

- 01/01/2007

BIPRU 8.7.25

See Notes

A firm may not apply the second method in BIPRU 8.7.13R (3) (accounting consolidation for the whole group) or apply accounting consolidation to parts of its UK consolidation group or non-EEA sub-group under method three as described in BIPRU 8.7.13R (4)(a) for the purposes of the calculation of the consolidated market risk requirement unless the group or sub-group and the undertakings in that group or sub-group satisfy the conditions in this rule. Instead the firm must use the aggregation approach described in BIPRU 8.7.13R (2) (method one) or BIPRU 8.7.13R (4)(c). Those conditions are as follows:

- (1) each of the undertakings in that group or sub-group is an institution that is:

- (a) a BIPRU firm;

- (b) an EEA firm;

- (c) a recognised third country credit institution; or

- (d) a recognised third country investment firm;

- (2) each of the undertakings referred to in (1) that is a BIPRU firm has capital resources that are equal to or in excess of its capital resources requirement and complies with BIPRU 10(Large exposures requirements);

- (3) each of the undertakings referred to in (1) that is an EEA firm complies with the CRD implementation measures in its EEA State that correspond to the requirements in (2);

- (4) each of the undertakings referred to in (1) that is a recognised third country credit institution or recognised third country investment firm complies with laws in the state or territory in which it has its head office that are equivalent to the requirements of the Banking Consolidation Directive or Capital Adequacy Directive relating to capital adequacy and concentration risk;

- (5) there is no material legal, regulatory or contractual impediment to the transfer of funds between those undertakings in that group or sub-group;

- (6) there is no material legal, regulatory or contractual impediment to mutual financial support between those undertakings in that group or sub-group;

- (7) the market risk position of the undertakings are monitored and managed on a co-ordinated basis; and

- (8) there is satisfactory allocation of capital within the group or sub-group.

- 31/12/2010

Special rules for the consolidated operational risk requirement

BIPRU 8.7.26

See Notes

- 01/01/2007

BIPRU 8.7.27

See Notes

- (1) This rule sets out how BIPRU 6.3.2 R (3) (Negative figure arising in calculation of the relevant indicator under the basic indicator approach) applies on a consolidated basis.

- (2) If the calculation for any individual undertaking under method one in BIPRU 8.7.13R (2) (application of aggregation approach to the whole group) or method three as described in BIPRU 8.7.13R (4)(c) (mixture of aggregation and accounting consolidation) or for any sub-group created under method three as described in BIPRU 8.7.13R (4)(a) results in a figure of zero or a negative figure, that figure must be excluded.

- (3) If a firm is using method two in BIPRU 8.7.13 R (accounting consolidation approach for the whole group), BIPRU 6.3.2 R (3) applies to the UK consolidation group or non-EEA sub-group as if it were a single undertaking.

- (4) (3) also applies to a sub-group created under method 3 as described in BIPRU 8.7.13R (4)(a).

- 01/01/2007

Special rules for calculating specific consolidated requirement components

BIPRU 8.7.28

See Notes

- 01/01/2007

Elimination of intra-group transactions

BIPRU 8.7.29

See Notes

In accordance with BIPRU 8.2.1 R and BIPRU 8.3.1 R (The basic consolidation rules for a UK consolidation group or non-EEA sub-group), a firm may exclude that part of the risk capital requirement that arises as a result of:

- (1) (in respect of the consolidated credit risk requirement) intra-group balances; or

- (2) (in respect of the consolidated operational risk requirement and consolidated fixed overheads requirement) intra-group transactions;

with other undertakings in the UK consolidation group or non-EEA sub-group.

- 01/01/2007

Other provisions about calculating risk capital requirements

BIPRU 8.7.30

See Notes

- (1) This rule applies when the rules applicable under BIPRU 8.7.12 R apply differently for different types of firms.

- (2) Where a firm's UK consolidation group or non-EEA sub-group is a group identified at Stage 1 in BIPRU 8 Annex 5 (Decision tree for identifying the consolidated capital resources requirement of a UK consolidation group or a non-EEA sub-group), the rules that apply are those that apply to a bank that is a BIPRU firm.

- (3) Where a firm's UK consolidation group or non-EEA sub-group is a group identified at Stage 2 in BIPRU 8 Annex 5, the rules that apply are those that apply to a full scope BIPRU investment firm.

- (4) Where a firm's UK consolidation group or non-EEA sub-group is a group identified at Stage 3 in BIPRU 8 Annex 5, the rules that apply are those that apply to a BIPRU limited activity firm.

- (5) Where a firm's UK consolidation group or non-EEA sub-group is a group identified at Stage 4 in BIPRU 8 Annex 5, the rules that apply are those that apply to a BIPRU limited licence firm.

- 01/01/2007

BIPRU 8.7.31

See Notes

- 01/01/2007

BIPRU 8.7.32

See Notes

- 01/01/2007

BIPRU 8.7.33

See Notes

- 01/01/2007

Use of the solo requirements of another EEA competent authority

BIPRU 8.7.34

See Notes

- 01/01/2007

BIPRU 8.7.35

See Notes

- (1) [deleted]

- (2) [deleted]

- 31/12/2011

Use of the consolidated requirements of another EEA competent authority

BIPRU 8.7.37

See Notes

- (1) This rule applies if:

- (a) a firm is applying an accounting consolidation approach to part of its UK consolidation group or non-EEA sub-group under method three as described in BIPRU 8.7.13R (4)(a); and

- (b) the part of the group in (a) constitutes the whole of a group subject to the consolidated capital requirements of a competent authority under the CRD implementation measures relating to consolidation under the Banking Consolidation Directive or the Capital Adequacy Directive.

- (2) If the conditions in this rule are satisfied, a firm may apply the consolidated capital requirement in (1)(b) as the risk capital requirement for the group identified in (1)(a) so far as that consolidated capital requirement corresponds to the FSA's rules that would otherwise apply under this section.

- 01/01/2007

Prohibition on using the standardised rules of a regulator outside the EEA

BIPRU 8.7.38A

See Notes

- (1) This rule applies to a firm if:

- (a) an institution in its UK consolidation group or non-EEA sub-group is subject to any of the rules or requirements of, or administered by, a third-country competent authority applicable to its financial sector that correspond to the sectoral rules applicable to that financial sector ("corresponding sectoral rules"); or

- (b) a part of its UK consolidation group or non-EEA sub-group constitutes the whole of a group subject to the consolidated capital requirements of a third-country competent authority under the corresponding sectoral rules applicable to the banking sector or the investment services sector for a state or territory outside the EEA.

- (2) A firm may not use the requirements under any of the corresponding sectoral rules of a state or territory outside the EEA in order to calculate the consolidated capital resources requirement of its UK consolidation group or non-EEA sub-group for the purpose of this chapter.

- 31/12/2011

Use of an advanced prudential calculation approach under the rules of an overseas regulator

BIPRU 8.7.39

See Notes

- 01/01/2007

BIPRU 8.8

Advanced prudential calculation approaches

- 01/01/2007

General

BIPRU 8.8.1

See Notes

- 01/01/2007

BIPRU 8.8.2

See Notes

- 01/01/2007

Prohibition on using the rules of an overseas regulator

BIPRU 8.8.3

See Notes

- 31/12/2011

Special provisions relating to the internal ratings based approach

BIPRU 8.8.4

See Notes

- 01/01/2007

Special provisions relating to the advanced measurement approach

BIPRU 8.8.5

See Notes

- 01/01/2007

BIPRU 8.8.6

See Notes

- 01/01/2007

BIPRU 8.8.7

See Notes

- 01/01/2007

Special provisions relating to the CCR internal model method

BIPRU 8.8.8

See Notes

- 01/01/2007

Corporate governance arrangement for the IRB approach and the AMA

BIPRU 8.8.9

See Notes

- 01/01/2007

BIPRU 8.9A

Consolidated large exposure requirements

- 31/12/2010

Integrated groups: core UK group and non-core large exposures group

BIPRU 8.9A.1

See Notes

- (1) BIPRU 10 (Large exposures) applies to a firm's UK consolidation group or (subject to (2)) non-EEA sub-group as if it were a single undertaking.

- (2) A firm may exempt the exposures of its non-EEA sub-group to its core concentration risk group counterparty or non-core concentration risk group counterparty from the limits in BIPRU 10.5 (Limits on exposures) that apply to the non-EEA sub-group on a sub-consolidated basis.

- 31/12/2010

BIPRU 8.9A.2

See Notes

- 31/12/2010

BIPRU 8.9A.3

See Notes

- 31/12/2010

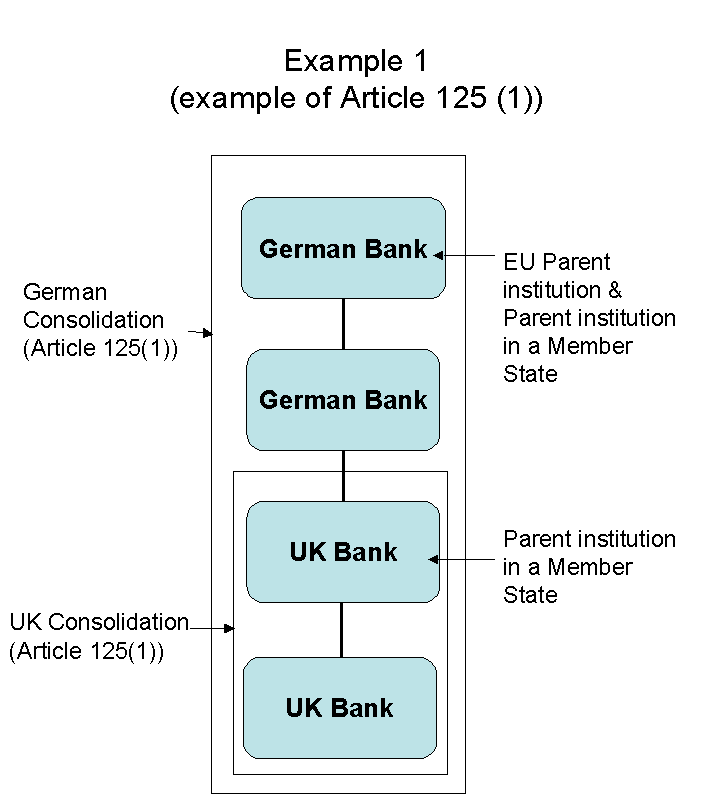

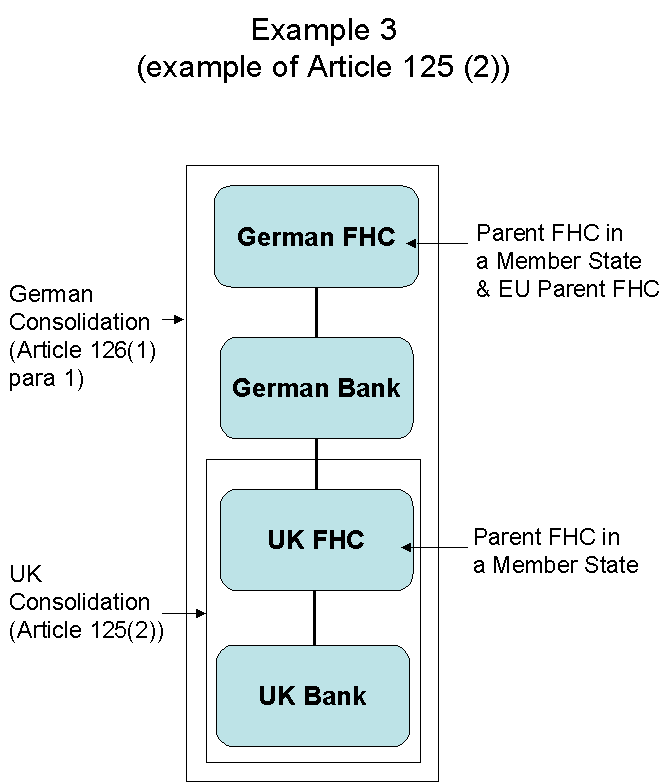

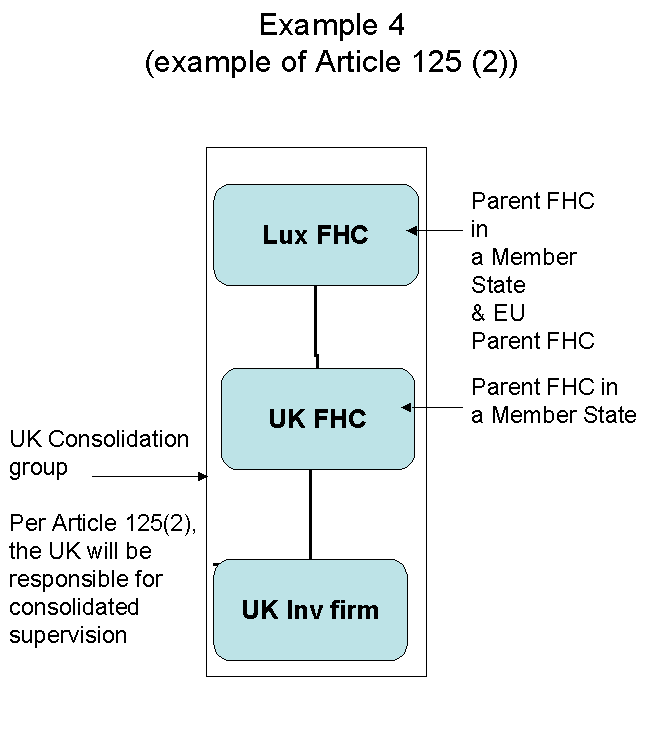

BIPRU 8 Annex 1

Decision tree identifying a UK consolidation group

- 01/01/2007

See Notes

- 01/01/2007

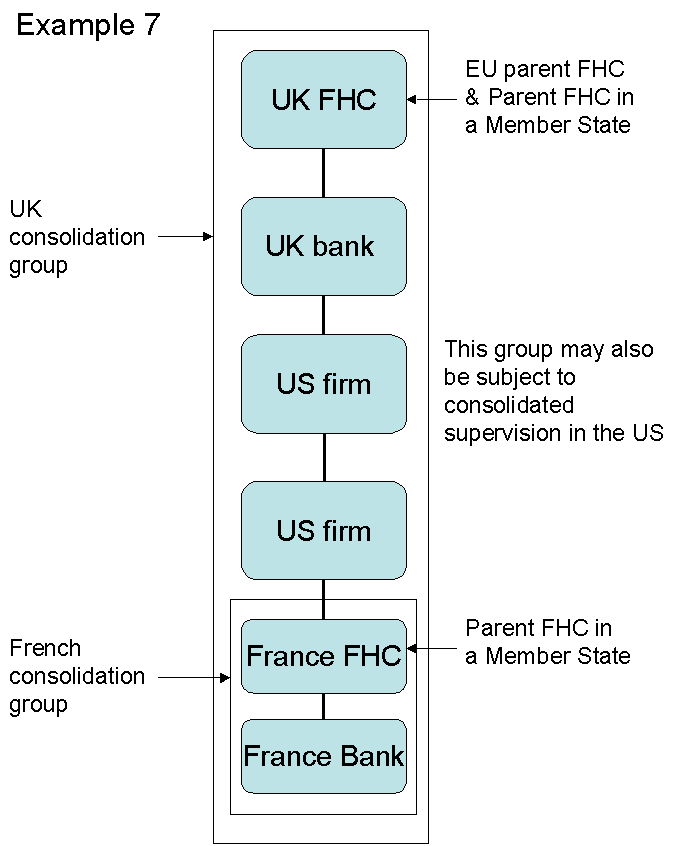

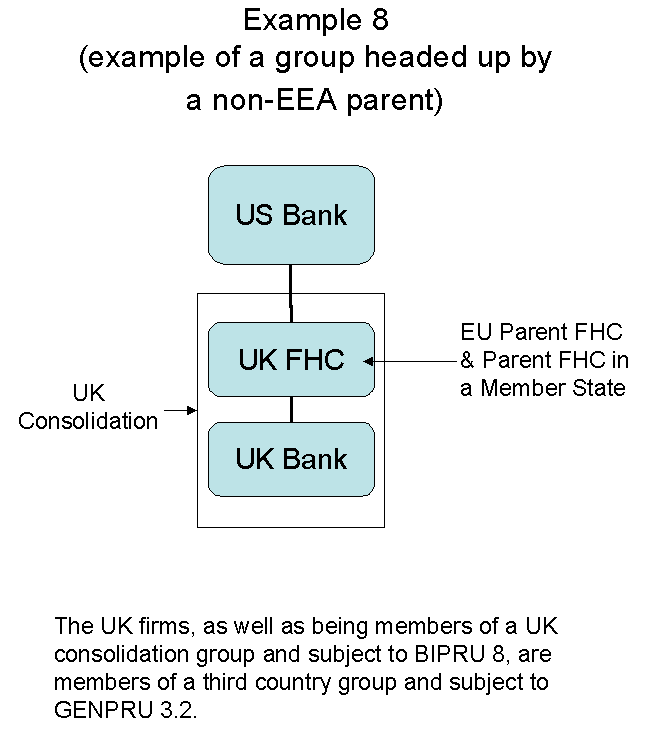

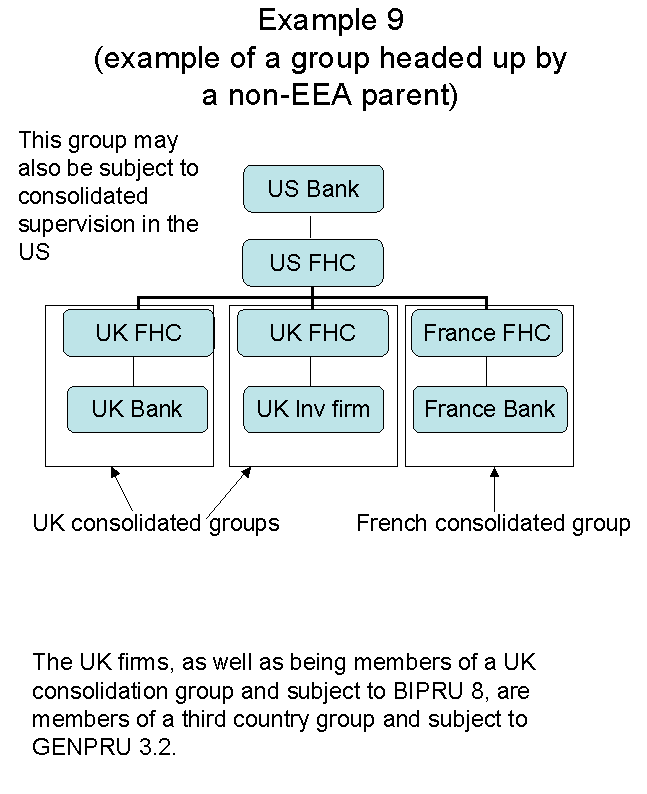

BIPRU 8 Annex 2

Examples of how to identify a UK consolidation group

- 01/01/2007

See Notes

- 01/01/2007

BIPRU 8 Annex 3

Examples of how to identify a non-EEA sub-group

- 01/01/2007

See Notes

- 01/01/2007

BIPRU 8 Annex 4

Text of Articles 125 and 126 of the Banking Consolidation Directive

- 01/01/2007

See Notes

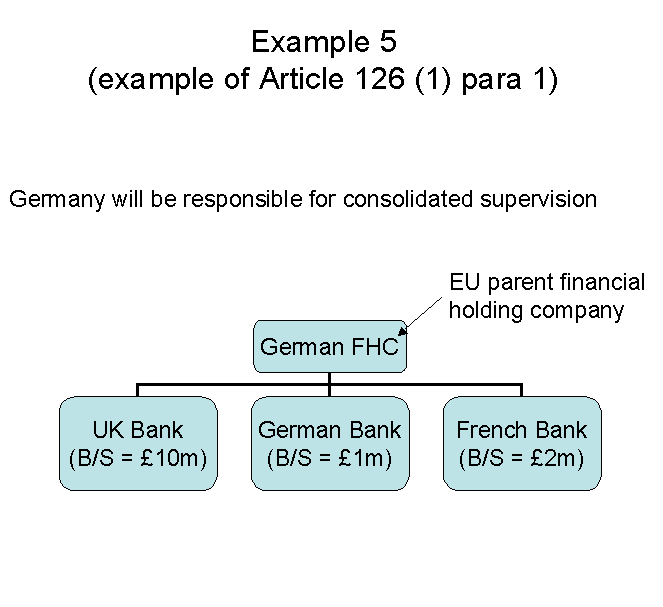

| Article 125 | ||

| 1. | Where a parent undertaking is a parent credit institution in a Member State or an EU parent credit institution, supervision on a consolidated basis shall be exercised by the competent authorities that authorised it under Article 6. | |

| 2. | Where the parent of a credit institution is a parent financial holding company in a Member State or an EU parent financial holding company, supervision on a consolidated basis shall be exercised by the competent authorities that authorised that credit institution under Article 6. | |

| Article 126 | ||

| 1. | Where credit institutions authorised in two or more Member States have as their parent the same parent financial holding company in a Member State or the same EU parent financial holding company supervision on a consolidated basis shall be exercised by the competent authorities of the credit institution authorised in the Member State in which the financial holding company was set up. | |

| Where the parents of credit institutions authorised in two or more Member States comprise more than one financial holding company with head offices in different Member States and there is a credit institution in each of these States, supervision on a consolidated basis shall be exercised by the competent authority of the credit institution with the largest balance sheet total. | ||

| 2. | Where more than one credit institution authorised in the Community has as its parent the same financial holding company and none of these credit institutions has been authorised in the Member State in which the financial holding company was set up, supervision on a consolidated basis shall be exercised by the competent authority that authorised the credit institution with the largest balance sheet total, which shall be considered, for the purposes of this Directive, as the credit institution controlled by an EU parent financial holding company. | |

| 3. | In particular cases, the competent authorities may by common agreement waive the criteria referred to in paragraphs 1 and 2 if their application would be inappropriate, taking into account the credit institutions and the relative importance of their activities in different countries, and appoint a different competent authority to exercise supervision on a consolidated basis. In these cases, before taking their decision, the competent authorities shall give the EU parent credit institution, or EU parent financial holding company, or credit institution with the largest balance sheet total, as appropriate, an opportunity to state its opinion on that decision. | |

| 4. | [Omitted] | |

| Note | The Capital Adequacy Directive says that generally references in Articles 125 and 126 of the Banking Consolidation Directive to credit institution should be read as including ones to CAD investment firms. Also, the Banking Consolidation Directive and the Capital Adequacy Directive apply to the EEA. Therefore for the purposes of BIPRU 8 Articles 125 and 126 of the Banking Consolidation Directive should be read with the following adjustments: | |

| (1) | a reference to a credit institution should be read as being one to a credit institution or CAD investment firm; | |

| (2) | a reference to a parent credit institution in a Member State should be read as being one to a parent institution in a Member State; | |

| (3) | a reference to a EU parent credit institution should be read as being one to an EEA parent institution; | |

| (4) | a reference to a EU parent financial holding company should be read as being one to an EEA parent financial holding company; | |

| (5) | a reference to a Member State should be read as being one to an EEA State; | |

| (6) | a reference to a credit institution authorised in the Community should be read as being to a credit institution or CAD investment firm authorised in an EEA State. | |

| Parent financial holding company in a Member State and financial holding company have the same meaning as they do in the Glossary. | ||

- 01/01/2007

BIPRU 8 Annex 5

Decision tree for identifying the consolidated capital resources requirement of a UK consolidation group or a non-EEA sub-group.

- 01/01/2007

See Notes

- 01/01/2007

BIPRU 8 Annex 6

Non-EEA regulators' requirements deemed CRD-equivalent for individual risks

- 01/01/2007

See Notes

| Part 1 (Non-EEA banking regulators' requirements deemed CRD-equivalent for individual risks) | |||

| Regime regulators | Market risk |

Credit

risk | Operational Risk |

|

USA

Office of the Comptroller of the Currency Board of Governors of the Federal Reserve System * a US banking subsidiary will be deemed equivalent for credit risk if: • it is categorised as well capitalised: and•it scales up its US Basel 1 credit risk requirement by 25% | √ √ | X* X* | X X |

|

Australia

Australian Prudential Regulation Authority [APRA] | √ | √ | X |

|

Canada

Office of the Superintendent of Financial Institutions [OSFI] | √ | √ | √ |

|

Switzerland

Swiss Federal Banking Commission [EBK] | √ | √ See note 2 | √ |

|

Japan

Financial Services Agency, Japan [JFSA] | √ | X | X |

|

South Africa

South African Reserve Bank [SARB] | √ | √ | √ |

|

Hong Kong

Hong Kong Monetary Authority [HKMA] | √ | √ | √ |

|

Singapore

Monetary Authority of Singapore [MAS] | √ | √ | √ |

|

India

Reserve Bank of India [RBI] | √ | √ | √ |

|

Korea

Financial Supervisory Service [FSS] | √ | X | X |

| Jersey | √ | √ | √ |

| Guernsey | X | √ | √ |

| Isle of Man | X | √ | √ |

| Note 1: A √ denotes that the requirements have been assessed as equivalent to EEA standards. A X denotes that the requirements have been assessed as not being equivalent to EEA standards. | |||

| Note 2: √ International standardised approach only. The treatment of the Lombard loans is not equivalent and they must be treated under the FSA's rules. | |||

| Part 2 (Non-EEA investment firm regulators' requirements deemed CRD-equivalent for individual risks) | |||

| Regime regulators | Market risk | Credit risk | Operational Risk |

|

Australia

Sydney Futures Exchange Australian Stock Exchange | √ √ | X X | X X |

|

Canada

Ontario Securities Commission Quebec Securities Commission British Columbia Securities Commission Alberta Securities Commission Investment dealers Association of Canada | √ √ √ √ √ | X X X X X | X X X X X |

|

Hong Kong

Hong Kong Monetary Authority [HKMA] Hong Kong Securities and Futures Commission | √ √ | X X | X X |

|

Japan

Financial Services Agency, Japan [JFSA] | √ | X | X |

|

Singapore

Monetary Authority of Singapore [MAS] Stock Exchange of Singapore | √ √ | X X | X X |

|

South Africa

South African Futures Exchange Johannesburg Stock Exchange Bond Exchange of South Africa | √ √ √ | X X X | X X X |

|

Switzerland

Swiss Federal Banking Commission [EBK] | √ | √ Note 2 | √ |

|

USA

Securities & Exchange Commission (SEC): Net Capital rule only Commodities and Futures Trading Commission | √ Note 3 √ | √ X | X X |

| Note 1: A √ denotes that the requirements have been assessed as equivalent to EEA standards. A X denotes that the requirements have been assessed as not being equivalent to EEA standards. | |||

| Note 2: √ International standardised approach only. The treatment of Lombard loans is not equivalent and they must be treated under the FSA's rules. | |||

| Note 3: √ Where entities are subject to a local regulatory capital requirement. | |||

- 01/01/2007