BIPRU 7

Market risk

BIPRU 7.1

Application, purpose, general provisions and non-standard transactions

- 01/01/2007

Application

BIPRU 7.1.1

See Notes

- 01/01/2007

Purpose

BIPRU 7.1.2

See Notes

- 01/01/2007

General provisions: Obligation to calculate PRR

BIPRU 7.1.3

See Notes

A firm must calculate a PRR in respect of:

- (1) all its trading book positions;

- (2) all positions falling within BIPRU 7.5.3 R (Scope of the foreign exchange PRR calculation), whether or not in the trading book; and

- (3) all positions in commodities (including physical commodities) whether or not in the trading book;

even if no treatment is provided for that position in the other sections of this chapter.

- 01/01/2007

BIPRU 7.1.4

See Notes

A firm must calculate a PRR for any position falling into BIPRU 7.1.3 R using:

- 01/01/2007

General provisions: Non-trading book items

BIPRU 7.1.5

See Notes

- 01/11/2007

General provisions: Frequency of calculation

BIPRU 7.1.6

See Notes

- 01/01/2007

BIPRU 7.1.7

See Notes

- 01/01/2007

Purpose of rules for non-standard transactions and instruments for which no PRR treatment has been specified

BIPRU 7.1.8

See Notes

- 01/01/2007

Instruments for which no PRR treatment has been specified

BIPRU 7.1.9

See Notes

- 01/01/2007

BIPRU 7.1.10

See Notes

- 01/01/2007

BIPRU 7.1.11

See Notes

- 01/01/2007

BIPRU 7.1.12

See Notes

- 01/01/2007

BIPRU 7.1.13

See Notes

- 01/01/2007

Instruments in non-standard form

BIPRU 7.1.14

See Notes

- (1) If a firm has a position:

- (a) in a PRR item in non-standard form; or

- (b) that is part of a non-standard arrangement; or

- (c) that, taken together with other positions (whether or not they are subject to PRR charges under BIPRU 7), gives rise to a non-standard market risk;

- the firm must notify the FSA of that fact and of details about the position, PRR item, arrangements and type of risk concerned.

- (2) Except as (1) provides to the contrary, (1) applies to a position that is subject to a PRR under BIPRU 7.1.3R.

- (3) The question of what is non-standard for the purposes of (1) must be judged by reference to the standards:

- 01/01/2007

BIPRU 7.1.15

See Notes

- 01/01/2007

Meaning of appropriate percentage for non-standard transactions

BIPRU 7.1.16

See Notes

- (1) In BIPRU 7.1.13R and, to the extent that that rule applies BIPRU 7.1.13R, BIPRU 7.1.15R, an "appropriate percentage" is:

- (a) 100%; or

- (b) a percentage which takes account of the characteristics of the position concerned and of discussions with the FSA or a predecessor regulator under the Banking Act 1987 or the Financial Services Act 1986.

- (2) Compliance with (1) may be relied on as tending to establish compliance with BIPRU 7.1.13R or, insofar as it incorporates the requirements relating to an appropriate percentage, BIPRU 7.1.15R.

- (3) Contravention of (1) may be relied on as tending to establish contravention with BIPRU 7.1.13 R or, insofar as it incorporates the requirements relating to an appropriate percentage, BIPRU 7.1.15 R.

- 01/01/2007

Stress testing and scenario analyses of trading book positions

BIPRU 7.1.17

See Notes

- 14/12/2009

BIPRU 7.1.17A

See Notes

- 14/12/2009

BIPRU 7.1.18

See Notes

- 14/12/2009

BIPRU 7.1.19

See Notes

This paragraph gives guidance in relation to the stress testing programme that a firm must carry out in relation to its trading book positions.

- (1) The frequency of the stress testing of trading book positions should be determined by the nature of the positions.

- (2) The stress testing should include shocks which reflect the nature of the portfolio and the time it could take to hedge out or manage risks under severe market conditions.

- (3) The firm should have procedures in place to assess and respond to the results of the stress testing programme. In particular, stress testing should be used to evaluate the firm's capacity to absorb losses or to identify steps to be taken by the firm to reduce risk.

- (4) As part of its stress testing programme, the firm should consider how prudent valuation principles (see GENPRU 1.3) will be met in a stressed scenario.

- 14/12/2009

BIPRU 7.1.20

See Notes

- 14/12/2009

BIPRU 7.2

Interest rate PRR

- 01/01/2007

General rule

BIPRU 7.2.1

See Notes

- (1) A firm must calculate its interest rate PRR under BIPRU 7.2 by:

- (a) identifying which positions must be included within the interest rate PRR calculation;

- (b) deriving the net position in each debt security in accordance with BIPRU 7.2.36R-BIPRU 7.2.41R;

- (c) including these net positions in the interest rate PRR calculation for general market risk and the interest rate PRR calculation for specific risk; and

- (d) summing all PRRs calculated for general market risk and specific risk.

- (2) A firm must calculate its interest rate PRR by adding the amount calculated under (1) to the amount calculated under the basic interest rate PRR calculation under BIPRU 7.3.45R.

- (3) All net positions, irrespective of their signs, must be converted on a daily basis into the firm's base currency at the prevailing spot exchange rate before their aggregation.

- (4) Net positions must be classified according to the currency in which they are denominated. A firm must calculate the capital requirement for general market risk and specific risk in each individual currency separately.

- 01/01/2007

BIPRU 7.2.2

See Notes

- 01/01/2007

Scope of the interest rate PRR calculation

BIPRU 7.2.3

See Notes

A firm's interest rate PRR calculation must:

- (1) include all trading book positions in debt securities, preference shares and convertibles, except:

- (a) positions in convertibles which have been included in the firm's equity PRR calculation;

- (b) positions fully deducted as a material holding under the calculations under the capital resources table, in which case the firm may exclude them; or

- (c) positions hedging an option which is being treated under BIPRU 7.6.26R (Table: Appropriate treatment for equities, debt securities or currencies hedging options);

- (2) include notional positions arising from trading book positions in the instruments listed in the table in BIPRU 7.2.4R; and

- (3) (if the firm is the transferor of debt securities or guaranteed rights relating to title to debt securities in a repurchase agreement or the lender of debt securities in a debt securities lending agreement) include such debt securities if those debt securities meet the criteria for inclusion in the trading book.

- 01/01/2007

BIPRU 7.2.4

See Notes

This table belongs to BIPRU 7.2.3R(2)

| Instrument | See |

| Futures, forwards or synthetic futures on debt securities | BIPRU 7.2.13 R |

| Futures, forwards or synthetic futures on debt indices or baskets | BIPRU 7.2.14R |

| Interest rate futures or forward rate agreements (FRAs) | BIPRU 7.2.18 R |

| Interest rate swaps or foreign currency swaps | BIPRU 7.2.21R |

| Deferred start interest rate swaps or foreign currency swaps | BIPRU 7.2.24R |

| The interest rate leg of an equity swap (unless the firm calculates the interest rate PRR on the instrument using the basic interest rate PRR calculation in BIPRU 7.3 (Equity PRR and basic interest rate PRR for equity derivatives)) | BIPRU 7.2.27R |

| The cash leg of a repurchase agreement or a reverse repurchase agreement | BIPRU 7.2.30R |

| Cash borrowings or deposits | BIPRU 7.2.31 R |

| Options on a debt security, a basket of debt securities, a debt security index, an interest rate or an interest rate future or swap (including an option on a future on a debt security) (unless the firm calculates a PRR on the option under BIPRU 7.6 (Option PRR)) | BIPRU 7.2.32R |

| Dual currency bonds | BIPRU 7.2.33R |

| Foreign currency futures or forwards | BIPRU 7.2.34R |

| Gold futures or forwards | BIPRU 7.2.34R |

| Forwards, futures or options (except cliquets) on an equity, basket of equities or equity index (unless the firm calculates the interest rate PRR on the instrument using the basic interest rate PRR calculation in BIPRU 7.3) | BIPRU 7.2.34R |

| Credit derivatives | BIPRU 7.11 |

| A warrant must be treated in the same way as an option | |

- 01/01/2007

BIPRU 7.2.5

See Notes

- 01/01/2007

BIPRU 7.2.6

See Notes

- 01/01/2007

BIPRU 7.2.7

See Notes

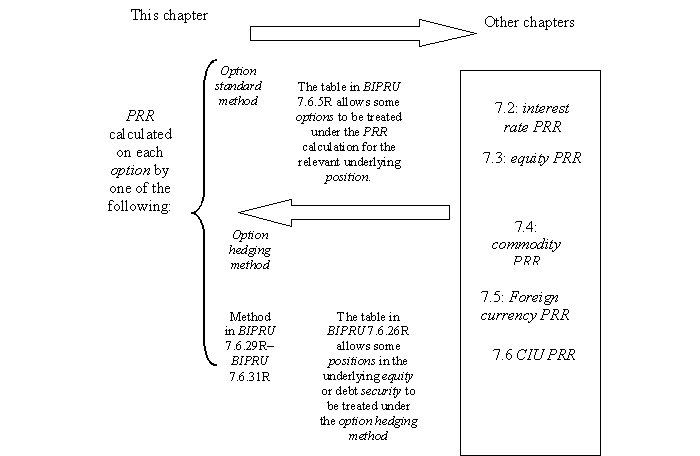

Firms are reminded that the table in BIPRU 7.6.5R (Table: Appropriate PRR calculation for an option or warrant) divides options and warrants on interest rates, debt securities and interest rate futures and swaps into:

- 01/01/2007

BIPRU 7.2.8

See Notes

- 01/01/2007

BIPRU 7.2.9

See Notes

- 01/01/2007

Derivation of notional positions: General approach

BIPRU 7.2.10

See Notes

BIPRU 7.2.11 R - BIPRU 7.2.35R convert the instruments listed in the table in BIPRU 7.2.4R into notional positions in:

- (1) the underlying debt security, where the instrument depends on the price (or yield) of a specific debt security; or

- (2) notional debt securities to capture the pure interest rate risk arising from future payments and receipts of cash (including notional payments and receipts) which, because they are designed to represent pure general market risk (and not specific risk), are called zero-specific-risk securities; or

- (3) both (1) and (2).

- 01/01/2007

BIPRU 7.2.11

See Notes

- (1) For the purposes of calculating interest rate PRR, unless specified otherwise, a firm must derive the value of notional positions as follows:

- (a) notional positions in actual debt securities must be valued as the nominal amount underlying the contract at the current market price of the debt security; and

- (b) positions in zero-specific-risk securities must be valued using one of the two methods in (2).

- (2) A firm must use one of the following two methods for all positions arising under (1)(b) and must use the same method for all positions denominated in the same currency:

- (a) the present value approach, under which the zero-specific-risk security is assigned a value equal to the present value of all the future cash flows that it represents; or

- (b) the alternative approach, under which the zero-specific-risk security is assigned a value equal to:

- (i) the market value of the underlying notional equity position in the case of an equity derivative;

- (ii) the notional principal amount in the case of an interest rate or foreign currency swap; or

- (iii) the notional amount of the future cash flow that it represents in the case of any other CRD financial instrument.

- 01/01/2007

BIPRU 7.2.12

See Notes

- 01/01/2007

Derivation of notional positions: Futures, forwards or synthetic futures on a debt security

BIPRU 7.2.13

See Notes

Futures, forwards or synthetic futures on a single debt security must be treated as follows:

- (1) a purchased future, synthetic future or forward is treated as:

- (a) a notional long position in the underlying debt security (or the cheapest to deliver (taking into account the conversion factor) where the contract can be satisfied by delivery of one from a range of securities); and

- (b) a notional short position in a zero coupon zero-specific-risk security with a maturity equal to the expiry date of the future or forward; and

- (2) a sold future, synthetic future or forward is treated as:

- (a) a notional short position in the underlying security (or the cheapest to deliver (taking into account the conversion factor) where the contract can be satisfied by delivery of one from a range of securities); and

- (b) a notional long position in a zero coupon zero-specific-risk security with a maturity equal to the expiry date of the future, synthetic future or forward.

- 01/01/2007

Derivation of notional positions: Futures, forwards or synthetic futures on a basket or index of debt securities

BIPRU 7.2.14

See Notes

Futures, forwards or synthetic futures on a basket or index of debt securities must be converted into forwards on single debt securities as follows (and then the resulting positions must be treated under BIPRU 7.2.13R):

- (1) futures, synthetic futures or forwards on a single currency basket or index of debt securities must be treated as either:

- (a) a series of forwards, one for each of the constituent debt securities in the basket or index, of an amount which is a proportionate part of the total underlying the contract according to the weighting of the relevant debt security in the basket; or

- (b) a single forward on a notional debt security; and

- (2) futures, synthetic futures or forwards on multiple currency baskets or indices of debt securities must be treated as either:

- (a) a series of forwards (using the method described in (1)(a)); or

- (b) a series of forwards, each one on a notional debt security to represent one of the currencies in the basket or index, of an amount which is a proportionate part of the total underlying the contract according to the weighting of the relevant currency in the basket.

- 01/01/2007

BIPRU 7.2.15

See Notes

- 01/01/2007

BIPRU 7.2.16

See Notes

- 01/01/2007

BIPRU 7.2.17

See Notes

- 01/01/2007

Derivation of notional positions: Interest rate futures and forward rate agreements (FRAs)

BIPRU 7.2.18

See Notes

- 01/01/2007

BIPRU 7.2.19

See Notes

This table belongs to BIPRU 7.2.18R

| A short position in a zero coupon zero-specific-risk security | A long position in a zero coupon zero-specific-risk security | |

| Where the firm buys an interest rate future or sells an FRA | Maturity equals the expiry date of the future (or settlement date of the FRA) | Maturity equals the expiry date of the future (or settlement date of the FRA) plus the maturity of the notional borrowing/deposit |

| Where the firm sells an interest rate future or buys an FRA | Maturity equals the expiry date of the future (or settlement date of the FRA) plus the maturity of the notional borrowing/deposit | Maturity equals the expiry date of the future (or settlement date of the FRA) |

- 01/01/2007

BIPRU 7.2.20

See Notes

- (1) The following example illustrates BIPRU 7.2.18R and BIPRU 7.2.19R in conjunction with BIPRU 7.2.11R (the last rule determines the value of notional positions). A firm sells £1mn notional of a 3v6 FRA at 6%. This results in:

- (a) a short position in a zero-specific-risk security with a zero coupon, three month maturity, and a nominal amount of £1million; and

- (b) a long position in a zero-specific-risk security with a zero coupon, six month maturity, and nominal amount of £1,015,000 (i.e. notional plus interest at 6% over 90 days).

- (2) If a firm were to apply the approach in BIPRU 7.2.11R(2)(a) the two nominal amounts would have to be present valued.

- 01/01/2007

Derivation of notional positions: Interest rate swaps or foreign currency swaps

BIPRU 7.2.21

See Notes

- 01/01/2007

BIPRU 7.2.22

See Notes

This table belongs to BIPRU 7.2.21R

| Paying leg (which must be treated as a short position in a zero-specific-risk security) | Receiving leg (which must be treated as a long position in a zero-specific-risk security) | |

| Receiving fixed and paying floating | Coupon equals the floating rate and maturity equals the reset date | Coupon equals the fixed rate of the swap and maturity equals the maturity of the swap |

| Paying fixed and receiving floating | Coupon equals the fixed rate of the swap and maturity equals the maturity of the swap | Coupon equals the floating rate and maturity equals the reset date |

| Paying floating and receiving floating | Coupon equals the floating rate and maturity equals the reset date | Coupon equals the floating rate and maturity equals the reset date |

- 01/01/2007

BIPRU 7.2.23

See Notes

- 01/01/2007

Derivation of notional positions: Deferred start interest rate swaps or foreign currency swaps

BIPRU 7.2.24

See Notes

- 01/01/2007

BIPRU 7.2.25

See Notes

This table belongs to BIPRU 7.2.24R

| Paying leg (which must be treated as a short position in a zero-specific-risk security with a coupon equal to the fixed rate of the swap) | Receiving leg (which must be treated as a long position in a zero-specific-risk security with a coupon equal to the fixed rate of the swap) | |

| Receiving fixed and paying floating | maturity equals the start date of the swap | maturity equals the maturity of the swap |

| Paying fixed and receiving floating | maturity equals the maturity of the swap | maturity equals the start date of the swap |

- 01/01/2007

BIPRU 7.2.26

See Notes

- 01/01/2007

Derivation of notional positions: Swaps where only one leg is an interest rate leg (e.g. equity swaps)

BIPRU 7.2.27

See Notes

A firm must treat a swap with only one interest rate leg as a notional position in a zero-specific-risk security:

- 01/01/2007

BIPRU 7.2.28

See Notes

- 01/01/2007

Derivation of notional positions: Cash legs of repurchase agreements and reverse repurchase agreements

BIPRU 7.2.29

See Notes

- 01/01/2007

BIPRU 7.2.30

See Notes

The forward cash leg of a repurchase agreement or reverse repurchase agreement must be treated as a notional position in a zero-specific-risk security which:

- (1) is a short notional position in the case of a repurchase agreement; and a long notional position in the case of a reverse repurchase agreement;

- (2) has a value equal to the market value of the cash leg;

- (3) has a maturity equal to that of the repurchase agreement or reverse repurchase agreement; and

- (4) has a coupon equal to:

- (a) zero, if the next interest payment date coincides with the maturity date; or

- (b) the interest rate on the contract, if any interest is due to be paid before the maturity date.

- 01/01/2007

Derivation of notional positions: Cash borrowings and deposits

BIPRU 7.2.31

See Notes

A cash borrowing or deposit must be treated as a notional position in a zero coupon zero-specific-risk security which:

- (1) is a short position in the case of a borrowing and a long position in the case of a deposit;

- (2) has a value equal to the market value of the borrowing or deposit;

- (3) has a maturity equal to that of the borrowing or deposit, or the next date the interest rate is reset (if earlier); and

- (4) has a coupon equal to:

- (a) zero, if the next interest payment date coincides with the maturity date; or

- (b) the interest rate on the borrowing or deposit, if any interest is due to be paid before the maturity date.

- 01/01/2007

Derivation of notional positions: Options and warrants

BIPRU 7.2.32

See Notes

- (1) Where included in the PRR calculation in BIPRU 7.2 (see the table in BIPRU 7.2.4R), options and warrants must be treated in accordance with this rule.

- (2) An option or warrant on a debt security, a basket of debt securities or a debt security index must be treated as a position in that debt security, basket or index.

- (3) An option on an interest rate must be treated as a position in a zero coupon zero-specific-risk security with a maturity equal to the sum of the time to expiry of the option and the length of the period for which the interest rate is fixed.

- (4) An option on a future - where the future is based on an interest rate or debt security - must be treated as:

- (a) a long position in that future for purchased call options and written put options; and

- (b) a short position in that future for purchased put options and written call options.

- (5) An option on a swap must be treated as a deferred starting swap.

- 01/01/2007

Derivation of notional positions: Bonds where the coupons and principal are paid in different currencies

BIPRU 7.2.33

See Notes

Where a debt security pays coupons in one currency, but will be redeemed in a different currency, it must be treated as:

- (1) a debt security denominated in the coupon's currency; and

- (2) a foreign currency forward to capture the fact that the debt security's principal will be repaid in a different currency from that in which it pays coupons, specifically:

- 01/01/2007

Derivation of notional positions: Interest rate risk on other futures, forwards and options

BIPRU 7.2.34

See Notes

Other futures, forwards, options and swaps treated under BIPRU 7.2 must be treated as positions in zero-specific-risk securities, each of which:

- (1) has a zero coupon;

- (2) has a maturity equal to that of the relevant contract; and

- (3) is long or short according to the table in BIPRU 7.2.35R.

- 01/01/2007

BIPRU 7.2.35

See Notes

This table belongs to BIPRU 7.2.34R.

| Instrument | Notional positions | ||

| foreign currency forward or future | a long position denominated in the currency purchased | and | a short position denominated in the currency sold |

| Gold forward or future | a long position if the forward or future involves an actual (or notional) sale of gold | or | a short position if the forward or future involves an actual (or notional) purchase of gold |

| Equity forward or future, or option (unless the interest rate PRR is calculated under the basic interest rate PRR calculation in BIPRU 7.3) | A long position if the contract involves an actual (or notional) sale of the underlying equity | or | A short position if the contract involves an actual (or notional) purchase of the underlying equity |

- 01/01/2007

Deriving the net position in each debt security: General

BIPRU 7.2.36

See Notes

- 01/01/2007

Deriving the net position in each debt security: Netting positions in the same debt security

BIPRU 7.2.37

See Notes

- (1) A firm must not net positions (including notional positions) unless those positions are in the same debt security. This rule sets out the circumstances in which debt securities may be treated as the same for these purposes.

- (2) Subject to (3) long and short positions are in the same debt security, and a debt security is the same as another if and only if:

- (a) they enjoy the same rights in all respects; and

- (b) are fungible with each other.

- (3) Long and short positions in different tranches of the same debt security may be treated as being in the same debt security for the purpose of (1) where:

- (a) the tranches enjoy the same rights in all respects; and

- (b) the tranches become fungible within 180 days and thereafter the debt security of one tranche can be delivered in settlement of the other tranche.

- 01/01/2007

Deriving the net position in each debt security: Netting the cheapest to deliver security with other deliverable securities

BIPRU 7.2.38

See Notes

- 01/01/2007

BIPRU 7.2.39

See Notes

- 01/01/2007

Deriving the net position in each debt security: Netting zero-specific-risk securities with different maturities

BIPRU 7.2.40

See Notes

A firm may net a notional long position in a zero-specific-risk security against a notional short position in a zero-specific-risk security if:

- (1) they are denominated in the same currency;

- (2) their coupons do not differ by more than 15 basis points; and

- (3) they mature:

- (a) on the same day, if they have residual maturities of less than one month;

- (b) within 7 days of each other, if they have residual maturities of between one month and one year; and

- (c) within 30 days of each other, if they have residual maturities in excess of one year.

- 01/01/2007

Deriving the net position in each debt security: Reduced net underwriting positions in debt securities

BIPRU 7.2.41

See Notes

- 01/01/2007

BIPRU 7.2.42

See Notes

- 01/01/2007

Specific risk calculation

BIPRU 7.2.43

See Notes

- (1) A firm must calculate the specific risk portion of the interest rate PRR for each debt security by multiplying the market value of the individual net position (ignoring the sign) by the appropriate PRA from the table in BIPRU 7.2.44R or as specified by BIPRU 7.2.45R - BIPRU 7.2.47R.

- (2) Notional positions in zero-specific-risk securities do not attract specific risk.

- 01/01/2007

BIPRU 7.2.44

See Notes

Table: specific risk PRAs

This table belongs to BIPRU 7.2.43R.

| Issuer | Residual maturity | PRA |

| Debt securities issued or guaranteed by central governments, issued by central banks, international organisations, multilateral development banks or EEA States' regional governments or local authorities which would qualify for credit quality step 1 or which would receive a 0% risk weight under the standardised approach to credit risk. | Any | 0% |

| (A) Debt securities issued or guaranteed by central governments, issued by central banks, international organisations, multilateral development banks or EEA States' regional governments or local authorities which would qualify for credit quality step 2 or 3 under the standardised approach to credit risk. (B) Debt securities issued or guaranteed by institutions which would qualify for credit quality step 1 or 2 under the standardised approach to credit risk. (C) Debt securities issued or guaranteed by institution which would qualify for credit quality step 3 under BIPRU 3.4.34 R (Exposures to institutions: Credit assessment based method) or which would do so if it had an original effective maturity of three months or less. (D) Debt securities issued or guaranteed by corporates which would qualify for credit quality step 1, 2 or 3 under the standardised approach to credit risk. (E) Other qualifying debt securities (see BIPRU 7.2.49R) |

Zero to six months | 0.25% |

| over 6 and up to and including 24 months | 1% | |

| Over 24 months | 1.6% | |

| (A) Debt securities issued or guaranteed by central governments, issued by central banks, international organisations, multilateral development banks or EEA States' regional governments or local authorities or institutions which would qualify for credit quality step 4 or 5 under the standardised approach to credit risk. (B) Debt securities issued or guaranteed by corporates which would qualify for credit quality step 4 under the standardised approach to credit risk. (C) Exposures for which a credit assessment by a nominated ECAI is not available. |

Any | 8% |

| (A) Debt securities issued or guaranteed by central governments, issued by central banks, international organisations, multilateral development banks or EEA States' regional governments or local authorities or institution which would qualify for credit quality step 6 under the standardised approach to credit risk. (B) Debt securities issued or guaranteed by corporate which would qualify for credit quality step 5 or 6 under the standardised approach to credit risk. (C) An instrument that shows a particular risk because of the insufficient solvency of the issuer of liquidity. This paragraph applies even if the instrument would otherwise qualify for a lower PRA under this table. |

Any | 12% |

| Note: The question of what a corporate is and of what category a debt security falls into must be decided under the rules relating to the standardised approach to credit risk. | ||

[Note: CAD Annex I point 14 Table 1]

- 31/12/2010

BIPRU 7.2.45

See Notes

- 01/01/2007

BIPRU 7.2.46

See Notes

- 01/01/2007

BIPRU 7.2.47

See Notes

- 01/01/2007

BIPRU 7.2.47A

See Notes

- 31/12/2010

BIPRU 7.2.47B

See Notes

- 31/12/2010

BIPRU 7.2.47C

See Notes

- 31/12/2010

BIPRU 7.2.48

See Notes

BIPRU 7.2.43R includes both actual and notional positions. However, notional positions in zero-specific-risk security do not attract specific risk. For example:

- (1) interest rate swaps, foreign currency swaps, FRAs, interest rate futures, foreign currency forwards, foreign currency futures, and the cash leg of repurchase agreements and reverse repurchase agreements create notional positions which will not attract specific risk; whilst

- (2) futures, forwards and swaps which are based on the price (or yield) of one or more debt securities will create at least one notional positions that attracts specific risk.

- 01/01/2007

Definition of a qualifying debt security

BIPRU 7.2.49

See Notes

A debt security is a qualifying debt security if:

- (1) it qualifies for a credit quality step under the standardised approach to credit risk corresponding at least to investment grade; or

- (2) it has a PD which, because of the solvency of the issuer, is not higher than that of the debt securities referred to under (1) under the IRB approach; or

- (3) it is a debt security for which a credit assessment by a nominated ECAI is unavailable and which meets the following conditions:

- (a) it is considered by the firm to be sufficiently liquid;

- (b) it is of investment quality, according to the firm's own discretion, at least equivalent to that of the debt securities referred to under (1); and

- (c) it is listed on at least one regulated market or designated investment exchange; or

- (4) it is a debt security issued by an institution subject to the capital adequacy requirements set out in the Banking Consolidation Directive that satisfies the following conditions:

- (a) it is considered by the firm to be sufficiently liquid;

- (b) its investment quality is, according to the firm's own discretion, at least equivalent to that of the assets referred to under (1) above; or

- (5) it is a debt security issued by an institution that is deemed to be of equivalent or higher credit quality than that associated with credit quality step 2 under the standardised approach to credit risk and that is subject to supervision and regulatory arrangements comparable to those under the Capital Adequacy Directive.

- 01/01/2007

BIPRU 7.2.50

See Notes

- 01/01/2007

BIPRU 7.2.51

See Notes

- 01/01/2007

General market risk calculation: General

BIPRU 7.2.52

See Notes

A firm must calculate the general market risk portion of the interest rate PRR for each currency using either:

- (1) the interest rate simplified maturity method;

- (2) the interest rate maturity method; or

- (3) the interest rate duration method.

- 01/01/2007

BIPRU 7.2.53

See Notes

- 01/01/2007

BIPRU 7.2.54

See Notes

A firm must not use the interest rate duration method for index-linked securities. Instead, these securities must:

- (1) be attributed a coupon of 3%; and

- (2) be treated separately under either the interest rate simplified maturity method or the interest rate maturity method.

- 01/01/2007

General market risk calculation: Simplified maturity method

BIPRU 7.2.55

See Notes

- 01/01/2007

BIPRU 7.2.56

See Notes

- 01/01/2007

BIPRU 7.2.57

See Notes

This table belongs to BIPRU 7.2.56R.

| Zone | Maturity band | PRA | |

| Coupon of 3% or more | Coupon of less than 3% | ||

| One | 0 ≤ 1 month | 0 ≤ 1 month | 0.00% |

| > 1 ≤ 3 months | > 1 ≤ 3 months | 0.20% | |

| > 3 ≤ 6 months | > 3 ≤ 6 months | 0.4% | |

| > 6 ≤ 12 months | > 6 ≤ 12 months | 0.7% | |

| Two | > 1 ≤ 2 years | > 1.0 ≤ 1.9 years | 1.25% |

| > 2 ≤ 3 years | > 1.9 ≤ 2.8 years | 1.75% | |

| > 3 ≤ 4 years | > 2.8 ≤ 3.6 years | 2.25% | |

| Three | > 4 ≤ 5 years | > 3.6 ≤ 4.3 years | 2.75% |

| > 5 ≤ 7 years | > 4.3 ≤ 5.7 years | 3.25% | |

| > 7 ≤ 10 years | > 5.7 ≤ 7.3 years | 3.75% | |

| > 10 ≤ 15 years | > 7.3 ≤ 9.3 years | 4.5% | |

| > 15 ≤ 20 years | > 9.3 ≤ 10.6 years | 5.25% | |

| > 20 years | > 10.6 ≤ 12.0 years | 6.00% | |

| > 12.0 ≤ 20.0 years | 8.00% | ||

| > 20 years | 12.50% | ||

- 01/01/2007

General market risk calculation: The maturity method

BIPRU 7.2.58

See Notes

- 01/01/2007

BIPRU 7.2.59

See Notes

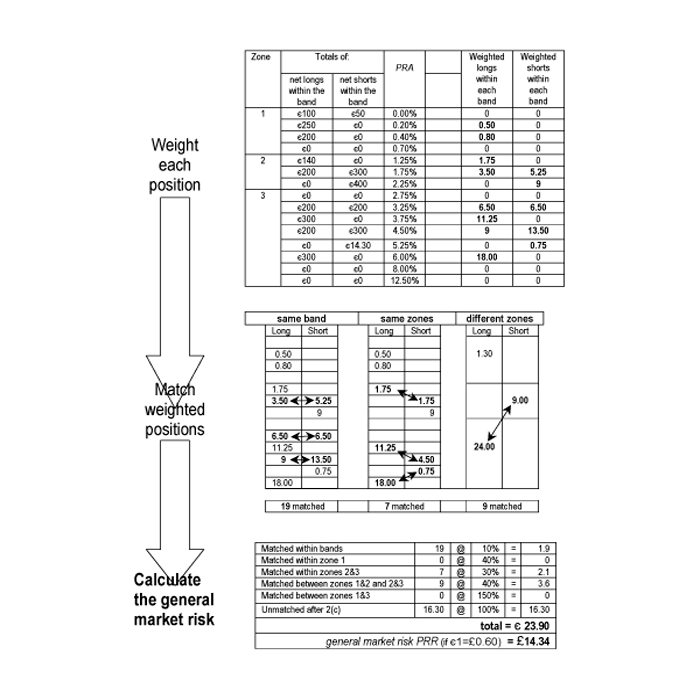

Under the interest rate maturity method, the portion of the interest rate PRR for general market risk is calculated as follows:

- (1) Step 1: each net position is allocated to the appropriate maturity band in the table in BIPRU 7.2.57R and multiplied by the corresponding PRA;

- (2) Step 2: weighted long and short positions are matched within:

- (a) the same maturity band;

- (b) the same zone (using unmatched positions from (a)); and

- (c) different zones (using unmatched positions from (b) and matching between zones 1 and 2 and 2 and 3 before zone 1 and 3); and

- (3) Step 3: the portion of the interest rate PRR for general market risk is the sum of:

- (a) 10% of the total amount matched within maturity bands;

- (b) 40% of the amount matched within zone 1 under (2)(b);

- (c) 30% of the amount matched within zones 2 & 3 under (2)(b);

- (d) 40% of the amounts matched between zones 1 and 2, and between zones 2 and 3;

- (e) 150% of the amount matched between zones 1 and 3; and

- (f) 100% of the weighted positions remaining unmatched after (2)(c).

- 01/01/2007

BIPRU 7.2.60

See Notes

- 01/01/2007

BIPRU 7.2.61

See Notes

- 01/01/2007

General market risk calculation: Duration method

BIPRU 7.2.62

See Notes

- 01/01/2007

BIPRU 7.2.63

See Notes

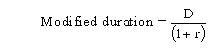

- (1) A firm must use the following formula to calculate modified duration for the purpose of the interest rate duration method:

- (2)

- (3) For the purpose of the formulae in (1) and (2):

- (a) Ct=cash payment at time t

- (b) m=total maturity

- (c) r=yield to maturity. In the case of a fixed-rate debt security a firm must take the current mark to market of the debt security and thence calculate its yield to maturity, which is the implied discount rate for that instrument. In the case of a floating rate instrument, a firm must take the current mark to market of the debt security and thence calculate its yield on the assumption that the principal is due on the date that the interest rate can next be changed.

- (d) t=time

- 01/01/2007

BIPRU 7.2.64

See Notes

Under the interest rate duration method, the portion of the interest rate PRR for general market risk is calculated as follows:

- (1) Step 1: allocate each net position to the appropriate duration zone in the table in BIPRU 7.2.65R and multiply it by:

- (a) its modified duration (using the formula in BIPRU 7.2.63R); and

- (b) the appropriate assumed interest rate change in the table in BIPRU 7.2.65R;

- (2) Step 2: match weighted long and short positions:

- (a) within zones; and

- (b) across zones (using unmatched positions from (2)(a) and following the process in BIPRU 7.2.59R (2)(c)); and

- (3) Step 3: calculate the portion of the interest rate PRR for general market risk as the sum of:

- 01/01/2007

BIPRU 7.2.65

See Notes

This table belongs to BIPRU 7.2.64R

| Zone | Modified Duration | Assumed interest rate change (percentage points) |

| 1 | 0 ≤ 12 months | 1.00 |

| 2 | > 12 months ≤ 3.6 years | 0.85 |

| 3 | > 3.6 years | 0.70 |

- 01/01/2007

BIPRU 7.2.66

See Notes

- 01/01/2007

BIPRU 7.3

Equity PRR and basic interest rate PRR for equity derivatives

- 01/01/2007

General rule

BIPRU 7.3.1

See Notes

- (1) A firm must calculate its equity PRR by:

- (a) identifying which positions must be included within the PRR calculation (see BIPRU 7.3.2R);

- (b) deriving the net position in each equity in accordance with BIPRU 7.3.23R;

- (c) including each of those net positions in either the simplified equity method (see BIPRU 7.3.29R) or, subject to BIPRU 7.3.27R, the standard equity method (see BIPRU 7.3.32R); and

- (d) summing the PRR on each net position as calculated under the simplified equity method and standard equity method.

- (2) All net positions, irrespective of their signs, must be converted on a daily basis into the firm's base currency at the prevailing spot exchange rate before their aggregation.

- 01/01/2007

Scope of the equity PRR calculation

BIPRU 7.3.2

See Notes

A firm's equity PRR calculation must:

- (1) include all trading book positions in equities, unless:

- (a) the position is fully deducted as a material holding under the calculations under the capital resources table, in which case the firm may exclude it; or

- (b) the position is hedging an option or warrant which is being treated under BIPRU 7.6.26R (Table: Appropriate treatment for equities, debt securities or currencies hedging options);

- (2) include notional positions arising from trading book positions in the instruments listed in the table in BIPRU 7.3.3R; and

- (3) (if the firm is the transferor of equities or guaranteed rights relating to title to equities in a repurchase agreement or the lender of equities in an equities lending agreement) include such equities if those equities meet the criteria for inclusion in the trading book.

- 01/01/2007

BIPRU 7.3.3

See Notes

This table belongs to BIPRU 7.3.2R(2)

| Instrument | See | |

| Depository receipts | BIPRU 7.3.12R | |

| Convertibles where: | (a) the convertible is trading at a market price of less than 110% of the underlying equity; and the first date at which conversion can take place is less than three months ahead, or the next such date (where the first has passed) is less than a year ahead; or | BIPRU 7.3.13R |

| (b) the conditions in (a) are not met but the firm includes the convertible in its equity PRR calculation rather than including it in its interest rate PRR calculation set out in BIPRU 7.2 (Interest rate PRR). | ||

| Futures, forwards, CFDs and synthetic futures on a single equity | BIPRU 7.3.14R | |

| Futures, forwards, CFDs and synthetic futures on a basket of equities or equity index | BIPRU 7.3.15R | |

| equity legs of an equity swap | BIPRU 7.3.19R | |

| Options or warrants on a single equity, an equity future, a basket of equities or an equity index (unless the firm calculates a PRR on the option or warrant under BIPRU 7.6). | BIPRU 7.3.21R | |

- 01/01/2007

BIPRU 7.3.4

See Notes

- 01/01/2007

BIPRU 7.3.5

See Notes

- 01/01/2007

BIPRU 7.3.6

See Notes

Firms are reminded that the table in BIPRU 7.6.5R (Table: Appropriate PRR calculation for an option or warrant) divides equity options and warrants into:

- 01/01/2007

BIPRU 7.3.7

See Notes

- 01/01/2007

BIPRU 7.3.8

See Notes

- 01/01/2007

Derivation of notional positions: General approach

BIPRU 7.3.9

See Notes

- 01/01/2007

BIPRU 7.3.10

See Notes

- 01/01/2007

BIPRU 7.3.11

See Notes

- (1) An example of BIPRU 7.3.10R is as follows. The current market value of a particular equity is £2.50. If a firm contracts to sell this equity in five year's time for £3 it would treat the notional short equity position as having a value of £2.50 when calculating the equity PRR.

- (2) In effect, the forward position has been treated as being equivalent to a spot position for the purposes of calculating equity PRR. To capture the risk that the forward price changes relative to the spot price, forward equity positions are included in the firm's interest rate PRR calculation (see BIPRU 7.3.45R or the table in BIPRU 7.2.4R (Table: Instruments which result in notional positions)).

- 01/01/2007

Derivation of notional positions: Depository receipts

BIPRU 7.3.12

See Notes

- 01/01/2007

Derivation of notional positions: Convertibles

BIPRU 7.3.13

See Notes

Where a convertible is included in BIPRU 7.3's PRR calculation (see the table in BIPRU 7.3.3R):

- (1) it must be treated as a position in the equity into which it converts; and

- (2) the firm's equity PRR must be adjusted by making:

- (a) an addition equal to the current value of any loss which the firm would make if it did convert to equity; or

- (b) a deduction equal to the current value of any profit which the firm would make if it did convert to equity (subject to a maximum deduction equal to the PRR on the notional position underlying the convertible).

- 01/01/2007

Derivation of notional positions: Futures, forwards and CFDs on a single equity

BIPRU 7.3.14

See Notes

- 01/01/2007

Derivation of notional positions: Futures, forwards and CFDs on equity indices or baskets

BIPRU 7.3.15

See Notes

A future (including a synthetic future), forward or CFD on an equity index or basket must be treated as either:

- (1) a position in each of the underlying equities; or

- (2) the positions shown in the table in BIPRU 7.3.16R.

- 01/01/2007

BIPRU 7.3.16

See Notes

This table belongs to BIPRU 7.3.15R(2)

| Under the simplified equity method (BIPRU 7.3.29R) | Under the standard equity method (BIPRU 7.3.32R) | |||

| Only one country in the index or basket (see BIPRU 7.3.32R) | One position in the index or basket | One position in the index or basket | ||

| More than one country in the index or basket | One position in the index or basket | Several notional basket positions, one for each country | or | One notional basket position in a separate, notional country |

- 01/01/2007

BIPRU 7.3.17

See Notes

- 01/01/2007

BIPRU 7.3.18

See Notes

The notional positions created under BIPRU 7.3.15R have the following values:

- (1) where only one notional position is created, it has a value equal to the total market value of the equities underlying the contract; or

- (2) where more than one notional position is created, each one has a value which reflects the relevant equity's or country's contribution to the total market value of the equities underlying the contract.

- 01/01/2007

Derivation of notional positions: Equity legs of equity swaps

BIPRU 7.3.19

See Notes

- 01/01/2007

BIPRU 7.3.20

See Notes

- 01/01/2007

Derivation of notional positions: Options

BIPRU 7.3.21

See Notes

If included in BIPRU 7.3's PRR calculation (see the table in BIPRU 7.3.3R), options must be treated as follows:

- 01/01/2007

Deriving the net position in each equity

BIPRU 7.3.22

See Notes

- 01/01/2007

BIPRU 7.3.23

See Notes

- (1) When deriving the net position in each equity, a firm must not net long and short positions except in accordance with this rule.

- (2) Subject to (3), a firm may net long and short positions in the same equity. Two equities are the same if and only if they:

- (a) enjoy the same rights in all respects; and

- (b) are fungible with each other.

- (3) Long and short positions in different tranches of the same equity may be treated as being in the same equity for the purpose of (1), where:

- (a) the tranches enjoy the same rights in all respects; and

- (b) the tranches become fungible with each other within 180 days, and thereafter the equity of one tranche can be delivered in settlement of the other tranche.

- 01/01/2007

BIPRU 7.3.24

See Notes

- 01/01/2007

BIPRU 7.3.25

See Notes

- 01/01/2007

Simplified and standard equity methods

BIPRU 7.3.26

See Notes

- 01/01/2007

BIPRU 7.3.27

See Notes

- 01/01/2007

BIPRU 7.3.28

See Notes

- 01/01/2007

Simplified equity method

BIPRU 7.3.29

See Notes

- 01/01/2007

BIPRU 7.3.30

See Notes

This table belongs to BIPRU 7.3.29R

| Instrument | PRA |

| Single equities | 12% |

| Qualifying equity indices (see BIPRU 7.3.38R) | 8% |

| All other equity indices or baskets | 12% |

| If it is necessary to distinguish between the specific risk PRA and the general market risk PRA, the specific risk PRA for the first and third rows is 4% and that for the second row is 0%. The rest of the PRA in the second column is the general market risk PRA. | |

- 01/01/2007

Standard equity method

BIPRU 7.3.31

See Notes

- 01/01/2007

BIPRU 7.3.32

See Notes

Under the standard equity method, a firm must:

- (1) group equity positions into country portfolios as follows:

- (a) a position in an individual equity belongs to:

- (i) the country it is listed in;

- (ii) any of the countries it is listed in, if more than one; or

- (iii) the country it was issued from, if unlisted;

- (b) a position in an equity basket or index that is treated under BIPRU 7.3.15R(2), is allocated to one or more country portfolios based on the countries to which the underlying equities belong to under (a) or a notional country provided for in the table in BIPRU 7.3.16R; and

- (2) sum:

- (a) the PRRs for specific risk calculated under BIPRU 7.3.33R; and

- (b) the PRRs for general market risk for each country portfolio as calculated under BIPRU 7.3.41R and BIPRU 7.3.42R.

- 01/01/2007

Standard equity method: Specific risk

BIPRU 7.3.33

See Notes

- 01/01/2007

BIPRU 7.3.34

See Notes

This table belongs to BIPRU 7.3.33R

| Instrument | PRA |

| Qualifying equities | 2% |

| Qualifying equity indices (see BIPRU 7.3.38R) | 0% |

| All other equities, equity indices or equities baskets | 4% |

- 01/01/2007

Definition of a qualifying equity

BIPRU 7.3.35

See Notes

A qualifying equity is one that satisfies the following conditions:

- (1) it belongs to a country portfolio that satisfies the following conditions:

- (a) no individual position exceeds 10% of the portfolio's gross value; and

- (b) the sum of positions (ignoring the sign) which individually represent between 5% and 10% of the portfolio's gross value, does not exceed 50% of the portfolio's gross value;

- (2) it is not of an issuer that has issued only traded debt securities that currently attracts an 8% or 12% PRA in the table in BIPRU 7.2.44R (Specific risk PRA) or that attract a lower requirement only because they are guaranteed or secured; and

- (3) it is a constituent of an index in the table in BIPRU 7.3.39R.

- 01/01/2007

BIPRU 7.3.36

See Notes

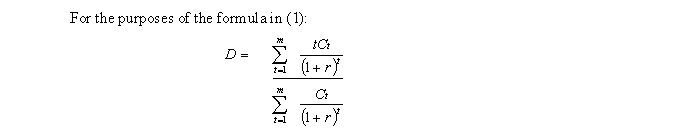

- (1) The following example illustrates BIPRU 7.3.35R(1).

- (2) A country portfolio has a gross value of £100 and is made up of positions in 29 different equities (some are long positions, others are short positions). Not all the equities are constituents of an index used to create the FT All-World Index (this criterion only becomes relevant once a firm has determined whether the country portfolio meets the test in BIPRU 7.3.35R(1)).

- (3) Six positions exceed the 5% threshold. The following diagram shows the composition of the portfolio.

- (4) Part (a): the portfolio meets the first part of the test because no individual position is worth more than 10% of the portfolio's value.

- (5) Part (b): the portfolio fails the second part of the test because the sum (ignoring the sign) of the six relevant positions is £52; this exceeds 50% of the portfolio's value.

- 01/01/2007

BIPRU 7.3.37

See Notes

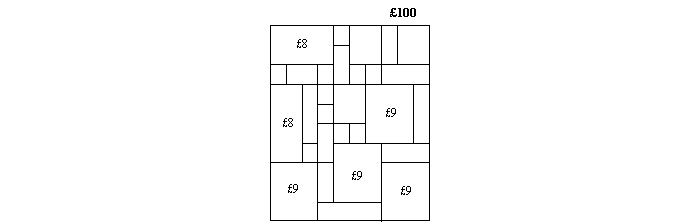

- (1) A country portfolio can be split into two sub-portfolios if this enables one sub-portfolio to meet the requirements in BIPRU 7.3.35R(1). Individual positions may be sub-divided between sub-portfolios.

- (2) Continuing the example above, one of the largest positions is taken out of the portfolio and put into a new portfolio. The new portfolio fails the two tests, but the amended portfolio meets both tests:

- (a) Part (a): no single remaining position exceeds £9.10.

- (b) Part (b): the sum of the five relevant positions is £43, this is less than 50% of the new portfolio's value of £91.

- 01/01/2007

Definition of a qualifying equity index

BIPRU 7.3.38

See Notes

A qualifying equity index is one which is traded on a recognised investment exchange or a designated investment exchange and:

- (1) is listed in the table in BIPRU 7.3.39R; or

- (2) is not listed in the table in BIPRU 7.3.39R, but is constructed in such a way that:

- 01/01/2007

BIPRU 7.3.39

See Notes

This table belongs to BIPRU 7.3.38R

| Country or territory | Name of index |

| Australia | All Ordinaries |

| Austria | Austrian Traded Index |

| Belgium | BEL 20 |

| Canada | TSE 35, TSE 100, TSE 300 |

| France | CAC 40, SBF 250 |

| Germany | DAX |

| European | Dow Jones Stoxx 50 Index, FTSE Eurotop 300, MSCI Euro Index |

| Hong Kong | Hang Seng 33 |

| Italy | MIB 30 |

| Japan | Nikkei 225, Nikkei 300, TOPIX |

| Korea | Kospi |

| Netherlands | AEX |

| Singapore | Straits Times Index |

| Spain | IBEX 35 |

| Sweden | OMX |

| Switzerland | SMI |

| UK | FTSE 100, FTSE Mid 250, FTSE All Share |

| US | S&P 500, Dow Jones Industrial Average, NASDAQ Composite, Russell 2000 |

- 01/01/2007

Standard equity method: General market risk: General

BIPRU 7.3.40

See Notes

- 01/01/2007

Standard equity method: General market risk: Approach One: No offset between different country portfolios

BIPRU 7.3.41

See Notes

- 01/01/2007

Standard equity method: General market risk: Approach Two: Limited offset between different country portfolios

BIPRU 7.3.42

See Notes

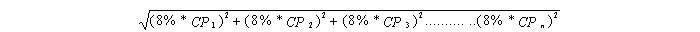

- (1) Under approach two as referred to in BIPRU 7.3.40R, the PRR for general market risk is calculated using the following formula:

- (2) In the formula in (1) CPi denotes the net value of ith country portfolio (converted to the firm's base currency using current spot foreign currency rates).

- (3) The conditions referred to in BIPRU 7.3.40R that must be met for a firm to be able to use approach two as referred to in BIPRU 7.3.40R are as follows:

- (a) at least four country portfolios are included (that is: n ≥ 4);

- (b) only country portfolios for countries which are full members of the OECD, Hong Kong or Singapore are included;

- (c) no individual country portfolio comprises more than 30% of the total gross value of country portfolios included; and

- (d) the total net value of country portfolios included equals zero, that is:

- 01/01/2007

BIPRU 7.3.43

See Notes

- 01/01/2007

Basic interest rate calculation for equity instruments

BIPRU 7.3.44

See Notes

- 01/01/2007

BIPRU 7.3.45

See Notes

This rule applies to a firm that does not include a forward, future, option or swap on an equity, basket of equities or equity index in the calculation of its interest rate PRR calculation under BIPRU 7.2 (Interest rate PRR). However it does not apply to cliquet as defined in BIPRU 7.6.18R (Table: Option PRR: methods for different types of option). A firm must calculate the interest rate PRR for a position being treated under this rule as follows:

- (1) multiply the market value of the notional equity position underlying the instrument by the appropriate percentage from the table in BIPRU 7.3.47R; and

- (2) sum the results from (1), ignoring the sign.

- 01/01/2007

BIPRU 7.3.46

See Notes

- 01/01/2007

BIPRU 7.3.47

See Notes

This table belongs to BIPRU 7.3.45R(1)

| Time to expiration | Percentage (%) |

| 0 ≤ 3 months | 0.20 |

| > 3 ≤ 6 months | 0.40 |

| > 6 ≤ 12 months | 0.70 |

| > 1 ≤ 2 years | 1.25 |

| > 2 ≤ 3 years | 1.75 |

| > 3 ≤ 4 years | 2.25 |

| > 4 ≤ 5 years | 2.75 |

| > 5 ≤ 7 years | 3.25 |

| > 7 ≤ 10 years | 3.75 |

| > 10 ≤ 15 years | 4.50 |

| > 15 ≤ 20 years | 5.25 |

| > 20 years | 6.00 |

- 01/01/2007

Additional capital charge in relation to equity indices

BIPRU 7.3.48

See Notes

- 01/01/2007

BIPRU 7.4

Commodity PRR

- 01/01/2007

General rule

BIPRU 7.4.1

See Notes

A firm must calculate its commodity PRR by:

- (1) identifying which commodity position must be included within the scope of the PRR calculation (see BIPRU 7.4.2R);

- (2) expressing each such position in terms of the standard unit of measurement of the commodity concerned;

- (3) expressing the spot price in each commodity in the firm's base currency at current spot foreign exchange rates;

- (4) calculating an individual PRR for each commodity (see BIPRU 7.4.20R); and

- (5) summing the resulting individual PRRs.

- 01/01/2007

Scope of the commodity PRR calculation

BIPRU 7.4.2

See Notes

A firm's commodity PRR calculation must, regardless of whether the positions concerned are trading book or non-trading book positions:

- (1) include physical commodity positions;

- (2) (if the firm is the transferor of commodities or guaranteed rights relating to title to commodities in a repurchase agreement or the lender of commodities in a commodities lending agreement) include such commodities;

- (3) include notional positions arising from positions in the instruments listed in the table in BIPRU 7.4.4R; and

- (4) exclude positions constituting a stock financing transaction.

- 01/01/2007

BIPRU 7.4.3

See Notes

- 01/01/2007

BIPRU 7.4.4

See Notes

This table belongs to BIPRU 7.4.2R(3)

| Instrument | See |

| Forwards, futures, CFDs, synthetic futures and options on a single commodity (unless the firm calculates a PRR on the option under BIPRU 7.6 (Option PRR)) | BIPRU 7.4.8R |

| A commitment to buy or sell a single commodity at an average of spot prices prevailing over some future period | BIPRU 7.4.10R |

| Forwards, futures, CFDs, synthetic futures and options on a commodity index (unless the firm calculates an PRR on the option under BIPRU 7.6) | BIPRU 7.4.13R - BIPRU 7.4.14R |

| Commodity swaps | BIPRU 7.4.16R - BIPRU 7.4.17R |

| A warrant relating to a commodity must be treated as an option on a commodity. |

- 01/01/2007

BIPRU 7.4.5

See Notes

- 01/01/2007

BIPRU 7.4.6

See Notes

Firms are reminded that the table in BIPRU 7.6.5R (Table: Appropriate PRR calculation for an option or warrant) divides commodity options into:

- 01/01/2007

Derivation of notional positions: General

BIPRU 7.4.7

See Notes

- 01/01/2007

Derivation of notional positions: Futures, forwards, CFDs and options on a single commodity

BIPRU 7.4.8

See Notes

Where a forward, future, CFD, synthetic future or option (unless already included in the firm's option PRR calculation) settles according to:

- (1) the difference between the price set on trade date and that prevailing at contract expiry, the notional position:

- (a) equals the total quantity underlying the contract; and

- (b) has a maturity equal to the expiry date of the contract; and

- (2) the difference between the price set on trade date and the average of prices prevailing over a certain period up to contract expiry, there is a notional position for each of the reference dates used in the averaging period to calculate the average price, which:

- (a) equals a fractional share of the total quantity underlying the contract; and

- (b) has a maturity equal to the relevant reference date.

- 01/01/2007

BIPRU 7.4.9

See Notes

- (1) The following example illustrates BIPRU 7.4.8R (2).

- (2) A firm buys a Traded Average Price Option (TAPO - a type of Asian option) allowing it to deliver 100 tonnes of Grade A copper and receive $1,750 in June. If there were 20 business days in June the short notional positions will each:

- (a) equal 5 tonnes per day (1/20 of 100 tonnes); and

- (b) have a maturity equal to one of the business days in June (one for each day).

- (3) In this example as each business day in June goes by the quantity per day for the remaining days does not change (5 tonnes per day) only the days remaining changes. Therefore, halfway through June there are ten, 5 tonne short notional positions remaining each for the ten remaining business days in June.

- 01/01/2007

Derivation of notional positions: Buying or selling a single commodity at an average of spot prices prevailing in the future

BIPRU 7.4.10

See Notes

Commitments to buy or sell at the average spot price of the commodity prevailing over some period between trade date and maturity must be treated as a combination of:

- (1) a position equal to the full amount underlying the contract with a maturity equal to the maturity date of the contract which is:

- (a) long, where the firm will buy at the average price; or

- (b) short, where the firm will sell at the average price; and

- (2) a series of notional positions, one for each of the reference dates where the contract price remains unfixed, each of which:

- 01/01/2007

BIPRU 7.4.11

See Notes

The following guidance provides an example of BIPRU 7.4.10R. In January, a firm agrees to buy 100 tonnes of copper for the average spot price prevailing during the 20 business days in February, and will settle on 30 June. After entering into this agreement, the firm faces the risk that the average price for February increases relative to that for 30 June. Therefore, as highlighted in the table below:

- 01/01/2007

BIPRU 7.4.12

See Notes

This table belongs to BIPRU 7.4.11G

| Application of BIPRU 7.4.10R(1) | Application of BIPRU 7.4.10R(2) | |

| From trade date to start of averaging period | Long position in 100 tonnes of copper with a maturity of 30 June. | A series of 20 notional short positions each equal to 5 tonnes of copper. Each position is allocated a maturity equal to one of the business days in February (one for each day). |

| During averaging period | Long position in 100 tonnes of copper with a maturity of 30 June. | As each business day goes by in February the price for 5 tonnes of copper is fixed and so there will be one less notional short position. |

| After averaging period | Long position in 100 tonnes of copper with a maturity of 30 June. | No short positions. |

- 01/01/2007

Derivation of notional positions: CFDs and options on a commodity index

BIPRU 7.4.13

See Notes

Commodity index futures and commodity index options (unless the option is included in the firm's option PRR calculation), must be treated as follows:

- (1) Step 1: the total quantity underlying the contract must be either:

- (a) treated as a single notional commodity position (separate from all other commodities); or

- (b) divided into notional positions, one for each of the constituent commodities in the index, of an amount which is a proportionate part of the total underlying the contract according to the weighting of the relevant commodity in the index;

- (2) Step 2: each notional position determined in Step 1 must then be included:

- (a) when using the commodity simplified approach (BIPRU 7.4.24R), without adjustment; or

- (b) when using the commodity maturity ladder approach (BIPRU 7.4.25R) or the commodity extended maturity ladder approach (BIPRU 7.4.32R), with the adjustments in BIPRU 7.4.14R.

- 01/01/2007

BIPRU 7.4.14

See Notes

This table belongs to BIPRU 7.4.13R(2)(b)

| Construction of index | Notional position (or positions) and maturity |

| Spot level of index is based on the spot price of each constituent commodity | Each quantity determined in Step 1 as referred to in BIPRU 7.4.13R is assigned a maturity equal to the expiry date of the contract. |

| Spot level of index is based on an average of the forward prices of each constituent commodity | Each quantity determined in Step 1 as referred to in BIPRU 7.4.13R is divided (on a pro-rata basis) into a series of forward positions to reflect the impact of each forward price on the level of the index. The maturity of each forward position equals the maturity of the relevant forward price determining the level of the index when the contract expires. |

- 01/01/2007

BIPRU 7.4.15

See Notes

- (1) An example of using BIPRU 7.4.13R and the table in BIPRU 7.4.14R is as follows.

- (2) A firm is long a three-month commodity index future where the spot level of the index is based on the one, two and three month forward prices of aluminium, copper, tin, lead, zinc and nickel (18 prices in total).

- (3) Step 1: the firm should decide whether to treat the full quantity underlying the contract as a single notional commodity position or disaggregate it into notional positions in aluminium, copper, tin, lead, zinc and nickel. In this case the firm decides to disaggregate the contract into notional positions in aluminium, copper, tin, lead, zinc and nickel.

- (4) Step 2: if the firm uses the commodity simplified approach, nothing more need be done to arrive at the notional position. In this case the firm uses the commodity maturity ladder approach and so subdivides each position in each metal into three because the level of the index is based on the prevailing one, two and three month forward prices. Since the future will be settled in three months' time at the prevailing level of the index, the three positions for each metal will have maturities of four, five and six months respectively.

- 01/01/2007

Derivation of notional positions: Commodity swaps

BIPRU 7.4.16

See Notes

- 01/01/2007

BIPRU 7.4.17

See Notes

This table belongs to BIPRU 7.4.16R

| Receiving amounts which are unrelated to any commodity's price | Receiving the price of commodity 'b' | |

| Paying amounts which are unrelated to any commodity's price | N/A | Long positions in commodity 'b' |

| Paying the price of commodity 'a' | Short positions in commodity 'a' | Short positions in commodity 'a' and long positions in commodity 'b' |

- 01/01/2007

BIPRU 7.4.18

See Notes

- 01/01/2007

BIPRU 7.4.19

See Notes

- 01/01/2007

Calculating the PRR for each commodity: General

BIPRU 7.4.20

See Notes

- 01/01/2007

BIPRU 7.4.21

See Notes

- 01/01/2007

BIPRU 7.4.22

See Notes

- (1) A firm must treat positions in different grades or brands of the same commodity-class as different commodities unless they:

- (a) can be delivered against each other; or

- (b) are close substitutes and have price movements which have exhibited a stable correlation coefficient of at least 0.9 over the last 12 months.

- (2) If a firm relies on (1)(b) it must then monitor compliance with the conditions in that paragraph on a continuing basis.

- 01/01/2007

BIPRU 7.4.23

See Notes

If a firm intends to rely on the approach in BIPRU 7.4.22R(1)(b):

- (1) it must notify the FSA in writing at least 20 business days prior to the date the firm starts relying on it; and

- (2) the firm must, as part of the notification under (1), provide to the FSA the analysis of price movements on which it relies.

- 01/01/2007

Calculating the PRR for each commodity: Simplified approach

BIPRU 7.4.24

See Notes

A firm which calculates a commodity PRR using the commodity simplified approach must do so by summing:

(and for these purposes the excess of a firm's long (short) positions over its short (long) positions in the same commodity (including notional positions under BIPRU 7.4.4R) is its net position in each commodity).

- 01/01/2007

Calculating the PRR for each commodity: Maturity ladder approach

BIPRU 7.4.25

See Notes

- 01/01/2007

BIPRU 7.4.26

See Notes

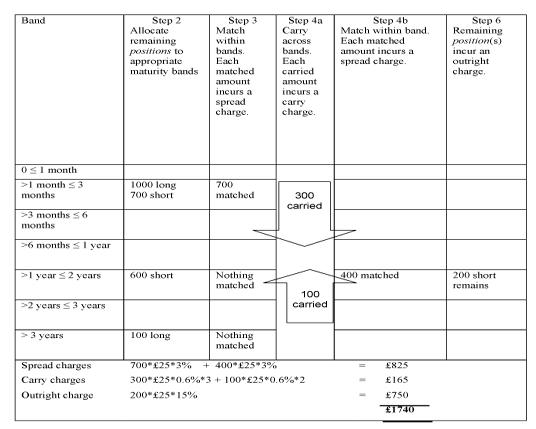

- (1) A firm must calculate the charges referred to in BIPRU 7.4.25R as follows.

- (2) Step 1: offset long and short positions maturing:

- (a) on the same day; or

- (b) (in the case of positions arising under contracts traded in markets with daily delivery dates) within 10 business days of each other.

- (3) Step 2: allocate the positions remaining after step 1 to the appropriate maturity band in the table in BIPRU 7.4.28R (physical commodity positions are allocated to band 1).

- (4) Step 3: match long and short positions within each band. In each instance, calculate a spread charge equal to the matched amount multiplied first by the spot price for the commodity and then by the spread rate of 3%.

- (5) Step 4: carry unmatched positions remaining after step 3 to another band where they can be matched, then match them. Do this until all matching possibilities are exhausted. In each instance, calculate:

- (a) a carry charge equal to the carried position multiplied by the spot price for the commodity, the carry rate of 0.6% and the number of bands by which the position is carried; and

- (b) a spread charge equal to the matched amount multiplied by the spot price for the commodity and the spread rate of 3%.

- (6) Step 5: calculate the outright charge on the remaining positions (which will either be all long positions or all short positions). The outright charge equals the remaining position (ignoring the sign) multiplied by the spot price for the commodity and the outright rate of 15%.

- 01/01/2007

BIPRU 7.4.27

See Notes

- 01/01/2007

BIPRU 7.4.28

See Notes

This table belongs to BIPRU 7.4.26R

| Band | Maturity of position |

| Band 1 | 0 ≤ 1 month |

| Band 2 | > 1 month ≤ 3 months |

| Band 3 | > 3 months ≤ 6 months |

| Band 4 | > 6 months ≤ 1 year |

| Band 5 | > 1 year ≤ 2 years |

| Band 6 | > 2 years ≤ 3 years |

| Band 7 | > 3 years |

- 01/01/2007

BIPRU 7.4.29

See Notes

- 01/01/2007

BIPRU 7.4.30

See Notes

This table belongs to BIPRU 7.4.29G

- 01/01/2007

Calculating the PRR for each commodity: Extended maturity ladder approach

BIPRU 7.4.31

See Notes

A firm may use the commodity extended maturity ladder approach to calculate the commodity PRR for a particular commodity provided the firm:

- (1) has a diversified commodities portfolio;

- (2) undertakes significant commodities business;

- (3) is not yet in a position to use the VaR model approach to calculate commodity PRR; and

- (4) at least twenty business days before the date the firm uses that approach notifies the FSA in writing of:

- (a) its intention to use the commodity extended maturity ladder approach; and

- (b) the facts and matters relied on to demonstrate that the firm meets the criteria in (1) - (3).

- 01/01/2007

BIPRU 7.4.32

See Notes

A firm using the commodity extended maturity ladder approach must calculate its commodity PRR by:

- (1) following the same steps as in BIPRU 7.4.26R but using the rates from the table in BIPRU 7.4.33R rather than those in BIPRU 7.4.26R; and

- (2) summing all spread charges, carry charges and outright charge that result.

- 01/01/2007

BIPRU 7.4.33

See Notes

This table belongs to BIPRU 7.4.32R

| Precious metals (excluding gold) | Base metals | Softs (agricultural) | Other (including energy) | |

| Spread rate (%) | 2 | 2.4 | 3 | 3 |

| Carry rate (%) | 0.3 | 0.5 | 0.6 | 0.6 |

| Outright rate (%) | 8 | 10 | 12 | 15 |

- 01/01/2007

BIPRU 7.4.34

See Notes

- 01/01/2007

BIPRU 7.4.35

See Notes

- 01/01/2007

BIPRU 7.4.36

See Notes

Where a firm is:

- (1) treating a commodity index derivative as if it was based on a single separate commodity (see BIPRU 7.4.13R(1)(a)); and

- (2) using the commodity extended maturity ladder approach to calculate the commodity PRR for that commodity;

it must determine which index constituent incurs the highest rate in the table in BIPRU 7.4.33R and apply that rate to the notional position for the purposes of BIPRU 7.4.32R.

- 01/01/2007

BIPRU 7.4.37

See Notes

- 01/01/2007

Liquidity and other risks

BIPRU 7.4.38

See Notes

- 01/01/2007

BIPRU 7.4.39

See Notes

- 01/01/2007

BIPRU 7.4.40

See Notes

- 01/01/2007

BIPRU 7.4.41

See Notes

- 01/01/2007

BIPRU 7.5

Foreign currency PRR

- 01/01/2007

General rule

BIPRU 7.5.1

See Notes

A firm must calculate its foreign currency PRR by:

- (1) identifying which foreign currency and gold positions to include in the PRR calculation;

- (2) calculating the net open position in each currency in accordance with this section (including where necessary the base currency calculated in the same way as it is for foreign currencies) and in gold;

- (3) calculating the open currency position for foreign currencies as calculated under BIPRU 7.5.19R and the net gold position (see BIPRU 7.5.20R); and

- (4) multiplying the sum of the absolutes of that open currency position and that net gold position by 8%.

- 01/01/2007

BIPRU 7.5.2

See Notes

- 01/01/2007

Scope of the foreign currency PRR calculation

BIPRU 7.5.3

See Notes

A firm's foreign currency PRR calculation must include the following items regardless of whether they are trading book or non-trading book positions:

- (1) all gold positions;

- (2) all spot positions in foreign currency (that is, all asset items less all liability items, including accrued interest, in the foreign currency in question);

- (3) all forward positions in foreign currency;

- (4) all CRD financial instruments and other items which are denominated in a foreign currency;

- (5) irrevocable guarantees (and similar instruments) that are certain to be called and likely to be irrecoverable to the extent they give rise to a position in gold or foreign currency; and

- (6) notional positions arising from the instruments listed in the table in BIPRU 7.5.5R.

- 01/01/2007

BIPRU 7.5.4

See Notes

- (1) The following are excluded from a firm's foreign currency PRR calculation:

- (a) foreign currency assets which have been deducted in full from the firm's capital resources under the calculations under the capital resources table;

- (b) positions hedging (a);

- (c) positions that a firm has deliberately taken in order to hedge against the adverse effect of the exchange rate on the ratio of its capital resources to its capital resources requirement; and

- (d) transactions to the extent that they fully hedge net future foreign currency income or expenses which are known but not yet accrued.

- (2) If a firm uses an exclusion under (1) it must:

- (a) notify the FSA before it makes use of it;

- (b) include in the notification in (a) the terms on which the relevant item will be excluded;

- (c) not change the terms of the exclusion under (b); and

- (d) document its policy on the use of that exclusion in its trading book policy statement.

- (3) A position may only be excluded under (1)(b) or (c) if it is of a non-trading or structural nature.

- 01/01/2007

BIPRU 7.5.5

See Notes

This table belongs to BIPRU 7.5.3R(6).

| Instruments | See |

| Foreign currency futures, forwards, synthetic futures and CFDs | BIPRU 7.5.11R |

| Foreign currency swaps | BIPRU 7.5.13R |

| Foreign currency options or warrants (unless the firm calculates a PRR on the option or warrant under BIPRU 7.6 (Option PRR)). | BIPRU 7.5.15R |

| Gold futures, forwards, synthetic futures and CFDs | BIPRU 7.5.16R |

| Gold options (unless the firm calculates a PRR on the option under BIPRU 7.6). | BIPRU 7.5.17R |

| Positions in CIUs | BIPRU 7.5.18R |

- 01/01/2007

BIPRU 7.5.6

See Notes

Firms are reminded that the table in BIPRU 7.6.5R (Table: Appropriate PRR calculation for an option or warrant) divides foreign currency options and warrants into:

- 01/01/2007

BIPRU 7.5.7

See Notes

- 01/01/2007

BIPRU 7.5.8

See Notes

- 01/01/2007

BIPRU 7.5.9

See Notes

- 01/01/2007

Derivation of notional positions: General

BIPRU 7.5.10

See Notes

- 01/01/2007

Derivation of notional positions: Foreign exchange forwards, futures, CFDs and synthetic futures

BIPRU 7.5.11

See Notes

- (1) A firm must treat a foreign currency forward, future, synthetic future or CFD as two notional currency positions as follows:

- (a) a long notional position in the currency which the firm has contracted to buy; and

- (b) a short notional position in the currency which the firm has contracted to sell.

- (2) In (1) the notional positions have a value equal to either:

- (a) the contracted amount of each currency to be exchanged in the case of a forward, future, synthetic future or CFD held in the non-trading book; or

- (b) the present value of the amount of each currency to be exchanged in the case of a forward, future, synthetic future or CFD held in the trading book.

- 01/01/2007

BIPRU 7.5.12

See Notes

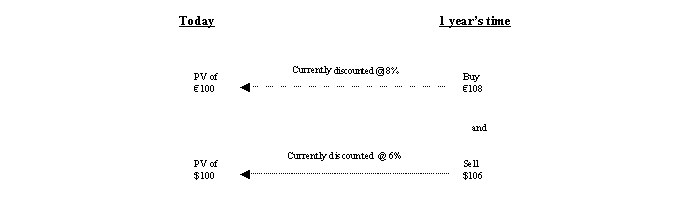

- (1) The following example illustrates BIPRU 7.5.11R. In this example, a firm contracts to sell $106 for €108 in one year's time and the present values of each cash flow are $100 and €100 respectively.

- (2) In the non-trading book, this forward would be treated as a combination of a €108 long position and a $106 short position.

- (3) In the trading book, this forward would be treated as a combination of a €100 long position and a $100 short position.

- (4) Firms are reminded that foreign currency forwards held in the trading book should also be included in the firm's interest rate PRR calculation (see BIPRU 7.2.4R (Instruments which result in notional positions for the purpose of the interest rate PRR)).

- 01/01/2007

Derivation of notional positions: Foreign currency swaps

BIPRU 7.5.13

See Notes

- (1) A firm must treat a foreign currency swap as:

- (a) a long notional position in the currency in which the firm has contracted to receive interest and principal; and

- (b) a short notional position in the currency in which the firm has contracted to pay interest and principal.

- (2) In (1) the notional positions have a value equal to either:

- (a) the nominal amount of each currency underlying the swap if it is held in the non-trading book; or

- (b) the present value amount of all cash flows in the relevant currency in the case of a swap held in the trading book.

- 01/01/2007

BIPRU 7.5.14

See Notes

- (1) The following example illustrates BIPRU 7.5.13R. In this example a firm enters into a five year foreign currency swap where it contracts to pay six month US$ Libor on $100 in return for receiving 6% fixed on €100. The present values of each leg are $100 and €98 respectively.

- (2) In the non-trading book, this swap would be treated as a combination of a €100 long position and a $100 short position.

- (3) In the trading book, this swap would be treated as a combination of a €98 long position and a $100 short position.

- (4) Firms are reminded that foreign currency swaps held in the trading book should also be included in the firm's interest rate PRR calculation (see BIPRU 7.2.4R (Instruments which result in notional positions for the purpose of the interest rate PRR)).

- 01/01/2007

Derivation of notional positions: Foreign currency options and warrants

BIPRU 7.5.15

See Notes

- 01/01/2007

Derivation of notional positions: Gold forwards, futures, synthetic futures and CFDs

BIPRU 7.5.16

See Notes

- 01/01/2007

Derivation of notional positions: Gold options

BIPRU 7.5.17

See Notes

- 01/01/2007

Derivation of notional positions: CIUs

BIPRU 7.5.18

See Notes

- (1) This rule deals with positions in CIUs.

- (2) The actual foreign currency positions of a CIU must be included in a firm's foreign currency PRR calculation under BIPRU 7.5.1 R .

- (3) A firm may rely on third party reporting of the foreign currency positions in the CIU, where the correctness of this report is adequately ensured.

- (4) If a firm is not aware of the foreign currency positions in a CIU, the firm must assume that the CIU is invested up to the maximum extent allowed under the CIUs mandate in foreign currency and the firm must, for trading book positions, take account of the maximum indirect exposure that it could achieve by taking leveraged positions through the CIU when calculating its foreign currency PRR. This must be done by proportionally increasing the position in the CIU up to the maximum exposure to the underlying investment items resulting from the investment mandate.