BIPRU 3

Standardised credit risk

BIPRU 3.1

Application and purpose

- 01/01/2007

Application

BIPRU 3.1.1

See Notes

- 01/01/2007

Purpose

BIPRU 3.1.2

See Notes

BIPRU 3 implements:

- (1) Articles 78 to 80, paragraph (1) of Article 81, Article 83, Annex II and Parts 1 and 3 of Annex VI of the Banking Consolidation Directive;

- (2) Article 18 of the Capital Adequacy Directive so far as it applies Articles 78 to 80, paragraph (1) of Article 81, Article 83 and Parts 1 and 3 of Annex VI of the Banking Consolidation Directive to investment firms; and

- (3) Article 40 of the Capital Adequacy Directive for the purposes of the calculation of credit risk under the Banking Consolidation Directive.

- 01/01/2007

BIPRU 3.1.3

See Notes

- 01/01/2007

BIPRU 3.1.4

See Notes

- 01/01/2007

Calculation of the credit risk capital component

BIPRU 3.1.5

See Notes

- 01/01/2007

BIPRU 3.1.6

See Notes

An exposure falls into this rule if:

- (1) it is in a firm's non-trading book; and

- (2) it has not been deducted from the firm's capital resources under GENPRU 2.2.

- 01/01/2007

BIPRU 3.2

The central principles of the standardised approach to credit risk

- 01/01/2007

BIPRU 3.2.1

See Notes

Subject to BIPRU 13:

- (1) the exposure value of an asset item must be its balance-sheet value, subject to any value adjustments required by GENPRU 1.3; and

- (2) the exposure value of an off-balance sheet item listed in the table in BIPRU 3.7.2 R must be the percentage of its value set out in that table.

[Note: BCD Article 78(1) part]

- 01/01/2007

BIPRU 3.2.2

See Notes

The off-balance sheet items listed in the table in BIPRU 3.7.2 R must be assigned to the risk categories as indicated in that table.

- 01/01/2007

BIPRU 3.2.3

See Notes

Where an exposure is subject to funded credit protection, a firm may modify the exposure value applicable to that item in accordance with BIPRU 5.

- 01/01/2007

BIPRU 3.2.4

See Notes

BIPRU 13 sets out the method for determination of the exposure value of a financial derivative instrument, with the effects of contracts of novation and other netting agreements taken into account for the purposes of that method in accordance with BIPRU 13.7.

- 01/01/2007

BIPRU 3.2.5

See Notes

BIPRU 13.3 and BIPRU 13.8 set out the provisions applying to the treatment and determination of the exposure value of repurchase transactions, securities or commodities lending or borrowing transactions, long settlement transactions and margin lending transactions (SFTs).

[Note: reference to BCD Article 78(2) second sentence. Implementation in BIPRU 13]

- 01/01/2007

BIPRU 3.2.6

See Notes

- 01/01/2007

BIPRU 3.2.7

See Notes

BIPRU 13.8 provides that, in the case of a firm using the financial collateral comprehensive method under BIPRU 5, where an exposure takes the form of an SFT, the exposure value should be increased by the volatility adjustment appropriate to such securities or commodities set out in BIPRU 5.4.30 R to BIPRU 5.4.65 R (Supervisory volatility adjustments approach and the own estimates of volatility adjustments approach).

- 01/01/2007

BIPRU 3.2.8

See Notes

BIPRU 13.3.13 R and BIPRU 13.8.8 R set out the provisions relating to determination of the exposure value of certain credit risk exposures outstanding with a central counterparty, where the central counterparty credit risk exposures with all participants in its arrangements are fully collateralised on a daily basis.

- 01/01/2007

Exposure Classes

BIPRU 3.2.9

See Notes

A firm must assign each exposure to one of the following exposure classes:

- (1) claims or contingent claims on central governments or central banks;

- (2) claims or contingent claims on regional governments or local authorities;

- (3) claims or contingent claims on administrative bodies and non-commercial undertakings;

- (4) claims or contingent claims on multilateral development banks;

- (5) claims or contingent claims on international organisation;

- (6) claims or contingent claims on institutions;

- (7) claims or contingent claims on corporates;

- (8) retail claims or contingent retail claims;

- (9) claims or contingent claims secured on real estate property;

- (10) past due items;

- (11) items belonging to regulatory high-risk categories;

- (12) claims in the form of covered bonds;

- (13) securitisation positions;

- (14) short-term claims on institutions and corporates;

- (15) claims in the form of CIUs; or

- (16) other items.

[Note: BCD Article 79(1)]

- 01/01/2007

BIPRU 3.2.10

See Notes

To be eligible for the retail exposure class, an exposure must meet the following conditions:

- (1) the exposure must be either to an individual person or persons, or to a small or medium sized entity;

- (2) the exposure must be one of a significant number of exposures with similar characteristics such that the risks associated with such lending are substantially reduced; and

- (3) the total amount owed to the firm, its parent undertakings and its subsidiary undertakings, including any past due exposure, by the obligor client or group of connected clients, but excluding claims or contingent claims secured on residential real estate collateral, must not, to the knowledge of the firm, exceed €1 million.

[Note: BCD Article 79(2)]

- 01/01/2007

BIPRU 3.2.11

See Notes

A firm must take reasonable steps to acquire the knowledge referred to in BIPRU 3.2.10 R (3).

- 01/01/2007

BIPRU 3.2.12

See Notes

Securities are not eligible for the retail exposure class.

- 01/01/2007

BIPRU 3.2.13

See Notes

The present value of retail minimum lease payments is eligible for the retail exposure class.

- 01/01/2007

Retail exposures: Significance

BIPRU 3.2.14

See Notes

- 01/01/2007

Retail exposures: Aggregation: Reasonable steps

BIPRU 3.2.15

See Notes

- 01/01/2007

Retail exposures: Aggregation: Single risk

BIPRU 3.2.16

See Notes

- (1) The definition of group of connected clients is set out in the Glossary. Paragraph (2) of that definition is "two or more persons ... who are to be regarded as constituting a single risk because they are so interconnected that, if one of them were to experience financial problems, the other or all of the others would be likely to encounter repayment difficulties".

- (2) Say that a firm has exposures to A and B. When deciding whether A and B come within paragraph (2) of the definition two conditions should be satisfied. Firstly the connections between A and B should mean that if A experiences financial problems, B should be likely to encounter repayment difficulties. Secondly, the connections between A and B should mean that if B experiences financial problems, A should be likely to encounter repayment difficulties.

- (3) The guidance in BIPRU 3.2.16 G is provided for the purpose of BIPRU 3.2.10 R only and not for the purposes of any other provision in the Handbook that uses the defined term group of connected clients.

- 01/01/2007

Retail exposures: Aggregation: Personal and business exposures

BIPRU 3.2.17

See Notes

- 01/01/2007

Retail exposures: Exchange rate

BIPRU 3.2.18

See Notes

- 01/01/2007

Retail exposures: Frequency of monitoring

BIPRU 3.2.19

See Notes

- 01/01/2007

BIPRU 3.2.20

See Notes

- (1) To calculate risk weighted exposure amounts, risk weights must be applied to all exposures, unless deducted from capital resources, in accordance with the provisions of BIPRU 3.4.

- (2) The application of risk weights must be based on the standardised credit risk exposure class to which the exposure is assigned and, to the extent specified in BIPRU 3.4, its credit quality.

- (3) Credit quality may be determined by reference to:

- (a) the credit assessments of eligible ECAIs in accordance with the provisions of BIPRU 3; or

- (b) the credit assessments of export credit agencies as described in BIPRU 3.4.

[Note: BCD Article 80(1)]

- 01/01/2007

BIPRU 3.2.21

See Notes

For the purposes of applying a risk weight, as referred to in BIPRU 3.2.20 R, the exposure value must be multiplied by the risk weight specified or determined in accordance with the standardised approach.

- 01/01/2007

BIPRU 3.2.22

See Notes

Notwithstanding BIPRU 3.2.20 R, where an exposure is subject to credit protection the risk weight applicable to that item may be modified in accordance with BIPRU 5.

- 01/01/2007

BIPRU 3.2.23

See Notes

Risk weighted exposure amounts for securitised exposures must be calculated in accordance with BIPRU 9.

- 01/01/2007

BIPRU 3.2.24

See Notes

Exposures the calculation of risk weighted exposure amounts for which is not otherwise provided for under the standardised approach must be assigned a risk weight of 100%.

- 01/01/2007

Zero risk-weighting for intra-group exposures

BIPRU 3.2.25

See Notes

- (1) Subject to BIPRU 3.2.35 R, and with the exception of exposures giving rise to liabilities in the form of the items referred to in BIPRU 3.2.26 R, a firm is not required to comply with BIPRU 3.2.20 R (Calculation of risk weighted exposures amounts under the standardised approach) in the case of the exposures of the firm to a counterparty which is its parent undertaking, its subsidiary undertaking or a subsidiary undertaking of its parent undertaking or to which the firm is linked by a consolidation Article 12(1) relationship provided that the following conditions are met:

- (a) the counterparty is:

- (i) an institution whose head office is in an EEA State; or

- (ii) an institution not within (a)(i),financial holding company, financial institution, asset management company or ancillary services undertaking subject to appropriate prudential requirements;

- (b) the condition in BIPRU 3.2.27 R is satisfied;

- (c) the counterparty is subject to the same risk evaluation, measurement and control procedures as the firm;

- (d) the counterparty is established in the United Kingdom and either it is incorporated in the United Kingdom or (if that counterparty is of a type that falls within the scope of that Regulation) the centre of its main interests is situated within the United Kingdom within the meaning of the Council Regulation of 29 May 2000 on insolvency proceedings (Regulation 1346/2000/EC); and

- (e) there is no current or foreseen material practical or legal impediment to the prompt transfer of capital resources or repayment of liabilities from the counterparty to the firm.

- (2) Where a firm chooses under (1) not to apply BIPRU 3.2.20 R, it must assign a risk weight of 0% to the exposure.

- (3) A firm need not apply the treatment in (1) and (2) to every exposure that is eligible for that treatment.

[Note: BCD Article 80(7), part]

- 01/01/2007

BIPRU 3.2.26

See Notes

A firm must not apply the treatment in BIPRU 3.2.25 R to exposures giving rise to liabilities in the form of any of the following items:

- (1) in the case of a BIPRU firm, any tier one capital or tier two capital; and

- (2) in the case of any other undertaking, any item that would be tier one capital or tier two capital if the undertaking were a BIPRU firm.

[Note: BCD Article 80(7), part]

- 01/01/2007

BIPRU 3.2.27

See Notes

- (1) The condition referred to in BIPRU 3.2.25 R (1)(b) is that both the counterparty and the firm are:

- (a) included within the scope of consolidation on a full basis with respect to the same UK consolidation group and BIPRU 8.3.1 R applies to the firm with respect to that UK consolidation group; or

- (b) included within the scope of consolidation on a full basis with respect to the same group by a competent authority of an EEA State other than the United Kingdom under the CRD implementation measures about consolidated supervision for that EEA State; or

- (c) (provided that this consolidation is carried out to standards equivalent to those in (a) and (b)) included within the scope of consolidation on a full basis with respect to the same group by a third country competent authority under prudential rules for the banking sector or investment services sector of or administered by that third country competent authority.

- (2) A group is subject to consolidation to equivalent standards for the purpose of (1)(c) only if the firm or another EEA firm in that group has been notified in writing by the FSA or a competent authority of another EEA State pursuant to Article 143 of the Banking Consolidation Directive that that group is subject to equivalent supervision.

[Note: BCD Article 80(7), part]

- 01/01/2007

BIPRU 3.2.28

See Notes

- 01/01/2007

BIPRU 3.2.29

See Notes

- 01/01/2007

BIPRU 3.2.30

See Notes

- 01/01/2007

BIPRU 3.2.31

See Notes

- 01/01/2007

BIPRU 3.2.32

See Notes

- 01/01/2007

BIPRU 3.2.33

See Notes

- 01/01/2007

BIPRU 3.2.34

See Notes

- 01/01/2007

BIPRU 3.2.35

See Notes

- (1) A firm may not apply BIPRU 3.2.25 R unless it has given one month's prior notice to the FSA that it intends do so.

- (2) A firm need only give the FSA the notice required in (1) once rather than with respect to each exposure.

- (3) A firm may stop applying BIPRU 3.2.25 R or may stop applying it to some exposures.

- (4) If a firm stops applying BIPRU 3.2.25 R it may start to apply it again if it notifies the FSA under (1) that it intends do so.

- (5) A firm must notify the FSA if it becomes aware that any exposure that it has treated as exempt under BIPRU 3.2.25 R has ceased to meet the conditions for exemption or if the firm ceases to treat an exposure under that rule.

- 01/01/2007

BIPRU 3.2.36

See Notes

- 01/01/2007

BIPRU 3.2.37

See Notes

- 01/01/2007

Exposures to recognized third-country investment firms, clearing houses and investment exchanges

BIPRU 3.2.38

See Notes

For the purposes of the standardised approach (including as it applies for the purposes of BIPRU 14) and without prejudice to BIPRU 13.3.13 R and BIPRU 13.8.8 R (Exposure to a central counterparty), exposures to recognised third country investment firms and exposures to recognised clearing houses, designated clearing houses, recognised investment exchanges and designated investment exchanges must be treated as exposures to institutions.

[Note: CAD Article 40]

- 01/01/2007

BIPRU 3.3

The use of the credit assessments of ratings agencies

- 01/01/2007

BIPRU 3.3.1

See Notes

An external credit assessment may be used to determine the risk weight of an exposure in accordance with BIPRU 3.2.20 R to BIPRU 3.2.26 R only if the ECAI which provides it is recognised by the FSA as an eligible ECAI for the purposes of the standardised approach to credit risk.

- 01/01/2007

Recognition of ratings agencies

BIPRU 3.3.2

See Notes

- 01/01/2007

BIPRU 3.3.3

See Notes

- 01/01/2007

BIPRU 3.3.4

See Notes

- 01/01/2007

BIPRU 3.3.5

See Notes

- 01/01/2007

BIPRU 3.3.6

See Notes

- 01/01/2007

Mapping of credit assessments

BIPRU 3.3.7

See Notes

- 01/01/2007

BIPRU 3.3.8

See Notes

- 01/01/2007

BIPRU 3.3.9

See Notes

The table mapping the credit assessments of eligible ECAIs to credit quality steps is published on the FSA website and amended from time to time in line with additions to and deletions from the list of eligible ECAIs. The table includes mappings made by a competent authority of another EEA State which are subsequently recognised by the FSA without carrying out its own determination process under Regulation 22(5) of the Capital Requirements Regulations 2006.

- 01/01/2007

BIPRU 3.4

Risk weights under the standardised approach to credit risk

- 01/01/2007

Risk weights: Exposures to central governments or central banks: Treatment

BIPRU 3.4.1

See Notes

Without prejudice to BIPRU 3.4.2 R to BIPRU 3.4.9 R, exposures to central governments and central banks must be assigned a 100% risk weight.

- 01/01/2007

BIPRU 3.4.2

See Notes

Subject to BIPRU 3.4.4 R, exposures to central governments and central banks for which a credit assessment by a nominated ECAI is available must be assigned a risk weight according to the table in BIPRU 3.4.3 R in accordance with the assignment by the FSA in accordance with the Capital Requirements Regulations 2006 of the credit assessments of eligible ECAIs to six steps in a credit quality assessment scale.

- 01/01/2007

Table: Exposures to central governments and central banks for which a credit assessment by a nominated ECAI is available

BIPRU 3.4.3

See Notes

| Credit quality step | 1 | 2 | 3 | 4 | 5 | 6 |

| Risk weight | 0 % | 20 % | 50 % | 100 % | 100 % | 150 % |

- 01/01/2007

BIPRU 3.4.4

See Notes

Exposures to the European Central Bank must be assigned a 0% risk weight.

- 01/01/2007

Exposures in the national currency of the borrower

BIPRU 3.4.5

See Notes

Exposures to EEA States' central governments and central banks denominated and funded in the domestic currency of that central government and central bank must be assigned a risk weight of 0%.

- 01/01/2007

BIPRU 3.4.6

See Notes

When the competent authorities of a third country which apply supervisory and regulatory arrangements at least equivalent to those applied in the EEA assign a risk weight which is lower than that indicated in BIPRU 3.4.1 R to BIPRU 3.4.3 R to exposures to their central government and central bank denominated and funded in the domestic currency, a firm may risk weight such exposures in the same manner.

- 01/01/2007

Use of credit assessments by export credit agencies

BIPRU 3.4.7

See Notes

An export credit agency credit assessment may be recognised by a firm for the purpose of determining the risk weight to be applied to an exposure under the standardised approach if either of the following conditions is met:

- (1) the credit assessment is a consensus risk score from export credit agencies participating in the OECD "Arrangement on Guidelines for Officially Supported Export Credits"; or

- (2) the export credit agency publishes its credit assessments, and the export credit agency subscribes to the OECD agreed methodology, and the credit assessment is associated with one of the eight minimum export insurance premiums (MEIP) that the OECD agreed methodology establishes.

[Note: BCD Annex VI Part 1 point 6]

- 01/01/2007

BIPRU 3.4.8

See Notes

Exposures for which a credit assessment by an export credit agency is recognised for risk weighting purposes must be assigned a risk weight according to the table in BIPRU 3.4.9 R.

- 01/01/2007

Table: Exposure for which a credit assessment by an export credit agency is recognised

BIPRU 3.4.9

See Notes

| MEIP | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Risk weight | 0% | 0% | 20% | 50% | 100% | 100% | 100% | 150% |

- 01/01/2007

Exposures to regional governments or local authorities: General

BIPRU 3.4.10

See Notes

Without prejudice to BIPRU 3.4.15 R to BIPRU 3.4.19 R:

- (1) a firm must risk weight exposures to regional governments and local authorities in accordance with BIPRU 3.4.11 R to BIPRU 3.4.14 R; and

- (2) the preferential treatment for short-term exposures specified in BIPRU 3.4.37 R, BIPRU 3.4.39 R and BIPRU 3.4.44 R must not be applied.

[Note: BCD Annex VI Part 1 point 8]

- 01/01/2007

Exposures to regional governments or local authorities: Central government risk weight based method

BIPRU 3.4.11

See Notes

- (1) Exposures to regional governments and local authorities must be assigned a risk weight according to the credit quality step to which exposures to the central government of the jurisdiction in which the regional government or local authority is established are assigned in accordance with the table in BIPRU 3.4.12 R.

- (2) Exposures to an unrated regional government or local authority must not be assigned a risk weight lower than that applied to exposures to its central government.

[Note: BCD Annex VI Part 1 points 25 and 26]

- 01/01/2007

Table: Central government risk weight based method

BIPRU 3.4.12

See Notes

| Credit quality step to which central government is assigned | 1 | 2 | 3 | 4 | 5 | 6 |

| Risk weight of exposure | 20% | 50% | 100% | 100% | 100% | 150% |

- 01/01/2007

BIPRU 3.4.13

See Notes

For exposures to regional governments and local authorities established in countries where the central government is unrated, the risk weight must be not more than 100%.

- 01/01/2007

BIPRU 3.4.14

See Notes

For exposures to regional governments and local authorities with an original effective maturity of three months or less, the risk weight must be 20%.

[Note: BCD Annex VI Part 1 point 28]

- 01/01/2007

BIPRU 3.4.15

See Notes

A firm must treat an exposure to a regional government or local authority of the United Kingdom listed in BIPRU 3 Annex 2 R as an exposure to the central government of the United Kingdom.

- 01/01/2007

BIPRU 3.4.16

See Notes

The FSA will include a regional government or local authority in the list in BIPRU 3 Annex 2 R where there is no difference in risk between exposures to that body and exposures to the central government of the United Kingdom because of the specific revenue-raising powers of the regional government or local authority, and the existence of specific institutional arrangements the effect of which is to reduce the risk of default.

[Note: BCD Annex VI Part 1 point 9]

- 01/01/2007

BIPRU 3.4.17

See Notes

A firm must treat an exposure to a regional government or local authority of an EEA State other than the United Kingdom as an exposure to the central government in whose jurisdiction that regional government or local authority is established if that regional government or local authority is included on the list of regional governments and local authorities drawn up by the competent authority in that EEA State under a CRD implementation measure with respect to point 9 of Part 1 of Annex VI of the Banking Consolidation Directive.

[Note: BCD Annex VI Part 1 point 9]

- 01/01/2007

BIPRU 3.4.18

See Notes

Exposures to churches or religious communities constituted in the form of a legal person under public law must, in so far as they raise taxes in accordance with legislation conferring on them the right to do so, be treated as exposures to regional governments and local authorities, except that BIPRU 3.4.15 R and BIPRU 3.4.17 R do not apply.

[Note: BCD Annex VI Part 1 point 10]

- 01/01/2007

BIPRU 3.4.19

See Notes

When competent authorities of a third country jurisdiction which apply supervisory and regulatory arrangements at least equivalent to those applied in the EEA treat exposures to regional governments and local authorities as exposures to their central government, a firm may risk weight exposures to such regional governments and local authorities in the same manner.

- 01/01/2007

Exposures to administrative bodies and non-commercial undertakings

BIPRU 3.4.20

See Notes

- 01/01/2007

Treatment

BIPRU 3.4.21

See Notes

Without prejudice to BIPRU 3.4.22 R to BIPRU 3.4.26 R, exposures to administrative bodies and non-commercial undertakings must be assigned a 100% risk weight.

[Note: BCD Annex VI Part 1 point 12]

- 01/01/2007

Public sector entities

BIPRU 3.4.22

See Notes

Without prejudice to BIPRU 3.4.23 R to BIPRU 3.4.26 R, exposures to public sector entities must be assigned a 100% risk weight.

[Note: BCD Annex VI Part 1 point 13]

- 01/01/2007

BIPRU 3.4.23

See Notes

A firm may treat an exposure to a public sector entity as an exposure to a regional government or local authority in accordance with BIPRU 3.4.11 R to BIPRU 3.4.14 R.

- 01/01/2007

BIPRU 3.4.24

See Notes

In exceptional circumstances a firm may treat an exposure to a public sector entity established in the United Kingdom as an exposure to the central government of the United Kingdom if there is no difference in risk between exposures to that body and exposures to the central government of the United Kingdom because of the existence of an appropriate guarantee by the central government.

[Note: BCD Annex VI Part 1 point 15]

- 01/01/2007

BIPRU 3.4.25

See Notes

Where a competent authority of another EEA State implements points 14 or 15 of Part 1 of Annex VI of the Banking Consolidation Directive by exercising the discretion to treat exposures to public sector entities as exposures to institutions or as exposures to the central government of the EEA State concerned, a firm may risk weight exposures to the relevant public sector entities in the same manner.

[Note: BCD Annex VI Part 1 point 16]

- 01/01/2007

BIPRU 3.4.26

See Notes

When competent authorities of a third country jurisdiction, which apply supervisory and regulatory arrangements at least equivalent to those applied in the EEA, treat exposures to public sector entities as exposures to institutions, a firm may risk weight exposures to the relevant public sector entities in the same manner.

[Note: BCD Annex VI Part 1 point 17]

- 01/01/2007

Exposures to multilateral development banks: Treatment

BIPRU 3.4.27

See Notes

Without prejudice to BIPRU 3.4.28 R to BIPRU 3.4.29 R:

- (1) a firm must treat exposures to multilateral development banks in the same manner as exposures to institutions in accordance with BIPRU 3.4.34 R to BIPRU 3.4.39 R (Exposures to institutions: credit assessment based method); and

- (2) the preferential treatment for short-term exposures specified in BIPRU 3.4.37 R, BIPRU 3.4.39 R and BIPRU 3.4.44 R must not be applied.

[Note: BCD Annex VI Part 1 point 19]

- 01/01/2007

BIPRU 3.4.28

See Notes

An exposure to a multilateral development bank listed in point (1) of the definition in the Glossary must be assigned a 0% risk weight.

[Note: BCD Annex VI Part 1 point 20]

- 01/01/2007

BIPRU 3.4.29

See Notes

A risk weight of 20% must be assigned to the portion of unpaid capital subscribed to the European Investment Fund.

- 01/01/2007

Exposures to international organisations

BIPRU 3.4.30

See Notes

Exposures to the following international organisations must be assigned a 0% risk weight:

- (1) the European Community;

- (2) the International Monetary Fund; and

- (3) the Bank for International Settlements.

[Note: BCD Annex VI Part 1 point 22]

- 01/01/2007

Exposures to institutions: General

BIPRU 3.4.31

See Notes

- 01/01/2007

Exposures to institutions: Treatment

BIPRU 3.4.32

See Notes

Without prejudice to BIPRU 3.4.33 R to BIPRU 3.4.47 R, exposures to financial institutions authorised and supervised by the competent authorities responsible for the authorisation and supervision of credit institutions and subject to prudential requirements equivalent to those applied to credit institutions must be risk weighted as exposures to institutions.

- 01/01/2007

Exposures to institutions: Risk weight floor on exposures to unrated institutions

BIPRU 3.4.33

See Notes

Exposures to an unrated institution must not be assigned a risk weight lower than that applied to exposures to its central government.

- 01/01/2007

Exposures to institutions: Credit assessment based method

BIPRU 3.4.34

See Notes

Exposures to institutions with an original effective maturity of more than three months for which a credit assessment by a nominated ECAI is available must be assigned a risk weight according to the table in BIPRU 3.4.35 R in accordance with the assignment by the FSA in accordance with the Capital Requirements Regulations 2006 of the credit assessments of eligible ECAIs to six steps in a credit quality assessment scale.

- 01/01/2007

Table: Exposures to institutions with an original effective maturity of more than three months for which a credit assessment by a nominated ECAI is available

BIPRU 3.4.35

See Notes

| Credit quality step | 1 | 2 | 3 | 4 | 5 | 6 |

| Risk weight | 20% | 50% | 50% | 100% | 100% | 150% |

- 01/01/2007

BIPRU 3.4.36

See Notes

Without prejudice to BIPRU 3.4.33 R, exposures to unrated institutions must be assigned a risk weight of 50%.

[Note: BCD Annex VI Part 1 point 30]

- 01/01/2007

BIPRU 3.4.37

See Notes

Exposures to an institution with an original effective maturity of three months or less for which a credit assessment by a nominated ECAI is available must be assigned a risk weight according to the table in BIPRU 3.4.38 R in accordance with the assignment by the FSA in accordance with the Capital Requirements Regulations 2006 of the credit assessments of eligible ECAIs to six steps in a credit quality assessment scale.

- 01/01/2007

Table: Exposures to an institution with an original effective maturity of three months or less for which a credit assessment by a nominated ECAI is available

BIPRU 3.4.38

See Notes

| Credit quality step | 1 | 2 | 3 | 4 | 5 | 6 |

| Risk weight | 20% | 20% | 20% | 50% | 50% | 150% |

- 01/01/2007

BIPRU 3.4.39

See Notes

Without prejudice to BIPRU 3.4.33 R, exposures to unrated institutions having an original effective maturity of three months or less must be assigned a 20% risk weight

- 01/01/2007

Exposures to institutions: Interaction with short-term credit assessments

BIPRU 3.4.40

See Notes

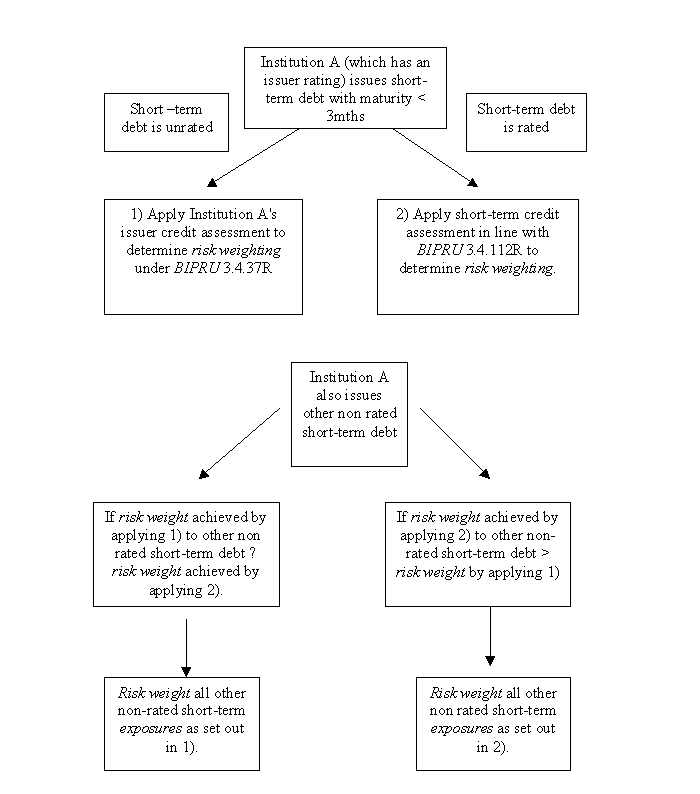

If there is no short-term credit assessment as set out in BIPRU 3.4.112 R, the general preferential treatment for short-term exposures as specified in BIPRU 3.4.37 R applies to all exposures to institutions of up to three months residual maturity.

- 01/01/2007

BIPRU 3.4.41

See Notes

If there is a short-term credit assessment as set out in BIPRU 3.4.112 R and such an assessment determines the application of a more favourable or identical risk weight than the use of the general preferential treatment for short-term exposures, as specified in BIPRU 3.4.37 R, then the short-term assessment and risk weighting specified in BIPRU 3.4.112 R must be used for that specific exposure only. Other short-term exposures must follow the general preferential treatment for short-term exposures, as specified in BIPRU 3.4.37 R.

[Note: BCD Annex VI Part 1 point 35]

- 01/01/2007

BIPRU 3.4.42

See Notes

If there is a short-term credit assessment as set out in BIPRU 3.4.112 R and such an assessment determines a less favourable risk weight than the use of the general preferential treatment for short-term exposures, as specified in BIPRU 3.4.37 R, then the general preferential treatment for short-term exposures must not be used and all unrated short-term claims must be assigned the same risk weight as that applied by the specific short-term assessment.

- 01/01/2007

BIPRU 3.4.43

See Notes

- 06/04/2007

Exposures to institutions: Short-term exposures in the national currency of the borrower

BIPRU 3.4.44

See Notes

A firm may assign to an exposure to an institution formed under the law of the United Kingdom of a residual maturity of 3 months or less denominated and funded in pounds sterling a risk weight that is one category less favourable than the preferential risk weight, as described in BIPRU 3.4.5 R (Exposures in the national currency of the borrower), assigned to exposures to the central government of the United Kingdom.

[Note: BCD Annex VI Part 1 point 37]

- 01/01/2007

BIPRU 3.4.45

See Notes

- (1) Where a competent authority of another EEA State implements point 37 of Part 1 of Annex VI of the Banking Consolidation Directive by exercising the discretion to allow the treatment in that point, a firm may assign to the relevant national currency exposures the risk weight permitted by that CRD implementation measure.

- (2) When the competent authority of a third country which applies supervisory and regulatory arrangements at least equivalent to those applied in the EEA assigns to an exposure to an institution formed under the law of that third country of a residual maturity of 3 months or less denominated and funded in the national currency a risk weight that is one category less favourable than the preferential risk weight, as described in BIPRU 3.4.6 R (Exposures in the national currency of the borrower), assigned to exposures to the central government of that third country, a firm may risk weight such exposures in the same manner.

[Note: BCD Annex VI Part 1 point 37]

- 01/01/2007

BIPRU 3.4.46

See Notes

No exposures of a residual maturity of 3 months or less denominated and funded in the national currency of the borrower may be assigned a risk weight less than 20%.

- 01/01/2007

Exposures to institutions: Investments in regulatory capital instruments

BIPRU 3.4.47

See Notes

Investments in equity or regulatory capital instruments issued by institutions must be risk weighted at 100%, unless deducted from capital resources.

[Note: BCD Annex VI Part 1 point 39]

- 01/01/2007

Exposures to institutions: Minimum reserves required by the ECB

BIPRU 3.4.48

See Notes

Where an exposure to an institution is in the form of minimum reserves required by the European Central Bank or by the central bank of an EEA State to be held by the firm, a firm may assign the risk weight that would be assigned to exposures to the central bank of the EEA State in question provided:

- (1) the reserves are held in accordance with Regulation (EC) No. 1745/2003 of the European Central Bank of 12 September 2003 or a subsequent replacement regulation or in accordance with national requirements in all material respects equivalent to that Regulation; and

- (2) in the event of the bankruptcy or insolvency of the institution where the reserves are held, the reserves will be fully repaid to the firm in a timely manner and will not be available to meet other liabilities of the institution.

[Note: BCD Annex VI Part 1 point 40]

- 01/01/2007

Exposures to corporates: General

BIPRU 3.4.49

See Notes

- 01/01/2007

Exposures to corporates: Treatment

BIPRU 3.4.50

See Notes

Exposures for which a credit assessment by a nominated ECAI is available must be assigned a risk weight according to the table in BIPRU 3.4.51 R in accordance with the assignment by the FSA in accordance with the Capital Requirements Regulations 2006 of the credit assessments of eligible ECAIs to six steps in a credit quality assessment scale.

- 01/01/2007

Table: Exposures for which a credit assessment by a nominated ECAI is available

BIPRU 3.4.51

See Notes

| Credit quality step | 1 | 2 | 3 | 4 | 5 | 6 |

| Risk weight | 20% | 50% | 100% | 100% | 150% | 150% |

- 01/01/2007

BIPRU 3.4.52

See Notes

Unrated exposures must be assigned a 100% risk weight or the risk weight of its central government, whichever is the higher.

- 01/01/2007

Retail exposures

BIPRU 3.4.53

See Notes

Exposures that comply with the criteria listed in BIPRU 3.2.10 R must be assigned a risk weight of 75%. However a firm may treat such an exposure under BIPRU 3.2.24 R (100% risk weight).

[Note: BCD Annex VI Part 1 point 43]

- 01/01/2007

Exposures secured by real estate property

BIPRU 3.4.54

See Notes

- 01/01/2007

BIPRU 3.4.55

See Notes

Without prejudice to BIPRU 3.4.56 R to BIPRU 3.4.94 R, exposures fully secured by real estate property must be assigned a risk weight of 100%.

[Note: BCD Annex VI Part 1 point 44]

- 01/01/2007

Exposures secured by mortgages on residential property

BIPRU 3.4.56

See Notes

Without prejudice to BIPRU 3.4.85 R, an exposure or any part of an exposure fully and completely secured, to the satisfaction of the firm, by mortgages on residential property which is or shall be occupied or let by the owner or the beneficial owner in the case of personal investment companies must be assigned a risk weight of 35%.

- 01/01/2007

BIPRU 3.4.57

See Notes

Exposures fully and completely secured, to the satisfaction of the firm, by shares in Finnish residential housing companies, operating in accordance with the Finnish Housing Company Act of 1991 or subsequent equivalent legislation, in respect of residential property which is or shall be occupied or let by the owner must be assigned a risk weight of 35%.

[Note: BCD Annex VI Part 1 point 46]

- 01/01/2007

BIPRU 3.4.58

See Notes

Without prejudice to BIPRU 3.4.85 R, an exposure or any part of an exposure to a tenant under a property leasing transaction concerning residential property under which the firm is the lessor and the tenant has an option to purchase, must be assigned a risk weight of 35% provided that the firm is satisfied that the exposure of the firm is fully and completely secured by its ownership of the property.

[Note: BCD Annex VI Part 1 point 47]

- 01/01/2007

BIPRU 3.4.59

See Notes

- 01/01/2007

BIPRU 3.4.60

See Notes

- (1) In the exercise of its judgement for the purposes of BIPRU 3.4.56 R to BIPRU 3.4.58 R, a firm may be satisfied only if the conditions in (2) to (6) are met.

- (2) The value of the property does not materially depend upon the credit quality of the obligor. This requirement does not preclude situations where purely macroeconomic factors affect both the value of the property and the performance of the borrower.

- (3) The risk of the borrower does not materially depend upon the performance of the underlying property or project, but rather on the underlying capacity of the borrower to repay the debt from other sources. As such, repayment of the facility does not materially depend on any cash flow generated by the underlying property serving as collateral.

- (4) The minimum requirements about:

- (a) legal certainty in BIPRU 3.4.64 R;

- (b) monitoring of property values in BIPRU 3.4.66 R;

- (c) documentation in BIPRU 3.4.72 R; and

- (d) insurance in BIPRU 3.4.73 R;

- are met.

- (5) The valuation rules set out in BIPRU 3.4.77 R to BIPRU 3.4.80 R are met.

- (6) The value of the property exceeds the exposures by a substantial margin as set out in BIPRU 3.4.81 R, BIPRU 3.4.83 R, BIPRU 3.4.84 R or BIPRU 3.4.85 R (as applicable).

[Note: BCD Annex VI Part 1 point 48]

- 01/01/2007

BIPRU 3.4.61

See Notes

BIPRU 3.4.60 R (3) does not apply to exposures fully and completely secured by mortgages on residential property which is situated within the United Kingdom.

- 01/01/2007

BIPRU 3.4.62

See Notes

- 01/01/2007

BIPRU 3.4.63

See Notes

If a CRD implementation measure of another EEA State exercises the discretion in point 49 of Part 1 of Annex VI of the Banking Consolidation Directive to dispense with the condition corresponding to BIPRU 3.4.60 R (3) (The risk of the borrower should not materially depend upon the performance of the underlying property or project), a firm may apply a risk weight of 35% to such exposures fully and completely secured by mortgages on residential property situated in that EEA State.

- 01/01/2007

BIPRU 3.4.64

See Notes

The requirements about legal certainty referred to in BIPRU 3.4.60 R (4)(a) are as follows:

- (1) the mortgage or charge must be enforceable in all relevant jurisdictions which are relevant at the time of conclusion of the credit agreement, and the mortgage or charge must be properly filed on a timely basis;

- (2) the arrangements must reflect a perfected lien (i.e. all legal requirements for establishing the pledge shall have been fulfilled); and

- (3) the protection agreement and the legal process underpinning it must enable the firm to realise the value of the protection within a reasonable timeframe.

[Note: BCD Annex VIII Part 2 point 8(a)]

- 01/01/2007

BIPRU 3.4.65

See Notes

- 01/01/2007

BIPRU 3.4.66

See Notes

- (1) The requirements about monitoring of property values referred to in BIPRU 3.4.60 R (4)(b) are as follows:

- (a) the value of the property must be monitored on a frequent basis and at a minimum once every three years for residential real estate;

- (b) more frequent monitoring must be carried out where the market is subject to significant changes in conditions;

- (c) statistical methods may be used to monitor the value of the property and to identify property that needs revaluation;

- (d) the property valuation must be reviewed by an independent valuer when information indicates that the value of the property may have declined materially relative to general market prices; and

- (e) for loans exceeding €3 million or 5% of the capital resources of the firm, the property valuation must be reviewed by an independent valuer at least every three years.

- (2) For the purposes of (1), 'independent valuer' means a person who possesses the necessary qualifications, ability and experience to execute a valuation and who is independent from the credit decision process.

[Note: BCD Annex VIII Part 2 point 8(b)]

- 01/01/2007

BIPRU 3.4.67

See Notes

- 01/01/2007

BIPRU 3.4.68

See Notes

- 01/01/2007

BIPRU 3.4.69

See Notes

- 01/01/2007

BIPRU 3.4.70

See Notes

- 01/01/2007

BIPRU 3.4.71

See Notes

- 01/01/2007

BIPRU 3.4.72

See Notes

The requirements about documentation referred to in BIPRU 3.4.60 R (4)(c) are that the types of residential real estate accepted by the firm and its lending policies in this regard must be clearly documented.

- 01/01/2007

BIPRU 3.4.73

See Notes

The requirements about insurance referred to in BIPRU 3.4.60 R (4)(d) are that the firm must have procedures to monitor that the property taken as protection is adequately insured against damage.

- 01/01/2007

BIPRU 3.4.74

See Notes

- 01/01/2007

BIPRU 3.4.75

See Notes

- 01/01/2007

BIPRU 3.4.76

See Notes

- 01/01/2007

BIPRU 3.4.77

See Notes

The property must be valued by an independent valuer at or less than the market value. In those EEA States that have laid down rigorous criteria for the assessment of the mortgage lending value in statutory or regulatory provisions the property may instead be valued by an independent valuer at or less than the mortgage lending value.

[Note: BCD Annex VIII Part 3 point 62]

- 01/01/2007

BIPRU 3.4.78

See Notes

Market value means the estimated amount for which the property should exchange on the date of valuation between a willing buyer and a willing seller in an arm's length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently and without compulsion. The market value must be documented in a transparent and clear manner.

- 01/01/2007

BIPRU 3.4.79

See Notes

Mortgage lending value means the value of the property as determined by a prudent assessment of the future marketability of the property taking into account long-term sustainable aspects of the property, the normal and local market conditions, the current use and alternative appropriate uses of the property. Speculative elements must not be taken into account in the assessment of the mortgage lending value. The mortgage lending value must be documented in a transparent and clear manner.

- 01/01/2007

BIPRU 3.4.80

See Notes

The value of the collateral must be the market value or mortgage lending value reduced as appropriate to reflect the results of the monitoring required under BIPRU 3.4.60 R (4)(b) and BIPRU 3.4.66 R and to take account of any prior claims on the property.

- 06/04/2007

BIPRU 3.4.81

See Notes

- 01/01/2007

BIPRU 3.4.82

See Notes

- (1) The application of BIPRU 3.4.81 R may be illustrated by an example. If a firm has a mortgage exposure of £100,000 secured on residential property in the United Kingdom that satisfies the criteria listed in BIPRU 3.4.56 R to BIPRU 3.4.80 R and the value of that property is £100,000, then £80,000 of that exposure may be treated as fully and completely secured and risk weighted at 35%. The remaining £20,000 may be risk weighted at 75% provided the exposure meets the criteria in BIPRU 3.2.10 R. The portion risk weighted at 75% should be treated as a retail exposure for the purposes of the aggregation calculations specified in BIPRU 3.2.10 R (3). A diagrammatic illustration of this example is in (2).

- (2)

- (3) The same approach applies to exposures described in BIPRU 3.4.58 R. On initiation a 35% risk weight should be applied to the first 80% of the principal/"purchase price" outstanding, with a 75% risk weight being applied to the remainder of the principal (assuming that the exposure meets the requirements in BIPRU 3.2 to be treated as a retail exposure).

- 01/01/2007

BIPRU 3.4.83

See Notes

- 01/01/2007

BIPRU 3.4.84

See Notes

- 01/01/2007

BIPRU 3.4.85

See Notes

For the purposes of BIPRU 3.4.56 R or BIPRU 3.4.58 R, where the residential property in question is situated in the territory of a third-country competent authority that is not listed as equivalent for credit risk in BIPRU 8 Annex 3 R:

- 01/01/2007

BIPRU 3.4.86

See Notes

- 01/01/2007

BIPRU 3.4.87

See Notes

- 01/01/2007

BIPRU 3.4.88

See Notes

- 01/01/2007

Exposures secured by mortgages on commercial real estate

BIPRU 3.4.89

See Notes

Exposures or any part of an exposure secured by mortgages on offices or other commercial premises which cannot properly be considered to fall within any other standardised credit risk exposure class or to qualify for a lower risk weight under BIPRU 3 must be assigned a risk weight of 100%.

[Note: BCD Annex VI Part 1 point 51]

- 01/01/2007

BIPRU 3.4.90

See Notes

Exposures fully and completely secured by shares in Finnish housing companies, operating in accordance with the Finnish Housing Company Act of 1991 or subsequent equivalent legislation, in respect of offices or other commercial premises may be assigned a risk weight of 50%.

- 01/01/2007

BIPRU 3.4.91

See Notes

If a CRD implementation measure in another EEA State implements the discretion in point 51 of Part 1 of Annex VI of the Banking Consolidation Directive, a firm may apply the same treatment as that CRD implementation measure to exposures falling within the scope of that CRD implementation measure which are fully and completely secured by mortgages on offices or other commercial premises situated in that EEA State.

- 01/01/2007

BIPRU 3.4.92

See Notes

If a CRD implementation measure in another EEA State implements the discretion in point 53 of Part 1 of Annex VI of the Banking Consolidation Directive, a firm may apply the same treatment as that CRD implementation measure to exposures related to property leasing transactions concerning offices or other commercial premises situated in that EEA State and governed by statutory provisions whereby the lessor retains full ownership of the rented assets until the tenant exercises his option to purchase, as long as that exposure falls within the scope of that CRD implementation measure.

- 01/01/2007

BIPRU 3.4.93

See Notes

In particular, if a firm applies BIPRU 3.4.91 R or BIPRU 3.4.92 R, it must comply with the corresponding CRD implementation measures in relation to points 54-56 of Part 1 of Annex VI of the Banking Consolidation Directive.

- 01/01/2007

BIPRU 3.4.94

See Notes

- (1) If a CRD implementation measure in another EEA State implements the discretion in point 58 of Part 1 of Annex VI of the Banking Consolidation Directive to dispense with the condition in point 54(b) for exposures fully and completely secured by mortgages on commercial property situated in that EEA State, a firm may apply the same treatment as that CRD implementation measure to exposures fully and completely secured by mortgages on commercial property situated in that EEA State falling within the scope of that CRD implementation measure.

- (2) However a firm may not apply the treatment in (1) if the eligibility to use that treatment under the CRD implementation measure referred to in (1) ceases as contemplated under point 59 of Annex VI of the Banking Consolidation Directive (condition in point 54(b) must apply where conditions in point 58 are not satisfied).

[Note: BCD Annex VI Part 1 points 58, 59 and 60]

- 01/01/2007

Past due items

BIPRU 3.4.95

See Notes

- 01/01/2007

BIPRU 3.4.96

See Notes

Without prejudice to the provisions contained in BIPRU 3.4.97 R to BIPRU 3.4.101 R, the unsecured part of any item that is past due for more than 90 days (irrespective of the amount of that item or of the unsecured portion of that item) must be assigned a risk weight of:

[Note: BCD Annex VI Part 1 point 61]

- 01/01/2007

BIPRU 3.4.97

See Notes

For the purpose of defining the secured portion of the past due item, eligible collateral and guarantees must be those eligible for credit risk mitigation purposes under BIPRU 5.

- 01/01/2007

BIPRU 3.4.98

See Notes

- 01/01/2007

BIPRU 3.4.99

See Notes

Exposures indicated in BIPRU 3.4.56 R to BIPRU 3.4.63 R (Exposures secured by mortgages on residential property) must be assigned a risk weight of 100% net of value adjustments if they are past due for more than 90 days. If value adjustments are no less than 20% of the exposure gross of value adjustments, the risk weight to be assigned to the remainder of the exposure is 50%.

- 01/01/2007

BIPRU 3.4.100

See Notes

The application of BIPRU 3.4.96 R and BIPRU 3.4.99 R may be illustrated on the basis of a £110,000 loan on a property valued at £100,000, where £80,000 of the loan is secured and £30,000 of the exposure is unsecured and provisions of £20,000 are taken:

- (1) Option 1 (application of BIPRU 3.4.96 R):

- (a) provision of £20,000 taken on £80,000 secured exposure;

- (b) provision exceeds 20%, so the firm should risk weight the remaining £60,000 secured exposure at 50%;

- (c) the risk weight to be applied to the unsecured exposure of £30,000 is 150%;

- (d) the average risk weight to be assigned to the net exposure of £90,000 is 83%.

- (2) Option 2 (application of BIPRU 3.4.99 R):

- (a) provision of £20,000 taken on £30,000 unsecured exposure;

- (b) provision exceeds 20%, so the firm should risk weight the remaining £10,000 unsecured exposure at 100%;

- (c) the risk weight to be applied to the secured exposure of £80,000 is 100%;

- (d) the average risk weight to be assigned to the net exposure of £90,000 is 100%.

- 01/01/2007

BIPRU 3.4.101

See Notes

Exposures indicated in BIPRU 3.4.89 R to BIPRU 3.4.94 R (Exposures secured by mortgages on commercial real estate) must be assigned a risk weight of 100% if they are past due for more than 90 days.

- 01/01/2007

BIPRU 3.4.102

See Notes

Non past due items to be assigned a 150% risk weight under BIPRU 3.4 and for which value adjustments have been established may be assigned a risk weight of:

- 01/01/2007

Items belonging to regulatory high-risk categories

BIPRU 3.4.103

See Notes

- 01/01/2007

BIPRU 3.4.104

See Notes

Exposures listed in BIPRU 3 Annex 3 R must be assigned a risk weight of 150%.

[Note: BCD Annex VI Part 1 point 66]

- 01/01/2007

BIPRU 3.4.105

See Notes

- 01/01/2007

Exposures in the form of covered bonds

BIPRU 3.4.106

See Notes

- 01/01/2007

BIPRU 3.4.107

See Notes

- (1) Covered bonds means covered bonds as defined in paragraph (1) of the definition in the glossary (Definition based on Article 22(4) of the UCITS Directive) and collateralised by any of the following eligible assets:

- (a) exposures to or guaranteed by central governments, central bank, public sector entities, regional governments and local authorities in the EEA;

- (b)

- (i) exposures to or guaranteed by non-EEA central governments, non-EEA central banks, multilateral development banks, international organisations that qualify for the credit quality step 1;

- (ii) exposures to or guaranteed by non-EEA public sector entities, non-EEA regional governments and non-EEA local authorities that are risk weighted as exposures to institutions or central governments and central banks according to BIPRU 3.4.23 R, BIPRU 3.4.24 R, BIPRU 3.4.10 R or BIPRU 3.4.16 G to BIPRU 3.4.17 R respectively and that qualify for the credit quality step 1; and

- (iii) exposures in the sense of this point (b) that qualify as a minimum for the credit quality step 2, provided that they do not exceed 20% of the nominal amount of outstanding covered bonds of issuing institutions;

- (c) exposures to institutions that qualify for the credit quality step 1 but so that:

- (i) the total exposure of this kind must not exceed 15% of the nominal amount of the outstanding covered bonds of the issuing credit institution;

- (ii) exposures caused by transmission and management of payments of the obligors of, or liquidation proceeds in respect of, loans secured by real estate to the holders of covered bonds must not be comprised by the 15% limit; and

- (iii) exposures to institutions in the EEA with a maturity not exceeding 100 days are not comprised by the step 1 requirement but those institutions must as a minimum qualify for credit quality step 2;

- (d) loans secured:

- (i) by residential real estate or shares in Finnish residential housing companies as referred to in BIPRU 3.4.57 R up to the lesser of the principal amount of the liens that are combined with any prior liens and 80% of the value of the pledged properties; or

- (ii) by senior units issued by French Fonds Communs de Créances or by equivalent securitisation entities governed by the laws of an EEA State securitising residential real estate exposures provided that at least 90% of the assets of such Fonds Communs de Créances or of equivalent securitisation entities governed by the laws of an EEA State are composed of mortgages that are combined with any prior liens up to the lesser of the principal amounts due under the units, the principal amounts of the liens, and 80% of the value of the pledged properties and the units qualify for credit quality step 1 where such units do not exceed 20% of the nominal amount of the outstanding issue; or

- (e)

- (i) loans secured by commercial real estate or shares in Finnish housing companies as referred to in BIPRU 3.4.57 R up to the lesser of the principal amount of the liens that are combined with any prior liens and 60% of the value of the pledged properties; or

- (ii) loans secured by senior units issued by French Fonds Communs de Créances or by equivalent securitisation entities governed by the laws of an EEA State securitising commercial real estate exposures provided that, at least, 90% of the assets of such Fonds Communs de Créances or of equivalent securitisation entities governed by the laws of an EEA State are composed of mortgages that are combined with any prior liens up to the lesser of the principal amounts due under the units, the principal amounts of the liens, and 60% of the value of the pledged properties and the units qualify for credit quality step 1 where such units do not exceed 20% of the nominal amount of the outstanding issue; or

- (iii) a firm may recognise loans secured by commercial real estate as eligible where the loan to value ratio of 60% is exceeded up to a maximum level of 70% if the value of the total assets pledged as collateral for the covered bonds exceed the nominal amount outstanding on the covered bond by at least 10%, and the bondholders' claim meets the legal certainty requirements set out in BIPRU 3 and BIPRU 5; the bondholders' claim must take priority over all other claims on the collateral; or

- (f) loans secured by ships where only liens that are combined with any prior liens within 60% of the value of the pledged ship.

- (2) For the purposes of BIPRU 3.4.107 R (1)(d)(ii) and BIPRU 3.4.107 R (1)(e)(ii)exposures caused by transmission and management of payments of the obligors of, or liquidation proceeds in respect of, loans secured by pledged properties of the senior units or debt securities must not be comprised in calculating the 90% limit.

- (3) For the purposes of BIPRU 3.4.107 R to BIPRU 3.4.110 R "collateralised" includes situations where the assets described in subpoints (1)(a) to (1)(f) are exclusively dedicated in law to the protection of the bond-holders against losses.

- (4) Until 31 December 2010 the 20% limit for senior units issued by French Fonds Communs de Créances or by equivalent securitisation entities specified in subpoints (d) and (e) does not apply, provided that those senior units have a credit assessment by a nominated ECAI which is the most favourable category of credit assessment made by the ECAI in respect of covered bonds.

- (5) Until 31 December 2010 the figure of 60% in (1)(f) can be replaced with a figure of 70%.

[Note: BCD Annex VI Part 1 point 68]

- 01/01/2007

BIPRU 3.4.108

See Notes

A firm must for real estate collateralising covered bonds meet the minimum requirements set out in BIPRU 3.4.64 R to BIPRU 3.4.73 R and the valuation rules set out in BIPRU 3.4.77 R to BIPRU 3.4.80 R.

- 01/01/2007

BIPRU 3.4.109

See Notes

Notwithstanding BIPRU 3.4.107 R to BIPRU 3.4.108 R, covered bonds meeting the definition of Article 22(4) of the UCITS Directive and issued before 31 December 2007 are also eligible for the preferential treatment until their maturity.

- 01/01/2007

BIPRU 3.4.110

See Notes

Covered bonds must be assigned a risk weight on the basis of the risk weight assigned to senior unsecured exposures to the credit institution which issues them. The following correspondence between risk weights applies:

- (1) if the exposures to the institution are assigned a risk weight of 20%, the covered bond must be assigned a risk weight of 10%;

- (2) if the exposures to the institution are assigned a risk weight of 50%, the covered bond must be assigned a risk weight of 20%;

- (3) if the exposures to the institution are assigned a risk weight of 100%, the covered bond must be assigned a risk weight of 50%; and

- (4) if the exposures to the institution are assigned a risk weight of 150%, the covered bond must be assigned a risk weight of 100%.

[Note: BCD Annex VI Part 1 point 71]

- 01/01/2007

Items representing securitisation positions

BIPRU 3.4.111

See Notes

Risk weighted exposure amounts for securitisation positions must be determined in accordance with BIPRU 9.

- 01/01/2007

Short-term exposures to institutions and corporates

BIPRU 3.4.112

See Notes

Short-term exposures to an institution or corporate for which a short-term credit assessment by a nominated ECAI is available must be assigned a risk weight according to the table in BIPRU 3.4.113 R in accordance with the mapping by the FSA in accordance with the Capital Requirements Regulations 2006 of the credit assessments of eligible ECAIs to six steps in a credit quality assessment scale.

- 01/01/2007

BIPRU 3.4.113

See Notes

This table belongs to BIPRU 3.4.112 R.

| Credit quality step | 1 | 2 | 3 | 4 | 5 | 6 |

| Risk weight | 20% | 50% | 100% | 150% | 150% | 150% |

- 01/01/2007

Exposures in the form of collective investment undertakings (CIUs)

BIPRU 3.4.114

See Notes

- 01/01/2007

BIPRU 3.4.115

See Notes

Without prejudice to BIPRU 3.4.116 R to BIPRU 3.4.125 R, exposures in CIUs must be assigned a risk weight of 100%.

- 01/01/2007

BIPRU 3.4.116

See Notes

Exposures in the form of CIUs for which a credit assessment by a nominated ECAI is available must be assigned a risk weight according to the table in BIPRU 3.4.117 R in accordance with the assignment by the FSA in accordance with the Capital Requirements Regulations 2006 of the credit assessments of eligible ECAIs to six steps in a credit quality assessment scale.

- 01/01/2007

BIPRU 3.4.117

See Notes

This table belongs to BIPRU 3.4.116 R.

| Credit quality step | 1 | 2 | 3 | 4 | 5 | 6 |

| Risk weight | 20% | 50% | 100% | 100% | 150% | 150% |

- 01/01/2007

BIPRU 3.4.118

See Notes

Where a firm considers that a position in a CIU is associated with particularly high risks it must assign that position a risk weight of 150%.

- 01/01/2007

BIPRU 3.4.119

See Notes

- 01/01/2007

BIPRU 3.4.120

See Notes

- 01/01/2007

BIPRU 3.4.121

See Notes

Where BIPRU 3.4.116 R does not apply, a firm may determine the risk weight for a CIU as set out in BIPRU 3.4.123 R to BIPRU 3.4.125 R, if the following eligibility criteria are met:

- (1) one of the following conditions is satisfied:

- (a) the CIU is managed by a company which is subject to supervision in an EEA State; or

- (b) the following conditions are satisfied:

- (i) the CIU is managed by a company which is subject to supervision that is equivalent to that laid down in Community law; and

- (ii) cooperation between competent authorities is sufficiently ensured; and

- (2) the CIU's prospectus or equivalent document includes:

- (a) the categories of assets in which the CIU is authorised to invest; and

- (b) if investment limits apply, the relative limits and the methodologies to calculate them; and

- (3) the business of the CIU is reported on at least an annual basis to enable an assessment to be made of the assets and liabilities, income and operations over the reporting period.

- 01/01/2007

BIPRU 3.4.122

See Notes

If another EEA competent authority approves a third country CIU as eligible under a CRD implementation measure with respect to point 77(a) of Part 1 of Annex VI of the Banking Consolidation Directive then a firm may make use of this recognition.

[Note: BCD Annex VI Part 1 point 78]

- 01/01/2007

BIPRU 3.4.123

See Notes

Where a firm is aware of the underlying exposures of a CIU, it may look through to those underlying exposures in order to calculate an average risk weight for the CIU in accordance with the standardised approach.

- 01/01/2007

BIPRU 3.4.124

See Notes

Where a firm is not aware of the underlying exposures of a CIU, it may calculate an average risk weight for the CIU in accordance with the standardised approach subject to the following rules: it will be assumed that the CIU first invests, to the maximum extent allowed under its mandate, in the standardised credit risk exposure classes attracting the highest capital requirement, and then continues making investments in descending order until the maximum total investment limit is reached.

- 01/01/2007

BIPRU 3.4.125

See Notes

A firm may rely on a third party to calculate and report, in accordance with the methods set out in BIPRU 3.4.123 R to BIPRU 3.4.124 R, a risk weight for the CIU provided that the correctness of the calculation and report is adequately ensured.

- 01/01/2007

Other items

BIPRU 3.4.126

See Notes

- 01/01/2007

Treatment

BIPRU 3.4.127

See Notes

Tangible assets within the meaning of Article 4(10) of the Bank Accounts Directive must be assigned a risk weight of 100%.

[Note: BCD Annex VI Part 1 point 82]

- 01/01/2007

BIPRU 3.4.128

See Notes

Prepayments and accrued income for which a firm is unable to determine the counterparty in accordance with the Bank Accounts Directive, must be assigned a risk weight of 100%.

[Note: BCD Annex VI Part 1 point 83]

- 01/01/2007

BIPRU 3.4.129

See Notes

Cash items in the process of collection must be assigned a 20% risk weight. Cash in hand and equivalent cash items must be assigned a 0% risk weight.

- 01/01/2007

BIPRU 3.4.130

See Notes

Holdings of equity and other participations except where deducted from capital resources must be assigned a risk weight of at least 100%.

- 01/01/2007

BIPRU 3.4.131

See Notes

Gold bullion held in own vaults or on an allocated basis to the extent backed by bullion liabilities must be assigned a 0% risk weight.

[Note: BCD Annex VI Part 1 point 87]

- 01/01/2007

BIPRU 3.4.132

See Notes

In the case of asset sale and repurchase agreements and outright forward purchases, the risk weight must be that assigned to the assets in question and not to the counterparties to the transactions.

- 01/01/2007

BIPRU 3.4.133

See Notes

Where a firm provides credit protection for a number of exposures under terms that the nth default among the exposures triggers payment and that this credit event terminates the contract, and where the product has an external credit assessment from an eligible ECAI the risk weights prescribed in BIPRU 9 must be assigned. If the product is not rated by an eligible ECAI, the risk weights of the exposures included in the basket must be aggregated, excluding n-1 exposures, up to a maximum of 1250% and multiplied by the nominal amount of the protection provided by the credit derivative to obtain the risk weighted asset amount. The n-1 exposures to be excluded from the aggregation must be determined on the basis that they include those exposures each of which produces a lower risk weighted exposure amount than the risk weighted exposure amount of any of the exposures included in the aggregation.

[Note: BCD Annex VI Part 1 point 89]

- 01/01/2007

BIPRU 3.5

Simplified method of calculating risk weights

- 01/01/2007

BIPRU 3.5.1

See Notes

- 01/01/2007

BIPRU 3.5.2

See Notes

- 01/01/2007

BIPRU 3.5.3

See Notes

- 01/01/2007

BIPRU 3.5.4

See Notes

- 01/01/2007

BIPRU 3.5.5

See Notes

This table belongs to BIPRU 3.5.4 G.

| Exposure class | Exposure sub-class | Risk weights | Comments |

| Central government | Exposures to United Kingdom government or Bank of England in sterling | 0% | |

| Exposures to United Kingdom government or Bank of England in the currency of another EEA State | 0% | See Note 2. | |

| Exposures to EEA State's central government or central bank in currency of that state | 0% | ||

| Exposures to EEA State's central government or central bank in the currency of another EEA State | 0% | See Notes 2 and 3. | |

| Exposures to central governments or central banks of certain countries outside the EEA in currency of that country | See next column | The risk weight is whatever it is under local law. See BIPRU 3.4.6 R for precise details. | |

| Exposures to European Central Bank | 0% | ||

| Other exposures | 100% | ||

| Regional/local governments | Exposures to the Scottish Parliament, National Assembly for Wales and Northern Ireland Assembly in sterling | 0% | |

| Exposures to the Scottish Parliament, National Assembly for Wales and Northern Ireland Assembly in the currency of another EEA State | 0% | See Note 2. | |

| Exposures to EEA States' equivalent regional/local governments in currency of that state | 0% | See BIPRU 3.4.17 R for details of type of local/regional government covered. | |

| Exposures to EEA States' equivalent regional/local governments in the currency of another EEA State | 0% | See BIPRU 3.4.17 R for details of type of local/regional government covered. See Notes 2 and 3. |

|

| Exposures to local or regional governments of certain countries outside the EEA in currency of that country | 0% | See BIPRU 3.4.19 R for details of type of local/regional government covered. See Note 1. |

|

| Exposures to United Kingdom or EEA States' local/regional government in currency of that state if the exposure has original effective maturity of 3 months or less | 20% | ||

| Exposures to United Kingdom or EEA States' local/regional government in the currency of another EEA State if the exposure has original effective maturity of 3 months or less | 20% | See Note 2. See Note 3 for local/regional government of an EEA State other than the United Kingdom | |

| Exposures to local or regional governments of countries outside the EEA in currency of that country if the exposure has original effective maturity of 3 months or less | 20% | See Note 1. | |

| Other exposures | 100% | ||

| PSE | Exposures to a PSE of the United Kingdom or of an EEA State if that PSE is guaranteed by its central government and if the exposure is be in currency of that PSE's state. | 0% | BIPRU 3.4.24 R describes the United Kingdom PSEs covered and BIPRU 3.4.25 R describes the EEA PSEs covered. |

| Exposures to PSE of a country outside the EEA if that PSE is guaranteed by the country's central government and if the exposure is in currency of that country. | 0% | See BIPRU 3.4.26 R and Note 1. | |

| Exposures to a PSE of the United Kingdom or of an EEA State in currency of that state if the exposure has original effective maturity of 3 months or less | 20% | ||

| Exposures to a PSE of the United Kingdom or of an EEA State in the currency of another EEA State if the exposure has original effective maturity of 3 months or less | 20% | See Notes 2 and 3. | |

| Exposures to PSE of a country outside the EEA in currency of that country if the exposure has original effective maturity of 3 months or less | 20% | See Note 1. | |

| Other exposures | 100% | ||

| Multilateral development banks | Exposures to multilateral development banks listed in paragraph (1) of the Glossary definition | 0% | Simplified approach does not apply. Normal rules apply. |

| Other exposures | Various | Treated as an institution | |

| European Community, the International Monetary Fund and the Bank for International Settlements | 0% | Simplified approach does not apply. Normal rules apply. | |

| Institutions | Exposures to United Kingdom institution in sterling with original effective maturity of three months or less | 20% | |

| Exposures to United Kingdom institution in the currency of another EEA State with original effective maturity of three months or less | 20% | See Note 2. | |

| Exposures to institution whose head office is in another EEA State in the currency of that state with original effective maturity of three months or less | 20% | ||

| Exposures to institution whose head office is in another EEA State in the currency of another EEA State with original effective maturity of three months or less | 20% | See Notes 2 and 3. | |

| Exposures to institution with a head office in a country outside the EEA in the currency of that country with original effective maturity of three months or less | 20% | See Note 1. | |

| Exposures to United Kingdom institution in sterling with original effective maturity of over three months | 50% | ||

| Exposures to United Kingdom institution in the currency of another EEA State with original effective maturity of over three months | 50% | See Note 2. | |

| Exposures to an EEA institution with a head office in another EEA State in the currency of that state with original effective maturity of over three months | 50% | ||

| Exposures to an EEA institution with a head office in another EEA State in the currency of another EEA State with original effective maturity of over three months | 50% | See Notes 2 and 3. | |

| Exposures to institution with a head office in a country outside the EEA in the currency of that country with original effective maturity of over three months | 50% | See Note 1. | |

| Other exposures | 100% | ||

| Corporates | 100% | ||

| Retail exposures | 75% | Simplified approach does not apply. Normal rules apply. | |

| Mortgages on residential or commercial property | Various | Simplified approach does not apply. Normal rules apply. | |

| Past due items | Various | Simplified approach does not apply. Normal rules apply. | |

| High risk items | 150% | Simplified approach does not apply. Normal rules apply. | |

| Covered bonds | Various | Risk weights are based on the risk weight of issuer as described in BIPRU 3.4.110 R. The risk weight of the issuer for this purpose should be calculated under the simplified approach. | |

| Securitisation exposures | Generally 1250%. May look through to underlying exposures if BIPRU 9 allows. | Use the BIPRU 9 rules for unrated exposures under the standardised approach | |

| Short term exposures with rating | See BIPRU 3.4.112 R. Not applicable as uses ECAI ratings. | ||

| CIUs | May look through to underlying under BIPRU 3.4.123 R | Various | Simplified approach does not apply. Normal rules apply. May use simplified approach to underlying if simplified approach applies to underlying. |

| May use average risk weight under BIPRU 3.4.124 R | Various | Simplified approach does not apply. Normal rules apply. May use simplified approach to underlyings if simplified approach applies to underlying. | |

| High risk under BIPRU 3.4.118 R | 150% | Simplified approach does not apply. Normal rules apply. | |

| Others | 100% | ||

| Other items under BIPRU 3.2.9 R (16) | Various | Simplified approach does not apply. Normal rules apply. | |

| Note 1: The risk weight should not be lower than the risk weight that applies for national currency exposures of the central government of the third country in question under BIPRU 3.5. That means that this risk weight only applies if the third country is one of those to which BIPRU 3.4.6 R (Preferential risk weight for exposures of the central government of countries outside the EEA that apply equivalent prudential standards) applies. | |||

| Note 2: This is a transitional measure. It lasts until 31 December 2012. | |||

| Note 3: The risk weight should not be lower than the risk weight that applies for exposures of the central government of the EEA State in question in the currency of another EEA State under BIPRU 3.5. | |||

- 06/04/2007

BIPRU 3.5.6

See Notes

- 01/01/2007

BIPRU 3.5.7

See Notes

- 01/01/2007

BIPRU 3.5.8

See Notes

- 01/01/2007

BIPRU 3.6

Use of rating agencies' credit assessments for the determination of risk weights under the standardised approach to credit risk

- 01/01/2007

BIPRU 3.6.1

See Notes

The use of ECAI credit assessments for the calculation of a firm's risk weighted exposure amounts must be consistent and in accordance with BIPRU 3.6. Credit assessments must not be used selectively.

[Note: BCD Article 83(1)]

- 01/01/2007

BIPRU 3.6.2

See Notes

Where the FSA's recognition of an ECAI is not limited to its solicited credit assessments, a firm may use an unsolicited credit assessment of an eligible ECAI for the calculation of a firm's risk weighted exposure amounts.

[Note: BCD Article 83(2)]

- 01/01/2007

BIPRU 3.6.3

See Notes

- 01/01/2007

Treatment

BIPRU 3.6.4

See Notes

A firm may nominate one or more eligible ECAIs to be used for the determination of risk weights to be assigned to asset and off-balance sheet items.

[Note: BCD Annex VI Part 3 point 1]

- 01/01/2007

BIPRU 3.6.5

See Notes

A firm which decides to use the credit assessments produced by an eligible ECAI for a certain class of items must use those credit assessments consistently for all exposures belonging to that class.

[Note: BCD Annex VI Part 3 point 2]

- 01/01/2007

BIPRU 3.6.6

See Notes

A firm which decides to use the credit assessments produced by an eligible ECAI must use them in a continuous and consistent way over time.

[Note: BCD Annex VI Part 3 point 3]

- 01/01/2007

BIPRU 3.6.7

See Notes

- 01/01/2007

BIPRU 3.6.8

See Notes

If only one credit assessment is available from a nominated ECAI for a rated item, that credit assessment must be used to determine the risk weight for that item.

[Note: BCD Annex VI Part 3 point 5]

- 01/01/2007

BIPRU 3.6.9

See Notes

If two credit assessments are available from nominated ECAIs and the two correspond to different risk weights for a rated item, the higher risk weight must be applied.

[Note: BCD Annex VI Part 3 point 6]

- 01/01/2007

BIPRU 3.6.10

See Notes