BIPRU 10

Large exposures requirements

BIPRU 10.1

Application and Purpose

- 01/01/2007

Application

BIPRU 10.1.1

See Notes

- (1) This chapter applies to a BIPRU firm unless it is:

- (a) a BIPRU limited licence firm; or

- (b) a BIPRU limited activity firm

- (2) It applies irrespective of whether the firm adopts the standardised approach or the IRB approach. If it adopts the IRB approach, it applies irrespective of whether the firm adopts the foundation IRB approach or the advanced IRB approach.

- 01/04/2013

Purpose

BIPRU 10.1.2

See Notes

- 01/04/2013

BIPRU 10.1.3

See Notes

- 01/04/2013

BIPRU 10.1.4

See Notes

- 01/04/2013

BIPRU 10.2

Identification of exposures and recognition of credit risk mitigation

- 31/12/2010

BIPRU 10.2.1

See Notes

Unless BIPRU 10.2.2 R applies, an exposure is:

- (1) any of the items included in BIPRU 3.2.9 R (Exposure classes for the purposes of the standardised approach) or the table in BIPRU 3.7.2 R (Classification of off-balance-sheet items for the purposes of the standardised approach), whether held in the trading book or the non-trading book, without application of the risk weight or degrees of risk there provided for;

- [Note: BCD Article 106(1) first paragraph]

- (2) any exposure arising from financial derivative instruments;

- [Note: BCD Article 106(1) second paragraph (part)]

- (3) any exposure to an individual counterparty that arises in the trading book calculated by summing the following items:

- (a) the excess - where positive - of the firm's long positions over its short positions in all the CRD financial instruments issued by the counterparty in question, the net position of each of the different CRD financial instruments being calculated in accordance with the relevant method in BIPRU 7;

- (b) the firm's net underwriting exposure to that counterparty; and

- (c) any exposure due to the transactions, agreements and contracts referred to in BIPRU 14.2.2 R (List of trading book exposures that give rise to a counterparty credit risk charge).

- [Note: CAD Article 29(1) first paragraph]

- 01/04/2013

BIPRU 10.2.2

See Notes

An exposure does not include:

- (1) an exposure which is entirely deducted from a firm's capital resources; or

- (2) in the case of foreign currency transactions, exposures incurred in the ordinary course of settlement during the two business days following payment; or

- (3) in the case of transactions for the purchase or sale of securities, exposures incurred in the ordinary course of settlement during the five business days following payment or delivery of the securities, whichever is earlier; or

- (4) in the case of the provision of money transmission including the execution of payment services, clearing and settlement in any currency and correspondent banking or financial instruments clearing, settlement and custody services to clients, delayed receipts in funding and other exposures arising from client activity which do not last longer than the following business day; or

- (5) in the case of the provision of money transmission including the execution of payment services, clearing and settlement in any currency and correspondent banking, intra-day exposures to institutions providing those services.

[Note: BCD Articles 106(1) third paragraph and 106(2)]

- 01/04/2013

BIPRU 10.2.2A

See Notes

- 01/04/2013

BIPRU 10.2.3A

See Notes

- (1) An exposure does not include exposures outstanding with a central counterparty to which a firm has attributed an exposure value of zero for CCR in accordance with BIPRU 13.3.13 R (Exposures to a central counterparty).

- (2) BIPRU 13.3.13 R applies to derivative contracts and long settlement transactions, or to other exposures arising in respect of those contracts or transactions (but excluding an exposure arising from collateral held to mitigate losses in the event of default of other participants in the central counterparty's arrangements).

- 01/04/2013

Calculation of exposures

BIPRU 10.2.5

See Notes

- 01/04/2013

BIPRU 10.2.6

See Notes

A firm must calculate the value of its exposures in its trading book in the manner laid down in BIPRU 14 (Capital requirements for settlement and counterparty risk) for the calculation of exposure values. For these purposes the reference in BIPRU 14.2.11 R (How to calculate exposure values and risk weighted exposure amounts for the purpose of calculating the counterparty risk capital component) to the provisions of the IRB approach does not apply.

[Note: CAD Article 29(1)(c) (part) and fourth paragraph]

- 01/04/2013

BIPRU 10.2.7

See Notes

Exposures arising from financial derivative instruments must be calculated in accordance with one of the methods set out in BIPRU 13 (Financial derivatives, SFTs and long settlement transactions). For the purposes of this chapter, BIPRU 13.6.6 R (Scope of CCR internal model method) also applies.

[Note: BCD Article 106(1) second paragraph]

- 01/04/2013

BIPRU 10.2.8

See Notes

- 01/04/2013

Recognition of credit risk mitigation

BIPRU 10.2.9

See Notes

Subject to this section, funded credit protection or unfunded credit protection that complies with the eligibility requirements and other minimum requirements set out in BIPRU 5 (Credit risk mitigation) and, if relevant, BIPRU 4.10 (The IRB approach: Credit risk mitigation) is permitted to be recognised for the purposes of calculating a firm's exposure. A firm utilising the methods below must still report to the appropriate regulator the gross value of its exposures.

[Note: BCD Articles 111(1) first paragraph (part) and 112(2)]

- 01/04/2013

BIPRU 10.2.10

See Notes

- 01/04/2013

The financial collateral simple method under the standardised approach

BIPRU 10.2.11

See Notes

- 01/04/2013

BIPRU 10.2.12

See Notes

A firm may only recognise collateral for the purpose of BIPRU 10.2.9R (Recognition of credit risk mitigation) if the collateral complies with the eligibility requirements and other minimum requirements set out in BIPRU 5 (Credit risk mitigation) for the purposes of calculating the risk weighted exposure amounts under the standardised approach using the financial collateral simple method or, if applicable, the method in BIPRU 5.5 (Other funded credit risk mitigation). In particular a firm may not recognise collateral for that purpose if it is not eligible under the financial collateral simple method or other applicable method.

[Note: BCD Article 112(2) (part)]

- 01/04/2013

BIPRU 10.2.13

See Notes

For the purpose of BIPRU 10.2.9R (Recognition of credit risk mitigation):

- (1) the requirements set out in BIPRU 5 (Credit risk mitigation) include:

- (a) the securities used as collateral should be valued at market price and should be either traded or effectively negotiable and regularly quoted on a recognised investment exchange or a designated investment exchange; and

- (b) where there is a mismatch between the maturity of the exposure and the maturity of the credit protection, the collateral must not be recognised; and

- (2) where the issuer of securities used as collateral is an institution, that collateral may not constitute the institution's capital resources.

- 01/04/2013

The financial collateral comprehensive method

BIPRU 10.2.14

See Notes

A firm which uses the financial collateral comprehensive method (but not under the full IRB approach (see BIPRU 10.2.10R)) may calculate the value of its exposures to a counterparty or to a group of connected clients as being the fully adjusted value of the exposures to the counterparty or group of connected clients calculated in accordance with the financial collateral comprehensive method under BIPRU 5 (Credit risk mitigation) and, if relevant, BIPRU 4.10 (The IRB approach: Credit risk mitigation) taking into account the credit risk mitigation, volatility adjustments and any maturity mismatch (E*) in accordance with those rules.

[Note: BCD Article 114(1) first paragraph]

- 01/04/2013

BIPRU 10.2.15

See Notes

- 01/04/2013

BIPRU 10.2.16

See Notes

For the purposes of BIPRU 10.2.9R (Recognition of credit risk mitigation), a firm may use both the financial collateral comprehensive method and the financial collateral simple method where it is permitted to use both those methods under BIPRU 5.4.16 R.

[Note: BCD Article 117(1) last paragraph]

- 01/04/2013

BIPRU 10.2.17

See Notes

- 01/04/2013

BIPRU 10.2.18

See Notes

- 01/04/2013

Firms using full IRB approach

BIPRU 10.2.19

See Notes

A firm that uses the full IRB approach (see BIPRU 10.2.10R) may recognise the effects described in (1) in calculating the value of its exposures to a counterparty or to a group of connected clients for the purposes of BIPRU 10.5 (Limits on exposures) if:

- (1) the firm is able to satisfy the appropriate regulator that it can estimate the effects of financial collateral on its exposures separately from other LGD-relevant aspects;

- (2) the firm is able to demonstrate the suitability of the estimates produced; and

- (3) the firm's IRB permission specifically allows it (also see BIPRU 4.1.23 R (4)).

[Note: BCD Article 114(2) first and second paragraphs]

- 01/04/2013

BIPRU 10.2.20

See Notes

If a firm that uses the full IRB approach (see BIPRU 10.2.10R) uses its own estimates of the effects of financial collateral on its exposures for large exposures purposes, it must do so on a consistent basis and on a basis consistent with the approach adopted in the calculation of capital requirements. A firm may only use one of BIPRU 10.2.14R (Financial collateral comprehensive method under standardised approach and IRB approach) and BIPRU 10.2.19R (Own estimates of effects of financial collateral).

[Note: BCD Article 114(2) third and fourth paragraphs]

- 01/04/2013

BIPRU 10.2.21

See Notes

If a firm relies on BIPRU 10.2.19R (Own estimates of effects of financial collateral) the recognition of credit protection is subject to the relevant requirements of the IRB approach.

[Note: BCD Article 112(3)]

- 01/04/2013

Stress testing of credit risk concentrations

BIPRU 10.2.22

See Notes

- (1) A firm which:

- (a) uses the financial collateral comprehensive method; or

- (b) calculates the value of its exposures in accordance with BIPRU 10.2.19R (Own estimates of effects of financial collateral);

- must conduct periodic stress tests of its credit risk concentrations including in relation to the realisable value of any collateral taken.

- (2) The stress tests required by this rule must address:

- (a) risks arising from potential changes in market conditions that could adversely impact the firm's adequacy of capital resources; and

- (b) risks arising from the realisation of collateral in stressed situations.

- (3) A firm must be able to satisfy the appropriate regulator that the stress tests it carries out under this rule are adequate and appropriate for the assessment of such risks.

- (4) In the event that a stress test carried out in accordance with this rule indicates a lower realisable value of collateral taken than would be permitted to be taken into account under BIPRU 10.2.14R (Financial collateral comprehensive method) or BIPRU 10.2.19R (Own estimates of effect of financial collateral) as appropriate, the value of collateral permitted to be recognised in calculating the value of exposures for the purposes of BIPRU 10.5 (Limits on exposures) is the lower value.

- (5) A firm to which this rule applies must include in its strategy to address concentration risk:

- (a) policies and procedures to address risks arising from maturity mismatches between exposures and any credit protection on those exposures;

- (b) policies and procedures in the event that a stress test indicates a lower realisable value of collateral than taken into account under BIPRU 10.2.14R (Financial collateral comprehensive method) or BIPRU 10.2.19R (Own estimates of effects of financial collateral); and

- (c) policies and procedures relating to concentration risk arising from the application of credit risk mitigation techniques, and in particular large indirect credit exposures (for example to a single issuer of securities taken as collateral).

[Note: BCD Article 114(3)]

- 01/04/2013

BIPRU 10.2.23

See Notes

Unless, and to the extent, permitted under BIPRU 10.6.3R (11) (Residential mortgages and leasing transactions) or BIPRU 10.6.3R (12) (Commercial mortgages and leasing transactions), a firm must not take into account the following collateral for the purposes of this section:

- (1) amounts receivable linked to a commercial transaction or transactions with an original maturity of less than or equal to one year;

- (2) a physical item of a type other than those types indicated in BIPRU 4.10.6 R to BIPRU 4.10.12 R (Eligibility of real estate collateral); and

- (3) property leased under a leasing transaction.

[Note: BCD Article 112(4)]

- 01/04/2013

BIPRU 10.2.24

See Notes

- 01/04/2013

BIPRU 10.3

Identification of counterparties

- 01/01/2007

BIPRU 10.3.1

See Notes

- 01/04/2013

BIPRU 10.3.2

See Notes

Examples of a counterparty include:

- (1) the customer or borrower; this includes governments, local authorities, public sector entities, individual trusts, corporations, unincorporated businesses (whether as sole traders or partnerships) and non-profit making bodies;

- (2) where the firm is providing a guarantee, the person guaranteed;

- (3) for a derivatives contract, the person with whom the contract was made;

- (4) for exchange traded contracts novated through a central clearing mechanism, that central clearing mechanism;

- (5) where a bill held by a firm has been accepted by a credit institution, the acceptor; and

- (6) where a firm is funding the activities of a company that trades on an exchange (whether as principal or on behalf of clients), that company.

- 01/04/2013

Identification of counterparties for guaranteed and collateralised exposures

BIPRU 10.3.3

See Notes

- (1) Where an exposure to a counterparty is:

- (a) guaranteed by a third party, a firm may treat the portion of the exposure which is guaranteed as having been incurred to the guarantor rather than to the counterparty, provided that the unsecured exposure to the guarantor would be assigned an equal or lower risk weight than a risk weight of the unsecured exposure to the counterparty under the standardised approach; or

- (b) secured by collateral issued by a third party, a firm may treat the portion of the exposure collateralised by the market value of recognised collateral as having been incurred to the third party rather than to the counterparty, provided that the collateralised portion of the exposure would be assigned an equal or lower risk weight than a risk weight of the unsecured exposure to the counterparty under the standardised approach.

- [Note: BCD Article 117(1)(a) and (b)]

- (2) In deciding whether or not to treat the exposure as an exposure to the third party a firm must ensure that the identification of counterparties for concentration risk purposes is applied in a consistent manner.

- (3) [deleted]

- (4) [deleted]

- (5) [deleted]

- (6) A guarantee or collateral may only be treated in accordance with (1) if the firm complies with the eligibility requirements and other minimum requirements set out in BIPRU 5 (Credit risk mitigation)and, if applicable, BIPRU 4.10 (The IRB approach: Credit risk mitigation) for the purposes of calculating risk weighted exposure amounts.

- (7) For the purpose of this rule, guarantee includes a credit derivative recognised under BIPRU 5 and, if applicable, BIPRU 4.10, other than a credit linked note.

- [Note: BCD Article 112(1)]

- 01/04/2013

BIPRU 10.3.4

See Notes

- (1) If a firm treats an exposure to a counterparty as guaranteed, or secured by collateral issued, by a third party for the purposes of BIPRU 5 (Credit risk mitigation), it should apply the same approach on a consistent basis when identifying a counterparty for the purposes of this chapter.

- (2) An example of the eligibility requirements and other minimum requirements set out in BIPRU 5 as referred to in BIPRU 10.3.3 R (6) is the requirement for a legal review in BIPRU 5.2.3 R.

- (3) Where the guarantee is denominated in a currency different from that in which the exposure is denominated, the provisions on the treatment of currency mismatch for unfunded credit protection in BIPRU 5.7 (Unfunded credit protection) and, if applicable, BIPRU 4.10 (The IRB approach: Credit risk mitigation) are applicable for the calculation of the amount of the exposure deemed to be covered.

- [Note: BCD Article 117(2)(a)]

- (4) Where there is a mismatch between the maturity of the exposure and the maturity of the protection provided by guarantee, BIPRU 5.8 (Maturity mismatches) and, if applicable, BIPRU 4.10 (The IRB approach: Credit risk mitigation) are applicable for the treatment for mismatch.

- [Note: BCD Article 117(2)(b)]

- (5) For the purpose of BIPRU 10.3.3R (1), where there is a mismatch between the maturity of the exposure and the maturity of the protection provided by collateral, BIPRU 5.8.7 R (Valuation of protection: Transactions subject to funded credit protection - financial collateral simple method) requires that the collateral must not be recognised.

- [Note: BCD Article 117(1) second paragraph]

- (6) In relation to a guarantee, BIPRU 5.7 (Unfunded credit protection) and, if applicable, BIPRU 4.10 (The IRB approach: Credit risk mitigation) are applicable for the treatment of partial coverage.

- [Note: BCD Article 117(2)(c)]

- 01/04/2013

Groups of connected clients

BIPRU 10.3.5

See Notes

A group of connected clients means one of the following:

- (1) two or more persons who, unless it is shown otherwise, constitute a single risk because one of them, directly or indirectly, has control over the other or others; or

- (2) two or more persons between whom there is no relationship of control as set out in (1) but who are to be regarded as constituting a single risk because they are so interconnected that, if one of them were to experience financial problems, in particular funding or repayment difficulties, the other or all of the others would be likely to encounter funding or repayment difficulties.

[Note: Article 4(45) of the Banking Consolidation Directive]

- 01/04/2013

BIPRU 10.3.5A

See Notes

- 01/04/2013

BIPRU 10.3.5B

See Notes

- 01/04/2013

BIPRU 10.3.6

See Notes

- (1) In identifying a group of connected clients, a firm should consider both third party clients and counterparties that are, or may be, connected to the firm itself.

- (2) Relationships between individual counterparties or between the firm and a counterparty which might be considered to constitute a single risk for the purposes of the definition of group of connected clients include:

- (a) undertakings in the same group;

- (b) companies whose ultimate owner (whether wholly or significantly) is the same individual or individuals, and which do not have a formal group structure;

- (c) companies having common directors or management;

- (d) where the same persons significantly influence the governing body of each of the undertakings;

- (e) where the firm has an exposure to an undertaking that was not incurred for the clear commercial advantage of the firm or the firm's group and which is not on an arm's length basis;

- (f) counterparties linked by cross guarantees;

- (g) where it is likely that the financial problems of one counterparty would cause difficulties for the other counterparty or counterparties in terms of full and timely repayment of liabilities;

- (h) where the funding problems of one counterparty are likely to spread to another due to a one-way or two-way dependence on the same main funding source, which may be the firm itself;

- (i) where counterparties rely on the firm for their main funding source, for example through explicit or implicit liquidity support or credit support; and

- (j) where the insolvency or default of one of them is likely to be associated with the insolvency or default of the other(s).

- 01/04/2013

BIPRU 10.3.7

See Notes

- 01/04/2013

BIPRU 10.3.8A

See Notes

- (1) The Committee of European Banking Supervisors (CEBS) has issued guidelines in relation to the definition of a group of connected clients, in particular with reference to the concepts of control and economic interconnection. These guidelines can be found at: www.eba.europa.eu/documents/Publications/Standards---Guidelines/2009/Large-exposures_all/Guidelines-on-Large-Exposures-reporting.aspx.

- (2) In applying the CEBS guidelines in relation to counterparties that are connected to the firm itself, the PRA has issued guidance in respect of structured finance vehicles. This guidance can be found at http://www.fsa.gov.uk/library/policy/policy/2012/12-21.shtml.

- 01/04/2013

Exposures to counterparties and groups of connected clients

BIPRU 10.3.9

See Notes

- 01/04/2013

BIPRU 10.3.10

See Notes

- 01/04/2013

Exposures to trustees

BIPRU 10.3.12

See Notes

- 01/04/2013

BIPRU 10.3.13

See Notes

When considering whether the treatment described in BIPRU 10.3.12 G is misleading, factors a firm should consider include:

- (1) the degree of independence of control of the fund, including the relation of the fund's board and senior management to the firm or to other funds or to both;

- (2) the terms on which the counterparty, when acting as trustee, is able to satisfy its obligation to the firm out of the fund of which it is trustee;

- (3) whether the beneficial owners of the fund are connected to the firm, or related to other funds managed within the firm's group, or both; and

- (4) for a counterparty that is connected to the firm itself, whether the exposure arises from a transaction entered into on an arm's length basis.

- 01/04/2013

BIPRU 10.3.14

See Notes

In deciding whether a transaction is at arm's length for the purposes of BIPRU 10.3.6G (2)(f), BIPRU 10.3.13 G (4) and BIPRU 10.10A.1R (1)(d), the following factors should be taken into account:

- (1) the extent to which the person to whom the firm has an exposure ('A') can influence the firm's operations, through e.g. the exercise of voting rights;

- (2) the management role of A where A is also a director of the firm; and

- (3) whether the exposure would be subject to the firm's usual monitoring and recovery procedures if repayment difficulties emerged.

- 01/04/2013

Exposures to underlying assets

BIPRU 10.3.15

See Notes

Where under a transaction or scheme (for example, securitisation positions or claims in the form of CIUs) there is an exposure to underlying assets, a firm must assess the exposure to the transaction or scheme, or its underlying exposures, or both, in order to determine the existence of a group of connected clients. For the purpose of this rule, a firm must evaluate the economic substance and the risks inherent in the structure of the transaction.

[Note: BCD Article 106(3)]

- 01/04/2013

BIPRU 10.3.16

See Notes

- 01/04/2013

BIPRU 10.5

Limits on exposures

- 31/12/2010

Definition of large exposure

BIPRU 10.5.1

See Notes

A large exposure of a firm means its total exposure to a counterparty or a group of connected clients, whether in the firm's non-trading book or trading book or both, which in aggregate equals or exceeds 10% of the firm's capital resources.

[Note: BCD Article 108]

- 01/04/2013

Definition of capital resources

BIPRU 10.5.2

See Notes

- 01/04/2013

BIPRU 10.5.3

See Notes

- 01/04/2013

BIPRU 10.5.4

See Notes

- 01/04/2013

BIPRU 10.5.5

See Notes

A firm must not take into account the following items:

- (1) surplus provisions (see GENPRU 2.2.190 R to GENPRU 2.2.193 R); or

- (2) expected loss amounts and other negative amounts (see GENPRU 2.2.236 R); or

- (3) securitisation positions (see GENPRU 2.2.237 R).

[Note: BCD Article 66(3)]

- 01/04/2013

Large exposure limits

BIPRU 10.5.6

See Notes

A firm must ensure that the total amount of its exposures to the following does not exceed 25% of its capital resources (as determined under BIPRU 10.5.2 R, BIPRU 10.5.3 R and BIPRU 10.5.5 R):

- (1) a counterparty; or

- (2) a group of connected clients

[Note: BCD Article 111(1) first paragraph]

- 01/04/2013

BIPRU 10.6

Exemptions

- 01/01/2007

General exemptions

BIPRU 10.6.1

See Notes

- 01/04/2013

BIPRU 10.6.2

See Notes

- (1) In BIPRU 10.6.3 R and BIPRU 10.6.4 R, references to guarantees include credit derivatives recognised under BIPRU 5 (Credit risk mitigation) and, if applicable, BIPRU 4.10 (The IRB approach: Credit risk mitigation), other than credit linked notes.

- [Note: BCD Article 112(1)]

- (2) BIPRU 10.3.3 R (6) (Compliance with minimum credit risk mitigation requirements) applies for the purpose of BIPRU 10.6.3 R and BIPRU 10.6.4 R.

- 01/04/2013

BIPRU 10.6.3

See Notes

The following exposures are exempt from the limits described in BIPRU 10.5 (Limits on exposures):

- (1) asset items constituting claims on central governments or central banks which claims would unsecured receive a 0% risk weight under the standardised approach;

- (2) asset items constituting claims on international organisations or multilateral development banks which claims would unsecured receive a 0% risk weight under the standardised approach;

- (3) asset items constituting claims carrying the explicit guarantees of central governments, central banks, international organisations or multilateral development banks, where unsecured claims on the entity providing the guarantee would receive a 0% risk weight under the standardised approach;

- (4) other exposures attributable to, or guaranteed by, central governments, central banks, international organisations, multilateral development banks or public sector entities where unsecured claims on the entity to which the exposure is attributable or by which it is guaranteed would receive a 0% risk weight under the standardised approach;

- (5) [deleted]

- (6) [deleted]

- (7) asset items constituting claims on EEA States' regional governments or local authorities which claims would receive a 0% risk weight under the standardised approach;

- (8) other exposures to or guaranteed by EEA States' regional governments or local authorities claims on which would receive a 0% risk weight under the standardised approach;

- (9) [deleted]

- (10) [deleted]

- (11) loans secured by mortgages on residential property and leasing transactions under which the lessor retains full ownership of the residential property leased for as long as the lessee has not exercised his option to purchase, in all cases up to 50% of the value of the residential property concerned;

- (12) the following, where they would receive a 50% risk weight under the standardised approach, and only up to 50% of the value of the commercial property concerned:

- (a) exposures secured by mortgages on offices or other commercial premises; and

- (b) exposures related to property leasing transactions concerning offices or other commercial premises;

- (13) [deleted]

- (14) asset items and other exposures secured by collateral in the form of cash deposits placed with the lending firm or with a credit institution which is the parent undertaking or a subsidiary undertaking of the lending firm;

- (15) asset items and other exposures secured by collateral in the form of certificates of deposit issued by the lending firm or by a credit institution which is the parent undertaking or a subsidiary undertaking of the lending firm and lodged with either of them; and

- (16) exposures arising from undrawn credit facilities that are classified as low risk off-balance sheet items in BIPRU 3.7.2 R and provided that an agreement has been concluded with the counterparty or group of connected clients under which the facility may be drawn only if it has been ascertained that it will not cause the limit in BIPRU 10.5.6 R (Limits on exposures) to be exceeded.

[Note: BCD Articles 113(3), 115(1) sub-paragraphs (a) and (b) and 115(2) sub-paragraphs (a) and (b)]

- 01/04/2013

BIPRU 10.6.4

See Notes

For the purposes of BIPRU 10.6.3R (11) (Loan secured by residential mortgages and leasing transactions):

- (1) the requirements set out in BIPRU 3.4.64 R to BIPRU 3.4.73 R (Requirements for recognition of real estate collateral) apply;

- (2) the value of the property must be calculated on the basis of prudent valuation standards laid down by law, regulation or administrative provisions;

- (3) valuation must be carried out at least once every three years;

- (4) the valuation rules set out in BIPRU 3.4.77 R to BIPRU 3.4.80 R apply; and

- (5) residential property means a residence to be occupied or let by the borrower.

[Note: BCD Article 115(1) second to fourth paragraphs]

- 01/04/2013

BIPRU 10.6.28

See Notes

For the purposes of BIPRU 10.6.3R (12) (Loans secured by commercial mortgages and leasing transactions):

- (1) the value of the property must be calculated on the basis of prudent valuation standards laid down by law, regulation or administrative provisions; and

- (2) the commercial property concerned must be fully constructed, leased and produce appropriate rental income.

[Note: BCD Article 115(2) second and third paragraphs]

- 01/04/2013

BIPRU 10.6.29

See Notes

- 01/04/2013

BIPRU 10.6.30

See Notes

- 01/04/2013

BIPRU 10.6.31

See Notes

- 01/04/2013

Institutional exemption

BIPRU 10.6.32

See Notes

Where a counterparty is an institution or where a group of connected clients includes one or more institutions:

- (1) the total amount of a firm's exposures to the same counterparty or group of connected clients may exceed 25% of the firm's capital resources so long as the total amount of such exposures does not exceed €150 million;

- (2) the firm must ensure that the total amount of its exposures, after taking into account the effect of credit risk mitigation, to other persons in that group of connected clients which are not institutions does not exceed 25% of the firm's capital resources;

- (3) where the amount of €150 million in (1) is higher than an amount equivalent to 25% of the firm's capital resources, the firm must ensure the following:

- (a) the total amount of those exposures in (1) in relation to the same counterparty or group of connected clients does not exceed a reasonable limit in terms of the firm's capital resources; and

- (b) in any case, the limit in this rule must not exceed 100% of the firm's capital resources; and

capital resources are as determined under BIPRU 10.5.2 R, BIPRU 10.5.3 R and BIPRU 10.5.5 R (Stage (N) of the calculation in the capital resources table (Total tier one capital plus tier two capital after deductions)); and

- (4) for the purpose of (3), the firm must determine the limit consistently with the policies and procedures required under BIPRU 10.12.3 R (Concentration risk policies).

[Note: BCD Article 111(1) second to fourth paragraphs]

- 01/04/2013

BIPRU 10.6.33

See Notes

- 01/04/2013

Sovereign large exposure waiver

BIPRU 10.6.34

See Notes

- 01/04/2013

BIPRU 10.6.35

See Notes

- 01/04/2013

BIPRU 10.6.36

See Notes

For the purpose of the sovereign large exposure waiver, and in relation to a firm, the exposures referred to in BIPRU 10.6.35R are limited to the following:

- (1) asset items constituting claims on central banks not within BIPRU 10.6.3R (1), which are in the form of required minimum reserves held at those central banks which are denominated and funded in their national currencies; and

- (2) asset items constituting claims on central governments not within BIPRU 10.6.3R (1), which are in the form of statutory liquidity requirements held in government securities denominated and funded in their national currencies.

[Note: BCD Article 113(4)(g) and (h)]

- 01/04/2013

BIPRU 10.6.37

See Notes

- 01/04/2013

BIPRU 10.8A

Intra-group exposures: core UK group

- 31/12/2010

Application

BIPRU 10.8A.1

See Notes

This section applies to a firm if:

- (1) it is a member of a core UK group (under BIPRU 3.2.25 R and this section); and

- (2) it has a core UK group waiver.

- 01/04/2013

Definition of core UK group

BIPRU 10.8A.2

See Notes

An undertaking is a member of a firm's core UK group if, in relation to the firm, that undertaking satisfies the following conditions:

- (1) it is a core concentration risk group counterparty;

- (2) it is an institution, financial holding company, financial institution, asset management company or ancillary services undertaking;

- (3) (in relation to a subsidiary undertaking) 100% of the voting rights attaching to the shares in its capital is held by the firm or a financial holding company (or a subsidiary undertaking of the financial holding company), whether individually or jointly, and that firm or financial holding company (or its subsidiary undertaking) must have the right to appoint or remove a majority of the members of the board of directors, committee of management or other governing body of the undertaking;

- (4) it is subject to the same risk evaluation, measurement and control procedures as the firm;

- (5) it is incorporated in the United Kingdom; and

- (6) there is no current or foreseen material practical or legal impediment to the prompt transfer of capital resources or repayment of liabilities from the counterparty to the firm.

- 01/04/2013

BIPRU 10.8A.3

See Notes

- 01/04/2013

BIPRU 10.8A.4

See Notes

- 01/04/2013

Minimum standards

BIPRU 10.8A.5

See Notes

- (1) For the purpose of BIPRU 10.8A.2R (6), a firm must be able to demonstrate fully to the appropriate regulator the circumstances and arrangements, including legal arrangements, by virtue of which there are no material practical or legal impediments, and none are foreseen, to the prompt transfer of capital resources or repayment of liabilities from the counterparty to the firm.

- (2) In relation to a counterparty that is not a firm, the arrangements referred to in (1) must include a legally binding agreement with each firm that is a member of the core UK group that it will promptly on demand by the firm increase that firm's capital resources by an amount required to ensure that the firm complies with GENPRU 2.1 (Calculation of capital resources requirements), BIPRU 10 (Large exposures requirements) and any other requirements relating to capital resources or concentration risk imposed on a firm by or under the regulatory system.

- 01/04/2013

BIPRU 10.8A.6

See Notes

The appropriate regulator will consider the following criteria when assessing whether the condition in BIPRU 10.8A.2R (6) is going to be met:

- (1) the speed with which funds can be transferred or liabilities repaid to the firm and the simplicity of the method for the transfer or repayment;

- (2) whether there are any interests other than those of the firm in the core concentration risk group counterparty and what impact those other interests may have on the firm's control over the core group concentration risk group counterparty and the ability of the firm to require a transfer of funds or repayment of liabilities;

- (3) whether there are any tax disadvantages for the firm or the core concentration risk group counterparty as a result of the transfer of funds or repayment of liabilities;

- (4) whether the purpose of the core concentration risk group counterparty prejudices the prompt transfer of funds or repayment of liabilities;

- (5) whether the legal structure of the core concentration risk group counterparty prejudices the prompt transfer of funds or repayment of liabilities;

- (6) whether the contractual relationships of the core concentration risk group counterparty with the firm and other third parties prejudices the prompt transfer of funds or repayment of liabilities; and

- (7) whether past and proposed flows of funds between the core concentration risk group counterparty and the firm demonstrate the ability to make prompt transfer of funds or repayment of liabilities.

- 01/04/2013

BIPRU 10.8A.7

See Notes

- (1) Firms are referred to the guidance relating to 0% risk weights for exposures within a core UK group under the standardised approach as follows:

- (a) BIPRU 3.2.28 G in respect of BIPRU 10.8A.2R (3) on same risk evaluation, measurement and control procedures; and

- (b) BIPRU 3.2.30 G and BIPRU 3.2.31 G in respect of BIPRU 10.8A.2R (6) on prompt transfer of capital resources and repayment of liabilities.

- (2) For the purpose of BIPRU 10.8A.5R (2), the obligation to increase the firm's capital resources may be limited to capital resources available to the counterparty and may reasonably exclude such amount of capital resources that, if transferred to the firm, would cause the counterparty to become balance sheet insolvent in the manner contemplated in section 123(2) of the Insolvency Act 1986.

- 01/04/2013

Exemption for a core UK group

BIPRU 10.8A.8

See Notes

- 01/04/2013

BIPRU 10.8A.9

See Notes

- 01/04/2013

Calculation of capital resources for a core UK group

BIPRU 10.8A.10

See Notes

- 01/04/2013

BIPRU 10.8A.11

See Notes

- 01/04/2013

Notification

BIPRU 10.8A.12

See Notes

- 01/04/2013

BIPRU 10.9A

Intra-group exposures: non-core large exposures group

- 31/12/2010

Application

BIPRU 10.9A.1

See Notes

This section applies to a firm if it has:

- (1) a non-core large exposures group; and

- (2) a non-core large exposures group waiver.

- 01/04/2013

Definition of non-core large exposures group

BIPRU 10.9A.3

See Notes

The non-core large exposures group of a firm consists of each non-core concentration risk group counterparty of the firm that is not a member of its core UK group but satisfies all other conditions for membership of the firm's core UK group except for the following:

- (1) BIPRU 10.8A.2R (1) (Core concentration risk group counterparty);

- (2) BIPRU 10.8A.2R (5) (Establishment in the United Kingdom); and

- (3) BIPRU 10.8A.5R (2) (Capital maintenance arrangements).

- 01/04/2013

Definition of non-core concentration risk group counterparty

BIPRU 10.9A.4

See Notes

A non-core concentration risk group counterparty (in relation to a firm) is a counterparty which is its parent undertaking, its subsidiary undertaking or a subsidiary undertaking of its parent undertaking, provided that (in each case) both the counterparty and the firm satisfy one of the following conditions:

- (1) they are included within the scope of consolidation on a full basis with respect to the same UK consolidation group and BIPRU 8.3.1 R applies to the firm with respect to that UK consolidation group; or

- (2) they are included within the scope of consolidation on a full basis with respect to the same group by a competent authority of an EEA State other than the United Kingdom under the CRD implementation measures about consolidated supervision for that EEA State; or

- (3) they are included within the scope of consolidation on a full basis with respect to the same group by a third country competent authority under prudential rules for the banking sector or investment services sector of or administered by that third country competent authority and the firm or another EEA firm in that group has been notified in writing by the appropriate regulator or a competent authority of another EEA State pursuant to Article 143 of the Banking Consolidation Directive that that group is subject to equivalent supervision.

- 01/04/2013

Revised large exposure limits for a non-core large exposures group

BIPRU 10.9A.5

See Notes

A firm to which this section applies must ensure that the rules listed in BIPRU 10.9A.6R are complied with on a consolidated basis subject to the following modifications:

- (1) (if the firm is not a member of a core UK group) the rules apply in relation to exposures of the firm to its non-core large exposures group as if it is a single undertaking;

- (2) if the firm is a member of a core UK group:

- (a) the rules apply in relation to its core UK group rather than in relation to the firm; and

- (b) the core UK group and the non-core large exposures group must each be treated as a single undertaking.

- 01/04/2013

BIPRU 10.9A.6

See Notes

The rules referred to in BIPRU 10.9A.5R are:

- (1) BIPRU 10.5.6 R (25% large exposures limit);

- (2) BIPRU 10.10A.2 R (Trading book limits) other than BIPRU 10.10A.2R (2) (CNCOM); and

- (3) BIPRU 10.10A.3 R (500% limit for trading book excess exposures).

- 01/04/2013

Non-trading book backstop limit for a non-core large exposures group

BIPRU 10.9A.7

See Notes

A firm must ensure that the total amount of non-trading book exposures between:

- (1) itself and members of its non-core large exposures group does not exceed 100% of the firm's capital resources; or

- (2) if it is a member of a core UK group, the members of its core UK group and members of its non-core large exposures group does not exceed 100% of the capital resources of the firm's core UK group.

- 01/04/2013

Concentrated exposures in a non-core large exposures group

BIPRU 10.9A.8

See Notes

- (1) Subject to the limit in BIPRU 10.9A.7R (Back-stop large exposures limit), a firm may concentrate its intra-group exposure to a particular member of its non-core large exposures group in excess of 25% of the capital resources of the firm's core UK group.

- (2) A firm may not apply (1) unless it has given prior written notice to the appropriate regulator that it intends to do so.

- (3) The written notice referred to in (2) must contain the following:

- (a) an explanation on how the firm will ensure that it will still meet the requirement in BIPRU 10.9A.7R (Backstop large exposures limit) on a continuing basis when applying (1);

- (b) details of the counterparty, the size of the exposure and the expected duration of the exposure; and

- (c) an explanation of the reason for the exposure.

- (4) If a firm stops applying (1) it may start to apply it again if it notifies the appropriate regulator under (2) that it intends to do so.

- 01/04/2013

Calculation of capital resources for a core UK group

BIPRU 10.9A.9

See Notes

- 01/04/2013

Exemption for intra-group exposures on a solo basis

BIPRU 10.9A.10

See Notes

- 01/04/2013

BIPRU 10.9A.11

See Notes

- 01/04/2013

Notification

BIPRU 10.9A.12

See Notes

- 01/04/2013

BIPRU 10.10A

Trading book limits

- 02/11/2012

Application

BIPRU 10.10A.1

See Notes

This section only applies to exposures in a firm's trading book to counterparties which fulfil the following conditions:

- (1) subject to (2), and in relation to a firm, a counterparty ('P') to whom the firm has an exposure and who fulfils at least one of the following conditions:

- (a) P is closely related to the firm; or

- (b) P is an associate of the firm; or

- (c) the same persons significantly influence the governing body of P and of the firm; or

- (d) the firm has an exposure to P that was not incurred for the clear commercial advantage of the firm or the firm's group and which is not on an arm's length basis;

- (2) where P is Business Growth Fund plc or another financial institution which makes venture capital investments and the firm is entitled to ignore that financial institution in accordance with GENPRU 2.2.209 R (2) for the purposes of determining whether there is a material holding, (1) applies with the following modifications to the definition of associate:

- (a) paragraph (3)(c) (community of interest) of that definition does not apply; and

- (b) in applying paragraph (3)(a) (affiliated company) of that definition, paragraph (1)(e) (participating interests) of the definition of group does not apply.

- 01/04/2013

BIPRU 10.10A.1A

See Notes

- 01/04/2013

Trading book limits

BIPRU 10.10A.2

See Notes

Exposures in a firm's trading book to counterparties falling within BIPRU 10.10A.1 R are exempt from the 25% limit in BIPRU 10.5.6 R (large exposures limit) if:

- (1) the total amount of the exposures on the firm's non-trading book to counterparties falling within BIPRU 10.10A.1 R does not exceed the limit laid down in that rule, calculated with reference to the definition of capital resources calculated at stage (N) of the calculation in the capital resources table (Total tier one capital plus tier two capital after deductions) as set out in BIPRU 10.5.2 R, BIPRU 10.5.3 R and BIPRU 10.5.5 R, so that the excess arises entirely on the trading book; and

- (2) the firm meets the additional capital requirements relating to the concentration risk capital component (CNCOM) in relation to the relevant trading book exposures.

- 01/04/2013

BIPRU 10.10A.2A

See Notes

- 01/04/2013

BIPRU 10.10A.3

See Notes

- 01/04/2013

How to calculate the concentration risk capital component

BIPRU 10.10A.4

See Notes

- 01/04/2013

BIPRU 10.10A.5

See Notes

- 01/04/2013

BIPRU 10.10A.6

See Notes

- 01/04/2013

BIPRU 10.10A.7

See Notes

- 01/04/2013

BIPRU 10.10A.8

See Notes

A firm must calculate its individual counterparty CNCOM for its exposures to its counterparties falling within BIPRU 10.10A.1 R as follows:

- (1) break down its total exposure into its trading book and non-trading book components;

- (2) calculate 25% of the firm's capital resources calculated at stage (N) of the calculation in the capital resources table (Total tier one capital plus tier two capital after deductions) to determine the total amount of the exposures in the firm's non-trading book does not exceed this limit in accordance with BIPRU 10.10A.2R (1);

- (3) calculate 25% of the firm's capital resources calculated at stage (T) of the capital resources table (Total capital after deductions) and deduct those parts of the total exposure which are in the non-trading book falling within the limit in (2);

- (4) a firm must allocate (in the order set out in (6)) trading book exposures to its counterparties falling within BIPRU 10.10A.1 R to the unutilised portion of the 25% limit of the firm's capital resources calculated at stage (T) of the capital resources table (Total capital after deductions) remaining after deducting the non-trading book exposures in accordance with (3);

- (5) no further trading book exposures can be allocated once the 25% limit in (4) has been reached; the remaining trading book exposures constitute the trading book concentration risk excess with respect to its counterparties falling within BIPRU 10.10A.1 R;

- (6) for the purposes of (4), a firm must allocate the trading book exposures in the order of the level of capital requirements, starting with the lowest capital requirements for specific risk under the market risk capital requirement and/or the lowest capital requirements under the counterparty risk capital component and moving towards those trading book exposures with the highest capital requirements last;

- (7) the individual counterparty CNCOM is the sum of the capital requirements for each individual exposure included in the trading book concentration risk excess in accordance with (8) and (9) (each such capital requirement being an individual CNCOM);

- (8) if the trading book concentration risk excess has persisted for 10 business days or less (irrespective of the age of each component part), the individual CNCOMs must be calculated in accordance with this formula:

- each individual CNCOM = capital requirement referred to in (6) 200%;

- (9) if the trading book concentration risk excess has persisted for more than 10 business days (irrespective of the age of each component part), the individual CNCOMs must be calculated in accordance with this formula:

- each individual CNCOM = capital requirement referred to in (6) appropriate percentage in BIPRU 10.10A.9R.

- 01/04/2013

BIPRU 10.10A.9

See Notes

The appropriate percentage referred to in BIPRU 10.10A.8R (9) must be established in accordance with the following:

- (1) the individual exposures included in the trading book concentration risk excess must be assigned to the bands in the first column of the table in BIPRU 10.10A.10R;

- (2) the maximum amount that may be put in any band other than the last equals the percentage of the firm's capital resources in column 1 of that table;

- (3) no amount may be allocated to the second or any later band unless the one before has been filled;

- (4) exposures must be assigned to the bands in the order established by BIPRU 10.10A.8R (6); and

- (5) for the purposes of (4), those exposures with the lowest capital requirements (as referred to in BIPRU 10.10A.8R (6)) must be assigned first and those with the highest last.

- 01/04/2013

Percentages applicable under BIPRU 10.10A.9R

BIPRU 10.10A.10

See Notes

| Trading book concentration risk excess (as a percentage of the firm's capital resources calculated at stage (T) of the capital resources table (Total capital after deductions)) | Percentage |

| Up to 40% | 200% |

| Portion from 40% - 60% | 300% |

| Portion from 60% - 80% | 400% |

| Portion from 80% - 100% | 500% |

| Portion from 100% - 250% | 600% |

| Portion over 250% | 900% |

- 01/04/2013

How CNCOM applies to the non-core large exposures group

BIPRU 10.10A.11

See Notes

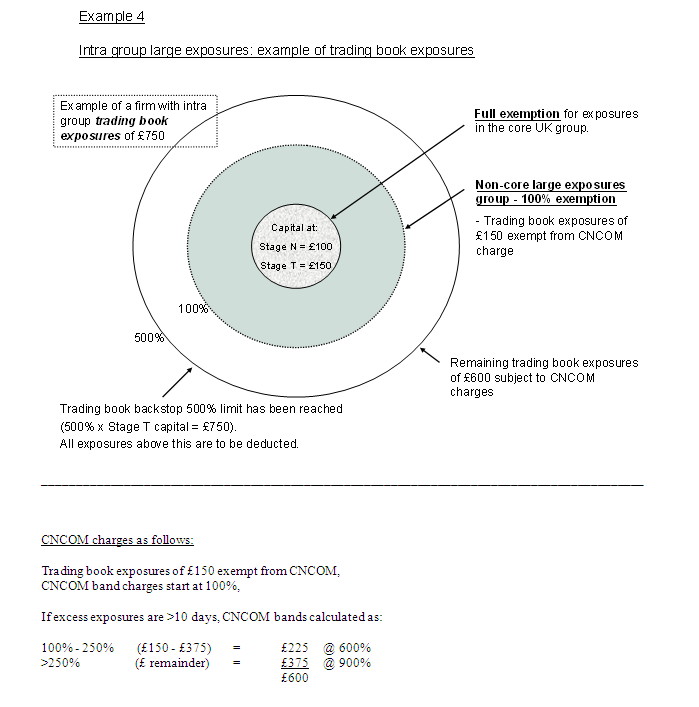

A firm that has a non-core large exposures group waiver must meet the CNCOM in relation to exposures to members of its non-core large exposures group in accordance with this section, subject to the following:

- (1) in BIPRU 10.10A.8 R, 25% is substituted with 100%; and

- (2) the excess exposures for the purpose of BIPRU 10.10A.8R (9) must be assigned to the bands in the first column of the table in BIPRU 10.10A.10 R beginning with the portion from 100% - 250%.

- 01/04/2013

Core UK group and non-core large exposures group: treatment of the trading book concentration risk excess

BIPRU 10.10A.12

See Notes

- (1) This rule applies to a firm that has a core UK group waiver or a non-core large exposures group waiver.

- (2) A firm must calculate the CNCOM in relation to the core UK group in question in accordance with BIPRU 10.10A.2 R (Trading book limits).

- (3) A firm must then calculate the percentage of the amount calculated under (2) which is attributable to exposures of the firm.

- (4) A firm must add the result of the calculation in (3) to the CNCOM applied to the firm on a solo basis in accordance with BIPRU 10.10A.5R to BIPRU 10.10A.11R (How to calculate the concentration risk capital component).

- 01/04/2013

Examples

BIPRU 10.10A.13

See Notes

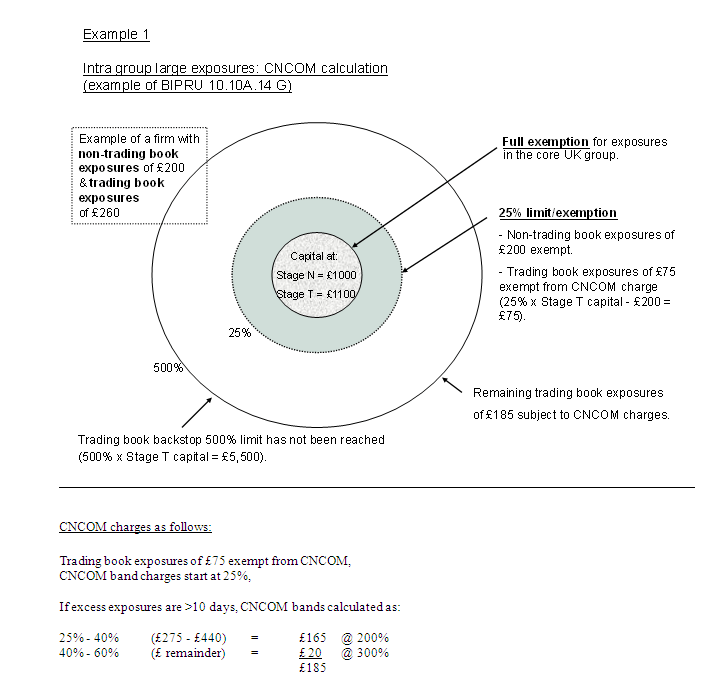

- (1) The table in BIPRU 10.10A.14G sets out an example of a CNCOM calculation under BIPRU 10.10A.8R.

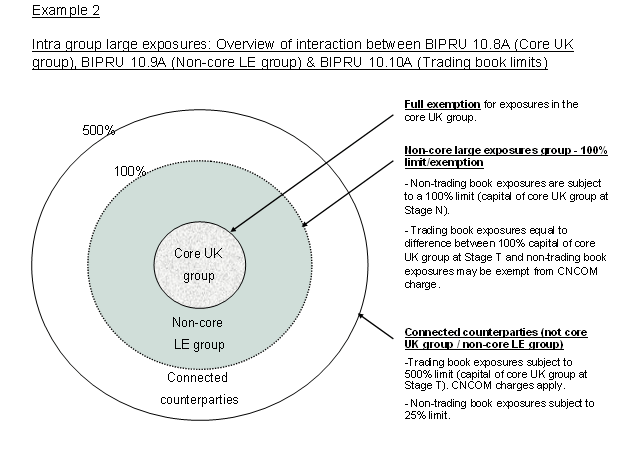

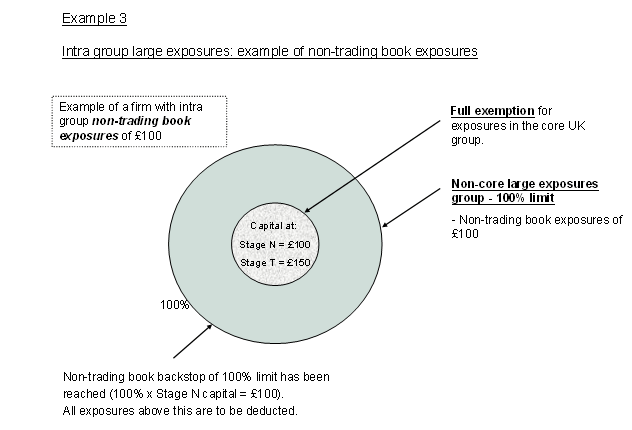

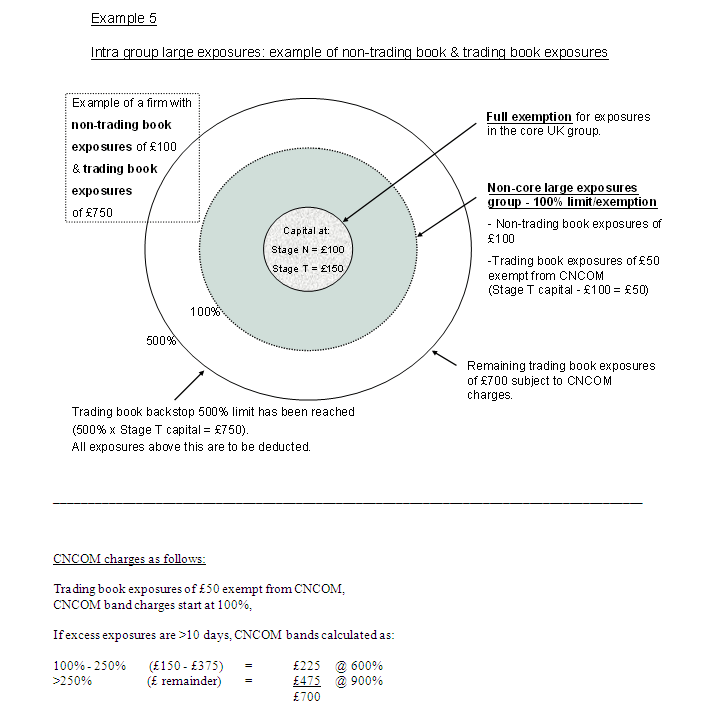

- (2) BIPRU 10 Annex 2 G (Examples of treatment of exposures under BIPRU 10) sets out examples of how the large exposures limits apply, particularly in relation to a core UK group and non-core large exposures group, taking into account various examples of firm's exposure profiles.

- 01/04/2013

Example of a CNCOM calculation (all numbers 000s)

BIPRU 10.10A.14

See Notes

| Capital resources position | |||

| (1) | An firm's capital resources comprises: | ||

| Tier one and tier two capital resources | 1000 | ||

| Eligible tier three capital resources | 100 | ||

| Amended capital resources | 1100 | ||

| (2) | The components of the large exposure comprise: | ||

| (a) Non-trading book exposure | 200 | ||

| (b) Mark to market value of trading book securities: | |||

| % specific risk weight | |||

| Short: qualifying bond | 1.00 | (20) | |

| Long: qualifying commercial paper | 0.25 | 100 | |

| Long: equity | 4.00 | 150 | |

| Long: qualifying convertible | 1.60 | 30 | |

| Total net long securities position: | 260 | ||

| Total net large exposures position [(a) + (b)] | 460 | ||

| Calculating the exposure for which incremental capital is needed | |||

| (3) | The short position in the qualifying bond is offset against the highest specific risk weight items - in this case equities: | ||

| Net long equity position (150- 20) | 130 | ||

| (4) | The remaining items are ranked according to specific risk weight. | ||

| % specific risk weight | Security | ||

| 0.25 | Qualifying commercial paper | 100 | |

| 1.60 | Qualifying convertible | 30 | |

| 4.00 | Equity (net) | 130 | |

| (5) | The 'headroom' between the non-trading book exposure and 25% of the amended capital resources is calculated. | ||

| 25% of amended capital base (1100) | 275 | ||

| Non-trading book exposure | 200 | ||

| Headroom | 75 | ||

| (6) | Applying the securities positions in ascending order of specific risk weight, 75 of the 100 qualifying commercial paper may be counted before 25% of the amended capital base is reached. The remaining 25 of qualifying commercial paper, along with 30 qualifying convertible and 130 equity (net) are traded securities exposures in excess of the limit and should therefore be covered by incremental capital. The amount of incremental capital should be included in the calculation for determining how much trading book capital a firm should have. |

||

| (7) | If the excess exposure has been outstanding for 10 days or less, the specific risk weights for the elements over 25% of amended capital resources should be doubled. The 25% limit (275) is taken up by 200 non-trading book exposure and 75 trading book exposure within the limit. These two items, when added to the items in bold below, total 460. 460 is the total net large exposures position as set out in (2) above. |

||

| Qualifying commercial paper | 25 x 0.25% x 200% = | 0.125 | |

| Qualifying convertible | 30 x 1.60% x 200% = | 0.960 | |

| Equity | 130 x 4% x 200% = | 10.400 | |

| Additional capital requirement | 11.485 | ||

| (8) | If the excess exposure has been outstanding for more than 10 days, the 25% limit (275) is taken up by 200 non-trading book exposure and 75 trading book exposure within the limit. These two items, when added to the items in bold below, total 460. 460 is the total net large exposures position as set out in (2) above. | ||

| (a) | Over 25% and up to 40% of amended capital base at 200% (40% of 1100 = 440) | ||

| Amount of trading book concentration risk excess = 185 Appropriate % Multiplier Band = 200% |

|||

| 25 x 0.25% x 200% = | 0.125 | ||

| 30 x 1.60% x 200% = | 0.960 | ||

| 110 x 4.00% x 200% = | 8.800 | ||

| (b) | Excess exposure 40% - 60% of amended capital base at 300% | ||

| 20 x 4.00% x 300% = | 2.400 | ||

| Additional capital requirement [(a)+(b)] | 12.285 | ||

- 01/04/2013

BIPRU 10.12

Systems and controls and general

- 01/01/2007

Systems and controls

BIPRU 10.12.1

See Notes

- 01/04/2013

BIPRU 10.12.2

See Notes

- 01/04/2013

Concentration risk policies

BIPRU 10.12.3

See Notes

A firm must be able to demonstrate to the appropriate regulator that:

- (1) it has written policies and procedures to address and control the concentration risk arising from:

- (a) exposures to counterparties and groups of connected clients;

- (b) counterparties in the same economic sector or geographic region;

- (c) the same activity or commodity; and

- (d) the application of credit risk mitigation techniques, including in particular risks associated with large indirect credit exposures (for example to a single collateral issuer); and

- (2) those policies and procedures are implemented.

- 01/04/2013

Reporting

BIPRU 10.12.4

See Notes

- 01/04/2013

Artificial transactions

BIPRU 10.12.5

See Notes

In line with the general principle in GENPRU 2.2.1 R (Purposive interpretation) a firm must not, with a view to avoiding the additional capital requirements that it would otherwise incur on exposures exceeding the limits laid down in BIPRU 10.5 (Limits on exposures and large exposures) once those exposures have been maintained for more than ten business days:

- 01/04/2013

BIPRU 10.12.6

See Notes

- 01/04/2013

BIPRU 10 Annex 2

Examples of treatment of intra-group exposures under BIPRU 10

- 31/12/2010

See Notes

- 01/04/2013