AUTH App 5

Guidance on Insurance Mediation Activities

AUTH App 5.1

Application and purpose

- 01/12/2004

Application

AUTH App 5.1.1

See Notes

- 14/01/2005

Purpose of guidance

AUTH App 5.1.2

See Notes

- 14/01/2005

AUTH App 5.1.3

See Notes

- 14/01/2005

AUTH App 5.1.4

See Notes

- 14/01/2005

AUTH App 5.1.5

See Notes

- 14/01/2005

AUTH App 5.1.6

See Notes

- 14/01/2005

Effect of guidance

AUTH App 5.1.7

See Notes

- 14/01/2005

AUTH App 5.1.8

See Notes

- 14/01/2005

AUTH App 5.1.9

See Notes

- 14/01/2005

AUTH App 5.1.10

See Notes

- 14/01/2005

Guidance on other activities

AUTH App 5.1.11

See Notes

- 14/01/2005

AUTH App 5.2

Introduction

- 01/12/2004

AUTH App 5.2.1

See Notes

- 14/01/2005

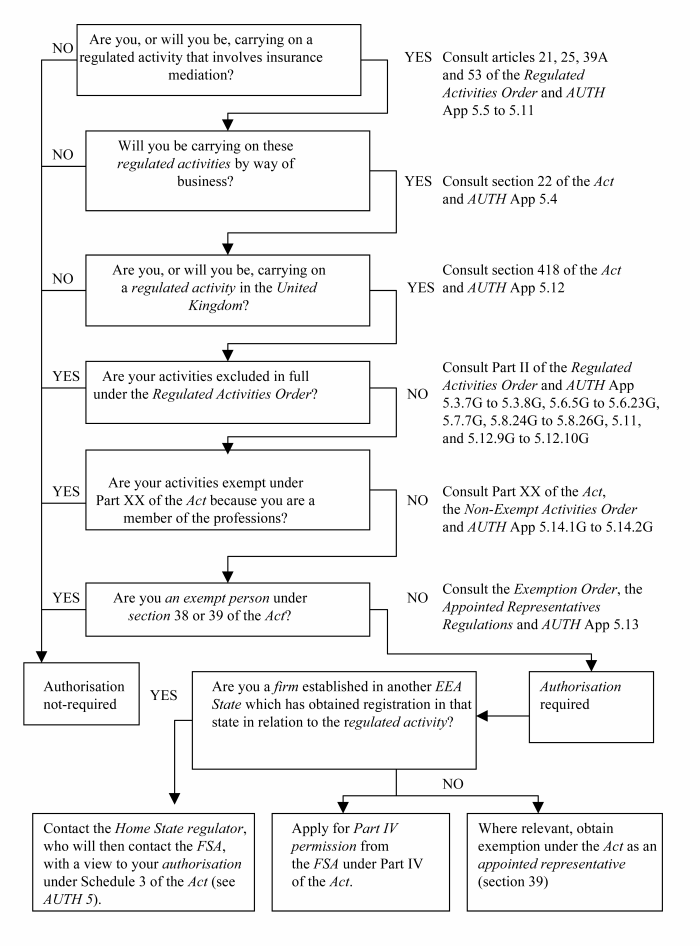

Requirement for authorisation or exemption

AUTH App 5.2.2

See Notes

- 14/01/2005

Questions to be considered to decide if authorisation is required

AUTH App 5.2.3

See Notes

- 14/01/2005

AUTH App 5.2.4

See Notes

- 14/01/2005

Approach to implementation of the IMD

AUTH App 5.2.5

See Notes

- 14/01/2005

AUTH App 5.2.6

See Notes

- 14/01/2005

AUTH App 5.2.7

See Notes

- 14/01/2005

AUTH App 5.2.8

See Notes

- 14/01/2005

AUTH App 5.2.9

See Notes

- 14/01/2005

Financial promotion

AUTH App 5.2.10

See Notes

- 14/01/2005

AUTH App 5.3

Contracts of insurance

- 01/12/2004

AUTH App 5.3.1

See Notes

- 14/01/2005

Definition

AUTH App 5.3.2

See Notes

- 14/01/2005

AUTH App 5.3.3

See Notes

- 14/01/2005

AUTH App 5.3.4

See Notes

- 14/01/2005

AUTH App 5.3.5

See Notes

- 14/01/2005

AUTH App 5.3.6

See Notes

- 14/01/2005

Connected contracts of insurance

AUTH App 5.3.7

See Notes

- 14/01/2005

Large risks

AUTH App 5.3.8

See Notes

- 14/01/2005

Specified investments

AUTH App 5.3.9

See Notes

- 14/01/2005

AUTH App 5.3.10

See Notes

- 14/01/2005

AUTH App 5.3.11

See Notes

- 14/01/2005

AUTH App 5.4

The business test

- 01/12/2004

AUTH App 5.4.1

See Notes

- 14/01/2005

AUTH App 5.4.2

See Notes

- 14/01/2005

AUTH App 5.4.3

See Notes

- 14/01/2005

AUTH App 5.4.4

See Notes

- 14/01/2005

AUTH App 5.4.5

See Notes

- 14/01/2005

AUTH App 5.4.6

See Notes

- 14/01/2005

AUTH App 5.4.7

See Notes

- 14/01/2005

AUTH App 5.4.8

See Notes

Table: Carrying on insurance mediation activities 'for remuneration' and 'by way of business'

| Carrying on insurance mediation activities 'for remuneration' and 'by way of business' | ||

| 'For remuneration' | ||

| Factor | Indicators that P does not carry on activities "for remuneration" | Indicators that P does carry on activities "for remuneration" |

| Direct remuneration, whether received from the customer or the insurer/broker (cash or benefits in kind such as tickets to the opera, a reduction in other insurance premiums, a remission of a debt or any other benefit capable of being measured in money's worth) | P does not receive any direct remuneration specifically identified as a reward for his carrying on insurance mediation activities. | P receives direct remuneration specifically identified as being a reward for providing insurance mediation services. |

| Indirect remuneration (such as any form of economic benefit as may be explicitly or implicitly agreed between P and the insurer/broker or P's customer - including, for example, through the acceptance of P's terms and conditions or mutual recognition of the economic benefit that is likely to accrue to P). An indirect economic benefit can include expectation of making a profit of some kind as a result of carrying on insurance mediation activities as part of other services. | P does not obtain any form of indirect remuneration through an economic benefit other than one which is not likely to have a material effect on P's ability to make a profit from his other activities. | P obtains an

economic benefit that: (a) is explicitly or implicitly agreed between P and the insurer/broker or P's customer; and (b) has the potential to go beyond mere cost recovery through fees or other benefits received for providing a package of services that includes insurance mediation activities but where no particular part of the fees is attributable to insurance mediation activities. This could include where insurance mediation activity are likely to: • play a material part in the success of P's other business activities or in P's ability to make a profit from them; or • provide P with a materially increased opportunity to provide other goods or services; or • be a major selling point for P's other business activities; or • be essential for P to provide other goods or services. P charges his customers a greater amount for other goods or services than would be the case if P were not also carrying on insurance mediation activities for those customers and this: • is explicitly or implicitly agreed between P and the insurer/broker or P's customer; and • has the potential to go beyond mere cost recovery. |

| Recovery of costs | P receives no benefits of any kind (direct or indirect) in respect of his insurance mediation activities beyond the reimbursement of his actual costs incurred in carrying on the activity (including receipt by P of a sum equal to the insurance premium that P is to pass on to the insurer or broker). | P receives benefits of any kind (direct or indirect) in respect of his insurance mediation activities which go beyond the reimbursement of his actual costs incurred in carrying on the activity. |

| 'By way of business' | ||

| Factor | Indicators that P does not carry on activities "by way of business" | Indicators that P does carry on activities "by way of business" |

| Regularity/ frequency | Involvement

is one-off or infrequent (for instance, once or twice a year) provided that

the transaction(s) is not of such size and importance that it is essential

to the success of P's other business activities. Transactions do not result from formal arrangements (for instance, occasional involvement purely as a result of an unsolicited approach). | Involvement

is frequent (for instance, once a week). Involvement is infrequent but the transactions are of such size or importance that they are essential to the success of P's other business activities. P has formal arrangements which envisage transactions taking place on a regular basis over time (whether or not such transactions turn out in practice to be regular). |

| Holding out | P does not hold himself out as providing a professional service that includes insurance mediation activities (by professional is meant not the services of a layman). | P holds himself out as providing a professional service that includes insurance mediation activities. |

| Relevance to other activities/ business |

Insurance mediation activities: • have no relevance to P's other activities; or • have some relevance but could easily be ceased without causing P any difficulty in carrying on his main activities; or • would be unlikely to result in a material reduction in income from P's main activities if ceased |

Insurance mediation activities: • are essential to P in carrying on his main activities; or • would cause a material disruption to P carrying on his main activities if ceased; or • would be likely to reduce P's income by a material amount. |

| Commercial benefit | P receives no

direct or indirect pecuniary or economic benefit. P is a layman and acting in that capacity. P would not obtain materially less income from his main activities if they did not include insurance mediation activities. | P receives a

direct or indirect pecuniary or economic benefit from carrying on insurance mediation activities -

such as a fee, a benefit in kind or the likelihood of materially enhanced

sales of other goods or services that P provides. P would obtain materially less income from his main activities if they did not include insurance mediation activities. |

- 14/01/2005

AUTH App 5.5

The regulated activities: dealing in contracts as agent

- 01/12/2004

AUTH App 5.5.1

See Notes

- 14/01/2005

AUTH App 5.5.2

See Notes

- 14/01/2005

AUTH App 5.5.3

See Notes

- 14/01/2005

AUTH App 5.6

The regulated activities: arranging deals in, and making arrangements with a view to transactions in, contracts of insurance

- 01/12/2004

AUTH App 5.6.1

See Notes

- 14/01/2005

Article 25(1): arranging (bringing about) deals in investments

AUTH App 5.6.2

See Notes

- 14/01/2005

Article 25(2): making arrangements with a view to transactions in investments

AUTH App 5.6.3

See Notes

- 14/01/2005

AUTH App 5.6.4

See Notes

- 14/01/2005

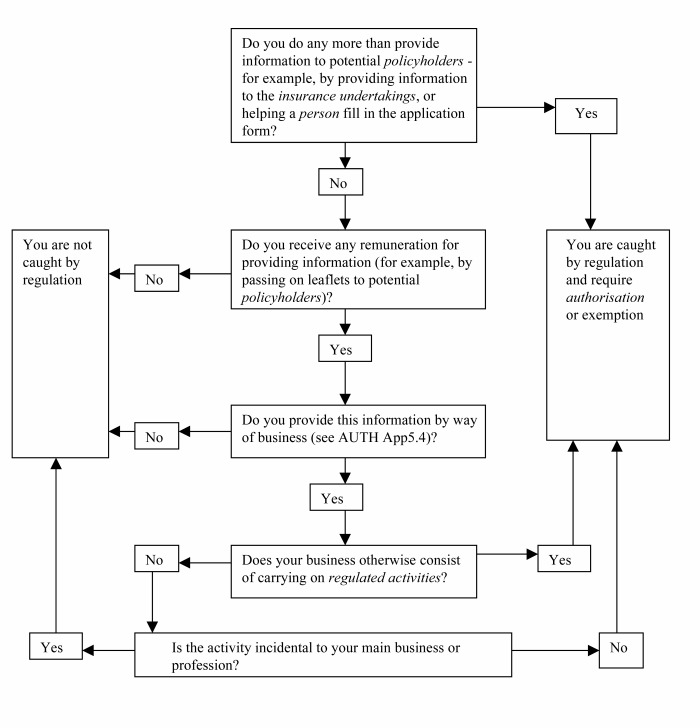

Exclusion: article 72C (Provision of information on an incidental basis)

AUTH App 5.6.5

See Notes

- 14/01/2005

AUTH App 5.6.6

See Notes

- 14/01/2005

AUTH App 5.6.7

See Notes

- 14/01/2005

AUTH App 5.6.8

See Notes

- 14/01/2005

AUTH App 5.6.9

See Notes

- 14/01/2005

Exclusion from article 25(2): arrangements enabling parties to communicate

AUTH App 5.6.10

See Notes

- 14/01/2005

AUTH App 5.6.11

See Notes

- 14/01/2005

Exclusion from article 25(2): transactions to which the arranger is a party

AUTH App 5.6.12

See Notes

- 14/01/2005

AUTH App 5.6.13

See Notes

- 14/01/2005

AUTH App 5.6.14

See Notes

- 14/01/2005

AUTH App 5.6.15

See Notes

- 14/01/2005

AUTH App 5.6.16

See Notes

- 14/01/2005

Exclusion from article 25(2) for introducing

AUTH App 5.6.17

See Notes

- 14/01/2005

AUTH App 5.6.18

See Notes

- 14/01/2005

AUTH App 5.6.19

See Notes

- 14/01/2005

AUTH App 5.6.20

See Notes

- 14/01/2005

AUTH App 5.6.21

See Notes

Application of article 33 to arrangements for making introductions. This table belongs to AUTH App 5.6.20 G.

| Type of introduction | Applicability of exclusion | |

| 1 | Introductions are purely for the purpose of the provision of independent advice - Introducer is completely indifferent to whether or not transactions take place after advice has been given. | Exclusion not relevant as introducer is not arranging under article 25(2). |

| 2 | Introduction is one-off or otherwise not part of pre-existing ongoing arrangements that envisage such introduction being made. | Exclusion not relevant as introducer is not arranging under article 25(2). |

| 3 | Introducer is not indifferent to whether or not transactions take place after advice has been given, but is indifferent to whether or not the transactions may involve a contract of insurance. | Exclusion will be available provided the introduction was made with a view to the provision of independent advice on investments generally. |

| 4 | Introducer is not indifferent to whether or not transactions take place after advice has been given (for example, because he expects to receive a percentage of the commission), and introductions specifically relate to contracts of insurance. | Exclusion is not available. If introducer is an unauthorised person, he will need authorisation or exemption as an designated investment business. If introducer is an authorised person (such as an IFA introducing to a general insurance broker), he will need to vary his Part IV permission accordingly. If introducer is an appointed representative, he will need to ensure that his agreement covers making such arrangements. |

- 14/01/2005

Exclusion from article 25(2): arrangements for the provision of finance

AUTH App 5.6.22

See Notes

- 14/01/2005

Other exclusions

AUTH App 5.6.23

See Notes

- 14/01/2005

AUTH App 5.7

The regulated activities: assisting in the administration and performance of a contract of insurance

- 01/12/2004

AUTH App 5.7.1

See Notes

- 14/01/2005

AUTH App 5.7.2

See Notes

- 14/01/2005

AUTH App 5.7.3

See Notes

- 14/01/2005

AUTH App 5.7.4

See Notes

- 14/01/2005

AUTH App 5.7.5

See Notes

- 14/01/2005

AUTH App 5.7.6

See Notes

- 14/01/2005

Exclusions

AUTH App 5.7.7

See Notes

- 14/01/2005

AUTH App 5.7.8

See Notes

- 14/01/2005

AUTH App 5.8

The regulated activities: advising on contracts of insurance

- 01/12/2004

AUTH App 5.8.1

See Notes

- 14/01/2005

AUTH App 5.8.2

See Notes

- 14/01/2005

AUTH App 5.8.3

See Notes

- 14/01/2005

Advice must relate to a particular contract of insurance

AUTH App 5.8.4

See Notes

- 14/01/2005

AUTH App 5.8.5

See Notes

Typical recommendations and whether they will be regulated as advice on contracts of insurance under article 53 of the Regulated Activities Order. This table belongs to AUTH App 5.8.4 G

| Recommendation | Regulated under article 53 or not? |

| I recommend you take the ABC Insurers motor insurance policy | Yes |

| I recommend that you take out the GHI Insurers life insurance policy | Yes |

| I recommend that you do not take out the ABC Insurers motor insurance policy | Yes |

| I recommend that you do not take out the GHI Insurers life insurance policy | Yes |

| I recommend that you take out either the ABC Insurers motor insurance policy or the DEF Insurers motor insurance policy | Yes |

| I recommend that you take out either the GHI Insurers life insurance policy or the JKL Insurers life insurance policy | Yes |

| I recommend that you take out (or do not take out) insurance with ABC Insurers | Possibly (depending on whether or not the circumstances relating to the recommendation, including the range of possible products, is such that this amounts to an implied recommendation of a particular policy) |

| I recommend that you take out (or do not take out) contents insurance | No, unless a specific insurance policy is implied by the context |

| I recommend that you take out (or do not take out) life insurance | No, unless a specific insurance policy is implied by the context |

- 14/01/2005

Advice given to a person in his capacity as an investor or potential investor

AUTH App 5.8.6

See Notes

- 14/01/2005

AUTH App 5.8.7

See Notes

- 14/01/2005

Advice or information

AUTH App 5.8.8

See Notes

- 14/01/2005

AUTH App 5.8.9

See Notes

- 14/01/2005

AUTH App 5.8.10

See Notes

- 14/01/2005

AUTH App 5.8.11

See Notes

- 14/01/2005

Advice must relate to the merits (of buying or selling a contract of insurance)

AUTH App 5.8.12

See Notes

- 14/01/2005

AUTH App 5.8.13

See Notes

- 14/01/2005

AUTH App 5.8.14

See Notes

- 14/01/2005

Pre-purchase questioning (including decision trees)

AUTH App 5.8.15

See Notes

- 14/01/2005

AUTH App 5.8.16

See Notes

- 14/01/2005

AUTH App 5.8.17

See Notes

- 14/01/2005

AUTH App 5.8.18

See Notes

- 14/01/2005

AUTH App 5.8.19

See Notes

- 14/01/2005

Medium used to give advice

AUTH App 5.8.20

See Notes

- 14/01/2005

AUTH App 5.8.21

See Notes

- 14/01/2005

AUTH App 5.8.22

See Notes

- 14/01/2005

AUTH App 5.8.23

See Notes

- 14/01/2005

Exclusion: periodical publications, broadcasts and web-sites

AUTH App 5.8.24

See Notes

- 14/01/2005

AUTH App 5.8.25

See Notes

- 14/01/2005

Other exclusions

AUTH App 5.8.26

See Notes

- 14/01/2005

AUTH App 5.9

The Regulated Activities: agreeing to carry on a regulated activity

- 01/12/2004

AUTH App 5.9.1

See Notes

- 14/01/2005

AUTH App 5.9.2

See Notes

- 14/01/2005

AUTH App 5.10

Renewals

- 01/12/2004

AUTH App 5.10.1

See Notes

- 14/01/2005

AUTH App 5.11

Other aspects of exclusions

- 01/12/2004

AUTH App 5.11.1

See Notes

- 14/01/2005

AUTH App 5.11.2

See Notes

- 14/01/2005

Exclusions disapplied where activities relate to contracts of insurance

AUTH App 5.11.3

See Notes

- 14/01/2005

AUTH App 5.11.4

See Notes

- 14/01/2005

AUTH App 5.11.5

See Notes

- 14/01/2005

AUTH App 5.11.6

See Notes

- 14/01/2005

Exclusions disapplied in connection with insurance mediation

AUTH App 5.11.7

See Notes

- 14/01/2005

Exclusions applying to more than one regulated activity

AUTH App 5.11.8

See Notes

- 14/01/2005

Activities carried on in the course of a profession or non-investment business

AUTH App 5.11.9

See Notes

- 14/01/2005

AUTH App 5.11.10

See Notes

- 14/01/2005

AUTH App 5.11.11

See Notes

- 14/01/2005

AUTH App 5.11.12

See Notes

- 14/01/2005

Activities carried on by a provider of relevant goods or services

AUTH App 5.11.13

See Notes

- 14/01/2005

AUTH App 5.11.14

See Notes

- 14/01/2005

AUTH App 5.11.15

See Notes

- 14/01/2005

Large risks

AUTH App 5.11.16

See Notes

- 14/01/2005

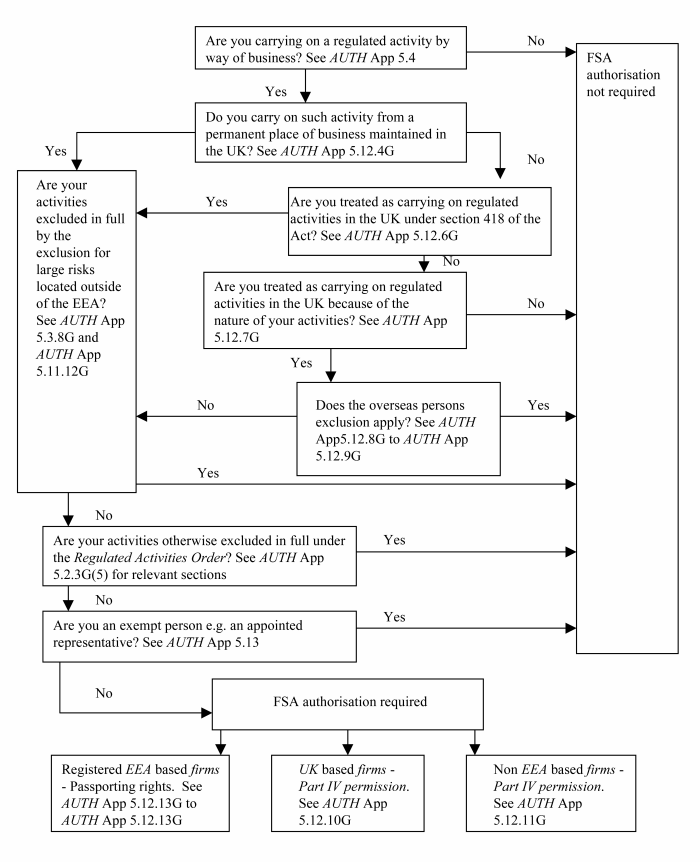

AUTH App 5.12

Link between activities and the United Kingdom

- 01/12/2004

Introduction

AUTH App 5.12.1

See Notes

- 14/01/2005

AUTH App 5.12.2

See Notes

- 14/01/2005

AUTH App 5.12.3

See Notes

- 14/01/2005

AUTH App 5.12.4

See Notes

Territorial issues relating to overseas insurance intermediaries carrying on insurance mediation activities in or into the United Kingdom

| Needs Part IV permission | Schedule 3 EEA passport rights available | Overseas persons exclusion available | |

| Registered EEA-based intermediary with UK branch (registered office or head office in another EEA State) | No | Yes | No |

| Registered EEA-based intermediary with no UK branch providing cross-border services | No | Yes | Potentially available [see Note 1] |

| Third country intermediary operating from branch in UK | Yes | No | No |

| Third country intermediary providing services in (or into) UK | Yes unless overseas persons exclusion applies | No | Potentially available |

| Note 1. This does not, however, affect the firm's authorisation under Schedule 3 to the Act (see AUTH App 5.12.13 G to AUTH App 5.12.14 G (Passporting)). | |||

- 14/01/2005

Where are insurance mediation activities carried on?

AUTH App 5.12.5

See Notes

- 14/01/2005

AUTH App 5.12.6

See Notes

- 14/01/2005

AUTH App 5.12.7

See Notes

- 14/01/2005

AUTH App 5.12.8

See Notes

- 14/01/2005

Overseas persons

AUTH App 5.12.9

See Notes

- 14/01/2005

AUTH App 5.12.10

See Notes

- 14/01/2005

How should persons be authorised?

AUTH App 5.12.11

See Notes

- 14/01/2005

AUTH App 5.12.12

See Notes

- 14/01/2005

Passporting

AUTH App 5.12.13

See Notes

- 14/01/2005

AUTH App 5.12.14

See Notes

- 14/01/2005

E-Commerce Directive

AUTH App 5.12.15

See Notes

- 14/01/2005

AUTH App 5.12.16

See Notes

- 14/01/2005

AUTH App 5.12.17

See Notes

- 14/01/2005

AUTH App 5.13

Appointed representatives

- 01/12/2004

What is an appointed representative?

AUTH App 5.13.1

See Notes

- 14/01/2005

AUTH App 5.13.2

See Notes

- 14/01/2005

Business for which an appointed representative is exempt

AUTH App 5.13.3

See Notes

- 14/01/2005

AUTH App 5.13.4

See Notes

Insurance mediation activities able to be carried on by an appointed representative. This table belongs to AUTH App 5.13.3 G

| Type of contract of insurance | Regulated activities an appointed representative can carry on |

| General insurance contract | •Dealing in investments as agent; •Arranging; •Assisting in the administration and performance of a contract of insurance; •Advising on investments; and • Agreeing to carry on these regulated activities. |

| Pure protection contract | •Dealing in investments as agent (but only where the contract is not a long-term care insurance contract); •Arranging; •Assisting in the administration and performance of a contract of insurance; •Advising on investments; and • Agreeing to carry on these regulated activities. |

| Life policy (note that this already has effect prior to 14 January 2005) | •Arranging; •Assisting in the administration and performance of a contract of insurance; •Advising on investments; and • Agreeing to carry on these regulated activities |

- 14/01/2005

Persons who are not already appointed representatives

AUTH App 5.13.5

See Notes

- 14/01/2005

Persons who are already appointed representatives

AUTH App 5.13.6

See Notes

- 14/01/2005

AUTH App 5.14

Exemptions

- 01/12/2004

Professionals

AUTH App 5.14.1

See Notes

- 14/01/2005

AUTH App 5.14.2

See Notes

- 14/01/2005

AUTH App 5.14.3

See Notes

- 14/01/2005

AUTH App 5.14.4

See Notes

- 14/01/2005

Other exemptions

AUTH App 5.14.5

See Notes

- 14/01/2005

AUTH App 5.15

Illustrative tables

- 01/12/2004

AUTH App 5.15.1

See Notes

- 14/01/2005

AUTH App 5.15.2

See Notes

- 14/01/2005

AUTH App 5.15.3

See Notes

- 14/01/2005

AUTH App 5.15.4

See Notes

Types of activity -are they regulated activities and, if so, why?

| Type of activity | Is it a regulated activity? | Rationale |

| MARKETING AND EFFECTING INTRODUCTIONS | ||

| Passive display of information-for example, medical insurance brochures in doctor's surgery (whether or not remuneration is received for this activity) | No. | Merely displaying information does not constitute making arrangements under article 25(2) (see AUTH App 5.6.4 G). |

| Recommending a broker/insurance undertaking and providing customer with contact details (whether by phone, fax, e-mail, face-to-face or any other means of communication) | Yes, but article 72C may be available. | This will constitute making arrangements under article 25(2). But, the exclusion in article 72C will apply if all the intermediary does is supply information to the customer and the conditions of article 72C are otherwise met (see AUTH App 5.6.5 G to AUTH App 5.6.9 G). Generally, this will not amount to advice under article 53 unless there is an implied recommendation of a particular policy (see AUTH App 5.8.4 G), in which case article 72C would not be available. |

| Providing an insurance undertaking/broker with contact details of customer | Yes. | This will constitute making arrangements under article 25(2) when undertaken in the context of regular or ongoing arrangements for introducing customers. Article 72C will not apply because the information is supplied to someone other than the policyholder or potential policyholder. |

| Marketing on behalf of insurance undertaking to intermediaries only (for example, broker consultants) | Yes. | This amounts to work preparatory to the conclusion of contracts of insurance and so constitutes making arrangements under article 25(2). Article 72C is not available because this activity does not involve provision of information to the policyholder or potential policyholder only. |

| Telemarketing services (that is, companies specialising in marketing an insurance undertaking's products/services to prospective customers) | Yes. | This amounts to introducing and/or other work preparatory to the conclusion of contracts of insurance and so constitutes making arrangements under article 25(2). This could also involve article 25(1) arranging where the telemarketing company actually sells a particular policy and could involve advising on investments. Article 72C will not be available where the provision of information is more than incidental to the telemarketing company's main business or where the telemarketing company is advising on investments. |

| PRE-PURCHASE DISCUSSIONS WITH CUSTOMERS AND ADVICE | ||

| Discussion with client about need for insurance generally/need to take out a particular type of insurance | Generally, no. Article 72C available if needed. | Not enough, of itself, to constitute making arrangements under article 25(2), but you should consider whether, viewed as a whole, your activities might amount to arranging. If so, article 72C might be of application (see AUTH App 5.6.5 G to AUTH App 5.6.9 G). |

| Advising on the level of cover needed | Generally, no. Article 72C available if needed. | Not enough, of itself, to constitute making arrangements under article 25(2), but you should consider whether, viewed as a whole, your activities might amount to making arrangements under article 25(2) (see AUTH App 5.8.3 G). If so, article 72C might be of application (see AUTH App 5.6.5 G to AUTH App 5.6.9 G). |

| Pre-purchase questioning in the context of filtered sales (intermediary asks a series of questions and then suggests several policies which suit the answers given) | Yes. Subject to Article 72 C exclusion where available. | This will constitute arranging although article 72C may be of application (see AUTH App 5.6.5 G to AUTH App 5.6.9 G). If there is no express or implied recommendation of a particular policy, this activity will not amount to advice under article 53 (see AUTH App 5.8.15 G to AUTH App 5.8.19 G). |

| Explanation of the terms of a particular policy or comparison of the terms of different policies | Possibly. Article 72C available. | This is likely to amount to making arrangements under article 25(2). In certain circumstances, it could involve advising on investments (see AUTH App 5.8.8 G (Advice or information)). Where the explanation is provided to the potential policyholder, and does not involve advising on investments, article 72C may be of application (see AUTH App 5.6.5 G to AUTH App 5.6.9 G), and where information is provided by a professional in the course of a profession, article 67 may apply (see AUTH App 5.11.9 G to AUTH App 5.11.12 G). |

| Advising that a customer take out a particular policy | Yes. | This amounts to advice on the merits of a particular policy under article 53 (see AUTH App 5.8.4 G to AUTH App 5.8.5 G). |

| Advising that a customer does not take out a particular policy | Yes. | This amounts to advice on the merits of a particular policy under article 53 (see AUTH App 5.8.4 G to AUTH App 5.8.5 G). |

| Advice by journalists in newspapers, broadcasts etc. | Generally, no because of the article 54 exclusion. | Article 54 provides an exclusion for advice given in newspapers etc (see AUTH App 5.8.24 G to AUTH App 5.8.25 G). |

| Giving advice to a customer in relation to his buying a consumer product, where insurance is a compulsory secondary purchase and/or a benefit that comes with buying the product | Not necessarily but depends on the circumstances | Where the advice relates specifically to the merits of the consumer product, it is possible that references to the accompanying insurance may be seen to be information and not advice. If, however, the advice relates, in part, to the merits of the insurance element, then it will be regulated activity. |

| ASSISTING CUSTOMERS WITH COMPLETING/SENDING APPLICATION FORMS | ||

| Providing information to customer who fills in application form | Possibly. Subject to article 67 or 72C exclusions where available. | This activity may amount to arranging although the exclusions in article 67 (see AUTH App 5.11.9 G to AUTH App 5.11.12 G) and article 72C (see AUTH App 5.6.5 G to AUTH App 5.6.9 G) may be of application. |

| Helping a potential policyholder fill in an application form | Yes. | This activity amounts to arranging. Article 72C will not apply because this activity goes beyond the mere provision of information to a policyholder or potential policyholder (see AUTH App 5.6.5 G to AUTH App 5.6.9 G). |

| Receiving completed proposal forms for checking and forwarding to an insurance undertaking (for example, an administration outsourcing service provider that receives and processes proposal forms) | Yes. | This amounts to arranging. Article 72C does not apply because this activity goes beyond the mere provision of information to a policyholder or potential policyholder (see AUTH App 5.6.5 G to AUTH App 5.6.9 G). |

| Assisting in completion of proposal form and sending to insurance undertaking | Yes. | This activity amounts to arranging. Article 72C does not apply because this activity goes beyond the mere provision of information (see AUTH App 5.6.5 G to AUTH App 5.6.9 G). |

| NEGOTIATING AND CONCLUDING CONTRACTS OF INSURANCE | ||

| Negotiating terms of policy on behalf of customer with the insurance undertaking | Yes. | This activity amounts to arranging (see AUTH App 5.6.2 G). |

| Negotiating terms of policy on behalf of insurance undertaking with the customer and signing proposal form on his behalf | Yes. | These activities amount to both arranging and dealing in investments as agent. |

| Concluding a contract of insurance on insurance company's behalf, for example, motor dealer who has authority to conclude insurance contract on behalf of insurance undertaking when selling a car | Yes. | A person carrying on this activity will be dealing in investments as agent. He will also be arranging (as the article 28 exclusion only applies in the limited circumstances envisaged under article 28(3)) (see AUTH App 5.6.12 G). |

| Agreeing, on behalf of a prospective policy holder, to buy a policy. | Yes. | A person who, with authority, enters into a contract of insurance on behalf of another is dealing in investments as agent under article 21, and will also be arranging. |

| Providing compulsory insurance as a secondary purchase | Yes. It will amount to dealing in investments as agent or arranging. | The fact that the insurance is secondary to the primary product does not alter the fact that arranging the package involves arranging the insurance. |

| COLLECTION OF PREMIUMS | ||

| Collection of cheque for premium from the customer at the pre-contract stage. | Yes (as part of arranging). | This activity is likely to form part of arranging. But the mere collection/receipt of premiums from the customer is unlikely, without more, to amount to arranging. |

| Collection of premiums at post-contract stage | No. | The mere collection of premiums from policyholders is unlikely, without more, to amount to assisting in the administration and performance of a contract of insurance. |

| MID-TERM ADJUSTMENTS AND ASSIGNMENTS | ||

| Solicitors or licensed conveyancers discharging client instructions to assign contracts of insurance. | Not where article 67 applies. | As the assignment of rights under a contract of insurance (as opposed to the creation of new contracts of insurance) does not fall within the IMD, article 67 is of potential application (see AUTH App 5.11.9 G to AUTH App 5.11.12 G). |

| Making mid-term adjustments to a policy, for example, property manager notifies changes to the names of the leaseholders registered as "interested parties" in the policy in respect of the property. | Yes. | Assuming the freeholder (as policyholder) is obliged under the terms of the policy to notify the insurance undertaking of changes to the identity of the leaseholders, the property manager is likely to be assisting in the administration and the performance of the contract of insurance. |

| TRADED ENDOWMENT POLICIES ("TEPs") | ||

| Making introductions for the purposes of selling TEPs | Yes, unless article 72C applies. | Making introductions for these purposes is arranging unless article 72C applies (see AUTH App 5.6.5 G to AUTH App 5.6.9 G). The exclusions in article 29 (Arranging deals with or through authorised persons) and 33 (Introducing) no longer apply to arranging contracts of insurance. |

| Market makers in TEPs | Yes, although the exclusion in article 28 may apply. | Unauthorised market makers can continue to make use of the exclusions in articles 15 (Absence of holding out etc.) and 16 (Dealing in contractually based investments), where appropriate. In order to avoid the need for authorisation in respect of arranging they may be able to rely upon article 28 (see AUTH App 5.6.12 G). |

| ASSISTING POLICYHOLDER WITH MAKING A CLAIM | ||

| Merely providing information to the insured to help him complete a claim form | No. | Of itself, this is likely to amount to assisting in the administration but not the performance of a contract of insurance. In the FSA's view, the provision of information in these circumstances is more akin to facilitating performance of a contract of insurance rather than assisting in the performance (see AUTH App 5.7.3 G to AUTH App 5.7.5 G) |

| Completion of claim form on behalf of insured | Potentially. | This activity amounts to assisting in the administration of a contract of insurance. Whether this activity amounts to assisting in the administration and performance of a contract of insurance will depend upon whether a person's assistance in filling in a claims form is material to whether performance of the contractual obligation to notify a claim takes place (see AUTH App 5.7.2 G to AUTH App 5.7.3 G). |

| Notification of claim to insurance undertaking and helping negotiate its settlement on the policyholder's behalf | Yes. | This activity amounts to assisting in the administration and performance of a contract of insurance (see AUTH App 5.7.4 G). |

| ASSISTING INSURANCE UNDERTAKING WITH CLAIMS BY POLICYHOLDERS | ||

| Negotiation of settlement of claims on behalf of an insurance undertaking | No. | Claims management on behalf of an insurance undertaking does not amount to assisting in the administration and performance of a contract of insurance by virtue of the exclusion in article 39B (see AUTH App 5.7.7 G). |

| Providing information to an insurance undertaking in connection with its investigation or assessment of a claim | No. | This activity does not amount to assisting in the administration and performance of a contract of insurance. |

| Loss adjusters and claims management services (for example, by administration outsourcing providers) | Potentially. | These activities may amount to assisting in the administration and performance of a contract of insurance. Article 39B excludes these activities, however, when undertaken on behalf of an insurance undertaking only (see AUTH App 5.7.7 G). |

| Providing an expert appraisal of a claim | No. | This activity does not amount to assisting in the administration and performance of a contract of insurance whether carried out on behalf of an insurance undertaking or otherwise. |

| Jeweller repairs customer's jewellery pursuant to a policy which permits the jeweller to carry out repairs | No. | This activity does not amount to assisting in the administration and performance of a contract of insurance. It amounts to managing claims on behalf of an insurance undertaking and so falls within the exclusion in article 39B (see AUTH App 5.7.7 G). |

- 14/01/2005

AUTH App 5.15.5

See Notes

- 14/01/2005

AUTH App 5.15.6

See Notes

- 14/01/2005

AUTH App 5.15.7

See Notes

- 14/01/2005

AUTH App 5.15.8

See Notes

- 14/01/2005

AUTH App 5.16

Meaning of insurance mediation

- 01/12/2004

AUTH App 5.16.1

See Notes

- 14/01/2005

AUTH App 5.16.2

See Notes

These activities when undertaken by an insurance undertaking or an employee of an insurance undertaking who is acting under the responsibility of the insurance undertaking shall not be considered as insurance mediation.

The provision of information on an incidental basis in the context of another professional activity provided that the purpose of that activity is not to assist the customer in concluding or performing an insurance contract, the management of claims of an insurance undertaking on a professional basis, and loss adjusting and expert appraisal of claims shall also not be considered as insurance mediation."

- 14/01/2005