AUTH App 4

Guidance on regulated activities connected with mortgages

AUTH App 4.1

Application and purpose

- 01/12/2004

Application

AUTH App 4.1.1

See Notes

- 31/10/2004

Purpose of guidance

AUTH App 4.1.2

See Notes

- 31/10/2004

Effect of guidance

AUTH App 4.1.3

See Notes

- 31/10/2004

AUTH App 4.1.4

See Notes

- 31/10/2004

AUTH App 4.1.5

See Notes

- 31/10/2004

Guidance on other activities

AUTH App 4.1.6

See Notes

- 31/10/2004

AUTH App 4.2

Introduction

- 01/12/2004

Requirement for authorisation or exemption

AUTH App 4.2.1

See Notes

- 31/10/2004

Professional firms

AUTH App 4.2.2

See Notes

- 31/10/2004

Questions to be considered to decide if authorisation is required

AUTH App 4.2.3

See Notes

- 31/10/2004

AUTH App 4.2.4

See Notes

- 31/10/2004

AUTH App 4.2.5

See Notes

- 31/10/2004

AUTH App 4.3

Regulated activities related to mortgages

- 01/12/2004

AUTH App 4.3.1

See Notes

- 31/10/2004

AUTH App 4.3.2

See Notes

- 31/10/2004

The business test

AUTH App 4.3.3

See Notes

- 31/10/2004

AUTH App 4.3.4

See Notes

- 31/10/2004

AUTH App 4.3.5

See Notes

Summary of which variant of the business test applies to the different regulated mortgage activities.

This table belongs to AUTH App 4.3.4 G

| By way of business | Carrying on the business |

| Entering into a regulated mortgage contract (article 61(1)) Administering a regulated mortgage contract (article 61(2)) (and the contract administered must have been entered into by way of business) |

Arranging (bringing about) regulated mortgage contracts (article 25A(1)) Making arrangements with a view to regulated mortgage contracts (article 25A(2)) Advising on regulated mortgage contracts (article 53A) |

- 31/10/2004

AUTH App 4.3.6

See Notes

- 31/10/2004

AUTH App 4.3.7

See Notes

- 31/10/2004

AUTH App 4.3.8

See Notes

- 31/10/2004

AUTH App 4.3.9

See Notes

- 31/10/2004

AUTH App 4.4

What is a regulated mortgage contract?

- 01/12/2004

The definition of "regulated mortgage contract"

AUTH App 4.4.1

See Notes

- 31/10/2004

Provision of credit

AUTH App 4.4.1A

See Notes

- 14/01/2005

Which borrowers?

AUTH App 4.4.2

See Notes

- 31/10/2004

Date the contract is entered into

AUTH App 4.4.3

See Notes

- 31/10/2004

AUTH App 4.4.4

See Notes

- 31/10/2004

Land in the United Kingdom

AUTH App 4.4.5

See Notes

- 31/10/2004

Occupancy requirement

AUTH App 4.4.6

See Notes

- 31/10/2004

AUTH App 4.4.7

See Notes

- 31/10/2004

AUTH App 4.4.8

See Notes

- 31/10/2004

AUTH App 4.4.9

See Notes

- 31/10/2004

Purpose of the loan is irrelevant

AUTH App 4.4.10

See Notes

- 31/10/2004

Type of lending

AUTH App 4.4.11

See Notes

- 31/10/2004

AUTH App 4.4.12

See Notes

- 31/10/2004

Regulated mortgage contracts and contract variations

AUTH App 4.4.13

See Notes

- 31/10/2004

AUTH App 4.4.14

See Notes

- 31/10/2004

AUTH App 4.5

Arranging regulated mortgage contracts

- 01/12/2004

Definition of the regulated activities involving arranging

AUTH App 4.5.1

See Notes

- 31/10/2004

AUTH App 4.5.2

See Notes

- 31/10/2004

AUTH App 4.5.3

See Notes

- 31/10/2004

Exclusion: article 25A(1) arrangements not causing a deal

AUTH App 4.5.4

See Notes

- 31/10/2004

Exclusion: article 25A(2) arrangements enabling parties to communicate

AUTH App 4.5.5

See Notes

- 31/10/2004

AUTH App 4.5.6

See Notes

- 31/10/2004

Exclusion: article 25A(1) and (2) arranging of contracts to which the arranger is a party

AUTH App 4.5.7

See Notes

- 31/10/2004

Exclusion: article 25A(1) and (2) arrangements with or through authorised persons

AUTH App 4.5.8

See Notes

- 31/10/2004

Exclusion: article 25A(1)(b) arrangements made in the course of administration by authorised person

AUTH App 4.5.9

See Notes

- 31/10/2004

Exclusion: article 25A(2) arrangements and introducing

AUTH App 4.5.10

See Notes

- 31/10/2004

AUTH App 4.5.11

See Notes

- 31/10/2004

AUTH App 4.5.12

See Notes

- 31/10/2004

AUTH App 4.5.13

See Notes

- 31/10/2004

AUTH App 4.5.14

See Notes

- 31/10/2004

AUTH App 4.5.15

See Notes

- 31/10/2004

AUTH App 4.5.16

See Notes

- 31/10/2004

AUTH App 4.5.17

See Notes

- 31/10/2004

AUTH App 4.5.18

See Notes

- 31/10/2004

Other exclusions

AUTH App 4.5.19

See Notes

- 31/10/2004

AUTH App 4.6

Advising on regulated mortgage contracts

- 01/12/2004

Definition of 'advising on regulated mortgage contracts'

AUTH App 4.6.1

See Notes

- 31/10/2004

AUTH App 4.6.2

See Notes

- 31/10/2004

AUTH App 4.6.3

See Notes

- 31/10/2004

AUTH App 4.6.4

See Notes

- 31/10/2004

Advice must relate to a particular regulated mortgage contract

AUTH App 4.6.5

See Notes

- 31/10/2004

AUTH App 4.6.6

See Notes

- 31/10/2004

AUTH App 4.6.7

See Notes

Typical recommendations and whether they will be regulated as advice under article 53A of the Regulated Activities Order

This table belongs to AUTH App 4.6.5 G

| Regulated or not? | |

| I recommend you take out the ABC Building Society 2 year fixed rate mortgage at 5%. | Yes. This is advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. |

| I recommend you do not take out the ABC Building Society 2 year fixed rate mortgage at 5%. | Yes. This is advice which steers the borrower away from a particular mortgage which the borrower could have entered into. |

| I recommend that you take out either the ABC Building Society 2 year fixed rate mortgage at 5% or the XYZ Bank standard variable rate mortgage. | Yes. This is advice which steers the borrower in the direction of more than one particular mortgage which the borrower could enter into. |

| I recommend you take out (or do not take out) an ABC Building Society fixed rate mortgage. | This will depend on the circumstances. If, for example, the society only offers one such mortgage, this would be a recommendation intended implicitly to steer the borrower in the direction of that particular mortgage which the borrower could enter into and therefore would be advice. |

| I suggest you take out (or do not take out) a mortgage with ABC Building Society. | No. This is not advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. However, if the society only offers one mortgage, this would be a recommendation intended implicitly to steer the borrower in the direction of that particular mortgage which the borrower could enter into and therefore would be advice. |

| I suggest you change (or do not change) your current mortgage from a variable rate to a fixed rate. | No in respect of the advice about rate type, as this does not steer the borrower in the direction of a particular mortgage which the borrower could enter into. Yes in respect of the advice about varying the terms of the particular mortgage that the borrower had already entered into. |

| I suggest you take out (or do not take out) a variable rate mortgage. | No. This is not advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. |

| I recommend you take out (or do not take out) a mortgage. | No. This is not advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. |

| I would always recommend buying a house and taking out a mortgage as opposed to renting a property. | No. This is an example of generic advice which does not steer the borrower in the direction of a particular mortgage that he could enter into. |

| I recommend you do not borrow more than you can comfortably afford. | No. This is an example of generic advice. |

| If you are looking for flexibility with your mortgage I would recommend you explore the possibilities of either a flexible mortgage or an off-set mortgage. There are a growing number of lenders offering both. | No. This is an example of generic advice. |

- 31/10/2004

AUTH App 4.6.8

See Notes

- 31/10/2004

AUTH App 4.6.9

See Notes

- 31/10/2004

Advice given to a person in his capacity as a borrower or potential borrower

AUTH App 4.6.10

See Notes

- 31/10/2004

AUTH App 4.6.11

See Notes

- 31/10/2004

AUTH App 4.6.12

See Notes

- 31/10/2004

Advice or information

AUTH App 4.6.13

See Notes

- 31/10/2004

AUTH App 4.6.14

See Notes

- 31/10/2004

AUTH App 4.6.15

See Notes

- 31/10/2004

AUTH App 4.6.16

See Notes

- 31/10/2004

Advice must relate to the merits (of entering into as borrower or varying)

AUTH App 4.6.17

See Notes

- 31/10/2004

AUTH App 4.6.18

See Notes

- 31/10/2004

AUTH App 4.6.19

See Notes

- 31/10/2004

AUTH App 4.6.20

See Notes

- 31/10/2004

Scripted questioning (including decisions trees)

AUTH App 4.6.21

See Notes

- 31/10/2004

AUTH App 4.6.22

See Notes

- 31/10/2004

AUTH App 4.6.23

See Notes

- 31/10/2004

AUTH App 4.6.24

See Notes

- 31/10/2004

AUTH App 4.6.25

See Notes

- 31/10/2004

Medium used to give advice

AUTH App 4.6.26

See Notes

- 31/10/2004

AUTH App 4.6.27

See Notes

- 31/10/2004

AUTH App 4.6.28

See Notes

- 31/10/2004

AUTH App 4.6.29

See Notes

- 31/10/2004

Exclusion: periodical publications, broadcasts and websites

AUTH App 4.6.30

See Notes

- 31/10/2004

Exclusion: advice in the course of administration by authorised person

AUTH App 4.6.31

See Notes

- 31/10/2004

Other exclusions

AUTH App 4.6.32

See Notes

- 31/10/2004

AUTH App 4.7

Entering into a regulated mortgage contract

- 01/12/2004

Definition of 'entering into a regulated mortgage contract'

AUTH App 4.7.1

See Notes

- 31/10/2004

Exclusions

AUTH App 4.7.2

See Notes

- 31/10/2004

Transfer of lending obligations

AUTH App 4.7.3

See Notes

- 31/10/2004

AUTH App 4.8

Administering a regulated mortgage contract

- 01/12/2004

Definition of 'administering a regulated mortgage contract'

AUTH App 4.8.1

See Notes

- 31/10/2004

AUTH App 4.8.2

See Notes

- 31/10/2004

AUTH App 4.8.3

See Notes

- 31/10/2004

Exclusion: arranging administration by authorised persons

AUTH App 4.8.4

See Notes

- 31/10/2004

AUTH App 4.8.5

See Notes

- 31/10/2004

AUTH App 4.8.6

See Notes

- 31/10/2004

Exclusion: administration pursuant to agreement with authorised person

AUTH App 4.8.7

See Notes

- 31/10/2004

Other exclusions

AUTH App 4.8.8

See Notes

- 31/10/2004

AUTH App 4.9

Agreeing to carry on a regulated activity

- 01/12/2004

AUTH App 4.9.1

See Notes

- 31/10/2004

AUTH App 4.9.2

See Notes

- 31/10/2004

AUTH App 4.10

Exclusions applying to more than one regulated activity

- 01/12/2004

Exclusion: Activities carried on in the course of a profession or non-investment business

AUTH App 4.10.1

See Notes

- 31/10/2004

AUTH App 4.10.2

See Notes

- 31/10/2004

AUTH App 4.10.3

See Notes

- 31/10/2004

AUTH App 4.10.4

See Notes

- 31/10/2004

Exclusion: Trustees, nominees and personal representatives

AUTH App 4.10.5

See Notes

- 31/10/2004

AUTH App 4.10.6

See Notes

- 31/10/2004

AUTH App 4.10.7

See Notes

- 31/10/2004

AUTH App 4.10.8

See Notes

- 31/10/2004

AUTH App 4.11

Link between activities and the United Kingdom

- 01/12/2004

Introduction

AUTH App 4.11.1

See Notes

- 31/10/2004

AUTH App 4.11.2

See Notes

- 31/10/2004

Legislative provisions: definition of "regulated mortgage contract"

AUTH App 4.11.3

See Notes

- 31/10/2004

Legislative provisions: section 418 of the Act

AUTH App 4.11.4

See Notes

- 31/10/2004

AUTH App 4.11.5

See Notes

- 31/10/2004

Legislative provisions: overseas persons exclusion

AUTH App 4.11.6

See Notes

- 31/10/2004

AUTH App 4.11.7

See Notes

- 31/10/2004

Territorial scenarios: general

AUTH App 4.11.8

See Notes

- 31/10/2004

AUTH App 4.11.9

See Notes

Simplified summary of the territorial scope of the regulated mortgage activities, to be read in conjunction with the rest of this section.

This table belongs to AUTH App 4.11.8 G

| Individual borrower resident and located: | |||

| in the UK | outside the UK | ||

| Service provider carrying on regulated activity from establishment: | in the UK | Yes | Yes |

| outside the UK | Yes | No | |

| Yes = authorisation or exemption required | |||

| No = authorisation or exemption not required | |||

- 31/10/2004

AUTH App 4.11.10

See Notes

- 31/10/2004

AUTH App 4.11.11

See Notes

- 31/10/2004

Service provider overseas: general

AUTH App 4.11.12

See Notes

- 31/10/2004

Service provider overseas: arranging regulated mortgage contracts

AUTH App 4.11.13

See Notes

- 31/10/2004

AUTH App 4.11.14

See Notes

- 31/10/2004

Service provider overseas: advising on regulated mortgage contracts

AUTH App 4.11.15

See Notes

- 31/10/2004

Service provider overseas: entering into a regulated mortgage contract

AUTH App 4.11.16

See Notes

- 31/10/2004

AUTH App 4.11.17

See Notes

- 31/10/2004

Service provider overseas: administering a regulated mortgage contract

AUTH App 4.11.18

See Notes

- 31/10/2004

AUTH App 4.11.19

See Notes

- 31/10/2004

Service provider: agreeing to carry on a regulated activity

AUTH App 4.11.20

See Notes

- 31/10/2004

E-Commerce Directive

AUTH App 4.11.21

See Notes

- 31/10/2004

Distance marketing directive

AUTH App 4.11.22

See Notes

- 31/10/2004

AUTH App 4.12

Appointed representatives

- 01/12/2004

What is an appointed representative?

AUTH App 4.12.1

See Notes

- 31/10/2004

AUTH App 4.12.2

See Notes

- 31/10/2004

AUTH App 4.12.3

See Notes

- 31/10/2004

Persons who are not already appointed representatives

AUTH App 4.12.4

See Notes

- 31/10/2004

Persons who are already appointed representatives

AUTH App 4.12.5

See Notes

- 31/10/2004

AUTH App 4.13

Other exemptions

- 01/12/2004

AUTH App 4.13.1

See Notes

- 31/10/2004

AUTH App 4.14

Mortgage activities carried on by professional firms

- 01/12/2004

Introduction

AUTH App 4.14.1

See Notes

- 31/10/2004

AUTH App 4.14.2

See Notes

- 31/10/2004

AUTH App 4.14.3

See Notes

- 31/10/2004

AUTH App 4.14.4

See Notes

- 31/10/2004

Part XX exemption: advising on regulated mortgage contracts

AUTH App 4.14.5

See Notes

- 31/10/2004

Part XX exemption: entering into and administering a regulated mortgage contract

AUTH App 4.14.6

See Notes

- 31/10/2004

AUTH App 4.15

Mortgage activities carried on by 'packagers'

- 01/12/2004

Introduction

AUTH App 4.15.1

See Notes

- 31/10/2004

AUTH App 4.15.2

See Notes

- 31/10/2004

Mortgage packaging companies

AUTH App 4.15.3

See Notes

- 31/10/2004

Broker packagers (sometimes called 'intermediary brokers')

AUTH App 4.15.4

See Notes

- 31/10/2004

AUTH App 4.16

Mortgage activities and securitisation

- 01/12/2004

Introduction

AUTH App 4.16.1

See Notes

- 31/10/2004

AUTH App 4.16.2

See Notes

- 31/10/2004

Entering into a regulated mortgage contract

AUTH App 4.16.3

See Notes

- 31/10/2004

Administering, arranging and advising on a regulated mortgage contract

AUTH App 4.16.4

See Notes

- 31/10/2004

AUTH App 4.17

Interaction with the Consumer Credit Act

- 01/12/2004

Entering into and administering a regulated mortgage contract

AUTH App 4.17.1

See Notes

- 31/10/2004

AUTH App 4.17.2

See Notes

- 31/10/2004

AUTH App 4.17.3

See Notes

- 31/10/2004

AUTH App 4.17.4

See Notes

- 31/10/2004

AUTH App 4.17.5

See Notes

- 31/10/2004

Advising on and arranging a regulated mortgage contract

AUTH App 4.17.6

See Notes

- 31/10/2004

AUTH App 4.17.7

See Notes

- 31/10/2004

AUTH App 4.17.8

See Notes

- 31/10/2004

AUTH App 4.17.9

See Notes

- 31/10/2004

AUTH App 4.17.10

See Notes

- 31/10/2004

AUTH App 4.17.11

See Notes

- 31/10/2004

AUTH App 4.17.12

See Notes

- 31/10/2004

AUTH App 4.17.13

See Notes

- 31/10/2004

AUTH App 4.17.14

See Notes

- 31/10/2004

Financial Promotion and advertisements

AUTH App 4.17.15

See Notes

- 31/10/2004

AUTH App 4.17.16

See Notes

- 31/10/2004

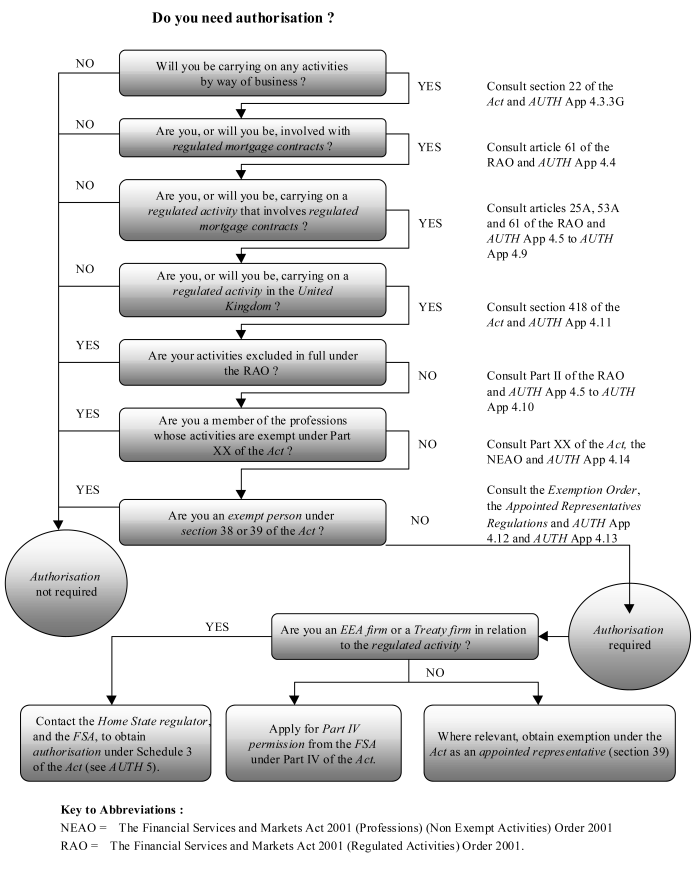

AUTH App 4.18

Regulated activities related to mortgages: flowchart

- 01/12/2004

AUTH App 4.18.1

See Notes

- 31/10/2004