Introduction

1.

This supervisory statement sets out details on information that firms should submit to the Prudential Regulation Authority (PRA) to facilitate resolution planning.

- 01/01/2019

2.

This statement is aimed at UK banks, building societies, PRA designated investment firms and qualifying parent undertakings (‘firms’) to which the Resolution Pack Part of the PRA Rulebook applies.

- 01/01/2019

3.

The PRA aims to minimise the adverse impact on the financial system of firms failing by ensuring that they can be resolved in an orderly fashion. To achieve this, PRA rules require firms to submit resolution packs containing information to enable the authorities to prepare for orderly resolution. The information submitted in resolution packs will allow the authorities to identify the appropriate resolution strategy for a firm; work with firms to identify barriers to an optimal resolution plan; and develop the remedial actions for the removal of barriers.

- 01/01/2019

4.

This supervisory statement has been informed by PRA and Bank of England experience of resolution planning following the publication of CP11/16 and FS12/1 and by the Financial Stability Board’s (FSB’s) guidance on resolution strategies. The development of resolution plans has advanced significantly since 2011 and the PRA’s revised approach is based on targeted information requests which are designed to be proportionate to the size and complexity of the firm.

- 01/01/2019

5.

Firms are expected to use this supervisory statement to inform the nature and scope of information they submit to the PRA.

- 01/01/2019

Information request overview

6.

- 01/01/2019

7.

- 01/01/2019

8.

Chapter 2 sets out the two parts of Phase 1, A and B, and the associated information requests in more detail. Part A of Phase 1 requests information relating to group structure, significant legal entities and the firm’s business model. This will enable the authorities to identify the most appropriate resolution strategy for the individual firm.

- 01/01/2019

9.

Part B of Phase 1 requests information on firms’ economic functions. This will enable authorities to identify those functions which are critical to the financial system and which will need to be protected in resolution and retained in post-resolution restructuring.

- 01/01/2019

10.

In some areas the PRA asks for information that is similar to information collected by the PRA in other regulatory reporting submissions. However, these requests typically ask for information at a different level of detail needed to meet the authorities’ needs for resolution planning. While the PRA recognises that submission of duplicative, or similar, information will be a cost to firms, the PRA does not consider this to be unreasonably burdensome. The benefit to the authorities of having all resolution information submitted and stored in one place is significant. First, it will allow the authorities to maintain appropriate and up-to-date resolution plans. Second, it will allow timely access to information during contingency planning.

- 01/01/2019

11.

Phase 2: This phase outlines the detailed information needed to support the authorities’ preferred resolution strategy while ensuring that critical economic functions are maintained. This section of the supervisory statement is designed to be tailored to individual firms. For example, large, interconnected firms with many complex business lines may be asked to provide information relating to use of the bail-in tool and payments services but they are less likely to be asked to provide information related to the Bank Insolvency Procedure. Small deposit-taking firms may well be asked for information related to the Bank Insolvency Procedure. Firms may be required to submit information relating to more than one resolution strategy in order to assess feasibility across a range of possible options.

- 01/01/2019

12.

- 01/01/2019

13.

Contingent information: The PRA may request additional information if a firm is experiencing stress and approaching possible resolution. Firms are expected to be able to provide this information at short notice. More detail on such requests is set out in Chapter 3.

- 01/01/2019

Process

14.

All firms are required to submit Phase 1 information. The PRA will request resubmission on a regular cycle of every two years[1] or following a material change to the firm’s structure or business activities. The PRA requires all firms to have made their first submission of Phase 1 information within fifteen months of publication of this statement. Supervisors of individual firms will specify the deadline for submission of Phase 1 information within that time frame.

Footnotes

- 1. Unless a firm is informed otherwise by the PRA.

- 01/01/2019

15.

The PRA will review Phase 1 submissions and, in conjunction with the Bank of England, will determine a preferred resolution strategy for the firm. This will define the information that should be requested in Phase 2. Supervisory judgement will inform the breadth and depth of the information firms will be requested to provide in Phase 2 and, where possible, this will be integrated with other scheduled supervisory initiatives (eg business model analysis reviews, liquidity reviews, operational risk reviews) in order to avoid duplication of effort. The PRA expects firms that are, or are likely to be, subject to external or internal MREL in excess of regulatory capital requirements to provide information on MREL resources as specified in Chapter 2 section A4 of this statement. Given the diversity of legal, financial and operational structures across firms, firms may be required to provide information beyond that which is outlined in this supervisory statement. The PRA will notify firms where updates are required to Phase 2 information. As firms move closer to resolution the PRA may ask for data to be updated.

- 01/01/2019

1

Phase 1

Phase 1 Part A: Corporate structure and significant legal entity information

1.1

The objective of this section is to provide the authorities with sufficient information to assess the preferred resolution strategy for the firm.

- 01/01/2019

1.2

All firms are expected to provide an overview of their business model, internal dependencies and external interconnectedness.

- 01/01/2019

1.3

Small firms should provide information relevant to their size and structure. Larger firms should provide information relating to their significant legal entities. Although firms are not expected to provide full details of entities that have no material bearing on how the firm operates, they are expected to provide details on entities with the ability to divert, shelter or freeze funds or which are material with regard to debt issuance (including off balance sheet entities). The purpose of these entities should also be explained and firms are expected to outline the criteria they have used to determine which legal entities are significant.[2]

Footnotes

- 2. As a guide, 90% of total balance sheet should be captured by the significant legal entities submitted by the firm.

- 01/01/2019

1.4

Information provided should include material global activities (both where these are material to the firm and where the firm is significant in overseas markets) and describe the global links and interactions.

- 01/01/2019

1.5

Where a firm’s parent organisation is a UK-incorporated entity, firms should provide information relating to all significant group entities (subsidiaries and branches).

- 01/01/2019

1.6

Where a firm’s parent organisation is incorporated outside the United Kingdom (eg foreign firms with UK subsidiaries) firms should provide information relating to:

- UK subsidiaries (and any associated overseas branches of these subsidiaries);

- UK branches of any overseas subsidiaries; and

- material interdependencies with non-UK legal entities in the group.

| Number | Heading | Required data/Detail required |

| 1 | Group structure and key information on legal entities | |

| 1.1 | Group structure | An overview diagram of the significant legal entities of the group and ownership structure. |

|

Group structure charts showing: |

||

| Group consolidated P&L and balance sheet, with the assets broken down between trading and non-trading book. | ||

| Note that some of the quantitative data requested may be similar to information collected by the PRA in other regulatory reporting submissions, including under Capital Requirements Regulation. |

||

| Provide the following data and analysis for significant legal entities | ||

| 1.2 | Use of branches and subsidiaries | Commentary on approach to using branches and/or subsidiaries in different geographies |

|

For each key geography that represents material revenues, profits or activity for the firm: |

||

| 2 | Business model | |

| 2.1 | Core business lines | Give an overview of the firm’s business model. Identify the business lines which are core to the group’s operations and profitability and explain their activities. Highlight if a branch or subsidiary is significant in the local market or critical to the group. |

| For each core business line, the analysis should include: An explanation of the main operations with P&L and balance sheet for each business line. The geographies in which the business line operates and corresponding analysis eg geographic breakdown of revenue, total operating costs, loan loss provisions, impairments, profit before tax and assets, as well as the client base and jurisdictions by level of activity. Provide an overview of the branch network. Highlight material participation in specific markets eg banking services provided to UK local authorities or particular industries (which services provided, extent of service provision). Provide geographic concentrations of lending and deposits. Provide an indication of the franchise value of each business line eg where a business line provides networks, international linkages or access to markets which are critical for the overall franchise of the firm. An explanation of the governance structure and division of powers between group HQ and core business lines. An explanation of how the business line is organised within the group, including a high-level overview of interaction with other areas and service areas (provide metrics eg revenue, P&L where material cross-selling occurs). Is the business line standalone or highly interwoven with the rest of the group? |

||

| 3 | Capital and funding | |

| 3.1 | Capital allocation and mobility | For each significant legal entity: Amount of capital required to support each significant legal entity The amount of capital currently allocated to each entity Explain method of capital provision to each entity Explain any maintenance and/or repatriation back to the ultimate parent entity (dividends, coupon, maturity cash flows etc.) |

| Details of at least the following should be supplied for significant legal entities: Minimum capital required by each legal entity to meet the thresholds set by regulators An analysis of capital by legal entity on a regulatory basis split into components (CET1, AT1 etc) An analysis of capital by legal entity on an accounting basis (permanent share capital, P&L reserves, other reserves, preference shares, subordinated debt and other intermediate capital etc). |

||

| Explanation of the sources of capital raised for each legal entity including sources external to the group |

||

| Quantification of capital which is surplus to regulatory requirements by each entity and in aggregate |

||

| Information regarding any restriction on transfers of capital to other group entities (dividends, capital contributions, repayments etc) and in particular any factors that mean surplus capital held in any entity is not transferable. For each entity, details of material holdings in other financial institutions. |

||

| Note that some of the quantitative data requested may be similar to information collected by the PRA in other regulatory reporting submissions, including under Capital Requirements Regulation. | ||

| 3.2 | Treasury function | An explanation of how the treasury function is organised |

| Indication of how quickly capital could be transferred to or from an entity if required and the procedures involved. | ||

| 3.3 | Funding | An overview of funding relationships in the group, including the main sources of funding for each significant entity and intra-group flows of funding. Break intra-group flows into secured/unsecured, short term/long term.[a] Highlight branches and subsidiaries which are significant in intra-group funding. |

| List of current material intra-group balances | ||

| Details of where there are current and potential impediments to the transfer of liquidity between entities or jurisdictions. |

||

| A summary of other funding sources not captured elsewhere. Examples include: Off balance sheet funding Other sources including: covered bonds, RMBS, repos and other short-term secured financing. |

||

| 3.4 | Intra-group guarantees | An overview of intra-group guarantees, including: How, why and when intra-group guarantees are used Types of guarantees extended (eg limited, unlimited guarantees) and the parties extending and receiving guarantees. Total exposures under intra-group guarantees, categorised into different types Overview of when guarantees can be enforced (including cross-defaults or events of default triggered by resolution) How intra-group guarantees are priced List of the most material intra-group guarantees List the entities that use, the entities sighted, and the underlying amounts of contracts that contain ‘Specified Entity’ or similar clauses. |

| 3.5 | Other financial dependencies |

An overview of all other material intra-group financial dependencies or exposures, including contingent exposures |

| 3.6 | Encumbrances | For each significant legal entity, an overview of which assets on the balance sheet are encumbered as at year-end. Highlight if they are intra-group or external encumbrances. |

| Information should also be provided on a group basis for UK-headquartered groups. For International banks headquartered outside the United Kingdom, operating via UK subsidiaries, information should be provided at the UK consolidated group level. |

||

| Detail of what proportion of each asset class is encumbered and in what manner including: proportion of assets which are not subject to any encumbrance; proportion of assets encumbered through overcollateralisation; and an outline of the bank’s practise on overcollateralisation. Provide an analysis of assets subject to encumbrance by type of instrument including an approximate split by: securitisations, covered bonds, repo, collateral for OTC derivatives exposure, collateral placed at central banks and any other encumbrances (description of nature and magnitude of other encumbrances should be provided). The analysis should also include an assessment of the term split of encumbrances between short-term versus long-term encumbrances. |

||

| 4 | Activities and operations | |

| 4.1 | Deposits analysis | Provide an overview of the deposit franchise eg maturity profile, geographic breakdown, depositor profile, deposit-taking channels (internet, branch etc), major competitors. Provide an overview of the quantum of offsetting balances in the deposit book. |

| An assessment of the timescale to produce the required Single Customer View (SCV) information by each UK entity and operational dependencies on other entities in the group or third parties to produce the information. Description of IT processes to produce SCV eg manual or automated, number of staff required. Confirm IT system capability to produce SCV within 72-hour period. | ||

|

Last date of review of the Single Customer View file by the FSCS and outcome of verification process. Provide details of any problematic accounts that would prevent timely deposit payout eg missing depositor data. Confirm if firm has completed remediation actions required by the PRA and is not under any sanction that would prevent depositor payout. |

||

| 4.2 | Access to Financial Market Infrastructure | A brief overview of the firm’s access to Financial Market Infrastructure (payment schemes, central counterparties etc.) including correspondent banking relationship and indirect access to key FMIs. Provide the legal entities that have this access and which entities within the group rely on this. |

| To what extent does the firm provide correspondent banking services/market access services/clearing services to third parties globally? Please provide the number of customers. To what extent, globally, does the firm rely on other firms for these services? What agreements govern these relationships and how will they be affected in a resolution? |

||

| If relevant and not covered under 2.1, provide an overview of global payments, clearing and settlement business, including a high-level summary on key products/services provided, types of clients serviced, geographical location of business and FMI relied upon. |

||

| 4.3 | Cash services | How is the cash services business integrated within the firm’s operations as a whole? Overview of role in cash industry: Note Circulation Scheme membership Cash supply Cash processing Commercial note issuance |

| 4.4 | Risk management practices | An overview of the firm’s booking practices by asset class. Does the group manage risk centrally from one entity (please provide main booking hubs by asset class)? To what extent is risk back-to-backed? Give an overview of the firm’s margining and collateral management for internal trades. Provide information on any remote booking practices. Provide information on the quantum of risk booked into each significant entity. |

| Give an overview of the use of unregulated affiliates globally for booking trades. |

||

| 4.5 | Counterparty risk management | Give an estimate of trades which are booked via an exchange or central counterparty clearing (CCP) and trades booked with a bilateral third party, and the firm’s approach to counterparty risk management. This should include a broad overview on collateral management and the use of netting, including master netting agreements. |

| 4.6 | Critical shared services |

A summary of how operations are organised in the firm. Provide a high-level summary (including diagrams where appropriate) of how critical shared services[b] are provided across legal entities, business lines and jurisdictions. At a minimum, split critical services into Treasury, Risk Management, Finance and Operations (this list is not exhaustive). These are services that are crucial to the functioning of the core business lines of the firm. Please consider, at a minimum (including outsourced services and joint ventures), IT services, staff, premises, licenses and intellectual property. Briefly summarise whether there are contracts which govern the provision of services across business lines, entities and jurisdictions. Provide a brief overview of internal support functions such as accounting and tax, internal audit and compliance, HR. Provide an indication of scale and the location of these functions, including those located outside the United Kingdom. |

| Please provide a summary of the pension arrangements within the group, including in which legal entity pension liabilities and administration reside. How fully funded is the pension scheme? |

||

Footnotes

- a. Short term refers to tenor of less than one year.

- b. The FSB defines critical shared services: For the purpose of this Guidance, a critical shared service has the following elements: (i) an activity, function or service is performed by either an internal line, a separate legal entity within the group or an external provider; (ii) that activity, function or service is performed for one or more business lines or legal entities of the group; (iii) the sudden and disorderly failure or malfunction would lead to the collapse of or present a serious impediment to the performance of critical functions.

- 01/01/2019

Phase 1 Part B: Economic functions

1.7

The objective of this section is to identify which of a firm’s economic functions may be critical to the financial system, either domestically or internationally. This will help the authorities to develop a resolution strategy that takes account of these functions.

- 01/01/2019

1.8

Information should be provided by legal entity. Market share information should be provided for both domestic market shares as well as local overseas market shares where such overseas activity may be material to the local market. Certain information is specifically requested from non-UK firms with activities in the United Kingdom. The following tables set out detailed information requirements.

| Economic function(s) |

Economic scale metrics (Value metrics should be in millions of GBP (£mn), unless otherwise stated, to standardise comparison. Where a different currency is used, please provide an exchange rate.) |

||

| Deposit-taking & Savings | Deposit-taking | ||

| Retail Current Accounts |

Provide: B . For deposits held in branches of UK entities: |

||

| SME[c] Current Accounts | As above for retail current accounts | ||

| Retail Savings Accounts/ Time Accounts |

As above for retail current accounts | ||

| SME Savings Accounts | As above for retail current accounts | ||

| Corporate Deposits |

Total liabilities (£mn) Total number of accounts Total number of customers Each metric to be shown on legal entity and jurisdiction basis. It should include deposits from cash management products where applicable. Market share-provide estimate of UK market share as well as overseas market shares where relevant. Identify any issues surrounding replacement of the firm’s services by other providers. |

||

| Where the firm is a non-UK bank (UK is host authority), please provide Deposits from parent (£mn) |

|||

| Lending & Loan Servicing |

Lending | ||

| Retail Mortgages/Other Secured (Auto) |

Total assets (£mn) Total committed facilities (£mn) Total number accounts Total number customers RWAs (£mn) For each of the metrics above, please provide the legal entity and jurisdiction. Market share- provide estimate of UK market share as well as overseas market shares where relevant. Please identify any issues surrounding replacement of the firm’s services by other providers. |

||

| Retail Unsecured Personal Lending | As above for retail mortgages |

||

| Retail Credit Cards | Total outstanding (£mn) Total committed facilities (£mn) Total number accounts Total number cards in issue RWAs (£mn) Number customers with more than one card Number customers not paid within one month For each of the metrics above, please provide the legal entity and jurisdiction. Market share- provide estimate of UK market share as well as overseas market shares where relevant. Please identify any issues surrounding replacement of the firm’s services by other providers. |

||

|

SME Lending (Secured) |

Total assets (£mn) Total committed facilities (£mn) Total number client accounts Total number customers RWAs Number accounts part of revolving credit facility Number customers not paid within one month For each of the metrics above, please provide the legal entity and jurisdiction. Market share- provide estimate of UK market share as well as overseas market shares where relevant. Please identify any issues surrounding replacement of the firm’s services by other providers. |

||

| Corporate Lending | Total assets (£mn) Total committed facilities (£mn) Total number client accounts Total number customers RWAs (£mn) Number accounts part of revolving and standby credit facilities Number accounts part of syndicate (syndicated loans) For each of the metrics above, please provide the legal entity and jurisdiction. Market share- provide estimate of UK market share as well as overseas market shares where relevant. Please identify any issues surrounding replacement of the firm’s services by other providers. |

||

| Where the firm is a non-UK bank (UK is host authority), please provide: Lending to and deposits in parent (£mn) |

|||

| Trade Finance | For each of the activities below: Documentary credit/documentary collection Guarantees Loans (import/export) Factoring/forfaiting and invoice financing Provide: Total number client accounts Annual amount lent (£mn) |

||

| Infrastructure Lending |

Total number client accounts Annual amount lent (£mn) |

||

| Loan Servicing |

|||

| Credit Card Merchant Services | Average daily activity (£mn) Average transaction value (£mn) Number of active merchant accounts |

||

| Capital Markets & Investment | Trading | ||

| Derivatives (required report see Table A) |

Total notional outstanding (£mn) Note that some of the quantitative data requested may be similar to information collected by the PRA in other regulatory reporting submissions, including under Capital Requirements Regulation. |

||

| Trading portfolio (required report see Table B) |

Balance sheet values by asset class (£mn) RWAs (£mn) |

||

| Other | |||

| Asset management |

Assets under management (£mn) Total number client accounts For each of the metrics above, please provide the legal entity and jurisdiction of clients. Segregate between institutional, retail and wealth management clients. |

||

| General insurance |

For each of the activities below: Policies eligible for FSCS protection Policies not eligible for FSCS protection Provide: Total policies by type (number) Total policyholders by type (number) For each of the metrics above, please provide the legal entity and jurisdiction. Market share – provide estimate of UK market share as well as overseas market shares where relevant. Please identify any issues surrounding replacement of the firm’s services by other providers. Average annual claims and benefits payout (latest three-year average, net of recoveries from reinsurers, £mn) |

||

| Life insurance, pensions, investments and annuities |

For each of the activities below: Policies eligible for FSCS protection Policies not eligible for FSCS protection Provide: Funds under management, for investment products (£mn) Total policies by type (number) Total policyholders by type (number) For each of the metrics above, please provide the legal entity and jurisdiction. Market share- provide estimate of UK market share as well as overseas market shares where relevant. Please identify any issues surrounding replacement of the firm’s services by other providers. |

||

| Wholesale Funding Markets |

Securities Financing (required report see Table C) |

Balance sheet values plus aggregate values for collateral accepted and given (£mn) Maturity profile Total number counterparties, including geographic distribution (number) |

|

| Securities Lending |

For each: Direct Third party (non-custodian lending) Agent (custodian lending) Provide: Gross value of open loans (£mn) Total number clients |

||

| Payments, clearing custody & settlement[d] |

Payment Services |

For all UK and material foreign payment systems[e] used, please provide: Legal entity which holds membership Transaction volumes (number, monthly/annual average, peak) Transaction values (number, monthly/annual average, peak) Flow volumes (£mn, monthly/annual average) Number of agents (flow volumes for these provided separately) Market share – provide estimate of UK market share as well as overseas market shares where relevant. Please identify any issues surrounding replacement of the firm’s services by other providers. |

|

| If required, could the firm transition from an affiliate (intra-group) network to a third-party correspondent network for payments and clearing? What timeline is required? |

|||

| Settlement Services |

For all UK and material foreign settlement systems[f] used, please provide: Legal entity which holds membership Transaction volumes (number, monthly average/annual average) Transaction values (£mn, monthly average/annual average) Flow volumes (£mn, monthly average/annual average) Market share- provide estimate of UK market share as well as overseas market shares where relevant. Please identify any issues surrounding replacement of the firm’s services by other providers. SWIFT average volumes (number, monthly average/annual average) |

||

| If required, could the firm transition from an affiliate network to a third-party correspondent network for settlement services? What timeline is required? |

|||

| Other related activities |

|||

| Cash Services (required report see Tables D and E) |

Please provide information for cash services in the United Kingdom only: Transaction inflows (value (£mn)/market share) Transaction outflows (value (£mn)/market share) Notes in Circulation- where own note issuance in Scotland and/or NI (value (£mn)/market share) Infrastructure -Cash centres (number/location/market share/coin centres) -ATMs (number/market share) -Branches (number/brand) For the ten largest inflow and ten largest outflow customers, provide a brief description of the relationship, along with the average monthly volumes and the proportion of the business they represent. Description of key industry relationships including but not limited to Bank of England, money printers, security providers, other banks and agents. Number of agency providers. |

||

| Custody Services |

Safe custody assets held (£mn) Client money held (£mn) Description of ancillary services offered in custody eg securities lending, general prime brokerage services |

||

| Third-Party Operational Services | For each (the list below is not exhaustive): Credit card systems Cheque processing Back office for retail banking Provide: Description of service Number of clients provided with service Number of other providers |

||

Footnotes

- c. As defined in Article 2.1(f) of the EU Prospectus Directive, SME refers to companies, which, according to their last annual or consolidated accounts, meet at least two of the following three criteria: (i) an average number of employees during the financial year of less than 250, (ii) a total balance sheet not exceeding €43 million, (iii) an annual net turnover not exceeding €50 million.

- d. The payments, clearing and settlement function is limited to those provided by firms to their clients. The scope extends to non-bank entities of a bank, as some of these functions may be provided by a non-bank entity eg a broker-dealer. A bank may provide payments, clearing and settlement services as an intermediary between its own clients or as an intermediary between a client and relevant FMIs. In some cases, the bank may also be a provider of payment, clearing and settlement services to an FMI or may provide access to FMIs to other banks that are not clearing members (known often interchangeably as agency/indirect/correspondent services).

- e. This refers to FMIs in which the firm has direct access. Examples include, but not limited to BACS, CHAPS, Faster Payments, cheque clearing system, Fedwire and TARGET2.

- f. This refers to FMIs in which the firm has direct access. Examples include, but not limited to CLS, Crest and Euroclear.

- 01/01/2019

Table A Derivatives (complete for each legal entity if firm performs this function):

| Outstanding notional contract amounts (£mn) | ||||

| Exchange-traded derivatives | Other derivative cleared through CCPS[g] | OTC[h] derivatives settled bilaterally | Total | |

| Equities | ||||

| Sovereign Credit | ||||

| Non-sovereign Credit Products |

||||

| Rates |

||||

| Foreign Exchange |

||||

| Commodities |

||||

| Number of derivative counterparties |

||

| Exchange-traded derivatives |

Other derivatives cleared through CCPs | OTC derivatives settled bilaterally |

Footnotes

- g. CCP = central clearing counterparty.

- h. OTC= over the counter.

- 01/01/2019

Table B Trading portfolio (complete for each legal entity if firm performs this function):

| Assets (£mn) | Liabilities (£mn) |

||

| Equities | Balance sheet values | RWA | Balance sheet values |

| Treasury |

|||

| Sovereign Credit |

|||

| Non-sovereign Credit |

|||

| Rates |

|||

| Foreign Exchange |

|||

| Commodities |

|||

- 01/01/2019

Table C Securities Financing (complete for each legal entity if firm performs this function):

| Reverse repurchase agreements and cash collateral on securities borrowed (£mn) | Repurchase agreements and cash collateral on securities lent (£mn) | Fair value of securities accepted as collateral under reverse repurchase agreements and securities borrowing transactions (£mn) | Fair value of securities given as collateral under repurchase agreements and securities lending transaction (£mn) |

- 01/01/2019

Table D Note flow statistics (cash services function):

| UK (annual) |

||

| Value (£mn) | Market share (%) | |

| Inflows | ||

| From customers | ||

| From own business |

||

| From other |

||

| Outflows |

||

| From customers |

||

| From own business |

||

| From other |

||

- 01/01/2019

Table E Infrastructure key statistics (complete the table and, where appropriate, split by legal entity):

| United Kingdom | England & Wales | Scotland | Northern Ireland | |||||

| Number | Market share (%) | Number | Market share (%) | Number | Market share (%) | Number | Market share (%) | |

| Cash centres | ||||||||

| ATMs | ||||||||

| ATM outflows (£mn/month) | ||||||||

| Branches | ||||||||

- 01/01/2019

Table on economic functions split by legal entities

1.9

The purpose of this table is to map the economic functions performed by firms to their legal entities, based on the analysis above.

- 01/01/2019

1.10

Where a firm’s parent organisation is a UK-incorporated entity, firms should complete this table for all significant legal entities and branches that form part of the group, both domestically and internationally. This will allow the UK authorities to understand the economic functions performed in each country and therefore to develop an appropriate resolution strategy and co-ordinate the group resolution plan taking into account these functions.

- 01/01/2019

1.11

Where a firm’s parent organisation is incorporated outside the United Kingdom, firms should only complete this table for:

- UK subsidiaries (and any associated overseas branches); and

- UK branches of any overseas subsidiaries.

- 01/01/2019

1.12

The overall purpose for the collection of information on economic activities and mapping them to legal entities is to inform the authorities’ selection of a preferred resolution strategy for a firm. These tables will also help inform the post-stabilisation restructuring analysis. In completing these tables, firms should include metrics that best show the importance of all material legal entities in relation to economic functions. Those metrics used in the economic function identification exercise in Chapter 2 B should provide a helpful source of metrics to quantify materiality on a legal-entity basis. Sample answers are provided in italics.

| Legal entity/branch 1 (£mn) (eg Bank A Ltd) |

Legal entity/branch 2 (£mn) (eg bank B Ltd) |

Legal entity/branch 3 (£mn) | Aggregate across legal entities/branches (£mn) |

|

| Where UK is home supervisor, firms should provide information on all significant legal entities/branches, even if they do not perform any activity in the United Kingdom. | ||||

| Economic Function 1 (eg Retail Current Accounts) |

Total liabilities – 9 |

Total liabilities - 9 | Total liabilities -18 | |

| Economic Function 2 (eg Retail Mortgages) |

Total assets - 10 |

Total assets - 10 | Total assets - 20 |

|

| Where UK is host supervisor, firms should provide information on legal entities/branches relevant to the United Kingdom as stated above. |

||||

| Economic Function 1 |

||||

| Economic Function 2 |

||||

- 01/01/2019

2

Phase 2

Phase 2 Part A: Strategy-specific information requests

A1 Bail-in

2.1

The information outlined below will be requested from firms to facilitate the development of a resolution plan based on the use of the bail-in tool and to monitor firms’ compliance with MREL and their ability to meet requirements in the future.

- 01/01/2019

2.2

The information will be used to identify the barriers to using a bail-in resolution strategy; where further work is required to overcome barriers; and to develop a detailed plan to effect the transaction.

- 01/01/2019

2.3

The information will also provide a baseline for potential further work relating to the continuity of the firm’s critical economic functions during a bail-in.

- 01/01/2019

2.4

The information requested may include the following:

A1.1 Loss absorbing capacity: equity and liability structures

A1.2 Intra-group exposures

A1.3 Contract documentation

A1.4 Operational shared services

- 01/01/2019

A1.1 Loss-absorbing capacity: equity and liability structures

2.5

This information will permit resolution authorities to:

- Assess a firm’s quantum of loss-absorbing capacity (LAC), including location of debt by legal entity in the group, and the feasibility of imposing losses on certain liabilities through the transaction structure.

- Analyse intra-group debt arrangements to define the quantum and mechanics of down-streaming LAC to subsidiaries from a holding company and up-streaming losses to the holding company. This includes analysing funded or unfunded commitments (eg guarantees) that could potentially be called on to recapitalise the entities during resolution.

- Identify and assess LAC across UK entities for non UK headquartered groups where a bail-in would be led by overseas resolution authorities. This includes assessing the quantum and mechanics of down-streaming LAC to UK entities and up-streaming losses to an overseas parent.

- 01/01/2019

(a) Overview of potential bail-in liabilities across all legal entities

2.6

Firms may be required to provide information on all unsecured intra-group and external loans or debt securities in issue. This includes subordinated and senior debt and privately placed issuances.

- 01/01/2019

(a)(1) MREL Reporting

2.6A

As part of the information on loss-absorbing capacity (section A1.1), firms should also provide information on MREL resources, projected resources, and individual instrument characteristics as set out in section A4.

- 01/01/2019

(a)(2) Further information on bail-in liabilities

2.7

The following information may be required for each instrument:

- Date of issuance

- Type of debt (eg medium-term notes, loans, bonds, convertible bonds)

- Class of debt (eg senior unsecured, AT1, subordinated debt)

- The amount in issue (par value)

- The maturity (first call date for debt with call options, final legal maturity)

- The currency in which the debt is issued

- Legal entity or entities in the group which issued the debt (including special purpose vehicle or branch of an entity)[3]

- The governing law (English, other EU, US, other) for the contractual terms of the debt. Where applicable, highlight contractual provisions recognising UK resolution powers where the debt is issued under foreign law.

- Details of any guarantee applicable to the debt

- Details of the trustee, whether in Global Bearer form, Global Registered form or otherwise:

- If in Global Bearer form, who is the Depositary/Common Safekeeper and where is the note located?

- If in Global Registered form, who is the registrar and where is the register kept?

- Are there any notes not in global form?

- Details of the location of any other bearer debt instruments

- Details of the applicable clearing systems (Clearstream, Euroclear, DTC?) if tradeable

- The exchanges on which the debt is listed

- The firm’s accounting treatment of the debt (eg amortised cost or designated at fair value)

- Whether the debt bears a fixed, floating or zero-rate coupon

- If the debt is structured, the determinants of the coupon and/or the redemption value and other terms of the program, eg any call or put options

- For convertible debt, details of the conversion terms

- An indication of any non-standard terms included in the debt, eg unusual termination events

- ISIN/CUSIP number

Footnotes

- 3. Where the debt is issued by, or an obligation of, a branch, the branch, and not the bank, should be indicated as the issuer. Also, where the issuer of the debt is a branch, please indicate whether the liability for the debt obligations issued are shown on the books of the branch as liabilities of the branch.

- 01/01/2019

2.8

Firms may also be required to submit:

- Details of any constraints on the issuance of new shares (for example a specified maximum authorised share capital in the legal entity’s constitution).

- Details of the key terms of each class of equity instrument in issue, including governing law, whether or not controlling rights are attached, details of any preferential rights to dividends.

- The legal entity’s constitutional documents.

- A reconciliation between the firm’s regulatory returns and financial accounts.

- 01/01/2019

(b) Contractual terms of debt instruments

2.9

Firms may be required to provide the following details about the contractual terms of their debt instruments:

- The firm’s proposed approach to aligning the contractual terms of debt instruments to facilitate a bail-in (standardised contractual terms and non-standardised)

- Details of the firm’s debt instrument documentation, including:

- The number of active and inactive contracts[4]

- The number of standardised and non-standardised contracts

- A breakdown according to type of debt issued

- The governing law of each contract

- Details of the system used for safekeeping legal documents and an estimate of how quickly information can be extracted from this system.

- Details of the non-standardised clauses in debt instrument agreements, including how these differ from the clauses used in standardised agreements.

- Identify events of default that could be triggered in resolution and the materiality of such provisions across the contract population (eg cross-default provisions, termination upon restructuring)

Footnotes

- 4. Inactive means no actual current service/transaction under contract.

- 01/01/2019

(c) Intra-group LAC arrangements

2.10

Firms may be required to provide the following information relating to intra-group LAC:

- An overview of the firm’s intra-group capital and funding structure

- The amount of intra-group LAC held by each legal entity in the group

- Notification if triggers for writing down intra-group financial exposures rest with host authorities

- Detailed arrangements for capital support and/or contingent liabilities between group entities

- The key terms and conditions of intra-group term funding, including:

- identity of issuer

- tenor

- whether subordinated or senior ranking

- whether convertible debt (if so give details of triggers)

- governing law

- any pledge or collateral, and

- any other relevant terms

- Details of cross-guarantees or cross-default provisions between group entities

- Details of contractual provisions recognising UK resolution powers where the debt is issued under foreign law.

- 01/01/2019

(d) Management Information (MI) systems

2.11

Firms may be required to provide the following information relating to their MI systems:

- Details of how information on LAC and funding is produced and updated using the firm’s existing MI systems

- An estimate of how quickly the firm would be able to produce (or update) the information outlined in this supervisory statement – and actions that could be taken to improve this

- Evidence of data quality - for example details of how MI is verified and signed off

- 01/01/2019

Sample template

2.12

Deleted.

- 01/01/2019

A1.2 Intra-group exposures

2.13

Groups will be required to quantify business as usual (twelve-month average) intra-group exposures between legal entities (branch or subsidiary). This will allow the authorities to assess the feasibility of executing a bail-in. It will also support post-resolution business reorganisation.

- 01/01/2019

2.14

The analysis should cover the entities of the group that are material from a funding flow perspective.

- 01/01/2019

2.15

For groups where the preferred group resolution is bail-in at the level of UK parent company, the assessment should identify intra-group flows between the UK entity and all significant legal entities within the group.

- 01/01/2019

2.16

For non-UK groups, where the preferred group resolution strategy is a bail-in led by overseas resolution authorities, the assessment will seek to identify intra-group flows that involve UK entities.

- 01/01/2019

2.17

Firms should submit information across products such as money market funding, debt instruments, secured transactions, collateral alignment, derivatives, off balance sheet commitments and guarantees. Exposures should be differentiated by remaining tenor and material currencies. Firms should also provide information on historic peak exposures over the previous twelve months.

- 01/01/2019

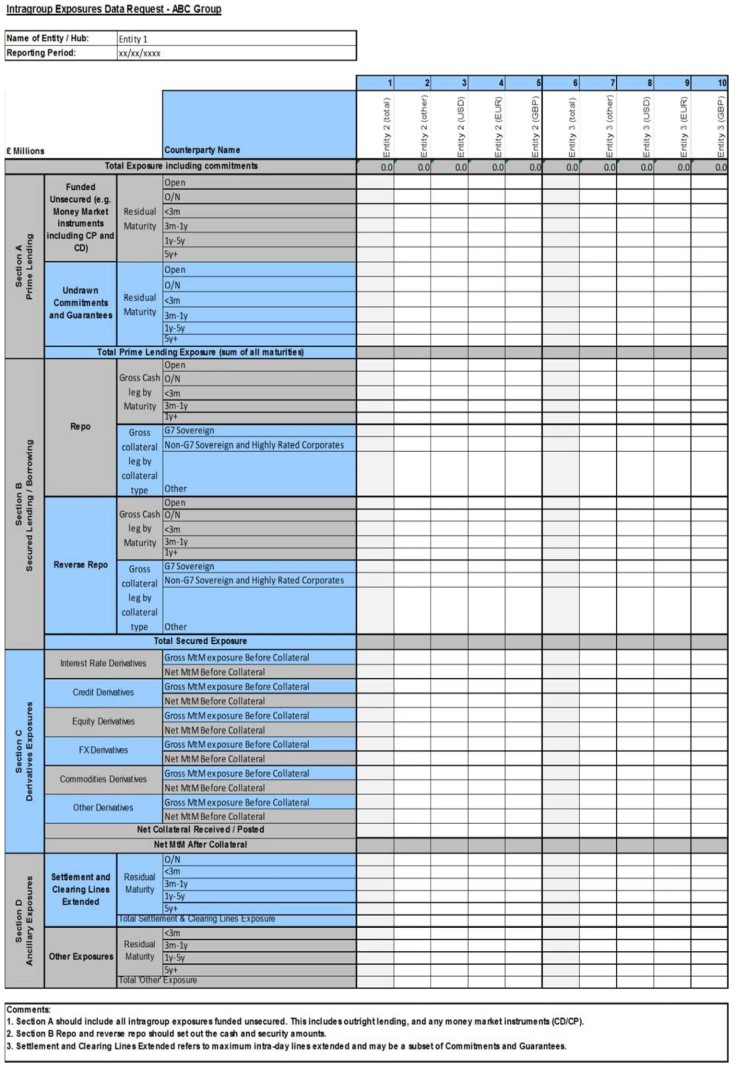

Sample template

2.18

The tables below are templates for summary information on intra-group exposures. However, supervisors will guide firms on the form of information to be provided as part of bilateral work (the templates are not regulatory returns). Firms should ensure management information systems are capable of producing the information requested by supervisors.

- 01/01/2019

- 01/01/2019

Intragroup Exposures Data Request - ABC Group

Peak Exposures in past 12 months

£ Millions

| Entity | Entity 1 | Entity 2 | Entity 3 | |||||

| 1 | 2 | 7 | 8 | 13 | 14 | |||

| Counterparty |

Entity 2 | Entity 3 | Entity 1 | Entity 3 | Entity 2 | Entity 1 | ||

| Section A Prime Lending |

Prime Lending - Funded Unsecured | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| Undrawn Commitments and Guarantees | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||

| Section B Secure Lending / Borrowing |

Repo | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| Reverse Repo | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||

| Section C Derivatives Exposures |

Net MtM Before Collateral | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| Net Collateral Received / Posted | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||

| Net MtM After Collateral | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||

| Comments | |

| 1. | Peak exposures should be on 'Total Currency' basis. |

| 2. | Monthly peak should be calculated separately for each of the categories. It is likely that all the peaks across the rows may not occur on same date. |

| 3. | Scope of items included in each category should follow the previous tabs. |

- 01/01/2019

A1.3 Contract documentation- resolution trigger events

2.19

In order to ensure that key services can be maintained in resolution, and that contracts prevent termination in resolution, firms are expected to provide contract documentation for service agreements and market counterparties. This information will allow the authorities to:

- assess the risks of adverse reactions from service providers (service agreements) and market counterparties (trading documentation) in resolution (eg triggering contract accelerations, cross-defaults, etc.);

- identify the measures required to alleviate these risks, including changes required to documentation (standardised[5] and non-standardised) to better align with the preferred resolution strategy;

- assess the extent to which the firm has amended contractual documentation (including terms of debt instruments) to facilitate cross-border recognition of resolution actions; and

- assess the extent to which resolution powers can be used to override termination provisions.

Footnotes

- 5. Standardised documentation refers to ISDA agreements. Non-standardised documentation refers to bilateral or bespoke agreements.

- 01/01/2019

2.20

Firms should describe their system for safekeeping legal documents and explain how easy it is to extract information from this system. Firms are expected to set out the firm’s proposed approach to aligning trading documentation (standardised and non-standardised) to facilitate the preferred resolution strategy.

- 01/01/2019

(a) Service Agreements

2.21

Quantify the scale of the firm’s service agreement documentation, providing a breakdown by:

- Number of contracts- active and inactive

- Breakdown of standardised versus non-standardised

- Economic materiality

- Group legal entities that are party to the agreements

- Governing law (English, other EU, US, other)

- 01/01/2019

2.22

For economically material contracts firms should provide details of key clauses such as break/insolvency, services, costs, encumbrances. Firms should make clear where these relate to intra-group agreements and agreements with external parties.

- 01/01/2019

(b) Market Counterparties (including FMI)

2.23

Quantify the scale of the firm’s trading documentation, including general breakdown by:

- Number of contracts- active and inactive

- Breakdown of standardised versus non-standardised

- Economic materiality

- Group legal entities that are party to the agreements

- Governing law

- Type of counterparty (eg sell-side dealer counterparties, FMI)

- 01/01/2019

2.24

For economically material contracts:

- Where there are non-standardised clauses, provide a description of the clauses that differ from the standardised agreement, and how they differ.

- Where there are triggers for collateral calls (eg debt ratings) from market counterparties, identify and describe them.

- Where there are events of default that could be triggered in resolution, identify and describe the materiality of such provisions across the contract population (eg cross-default provisions, termination upon restructuring, etc.)

- 01/01/2019

(c) Guarantees (issued and received, internal and with external parties)

2.25

Quantify the scale of the firm’s guarantees, including general breakdown by:

- Number of guarantees- active and inactive

- Breakdown of standardised versus non-standardised

- Breakdown between intra-group and extra-group guarantees

- Economic materiality

- Group legal entities that have issued/received the guarantees

- Governing law

- 01/01/2019

2.26

For economically material contracts:

- Where there are non-standardised clauses, provide a description of the clauses that differ from the standardised agreement, and how they differ.

- Identify events of default that could be triggered in resolution and the materiality of such provisions across the contract population (eg cross-default provisions, termination upon restructuring)

- 01/01/2019

(d) Contract Documentation

2.27

Set out the firm’s proposed approach for aligning contract documentation (standardised and non-standardised) to facilitate the preferred resolution strategy.

- 01/01/2019

A1.4 Operational shared services- bail in

2.28

The information provided in this section will allow the authorities to understand any critical internal or external operational shared services that may hinder resolution and affect post-resolution business reorganisation.

- 01/01/2019

2.29

An indicative list of the information that firms should submit is listed below. Where critical dependencies may represent a barrier to the execution of a post bail-in business reorganisation, firms should set out how they will overcome this. The information should:

- (a) Identify solutions to provide continuity of service throughout resolution (eg resolution-proof service agreements, service company models, outsourcing).

- (b) Identify dependencies of the UK group operations on i) other group entities, and ii) third-party entities for the following services:

- Human resources support (eg payroll).

- IT (eg data storage and processing, data centres, software licences, access to external providers, application maintenance and user support).

- Transaction processing (eg legal transactional issues such as anti-money laundering).

- Real estate provision or management (eg facilities management, security, real estate portfolio management).

- Legal service/compliance (eg corporate legal support, compliance support).

- (c) Describe governance and management arrangements (eg reporting lines) for the services above.

- (d) Describe material cross-border activity (eg where services are provided by UK entities to non-UK entities (branch or subsidiary) and vice versa).

- (e) Provide an assessment of the extent to which critical interdependencies can be maintained in a bail-in.

- 01/01/2019

A2 Partial transfer and bridge bank

2.30

The information outlined below will enable the authorities to develop a resolution plan based on the use of stabilisation transfer tools under the Banking Act 2009 – that is a whole or partial transfer to a bridge bank or private sector purchaser.

- 01/01/2019

2.31

Information provided by firms will enable the authorities to assess the feasibility of grouping and separating the firm’s functions into viable business units. It will facilitate the identification of barriers to splitting up a firm, and actions that would overcome these, and ensure that the firm’s critical economic functions are maintained.

- 01/01/2019

A2.1 Effecting a transfer

2.32

The information provided in this section will facilitate the identification of the different options for grouping the firm’s assets and liabilities to be saleable or transferable to a third party or bridge bank. Firms are expected to provide the following:

(a) Strategy and business model analysis

- Identify asset portfolios that may be transferred to a bridge bank or private sector purchaser and asset portfolios that may be wound down in the Bank Administration Procedure.

- Provide details of the profit drivers of the business, and an assessment of the sustainability of profitability following transfer.

- Provide an assessment of the quality of assets and liabilities.

- Identify critical functions (and critical shared services) that will be included within the asset portfolios designated for a transfer.

- Provide an assessment of feasibility and credibility of each of the transfer options

(b) Details of existing asset valuation, controls and systems for fair value assets and amortised cost assets[6]

(c) Identification of barriers to achieving separable resolution units, covering:

- Outstanding repos and warranties on loan assets

- Securitisations Syndicated loan transactions

- Asset servicing arrangements

- Material outstanding litigation

Footnotes

- 6. The overriding purpose is for the Authorities to gain a better understanding of the firm’s existing valuation processes and systems. Please refer to Phase 2 C4 Valuation as a guide to the information that might be requested.

- 01/01/2019

A2.2 Operational shared services- partial transfer/bridge bank

2.33

Information provided in this section will enable the authorities to understand any critical internal or external operational shared services that may hinder resolution and post-resolution bridge bank exit and/or business reorganisation. An indicative, but non-exhaustive, list is shown below. Where critical dependencies may represent a barrier to feasible transfer, the firm should identify solutions. Firms are expected to provide the following:

- (a) Business solutions to provide continuity of service throughout resolution (eg resolution-proof service agreements, service company models, outsourcing).

- (b) Dependencies of the UK group operations on i) other group entities, and ii) third-party entities for the following services:

- Human resources and HR support (eg payroll).

- IT (eg data storage and processing, data centres, software licences, access to external providers, cyber-risk defences, application maintenance and user support).

- Transaction processing (eg legal transactional issues such as anti-money laundering).

- Real estate provision or management (eg facilities management, security, real estate portfolio management).

- Legal service/compliance (eg corporate legal support, compliance support).

- (c) Governance and management arrangements of UK operations.

- (d) Description of material cross-border activity (eg where services are provided by UK entities to non-UK entities (branch or subsidiary) and vice versa).

- (e) Analysis on the extent to which critical interdependencies can be maintained in a partial transfer/bridge bank.

- 01/01/2019

A2.3 Continuity

2.34

Firms are expected to assess the level of continuity of critical functions provided when executing a transfer of each of the packages of assets and liabilities (described in Section A2.1) to a private sector purchaser or bridge bank and taking into account the key dependencies identified in Section A2.2. Firms may be requested to consider a range of options for packaging the assets and liabilities. Firms should:

- (a) Explain how the packages would be separated from the group, and provide an expected timeline for achieving this.

- (b) Outline how any barriers to continuity, which would prevent a critical function or business line from continuing to operate during separation, could be overcome.

- 01/01/2019

2.35

Examples of barriers that the firm should address include activities that span legal jurisdictions, associated derivatives exposures and netting arrangements, or operational/financial/structural idiosyncrasies.

- 01/01/2019

A2.4 MREL reporting

2.35A

Firms should also provide information on MREL resources, projected resources, and individual instrument characteristics as set out in section A4.

- 01/01/2019

A3 Bank Insolvency Procedure

2.36

Most of the information required to assess the feasibility of executing a Bank Insolvency Procedure is already provided to the authorities through business as usual regulatory reporting and the information provided in Phase 1. This includes the requirement to be able to provide the FSCS with a Single Customer View (SCV) file within 72 hours.

- 01/01/2019

2.37

The PRA requires firms to be able to produce a single, consistent view of each eligible depositor’s funds, to enable the FSCS to implement rapid payout in the event of a resolution. We require firms at all times to be able to provide information to us to assess its SCV capabilities, in line with the PRA’s Compensation rules.

- 01/01/2019

2.38

However firms may be required to submit additional information, for example, if they undertake a specific economic function that may present particular complications in resolution. In this case firms may be required to submit more granular information as outlined in Part B of Phase 2 (eg cash services).

- 01/01/2019

A4 MREL reporting

2.38A

The PRA expects firms that have been notified by the Bank of England that they are, or are likely to be, subject to external or internal MREL in excess of regulatory capital requirements to provide information on MREL resources, projected resources, and individual instrument characteristics.

- 01/01/2019

2.38B

The PRA expects firms to submit information on MREL resources as set out in the templates in the appendix of this statement. The names and contents of the templates are as follows:

- MREL Resources (MRL001) - amount and maturity profile of MREL eligible liabilities, cross-holdings of MREL and regulatory capital that does not qualify as MREL resources.

- MREL Resources Forecast (MRL002) - projected MREL eligible resources.

- MREL Debt (MRL003) - individual characteristics of internal and external MREL resources, issued by entities within the UK consolidation group.

- 01/01/2019

2.38C

The PRA expects firms to report at the following frequencies.

- MREL Resources (MRL001) - the same frequency, reporting end date and submission due date as firms’ COREP C 01.00 submissions.

- MREL Resources Forecast (MRL002) - the same frequency, reporting end date and submission due date as firms’ Capital+ submissions. Firms that submit Capital+ on a monthly basis may submit this template on a quarterly basis (with the same submission due date as Capital+ submissions and the same reporting dates as would be the case if their Capital+ submissions were quarterly) at all levels of application of reporting. The PRA may ask these firms to submit the information in this template on a more frequent basis.

- MREL Debt (MRL003) -quarterly, on the same reporting end date and submission due date as firms’ COREP C 01.00 submissions. The PRA may ask firms to submit MRL003 template on a more frequent basis.

- 01/01/2019

2.38D

The following table shows the level of application and frequency of MREL reporting:

| MREL Resources (MRL001) | MREL Resources Forecast (MRL002) | MREL Debt (MRL003) | |

| Level of application | UK consolidation group, UK resolution group,[7] material subsidiaries and material subgroups | UK consolidation group, UK resolution group, material subsidiaries and material subgroups | One template should be submitted in respect of all entities within the UK consolidation group |

| Frequency | Aligned with COREP C 01.00 | Aligned with Capital+ | Quarterly (aligned with COREP C 01.00) |

Footnotes

- 7. For example, a multiple point of entry (MPE) group headed by a resolution entity for which the Bank is the home resolution authority.

- 01/01/2019

2.38E

Firms should provide information in the XBRL format using the templates in the appendix.

- 01/01/2019

2.38F

The PRA expects firms to commence reporting at the following times.

- 01/01/2019

External MREL

- Firms that have been notified by the Bank of England prior to 1 January 2017 that they are likely to be set external MREL in excess of regulatory capital requirements (whether interim and/or end-state) should start reporting, at the same time and frequency as their Capital+ and COREP C 01.00 reporting from 1 January 2019.[8]

- Firms that have been notified after 1 January 2017 that they are likely to be set external MREL in excess of regulatory capital requirements (whether interim and/or end-state) by the Bank of England, should start reporting at the same time and frequency as their Capital+ and COREP C 01.00 reporting, starting at least 12 months prior to the end of the transitional period set by the Bank of England. The Bank of England intends to communicate to firms the first expected reporting date at the same time as it communicates external MREL to firms.

Footnotes

- 8. Similarly to firms’ Capital and COREP C 01.00 reporting, the first submission for most firms will be based on figures as at 31 December 2018.

- 01/01/2019

Internal MREL

- Firms that have been notified by the Bank of England prior to 1 January 2020 that they are likely to be set internal MREL in excess of regulatory capital requirements (whether interim and/or end-state) should start reporting, at the same time and frequency as their Capital+ and COREP C 01.00 reporting, starting 6 months after the Bank of England has communicated their internal MREL, but not before 1 January 2019.[9]

- Firms that have been notified after 1 January 2020 that they are likely to be set internal MREL in excess of regulatory capital requirements (whether interim and/or end-state) by the Bank of England, should start reporting at the same time and frequency as their Capital+ and COREP C 01.00 reporting, starting at least 12 months prior to the end of the transitional period set by the Bank of England. The Bank of England will communicate to firms the first expected reporting date at the same time as it communicates internal MREL to firms.

Footnotes

- 9. Reference as in footnote 2.

- 01/01/2019

Phase 2 Part B: Critical function information requests

2.39

The following section sets out additional information and analysis that may be requested from firms in order to further assess the feasibility of a particular resolution strategy, identify barriers to this, and make a detailed resolution plan which ensures that any critical economic functions are protected.

- 01/01/2019

2.40

Firms should consider the need to maintain continuity in the critical economic functions that they provide as well as the need to limit contagion and disruption to customers counterparties and other market participants.

- 01/01/2019

2.41

The authorities’ need for further information will depend on the complexity of the individual firm and its preferred resolution strategy. Additional information requested may include, but is not limited to, the following areas, which are outlined in more detail in the following tables:

- 01/01/2019

B1 Payments, clearing and settlement

2.42

This section focuses on the Financial Market Infrastructure (FMI) which are critical to the firm and customers with which it has a correspondent banking relationship.

- 01/01/2019

| Provide, as appropriate, the following data and analysis for the significant legal entities that have been identified in Phase 1. |

||

| 1 | Business overview | List of FMIs used for each core business area within each jurisdiction, with key metrics (value/volume of transactions, £mn). Under which jurisdictions are the FMIs located? Access to FMIs? Direct membership: Names of legal entities which have direct access. What are the necessary comforts (eg pre-funding) that will need to be delivered to the FMI to maintain direct participation in the FMI at the point of resolution? Indirect membership: For legal entities that access FMI indirectly, please provide a high-level description of how access is obtained (either via other legal entities in the Group or via third parties). Are there any existing contingency plans on alternative means to access FMI indirectly or apply for direct access? How practical is it to set up (pre-resolution) contingency arrangements with alternative providers? Even where no contingency plan is in place, please provide an assessment on the following: Name the likely third parties that can be utilised Where intra-group relationships are changed to third-party relationships, what are the high-level steps required to ensure ex-affiliates can be treated on third-party commercial terms (eg system changes and recalibration of risk/exposure limits)? What are the operational steps required? What is the timescale? What are the likely financial terms? |

| 2 | FMIs | FMIs: Are there any FMIs in which the Group is a material provider/receiver of liquidity to facilitate settlement? Are there any securities clearing schemes for which the Group provides a settlement service? (eg liquidity provider in CREST) Are there any CCPs in which the group is a material (Top 5) participant? How many alternative financial institutions exist in the market for these services? How many alternative financial institutions are able to take on additional settlement capacity, based on current market share? |

| 3 | Provision of services to other entities | Other legal entities within the Group: Please provide a high-level assessment of how payments, settlement and clearing systems are critical to other critical functions within the Group. Agency and Correspondent Banking Relationships: Where other internal/external entities rely on the Group for agency and correspondent banking, provide a breakdown of customer types eg banks, corporates, institutional investors, government entities. Name the legal entities which provide the service. What are the terms of the contracts governing the relationships and how would these relationships be affected in a resolution? Could payments, clearing and settlement services be maintained pending a sale of the firm to a third party or bridge bank? Under what scenarios would the firm cease to offer settlement bank services to another financial institution customer? Please include commentary on case where the Group is significant direct participant in FMI in non-UK jurisdictions. Can these relationships still be maintained given the loss of the global franchise? If so, would these services be continued under current terms? Describe the credit approval and operational processes in providing settlement services eg reliance from customers in terms of credit to support their daily settlement requirements. Describe the channels that customers use in communicating with the firm ie the scale of customers reliant and dependent upon firm proprietary systems in accessing FMIs versus market-wide channels such as SWIFT. Cash Management business (where applicable): Brief description of main products offered, and clients serviced. In particular, please identify any globalised services such as cross-currency products and CLS clearing. Key metrics for current business where appropriate (revenue, number of clients etc). How many alternative providers exist in the market for these services? How easily could clients’ funds be transferred to an alternative provider? How would proprietary vs client custodial assets be separated? What rights does the Group have over client assets? Indicate which products/services would be core to the regional business post-resolution. |

| 4 | Procurement of services from other entities |

Settlement/clearing Banking Relationships: Where the firm relies on other entities for settlement/clearing bank services, provide the following, for each of the FMI utilised: A walkthrough of the payment life-cycle, from initiation of payment instruction to settlement and booking in customer account ledger. Provide critical cut-off times and highlight points of irrevocability. Provide an assessment of the average daily volume of in-flight transactions for each payment scheme (£mn). Provide average and peak volumes (£mn) of ATM withdrawals. An overview of any service agreements including whether the service agreements can survive a resolution and assure continued indirect access. Where no service agreements are in force, can indirect access continues, and for how long? |

| 5 | Funding | What are the BAU and stressed liquidity needs by currency for payment, clearing and settlement activities? What are the main sources of intraday/overnight liquidity in BAU? Are there any contingent funding sources? |

| 6 | Operational and managerial interdependencies |

For each of the following: Funding- any dependence on a centralised Treasury function Compliance and risk functions eg KYC/AML, fraud management Key operational centres Data centres and IT infrastructure (propriety systems, hardware and software, including outsourcing and licences) Key staff Please provide: Legal entities where the functions are located (for intra-group dependencies). Please indicate the level of capital in each entity, and to what extent it is capitalised intra-group. Details of key clauses such as break/insolvency, services, costs, encumbrances, etc (please break down between intra-group and extra-group agreements) High-level assessment of whether the service agreements can survive a resolution and whether current structure is capable of implementing the preferred resolution strategy |

| 7 | Business Model review (forward-looking – restructuring of Group) |

Please identify the jurisdictions/regions where continued direct access to global payment/clearing facilities is critical to the business model (in terms of revenue/profit and funding) and franchise. For the remaining regions consider which local payment and clearing functions would still need to be retained. |

- 01/01/2019

B2 Trading book analysis

2.43

This section focuses on the trading book, with particular focus on the firm’s booking model, trade documentation and operational continuity of the trading book in a resolution.

- 01/01/2019

| Number | Heading | Required data/Detail required |

| Provide, as appropriate, the following data and analysis for the significant legal entities that the firm has identified. | ||

| 1 | Risk Management practices (booking models) overview |

Please provide a diagram of the firm’s booking model Please provide information on the jurisdiction where each legal entity involved is located, as well as the use of unregulated affiliates. Information below is to be provided for each combination of UK-regulated legal entity and its unregulated affiliate (UK or overseas) within a group, where they transact with each other: |

| 2 | Derivatives booking model | For each legal entity and branch in the United Kingdom, please provide: OTC derivatives external gross Mark to Market (MtM) and notional held (£mn) OTC derivatives intra-group gross MtM and notional held, by entity pairs and by desks (£mn) Monthly average and peak derivative external trade volume by value, by desks (£mn) Monthly average and peak derivative intra-group trade volume by value, by desks (£mn) OTC derivatives external gross MtM and notional executed by non-UK traders held, by country (use ISO country code) and by product line (£mn) House Initial Margin (IM) and notional with CCP and Derivative Exchanges executed by non-UK traders by country and exchanges (£mn) |

| 3 | Cash securities booking model | For each legal entity and branch in the United Kingdom, please provide: Monthly average and peak external trade volumes (number) and values (£mn) by asset class (eg rates, credit, equities) or lines of business, entities and depositories Monthly average and peak intra-group trade volumes (number) and values (£mn) by asset classes (eg rates, credit, equities) or line of business, entity pairs and depositories |

| 4 | Derivatives FMI membership |

Direct derivatives clearing memberships: House Initial Margin (IM) and notional with CCP and Derivative Exchanges (£mn) External Clients IM and notional with CCP and Derivative Exchanges (£mn) Intra-group IM and notional with CCP and Derivative Exchanges (£mn) Indirect derivatives clearing memberships: IM and notional with CCP and Derivative Exchanges held with third-party clearers (£mn) |

| 5 | Operational and managerial interdependencies |

For each of the following: Middle and back offices, including key staff Data centres and IT infrastructure (proprietary systems, servers, hardware and software, including outsourcing and licences) Please provide: Legal entities where the functions are located (for intra-group dependencies). Please indicate the level of capital in each entity, and to what extent it is capitalised intra-group. Copy of service agreements, or as a minimum details of key clauses such as break/insolvency, services, costs, governing law, encumbrances, etc (please break down between intra-group and extra-group agreements) High-level assessment of whether the service agreements can survive a resolution and whether current structure is capable of implementing the preferred resolution strategy. |

- 01/01/2019

B3 Cash services

2.44

This section focuses on the scope and scale of the cash services business line, and operational continuity of these operations in a resolution.

- 01/01/2019

| Number | Heading | Required data/Detail required |

| Provide, as appropriate, the following data and analysis for the significant legal entities that the firm has identified and geography (E&W, Scotland, NI) | ||

| 1 | Customers | Overview of services provided, including volumes |

| 2 | Joint ventures | Copies of relevant contracts, or as a minimum detail of key clauses such as break/insolvency, services, costs, governing law, encumbrances. |

| 3 | Property | For each Cash Centre: Ownership details Operational details (if outsourced) Copies of relevant contracts if not self-owned or operated, or as a minimum details of key clauses such as break/insolvency, services, costs, governing law, encumbrances. |

| 4 | IT systems | Name and overview of system function/use and whether off shelf or bespoke Ownership details- licence requirements if not owned/developed in-house Details of other relevant licences and intellectual property |

| 5 | Key service providers |

Details of key clauses such as services provided, break/insolvency, costs, for: ATM replenishment Cash in Transit (CIT) movements IT systems essential for cash business Equipment maintenance (High Speed Note Sorting (HSNS), ATMs etc) Printing of own-note issuance Processing of own-note issuance |

| 6 | Funding/Capital Requirements/Costs |

Provision of treasury function for cash handling Guarantees Booking of business, and transfers of ownership of notes |

| 7 | Wind down/separation |