6

Additional considerations for the supervision and authorisation of branches

6.1

As discussed in Chapter 2, a branch of an international bank forms part of a legal entity incorporated outside the UK. It follows that its operations are necessarily dependent on those of the legal entity as a whole. PRA authorisation applies to the whole firm. However, the PRA’s approach is to place appropriate reliance on the prudential supervision of the overseas firm by the home state supervisor, subject to appropriate safeguards. For example, the PRA does not apply capital requirements to a firm operating only through a UK branch, and the PRA looks to the home state regime to apply solo capital requirements to the firm.

- 26/07/2021

6.2

While the PRA’s expectations set out in Chapters 3, 4, and 5 of this SS apply to international banks that operate in the UK via branches as well as to subsidiaries, in the case of a branch there are additional expectations which arise since:

- there are potential risks arising in the head office or other branches of the firm which may affect the UK branch operations;

- the PRA authorises the firm as a whole; that is, the entire legal entity and not only the UK branch, and so the firm as a whole must meet threshold conditions; and

- there is a home state supervisory authority which will be responsible for the prudential supervision of the firm as a whole, and with which the PRA will need to agree how each regulator’s respective responsibilities are to be discharged in accordance with their legal duties and, for the PRA, in a proportionate and cost-effective manner.

- 26/07/2021

6.3

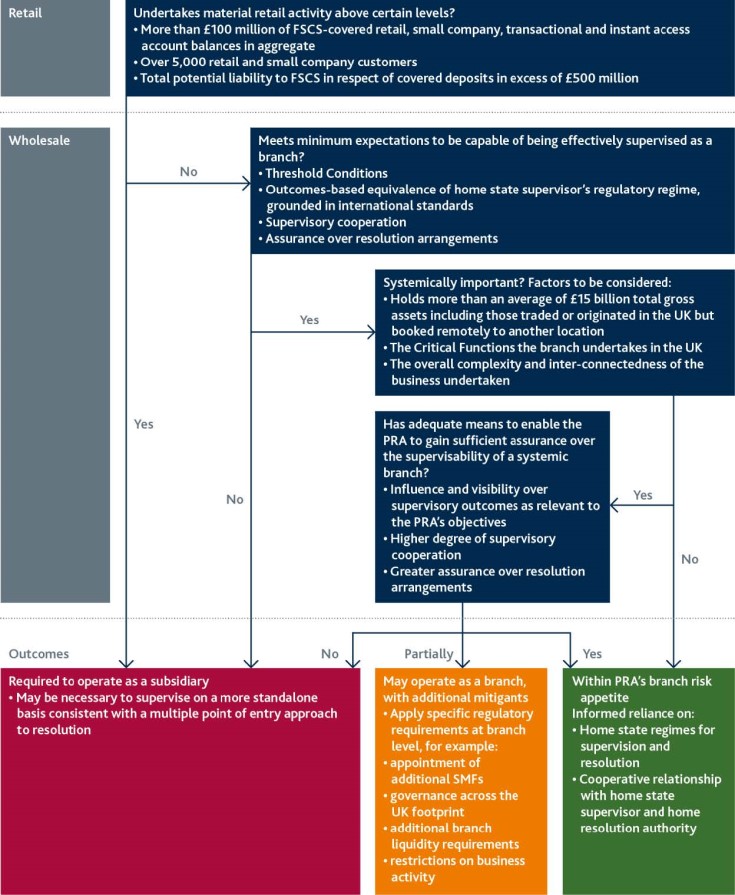

The matters that the PRA considers when deciding whether it may be content to authorise a firm to operate in the UK through a branch are summarised in Figure 2 below (which was originally published in SS1/18). This diagram should be read in conjunction with Figure 1, which relates to both firms that are part of groups and firms that have branches.

- 26/07/2021

Threshold conditions

6.4

In determining whether its threshold conditions are met, the PRA may have regard to the opinion of an overseas regulator, if relevant, taking into account the nature and scope of supervision exercised by it.[49] The PRA will have appropriate regard to the opinion of the home state supervisor about the firm’s compliance with the PRA’s threshold conditions when forming its own judgement.

Footnotes

- 49. Section 55D of FSMA. Available at: https://www.legislation.gov.uk/ukpga/2000/8/section/55D.

- 26/07/2021

Equivalence

6.5

The PRA’s approach to assessing supervisory equivalence for UK branches is the same as for UK subsidiaries of foreign groups (see Chapter 3).

- 26/07/2021

Figure 2: PRA considerations for branch authorisation

- 26/07/2021

Supervisory co-operation

6.6

There are additional expectations the PRA has for co-operation concerning branches:

- The PRA will seek to establish a clear acceptance from the home state supervisor of its prudential responsibility for branches in the UK. This will include confirmation from the home state supervisor that the whole firm meets the PRA’s threshold conditions, and requires the existence of a specific agreement with the home state supervisor on the split of responsibilities for prudential supervision of branches from that jurisdiction. The latter typically covers the performance of respective supervisory tasks and responsibilities, the reliance each supervisor may place on the other, co-operation and information sharing, meetings with and information requests to the firm, and how each risk element will be assessed.

- The PRA will expect there to be agreement concerning the information required from the home state supervisor in relation to the firm, which may include information on liquidity; this supplements the whole-firm liquidity information that the PRA expects the firm to provide.[50]

Footnotes

- 50. SS1/17 sets out the PRA’s expectations for liquidity reporting by PRA-regulated branches of third-country and non-EEA credit institutions and designated investment firms, February 2017: http://www.bankofengland.co.uk/prudential-regulation/publication/2017/supervising-international-banks-the-pras-approach-to-branch-supervision-liquidity-reporting-ss.

- 26/07/2021

6.7

Both would be subject to periodic review to ensure each authority is meeting the other’s expectations.

- 26/07/2021

Groups with both UK subsidiaries and UK branches

6.8

Where firms operate in the UK with both a subsidiary and a branch (or one or more of each), the PRA expects appropriate governance to oversee and manage the linkages between the entities.[51] In supervising these firms, the PRA will delineate its supervision between the entities, and expect the firm to have a clear booking arrangement in place setting out what it will book in each entity and how its application will be verified.

Footnotes

- 51. SS4/16 ‘Internal governance of third country branches’, February 2016: http://www.bankofengland.co.uk/prudential-regulation/publication/2016/internal-governance-of-third-country-branches-ss.

- 26/07/2021

Resolution

6.9

The assessment of the home state resolution framework for UK branches is the same as for UK subsidiaries of foreign groups (see Chapter 3), but in addition the PRA considers whether depositors of the UK branch will receive fair treatment under the home jurisdiction’s insolvency and resolution regime.

- 26/07/2021

6.10

The PRA will also assess the group resolution strategy and broader resolution arrangements in a similar way to that of UK subsidiaries of foreign groups (see Chapter 4). In particular, the PRA will take into account the Bank’s assessments as to whether the group resolution strategy would deliver orderly resolution in the UK, with reference to the provisions set out in the Bank’s RAF.

- 26/07/2021

Treatment of UK depositors and creditors

6.11

While the PRA, in consultation with the Bank as UK resolution authority, can gain assurance over resolution plans and the stated intentions of the home state supervisor and home resolution authority, doubts may remain over the certainty with which these plans will be applied in practice. The PRA’s starting point is that UK creditors and depositors should be treated equally with their home state equivalents. Where that is not, or may not, be the case, the PRA will consider the impact on its objectives in deciding what action, if any, to take.

- 26/07/2021

6.12

If there is a legally clear form of domestic depositor preference, then this is a known risk that can be assessed.[52] However, the PRA will also take account of two related risks that are harder to assess:

- the risk of short-notice legislative change in the home jurisdiction during a crisis that is intended to favour domestic depositors or creditors; and

- the risk that, actual administrative discrimination against foreign depositors or creditors takes place during the post-failure liquidation or resolution process.

Footnotes

- 52. FSA Consultation Paper 12/23, ‘Addressing the implications of non-EEA national depositor preference regimes’, September 2012: https://www.bankofengland.co.uk/prudential-regulation/publication/2013/addressing-the-implications-of-non-eea-national-depositor-preference-regimes.

- 26/07/2021

6.13

The PRA’s preferred approach is to gain assurance that the home resolution authority’s resolution regime will deliver the appropriate outcomes for the PRA’s and the Bank’s objectives as UK resolution authority. In the absence of adequate levels of assurance, the PRA will likely not be prepared to host such a branch from that jurisdiction.[53] In the case of an international bank operating through an existing branch, it may be required to establish a UK subsidiary. If there is insufficient assurance over the home state resolution arrangements, this may in turn mean that it would be necessary for the firm to be supervised on a more standalone basis consistent with a MPE approach to resolution.

Footnotes

- 53. The Bank has certain resolution powers over branches, including the power to resolve branches on a standalone basis in certain circumstances.

- 26/07/2021

Approach to significant retail activities

6.14

In general, the PRA will not be content for branches to undertake retail banking activities beyond the levels described in the next paragraph. This ensures that the PRA is able to meet its supervisory objectives and mitigate the risks to UK financial stability.

- 26/07/2021

6.15

In assessing whether the PRA will be content for an international bank to undertake retail activities in the UK through a branch, the PRA will make a determination based on the following:

- the value and type of account: while this is not a hard threshold and may vary on a firm-by-firm basis, the PRA expects branches to have under £100 million of retail and small company[54] transactional or instant access account balances covered by the Financial Services Compensation Scheme (FSCS);[55]

- the number of customers: in addition to the value of deposits, the PRA will also take into account the number of customers. Where branches have in aggregate more than 5,000 retail and small company customers with accounts that are used for transactional purposes, this may be of concern, though this may differ on a firm-by-firm basis;

- planned growth: while a branch’s existing retail deposits could be within the PRA’s appetite, the PRA may conclude that the branch’s plans to grow retail deposits are outside its risk appetite.

Footnotes

- 54. A ‘small company’ is defined as under the Companies Act 2006: http://www.legislation.gov.uk/ukpga/2006/46/part/15/chapter/1/crossheading/companies-subject-to-the-small-companies-regime. This definition is used here for supervisory purposes only, and firms should use this definition for their branch return submissions. For the avoidance of doubt, the definition of ‘micro, small and medium-sized enterprises’ for the purposes of the Depositor Protection Part of the PRA Rulebook remains unchanged.

- 55. In general, the PRA starts from the understanding that an account, while it may have transactional functionality, is only considered a ‘transactional account’ if withdrawals from it have been made nine or more times within a three month period, but it may additionally consider other factors. The PRA will continue to take a pragmatic, judgement-based view as to whether the accounts are transactional in practice.

- 26/07/2021

6.16

The PRA’s approach to authorising and supervising international banks that propose to undertake significant retail banking activities through branches is also driven by the fact that eligible deposits of these branches are covered by the FSCS. In the event of failure, if the FSCS were unable to recoup the amount it paid out via the bank insolvency procedure from recoveries, ultimately there would be a liability to the UK financial system. Given this, the PRA will not, in general, be content for a branch to undertake deposit activity where the total potential liability to the FSCS in relation to covered deposits (as defined in the Depositor Protection Part of the PRA Rulebook) is in excess of £500 million.

- 26/07/2021

6.17

The PRA expects new branches of international banks operating in the UK to focus primarily on wholesale banking activities.

- 26/07/2021

6.18

Where the PRA requires an international bank to use a subsidiary in order to undertake retail banking activities in the UK beyond certain levels, it does not automatically mean that the Bank, as resolution authority, would expect to apply its resolution powers on the subsidiary in the event of failure. This reflects the fact that it may be consistent with the PRA’s objectives to gain greater supervisory influence over a firm, even if the test for use of stabilisation tools is different. The actual approach taken to resolve a firm will depend on the circumstances at the time of its failure.

- 26/07/2021

Approach to systemic wholesale branches

6.19

Given the cross-border nature of many wholesale banking activities, wholesale branches tend to involve greater complexity in terms of structures, business models, and booking arrangements. Accordingly, where they may become of systemic importance, the PRA has additional expectations.

- 26/07/2021

Systemic importance

6.20

The PRA will identify wholesale branches as systemically important when their size, complexity, and interconnectedness indicate that the failure of the firm could have significant consequences for financial stability in the UK. The PRA will inform the firm in cases where its wholesale branch is determined to be systemically important.

- 26/07/2021

6.21

As its starting point, the PRA will have regard to the size of a firm’s UK footprint in deciding whether to determine that a wholesale branch is systemically important, specifically whether it exceeds an average of £15 billion total gross assets. In calculating this figure, the PRA will take account both of assets booked onto the balance sheet of the branch, and assets traded or originated in the UK but booked remotely to another jurisdiction. The PRA will use the data provided in the Branch Return to assist in determining whether the wholesale branch is systemically important.[56]

- 26/07/2021

6.22

Where a group maintains more than one UK branch, the PRA will aggregate the UK footprint of those branches to assess the overall significance of the UK branches of the group. Where a group also maintains a UK branch of an investment firm, the PRA may also take into account the assets of that branch.

- 26/07/2021

6.23

The PRA’s assessment will also take account of the likelihood that a firm will exceed the threshold in future.

- 26/07/2021

6.24

The £15 billion threshold is only indicative. In determining systemic importance, the PRA will also focus on the overall complexity and interconnectedness of the business undertaken in the branch, including where a branch provides significant operational services or is otherwise interconnected to a systemically important UK bank. It will also take account of the level of provision of critical functions the branch undertakes.

- 26/07/2021

6.25

Box 3 sets out the PRA’s expectations of systemic wholesale branches.

- 26/07/2021

Box 3: The PRA’s expectations of systemic wholesale branches

Expectations of systemic wholesale branches

Whereas the PRA expects all branches’ organisational arrangements to be comprehensive yet proportionate to the nature, scale, and complexity of their business, the PRA has additional expectations for systemic wholesale branches.[57]

Where the PRA identifies wholesale branches as being of systemic importance to the UK, the intensity of the PRA’s supervision of the branch will generally be greater, and the PRA’s expectations of its organisational arrangements will be higher. The specific arrangements will vary across firms, but the PRA has the following general expectations.

Supervisory engagement

Systemic wholesale branches are among those firms for whom the PRA has a continuous assessment programme. This programme includes an assessment of the business undertaken by the branch, the authorised entity of which it is part, and the group. It also includes consideration of booking arrangements as set out in Box 2. This assessment informs the depth and nature of the information and engagement the PRA expects from both the home state supervisor and the branch.

The PRA will look to the Head of Overseas Branch (SMF19) to ensure it receives the requisite information it expects for all branches. For systemic wholesale branches, as part of its supervisory programme, the PRA will expect to meet at least annually as part of existing annual meetings with the CEO or the CRO, or both, of the authorised entity of which the branch is part, to discuss the PRA’s expectations on information sharing, as outlined in Box 1, for the firm.

Governance

All branches must have the SMF19 approved by the PRA, with FCA consent. Individual(s) performing the SMF19 should have the highest degree of individual decision-making authority within the branch over activities and areas subject to UK regulation.

For systemic wholesale branches, the person exercising SMF19 is expected to be a senior figure within the firm, who is credible and influential at the group executive level. That person should be well-informed on group developments and how these will affect the operations of the branch. This person should be in a position to ensure that the PRA receives the information set out in Box 1 where this information can be provided by the firm.

In addition to having such an individual holding the SMF19 function, systemic wholesale branches should consider, whether they need the following SMFs: CROf (SMF4), CFO (SMF2), and COO (SMF24). The PRA may also expect or require the firm to have these positions in respect of the branch.

Where an individual based in the head office of the firm, or in another undertaking which is a member of the firm’s group, has significant influence over the branch’s booking arrangements, then that individual should seek approval as Group Entity Senior Manager function (SMF7). This includes where there is a group executive responsible for firm-wide systems or operations upon which the branch relies (for example, in custody, which is often run as a globally integrated activity). However, where other persons provide the appropriate connectivity with the authorised entity or group, the PRA may judge that this may not be necessary (for example, where the branch manager is on the firm’s executive committee).

Risk management

A branch should establish, implement, and maintain adequate risk management policies and procedures, including effective procedures for risk assessment, which identify the risks relating to the branch’s activities, processes, and systems, and where appropriate, set its risk appetite or the level of risk tolerated by the branch.[58] For systemic wholesale branches, the PRA will expect to see evidence of this and to understand the firm’s policies governing the nature and amount of risk associated with business undertaken through the branch. It can do this either through seeing policies written at the branch level, or policies written for the firm as a whole, which identify how the branch risks are to be managed.

The PRA expects these policies to set out criteria against which to judge whether business should be undertaken through the branch or elsewhere in the firm. These policies should include an assessment of non-financial risks (legal, reputational, conduct, operational, etc) that may arise through branch activities.

The branch should have in place the appropriate governance for booking policies and controls that mirror those set out in Box 2, which describes booking arrangements as between different entities within a group. In the case of international banks with UK branches, the arrangements should differentiate between what is booked to the firm’s head office and what is booked to the UK branch.

UK footprint

Where a systemic wholesale branch operates in the UK alongside a material subsidiary, the PRA expects there to be controls around the division of risks accepted though the subsidiary and the branch (for example, in the supply of key services between those entities and in the booking of higher risk and unprofitable business). While there is scope for key risk management function holders to combine roles across the UK entities (subsidiary and branch), firms will need to ensure that any conflicts of interest that may arise for the function holder as a result are appropriately managed.

Footnotes

- 57. See SS4/16 ‘Internal governance of third country branches’, February 2016: https://www.bankofengland.co.uk/prudential-regulation/publication/2016/internal-governance-of-third-country-branches-ss.

- 58. See SS4/16 ‘Internal governance of third country branches’, February 2016: https://www.bankofengland.co.uk/prudential-regulation/publication/2016/internal-governance-of-third-country-branches-ss.

- 26/07/2021