1

Introduction

1.1

This supervisory statement (SS) is addressed to all UK general insurance firms regulated by the Prudential Regulation Authority (PRA) within the scope of the Solvency II Directive (the Directive),[1] including the Society of Lloyd’s (Lloyd’s) and managing agents (‘Solvency II firms’). The SS is aimed particularly at those firms operating in the global specialty insurance and reinsurance market known as the London Market, whose business models are exposed to low-probability, high-severity catastrophe risks. It sets out the PRA’s expectations of how such firms [2] might prepare for and respond to a major general insurance loss event, which might affect their solvency and future business plans, and explains how the PRA expects firms to interact with the PRA on these issues. The PRA expects the level of consideration given to these issues by firms to be proportionate to the nature and scale of their business, and the impact that a market turning event (MTE) is likely to have on its operations.

Footnotes

- 1. Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (recast).

- 2. Unless otherwise stated, references to ‘firms’ in this statement mean general insurance firms regulated by the PRA.

- 05/07/2017

1.2

The paper also responds to the recommendation in the industry ‘London Market looks ahead’ White Paper [3] for greater clarity on the PRA’s expectations of firms following a market turning event.

Footnotes

- 3. Published in January 2017 by an industry steering group comprised of insurers and brokers from across the market, as well as Lloyd’s ‘London Market looks ahead: Preparing for the next big insurance event’, available at www.hiscoxgroup.com/news/press-releases/2017/31-01-2017.aspx.

- 05/07/2017

1.3

This SS should be read in conjunction with the PRA’s rules in the Solvency II section of the PRA Rulebook,[4] and ‘The PRA’s approach to insurance supervision’.[5]

Footnotes

- 4. Solvency II contains the concept of an ‘exceptional adverse event’ under which firms may be granted an extension in the time in which they should recover a breach of solvency capital requirement (SCR). The intention is that this SS would be relevant not only in circumstances where an exceptional adverse situation has been declared by European Insurance and Occupational Pensions Authority (EIOPA), but that it could be considered alongside and/or in absence of this.

- 5. March 2016, available at https://www.bankofengland.co.uk/prudential-regulation/publication/pras-approach-to-supervision-of-the-banking-and-insurance-sectors.

- 05/07/2017

1.4

This SS expands on the PRA’s general approach as set out in its insurance approach document. By clearly and consistently explaining its expectations of firms in relation to the particular areas addressed, the PRA seeks to advance its statutory objectives of ensuring the safety and soundness of the firms it regulates, and contributing to securing an appropriate degree of protection for policyholders.

- 05/07/2017

2

Market turning events (MTEs)

2.1

The insurance risks covered by general insurers, particularly those operating in the specialist London Market, include complex, low-probability, high-severity events for which limited data might be available to quantify potential exposures accurately. For such firms, individual large claims (or a combination of claims) might, in certain circumstances, impact significantly their capital resources or future business plans.

- 05/07/2017

2.2

This SS does not attempt to forecast the potential likelihood or impact of such a major general insurance loss event. Instead, it starts from the premise that an extreme general insurance loss event has occurred, impacting multiple insurers, but makes no assumption about the cause of the event. The event in question is assumed to be sufficiently material to cause some or all of the following consequences, although this may not be an exhaustive list:

- the event is likely to generate significant insurance claims (potentially, large in size), across one or more lines of business, to a number of firms operating in the general insurance market;

- the full extent of likely claims and their eventual settlement cost might take some time to be known with certainty;[6]

- some firms might have been impacted severely by the event, to the extent that their potential losses mean they might no longer have sufficient financial resources to meet their regulatory capital requirements;

- given the initial uncertainties involved in estimating claims, some affected firms might not know for some time how the event has impacted their overall regulatory capital position, or the full nature of the claims to which they are exposed;

- some other firms might not be impacted at all by claims from the event, or are impacted to a much lesser extent (eg depending on capital resources, reinsurance arrangements or risk profile);

- the event impacts prevailing market conditions for general insurance products including the availability, price and/or terms of insurance coverage that firms are able to offer policyholders for future policies. The impact might or might not be limited to the class(es) of business most directly affected by the event;

- if premium rates rise, some firms are likely to wish to take advantage of this to write more business; and

- some firms might need to raise additional capital to continue to trade, or might wish to raise additional capital to take advantage of perceived market opportunities. Sources of capital could include a parent company, or third-party investors.

Footnotes

- 6. For example, news may emerge only over time about the circumstances relating to the event in question. It may also take firms some time to assemble data on their exposures. The full implications of the event and the existence of secondary losses may only become apparent over time. Finally, firms might have risk mitigation arrangements in place (for example, reinsurance protection) which may enable some losses to be recovered in time.

- 05/07/2017

2.3

A significant general insurance event which has many of these consequences is referred to in this SS as a MTE. In reality, ‘event’ for these purposes might be one very large single insurance loss event, a combination of significant individual insurance loss events, or a combination of an insurance event and a secondary simultaneous disruption (e.g. a wider dislocation in financial markets). A MTE may also have characteristics that make it distinct to a more typical large insurance event, such as being unusual, unexpected, un-modelled or hard to price. These characteristics may increase the uncertainty experienced by general insurers following a MTE.

- 05/07/2017

3

PRA expectations for firms affected by a MTE

3.1

The PRA expects firms to consider in advance the possible implications of a MTE on their business, including what steps might reasonably be taken in advance to enable them to respond appropriately and meet their regulatory obligations.

- 05/07/2017

3.2

Where a firm’s business is such that a MTE and its potential consequences could have a significant impact on the firm’s financial position or future business plans, the PRA expects firms to consider their approach to MTEs particularly with regard to risk management, capital management and financing, governance, and reporting and disclosure. The following sections set out the PRA’s expectations in these areas in more detail.

- 05/07/2017

3.3

The PRA recognises that there is a limit to how much detailed planning can be undertaken for a future event whose cause and likely consequences are uncertain, and that firms will need to preserve appropriate flexibility within their plans to respond appropriately to circumstances at the time. The PRA’s expectations in relation to firms’ planning for a MTE focus on the general considerations which might arise in dealing with such an event, rather than specific detailed planning for a particular MTE scenario.

- 05/07/2017

3.4

The PRA recognises that firms are likely to have other information and analysis which might be relevant to their planning for a MTE, such as information contained within firms’ own risk and solvency assessments (ORSAs), business continuity plans, or stress testing analysis. The PRA expects firms to take this other information and analysis into account when considering how to assess and plan for a MTE, and to consider for themselves whether and how best to incorporate any MTE analysis or plans into any existing material (or vice versa). The PRA recognises that firms may wish to cross-refer to other relevant material rather than duplicate analysis already undertaken.

- 05/07/2017

3.5

The PRA is open to meeting with firms to discuss their MTE planning in more detail and firms should contact their usual supervision team to arrange such meetings.

- 05/07/2017

4

Risk management

4.1

As part of their general governance and risk management, the PRA expects firms to put in place appropriate processes and procedures that would enable them to prepare for and manage the impact of a MTE on their business. To do this, the PRA expects a firm to consider in its planning the following factors (among others):

- how it would go about gathering initial estimates of exposures and possible losses, the speed at which it might be able to produce credible initial estimates, and the range of possible uncertainties it might face in collecting and compiling relevant data;

- how, in the event of significant uncertainty, it would look to parameterise or validate its initial loss estimates/assumptions (e.g. based on market share data, reverse stress testing, exposure profiles etc.);

- how its own resources might need to be mobilised to ensure a timely and joined-up internal response to a MTE; for example how it would ensure that it drew appropriately on expertise from teams dealing with claims, reserving and capital, reinsurance, financial reporting, and communications issues;

- what lessons might be drawn from previous events concerning a firm’s ability to calculate reliable loss estimates at different stages of the development of the loss;

- how it might use a dry-run scenario or reverse stress testing to test its likely financial and operational response to a MTE, including some of the factors mentioned in the following chapters;

- where firms are part of larger international groups, how any local response might need to be co-ordinated or managed as part of a wider group initiative; and

- how it might respond if actions being taken across the market as a whole (e.g. simultaneous attempts at recapitalisation) affect its ability to act in the way it had originally planned.

- 05/07/2017

4.2

After a MTE, the PRA would expect a firm to use all the tools at its disposal, including its understanding of its business model and the risks it faces, to help inform its analysis of the impact of the MTE and how it might respond. The PRA expects that, following a MTE, firms should consider appropriate methods for:

- assessing potential uncertainties around initial loss estimate(s);

- establishing and maintaining appropriate reserves for the loss event, and assessing the potential for future reserve deterioration;

- assessing any proposed revisions to an agreed business plan, including any potential implications for a firm’s economic or regulatory capital requirements of changes to business volumes or mix of business;

- assessing the ongoing appropriateness of a firm’s stated risk tolerances, risk appetites, or the appropriateness of its reinsurance programme;

- assessing the continued appropriateness of a firm’s investment strategy, given the potential for different MTEs to have different speeds of loss development and payment profiles; and

- informing any rating agency capital analysis, or the potential need for revisions to a firm’s ORSA or stress and scenario analysis.

- 05/07/2017

Firms with internal models approved under Solvency II

4.3

After a MTE, the PRA would expect a firm with an approved internal model to consider how it might use its model to help inform its analysis of the impact of the MTE and how it might respond. The PRA does not expect that the internal model would be the only tool that firms would use in such a scenario. Nevertheless, the PRA expects that, following a MTE, firms might consider using their internal models for a range of purposes including the matters listed in paragraph 4.2 above.

- 05/07/2017

4.4

Firms with approved internal models are responsible for ensuring their internal models meet the required tests and standards on an ongoing basis, and for assessing whether model changes might be required in accordance with their approved model change policies. After a MTE, the PRA would expect firms to consider whether the event might prompt a need to review elements of an approved internal model. For example, a MTE might generate new data which might change firms’ assessments of the likelihood or severity of extreme events, or affect firms’ judgements on possible correlations or dependencies between risks. Depending on a firm’s model change policy, a model change might be triggered as a result of a change in a firm’s business plan following a MTE, or as a result of changes to a model’s methodology and/ or assumptions.

- 05/07/2017

4.5

At the same time, the PRA recognises that it might take some time after a MTE for reliable data to become available which are sufficiently complete and accurate to enable the firm to undertake a robust assessment of whether (and, if so, how) a change to its internal model is needed and/or whether the internal model should be revalidated. The PRA has published in SS12/16 ‘Solvency II: Changes to internal models by UK insurance firms’ its expectations of firms in relation to internal model changes.[7] This includes its expectations on how firms should liaise with the PRA to deal with any temporary deficiency in its internal model which might arise following an external event such as a MTE.

Footnotes

- 7. September 2016: www.bankofengland.co.uk/pra/Pages/publications/ss/2016/ss1216.aspx

- 05/07/2017

4.6

Following a MTE it is also possible that, should rates rise significantly, rate-driven premium increases may trigger premium thresholds in some firms’ model change policies without any underlying increase in exposure or change in model methodology. Firms may wish to consider amending existing model change policies to make clear that increases in premium levels that are driven solely by rate changes (without a corresponding increase in exposure or a change in model methodology), may not constitute a major model change automatically. Such changes to a model change policy could be considered by the PRA in advance of or alongside any planned model change application.

- 05/07/2017

5

Capital management and financing

5.1

Firms are required to monitor their Solvency Capital Requirement (SCR) on an ongoing basis. In the event of a breach, or potential breach within the following three months, of the SCR or Minimum Capital Requirement (MCR), firms are required to inform the PRA, and provide either a realistic recovery plan or finance schedule according to the requirements in the PRA Rulebook, Undertakings in Difficulty 3.1 and 4.1. If a MTE coincided with a declaration of an exceptional adverse situation then there is also the possibility that the recovery period could be extended, by a maximum of seven years.

- 05/07/2017

5.2

The PRA recognises that for some events, it might take some time for firms to gather reliable and stable loss estimates. Nevertheless the PRA expects firms to consider in advance how they could gather information as quickly as practicable after a major event to assess the likely impact on their financial positions, to enable their boards and senior management to respond as necessary.

- 05/07/2017

5.3

Although firms might assume that additional capital would be available quickly after a MTE, either to help restore a firm’s solvency position, or to provide funds to enable additional business to be written, the PRA expects firms to also consider what actions might be required in the event that further capital was not available as quickly as assumed (e.g. if the MTE occurred at a time of wider financial market disruption, if investor appetite was less than anticipated due to multiple firms attempting simultaneous recapitalisation, or if additional capital from other group companies was not available).

- 05/07/2017

5.4

As with any adverse situation, firms impacted by a MTE would be required to keep the PRA informed of their assessment of the impact of the event on their financial position, their strategy and business plans, their operational capabilities, and any other issues that might be material to the PRA’s prudential assessment. The PRA would also expect firms to keep their supervisors updated if their assessments changed over time.

- 05/07/2017

5.5

The PRA rules require firms to remain adequately capitalised at all times.[8] For internal model firms, this includes a period in which a model change application is being reviewed by the PRA. The PRA may consider using supervisory tools (including as a temporary measure) to ensure that any risks are adequately mitigated where an internal model no longer meets the required tests and standards.

Footnotes

- 8. Fundamental Rules 2.4 and Solvency Capital Requirement – General Provisions 2.1.

- 05/07/2017

6

Governance

6.1

The PRA expects firms to consider in advance and to put in place appropriate arrangements to ensure that their boards and senior management teams are able to provide effective management oversight following a MTE, and to ensure that significant decisions can be made quickly where necessary.

- 05/07/2017

6.2

It is the responsibility of a firm’s board of directors to assess whether the financial position of the firm is sufficiently secure to enable it to continue to trade and to meet its ongoing legal and regulatory obligations. The PRA expects a firm to consider in advance what information its board would wish to see to gain assurance about the firm’s financial position after a MTE, and to assess what contingency actions might be available to the firm to improve its financial position if necessary. These actions might include potential recapitalisation options, either immediately after an event or in the event of future deterioration over time as loss estimates develop.

- 05/07/2017

6.3

The PRA expects that after a MTE a firm’s board would need to take particular care to consider how the financial position of the firm might have been affected by the event when deciding how it should respond, particularly given the likely uncertainties involved in developing loss estimates in the early stages after a MTE. The PRA expects firms to be able to explain, if asked, the judgements that their boards have reached in this area.

- 05/07/2017

6.4

Some firms might wish to respond to changed market conditions after a MTE by significantly amending their business plans to write greater levels of business or different classes of business than previously expected. The PRA expects firms wishing to respond in this way to assure themselves and their boards of directors that their financial position is sufficiently robust to justify their plans at a time of uncertainty that is likely to follow a MTE. The PRA expects a firm in this position to consider factors such as:

- the robustness of its short-term financial position, taking into account the possible initial uncertainty on loss estimates;

- the potential impact of any losses on the remaining coverage available within a firm’s reinsurance programme;

- the availability and speed of access to additional capital where needed;

- the financial and non-financial resources available to the firm to support writing higher volumes of business;

- the expertise available to the firm to ensure business written in new areas (geographies, products etc.) can be understood, monitored and controlled appropriately; and

- for subsidiaries of broader international groups, the extent to which support is likely to be available from other group companies.

- 05/07/2017

6.5

The PRA also expects firms to notify the PRA of any material changes to business plans agreed by their boards in these circumstances.

- 05/07/2017

7

Reporting and disclosure

7.1

Firms are likely to have a number of potential parties to whom they might owe obligations to communicate or disclose information following a MTE, such as investors, other market participants, policyholders, staff and regulators. Firms are responsible for determining the obligations they have in these areas and for making the appropriate disclosures. When planning for such an event, the PRA expects firms to have considered what notifications or applications they might need or wish to make to the PRA, Lloyd’s or other authorities in such circumstances, and to consider what planning they might undertake ahead of a MTE to ensure they could make these notifications or applications in a timely manner.

- 05/07/2017

Matters requiring notification or applications to the PRA

7.2

Beyond firms’ general obligation to keep the PRA informed of any significant impacts of a MTE on their financial position, operational capabilities, or business plans, some firms might wish (or need) to approach the PRA following a MTE to make some specific regulatory notifications or applications.

- 05/07/2017

7.3

The PRA expects firms to consider (in advance, and at the time of a MTE) whether any aspects of their proposed response to a MTE might require prior approval from the PRA or other bodies, or whether there are matters which might require prior notification to the PRA, based on requirements within the PRA Rulebook. Some examples might include (but are not limited to):

- notification of an intention to issue new ‘own funds’ items, as specified in the Own Funds Part of the PRA Rulebook;

- applications for PRA approval to include items within a firm’s own funds, such as ‘ancillary own funds’;

- notification of changes to internal models where these models are approved by the PRA for the calculation of firms’ regulatory capital requirements;

- notification of significant changes to reinsurance arrangements;

- applications for Part 4A permission for new insurance entities; and

- other matters required to be notified to the PRA (for example, requirements within the Notifications Part of the PRA Rulebook).

- 05/07/2017

7.4

The PRA encourages firms to consider in advance what approvals they might wish to seek from the PRA in advance of a MTE, and to discuss their proposed approach and likely plans with the PRA. A firm should factor in the need for approval of any such applications into its planning for dealing with MTEs.

- 05/07/2017

7.5

The PRA requires Lloyd’s to comply with the applicable notification requirements of the PRA Rulebook.[9] If an individual Lloyd’s managing agent believes the impact of the MTE has been sufficiently large to affect its ability to discharge its own regulatory responsibilities, the PRA expects the managing agent to discuss this with the PRA as well as discussing the situation with Lloyd’s. More generally, the PRA expects Lloyd’s to gather what information it believes necessary from managing agents to allow it to assess the impact of the event on the Lloyd’s market as a whole, and to share this information promptly with the PRA. The PRA will seek to avoid unnecessary duplication of requests to managing agents in line with its general co-ordination agreement with Lloyd’s, but the PRA reserves the right to request information directly from managing agents if it judges this to be necessary.

Footnotes

- 9. See Notifications 3 in the PRA Rulebook.

- 05/07/2017

8

PRA data collection following a MTE

8.1

If the PRA judges that a MTE may have occurred, the PRA will contact firms through its usual supervisory channels to understand their initial assessment of the likely impact on their financial position. Although firms’ initial estimates might be based largely on a high-level exposure assessment, the PRA expects firms to seek to understand as quickly as possible the extent to which the event might impact the level of their own funds or SCR.

- 05/07/2017

8.2

At some point after a MTE, the PRA might consider collecting certain information from affected firms on a standardised basis through an ad hoc data request, to assist the PRA in assessing firms’ individual financial positions and to improve its ability to make decisions quickly.

- 05/07/2017

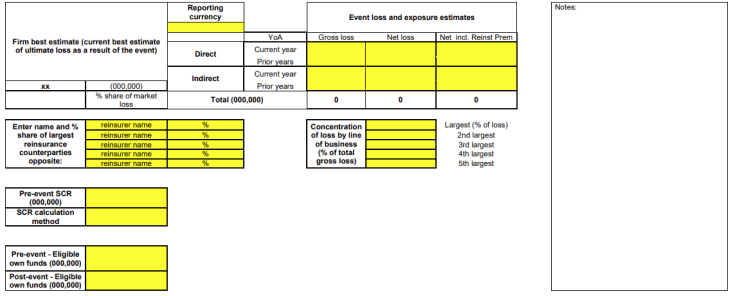

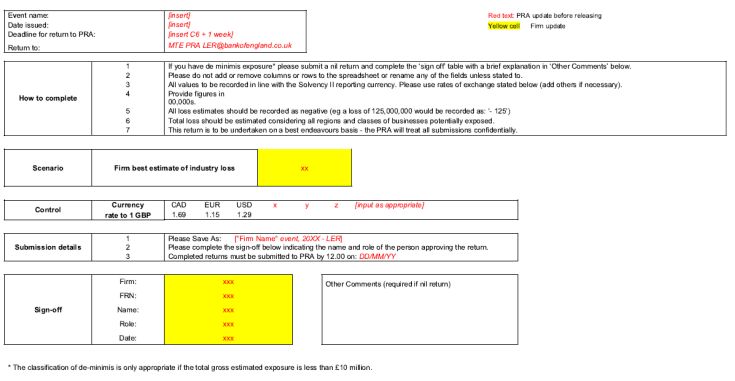

8.3

As it is likely to be helpful for firms to understand in advance the information that the PRA might request in such circumstances, the Appendix to this supervisory statement includes an example of a standardised loss return template containing the information that the PRA believes it is most likely to need following a MTE. The PRA expects firms to review the template and consider the types of information that are likely to be useful to, and required by, the PRA at the time of an event, and to consider what steps can be taken in advance to improve firms’ ability to provide this information to the PRA at short notice and on request following a MTE.

- 05/07/2017

8.4

The draft template has been prepared with no prior assumptions made about the nature of the possible MTE, its cause or its consequences. As a result, it is possible that the information template used in response to an actual event would be refined to ensure that the data requested was focused and relevant to the specific scenario.

- 05/07/2017

8.5

As part of this data collection, UK entities that are part of a wider group might also be asked by the PRA to provide high-level narrative information on the impact of the event at group level, particularly where there are close financial or operational dependencies between the UK entity and other group companies. Such information may include, but may not be limited to, the impact of the event on: group solvency and/or liquidity; shared reinsurance arrangements (eg where the UK entity may be a beneficiary of shared ‘group’ reinsurance programmes), including any contribution to reinstatement premiums; group credit ratings; and other material intragroup connections. Such requests may be varied depending on the circumstances prevailing at the time of the event and the PRA does not intend to prescribe a template for the provision of such information. Where a global supervisory college exists, the PRA would consider using this mechanism, or bilateral discussions with relevant supervisors, to gather this information. Should this not be possible, the PRA would look to relevant UK entities to use their best endeavours to provide such information to the PRA on request.

- 05/07/2017

Dealing with initial uncertainties in loss estimates

8.6

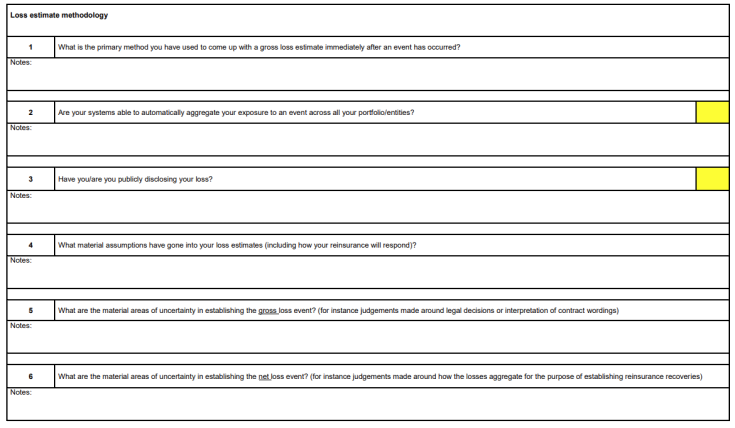

The PRA recognises that there are a number of factors that would need to be taken into account by firms in making and interpreting initial loss estimates following a MTE, potentially affecting the accuracy of data submitted by firms to the PRA in these circumstances.[10] The uncertainties involved in making loss estimates are likely to diminish over time, but in the initial period, the PRA recognises that after a MTE, firms might seek to use a range of techniques to come up with initial estimates, including vendor models, expert judgement and market benchmarks. Further uncertainties might be introduced if firms make adjustments to estimate likely net rather than gross losses, taking into account factors such as likely reinsurance recoveries or subrogation. Firms might differ in their ability to aggregate quickly (or in an automated fashion) exposures from different portfolios or legal entities.

Footnotes

- 10. For example, in a natural catastrophe event, physical access to affected geographic areas might not be possible for some time. Furthermore, the consequences of the primary or secondary events might take time to be fully understood and appreciated.

- 05/07/2017

8.7

Given these uncertainties, the PRA expects firms to use whatever techniques they believe are available and appropriate in the circumstances to begin to develop loss estimates or ranges at an early stage. The PRA believes it is not appropriate for it to prescribe the basis on which firms must compile and report their loss estimates. Instead, the PRA proposes to include in the standardised template a facility for firms to provide some narrative information to explain the basis on which initial estimates have been compiled. This should help identify any material inconsistencies in the way in which firms have provided the estimates, and thereby reduce the likelihood that inappropriate comparisons or conclusions are drawn from the data.

- 05/07/2017

Timing of information request

8.8

The PRA understands that in a MTE scenario there is likely to be a trade-off between the timescale in which a standard data request is made and returned, and the reliability of the data submitted. As a guide, the PRA believes that in most cases it is likely to look to issue its initial data request template within a week of the identification of a significant general insurance loss event, and request initial submissions from firms a week thereafter. However, the actual timeframes in which a request is made and the deadlines for responses will be determined by the PRA at the time, according to its assessment of what is appropriate and reasonable. To the extent possible in the circumstances, the PRA might seek to invite a sample of firms to comment at the time on the feasibility of the proposed timetable for initial data submission, and on any changes it proposes to make to the data requested.

- 05/07/2017

8.9

The PRA might also ask firms to provide updated loss estimates periodically as further information on the event and its impact becomes available. This could be through updated versions of the standardised template or through more bespoke requests if appropriate. The frequency of any such further requests is likely to reflect the speed at which new information is likely to emerge, and will be considered by the PRA and discussed with firms at the time.

- 05/07/2017

8.10

As claims payments start to materialise, the PRA might also ask firms to provide additional information on their liquidity position. This could include asking firms to project likely cash flow requirements to identify any potential liquidity strain arising out of the sudden and unexpected increase in claims payments. In making such projections, firms should consider potential risks to liquidity, including, but not limited to: the possibility of delays and disputes in reinsurance payments; broader market conditions (e.g. the potential for assets to be less liquid than anticipated) and/or the triggering of contractual terms and conditions (e.g. requiring the posting of collateral).

- 05/07/2017

9

Longer-term lessons from a MTE

9.1

When firms have managed the immediate issues associated with a MTE, the PRA would expect firms to consider what longer-term lessons might be drawn from the event, to improve firms’ future governance and risk management arrangements and to improve their preparation for similar future events. Some factors that the PRA would expect a firm to consider include (among other things):

- how its actual loss experience (e.g. in capital models, aggregate exposure management) compared with expected or modelled experience prior to the MTE, and what lessons might be drawn for the robustness of previous assumptions, modelling techniques, processes and controls;

- the ease with which initial loss estimates could be assembled following the MTE, how loss estimates developed over time, and whether changes might be made to systems, internal processes or data collection to improve the timeliness or accuracy of initial estimates for future similar events;

- whether policy definitions and terms and conditions performed as expected or whether changes might need to be made to ensure contracts operated as all parties intended;

- whether its reinsurance programme responded as expected or intended, and whether amendments are required in future including in the event of a change in the firm’s risk appetite;

- whether its liquidity arrangements responded as expected or intended, and whether amendments are required in future to allow for unforeseen events such as delays in reinsurance recoveries;

- whether its medium-term business plans, risk appetites, or ORSA remain appropriate in the light of any changes to business profile or future capital position; and

- whether any crisis management, disaster recovery or business continuity arrangements invoked by the firm operated as expected during the event, and whether any changes might be made to improve the firm’s response to future similar events.

- 05/07/2017

Appendix: Loss return template (example information request issued to firms from the PRA for possible use after a MTE)

Loss estimate return - cover sheet

- 05/07/2017

Loss Estimate Return

- 05/07/2017

- 05/07/2017