9

The PRA buffer

Purpose and objective of the PRA buffer

9.1

The PRA buffer (also referred to as Pillar 2B) is an amount of capital firms should maintain in addition to their total capital requirement[32] (TCR) and the combined buffer. The PRA buffer absorbs losses that may arise under a severe stress scenario, while avoiding duplication with the combined buffers. Together the PRA buffer, the combined buffer[33] and the TCR make up the PRA’s capital framework as illustrated by the capital stack in Figure 2.

Footnotes

- 32. Total capital requirements is the sum of Pillar 1 capital requirements plus Pillar 2A capital requirements.

- 33. The combined buffer comprises the Capital Conservation Buffer (CCoB), the Countercyclical Buffer (CCyB), the buffer for global systemically important institutions (G-SIIs) and (for ring-fenced banks and the largest building societies) the other systemically important institutions buffer (O-SII buffer).

- 01/01/2022

Figure 2 The capital stack

|

Firm-specific buffer |

PRA buffer (may include non-stress related elements) |

Buffers examined by stress test |

|

|

Combined buffer |

Countercyclical capital buffer | ||

| Capital conservation buffer | |||

| Systemic buffers | Set with reference to impact of failure | ||

|

Total capital requirement |

Pillar 2A | ||

| Pillar 1 | |||

Additional capital requirements and/or buffers could be imposed to capture macroprudential risks. This has not been represented in this figure.

- 01/01/2022

9.2

Firms should maintain capital to meet their TCR (regulatory minimum) at all times. Firms also maintain capital in the PRA buffer and the combined buffer for use (either immediately or in the future) to withstand the impact of a severe but plausible stress.

- 01/01/2022

9.3

- (a) the ‘stress impact’ – an assessment of the amount of capital firms should maintain to withstand a severe stress scenario;

- (b) the ‘risk management and governance assessment’ – an assessment of whether a firm has significant risk management and governance (RMG) weaknesses; and

- (c) ‘supervisory judgment’ – an assessment of any other relevant information to inform adjustments to the PRA buffer in order to protect the safety and soundness of firms.

- 01/01/2022

9.4

All components of the PRA buffer including RMG should be met by CET1 capital.

- 01/01/2022

9.5

The PRA considers that all buffers in the capital framework, including the PRA buffer, can be used as required in times of stress. When this happens, the PRA will be content for firms to rebuild their buffers over a reasonable period of time. In exercising its judgement on what constitutes a reasonable time to rebuild buffers drawn down in stress, the PRA will take into account the amount by which the buffer has been used and the expected duration of the stress. It will consider any firm-specific drivers of the use of the buffer, in the context of current and forecast macroeconomic and financial conditions. There is no expectation on firms to maintain additional amounts of capital to avoid being within the PRA buffer in the event of a stress. More detail on the PRA’s response to firms using buffers can be found in SS31/15.[34]

Footnotes

- 34. ‘The Internal Capital Adequacy Assessment Process (ICAAP) and the Supervisory Review and Evaluation Process (SREP)’, March 2019: https://www.bankofengland.co.uk/prudential-regulation/publication/2013/the-internal-capital-adequacy-assessment-process-and-supervisory-review-ss.

- 01/01/2022

Setting the PRA buffer

9.6

The frequency of assessment of the PRA buffer is aligned to a firm’s SREP cycle; annually for major UK firms, and every two to three years for other firms. The PRA may reassess the PRA buffer more frequently when a firm’s circumstances change. For example a change in business model or strategy, a material change in a firm’s risk profile, or when RMG weaknesses are either identified or resolved.

- 01/01/2022

9.7

Together the combined buffer and PRA buffer (the components relating to the stress impact) aim to ensure firms’ capital is at a level to withstand the impact of a suitably severe stress. The PRA buffer captures firm-specific risks and is set with reference to a firm’s hurdle rate. The risk-weighted CET1 hurdle rate is the level of CET1 capital firms are expected to maintain throughout the economic cycle and in a severe but plausible stress. The scenario is severe but plausible, and is common to all firms. The Bank and PRA jointly publishes benchmarks for the appropriate severity of the scenario firms should consider.

- 01/01/2022

9.8

For all firms not participating in the annual stress tests (AST), the hurdle rate is equal to total capital requirements (TCR). For firms participating in the AST, the hurdle rate is set out in the annual guidance published on the Bank’s website.[35]

Footnotes

- 35. The hurdle rate reflects the level of capital firms are expected to maintain in a stress. This is specific to each stress test. Firms participating in the AST should refer to the guidance for each test: https://www.bankofengland.co.uk/stress-testing.

- 01/01/2022

9.9

Firms subject to leverage requirements will also be subject to a hurdle rate based on the Tier 1 leverage measure. Refer to the Bank’s website[36] for the applicable hurdle rate.

Footnotes

- 01/01/2022

9.10

TCR refers to the minimum requirement applicable to all tiers of capital. CET1 capital may be required to cover any shortfalls in AT1 or T2 capital, including those projected under the stress scenario, before it can count towards the buffers or considered excess CET1 capital.

- 01/01/2022

9.11

Where a buffer[37] for an entity established outside the UK exceeds that entity’s share[38] of the buffer applicable at the consolidated group level to cover the same risk, the difference will generally be reflected in the setting of the consolidated group’s PRA buffer to reflect the associated group risk at the consolidated group level. The PRA would generally not reflect such a difference in the consolidated group PRA buffer where the underlying risk of the credit institution established outside the United Kingdom is otherwise mitigated in the consolidated group requirements.

Footnotes

- 37. In this context, buffer refers to capital that overseas authorities expect firms to hold in addition to minimum capital, and which is intended to be able to be drawn down in periods of stress.

- 38. An entity’s share of a particular consolidated group buffer can be determined by multiplying that consolidated group buffer by the proportion of the consolidated group’s Pillar 1 RWAs that are attributable to that entity. The consolidated group’s RWAs that are attributable to an entity is calculated as the entity’s Pillar 1 RWAs, calculated on the same basis as the group RWAs, minus the risk-weighted exposures of that entity to other group entities.

- 01/01/2022

9.12

Where a particular buffer applicable on a sub-consolidated basis for the RFB sub-group is higher than the RFB sub-group’s share[39] of the corresponding buffer on a consolidated basis, the difference will generally be considered in the setting of the consolidated group’s PRA buffer. This is to reflect the associated RFB group risk at the consolidated group level.

Footnotes

- 39. The RFB sub-group’s share of a particular consolidated group buffer can be determined by multiplying that consolidated group buffer by the proportion of the consolidated group’s Pillar 1 RWAs that are attributable to the RFB sub-group. The consolidated group’s RWAs that are attributable to the RFB sub-group is calculated as the RFB sub-group’s Pillar 1 RWAs (calculated on a sub-consolidated basis) minus the risk-weighted exposures of the RFB sub-group to group entities that are not members of the RFB sub-group.

- 01/01/2022

The stress impact

9.13

The PRA carries out an assessment of firms’ ICAAP stress testing as part of the SREP.[40] For the major UK firms this is supplemented by the Bank’s annual stress test (AST).[41]

Footnotes

- 40. Stress testing and scenario analysis requirements are set out in Chapter 12 of the Internal Capital Adequacy Assessment rules and in Chapter 3 of the SS31/15 ‘The Internal Capital Adequacy Assessment Process (ICAAP) and the Supervisory Review and Evaluation Process (SREP)’: https://www.bankofengland.co.uk/prudential-regulation/publication/2013/the-internal-capital-adequacy-assessment-process-and-supervisory-review-ss.

- 41. https://www.bankofengland.co.uk/stress-testing.

- 01/01/2022

9.14

The assessment considers the credibility and reasonableness of firms’ projected stress results and the underlying assumptions on which the stress projections are build. The assessment focusses on the areas where the stress scenario adversely impacts firms’ capital positions (ie reducing capital resources and increasing capital requirements), the nature and severity of the scenario on which the stress results are based and the reasonableness of mitigating actions firms propose to mitigate the impact of the stress.

- 01/01/2022

9.15

Firms’ assumptions, choice of scenario and stress projections are analysed and compared against the PRA’s own internal models, peer benchmarks and information submitted in their ICAAPs. Where the PRA has concerns around the credibility of firms’ stress results, adjustments will be made to the results or to the PRA buffer.

- 01/01/2022

Stress scenario

9.16

The Bank publishes the stress scenario that major UK firms should consider. These are used in the Bank’s AST exercise.

- 01/01/2022

9.17

For firms that are not part of this AST, the PRA regularly publishes scenarios to serve as a guide when designing their own scenarios for ICAAPs.[42] These scenarios provide a benchmark for the severity and nature of stress scenarios, to be considered, to ensure consistent assessments across firms.[43]

Footnotes

- 42. https://www.bankofengland.co.uk/stress-testing.

- 43. The PRA may also ask firms to run additional sensitivity analyses, the purpose of which will be to explore the impact on portfolios and/or regions, which are not covered in the PRA’s published scenarios or the firms’ idiosyncratic scenarios. The results of these sensitivity tests may be used to adjust the assessment of the stress impact.

- 01/01/2022

9.18

The assessment of firms’ stress testing includes an analysis of the severity of the stress scenario considered by firms for the purposes of calculating the PRA buffer and the reasonableness of the stressed projections of the associated economic/market indicators that are part of the firm’s scenario expansion.

- 01/01/2022

Capital resources in stress testing

9.19

Capital resources are expected to reduce in a stress scenario driven by reduced income and lower profitability, as a result of increased losses, and adverse movements in capital deductions.

- 01/01/2022

9.20

The assessment of stressed capital resources includes an analysis of firms’ income and impairment projections, the reasonableness of the balance sheet assumptions under stress, the stressed projections of potential misconduct costs beyond those already paid or provided for, (if relevant for an individual firm) and the credibility of the projections of stressed capital resources.

- 01/01/2022

Capital requirements in stress testing

9.21

In a stress, capital requirements are expected to change as a result of changes in balance sheets and a deteriorating economic environment. Pillar 2A covers a range of risks not addressed under Pillar 1 (eg concentration risk, IRRBB) or not adequately addressed under Pillar 1 (eg operational risk). While Pillar 2A is typically expressed as a share of RWAs, the nature of some of these risks (eg pension deficit risk) is not related to RWAs and may evolve differently from RWAs in stressed conditions.

- 01/01/2022

9.22

To reflect the evolution of the Pillar 2A requirements in a stress the PRA scales each of the Pillar 2A risk components with a suitable metric considered to be an underlying driver (or closely related to an underlying driver) of the particular risk type (see Table E). For example, Pillar 2A requirements for credit risk will scale with changes in credit RWAs rather than total RWAs.

- 01/01/2022

9.23

These scaling bases do not reflect the way the PRA sets Pillar 2A requirements. Rather, they provide a simple way to ensure Pillar 2A requirements in the stress test reflect more closely the probable impact of the stress on the risks captured in Pillar 2A.

- 01/01/2022

Table E – Pillar 2A scaling bases[44]

| Risk type | Scaling base |

|---|---|

| Operational risk[45] | Leverage exposure measure |

| Pension risk | No scaling – remains a fixed add-on |

| Interest rate risk in the banking book (IRRBB) |

Leverage exposure measure |

| Credit concentration risk |

Pillar 1 credit RWAs |

| Market and counterparty credit risk[46] |

Pillar 1 market risk RWAs |

| Credit risk |

Pillar 1 credit RWAs |

| RFB group risk |

No scaling – remains a fixed add-on |

| Other risks | As appropriate |

Footnotes

- 44. Table E covers the material risks captured by Pillar 2A requirements for the firms participating in the annual stress test. For other risks, the PRA will consider the best scaling base to apply while maintaining the simplicity of the calculation.

- 45. Including information technology risk.

- 46. The Pillar 2A requirement for counterparty credit risk typically relates to the market risk aspect of counterparty credit risk. The credit risk component would typically be captured in credit concentration risk requirements.

- 01/01/2022

Management actions

9.24

The PRA recognises management actions that firms could and would realistically take to mitigate the impact of the stress scenario. Guidance on management actions is provided in SS31/15. Additional expectations on management actions for the major UK firms participating in the Bank’s AST are published on the Bank’s website.[47]

Footnotes

- 01/01/2022

9.25

When assessing the credibility of the management actions, the PRA will consider the following:

- (a) the credibility of the actions in the hypothetical stressed market conditions;

- (b) any effects management actions could have on firms’ reputation with its counterparties, investors and customers;

- (c) the main risks associated with executing these actions;

- (d) the time required to implement actions and for these to take effect; and

- (e) whether or not a firm has a proven track record of executing management actions or similar actions.

- 01/01/2022

9.26

The firms participating in the Bank’s AST are expected to meet the projected demand for credit from UK households and businesses in the stress. This may limit the management actions recognised by the PRA in this context.

- 01/01/2022

9.27

The credibility of capital related management actions such as the issuance, redemption and amortisation of additional Tier 1 (AT1) and Tier 2 capital instruments will be considered against the planned capital exercises in firms’ baseline projections. The feasibility, timing and pricing of the issuances and redemptions in the stress scenario will be considered.

- 01/01/2022

Overlaps with the combined buffer

9.28

Together the CCoB and the CCyB aim to ensure the banking system as a whole has sufficient capital to absorb system-wide losses that could occur in stress. The CCoB establishes a basic level of capacity across the system to absorb losses. The CCyB aims to ensure that the banking system is able to withstand the stress throughout the cycle without restricting essential services, such as the supply of credit.

- 01/01/2022

9.29

The PRA buffer aims to ensure that firms can meet their TCR in a severe but plausible stress. A portion of the amount of capital firm need to meet their TCR in stress is therefore already captured by the CCoB and CCyB. To avoid double counting between the buffers, the component of the PRA buffer that relates to the impact of the stress is calculated as the excess amount of capital required over and above the CCoB and relevant CCyB to withstand a severe but plausible stress.

- 01/01/2022

9.30

The PRA considers there to be no overlap between the systemic buffers and the other buffers.

- 01/01/2022

9.31

Changes in the CCyB will generally be additive to firms’ existing PRA buffer. For example, if the FPC increases the CCyB rate by 0.25% to reflect the risk environment, the PRA buffer does not mechanically change.

- 01/01/2022

Stylised example

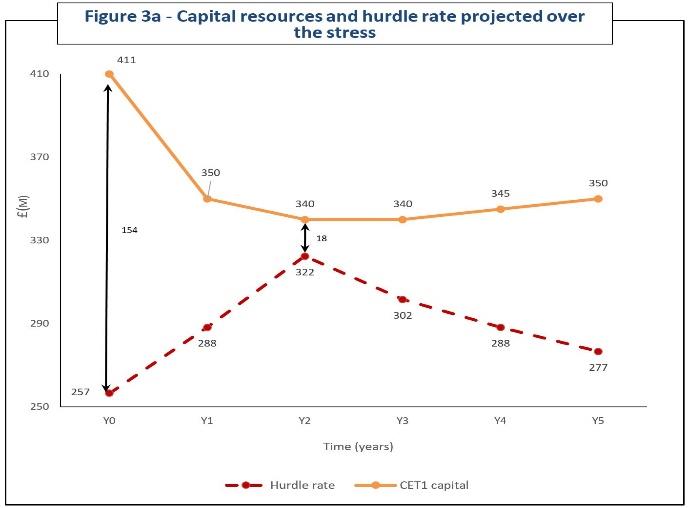

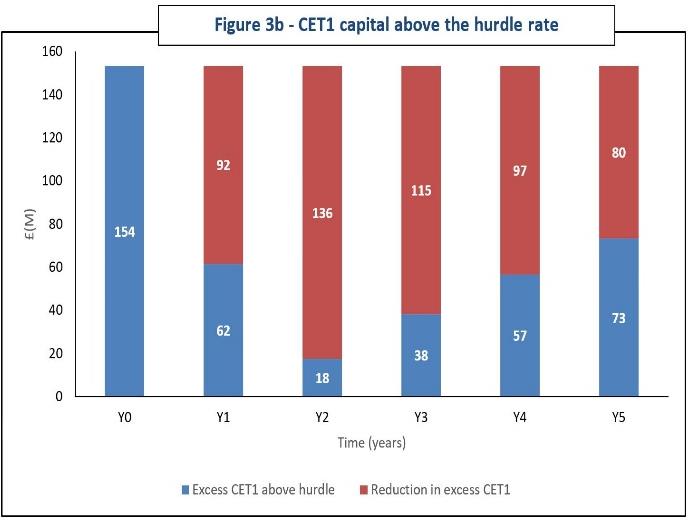

9.32

Figure 3 below presents a stylised example[48] to illustrate the key steps to calculate the PRA buffer. The results from the stress test inform the amount of CET1 capital needed to maintain a firm’s capital levels above the hurdle rate in a severe but plausible stress. Figure 3a shows the projected CET1 capital resources and the risk weighted CET1 hurdle rate for a hypothetical firm in a stress scenario. At each reporting point, the excess CET1 capital above the hurdle rate is calculated (blue bars in figure 3b). The total amount of CET1 capital the firm is expected to hold is set to equal the largest reduction in excess CET1 capital. In this example, this is equivalent to the reduction in CET1 in year 2 (£136m, red bar in Figure 3b), when the stress impact on the firm’s capital is the greatest from the starting position (red bars in Figure 3b). The PRA buffer is set as the amount of CET1 needed to remain above the hurdle rate in stress that is not covered by the CCoB and the CCyB.

Footnotes

- 48. This is a stylised example to show the mechanics of the stress impact assessment for a firm not subject to the Tier 1 leverage hurdle rate. It does not represent all considerations taken into account for the assessment. The illustrative example assumes the firm does not breach the hurdle rate and has excess CET1 throughout the stress. The cases of a projected CET1 shortfall is likely to increase the PRA buffer calculation.

- 01/01/2022

9.33

Assume the CCoB is £94m (2.5% of £3778m – the starting RWAs), and CCyB is set at £19m (0.5% of £3778 RWAs). The amount of CET1 capital depletion not covered by the CCoB and the CCyB is the PRA buffer, i.e. £136m minus £94m minus £19m = £23m (0.6% of £3778m RWAs). As the firm has excess capital resources to meet the CCoB, CCyB and the PRA buffer, based on this example, the firm will not need to raise capital to meet the PRA buffer.

- 01/01/2022

Figure 3 Calculation of the PRA buffer – Illustrative example

- 01/01/2022

The risk management and governance assessment (RMG)

9.34

Where the PRA assesses a firm’s RMG to be significantly weak, it may also set the PRA buffer to cover the risks posed by those weaknesses until they are addressed. This will generally be calibrated in the form of a scalar applied to the amount of CET1 required to meet the TCR. The scalar could be up to 40% of the total CET1 TCR (variable).

- 01/01/2022

9.35

Depending on the severity of the weaknesses identified and the proposed remediation actions, the PRA may allow the firm time to address the identified weaknesses before applying a scalar. In these circumstances, the PRA may give the firm an indicative figure for the size of the scalar – often referred to as a ‘suspended scalar’. If a scalar is applied, the amount may vary from the indicative figure as it will be based on the facts at the time of application.

- 01/01/2022

9.36

If an RMG scalar is included in the PRA buffer, RMG weaknesses identified in specific risk categories would not ordinarily be reflected in Pillar 2A capital requirements for those categories.[49] Once the identified weaknesses have been remedied, the scalar should be removed. If new weaknesses emerge that are not adequately addressed by the scalar or if previous remedial action taken by the firm has led to its removal a new scalar may be applied.

Footnotes

- 49. An exception might be if the risk were only partially addressed by the imposition of a scalar.

- 01/01/2022

9.37

To ensure consistency, RMG scalar decisions will be subject to a peer review process within the PRA.

- 01/01/2022

Overall supervisory judgement

9.38

While supervisory judgement may be applied at all levels of the assessment process, a number of specific areas are outlined below. The PRA may use any appropriate information to inform adjustments to firms’ PRA buffer.

- 01/01/2022

Group risk

9.39

The PRA’s assessment of the total amount of the PRA buffer at consolidated group level for group risk will be informed by the amount by which any buffer applicable on an entity established outside the United Kingdom exceeds that entity’s share of the buffer applicable at the consolidated group level to cover the same risk.[50] [51]

Footnotes

- 50. For example, when making this assessment, the PRA may consider the extent to which any domestic systemically important bank (D-SIB) buffer exceeds the D-SIB’s share of any group-wide global systemically important institution (G-SII) buffer, after accounting for the effect of risks that net off on consolidation.

- 51. The PRA would not reflect such a difference in the consolidated group PRA buffer where the underlying risk of the entity established outside the United Kingdom is otherwise mitigated in the consolidated group requirements.

- 01/01/2022

9.40

The PRA’s assessment of the total amount of the PRA buffer applicable to the consolidated group will be informed by:

- (a) for systemically important institutions, the amount by which any other systemically important institutions buffer (O-SII buffer) exceeds the RFB sub-group’s share of any buffer for global systemic importance (the G-SII buffer) at the consolidated group level. If the G-SII buffer is zero, RFB group risk will be informed by the full amount of any O-SII buffer, taking account of the RFB sub-group’s size relative to the consolidated group; and

- (b) the amount by which any other buffer (such as the PRA buffer and including the RMG scalar) applicable to the RFB sub-group is higher than its share of the corresponding buffer for the consolidated group.

- 01/01/2022

Impact of projections under the base case

9.41

Firms are expected to be able to meet their combined buffer[52] and PRA buffer under the base case. Where a firm’s CET1 capital falls short of meeting the PRA buffer in the base case, the PRA’s response will depend on the situation, but will most likely include a request for a revised capital plan to improve its stress resilience.

Footnotes

- 52. This would include the CCoB, the CCyB and systemic buffers, if any.

- 01/01/2022

Post-balance sheet adjustments

9.42

The PRA buffer calculation is dependent on the firms’ balance sheet used to complete the ICAAP. At the time the PRA buffer is set the firms’ balance sheet may have materially changed, eg disposals and/or acquisitions. Where this has occurred adjustments will be made ensuring capital requirements remain consistent with a firm’s balance sheet risks.

- 01/01/2022

Weaknesses in stress testing processes and data quality

9.43

Supervisors consider the adequacy of a firm’s stress testing processes, the quality of its data submissions and the effectiveness of its model risk management practices. Where shortcomings and deficiencies are identified, the PRA may apply adjustments to specific stress results or set a higher PRA buffer to gain more comfort in a firm’s stress results. Enhanced supervision may also be considered in instances of serious or persistent failings.

- 01/01/2022

Other factors

9.44

The PRA expects firms to hold a larger buffer or strengthen their capital position where necessary based on other factors. These include, but are not limited to: the firm’s leverage ratio; Tier 1 and total capital ratios; risks associated with double leverage; and the extent to which potentially significant risks are not captured fully as part of the stress test. Until the end of 2023, the PRA will also assess firms’ capital positions under transitional arrangements for International Financial Reporting Standards (IFRS) 9,[53] where firms are using these arrangements.

Footnotes

- 53. IFRS 9 was issued in July 2014 and sets out new rules for accounting for financial instruments, replacing the rules in International Accounting Standard (IAS) 39. Following endorsement for use in the EU, IFRS 9 is effective for annual periods beginning on or after 1 January 2018. The PRA’s communications to firms on IFRS 9 are available on the Bank’s website at https://www.bankofengland.co.uk/prudential-regulation/letter/2017/transition-disclosures-for-ifrs9-financial-instruments.

- 01/01/2022

New entrants and expanding smaller banks

9.45

- 01/01/2022

Reporting

9.46

The scope and intensity of the PRA’s assessment is proportionate to the nature, scale, size, and complexity of the firms and is reflected in the granularity of the stress test data firms are required to submit. The Stress Test Data Framework (STDF) contains the data templates for the larger UK firms participating in the Bank’s AST.

- 01/01/2022

9.47

All firms with total assets equal to or greater than £5 billion, at the relevant level of consolidation used as the basis of their ICAAP, must report the data in the stress testing Pillar 2 data item (PRA111) in accordance with Reporting Pillar 2. Firms are required to submit the data with their ICAAP submissions. Firms with total assets less than £5 billion may be requested by supervisors to complete PRA111 on a case-by-case basis. The information in PRA111 includes information on firms’ base and stress scenario projections used in the ICAAP. PRA111 is aligned to the STDF used in the Bank’s annual stress test with reduced granularity.

- 01/01/2022